First Quarter 2024

Highlights

- 1Q 2024 Overall Invoiced Sales Amounted to €84.5 Million,

Substantially in Line With the Level of Activity of Last

Year.

- In 1Q 2024, Sales From Directly Operated Stores Were €20.5

Million, up 13.6% From 1Q 2023 and 10.0% From 1Q 2022, Confirming

Our Focus on Strengthening Direct Retail. In North America, DOS

Sales Grew 29.8% From 1Q 2023 and 32.4% From 1Q 2022, Highlighting

Our Commitment to Regional Retail Growth, Especially for Natuzzi

Italia.

- Improved 1Q 2024 Gross Margin at 36.9%, Compared to 35.6% in

1Q 2023, 34.3% in 1Q 2022 and 30.1% Versus the Pre-COVID Level of

1Q 2019.

- 1Q 2024 Operating Profit of €0.6 Million Compared to an

Operating Loss of (€0.9) Million in 1Q 2023 and (€3.0) Million

Versus the Pre-COVID Level of 1Q 2019.

- Net Finance Costs of (€2.2) Million, Compared to Net Finance

Costs of (€3.4) Million in 1Q 2023. Finance Costs Negatively

Affected by Persisting High Interest Rates.

- In 1Q 2024 We Continued Our Restructuring With a Reduction

of 94 Headcount as Part of Our Long-Term Transformation Process to

Increase Competitiveness and Enhance Margin Generation. Total

Headcount Reduced by ~18% Compared to 2021.

- In 1Q 2024 We Invested €1.6 Million in Capex of Which €0.4

Million in DOS Located in the US and €1.2 Million Mainly to Upgrade

Our Italian Factories.

- As of March 31, 2024, We Held €29.7 Million in

Cash.

- The Market Remains Challenging, Delaying the Full Impact of

Our Retail Expansion. We Remain Focused on Adapting Our Fixed Cost

Structure as Part of Our Long-Term Transformation.

Natuzzi S.p.A. (NYSE: NTZ) (“we”, “Natuzzi” or the “Company”

and, together with its subsidiaries, the “Group”), one of the most

renowned brands in the production and distribution of design and

luxury furniture, today reported its unaudited financial

information for the first quarter ended March 31, 2024.

Pasquale Natuzzi, Chairman of the Group, commented: “Our

business is still confronting difficult market conditions alongside

cautious customer behavior. Persistent high interest rates are

postponing the housing market recovery, which remains a primary

driver for new demand of furnishing.

In this market context, our team is efficiently allocating

resources and tightly managing discretionary expenses. Our primary

objective remains leveraging our brand strength to regain growth

and execute our mid-term plan. We continue investing in the quality

of our collections, in coherence with the DNA of our Brand, that

blends design, functions, materials and colors to create harmonious

living. The recent endorsement of our CEO and Board of Directors

provides the competences and stability needed to navigate these

challenging times. I am confident that our combined efforts will

drive us towards achieving our mid-term growth objectives and

enhancing the efficiency of our operating model.

Antonio Achille, CEO of the Group, commented: “We remain

steadfast in the execution of the 8 key pillars of our mid-term

value creation strategy:

1) Expand margins and lower Break-Even Point: Since 1Q

2019, we improved gross margin by ~7 p.p. Last year, despite a drop

of business of 29.9%, gross margin decreased only by 0.7 p.p., a

proof of the improvement we achieved on our operating model. We

improved gross margin despite hyperinflation of raw materials and

low saturation of our plants, which resulted in a higher impact of

indirect production costs. Without these non-structural negative

effects, the improvement in gross margin would have been even

greater. This process continued in the first quarter of 2024,

achieving a gross margin of 36.9%, up from 35.6% in 1Q 2023, 34.3%

in 1Q 2022. We remain focused on reducing fixed costs and improving

our margin/sales conversion to prepare our operating model to

deliver substantial value once the market and consumer behavior

normalize.

2) Leverage and nurture the strength of our Brand: As per

April 2024 survey by an independent market research company,

Natuzzi enjoys a substantial brands awareness both spontaneous and

aided. Specifically:

- US: Natuzzi is the 1st brand among European brands;

- China: Natuzzi is the 1st brand among European brands;

- UK: Natuzzi is the 1st European brand in the premium

segment.

We are prioritizing marketing investments, including digital

strategies, to leverage our brand strengths to increase foot

traffic to our own stores and those of our partners. Additionally,

we are expanding our Trade and Contract division globally,

leveraging our brand awareness and design expertise to capitalize

on opportunities with designers and real estate developers.

