National Storage Affiliates Trust ("NSA" or the "Company")

(NYSE: NSA) today reported the Company’s third quarter 2024

results.

Third Quarter 2024 Highlights

- Reported net income of $29.8 million for the third quarter of

2024, a decrease of 30.9% compared to the third quarter of 2023.

Reported diluted earnings per share of $0.18 for the third quarter

of 2024 compared to $0.26 for the third quarter of 2023.

- Reported core funds from operations ("Core FFO") of $83.9

million, or $0.62 per share and unit for the third quarter of 2024,

a decrease of 7.5% per share compared to the third quarter of

2023.

- Reported a decrease in same store net operating income ("NOI")

of 5.3% for the third quarter of 2024 compared to the same period

in 2023, driven by a 3.5% decrease in same store total revenues and

an increase of 1.2% in same store property operating expenses.

- Reported same store period-end occupancy of 85.6% as of

September 30, 2024, a decrease of 270 basis points compared to

September 30, 2023.

- One of the Company's unconsolidated real estate ventures

acquired 18 self storage properties for approximately $147.9

million, in two separate transactions. The venture financed the

acquisitions with capital contributions from the venture members,

of which the Company contributed approximately $37.0 million.

- On September 5, 2024, the Company issued $350.0 million of

senior unsecured notes with a weighted average interest rate of

5.6% and a weighted average maturity of 7.6 years in a private

placement with institutional investors.

- As previously announced, effective July 1, 2024 (the "Closing

Date"), the Company completed the internalization of its

participating regional operator ("PRO") structure. As a result, the

Company purchased the PROs' management contracts, and in some

cases, their brand names, related intellectual property and certain

rights related to the PROs' tenant insurance programs. As of the

Closing Date, the Company will no longer pay supervisory and

administrative fees or reimbursements under the previous agreements

with the PROs. The Company continues to transition the majority of

operations in a phased approach, which has begun and is expected to

continue over the 12 month period following the Closing Date, and

the Company has executed new asset management and property

management agreements with a number of the PROs for all or a part

of this transitionary period at newly negotiated management fees.

In connection with the internalization, on July 1, 2024, 11,906,167

subordinated performance units and DownREIT subordinated

performance units were converted into 17,984,787 OP units and

DownREIT OP units.

David Cramer, President and Chief Executive Officer, commented,

“We are pleased to announce that all our team members are safe

following Hurricanes Helene and Milton. We hope that all affected

by these storms remain safe, and we wish them the best as they work

their way through the tough recovery period. While several of our

facilities in the path of these storms experienced minor damage,

largely impacting gates, roofs, and signage, all of our stores are

back open for business. Separately, we made meaningful progress on

our PRO internalization during the quarter, and I am very proud of

our team’s effort on this significant transition for our company.

Although still early, we are encouraged by the benefits that we are

already starting to realize from implementing consistent marketing

and pricing strategies while utilizing a centralized web

platform.”

Mr. Cramer further commented, “Results for the quarter were in

line with our expectations, as our team did a good job navigating

the competitive operating environment while working on the PRO

transition. On a positive note, the transaction environment is

improving as we are seeing more deals come to market, with sellers

becoming more realistic about pricing. As a result, we acquired 18

properties totaling almost $150 million through our 2023 Joint

Venture during the quarter. Further, we opportunistically accessed

the debt private placement market by issuing $350 million of senior

unsecured notes with a weighted average coupon of 5.6%. The

combination of an improving acquisition environment, more

attractive cost of capital and the benefits from the

internalization of the PRO structure, make us excited about what

the future holds for NSA.”

