Net income increased 106.4% year over year to

$32.1 million, a Company record for any quarter

Adjusted net income1 increased 116.2% year over

year to $28.8 million, a Company record for any quarter

Basic and diluted EPS of $0.21 and $0.21,

respectively

Adjusted EPS1 increased 112.4% year over year

to $0.33

Net charge-off rate as a percentage of total

revenue decreased 810 basis points year over year to 34.3%

Average yield, annualized increased by 540

basis points year over year to 133.9%

Total revenue increased 2.6% year over year to

$136.6 million, a Company record for any quarter

Adjusted EPS1 guidance for full-year 2024

increased to $0.85 to $0.87 from $0.73 to $0.75

OppFi Inc. (NYSE: OPFI) (“OppFi” or the “Company”), a

tech-enabled, mission-driven specialty finance platform that

broadens the reach of community banks to extend credit access to

everyday Americans, today reported financial results for the third

quarter ended September 30, 2024.

“We’re proud to report our third quarter 2024 results, in which

we achieved the highest total revenue and net income for any

quarter in Company history,” said Todd Schwartz, Chief Executive

Officer and Executive Chairman of OppFi. “The record net income was

a result of credit initiatives that continue to drive strong loss,

payment, and recovery performance, marketing cost efficiency, and

prudent expense discipline across the organization.”

“We have continued to demonstrate our commitment to returning

value to stockholders by repurchasing an additional $1.0 million of

shares of Class A common stock in the third quarter,” Schwartz

added. “Given our results and current business trends, we have

raised full-year earnings guidance for the third time this year and

we look forward to ending the year strong.”

(1) Non-GAAP Financial Measures: Adjusted

Net Income and Adjusted EPS are financial measures that have not

been prepared in accordance with GAAP. See “Reconciliation of

Non-GAAP Financial Measures” below for a detailed description and

reconciliation of such Non-GAAP financial measures to their most

directly comparable GAAP financial measures.

Financial Summary

The following tables present a summary of OppFi’s results for

the three and nine months ended September 30, 2024 and 2023 (in

thousands, except per share data). Certain columns and rows may not

sum due to the use of rounded numbers for disclosure purposes.

Percentages presented are calculated from the underlying

whole-dollar amounts.

Three Months Ended September

30,

Change

(unaudited)

2024

2023

%

Total revenue

$

136,593

$

133,165

2.6

%

Net income

$

32,057

$

15,532

106.4

%

Adjusted net income(1,2)

$

28,808

$

13,325

116.2

%

Basic EPS

$

0.21

$

0.13

62.8

%

Diluted EPS(3)

$

0.21

$

0.13

63.6

%

Adjusted EPS(1,2,3)

$

0.33

$

0.16

112.4

%

(1) Non-GAAP Financial Measures: Adjusted

Net Income and Adjusted EPS are financial measures that have not

been prepared in accordance with GAAP. See “Reconciliation of

Non-GAAP Financial Measures” below for a detailed description and

reconciliation of such Non-GAAP financial measures to their most

directly comparable GAAP financial measures.

(2) Beginning with the quarter ended March

31, 2024, for all periods presented, the Company has updated its

presentation and calculation of Adjusted EBT, and the corresponding

presentations and calculations of Adjusted Net Income and Adjusted

EPS, to no longer add back debt issuance cost amortization.

(3) Diluted EPS calculated on a GAAP basis

excludes dilutive securities, including Class V Voting Stock,

restricted stock units, performance stock units, and stock options

in any periods in which their inclusion would have an antidilutive

effect.

