Adams Natural Resources Fund Announces 2024 Performance

17 January 2025 - 9:16AM

Adams Natural Resources Fund, Inc. (NYSE: PEO) announces the Fund’s

investment returns for 2024. The total return on the Fund’s net

asset value for 2024 was 5.3%, with dividends and capital gains

reinvested. The comparable figures for the S&P 500 Energy

Sector and the S&P 500 Materials Sector were 5.7% and 0.0%,

respectively. Our benchmark, which is comprised of the

S&P 500 Energy Sector (80%) and the S&P 500 Materials

Sector (20%), returned 4.6%. The total return on the Fund’s market

price for the same period was 13.8%.

The Fund paid $1.77 per share in income dividends and realized

capital gain distributions to shareholders in 2024, producing an

annual distribution rate of 6.7% of net asset value.

“The Energy market presented challenges in 2024. Our disciplined

approach supported good stock selection that enabled the Fund to

outperform its benchmark,” said Jim Haynie, CEO of Adams

Funds.

The 2024 Annual Report is expected to be released on or about

February 19, 2025.

| ANNUALIZED

ONE, THREE, FIVE, AND TEN-YEAR COMPARATIVE RETURNS

(12/31/24) |

| |

|

|

|

|

|

|

1 Year |

3 Year |

5 Year |

10 Year |

| Adams Natural

Resources Fund (NAV) |

5.3% |

16.1% |

12.5% |

5.5% |

| Adams Natural

Resources Fund (market price) |

13.8% |

17.8% |

13.0% |

5.8% |

| S&P 500 Energy

Sector |

5.7% |

20.0% |

12.1% |

4.9% |

| S&P 500 Materials

Sector |

0.0% |

-0.4% |

8.7% |

7.9% |

| |

|

|

|

|

NET ASSET VALUE ANNOUNCED

The Fund’s net asset value at the end of 2024, compared with the

year earlier, was:

|

|

12/31/24 |

12/31/23 |

| Net assets |

$636,334,398 |

$633,446,941 |

| Shares

outstanding |

26,284,550 |

25,514,441 |

| Net asset value per

share |

$24.21 |

$24.83 |

| |

|

|

| TEN

LARGEST EQUITY PORTFOLIO HOLDINGS (12/31/24) |

| |

|

|

|

% of Net Assets |

| Exxon Mobil

Corporation |

24.2% |

| Chevron

Corporation |

11.6% |

| ConocoPhillips |

6.4% |

| Linde plc |

4.6% |

| EOG Resources,

Inc. |

4.2% |

| Williams Companies,

Inc.. |

3.1% |

| ONEOK, Inc. |

3.0% |

| Hess Corporation |

2.9% |

| Baker Hughes

Company |

2.8% |

| Phillips 66 |

2.5% |

|

Total |

65.3% |

| |

|

| INDUSTRY

WEIGHTINGS (12/31/24) |

| |

|

|

|

% of Net Assets |

|

Energy |

|

| Integrated Oil &

Gas |

35.8% |

| Exploration &

Production |

20.7% |

| Storage &

Transportation |

10.3% |

| Refining &

Marketing |

6.4% |

| Equipment &

Services |

6.3% |

|

Energy Related |

0.5% |

|

Materials |

|

| Chemicals |

13.0% |

| Metals & Mining

|

3.1% |

| Containers &

Packaging |

1.9% |

| Construction

Materials |

1.5% |

| |

|

About Adams Funds

Since 1929, Adams Funds has consistently helped generations of

investors reach their investment goals. Adams Funds is comprised of

two closed-end funds, Adams Diversified Equity Fund, Inc. (NYSE:

ADX) and Adams Natural Resources Fund, Inc. (NYSE: PEO). The Funds

are actively managed by an experienced team with a disciplined

approach and have paid dividends for more than 90 years across many

market cycles. The Funds are committed to paying a minimum annual

distribution rate of 8% of NAV paid evenly each quarter throughout

the year, providing reliability for long-term shareholders. A

portion of any distribution may be treated as paid from sources

other than net income, including but not limited to short-term

capital gain, long-term capital gain, and return of capital. The

final determination of the source of all distributions for tax

reporting purposes in a calendar year, including the percentage of

qualified dividend income, will be made after year-end. Shares can

be purchased through our transfer agent or through a broker. For

more information about Adams Funds, please

visit: adamsfunds.com.

For further information please contact:

adamsfunds.com/about/contact │800.638.2479

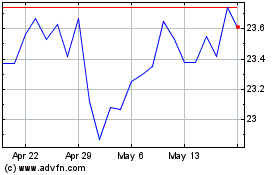

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

From Feb 2025 to Mar 2025

Adams Natural Resources (NYSE:PEO)

Historical Stock Chart

From Mar 2024 to Mar 2025