0000726728false00007267282024-06-042024-06-040000726728us-gaap:CommonClassAMember2024-06-042024-06-040000726728o:A6000SeriesACumulativeRedeemablePreferredStock001ParValueMember2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable1.125DueJuly2027Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable1.875DueJanuary2027Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable1.625DueDecember2030Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable4.875DueJuly2030Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable5750Due2031Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable1.750DueJuly2033Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable5.125DueJuly2034Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable6000Due2039Member2024-06-042024-06-040000726728o:SeniorUnsecuredNotesPayable2.500DueJanuary2042Member2024-06-042024-06-04

United States

Securities and Exchange Commission

Washington, D.C. 20549

Form 8-K

Current Report

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report: June 4, 2024

(Date of Earliest Event Reported)

REALTY INCOME CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 1-13374 | | 33-0580106 |

(State or Other Jurisdiction of

Incorporation or Organization) | | (Commission File Number) | | (IRS Employer Identification No.) |

11995 El Camino Real, San Diego, California 92130

(Address of principal executive offices)

(858) 284-5000

(Registrant’s telephone number, including area code)

N/A

(former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange On Which Registered |

| Common Stock, $0.01 Par Value | O | New York Stock Exchange |

| 6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value | O PR | New York Stock Exchange |

| 1.125% Notes due 2027 | O27A | New York Stock Exchange |

| 1.875% Notes due 2027 | O27B | New York Stock Exchange |

| 1.625% Notes due 2030 | O30 | New York Stock Exchange |

| 4.875% Notes due 2030 | O30A | New York Stock Exchange |

| 5.750% Notes due 2031 | O31A | New York Stock Exchange |

| 1.750% Notes due 2033 | O33A | New York Stock Exchange |

| 5.125% Notes due 2034 | O34 | New York Stock Exchange |

| 6.000% Notes due 2039 | O39 | New York Stock Exchange |

| 2.500% Notes due 2042 | O42 | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 7.01 Regulation FD Disclosure

On June 4, 2024, Realty Income Corporation (the “Company”) issued a press release setting forth updated earnings and investment volume guidance for the year ending December 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. The press release included as Exhibit 99.1 to this report is being furnished pursuant to this Item 7.01 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, and is not incorporated by reference into any of the Company’s filings, whether made before or after the date hereof, regardless of any general incorporation language in any such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

104 The Form 8-K cover page, formatted in Inline Extensible Business Reporting Language and included as Exhibit 101

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

Dated: June 4, 2024 | REALTY INCOME CORPORATION |

| | |

| | By: | /s/ JONATHAN PONG |

| | | Jonathan Pong |

| | | Executive Vice President, Chief Financial Officer and Treasurer |

Exhibit 99.1

REALTY INCOME RAISES 2024 EARNINGS AND INVESTMENT GUIDANCE

SAN DIEGO, CALIFORNIA, June 4, 2024....Realty Income Corporation (Realty Income, NYSE: O), The Monthly Dividend Company®, today announced that it has revised its 2024 outlook. The Company now expects to achieve Adjusted Funds from Operations (AFFO) in a range of $4.15 to $4.21 per diluted share as compared to previous guidance of $4.13 to $4.21 per diluted share. The Company also now expects 2024 investment volume to be approximately $3.0 billion as compared to previous guidance of $2.0 billion.

“We are pleased to raise our guidance for full year AFFO per share and investment volume, reflecting our continued confidence in our business outlook as we approach the mid-point of the year,” said Sumit Roy, Realty Income’s President and Chief Executive Officer. “These increases stem from an improving investment environment, particularly in Europe. Additionally, we continue to see stable operating performance in our high-quality, diversified global real estate portfolio. We believe our size and scale place us in a unique competitive position to capitalize on the current market environment.”