Nine Months Ended September

30,

Change

(unaudited)

2024

2023

%

Total revenue

$

390,240

$

376,025

3.8

%

Net income

$

69,864

$

37,538

86.1

%

Adjusted net income(1,2)

$

62,370

$

33,048

88.7

%

Basic EPS

$

0.65

$

0.29

126.4

%

Diluted EPS(3)

$

0.65

$

0.29

125.2

%

Adjusted EPS(1,2,3)

$

0.72

$

0.39

85.4

%

(1) Non-GAAP Financial Measures: Adjusted

Net Income and Adjusted EPS are financial measures that have not

been prepared in accordance with GAAP. See “Reconciliation of

Non-GAAP Financial Measures” below for a detailed description and

reconciliation of such Non-GAAP financial measures to their most

directly comparable GAAP financial measures.

(2) Beginning with the quarter ended March

31, 2024, for all periods presented, the Company has updated its

presentation and calculation of Adjusted EBT, and the corresponding

presentations and calculations of Adjusted Net Income and Adjusted

EPS, to no longer add back debt issuance cost amortization.

(3) Diluted EPS calculated on a GAAP basis

excludes dilutive securities, including Class V Voting Stock,

restricted stock units, performance stock units, and stock options

in any periods in which their inclusion would have an antidilutive

effect.

Key Performance Metrics

The following table represents key quarterly metrics (in

thousands, except percentage metrics). The key performance metrics

presented are for the OppLoans product only and exclude the

SalaryTap and OppFi Card products.

As of and for the Three Months

Ended,

September 30,

June 30,

September 30,

(unaudited)

2024

2024

2023

Total net originations(a)

$

218,801

$

205,549

$

195,671

Total retained net originations(a)

$

198,441

$

189,344

$

190,727

Ending receivables(b)

$

413,714

$

387,086

$

415,933

% of Originations by bank partners

100

%

100

%

98

%

Net charge-offs as % of total

revenue(c)

34

%

33

%

42

%

Net charge-offs as % of average

receivables, annualized(c)

46

%

44

%

55

%

Average yield, annualized(d)

134

%

135

%

129

%

Auto-approval rate(e)

77

%

76

%

73

%

(a) Total net originations are defined as

gross originations net of transferred balance on refinanced loans,

while total retained net originations are defined as the portion of

total net originations with respect to which the Company ultimately

purchased a receivable from bank partners or originated

directly.

(b) Ending receivables are defined as the

unpaid principal balances of loans at the end of the reporting

period.

(c) Net charge-offs as a percentage of

total revenue and net charge-offs as a percentage of average

receivables represent total charge-offs from the period less

recoveries as a percentage of total revenue and as a percentage of

average receivables. Net charge-offs as a percentage of average

receivables is presented as an annualized metric. Finance

receivables are charged off at the earlier of the time when

accounts reach 90 days past due on a recency basis, when OppFi

receives notification of a customer bankruptcy or is otherwise

deemed uncollectible.

(d) Average yield is defined as total

revenue from the period as a percent of average receivables and is

presented as an annualized metric.

(e) Auto-approval rate is calculated by

taking the number of approved loans that are not decisioned by a

loan processor or underwriter (auto-approval) divided by the total

number of loans approved.

Share Repurchase Program

Update

As of September 30, 2024, $16.4 million of the repurchase

authorization under OppFi’s previously announced Repurchase Program

remained available. During the three months ended September 30,

2024, OppFi repurchased 264,995 shares of Class A Common Stock,

which were held as treasury stock as of September 30, 2024, for an

aggregate purchase price of $1.0 million at an average purchase

price per share of $3.82. During the nine months ended September

30, 2024, the Company repurchased 1,034,710 shares of Class A

Common Stock, which were held as treasury stock as of September 30,

2024, for an aggregate purchase price of $3.6 million at an average

purchase price per share of $3.41.

Full Year 2024 Guidance

Update

- Affirm total revenue

- $510 million to $530 million

- Raise adjusted net income

- $74 million to $76 million, from previous range of $63 million

to $65 million; and

- Increase adjusted earnings per share

- $0.85 to $0.87 from previous range of $0.73 to $0.75, based on

approximate weighted average diluted share count of 86.5

million

Conference Call

Management will host a conference call today at 9:00 a.m. ET to

discuss OppFi’s financial results and business outlook. The webcast

of the conference call will be made available on the Investor

Relations page of the Company's website.