Financial Results

($ in thousands, except per share and unit

data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

Net income

$

29,771

$

43,064

(30.9

)%

$

157,139

$

128,932

21.9

%

Funds From Operations

("FFO")(1)

$

82,365

$

85,418

(3.6

)%

$

224,377

$

258,161

(13.1

)%

Add back acquisition costs

287

341

(15.8

)%

1,274

1,424

(10.5

)%

Add integration and executive severance

costs(2)

907

—

—

%

1,534

—

—

%

Subtract casualty-related

recoveries(3)

—

—

—

%

—

(522

)

—

%

Add loss on early extinguishment of

debt

323

—

—

%

323

758

(57.4

)%

Core FFO(1)

$

83,882

$

85,759

(2.2

)%

$

227,508

$

259,821

(12.4

)%

Earnings per share - basic

$

0.18

$

0.28

(35.7

)%

$

1.03

$

0.83

24.1

%

Earnings per share - diluted

$

0.18

$

0.26

(30.8

)%

$

1.03

$

0.77

33.8

%

FFO per share and unit(1)

$

0.61

$

0.67

(9.0

)%

$

1.81

$

1.99

(9.0

)%

Core FFO per share and unit(1)

$

0.62

$

0.67

(7.5

)%

$

1.84

$

2.01

(8.5

)%

(1)

Non-GAAP financial measures, including

FFO, Core FFO and NOI, are defined in the Glossary in the

supplemental financial information and, where appropriate,

reconciliations of these measures and other non-GAAP financial

measures to their most directly comparable GAAP measures are

included in the Schedules to this press release and in the

supplemental financial information.

(2)

Integration costs relate to expenses

incurred as a part of the internalization of the PRO structure.

Executive severance costs are recorded within the line items

"General and administrative expenses" and "Non-operating (expense)

income" in our consolidated statements of operations.

(3)

Casualty-related recoveries relate to

casualty-related expenses incurred during 2022 and are recorded in

the line item "Other" within operating expenses in our consolidated

statements of operations.

Net income decreased $13.3 million for the third quarter of 2024

and increased $28.2 million for the nine months ended September 30,

2024 ("year-to-date") as compared to the same periods in 2023. The

decrease in net income in the third quarter of 2024 was primarily

due to a decrease in NOI, primarily driven by (i) the sale of 32

self storage properties to a third party in December 2023, (ii) the

contribution of 56 self storage properties to a joint venture

between a subsidiary of NSA and a subsidiary of Heitman Capital

Management, LLC (the "2024 Joint Venture"), in the first quarter of

2024, and (iii) the sale of 40 self storage properties to third

parties in the nine months ended September 30, 2024, partially

offset by decreases in depreciation expense of $8.2 million and

interest expense of $3.5 million. The year-to-date increase in net

income resulted primarily from the gain on the sale of 40 self

storage properties to third parties and 56 self storage properties

contributed to the 2024 Joint Venture during the nine months ended

September 30, 2024.

The decreases in FFO and Core FFO for the third quarter of 2024

and year-to-date were the result of a decrease in NOI of 14.5% and

12.4%, respectively, which were partially offset by a decrease in

interest expense of 8.1% and 4.8%, respectively, as compared to the

same periods in 2023. The decrease in FFO and Core FFO per share

and unit for the third quarter of 2024 and year-to-date was largely

driven by a decrease in same store NOI, partially offset by

decreased management fees paid to former PROs, reflected within

general and administrative expenses, following the internalization

of the PRO structure.

Same Store Operating Results (776 Stores)

($ in thousands, except per square foot

data)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

Change

2024

2023

Change

Total revenues

$

174,808

$

181,211

(3.5

)%

$

522,861

$

536,982

(2.6

)%

Property operating expenses

50,164

49,566

1.2

%

149,659

144,674

3.4

%

Net Operating Income (NOI)