3) Retail first, focusing on Natuzzi Italia. Sales from

our directly operated stores (DOS) grew by 13.6% in the quarter,

led by US. The share of sales from our retail operations (DOS and

Franchising) has steadily increased, rising from 41.4% in 1Q 2019

to 66.4% in 1Q 2024. We continue investing to improve our retail.

At the recent Milan Design Week in April, we unveiled an evolved

concept for the Natuzzi Italia store. This new retail format is a

key element of our retail strategy, which aims to accelerate

organic growth by providing an immersive customer experience. This

updated store concept is set to become the standard for our 236

Natuzzi Italia stores worldwide and of course for our future

expansion. Expansion of Natuzzi Italia stores in the US remains

central to our growth strategy.

4) Re-imagined Gallery to elevate the relationship with

Wholesale. Wholesale branded today is ~35% of our business. A

key aspect of our strategy is the upgrade of our 'gallery' format.

We launched a “reimagined gallery format”: an enhanced

store-in-store concept, where we meticulously curated merchandising

to deliver an immersive brand experience. The “Re-imagined Gallery

Concept” will be used now to standardize and evolve our Natuzzi

brand gallery distribution model within multi-brand retail store

environments. We have already signed 29 gallery agreements in North

America and another 92 in the rest of the world.

5) Collection with enhanced Brand’s DNA: Milan Design

Week marked a step acceleration in term of new collection launch

for Natuzzi Italia. New collections have been well received by

dealers and the market. The new collections emphasized elements

core to the DNA of Natuzzi, such as its iconic style, combined with

unique and modern comfort. To define this, we created the word

'COMFORTNESS,' to signify its delivery of physical and mental

well-being. These new collections will begin appearing in our

stores worldwide in the coming weeks, significantly enhancing the

customer experience and, we are confident, contributing to support

sales.

6) Focus on Core Markets: While we operate in over 100

markets, leveraging the global reach of our brands, our future

development and investments will focus on three core geographies:

US, China, Europe (Italy, Spain, UK).

- US: there are 29 Natuzzi stores, of which 18 DOS and 3 stores

managed in joint venture with a local partner, as well almost 100

galleries. We consider US one of our highest priorities and a

significant opportunity, given that it's where the Company is

listed and where our business model has evolved.

- China: there are 345 Natuzzi stores, of which 21 operated

directly by our joint venture. We do not consolidate our China

stores as they are part of our 49% stake in the joint venture we

established in 2018. We are making substantial investments to align

the JV team with our modern retail strategy and to provide detailed

visibility into the JV's performance within our IT systems. This

enables us to support the local JV team in improving performance

through strategic decisions in store layout, merchandising,

branding, and customer experience.

- Europe. While concentrating on our three largest markets (UK,

Italy and Spain), we are also reintroducing ourselves to markets

such as Germany, where the Company previously experienced

significant growth. We have recently signed an agreement with KHG

Group for a first wave of at least 22 galleries that will be opened

in the next future.

7) Modernize our factories and execute our restructuring.

We continue to execute the staff restructuring, in compliance with

our ethics standards and with the labor regulations of the

different markets which are particularly restrictive in some

geographic areas in which we operate, chiefly in Italy.

8) Free up non-strategic resources to reinvest in retail and

restructuring. We are actively pursuing the sale of non-core

assets to support our long-term strategic goals: Retail expansion

and accelerated restructuring. Specifically, we are working to

divest from non-strategic assets, such as our property in High

Point, a tannery in northern Italy, and several other minor assets,

including a land in Romania.

***

1Q 2024 CONSOLIDATED REVENUE

1Q 2024 consolidated revenue amounted to €84.5 million, compared

to €86.1 million in 1Q 2023. 1Q 2024 continued to be affected by

the persisting macroeconomic and industry-specific challenges,

resulting in a reduced consumers’ spending capacity and

postponement of durable purchases.

Excluding “other sales” of €2.1 million, 1Q 2024 invoiced sales

from upholstered and other home furnishings products amounted to

€82.4 million, compared to €84.0 million in 1Q 2023.

Revenues from upholstered and other home furnishings products

are hereafter described according to the main dimensions of the

Group’s business:

- A: Branded/Unbranded Business

- B: Key Markets

- C: Distribution

A. BRANDED/UNBRANDED BUSINESS

The Group operates in the branded business (with Natuzzi Italia,

Natuzzi Editions and Divani&Divani by Natuzzi) and unbranded

business, the latter with collections dedicated to large-scale

distribution.