The conference call can also be accessed with the following

dial-in information:

- Domestic: (800) 274-8461

- International: (203) 518-9814

- Conference ID: OPPFI

An archived version of the webcast will be available on OppFi's

website.

About OppFi

OppFi (NYSE: OPFI) is a tech-enabled, mission-driven specialty

finance platform that broadens the reach of community banks to

extend credit access to everyday Americans. Through a transparent

and responsible lending platform, which includes financial

inclusion and an excellent customer experience, the Company

supports consumers, who are turned away by mainstream options, to

build better financial health. OppLoans by OppFi maintains a

4.5/5.0 star rating on Trustpilot with more than 4,400 reviews,

making the Company one of the top consumer-rated financial

platforms online. OppFi also holds a 35% equity interest in Bitty

Holdings, LLC (“Bitty”), a credit access company that offers

revenue-based financing and other working capital solutions to

small businesses. For more information, please visit oppfi.com.

Forward-Looking Statements

This press release includes “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended. OppFi’s actual results

may differ from its expectations, estimates and projections and

consequently, you should not rely on these forward-looking

statements as predictions of future events. Words such as “expect,”

“estimate,” “project,” “budget,” “forecast,” “anticipate,”

“intend,” “plan,” “may,” “will,” “could,” “should,” “believes,”

“predicts,” “potential,” “possible,” “continue,” and similar

expressions may identify forward-looking statements, but the

absence of these words does not mean that a statement is not

forward-looking. These forward-looking statements include, without

limitation, OppFi’s expectations with respect to its full year 2024

guidance, the future performance of OppFi’s platform, and

expectations for OppFi’s growth and future financial performance.

These forward-looking statements are based on OppFi’s current

expectations and assumptions about future events and are based on

currently available information as to the outcome and timing of

future events. These forward-looking statements involve significant

risks and uncertainties that could cause the actual results to

differ materially from the expected results. Most of these factors

are outside OppFi’s control and are difficult to predict. Factors

that may cause such differences include, but are not limited to:

the impact of general economic conditions, including economic

slowdowns, inflation, interest rate changes, recessions, and

tightening of credit markets on OppFi’s business; the impact of

challenging macroeconomic and marketplace conditions; the impact of

stimulus or other government programs; whether OppFi will be

successful in obtaining declaratory relief against the Commissioner

of the Department of Financial Protection and Innovation for the

State of California; whether OppFi will be subject to AB 539;

whether OppFi’s bank partners will continue to lend in California

and whether OppFi’s financing sources will continue to finance the

purchase of participation rights in loans originated by OppFi’s

bank partners in California; OppFi’s ability to scale and grow the

Bitty business; the impact that events involving financial

institutions or the financial services industry generally, such as

actual concerns or events involving liquidity, defaults, or

non-performance, may have on OppFi’s business; risks related to the

material weakness in OppFi’s internal controls over financial

reporting; the ability of OppFi to grow and manage growth

profitably and retain its key employees; risks related to new

products; risks related to evaluating and potentially consummating

acquisitions; concentration risk; risks related to OppFi’s ability

to comply with various covenants in its corporate and warehouse

credit facilities; costs related to the business combination;

changes in applicable laws or regulations; the possibility that

OppFi may be adversely affected by other economic, business, and/or

competitive factors; risks related to management transitions; risks

related to the restatement of OppFi’s financial statements and any

accounting deficiencies or weaknesses related thereto; and other

risks and uncertainties indicated from time to time in OppFi’s

filings with the United States Securities and Exchange Commission,

in particular, contained in the section or sections captioned “Risk

Factors.” OppFi cautions that the foregoing list of factors is not

exclusive, and readers should not place undue reliance upon any

forward-looking statements, which speak only as of the date made.

OppFi does not undertake or accept any obligation or undertaking to

release publicly any updates or revisions to any forward-looking

statements to reflect any change in its expectations or any change

in events, conditions or circumstances on which any such statement

is based.