Earnings Guidance

Summarized below are approximate estimates of the key components of our 2024 earnings guidance.

| | | | | | | | | | | | | | |

| | | Prior 2024 Guidance (1) | | Revised 2024 Guidance |

Net income per share (2) | | $1.23 - $1.35 | | $1.26 - $1.35 |

Real estate depreciation and impairments per share (3) | | $2.84 | | $2.84 |

Other adjustments per share (3) | | $0.10 | | $0.09 |

Normalized FFO per share (2)(4) | | $4.17 - $4.29 | | $4.19 - $4.28 |

AFFO per share (4) | | $4.13 - $4.21 | | $4.15 - $4.21 |

Same store rent growth (5) | | Approx 1.0% | | Approx 1.0% |

| Occupancy | | Over 98% | | Over 98% |

Cash G&A expenses (% of revenues) (6)(7) | | Approx 3.0% | | Approx 3.0% |

Property expenses (non-reimbursable) (% of revenues) (6) | | 1.0% - 1.5% | | 1.0% - 1.5% |

| Income tax expenses | | $65 to $75 million | | $65 to $75 million |

Investment volume (8) | | Approx $2.0 billion | | Approx $3.0 billion |

| | |

(1) As issued on May 6, 2024. |

(2) Net income per share and Normalized FFO per share include non-cash interest expense impact related to the Spirit merger. |

(3) Includes gain on sales of properties and merger and integration-related costs. |

(4) Normalized FFO per share and AFFO per share exclude merger and integration-related costs associated with our merger with Spirit. Per share amounts may not add due to rounding. |

(5) Reserve reversals recognized in 2023 represent an approximately 30 basis point headwind to same store rent growth in 2024. |

(6) Revenue excludes contractually obligated reimbursements by our clients. Cash G&A expenses exclude stock-based compensation expense. |

(7) G&A expenses inclusive of stock-based compensation expense as a percentage of rental revenue, excluding reimbursements, is expected to be approximately 3.4% - 3.7% in 2024. |

(8) Investment volume excludes merger with Spirit, which closed January 23, 2024. |

About Realty Income

Realty Income (NYSE: O), an S&P 500 company, is real estate partner to the world's leading companies. Founded in 1969, we invest in diversified commercial real estate and have a portfolio of over 15,450 properties in all 50 U.S. states, the U.K., and six other countries in Europe. We are known as "The Monthly Dividend Company®," and have a mission to deliver stockholders dependable monthly dividends that grow over time. Since our founding, we have declared 647 consecutive monthly dividends and are a member of the S&P 500 Dividend Aristocrats® index for having increased our dividend for the last 25 consecutive years. Additional information about the company can be found at www.realtyincome.com.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Exchange Act of 1934, as amended. When used in this press release, the words "estimated," "anticipated," "expect," "believe," "intend," "continue," "should," "may," "likely," "plans," and similar expressions are intended to identify forward-looking statements. Forward-looking statements include discussions of our business and portfolio; growth strategies and intentions to acquire or dispose of properties (including geographies, timing, partners, clients and terms); re-leases, re-development and speculative development of properties and expenditures related thereto; future operations and results; the announcement of operating results, strategy, plans, and the intentions of management; guidance; settlement of shares of common stock sold pursuant to forward sale confirmations under our ATM program; dividends; and trends in our business, including trends in the market for long-term leases of freestanding, single-client properties. Forward-looking statements are subject to risks, uncertainties, and assumptions about us, which may cause our actual future results to differ materially from expected results. Some of the factors that could cause actual results to differ materially are, among others, our continued qualification as a real estate investment trust; general domestic and foreign business, economic, or financial conditions; competition; fluctuating interest and currency rates; inflation and its impact on our clients and us; access to debt and equity capital markets and other sources of funding (including the terms and partners of such funding); continued volatility and uncertainty in the credit markets and broader financial markets; other risks inherent in the real estate business including our clients' solvency, client defaults under leases, increased client bankruptcies, potential liability relating to environmental matters, illiquidity of real estate investments, and potential damages from natural disasters; impairments in the value of our real estate assets; changes in domestic and foreign income tax laws and rates; property ownership through joint ventures, partnerships and other arrangements which may limit control of the underlying investments; epidemics or pandemics including measures taken to limit their spread, the impacts on us, our business, our clients, and the economy generally; the loss of key personnel; the outcome of any legal proceedings to which we are a party or which may occur in the future; acts of terrorism and war; the anticipated benefits from mergers and acquisitions including from the merger with Spirit; and those additional risks and factors discussed in our reports filed with the U.S. Securities and Exchange Commission. Readers are cautioned not to place undue reliance on forward-looking statements. Forward-looking statements are not guarantees of future plans and performance and speak only as of the date of this press release. Actual plans and operating results may differ materially from what is expressed or forecasted in this press release. We do not undertake any obligation to update forward-looking statements or publicly release the results of any forward-looking statements that may be made to reflect events or circumstances after the date these statements were made.

