SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C. 20549

FORM 6-K

Report

of Foreign Private Issuer Pursuant to Rule 13a-16 or 15d-16 of the Securities Exchange Act of 1934

For the month of July,

2023

Commission File Number 001-41129

Nu Holdings Ltd.

(Exact name of registrant as specified

in its charter)

Nu Holdings Ltd.

(Translation of Registrant's

name into English)

Campbells Corporate Services

Limited, Floor 4, Willow House, Cricket Square, KY1-9010 Grand Cayman, Cayman Islands

+1 345 949 2648

(Address of principal executive

office)

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F (X) Form 40-F

Indicate by check mark whether the registrant by furnishing

the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under the

Securities Exchange Act of 1934.

Yes No (X)

NU HOLDINGS LTD.

CNPJ/ME No. 24.410.913/0001-44

Public Company

CVM Code # 80209

NOTICE TO HOLDERS OF

DEPOSITARY RECEIPTS - BDRS LEVEL III

NU HOLDINGS LTD. (NYSE: NU, B3: NUBR33)

("Nu" or the "Company"), a publicly-held company registered with the Brazilian Securities Commission

("CVM") as a foreign issuer of class "A" securities and sponsor of the Level III Brazilian Depositary Receipts

program, each of which represents one-sixth (1/6) of a share of its class A Ordinary shares ("Class A Ordinary Shares",

"Level III BDRs" and "Level III BDR Program"), in continuity of the Material Facts disclosed on April

5, 2023 and June 28, 2023, hereby informs holders of Level III BDRs that, on June 27, 2023, the CVM Collegiate approved the request for

a differentiated procedure for voluntary discontinuance of it's Level III BDR Program ("BDR Program Discontinuance"),

under the terms defined below.

| 1. | DISCONTINUANCE OF THE BDRS PROGRAM AND ITS CANCELLATION |

1.1.

The BDR Program will be discontinued under the terms of the Issuer's Manual of B3 - Brasil, Bolsão, Balcão ("B3"

and "Manual"), with its cancellation at CVM based on CVM Resolution 182, of May 11, 2023 ("CVM Resolution 182")

and CVM Resolution 80, of March 29, 2022 ("CVM Resolution 80").

1.2.

On April 5, 2023, the Company's Board of Directors approved: (i) the presentation of a new plan for the Discontinuance

of the BDR Program, replacing the one previously submitted to B3 and which had been subject to resolution by the Collegiate of CVM on

December 22, 2022, with its consequent cancellation before CVM; and (ii) upon completion of the Discontinuance of the Level III

BDR Program, the cancellation of the Company's registration before CVM as a foreign publicly traded company issuer of securities category

"A" ("Cancellation of Registration").

1.3.

Subject to the requirements described below, the Company will discontinue the BDR Program, with its consequent cancellation,

through: (i) the delivery of Class A Ordinary Shares, tradable on the New York Stock Exchange ("NYSE"), to holders

of Level III BDRs who opt for this alternative; (ii) the delivery of Unsponsored Level I BDRs, tradable on B3, to holders of Level

III BDRs who opt for this alternative; and (iii) the sale, on NYSE, of the Class A Ordinary Shares backing the Level III BDRs

remaining after the Choice Period (as defined below).

| 1.3.1. | Unsponsored Level I BDRs have the same composition as Level III BDRs, that is, each Unsponsored Level

I BDR represents 1/6 (one sixth) of a Class A Ordinary Share issued by the Company. |

| 1.3.2. | Banco Bradesco S.A. ("Depositary"), the current depositary institution of the Level III

BDR program, is also the depositary institution of the Unsponsored Level I BDRs. |

| 1.3.3. | The registration of the Unsponsored Level I BDR program was granted by the CVM through Official Letter

145/2023/CVM/SRE/GER-2, dated June 28, 2023. |

1.4.