Non-GAAP Financial Measures

This press release includes certain non-GAAP financial measures

that are unaudited and do not conform to GAAP, such as Adjusted

EBT, Adjusted Net Income, and Adjusted EPS. Adjusted EBT is defined

as Net Income, adjusted for (1) income tax expense; (2) change in

fair value of warrant liabilities; (3) other addbacks and one-time

expenses, net; and (4) other income. Adjusted Net Income is defined

as Adjusted EBT as defined above, adjusted for taxes assuming a tax

rate of 23.56% for the three and nine months ended September 30,

2024 and a tax rate of 24.17% for the three and nine months ended

September 30, 2023, reflecting the U.S. federal statutory rate of

21% and a blended statutory rate for state income taxes, in order

to allow for a comparison with other publicly traded companies.

Adjusted EPS is defined as Adjusted Net Income as defined above,

divided by weighted average diluted shares outstanding, which

represents shares of both classes of common stock outstanding,

excluding 25,500,000 shares related to earnout units, and including

the impact of dilutive securities, such as restricted stock units,

performance stock units, and stock options. The earnout units were

not earned pursuant to the earnout provisions of the Business

Combination Agreement on or prior to July 21, 2024, the third

anniversary of the closing date of the Company’s business

combination. Accordingly, on such date the earnout units and

associated Class V Voting Stock were forfeited. Adjusted EPS is

useful to investors and others because, due to OppFi’s Up-C

structure, Basic EPS calculated on a GAAP basis excludes a large

percentage of OppFi’s outstanding shares of common stock, which are

Class V Voting Stock, and Diluted EPS calculated on a GAAP basis

excludes dilutive securities, including Class V Voting Stock,

restricted stock units, performance stock units, and stock options,

in any periods in which their inclusion would have an antidilutive

effect. These non-GAAP financial measures have not been prepared in

accordance with accounting principles generally accepted in the

United States and may be different from non-GAAP financial measures

used by other companies. OppFi believes that the use of these

non-GAAP financial measures provides an additional tool for

investors to use in evaluating ongoing operating results and

trends. These non-GAAP measures with comparable names should not be

considered in isolation from, or as an alternative to, financial

measures determined in accordance with GAAP. See “Reconciliation of

Non-GAAP Financial Measures” below for reconciliations for OppFi's

non-GAAP financial measures to the most directly comparable GAAP

financial measures. A reconciliation of projected full year 2024

Adjusted Net Income and Adjusted EPS to the most directly

comparable GAAP financial measures is not included in this press

release because, without unreasonable efforts, the Company is

unable to predict with reasonable certainty the amount or timing of

non-GAAP adjustments that are used to calculate these measures.

Third Quarter Results of

Operations

Consolidated Statements of Operations

The following tables present consolidated results of operations

for the three and nine months ended September 30, 2024 and 2023 (in

thousands, except share and per share data). Certain columns and

rows may not sum due to the use of rounded numbers for disclosure

purposes. Percentages presented are calculated from the underlying

whole-dollar amounts.

Comparison of the three months ended September 30, 2024 and

2023

Three Months Ended September

30,

Change

(unaudited)

2024

2023

$

%

Interest and loan related income

$

135,535

$

132,090

$

3,445

2.6

%

Other revenue

1,058

1,075

(17

)

(1.6

)

Total revenue

136,593

133,165

3,428

2.6

Change in fair value of finance

receivables

(45,425

)

(57,302

)

11,877

(20.7

)

Provision for credit losses on finance

receivables

(3

)

(195

)

192

(98.4

)

Net revenue

91,165

75,668

15,497

20.5

Expenses:

Sales and marketing

11,256

12,814

(1,558

)

(12.2

)

Customer operations(a)

12,202

11,996

206

1.7

Technology, products, and analytics

8,437

9,732

(1,295

)

(13.3

)

General, administrative, and other(a)