A1. Branded business. Within the branded business,

Natuzzi is pursuing a dual-brand strategy:

i) Natuzzi Italia, our

luxury furniture brand, offers products entirely designed and

manufactured in Italy and targets an affluent and more

sophisticated global consumer with a highly inspirational

collection that is largely the same across all our global stores to

best represent our Brand. Natuzzi Italia products are almost

exclusively sold in mono-brand stores (directly operated or

franchises).

ii) Natuzzi Editions, our

contemporary collection, offers products entirely designed in Italy

and produced in different plants strategically located to best

serve individual markets (mainly China, Romania and Brazil).

Natuzzi Editions products are distributed in Italy under the brand

Divani&Divani by Natuzzi, which is manufactured in Italy to

shorten the lead time to serve the Italian market where the brand

is distributed. The store merchandising of Natuzzi Editions,

starting from a common collection, is tailored to best fit the

opportunities of each market. The Natuzzi Editions products are

sold primarily through galleries and selected mono-brand franchise

stores.

In 1Q 2024, Natuzzi’s branded invoiced sales amounted to €76.0

million, compared to €77.5 million in 1Q 2023. In the context of

deteriorated consumer spending and postponement of durable

purchase, Natuzzi Italia continues to be affected strongly given

its premium positioning relatively to Natuzzi Editions.

The following is the contribution of each Brand to 1Q 2024

invoiced sales:

- Natuzzi Italia invoiced sales amounted to €29.5 million,

compared to €31.6 million in 1Q 2023.

- Natuzzi Editions invoiced sales (including invoiced

sales from Divani&Divani by Natuzzi) amounted to €46.5 million,

compared to €45.9 million in 1Q 2023.

A2. Unbranded business. Invoiced sales from our unbranded

business amounted to €6.4 million in 1Q 2024, compared to €6.5

million in 1Q 2023. The Company’s strategy is to focus on selected

large accounts and serve them with a more efficient go-to-market

model.

B. KEY MARKETS

Below is a breakdown of 1Q 2024 upholstery and home-furnishings

invoiced sales compared to 1Q 2023, according to the following

geographic areas.

1Q 2024

1Q 2023

Delta €

Delta %

North America

24.0

23.3

0.7

2.8%

Greater China

5.8

4.4

1.4

31.3%

West & South Europe

28.8

32.4

(3.6)

(11.1%)

Emerging Markets

12.7

13.2

(0.5)

(3.4%)

Rest of the World*

11.1

10.7

0.4

3.8%

Total

82.4

84.0

(1.6)

(1.9%)

Figures in €/million, except

percentage.

*Include South and Central America, Rest

of APAC.

In North America the increase in sales from the retail part of

the business has more than offset the weak performance in the

wholesale branded channel, as distributors continue to be focused

on reducing their stock rather than placing new orders.

In Greater China, although revenue has increased compared to 1Q

2023, the furniture industry and real estate markets continue to

encounter significant challenges. Enhanced coordination efforts

within our joint venture have been instrumental in reducing the

inventory of Natuzzi Italia products accumulated during 2022.

Concurrently, the JV is realigning the organization’s scale and

capabilities to better reflect recent business trends.

As anticipated, we are placing renewed emphasis on the wholesale

segment of our business, which remain a strategic channel in

several geographies including US and Europe. To support this, we

are introducing a re-imagined gallery concept, which provides a

practical setting for sales associates to engage with clients,

narrate the captivating Natuzzi story, showcase our collections,

and support sales.

C. DISTRIBUTION

During the first three months 2024, the Group distributed its

branded collections in 89 countries, according to the following

table.

Direct Retail

FOS

Total retail stores

(March. 31, 2024)

North America

21(1)

9

30

West & South Europe

32

101

133

Greater China

21(2)

324

345

Emerging Markets

─

76

76

Rest of the World

4

88

92

Total

78

598

676

(1) Included 3 DOS in the U.S. managed in

joint venture with a local partner. As the Natuzzi Group does not

exert full control in each of these DOS, we consolidate only the

sell-in from such DOS.

(2) All directly operated by our joint

venture in China. As the Natuzzi Group owns a 49% stake in the

joint venture and does not control it, we consolidate only the

sell-in from such DOS.

FOS = Franchise stores managed by

independent partners.