For a period of thirty (30) days beginning on July 13, 2023, i.e., from July 13, 2023 to August 11, 2023 ("Choice Period"),

all holders of Level III BDRs, including participants in the NuSócios Customer Program, will be given the ability to:

| (i) | remain as a shareholder of the Company, through the receipt, abroad, of Class A Ordinary Shares, in the

proportion of six (6) Level III BDRs for each one (1) Class A Ordinary Share ("Receipt of Class A Ordinary Shares"); |

| (ii) | remain as a holder of the Company's BDRs by receiving Unsponsored Level I BDRs, in the proportion of one

(1) Level III BDR for each one (1) Unsponsored Level I BDR ("Receiving Unsponsored Level I BDRs"); or |

| (iii) | if no declaration during the Choice Period is made, the Company will sell on NYSE all the underlying shares

of its Level III BDRs, and the resulting dollar amount will be converted into Brazilian Reais by the depositary institution of the Level

III BDR Program (converted at the current USD/BRL exchange rate) and the former holders of such Level III BDRs will receive, for each

Level III BDR, an amount equivalent to the average price per share at which the shares were sold, after deduction of all taxes which may

be due in accordance with applicable legislation ("Sales Procedure"). |

Holders of Level III BDRs, including participants

in the NuSócios Customer Program, who opt to receive Class A Ordinary Shares or to receive Unsponsored Level I BDRs must manifest

within the Choice Period, pursuant to the terms herein stipulated. The lack of manifestation, or manifestation in disagreement with the

procedures described in the Sections below, within the Choice Period, will be understood as tacit and automatic adhesion to the Sales

Procedure. Holders of Level III BDRs that do not manifest within the Choice Period will have all their Level III BDRs directed to the

Sales Procedure.

1.5.

The deadline for the request for issuance of Level III BDRs and the respective conversion of Class A Ordinary Shares into

Level III BDRs, subject to the requirements applicable to this procedure, is 4 of August 2023. As of 9 of August 2023, the books will

be closed in Brazil for the issuance and cancellation of Level III BDRs, and the issuance of new Level III BDRs will be suspended. Level

III BDR trading will be permitted at B3 until the close of trading on August 11, 2023. Unsponsored Level I BDRs will begin trading on

B3 on August 14, 2023.

1.6.

The tentative schedule containing all relevant procedures is attached as Annex I to this Notice. For purposes of this

Notice and the schedule, "Business Day" is deemed to be a business day in either São Paulo, Brazil or New York, United

States.

| 2. | RECEIPT OF CLASS A ORDINARY SHARES |

2.1.

The holder of Level III BDRs who wishes to remain a shareholder of the Company, through the receipt of Class A Ordinary Shares,

must manifest in the Choice Period.

| 2.1.1. | Holders of Level III BDRs who wish to opt to receive Class A Ordinary Shares must hold six (6) Level III

BDRs for each Class A Ordinary Share. |

| 2.1.2. | If there are fractions of Class A Ordinary Shares (in cases where the investor holds a number of Level

III BDRs not greater than six), the investor must, at the same time of choosing among the options available under the BDR Program Discontinuance,

indicate whether he/she wishes the fractions of Class A Ordinary Shares to be dealt with under the Sales Procedure or whether he/she wishes

to receive the corresponding Unsponsored Level I BDRs. If no such indication is made, the fractions of Class A Ordinary Shares will be

dealt with under the Sales Procedure. |

2.2.

Holders of Level III BDRs who keep their Level III BDRs in custody at B3's Central Depository under the responsibility of a

custody agent, and who wish to opt for the Receipt of Class A Ordinary Shares, shall, during the Choice Period, instruct their local custody

agent or brokerage house, as the case may be, to cancel their respective Level III BDRs, so that their local custody agent or brokerage

house, upon instructions given to B3, may proceed with this request, pursuant to B3's regulations.

For details on the procedures applicable to

the Receipt of Class A Ordinary Shares, holders of Level III BDRs should, in advance, contact their respective local custody agent or

brokerage firm to understand the necessary arrangements, deadlines and rules of such intermediaries, including the time limit.

Holders of Level III BDRs who are customers

of Nu Pagamentos S.A. - Instituição de Pagamento ("Nubank") may elect, during the Choice Period, to receive

Class A Ordinary Shares through the Nubank application, subject to the applicable time limit.

Holders of Level III BDRs who are customers

of Nu Invest Corretora de Valores S.A. ("Nu Invest") may opt during the Choice Period to receive Class A Ordinary Shares

through Nu Invest's application, subject to the applicable time limit.

2.3.

The instruction to cancel Level III BDRs for Receipt of Class A Ordinary Shares, as indicated above, shall constitute irrevocable

and irreversible consent of the respective holder of Level III BDRs to Receipt of Class A Ordinary Shares.

2.4.