12,893

13,468

(575

)

(4.3

)

Total expenses before interest expense

44,788

48,010

(3,222

)

(6.7

)

Interest expense

11,285

12,077

(792

)

(6.6

)

Total expenses

56,073

60,087

(4,014

)

(6.7

)

Income from operations

35,092

15,581

19,511

125.2

Change in fair value of warrant

liabilities

(1,445

)

334

(1,779

)

(532.2

)

Income from equity method investment

627

—

627

—

Other income

80

80

—

—

Income before income taxes

34,354

15,995

18,359

114.8

Income tax expense

2,297

463

1,834

396.4

Net income

32,057

15,532

16,525

106.4

Less: net income attributable to

noncontrolling interest

27,793

13,363

14,430

108.0

Net income attributable to OppFi Inc.

$

4,264

$

2,169

$

2,095

96.6

%

Earnings per share attributable to OppFi

Inc.:

Earnings per common share:

Basic

$

0.21

$

0.13

Diluted

$

0.21

$

0.13

Weighted average common shares

outstanding:

Basic

20,248,004

16,772,275

Diluted

20,248,004

17,057,778

(a) Beginning with the quarter ended March

31, 2024, for all periods presented, the company reclassified

certain expenses that were previously included in general,

administrative, and other expenses to customer operations

expenses.

Comparison of the nine months ended

September 30, 2024 and 2023

Nine Months Ended September

30,

Change

(unaudited)

2024

2023

$

%

Interest and loan related income

$

386,890

$

373,615

$

13,275

3.6

%

Other revenue

3,350

2,410

940

39.0

Total revenue

390,240

376,025

14,215

3.8

Change in fair value of finance

receivables

(149,546

)

(164,463

)

14,917

(9.1

)

Provision for credit losses on finance

receivables

(34

)

(4,131

)

4,097

(99.2

)

Net revenue

240,660

207,431

33,229

16.0

Expenses:

Sales and marketing

30,258

34,975

(4,717

)

(13.5

)

Customer operations(a)

35,173

34,770

403

1.2

Technology, products, and analytics

27,364

29,465

(2,101

)

(7.1

)

General, administrative, and other(a)

44,323

35,897

8,426

23.5

Total expenses before interest expense

137,118

135,107

2,011

1.5

Interest expense

33,679

34,679

(1,000

)

(2.9

)

Total expenses

170,797

169,786

1,011

0.6

Income from operations

69,863

37,645

32,218

85.6

Change in fair value of warrant

liabilities

2,750

838

1,912

228.2

Income from equity method investment

627

—

627

—

Other income

239

352

(113

)

(32.1

)

Income before income taxes

73,479

38,835

34,644

89.2

Income tax expense

3,615

1,297

2,318

178.7

Net income

69,864

37,538

32,326

86.1

Less: net income attributable to

noncontrolling interest

56,997

32,976

24,021

72.8

Net income attributable to OppFi Inc.

$

12,867

$

4,562

$

8,305

182.0

%

Earnings per share attributable to OppFi

Inc.:

Earnings per common share:

Basic

$

0.65

$

0.29

Diluted

$

0.65

$

0.29

Weighted average common shares

outstanding:

Basic

19,711,752

15,820,262

Diluted

20,460,396

16,046,831

(a) Beginning with the quarter ended March

31, 2024, for all periods presented, the company reclassified

certain expenses that were previously included in general,

administrative, and other expenses to customer operations

expenses.