$

124,644

$

131,645

(5.3

)%

$

373,202

$

392,308

(4.9

)%

NOI Margin

71.3

%

72.6

%

(1.3

)%

71.4

%

73.1

%

(1.7

)%

Average Occupancy

86.3

%

89.2

%

(2.9

)%

86.1

%

89.4

%

(3.3

)%

Average Annualized Rental Revenue Per

Occupied Square Foot

$

15.67

$

15.81

(0.9

)%

$

15.72

$

15.61

0.7

%

Year-over-year same store total revenues decreased 3.5% for the

third quarter of 2024 and 2.6% year-to-date as compared to the same

period in 2023. The decrease for the third quarter was driven

primarily by a 290 basis point decrease in average occupancy and a

0.9% decrease in average annualized rental revenue per occupied

square foot. The year-to-date same store total revenue decrease was

driven primarily by a 330 basis point decrease in average

occupancy, partially offset by a 0.7% increase in average

annualized rental revenue per occupied square foot. Markets which

generated above portfolio average same store total revenue growth

for the third quarter of 2024 include: San Juan, Wichita and

Portland. Markets which generated below portfolio average same

store total revenue growth for the third quarter of 2024 include:

Atlanta, Phoenix and Sarasota-Bradenton.

Year-over-year same store property operating expenses increased

1.2% for the third quarter of 2024 and 3.4% year-to-date as

compared to the same periods in 2023. The increases in the third

quarter of 2024 primarily resulted from increases in property tax

and insurance expense.

Investment Activity

During the third quarter, a joint venture between a subsidiary

of NSA and a state pension fund advised by Heitman Capital

Management, LLC (the "2023 Joint Venture") acquired 18 self storage

properties for approximately $147.9 million in two separate

transactions. The 2023 Joint Venture financed the acquisitions with

capital contributions from the venture members, of which the

Company contributed approximately $37.0 million.

On July 1, 2024, as part of the internalization of the PRO

structure, the Company paid consideration in cash and equity for

the purchase of the PRO management contracts and, in some cases,

their brand names and related intellectual property at a value of

approximately $34.6 million and to acquire certain rights with

respect to each PROs' tenant insurance programs at a value of

approximately $60.3 million. The total cash and equity

consideration for these transactions consisted of approximately

$32.6 million in cash and the issuance of 1,548,866 OP units.

Balance Sheet

On September 5, 2024, NSA issued $75.0 million of 5.40% senior

unsecured notes due September 5, 2028, $125.0 million of 5.55%

senior unsecured notes due September 5, 2031 and $150.0 million of

5.74% senior unsecured notes due September 5, 2034 in a private

placement with institutional investors. The Company used the

proceeds from the private placement to repay its $325.0 million

Tranche C term loan, which addresses all debt maturities in 2025, a

portion of the revolving line of credit and for general corporate

purposes.

Common Share Dividends

On August 15, 2024, NSA's Board of Trustees declared a quarterly

cash dividend of $0.56 per common share. The third quarter 2024

dividend was paid on September 30, 2024 to shareholders of record

as of September 13, 2024.

2024 Guidance

NSA reaffirms its previously provided Core FFO guidance

estimates and related assumptions for the year ended December 31,

2024.

Current Ranges for Full

Year 2024

Actual Results for Full Year

2023

Low

High

Core FFO per share(1)

$

2.36

$

2.44

$

2.69

Same store operations(2)

Total revenue growth

(3.75

)%

(2.25

)%

2.4

%

Property operating expenses growth

3.5

%

5.0

%

4.7

%

NOI growth

(6.5

)%

(4.5

)%

1.6

%

General and administrative expenses

General and administrative expenses

(excluding equity-based compensation), in millions

$

50.0

$

52.0

$

52.6

Equity-based compensation, in millions

$

7.75

$

8.25

$

6.7

Management fees and other revenue, in

millions

$

39.5

$

41.5

$

34.4

Core FFO from unconsolidated real estate

ventures, in millions

$

22.0

$

24.0

$

24.6

Subordinated performance unit

distributions, in millions

$

21.6

$

21.6

$

49.0

Acquisitions of self storage properties,

in millions

$

100.0

$

300.0

$

229.5

Current Ranges for Full

Year 2024

Low

High

Earnings per share - diluted

$

1.10

$

1.17

Impact of the difference in weighted

average number of shares and GAAP accounting for noncontrolling

interests, two-class method and treasury stock method

0.18

0.11

Add real estate depreciation and

amortization

1.45

1.49

Add (subtract) equity in losses (earnings)

of unconsolidated real estate ventures

0.11

0.13

Add NSA's share of FFO of unconsolidated

real estate ventures

0.17

0.19

FFO attributable to subordinated

unitholders

(0.17

)