The Group also sells its branded products by means of

approximately 600 points of sales located in five continents,

encompassing mostly shop-in-shop galleries (including 12 Natuzzi

Concessions, i.e., store-in-store points of sale directly managed

by the Mexican subsidiary of the Group).

During 1Q 2024, Group’s invoiced sales from direct retail,

DOS and Concessions directly operated by the Group, amounted

to €20.5 million, compared to €18.0 million in 1Q 2023. In an

effort to continuously improve the productivity of our DOS, we

closed the tail of 2 nonperforming DOS, namely in Switzerland

(Zurich) and Spain (Tres Aguas).

In 1Q 2024, invoiced sales from franchise stores (FOS)

amounted to €34.2 million, compared to €33.8 million in 1Q

2023.

We continue executing our strategy to evolve into a

Brand/Retailer and improve the quality of our distribution network.

The weight of the invoiced sales generated by the retail network

(Direct retail and Franchise Operated Stores) on total upholstered

and home furnishings business in 1Q 2024 was 66.4% compared to

61.7% in 1Q 2023.

The Group also sells its products through the wholesale

channel, consisting primarily of Natuzzi-branded galleries in

multi-brand stores, as well as mass distributors selling unbranded

products. During 1Q 2024, invoiced sales from the wholesale channel

amounted to €27.7 million, compared to €32.2 million in 1Q

2023.

1Q 2024 GROSS MARGIN

During 1Q 2024, we had a gross margin of 36.9%, compared to

35.6% in 1Q 2023, for a total improvement of 1.4 p.p.

The increase in gross margin was primarily driven by enhanced

efficiency in material consumption during the manufacturing

process, successful renegotiation of supplier terms, and a general

decline in raw material costs. Additionally, we benefited from

reduced industrial costs, improved channel mix, and disciplined

cost control measures.

In 1Q 2024, labor costs rose by €0.3 million compared to 1Q

2023. This includes a €1.3 million increase at our Italian

industrial facilities, largely due to the renegotiation of national

collective bargaining agreements. This increase was partially

offset by cost savings from headcount reductions implemented in

2023 at our plants in China and Romania. Additionally, 1Q 2024

labor costs include a €0.1 million accrual (or 0.2% of revenue)

related to our workforce reduction program at the Italian

operations.

We intend to find further sources of efficiency, as the increase

in the Group’s flexibility to enhance gross margin remains among

our top priorities.

1Q 2024 OPERATING EXPENSES

During 1Q 2024, operating expenses, which encompass selling

expenses, administrative expenses, other operating income/expenses,

and the impairment of trade receivables, totaled (€30.6) million,

or 36.2% of revenue, compared to (€31.5) million, or 36.6% of

revenue, in 1Q 2023.

Key drivers included a €1.8 million reduction in transportation

costs due to lower transportation rates and renegotiated carrier

terms. This reduction was partially offset by the increase of €0.4

million in marketing expenses, €0.2 million in utility costs and

€0.2 million increase in amortization expenses both related to new

store openings in 2023, and a €0.1 million increase for ERP system

upgrades.

Looking ahead, the Company remains committed to further reducing

selling and administrative expenses in 2024. Strategies include

renegotiating supplier contracts, optimizing staff allocation at

headquarters and retail levels, and refining overall processes to

enhance efficiency.

1Q 2024 NET FINANCE INCOME/(COSTS)

During 1Q 2024, the Company accounted for (€2.2) million of Net

Finance costs compared to Net Finance costs of (€3.4) million in 1Q

2023. Persisting high interest rates continue to adversely impact

our results principally in terms of increased interest expenses of

rental contracts as well as third-party financing, while in 2024 we

were not impacted by adverse exchange rate.

BALANCE SHEET AND CASH FLOW

During the first three months of 2024, (€5.2) million of net

cash were used by operating activities as a result of:

- a loss for the period of (€1.8) million.

- adjustments for non-monetary items of €7.5 million, of which

depreciation and amortization of €5.2 million.

- (€8.7) million from working capital change, mainly as a result

of (€0.5) million from increased inventory level, (€7.1) million

from increased trade receivables and other assets, and (€1.0)

million for payments connected to the reduction in workforce,

partially offset by €0.2 million from increased trade payables and

other liabilities.

- interest and taxes paid for (€2.2) million.

During the first three months of 2024, (€1.5) million of cash

were used in net capital expenditure.