Condensed Consolidated Balance

Sheets

Comparison as of September 30, 2024 and

December 31, 2023 (in thousands):

(unaudited)

September 30,

December 31,

2024

2023

Assets

Cash and restricted cash

$

74,233

$

73,943

Finance receivables at fair value

461,457

463,320

Finance receivables at amortized cost,

net

8

110

Equity method investment

19,429

—

Other assets

64,139

64,170

Total assets

$

619,266

$

601,543

Liabilities and stockholders’

equity

Accounts payable and accrued expenses

$

30,420

$

26,448

Other liabilities

38,876

40,086

Total debt

325,550

334,116

Warrant liabilities

4,114

6,864

Total liabilities

398,960

407,514

Total stockholders’ equity

220,306

194,029

Total liabilities and stockholders’

equity

$

619,266

$

601,543

Total cash and restricted cash increased by $0.3 million as of

September 30, 2024 compared to December 31, 2023 driven by an

increase in received payments relative to originations, partially

offset by the cash consideration for the acquisition of the equity

interest in Bitty. Finance receivables at fair value decreased by

$1.9 million as of September 30, 2024 compared to December 31, 2023

mainly driven by one of our bank partners retaining a higher

percentage of loans originated in certain states. Finance

receivables at amortized cost, net, decreased by $0.1 million as of

September 30, 2024 compared to December 31, 2023 due to the

continued rundown of SalaryTap finance receivables. Equity method

investment increased by $19.4 million as of September 30, 2024

compared to December 31, 2023 due to the acquisition of 35% of the

outstanding equity securities in Bitty. Other assets decreased by

$31 thousand as of September 30, 2024 compared to December 31, 2023

mainly due to a decrease in the operating lease right of use asset

of $1.2 million and a decrease in the deferred tax asset of $3.5

million, partially offset by an increase in the settlement

receivable of $3.2 million and an increase in property, equipment,

and software of $1.1 million.

Accounts payable and accrued expenses increased by $4.0 million

as of September 30, 2024 compared to December 31, 2023 driven by an

increase in accrued expenses of $3.7 million and an increase in

accounts payable of $0.2 million. Other liabilities decreased by

$1.2 million as of September 30, 2024 compared to December 31, 2023

driven by a decrease in the operating lease liability of $1.3

million, partially offset by an increase in the tax receivable

agreement liability of $0.1 million. Total debt decreased by $8.6

million as of September 30, 2024 compared to December 31, 2023

driven by a decrease in the term loan of $9.7 million and notes

payable of $1.4 million, partially offset by an increase in

utilization of revolving lines of credit of $2.6 million. Warrant

liabilities decreased by $2.8 million due to the decrease in the

valuation of the warrants as of September 30, 2024 compared to

December 31, 2023. Total stockholders’ equity increased by $26.3

million as of September 30, 2024 compared to December 31, 2023

driven by net income and stock-based compensation, partially offset

by purchases of treasury stock and dividend issuance.

Financial Capacity and Capital

Resources

As of September 30, 2024, OppFi had $44.8 million in

unrestricted cash, an increase of $13.0 million from December 31,

2023. As of September 30, 2024, OppFi had an additional $199.4

million of unused debt capacity under its financing facilities for

future availability, representing a 38% overall undrawn capacity,

an increase from $192.3 million as of December 31, 2023. The

increase in undrawn debt was driven primarily by using excess cash

to pay down debt on our term loan. Including total financing

commitments of $525.0 million and cash and restricted cash on the

balance sheet of $74.2 million, OppFi had approximately $599.2

million in funding capacity as of September 30, 2024.

Reconciliation of Non-GAAP Financial

Measures

The following tables present reconciliations of non-GAAP

financial measures for the three and nine months ended September

30, 2024 and 2023 (in thousands, except share and per share data).

Certain columns and rows may not sum due to the use of rounded

numbers for disclosure purposes. Percentages presented are

calculated from the underlying whole-dollar amounts.