Any and every holder of Level III BDRs that chooses to receive Class A Ordinary Shares must open a custody account with a brokerage

house authorized to trade on the NYSE prior to requesting the cancellation of their Level III BDRs. In other words, the account must be

already active by the time of the transfer of the shares underlying their respective Level III BDRs, as described above.

| 2.4.1. | The costs for opening and maintaining a checking account and a custody account with a brokerage house

authorized to trade on the NYSE must be borne by the investor who so chooses. |

2.5.

Upon completion of the procedures informed above, B3, pursuant to the applicable regulations, will block, in the CBLC Net System

of B3, the balance of Level III BDRs of the respective holders. The Depositary, as instructed in the BDR cancellation requests received,

will instruct The Bank of New York Mellon ("Custodian") to transfer the Class A Ordinary Shares underlying the canceled

Level III BDRs to the custody accounts of their respective holders. Upon delivery of the shares underlying the Level III BDRs to the investor's

custody account with the brokerage house authorized to trade on the NYSE, the Custodian will cancel the respective blocked Level III BDRs.

| 2.5.1. | If the documents are forwarded after 3:00 p.m. (3:00 p.m. BRT), the blocking, the delivery of the back

shares and the cancellation of Level III BDRs will only take place on the next business day after the receipt of the instruction by the

investor. |

| 2.5.2. | Level III BDR holders who elect to receive Class A Ordinary Shares should instruct the broker(s) authorized

to deal on NYSE of their choice regarding such transfer so that the broker(s) are aware of and take the necessary steps to receive the

transfer by the Custodian of their position in Class A Ordinary Shares. |

The custody account with a brokerage house

authorized to trade on the NYSE must be informed on B3's CBLC Net System, so that the account opening procedure by Level III BDR holders

who opt for the Receipt of Class A Ordinary Shares must be concluded within the Choice Period.

Level III BDR holders who elect to receive

Class A Ordinary Shares will have their Level III BDRs blocked in their local custody account until the actual receipt of the Class A

Ordinary Shares into their custody account with an institution authorized to deal on the NYSE.

| 3. | RECEIVING UNSPONSORED LEVEL I BDRS |

3.1.

A holder of Level III BDRs who wishes to remain a holder of the Company's BDRs by receiving Unsponsored Level I BDRs must make

manifestation during the Choice Period.

3.2.

Holders of Level III BDRs who keep their Level III BDRs in custody at B3's Central Depository and who wish to opt for receiving

Unsponsored Level I BDRs must do so through B3's CBLC Net System. In order to do so, they should contact the institution where their shares

are held in custody to verify the procedures required by that institution, where applicable.

| 3.2.1. | The local custody agent or brokerage house for holders of Level III BDRs under custody at B3's Central

Depository who choose to receive Unsponsored Level I BDRs must follow the procedures described above, as applicable. |

| 3.2.2. | NuSócios Customer Program participants whose respective Level III BDRs are still under the responsibility

of the Mercantile Commissioner, and who elect to receive Unsponsored Level I BDRs, will receive their Unsponsored Level I BDRs through

the Mercantile Commissioner. |

For details on the procedures applicable to

the Receipt of Unsponsored Level I BDRs, holders of Level III BDRs should, in advance, contact their respective local custody agent or

brokerage house to understand the necessary arrangements, deadlines and rules of such intermediaries, including time limit.

Holders of Level III BDRs who are customers

of Nubank may elect during the Choice Period to receive Unsponsored Level I BDRs through the Nubank's application, subject to the applicable

time limit.

Holders of Level III BDRs who are customers

of Nu Invest may opt during the Choice Period to receive Unsponsored Level I BDRs through Nu Invest's application, subject to the applicable

time limit.

Holders of Level III BDRs who are participants

in the NuSócios Customer Program may elect during the Choice Period to receive Unsponsored Level I BDRs through the Nubank's application,

subject to the applicable time limit.

4.1.

Holders of Level III BDRs, including participants of the NuSócios Customer Program, that do not manifest themselves

until 11 of August 2023 (end date of the Choice Period), or that manifest themselves in disagreement with the terms established in Sections

2 and 3 above, will automatically adhere to the Sales Procedure, by means of which all the shares that serve as the underlying of their

Level III BDRs will be sell on NYSE, in order to receive an amount equivalent to the average price per share practiced in the sale of

the shares, net of any taxes that may be due according to the applicable legislation.