(0.17

)

Less gain on sale of self storage

properties

(0.50

)

(0.50

)

Add integration and executive severance

costs

0.01

0.01

Add acquisition costs and NSA's share of

unconsolidated real estate venture acquisition costs

0.01

0.01

Core FFO per share and unit

$

2.36

$

2.44

(1) The table above provides a

reconciliation of the range of estimated earnings per share -

diluted to estimated Core FFO per share and unit.

(2) 2024 guidance reflects NSA's 2024 same

store pool comprising 776 stores. 2023 actual results reflect NSA's

2023 same store pool comprising 724 stores.

Supplemental Financial Information

The full text of this earnings release and supplemental

financial information, including certain financial information

referenced in this release, are available on NSA's website at

https://ir.nsastorage.com and as exhibit 99.1 to the Company's Form

8-K furnished to the SEC on October 30, 2024.

Non-GAAP Financial Measures & Glossary

This press release contains certain non-GAAP financial measures.

These non-GAAP measures are presented because NSA's management

believes these measures help investors understand NSA's business,

performance and ability to earn and distribute cash to its

shareholders by providing perspectives not immediately apparent

from net income (loss). These measures are also frequently used by

securities analysts, investors and other interested parties. The

presentations of FFO, Core FFO and NOI in this press release are

not intended to be considered in isolation or as a substitute for,

or superior to, the financial information prepared and presented in

accordance with GAAP. In addition, NSA's method of calculating

these measures may be different from methods used by other

companies, and, accordingly, may not be comparable to similar

measures as calculated by other companies that do not use the same

methodology as NSA. These measures, and other words and phrases

used herein, are defined in the Glossary in the supplemental

financial information and, where appropriate, reconciliations of

these measures and other non-GAAP financial measures to their most

directly comparable GAAP measures are included in the Schedules to

this press release and in the supplemental financial

information.

Quarterly Teleconference and Webcast

The Company will host a conference call at 1:00 pm Eastern

Daylight Time on Thursday, October 31, 2024 to discuss its third

quarter 2024 financial results. At the conclusion of the call,

management will accept questions from certified financial analysts.

All other participants are encouraged to listen to a webcast of the

call by accessing the link found on the Company's website at

www.nsastorage.com.

Conference Call and Webcast:

Date/Time: Thursday, October 31, 2024, 1:00 pm EDT

Webcast available at: www.nsastorage.com

Domestic (Toll Free US & Canada): 877.407.9711

International: 412.902.1014

A replay of the webcast will be available for 30 days on NSA's

website at www.nsastorage.com.

Upcoming Industry Conference

NSA management is scheduled to participate in the upcoming

Nareit REITworld 2024 Annual Conference on November 18 – 20, 2024

in Las Vegas, Nevada, and the Jefferies Real Estate Conference on

December 10 – 11, 2024 in Miami Beach, Florida.

About National Storage Affiliates Trust

National Storage Affiliates Trust is a real estate investment

trust headquartered in Greenwood Village, Colorado, focused on the

ownership, operation and acquisition of self storage properties

predominantly located within the top 100 metropolitan statistical

areas throughout the United States. As of September 30, 2024, the

Company held ownership interests in and operated 1,070 self storage

properties located in 42 states and Puerto Rico with approximately

70.0 million rentable square feet. NSA is one of the largest owners

and operators of self storage properties among public and private

companies in the United States. For more information, please visit

the Company’s website at www.nsastorage.com. NSA is included in the MSCI US

REIT Index (RMS/RMZ), the Russell 1000 Index of Companies and the

S&P MidCap 400 Index.