Adjusted EBT and Adjusted Net Income

Comparison of the three months ended September 30, 2024 and

2023

Three Months Ended September

30,

Variance

(unaudited)

2024

2023

$

%

Net income

$

32,057

$

15,532

$

16,525

106.4

%

Income tax expense

2,297

463

1,834

396.4

Other income

(80

)

(80

)

—

—

Change in fair value of warrant

liabilities

1,445

(334

)

1,779

532.2

Other addbacks and one-time expenses,

net(a)

1,967

1,991

(24

)

(1.2

)

Adjusted EBT(b)

37,686

17,572

20,114

114.5

Less: pro forma taxes(c)

8,878

4,247

4,631

109.0

Adjusted net income(b)

$

28,808

$

13,325

$

15,483

116.2

%

Adjusted earnings per share(b)

$

0.33

$

0.16

Weighted average diluted shares

outstanding

86,806,628

85,288,105

(a) For the three months ended September

30, 2024, other addbacks and one-time expenses, net, of $2.0

million included $1.1 million in expenses related to stock

compensation, $0.9 million in expenses related to legal matters,

and $0.1 million in expenses related to OppFi Card’s exit

activities, partially offset by a $0.2 million addback related to

corporate development. For the three months ended September 30,

2023, other addbacks and one-time expenses, net, of $2.0 million

included $1.1 million in expenses related to stock compensation,

$0.4 million in expenses related to corporate development, $0.2

million in expenses related to legal matters, $0.2 million in

expenses related to provision for credit losses on the OppFi Card

finance receivables, and $0.1 million in expenses related to

retention and severance.

(b) Beginning with the quarter ended March

31, 2024, for all periods presented, the Company has updated its

presentation and calculation of Adjusted EBT, and the corresponding

presentations and calculations of Adjusted Net Income and Adjusted

EPS, to no longer add back debt issuance cost amortization.

(c) Assumes a tax rate of 23.56% for the

three months ended September 30, 2024 and 24.17% for the three

months ended September 30, 2023, reflecting the U.S. federal

statutory rate of 21% and a blended statutory rate for state income

taxes.

Comparison of the nine months ended

September 30, 2024 and 2023

Nine Months Ended September

30,

Variance

(unaudited)

2024

2023

$

%

Net income

$

69,864

$

37,538

$

32,326

86.1

%

Income tax expense

3,615

1,297

2,318

178.7

Other income

(239

)

(352

)

113

(32.1

)

Change in fair value of warrant

liabilities

(2,750

)

(838

)

(1,912

)

228.2

Other addbacks and one-time expenses,

net(a)

11,103

5,934

5,169

87.1

Adjusted EBT(b)

81,593

43,579

38,014

87.2

Less: pro forma taxes(c)

19,223

10,531

8,692

82.5

Adjusted net income(b)

$

62,370

$

33,048

$

29,322

88.7

%

Adjusted earnings per share(b)

$

0.72

$

0.39

Weighted average diluted shares

outstanding

86,368,930

84,826,413

(a) For the nine months ended September

30, 2024, other addbacks and one-time expenses, net, of $11.1

million included $4.2 million in expenses related to stock

compensation, $3.0 million in expenses related to OppFi Card’s exit

activities, $2.1 million in expenses related to legal matters, $1.2

million in expenses related to severance, and $0.7 million in

expenses related to corporate development. For the nine months

ended September 30, 2023, other addbacks and one-time expenses,

net, of $5.9 million included $4.0 million in expenses related to

provision for credit losses on the OppFi Card finance receivables,

$3.1 million in expenses related to stock compensation, $0.9

million in expenses related to retention and severance, $0.8

million in expenses related to corporate development, and $0.2

million in expenses related to legal matters, partially offset by a

$3.0 million addback from the reclassification of OppFi Card

finance receivables from assets held for sale to assets held for

investment at amortized cost.

(b) Beginning with the quarter ended March

31, 2024, for all periods presented, the Company has updated its

presentation and calculation of Adjusted EBT, and the corresponding

presentations and calculations of Adjusted Net Income and Adjusted

EPS, to no longer add back debt issuance cost amortization.

(c) Assumes a tax rate of 23.56% for the

nine months ended September 30, 2024 and a 24.17% tax rate for the

nine months ended September 30, 2023, reflecting the U.S. federal

statutory rate of 21% and a blended statutory rate for state income

taxes.