In the same period, €1.3 million of cash were provided by

financing activities, as a result of €3.0 million from a new

long-term borrowing granted by an Italian financial institution,

€1.8 million from a higher utilization of credit facilities under

bank overdrafts and short-term borrowings, partially offset by the

repayment of long-term borrowings for (€1.1) million and (€2.4)

million for lease-related payments.

As a result, as of March 31, 2024, cash and cash equivalents was

€29.7 million.

As of March 31, 2024, we had a net financial position before

lease liabilities (cash and cash equivalents minus long-term

borrowings minus bank overdraft and short-term borrowings minus

current portion of long-term borrowings) of (€17.9) million,

compared to (€6.6) million as of December 31, 2023.

*******

CONFERENCE CALL

The Company will host a conference call on Monday June 24,

2024, at 10:00 a.m. U.S. Eastern time (4.00 p.m. Italy time, or

3.00 p.m. UK time) to discuss financial information.

To join live the conference call, interested persons will need

to either:

- dial-in the following number: Toll/International: +

1-412-717-9633, then passcode 39252103#, or

- click on the following link:

https://www.c-meeting.com/web3/join/3PQUFXRW48XTKQ to join via

video. Participants also have option to listen via phone after

registering to the link.

*******

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statement of profit or loss for the first quarter of 2024 and 2023

on the basis of IFRS-IAS (expressed in millions Euro, except as

otherwise indicated)

First quarter ended on

Change Percentage of revenue

31-Mar-24 31-Mar-23 %

31-Mar-24 31-Mar-23 Revenue

84.5

86.1

-1.8

%

100.0

%

100.0

%

Cost of Sales

(53.3

)

(55.4

)

-3.9

%

-63.1

%

-64.4

%

Gross profit

31.2

30.6

1.9

%

36.9

%

35.6

%

Other income

1.2

1.3

1.4

%

1.5

%

Selling expenses

(23.2

)

(23.8

)

-2.4

%

-27.5

%

-27.7

%

Administrative expenses

(8.5

)

(8.9

)

-4.4

%

-10.0

%

-10.3

%

Impairment on trade receivables

0.0

(0.0

)

0.0

%

-0.1

%

Other expenses

(0.1

)

(0.1

)

-0.1

%

-0.1

%

Operating profit/(loss)

0.6

(0.9

)

0.7

%

-1.0

%

Finance income

0.2

0.1

0.2

%

0.1

%

Finance costs

(2.6

)

(2.1

)

-3.1

%

-2.4

%

Net exchange rate gains/(losses)

0.2

(1.4

)

0.3

%

-1.7

%

Net finance income/(costs)

(2.2

)

(3.4

)

-2.6

%

-4.0

%

Share of profit/(loss) of equity-method investees

(0.2

)

1.1

-0.2

%

1.3

%

Profit/(Loss) before tax

(1.8

)

(3.2

)

-2.1

%

-3.7

%

Income tax expense/(benefit)

(0.0

)

(0.1

)

-0.1

%

-0.2

%

Profit/(Loss) for the period

(1.8

)

(3.3

)

-2.1

%

-3.9

%

Profit/(Loss) attributable to:

Owners of the Company

(1.7

)

(3.3

)

Non-controlling interests

(0.1

)

(0.1

)

Natuzzi S.p.A. and Subsidiaries

Unaudited consolidated statements of financial position

(condensed)on the basis of IFRS-IAS(Expressed in millions of

Euro)

31-Mar-24

31-Dec-23

ASSETS Non-current assets

186.3

188.6

Current assets

152.6

149.7

TOTAL ASSETS

338.9

338.3

EQUITY AND LIABILITIES

Equity attributable to Owners of the Company

67.5

68.9

Non-controlling interests

4.4

4.3

Non-current liabilities

111.8

110.4

Current liabilities

155.2

154.7

TOTAL EQUITY AND LIABILITIES

338.9

338.3

Natuzzi S.p.A. and Subsidiaries Unaudited consolidated

statements of cash flows (condensed) (Expressed in millions of

Euro)

31-Mar-24

31-Dec-23

Net cash provided by (used in) operating

activities

(5.2)

3.2

Net cash provided by (used in) investing

activities

(1.5)

(7.9)

Net cash provided by (used in) financing

activities

1.3

(15.7)

Increase (decrease) in cash and cash

equivalents

(5.4)

(20.4)

Cash and cash equivalents, beginning of the

year

31.6

52.7

Effect of movements in exchange rates on cash

held

0.3

(0.8)