4.2.

After the end of the Choice Period, if the holder of Level III BDRs has not manifested the choice, B3 will, after August 11,

2023, block the respective balance of the holder of Level III BDRs until the date of sale of the Class A Ordinary Shares on NYSE and will

register in its systems a provision for the redemption of Level III BDRs which corresponds to the market value of the Class A Ordinary

Shares as of the close of business on August 11, 2023 in Dollars, which will be converted into Brazilian currency at the current US$/BRL

exchange rate.

| 4.2.1. | Such amount will be disclosed by the Company through the publication of a Notice to BDR Holders ("First

Notice") and will be considered only an estimate, which may be altered upon the actual sale of the Class A Ordinary Shares on

the NYSE, and may be higher, lower or equal to the estimated sales value. |

| 4.2.2. | The final sales value of the Class A Ordinary Shares underlying the Level III BDRs will be informed in

due course, and such value will be used for the financial settlement of the redemption of the Level III BDRs by B3. |

4.3.

By August 18, 2023, B3 will calculate the number of Class A Ordinary Shares for which there has been no manifestation for the

Receipt of Class A Ordinary Shares or the Receipt of Unsponsored Level I BDRs and will inform the Custodian bank, which will take the

necessary procedures to operationalize the sale of the Class A Ordinary Shares on the NYSE.

4.4.

The sale of the Class A Ordinary Share will be conducted on a best efforts basis by the Depositary on the NYSE within thirty

(30) days of August 21, 2023.

| 4.4.1. | The commencement date for the sale of the Class A Ordinary Stock on the NYSE may be advanced or delayed

for operational reasons. |

| 4.4.2. | The Depositary may, at its discretion, conduct the sales of the Class A Ordinary Shares that are the object

of the Sales Procedure in a period of less than thirty (30) days, in which case the estimated dates in the schedule of Annex I shall

be adjusted accordingly. |

| 4.4.3. | Depending on the number of Class A Ordinary Shares to be sold, the sale may take place on one or more

subsequent days, and the sale price of each share to be paid to the respective holders of Level III BDRs will correspond to the average

of the sale prices of such Class A Ordinary Shares on the NYSE, less any taxes that may be due under the applicable legislation. |

| 4.4.4. | The amount at which the Class A Ordinary Shares will be sold on the NYSE through the Sales Procedure may

be less than the listing price of the Class A Ordinary Shares on the NYSE on the date of the sale if there has been some other event that

creates a variation in the listing price of the Class A Ordinary Shares on the NYSE or, for example, the sale of the Class A Ordinary

Shares is made through a block-trade, which traditionally is executed at a discount from the market quotation price. |

| 4.4.5. | The Custodian, the Depositary and the Company assume no obligation to Level III BDR holders to sell the

Class A Ordinary Shares underlying the Level III BDRs for any specific amount or to compensate such Level III BDR holders for any loss,

damage or liability that may arise as a result of the sale of the Class A Ordinary Shares underlying the Level III BDRs through the Sales

Procedure. |

4.5.

In order to allow Level III BDR holders to make an informed decision, the Company presents the following information. Such

information, however, does not constitute a guarantee of the sale price of the Class A Ordinary Shares underlying the Level III BDRs in

the context of the Sales Procedure, and should not under any circumstances be considered a recommendation to sell or hold the Class A

Ordinary Shares underlying the Level III BDRs.

4.5.1.

Weighted average price of BDRs Level III at B3 in the 12 (twelve) months prior to the publication of this Notice: R$ 4.33

4.5.2.

Weighted average listing price of the Class A Ordinary Shares on the NYSE in the twelve (12) months prior to the publication

of this Notice in U.S. dollars: $5.00

4.5.3.

Weighted average listing price of the Class A Ordinary Shares on NYSE in the twelve (12) months prior to the publication of

this Notice in Reais: R$25.65

4.5.4.

Equity value per BDR based on the Company's Interim Financial Statements for the period ended March 31, 2023: R$278.99

4.5.5.

Equity value per Class A Ordinary Share based on the Company's Interim Financial Statements for the period ended March 31,

2023: $1.44 (*)

(*) US$1 = R$5.0804, based on the exchange

rate on March 31, 2023.

4.6.