Adjusted Earnings Per Share

Comparison of the three months ended

September 30, 2024 and 2023

Three Months Ended September

30,

(unaudited)

2024

2023

Weighted average Class A common stock

outstanding

20,248,004

16,772,275

Weighted average Class V voting stock

outstanding

65,664,358

93,730,327

Elimination of earnouts at period end

—

(25,500,000

)

Dilutive impact of restricted stock

units

811,941

235,514

Dilutive impact of performance stock

units

73,564

49,989

Dilutive impact of stock options

8,761

—

Weighted average diluted shares

outstanding

86,806,628

85,288,105

Three Months Ended

Three Months Ended

(in thousands, except share and per share

data)

September 30, 2024

September 30, 2023

(unaudited)

$

Per Share

$

Per Share

Weighted average diluted shares

outstanding

86,806,628

85,288,105

Net income

$

32,057

$

0.37

$

15,532

$

0.18

Income tax expense

2,297

0.03

463

0.01

Other income

(80

)

—

(80

)

—

Change in fair value of warrant

liabilities

1,445

0.02

(334

)

—

Other addbacks and one-time expenses,

net

1,967

0.02

1,991

0.02

Adjusted EBT(a)

37,686

0.43

17,572

0.21

Less: pro forma taxes

8,878

0.10

4,247

0.05

Adjusted net income(a)

28,808

0.33

13,325

0.16

(a) Beginning with the quarter ended March

31, 2024, for all periods presented, the Company has updated its

presentation and calculation of Adjusted EBT, and corresponding

presentations and calculations of Adjusted Net Income and Adjusted

EPS, to no longer add back debt issuance cost amortization.

Comparison of the nine months ended

September 30, 2024 and 2023

Nine Months Ended September

30,

(unaudited)

2024

2023

Weighted average Class A common stock

outstanding

19,711,752

15,820,262

Weighted average Class V voting stock

outstanding

65,908,534

94,279,582

Elimination of earnouts at period end

—

(25,500,000

)

Dilutive impact of restricted stock

units

672,399

198,698

Dilutive impact of performance stock

units

73,325

27,871

Dilutive impact of stock options

2,920

—

Weighted average diluted shares

outstanding

86,368,930

84,826,413

Nine Months Ended

Nine Months Ended

(in thousands, except share and per share

data)

September 30, 2024

September 30, 2023

(unaudited)

$

Per Share

$

Per Share

Weighted average diluted shares

outstanding

86,368,930

84,826,413

Net income

$

69,864

$

0.81

$

37,538

$

0.44

Income tax expense

3,615

0.04

1,297

0.02

Other income

(239

)

—

(352

)

—

Change in fair value of warrant

liabilities

(2,750

)

(0.03

)

(838

)

(0.01

)

Other addbacks and one-time expenses,

net

11,103

0.13

5,934

0.07

Adjusted EBT(a)

81,593

0.94

43,579

0.51

Less: pro forma taxes

19,223

0.22

10,531

0.12

Adjusted net income(a)

62,370

0.72

33,048

0.39

(a) Beginning with the quarter ended March

31, 2024, for all periods presented, the Company has updated its

presentation and calculation of Adjusted EBT, and corresponding

presentations and calculations of Adjusted Net Income and Adjusted

EPS, to no longer add back debt issuance cost amortization.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107458477/en/

Investor Relations: investors@oppfi.com

Media Relations: media@oppfi.com

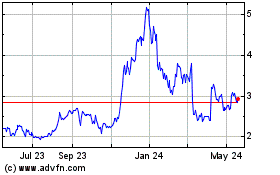

OppFi (NYSE:OPFI)

Historical Stock Chart

From Jan 2025 to Feb 2025

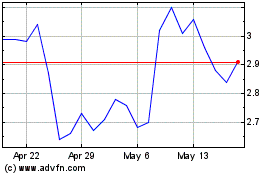

OppFi (NYSE:OPFI)

Historical Stock Chart

From Feb 2024 to Feb 2025