Cash and cash equivalents, end of the

period

26.4

31.6

For the purpose of the statements of cash

flow, cash and cash equivalents comprise the following:

(Expressed in millions of Euro)

31-Mar-24

31-Dec-23

Cash and cash equivalents in the statement of financial position

29.7

33.6

Bank overdrafts repayable on demand

(3.3)

(2.0)

Cash and cash equivalents in the statement of cash flows

26.4

31.6

CAUTIONARY STATEMENT CONCERNING

FORWARD-LOOKING STATEMENTS Certain statements included

in this press release constitute forward-looking statements within

the meaning of the safe harbor provisions of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934, as amended. These statements may be expressed in a

variety of ways, including the use of future or present tense

language. Words such as “estimate,” “forecast,” “project,”

“anticipate,” “likely,” “target,” “expect,” “intend,” “continue,”

“seek,” “believe,” “plan,” “goal,” “could,” “should,” “would,”

“may,” “might,” “will,” “strategy,” “synergies,” “opportunities,”

“trends,” “ambition,” “objective,” “aim,” “future,” “potentially,”

“outlook” and words of similar meaning may signify forward-looking

statements. These statements involve inherent risks and

uncertainties, as well as other factors that may be beyond our

control. The Company cautions readers that a number of important

factors could cause actual results to differ materially from those

contained in any forward-looking statement. Such factors include,

but are not limited to: effects on the Group from competition with

other furniture producers, material changes in consumer demand or

preferences, significant economic developments in the Group’s

primary markets, the Group’s execution of its reorganization plans

for its manufacturing facilities, significant changes in labor,

material and other costs affecting the construction of new plants,

significant changes in the costs of principal raw materials and in

energy costs, significant exchange rate movements or changes in the

Group’s legal and regulatory environment, including developments

related to the Italian Government’s investment incentive or similar

programs, the duration, severity and geographic spread of any

public health outbreaks (including the spread of new variants of

COVID-19), consumer demand, our supply chain and the Company’s

financial condition, business operations and liquidity, the

geopolitical tensions and market uncertainties resulting from the

ongoing armed conflict between Russia and Ukraine and the

Israel-Hamas war and the inflationary environment and increases in

interest rates. The Company cautions readers that the foregoing

list of important factors is not exhaustive. When relying on

forward-looking statements to make decisions with respect to the

Company, investors and others should carefully consider the

foregoing factors and other uncertainties and events. Additional

information about potential factors that could affect the Company’s

business and financial results is included in the Company’s filings

with the U.S. Securities and Exchange Commission, including the

Company’s most recent Annual Report on Form 20-F. The Company

undertakes no obligation to update any of the forward-looking

statements after the date of this press release.

About Natuzzi S.p.A. Founded

in 1959 by Pasquale Natuzzi, Natuzzi S.p.A. is one of the most

renowned brands in the production and distribution of design and

luxury furniture. As of March 31, 2024, Natuzzi distributes its

collections worldwide through a global retail network of 676

monobrand stores and approximately 600 wholesale points of sale,

including shop-in-shop galleries and various distribution profiles.

Natuzzi products embed the finest spirit of Italian design and the

unique craftmanship details of the “Made in Italy”, where a

predominant part of its production takes place. Natuzzi has been

listed on the New York Stock Exchange since May 13, 1993. Committed

to social responsibility and environmental sustainability, Natuzzi

S.p.A. is ISO 9001 and 14001 certified (Quality and Environment),

ISO 45001 certified (Safety on the Workplace) and FSC® Chain of

Custody, CoC (FSC-C131540).

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240621058492/en/

Natuzzi Investor Relations Piero Direnzo | +39

080-8820-812 | pdirenzo@natuzzi.com

Natuzzi Corporate Communication Giancarlo Renna

(Communication Manager) | +39. 342.3412261 | grenna@natuzzi.com

Barbara Colapinto | +39 331 6654275 | bcolapinto@natuzzi.com

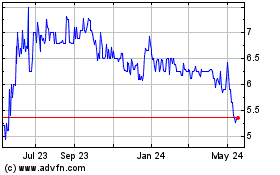

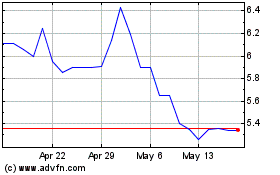

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Oct 2024 to Nov 2024

Natuzzi S P A (NYSE:NTZ)

Historical Stock Chart

From Nov 2023 to Nov 2024