NOTE REGARDING FORWARD LOOKING

STATEMENTS

Certain statements contained in this press release constitute

forward-looking statements as such term is defined in Section 27A

of the Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and such statements

are intended to be covered by the safe harbor provided by the same.

Forward-looking statements are subject to substantial risks and

uncertainties, many of which are difficult to predict and are

generally beyond the Company's control. These forward-looking

statements include information about possible or assumed future

results of the Company's business, financial condition, liquidity,

results of operations, plans and objectives. Changes in any

circumstances may cause the Company's actual results to differ

significantly from those expressed in any forward-looking

statement. When used in this release, the words "believe,"

"expect," "anticipate," "estimate," "plan," "continue," "intend,"

"should," "may" or similar expressions are intended to identify

forward-looking statements. Statements regarding the following

subjects, among others, may be forward-looking: market trends in

the Company's industry, interest rates, inflation, the debt and

lending markets or the general economy; the Company's business and

investment strategy; the acquisition of properties, including those

under contract and the Company's ability to execute on its

acquisition pipeline; the timing of acquisitions under contract;

and the Company's guidance estimates for the year ended December

31, 2024. For a further list and description of such risks and

uncertainties, see the Company's most recent Annual Report on Form

10-K and subsequent Quarterly Reports on Form 10-Q and Current

Reports on Form 8-K filed with the Securities and Exchange

Commission, and the other documents filed by the Company with the

Securities and Exchange Commission. The forward-looking statements,

and other risks, uncertainties and factors are based on the

Company's beliefs, assumptions and expectations of its future

performance, taking into account all information currently

available to the Company. Forward-looking statements are not

predictions of future events. The Company disclaims any intention

or obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise,

except as required by law.

National Storage Affiliates

Trust Consolidated Statements of Operations (in thousands,

except per share amounts) (unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

REVENUE

Rental revenue

$

174,467

$

201,833

$

529,218

$

595,273

Other property-related revenue

7,405

7,764

20,654

22,184

Management fees and other revenue

11,749

9,550

30,345

25,194

Total revenue

193,621

219,147

580,217

642,651

OPERATING EXPENSES

Property operating expenses

52,712

58,581

159,607

172,158

General and administrative expenses

13,114

15,100

44,977

44,325

Depreciation and amortization

47,661

55,842

141,702

168,005

Other

3,643

4,138

10,510

8,531

Total operating expenses

117,130

133,661

356,796

393,019

OTHER INCOME (EXPENSE)

Interest expense

(39,575

)

(43,065

)

(114,920

)

(120,706

)

Loss on early extinguishment of debt

(323

)

—

(323

)

(758

)

Equity in (losses) earnings of

unconsolidated real estate ventures

(4,712

)

1,930

(10,791

)

5,469

Acquisition and integration costs

(1,164

)

(341

)

(2,151

)

(1,424

)

Non-operating (expense) income

(83

)

(24

)

352

(426

)

Gain on sale of self storage

properties

—

—

63,841

—

Other expense, net

(45,857

)

(41,500

)

(63,992

)

(117,845

)

Income before income taxes

30,634

43,986

159,429

131,787

Income tax expense

(863

)

(922

)

(2,290

)

(2,855

)

Net income

29,771

43,064

157,139

128,932

Net income attributable to noncontrolling

interests

(11,070

)

(13,827

)

(62,349

)

(41,290

)

Net income attributable to National

Storage Affiliates Trust

18,701

29,237

94,790

87,642

Distributions to preferred

shareholders

(5,112

)

(5,110

)

(15,332

)

(13,908

)