Proceeds from the sale of the Class A Ordinary Shares underlying the Level III BDRs will be received by the Depositary in Dollars

upon completion of the sale of all shares underlying the Level III BDRs subject to the Sales Procedure.

| 4.6.1. | The Depositary will convert the amount into Reais, considering the US$/BRL exchange rate current on the

day of conversion, after deducting any applicable taxes under the terms of the legislation in force. |

| 4.6.2. | The Company will publish a new Notice to BDR Holders ("Second Notice") informing, among

other information, (i) the total amount of Class A Ordinary Shares underlying the Level III BDRs sold, (ii) the average

prices in Dollars per share/BDR, (iii) the estimated date of payment to Level III BDR holders in Brazil, and (iv) the final

price in Brazilian Reais to be paid per Level III BDR to Level III BDRs holders, net of any taxes which may be due, pursuant to applicable

legislation |

| 4.6.3. | The Depositary (i) will transfer to B3 the funds related to Level III BDR holders that maintained

their positions deposited with B3's Central Depository, which in turn will be responsible for transferring such funds to the respective

holders, through its custody agents; and (ii) will transfer the amounts due to Level III BDR holders that maintained their positions

directly with the Depositary. |

If the holder of a Level III BDR is not registered

with his custody agent, he must update his registration, since the proceeds from the sale of shares will be transferred according to the

data registered with the custody agent at B3 on the date of the above-mentioned transfer.

4.7.

BDR Level III holders who do not have their records updated with their custody agent, as the case may be, should contact their

custody agent, as the case may be, to withdraw their funds.

| 5. | CANCELLATION OF THE REGISTRATION AS A PUBLICLY-HELD COMPANY WITH CVM |

5.1.

After the discontinuance of the Level III BDR Program through the realization of the procedures foreseen in the previous items,

the Company will proceed with the request for the Cancellation of the Registration.

5.2.

The Company will keep the market informed, under the terms of the applicable legislation, about the CVM decision regarding

the Cancellation of Registration.

6.1.

The Company confirms that (i) it has not issued other securities that are outstanding in Brazil and that, therefore,

the Discontinuance of the Level III BDR Program will lead to the Cancellation of the Registration; and (ii) all information about

the Company, its results and operations, as well as all information required by CVM, is available on the CVM (http://www.cvm.gov.br),

B3 (http://www.b3.com.br) and the Company's own website (https://www.investidores.nu/en/).

6.2.

The costs arising from the disassembly of the Level III BDRs into Class A Ordinary Shares, and/or from the conversion of Sponsored

Level III BDRs into Unsponsored Level I BDRs, due to the option made during the Choice Period, will be borne by the Company. The costs

arising from the Sales Procedure, including those related to the hiring of the Bank responsible for the selling of the Class A Ordinary

Shares on the NYSE, will also be borne by the Company. The taxes and other costs, including those related to the opening and maintenance

of accounts at an institution authorized to operate on NYSE, will be borne exclusively by the holder of the Level III BDR in question.

6.3.

Holders of Level III BDRs, residents and nonresidents in Brazil, are responsible for verifying the tax and exchange effects

of the transactions contemplated in this Notice, as well as for compliance with the obligations arising from the option made. The Company

recommends that investors resident and nonresident in Brazil consult their own legal advisors for further information about the matters

mentioned in this item, and does not assume any liability arising therefrom.

6.4.

Investors with eventual covered forward long positions and who wish to manifest during the Choice Period, as well as Level

III BDR holders with eventual donor positions in loan/leaseback contracts who wish to manifest during the Choice Period, should inquire

about the necessary procedures to do so with their respective custody agents or brokers.

The Company will keep the

market, its shareholders and NuSócios Customer Program participants informed throughout the Discontinuance of the Level III BDR

Program.

São Paulo, July

10 2023.

NU HOLDINGS LTD.

Jörg Friedemann

Legal Representative of the Company in Brazil

ANNEX I

TENTATIVE SCHEDULE FOR VOLUNTARY DISCONTINUANCE

OF THE BDRS LEVEL III PROGRAM

●

April 5, 2023. Resolution of the Company's Board of Directors approving: (i) the presentation of a new plan for the

Discontinuance of the BDR Program, replacing the one previously submitted to B3 and that was subject to resolution by the Collegiate of

CVM on December 22, 2022; with its consequent cancellation before CVM; and (ii) after the conclusion of the Discontinuance of the

Level III BDR Program, the cancellation of the Company's registration before CVM as a foreign public company issuer of "category

A" securities.

