0000822416falsetrue00008224162025-01-292025-01-290000822416us-gaap:CommonStockMember2025-01-292025-01-290000822416phm:SeriesAJuniorParticipatingPreferredSharePurchaseRightsMember2025-01-292025-01-29

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): January 29, 2025

PULTEGROUP, INC.

(Exact name of registrant as specified in its Charter)

| | | | | | | | |

| Michigan | 1-9804 | 38-2766606 |

| (State or other jurisdiction | (Commission | (IRS Employer |

| of incorporation) | File Number) | Identification No.) |

| | | | | | | | |

| 3350 Peachtree Road NE, Suite 1500 |

| Atlanta, | Georgia | 30326 |

| (Address of principal executive offices) (Zip Code) |

| | | | | | | | |

| Registrant's telephone number, including area code: | 404 | 978-6400 |

____________________________________________________

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Shares, par value $0.01 | PHM | New York Stock Exchange |

| Series A Junior Participating Preferred Share Purchase Rights | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On January 30, 2025, PulteGroup, Inc. (the "Company") issued a press release announcing its financial results for its fourth quarter ended December 31, 2024. A copy of this earnings press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated in Item 2.02 by reference.

ITEM 8.01 OTHER EVENTS

On January 30, 2025, the Company issued a separate press release announcing a $1.5 billion increase in its share repurchase program, effective January 29, 2025. A copy of this press release is filed as Exhibit 99.2 to this Current Report on Form 8-K.

ITEM 9.01 FINANCIAL STATEMENTS AND EXHIBITS

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

The information in Item 2.02 of this Current Report on Form 8-K, including the earnings press release incorporated in such Item 2.02, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall it be incorporated by reference in any filing under the Securities Act of 1933, except as expressly set forth by specific reference in such filing.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | PULTEGROUP, INC. |

| | | | | |

| | | | | |

| Date: | January 30, 2025 | | By: | /s/ Todd N. Sheldon |

| | | | Name: | Todd N. Sheldon |

| | | | Title: | Executive Vice President, General Counsel and Corporate Secretary |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| FOR IMMEDIATE RELEASE | Company Contact |

| Investors: Jim Zeumer |

| (404) 978-6434 |

| jim.zeumer@pultegroup.com |

PULTEGROUP REPORTS FOURTH QUARTER 2024 FINANCIAL RESULTS

•Earnings Per Share of $4.43

•Closings Increased 6% to 8,103

•Home Sale Revenues Increased 13% to $4.7 Billion

•Home Sale Gross Margin of 27.5%

•Net New Orders of 6,167 Homes with a Value of $3.5 Billion

•Unit Backlog of 10,153 Homes with a Value of $6.5 Billion

•Repurchased $320 Million of Common Shares in the Quarter

•Announces $1.5 Billion Increase to Share Repurchase Authorization

ATLANTA – Jan. 30, 2025 – PulteGroup, Inc. (NYSE: PHM) announced today financial results for its fourth quarter ended December 31, 2024. For the quarter, the Company reported net income of $913 million, or $4.43 per share. Reported net income includes a pre-tax insurance benefit of $255 million, or $0.93 per share. In the prior year period, the Company reported net income of $711 million, or $3.28 per share, inclusive of a pre-tax insurance benefit of $65 million, or $0.23 per share.

“PulteGroup’s strong fourth quarter financial results completed a record-setting year,” said PulteGroup President and CEO, Ryan Marshall. “For the full year, PulteGroup generated nearly $18 billion in revenues and net income of $3.1 billion, while generating a return on equity of 27.5%*. These results allowed us to invest $5.3 billion into our business, return $1.4 billion to our shareholders through stock repurchases and dividends, and retire $310 million of senior notes.

“Despite Federal Reserve actions to lower short-term interest rates, mortgage interest rates remained elevated in the fourth quarter, which impacted buyer demand as homebuyers continue to face affordability challenges. The operational changes we have implemented in response to these conditions, including targeted sales incentives coupled with faster construction cycle times, have yielded a sales backlog and inventory in process that have us well-positioned for the upcoming spring selling season.”

Fourth Quarter Results

Home sale revenues in the fourth quarter increased 13% over the prior year to $4.7 billion. Higher revenues in the fourth quarter were driven by a 6% increase in closings to 8,103 homes. The average selling price of homes closed in the period was $581,000, an increase of 6% compared with $547,000 in the prior year period.

The Company’s reported home sale gross margin in the fourth quarter was 27.5%, compared with 28.9% in the prior year period. Homebuilding SG&A expense for the fourth quarter was $196 million, or 4.2% of home sale

revenues, compared with $308 million, or 7.4% in the prior year period. Reported SG&A expense reflects insurance benefits of $255 million and $65 million recorded in the fourth quarter of 2024 and 2023, respectively.

The Company’s net new orders for the fourth quarter were 6,167 homes, which is consistent with net new orders of 6,214 homes in the prior year period. The value of net new orders in the quarter was $3.5 billion, or an increase of 4% over last year. Average community count for the fourth quarter was 960, which is up 4% from the prior year.