Net income attributable to common

shareholders

$

13,589

$

24,127

$

79,458

$

73,734

Earnings per share - basic

$

0.18

$

0.28

$

1.03

$

0.83

Earnings per share - diluted

$

0.18

$

0.26

$

1.03

$

0.77

Weighted average shares outstanding -

basic

75,760

87,004

77,047

88,263

Weighted average shares outstanding -

diluted

75,760

146,118

77,047

147,610

National Storage Affiliates

Trust Consolidated Balance Sheets (dollars in thousands, except

per share amounts) (unaudited)

September 30,

December 31,

2024

2023

ASSETS

Real estate

Self storage properties

$

5,821,364

$

5,792,174

Less accumulated depreciation

(1,006,543

)

(874,359

)

Self storage properties, net

4,814,821

4,917,815

Cash and cash equivalents

69,886

64,980

Restricted cash

8,539

22,713

Debt issuance costs, net

6,343

8,442

Investment in unconsolidated real estate

ventures

257,381

211,361

Other assets, net

211,176

134,002

Assets held for sale, net

—

550,199

Operating lease right-of-use assets

21,515

22,299

Total assets

$

5,389,661

$

5,931,811

LIABILITIES AND EQUITY

Liabilities

Debt financing

$

3,428,304

$

3,658,205

Accounts payable and accrued

liabilities

108,424

92,766

Interest rate swap liabilities

7,774

3,450

Operating lease liabilities

23,493

24,195

Deferred revenue

20,778

27,354

Total liabilities

3,588,773

3,805,970

Equity

Preferred shares of beneficial interest,

par value $0.01 per share. 50,000,000 authorized, 14,692,381 and

14,685,716 issued (in series) and outstanding at September 30, 2024

and December 31, 2023, respectively, at liquidation preference

340,818

340,651

Common shares of beneficial interest, par

value $0.01 per share. 250,000,000 shares authorized, 76,216,680

and 82,285,995 shares issued and outstanding at September 30, 2024

and December 31, 2023, respectively

762

823

Additional paid-in capital

1,124,533

1,509,563

Distributions in excess of earnings

(498,787

)

(449,907

)

Accumulated other comprehensive income

19,543

21,058

Total shareholders' equity

986,869

1,422,188

Noncontrolling interests

814,019

703,653

Total equity

1,800,888

2,125,841

Total liabilities and equity

$

5,389,661

$

5,931,811

Reconciliation of Net Income to FFO and

Core FFO

(in thousands, except per share and unit

amounts) (unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income

$

29,771

$

43,064

$

157,139

$

128,932

Add (subtract):

Real estate depreciation and

amortization

47,286

55,528

140,588

167,078

Equity in losses (earnings) of

unconsolidated real estate ventures

4,712

(1,930

)

10,791

(5,469

)

Company's share of FFO in unconsolidated

real estate ventures

6,164

6,217

18,026

18,542

Gain on sale of self storage

properties

—

—

(63,841

)

—

Distributions to preferred shareholders

and unitholders

(5,568

)

(5,393

)

(16,704

)

(14,758

)

FFO attributable to subordinated

performance units(1)

—

(12,068

)

(21,622

)

(36,164

)

FFO attributable to common

shareholders, OP unitholders, and LTIP unitholders

82,365

85,418

224,377

258,161

Add (subtract):

Acquisition costs

287

341

1,274

1,424

Integration and executive severance

costs(2)

907

—

1,534

—

Casualty-related recoveries(3)

—

—

—

(522

)

Loss on early extinguishment of debt

323

—

323

758

Core FFO attributable to common

shareholders, OP unitholders, and LTIP unitholders

$

83,882

$

85,759

$

227,508

$

259,821

Weighted average shares and units

outstanding - FFO and Core FFO:(4)

Weighted average shares outstanding -

basic

75,760

87,004

77,047

88,263

Weighted average restricted common shares

outstanding

19

25

21

26

Weighted average OP units outstanding

52,740

38,030

42,709

38,504

Weighted average DownREIT OP unit

equivalents outstanding

5,769

2,120

3,346

2,120

Weighted average LTIP units

outstanding

663

562

676

545

Total weighted average shares and units

outstanding - FFO and Core FFO

134,951

127,741

123,799

129,458

FFO per share and unit

$

0.61

$

0.67

$

1.81

$

1.99

Core FFO per share and unit

$

0.62

$

0.67

$

1.84

$

2.01

(1)

Amounts represent distributions declared

for subordinated performance unitholders and DownREIT subordinated

performance unitholders for the periods presented.