●

April 5, 2023. Disclosure of Material Fact announcing the Board of Directors' deliberation and the plan to discontinue the

BDR Program.

●

April 6, 2023. Submission by the Company for approval by B3 and CVM of the "New Application for Approval of Procedures

and Conditions for Voluntary Discontinuance of the Sponsored Level III Brazilian Depositary Receipts (BDRs) Program backed by Class "A"

Ordinary Shares and cancellation of the Foreign Issuer Registration".

●

April 6, 2023. Submission by Bradesco, for approval by B3 and CVM, of the "Application for Registration of the Unsponsored

Level I BDR Program".

●

June 27, 2023. CVM approval of the Level III BDR Program Discontinuance Plan.

●

June 28, 2023. CVM approves the application for registration of the Unsponsored Level I BDR Program.

●

June 28, 2023. Disclosure of Material Fact announcing the approval by CVM of the Level III BDR Program Discontinuance Plan.

●

July 10, 2023. Disclosure of this Notice to Level III BDR Holders.

●

July 13, 2023. Beginning of the 30-day Choice Period and consequent blocking of Level III BDRs of investors who opt for

the Receipt of Class A Ordinary Shares or the Receipt of Unsponsored Level I BDRs.

●

July 14, 2023. Start of the procedures described in items 2 and 3 above.

●

August 4, 2023. Deadline for requesting the issuance of Level III BDRs and the respective conversion of Class A Ordinary

Shares into Level III BDRs, subject to the requirements applicable to this procedure.

●

August 9, 2023 Closing of the books in Brazil for issuances and cancellations of Level III BDRs and suspension of the issuance

of new Level III BDRs.

| ● | August 11, 2023. End of Choice Period. |

●

August 11, 2023 Last day of trading with Level III BDRs at B3.

●

Until August 14, 2023. Blocking, by B3, of the balances of Level III BDR holders that will participate in the Sales Procedure.

●

Until August 14, 2023. Disclosure of the First Notice to BDR Holders informing the redemption provision value of Level III

BDRs for the purpose of blockage at B3, which corresponds to the market value of the Class A Ordinary Shares verified at the closing of

the day of August 11, 2023, converted into Reais based on the current rate.

●

August 14, 2023 Beginning of trading of the Unsponsored Level I BDRs on B3.

●

Until 16 August 2023. Delivery of Unsponsored Level I BDRs to investors who have opted to receive Unsponsored Level I BDRs.

●

Until August 18, 2023. Calculation by B3 of the number of Class A Ordinary Shares to be sold on NYSE.

●

August 21, 2023. Start of the 30 (thirty) day period for the Sales Procedure.

●

Until September 20, 2023. End of the thirty (30) day period for the Sales Procedure of the Class A Ordinary Shares.

●

Until October 9, 2023. Disclosure of the Second Notice to BDR Holders informing (i) the final amount in Brazilian

Reais to be paid to the former holders of Level III BDRs that had the underlying Class A Ordinary Shares sold on NYSE; and (ii) the

estimated date of payment of the amount resulting from the sale of the shares to the respective former holders of Level III BDRs.

●

Until October 16, 2023. Payment to investors of the proceeds from the sale of Level III BDRs that are the object of the

Sales Procedure.

●

Until October 23, 2023. Protocol, before B3 and CVM, of the requests for cancellation of the Level III BDRs program and

the Cancellation of Registration. The Company will keep the market informed, pursuant to the applicable legislation, about the CVM's decision

regarding the Cancellation of Registration.

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Nu Holdings Ltd. |

| |

|

| |

By: |

/s/ Jorg

Friedemann |

| |

|

Jorg

Friedemann

Investor

Relations Officer |

Date: July

10, 2023

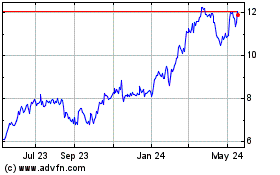

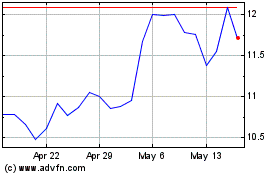

Nu (NYSE:NU)

Historical Stock Chart

From Dec 2024 to Jan 2025

Nu (NYSE:NU)

Historical Stock Chart

From Jan 2024 to Jan 2025