Banco Azteca Achieves Massive Cost Savings and Speeds Digital Transformation with UiPath AI and Automation

24 October 2024 - 5:00AM

Business Wire

With the integration of the UiPath Platform,

leading Mexico financial services firm achieves unparalleled speed

and accuracy in processing high-volume tasks and boosts

productivity by 50 percent

UiPath (NYSE: PATH), a leading enterprise automation and AI

software company, announced today that Banco Azteca is transforming

its operations and achieving significant efficiency gains with the

strategic implementation of AI and automation from UiPath.

Banco Azteca is one of Mexico's largest financial institutions,

and a subsidiary of Grupo Salinas, which offers a comprehensive

range of financial services, including savings accounts, loans,

credit cards, insurance, and investment options. With an extensive

network across Mexico and Central and South America, Banco Azteca

serves millions of customers, focusing on financial inclusion and

empowering individuals and small businesses. The company’s AI and

automation initiative is revolutionizing business operations by

transitioning from labor intensive, error-prone manual processes to

streamlined, automated workflows.

“The transformation that we have achieved using the UiPath

Platform fortifies our competitive edge and underscores our

commitment to innovation, setting a new standard for excellence in

the financial sector,” said Kathia Barrios, Director of

Transformation Operations at Banco Azteca. “We have completely

overhauled batch processing, which took many hours to complete,

created drastic improvements in processing high quantities of

claims, and realized significant operational efficiencies. Our

transformation is enhancing customer experiences and employee

satisfaction.”

Banco Azteca incorporated AI and ML to tackle more complex tasks

and make smarter decisions. Initially, Banco Azteca built 15

automations to establish the foundation of its digital

transformation, but quickly realized the full potential of the

UiPath Platform within its Center of Excellence and developed more

automations to significantly improve customer service. The company

now has 190 automations designed to optimize diverse processes. For

example, 56% of banking transaction clarifications are now resolved

in under 24 hours and response times decreased from an average of

13 to 1 day. Business outcomes include enhanced service delivery,

heightened productivity, and increased shareholder value.

“AI and automation are revolutionizing the way we work by

empowering businesses to unleash innovation and tackle some of

their most time-consuming challenges to help people spend time on

more meaningful work,” said Brandon Deer, Go-to-Market Chief

Operations Officer and Chief Strategy Officer at UiPath. “The

results that Banco Azteca has achieved are truly inspirational not

only within the financial services sector, but to any business that

is seeking to modernize for the digital age with AI and automation.

This kind of success in operations and productivity is immediately

beneficial to customers, partners, and employees, all while

maintaining security and compliance with strict banking

regulations.”

UiPath Insights, which provides unparalleled visibility into

process performance and outcomes, is a fundamental pillar of Banco

Azteca's success. This, coupled with UiPath Automation Hub, enables

the company to identify and prioritize high-impact automation

opportunities. Additionally, the UiPath Action Center helps Banco

Azteca streamline validation processes, offering a user-friendly

interface that accelerates decision-making. The company is also

harnessing the power of UiPath Document Understanding to

intelligently extract information from structured and unstructured

documents, ensuring compliance with stringent banking regulations.

For instance, Document Understanding has been instrumental in

validating identification documents, a critical requirement for

Mexican and international banking standards.

In life insurance claims management, Banco Azteca has processed

18,400 folios and validated 237,000 documents in a single year,

leading to a remarkable savings of 7,300 working hours. In their

legal department, Banco Azteca has improved processing capacity and

generated over two hundred thousand dollars in savings per month.

Additionally, the bank’s financial document review process handles

1,300 documents daily, effectively eliminating human errors and

averting potential regulatory penalties. The capacity to perform

complex, high-volume tasks with unparalleled speed and accuracy has

not only boosted productivity by 50% but has also halved the

development time of complex bots.

Banco Azteca was also recently honored as a winner of the UiPath

AI25 Awards, which recognize companies that are using AI and

automation from UiPath to enhance productivity, transform

experiences, create substantial ROI, and deliver exceptional

business results.

About UiPath

UiPath (NYSE: PATH) develops AI technology that mirrors human

intelligence with ever-increasing sophistication, transforming how

businesses operate, innovate, and compete. The UiPath Platform™

accelerates the shift toward a new era of agentic automation—one

where agents, robots, people, and models integrate seamlessly to

enable autonomous processes and smarter decision making. With a

focus on security, accuracy, and resiliency, UiPath is committed to

shaping a world where AI enhances human potential and

revolutionizes industries. For more information, visit

www.uipath.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241023627252/en/

UiPath Media Contact UiPath pr@uipath.com

UiPath Investor Relations Contact UiPath

investor.relations@uipath.com

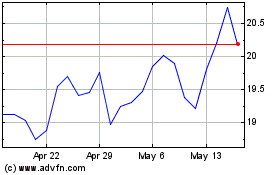

UiPath (NYSE:PATH)

Historical Stock Chart

From Oct 2024 to Nov 2024

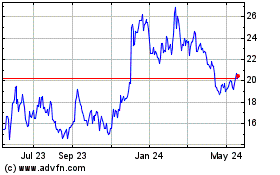

UiPath (NYSE:PATH)

Historical Stock Chart

From Nov 2023 to Nov 2024