(2)

Integration costs relate to expenses

incurred as a part of the internalization of the PRO structure.

Executive severance costs are recorded within the line items

"General and administrative expenses" and "Non-operating (expense)

income" in our consolidated statements of operations.

(3)

Casualty-related recoveries relate to

casualty-related expenses incurred during 2022 and are recorded in

the line item "Other" within operating expenses in our consolidated

statements of operations.

(4)

NSA combines OP units and DownREIT OP

units with common shares because, after the applicable lock-out

periods, OP units in the Company's operating partnership are

redeemable for cash or, at NSA's option, exchangeable for common

shares on a one-for-one basis and DownREIT OP units are also

redeemable for cash or, at NSA's option, exchangeable for OP units

in the Company's operating partnership on a one-for-one basis,

subject to certain adjustments in each case. LTIP units may also,

under certain circumstances, be convertible into or exchangeable

for common shares (or other units that are convertible into or

exchangeable for common shares). All subordinated performance units

and DownREIT subordinated performance units were converted into OP

units on July 1, 2024, in connection with the internalization of

the PRO structure. See footnote(5) for additional discussion of

subordinated performance units, DownREIT subordinated performance

units, and LTIP units in the calculation of FFO and Core FFO per

share and unit.

Reconciliation of Earnings Per Share -

Diluted to FFO and Core FFO Per Share and Unit

(in thousands, except per share and unit

amounts) (unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Earnings per share - diluted

$

0.18

$

0.26

$

1.03

$

0.77

Impact of the difference in weighted

average number of shares(5)

(0.08

)

0.04

(0.39

)

0.11

Impact of GAAP accounting for

noncontrolling interests, two-class method and treasury stock

method(6)

0.08

—

0.49

—

Add real estate depreciation and

amortization

0.35

0.44

1.14

1.29

Add (subtract) equity in losses (earnings)

of unconsolidated real estate ventures

0.03

(0.02

)

0.08

(0.04

)

Add Company's share of FFO in

unconsolidated real estate ventures

0.05

0.05

0.15

0.14

Subtract gain on sale of self storage

properties

—

—

(0.52

)

—

FFO attributable to subordinated

performance unitholders

—

(0.10

)

(0.17

)

(0.28

)

FFO per share and unit

0.61

0.67

1.81

1.99

Add acquisition costs

—

—

0.01

0.01

Add integration and executive severance

costs

0.01

—

0.02

—

Add loss on early extinguishment of

debt

—

—

—

0.01

Core FFO per share and unit

$

0.62

$

0.67

$

1.84

$

2.01

(5)

Adjustment accounts for the difference

between the weighted average number of shares used to calculate

diluted earnings per share and the weighted average number of

shares used to calculate FFO and Core FFO per share and unit.

Diluted earnings per share is calculated using the two-class method

for the company's restricted common shares and the treasury stock

method for certain unvested LTIP units, and assumes the conversion

of vested LTIP units into OP units on a one-for-one basis and the

hypothetical conversion of subordinated performance units, and

DownREIT subordinated performance units into OP units, even though

such units may only be convertible into OP units (i) after a

lock-out period and (ii) upon certain events or conditions. All

outstanding subordinated performance units and DownREIT

subordinated performance units were converted into OP units on July

1, 2024, in connection with the internalization of the PRO

structure. The computation of weighted average shares and units for

FFO and Core FFO per share and unit includes all restricted common

shares and LTIP units that participate in distributions and

excludes all subordinated performance units and DownREIT

subordinated performance units because their effect has been

accounted for through the allocation of FFO to the related

unitholders based on distributions declared.