Investor Relations:

Steve Bakke

Senior Vice President, Corporate Finance

+1 858 284 5425

sbakke@realtyincome.com

v3.24.1.1.u2

Cover

|

Jun. 04, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jun. 04, 2024

|

| Entity Registrant Name |

REALTY INCOME CORPORATION

|

| Entity Central Index Key |

0000726728

|

| Amendment Flag |

false

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

1-13374

|

| Entity Tax Identification Number |

33-0580106

|

| Entity Address, Address Line One |

11995 El Camino Real

|

| Entity Address, City or Town |

San Diego

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92130

|

| City Area Code |

858

|

| Local Phone Number |

284-5000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| 6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.000% Series A Cumulative Redeemable Preferred Stock, $0.01 Par Value

|

| Trading Symbol |

O PR

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 1.125 Due July 2027 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.125% Notes due 2027

|

| Trading Symbol |

O27A

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 1.875 Due January 2027 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.875% Notes due 2027

|

| Trading Symbol |

O27B

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 1.625 Due December 2030 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.625% Notes due 2030

|

| Trading Symbol |

O30

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 4.875 Due July 2030 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

4.875% Notes due 2030

|

| Trading Symbol |

O30A

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 5.750 Due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.750% Notes due 2031

|

| Trading Symbol |

O31A

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 1.750 Due July 2033 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

1.750% Notes due 2033

|

| Trading Symbol |

O33A

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 5.125 Due July 2034 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

5.125% Notes due 2034

|

| Trading Symbol |

O34

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 6.000 Due 2039 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

6.000% Notes due 2039

|

| Trading Symbol |

O39

|

| Security Exchange Name |

NYSE

|

| Senior Unsecured Notes Payable 2.500 Due January 2042 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

2.500% Notes due 2042

|

| Trading Symbol |

O42

|

| Security Exchange Name |

NYSE

|

| Common Stock, $0.01 Par Value |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 Par Value

|

| Trading Symbol |

O

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_A6000SeriesACumulativeRedeemablePreferredStock001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable1.125DueJuly2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable1.875DueJanuary2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable1.625DueDecember2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable4.875DueJuly2030Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable5750Due2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable1.750DueJuly2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable5.125DueJuly2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable6000Due2039Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=o_SeniorUnsecuredNotesPayable2.500DueJanuary2042Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonClassAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

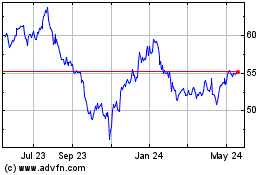

Realty Income (NYSE:O)

Historical Stock Chart

From May 2024 to Jun 2024

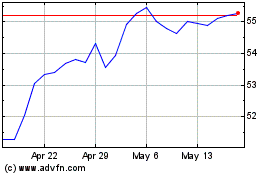

Realty Income (NYSE:O)

Historical Stock Chart

From Jun 2023 to Jun 2024