0001792580false00017925802023-09-262023-09-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 26, 2023

Ovintiv Inc.

(Exact Name of Registrant as Specified in its Charter)

|

|

|

Delaware (State or Other Jurisdiction of Incorporation) |

001-39191 (Commission File Number) |

84-4427672 (I.R.S. Employer Identification No.) |

|

|

|

Suite 1700, 370 - 17th Street Denver, Colorado (Address of principal executive offices) |

|

80202 (Zip Code) |

(303) 623-2300

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.01 per share |

|

OVV |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 8.01 Other Events.

On September 26, 2023, Ovintiv Inc. (the “Company”) issued a news release announcing that it has received acceptance from the Toronto Stock Exchange to renew its normal course issuer bid to purchase up to 26,734,819 common shares during the 12-month period commencing on October 3, 2023, and ending October 2, 2024. A copy of the news release is attached as Exhibit 99.1 to this Current Report on Form 8-K.

ITEM 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 26, 2023

|

|

|

|

|

OVINTIV INC. |

|

(Registrant) |

|

|

|

|

|

By: |

/s/ Dawna I. Gibb |

|

|

Name: Dawna I. Gibb |

|

|

Title: Assistant Corporate Secretary |

|

|

|

Exhibit 99.1 news release |

|

|

Ovintiv Renews Annual Share Buy-Back Program

Company Receives TSX Approval for Renewal of Normal Course Issuer Bid

DENVER, September 26, 2023—Ovintiv Inc. (NYSE, TSX: OVV) today announced it has received regulatory approvals for the renewal of its share buy-back program. This action is consistent with the Company’s capital allocation framework, which returns at least 50 percent of post base dividend Non-GAAP Free Cash Flow to shareholders.

The Toronto Stock Exchange ("TSX") has accepted Ovintiv’s notice of intention to renew its normal course issuer bid ("NCIB") to purchase up to 26,734,819 common shares during the 12-month period commencing October 3, 2023, and ending October 2, 2024. The number of shares authorized for purchase represents 10 percent of Ovintiv’s public float as of September 21, 2023, as calculated pursuant to TSX rules. Purchases will be made on the open market through the facilities of the TSX, New York Stock Exchange ("NYSE") and/or alternative trading systems at the market price at the time of acquisition, as well as by other means permitted by stock exchange rules and securities laws including Rule 10b-18 under the Securities Exchange Act of 1934, as amended.

Ovintiv has also renewed its automatic share purchase plan ("ASPP") allowing it to purchase common shares under the NCIB when Ovintiv would ordinarily not be permitted to purchase shares due to regulatory restrictions and customary self-imposed blackout periods. Pursuant to the ASPP, Ovintiv will provide instructions during non-blackout periods to its designated broker, which may not be varied or suspended during the blackout period. Purchases by Ovintiv’s designated broker will be in accordance with applicable stock exchange rules and securities laws and the terms of the ASPP. All purchases made under the ASPP are included in computing the number of common shares purchased under the NCIB. The ASPP has been pre-cleared as required by the TSX.

The actual number of common shares that may be purchased under the NCIB and the timing of any such purchases will be determined by Ovintiv. The average daily trading volume through the facilities of the TSX, excluding purchases made on such facilities, during the most recently completed six-month period was 239,240 common shares. Consequently, daily purchases through the facilities of the TSX will be limited to 59,810 common shares, other than block purchase exceptions. Purchases over the NYSE will be made in compliance with the volume limitations in Rule 10b-18 in relation to average daily trading volume and block trades. All common shares acquired by Ovintiv under the NCIB may be cancelled or returned to treasury as authorized but unissued shares.

Pursuant to its existing NCIB, under which Ovintiv received approval from the TSX to purchase up to 24,846,855 common shares during the 12-month period commencing October 3, 2022 and ending October 2, 2023, Ovintiv has purchased 11,199,940 common shares on the TSX, NYSE and alternative trading systems at a weighted average purchase price of US$46.06 per common share.

On March 9, 2022, Ovintiv obtained an exemption order (the "NCIB Exemption") from applicable Canadian regulators, permitting Ovintiv to make repurchases under the NCIB through the facilities of the NYSE and other United States-based trading systems in excess of 5 percent of Ovintiv’s outstanding number of shares, the maximum allowable under applicable Canadian securities laws absent an exemption. The NCIB Exemption allows Ovintiv to repurchase up to 10 percent of Ovintiv’s public float on such U.S. marketplaces provided that Ovintiv’s aggregate repurchases on all marketplaces do not exceed this amount over the 12-month period of the NCIB, which is consistent with the maximum number of shares Ovintiv is able to purchase under the NCIB. The other conditions to the NCIB Exemption are outlined in Ovintiv’s 2023 second quarter report on Form 10-Q filed on EDGAR and SEDAR+.

ADVISORY REGARDING FORWARD-LOOKING STATEMENTS - This news release contains certain forward-looking statements or information (collectively, "FLS") within the meaning of applicable securities legislation, including the United States Private Securities Litigation Reform Act of 1995. FLS include: the planned share repurchase program, including the amount and number of shares to be acquired, treatment of such shares following purchase, anticipated timeframe, method and location of purchases, announced capital framework; and benefits of the NCIB.

Readers are cautioned against unduly relying on FLS which, by their nature, involve numerous assumptions, risks and uncertainties that may cause such statements not to occur, or results to differ materially from those expressed or implied. These assumptions include: future commodity prices and differentials; foreign exchange rates; ability to access cash, credit facilities and shelf prospectuses; and expectations and projections made in light of, and generally consistent with, Ovintiv's historical experience and its perception of historical trends, including with respect to the pace of technological development, benefits achieved and general industry expectations.

Risks and uncertainties that may affect these business outcomes include: ability to generate sufficient cash flow to meet obligations and fund the NCIB; commodity price volatility; variability in the amount, number of shares, method, location and timing of purchases, if any, pursuant to the NCIB; fluctuations in currency and interest rates; and other risks and uncertainties impacting Ovintiv's business, as described in its most recent Annual Report on Form 10-K and as described from time to time in Ovintiv's other periodic filings as filed on EDGAR and SEDAR+.

Although Ovintiv believes the expectations represented by such FLS are reasonable, there can be no assurance that such expectations will prove to be correct. Readers are cautioned that the assumptions, risks and uncertainties referenced above are not exhaustive. FLS are made as of the date of this news release and, except as required by law, Ovintiv undertakes no obligation to update publicly or revise any FLS. FLS contained in this news release are expressly qualified by these cautionary statements.

Further information on Ovintiv is available on the company's website, www.ovintiv.com, or by contacting:

|

|

|

Investor contact: (888) 525-0304 |

Media contact: (403) 645-2252 |

SOURCE: Ovintiv Inc. |

|

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

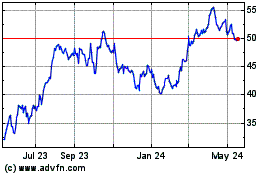

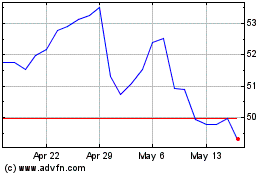

Ovintiv (NYSE:OVV)

Historical Stock Chart

From Apr 2024 to May 2024

Ovintiv (NYSE:OVV)

Historical Stock Chart

From May 2023 to May 2024