(6)

Represents the effect of adjusting the

numerator to consolidated net income prior to GAAP allocations for

noncontrolling interests, after deducting preferred share and unit

distributions, and before the application of the two-class method

and treasury stock method, as described in footnote(5).

Net Operating Income

(dollars in thousands) (unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income

$

29,771

$

43,064

$

157,139

$

128,932

(Subtract) add:

Management fees and other revenue

(11,749

)

(9,550

)

(30,345

)

(25,194

)

General and administrative expenses

13,114

15,100

44,977

44,325

Other

3,643

4,138

10,510

8,531

Depreciation and amortization

47,661

55,842

141,702

168,005

Interest expense

39,575

43,065

114,920

120,706

Equity in losses (earnings) of

unconsolidated real estate ventures

4,712

(1,930

)

10,791

(5,469

)

Loss on early extinguishment of debt

323

—

323

758

Acquisition and integration costs

1,164

341

2,151

1,424

Income tax expense

863

922

2,290

2,855

Gain on sale of self storage

properties

—

—

(63,841

)

—

Non-operating expense (income)

83

24

(352

)

426

Net Operating Income

$

129,160

$

151,016

$

390,265

$

445,299

EBITDA and Adjusted EBITDA (dollars

in thousands) (unaudited)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Net income

$

29,771

$

43,064

$

157,139

$

128,932

Add:

Depreciation and amortization

47,661

55,842

141,702

168,005

Company's share of unconsolidated real

estate ventures depreciation and amortization

5,418

4,287

15,110

13,073

Interest expense

39,575

43,065

114,920

120,706

Income tax expense

863

922

2,290

2,855

Loss on early extinguishment of debt

323

—

323

758

EBITDA

123,611

147,180

431,484

434,329

Add (subtract):

Acquisition costs

287

341

1,274

1,424

Effect of hypothetical liquidation at book

value (HLBV) accounting for unconsolidated 2024 Joint

Venture(1)

5,458

—

13,707

—

Gain on sale of self storage

properties

—

—

(63,841

)

—

Integration and executive severance costs,

excluding equity-based compensation(2)

877

—

1,100

—

Casualty-related recoveries(3)

—

—

—

(522

)

Equity-based compensation expense

1,911

1,702

6,097

5,028

Adjusted EBITDA

$

132,144

$

149,223

$

389,821

$

440,259

(1)

Reflects the non-cash impact of applying

HLBV to the 2024 Joint Venture, which allocates GAAP income (loss)

on a hypothetical liquidation of the underlying joint venture at

book value as of the reporting date.

(2)

Integration costs relate to expenses

incurred as a part of the internalization of the PRO structure.

Executive severance costs are recorded within the line items

"General and administrative expenses" and "Non-operating (expense)

income" in our consolidated statements of operations.

(3)

Casualty-related recoveries relate to

casualty-related expenses incurred during 2022 and are recorded in

the line item "Other" within operating expenses in our consolidated

statements of operations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241030797986/en/

National Storage Affiliates Trust

Investor/Media Relations

George Hoglund, CFA Vice President - Investor Relations

720.630.2160 ghoglund@nsareit.net

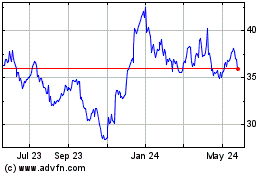

National Storage Affilia... (NYSE:NSA)

Historical Stock Chart

From Nov 2024 to Dec 2024

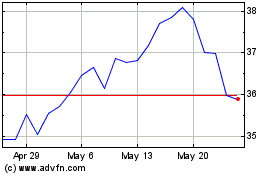

National Storage Affilia... (NYSE:NSA)

Historical Stock Chart

From Dec 2023 to Dec 2024