The Company's financial services operations generated pre-tax income of $51 million, an increase of 16% over prior year pre-tax income of $44 million. Higher pre-tax income for the period reflects higher volumes and average selling prices in the Company’s homebuilding operations, coupled with a slightly higher mortgage capture rate of 86%, up from 85% last year.

Fourth quarter pre-tax income for the Company increased 25% over the prior year period to $1.2 billion. Income tax expense for the fourth quarter was $269 million, or an effective tax rate of 22.8%.

PulteGroup repurchased 2.5 million of its common shares in the fourth quarter for $320 million, or an average price of $129.90 per share. During 2024, the Company repurchased 10.1 million common shares, or 4.7% of shares outstanding, for $1.2 billion, or $119.21 per share. The Company ended the quarter with $1.7 billion of cash and a debt-to-capital ratio of 11.8%.

In a separate release, the Company announced that its Board of Directors approved a $1.5 billion increase to the Company’s share repurchase authorization, bringing its remaining share repurchase authorization to $2.1 billion.

A conference call discussing PulteGroup's fourth quarter 2024 results is scheduled for Thursday, January 30, 2025, at 8:30 a.m. Eastern Time. Interested investors can access the live webcast via PulteGroup's corporate website at www.pultegroupinc.com.

* The Company's return on equity is calculated as net income for the trailing twelve months divided by average shareholders' equity, where average shareholders' equity is the sum of ending shareholders' equity balances of the trailing five quarters divided by five.

Forward-Looking Statements

This release includes “forward-looking statements.” These statements are subject to a number of risks, uncertainties and other factors that could cause our actual results, performance, prospects or opportunities, as well as those of the markets we serve or intend to serve, to differ materially from those expressed in, or implied by, these statements. You can identify these statements by the fact that they do not relate to matters of a strictly factual or historical nature and generally discuss or relate to forecasts, estimates or other expectations regarding future events. Generally, the words “believe,” “expect,” “intend,” “estimate,” “anticipate,” “plan,” “project,” “may,” “can,” “could,” “might,” “should,” “will” and similar expressions identify forward-looking statements, including statements related to any potential impairment charges and the impacts or effects thereof, expected operating and performing results, planned transactions, planned objectives of management, future developments or conditions in the industries in which we participate and other trends, developments and uncertainties that may affect our business in the future.

Such risks, uncertainties and other factors include, among other things: interest rate changes and the availability of mortgage financing; the impact of any changes to our strategy in responding to the cyclical nature of the industry or deteriorations in industry changes or downward changes in general economic or other business conditions, including any changes regarding our land positions and the levels of our land spend; economic changes nationally or in our local markets, including inflation, deflation, changes in consumer confidence and preferences and the state of the market for homes in general; labor supply shortages and the cost of labor; the availability and cost of land and other raw materials used by us in our homebuilding operations; a decline in the value of the land and home inventories we

maintain and resulting possible future writedowns of the carrying value of our real estate assets; competition within the industries in which we operate; rapidly changing technological developments including, but not limited to, the use of artificial intelligence in the homebuilding industry; governmental regulation directed at or affecting the housing market, the homebuilding industry or construction activities, slow growth initiatives and/or local building moratoria; the availability and cost of insurance covering risks associated with our businesses, including warranty and other legal or regulatory proceedings or claims; damage from improper acts of persons over whom we do not have control or attempts to impose liabilities or obligations of third parties on us; weather related slowdowns; the impact of climate change and related governmental regulation; adverse capital and credit market conditions, which may affect our access to and cost of capital; the insufficiency of our income tax provisions and tax reserves, including as a result of changing laws or interpretations; the potential that we do not realize our deferred tax assets; our inability to sell mortgages into the secondary market; uncertainty in the mortgage lending industry, including revisions to underwriting standards and repurchase requirements associated with the sale of mortgage loans, and related claims against us; risks associated with the implementation of a new enterprise resource planning system; risks related to information technology failures, data security issues, and the effect of cybersecurity incidents and threats; the impact of negative publicity on sales; failure to retain key personnel; the impairment of our intangible assets; the disruptions associated with the COVID-19 pandemic (or another epidemic or pandemic or similar public threat or fear of such an event), and the measures taken to address it; the effect of cybersecurity incidents and threats; and other factors of national, regional and global scale, including those of a political, economic, business and competitive nature. See Item 1A – Risk Factors in our Annual Report on Form 10-K for the fiscal year ended December 31, 2023 for a further discussion of these and other risks and uncertainties applicable to our businesses. We undertake no duty to update any forward-looking statement, whether as a result of new information, future events or changes in our expectations.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one of America’s largest homebuilding companies with operations in more than 45 markets throughout the country. Through its brand portfolio that includes Centex, Pulte Homes, Del Webb, DiVosta Homes, American West and John Wieland Homes and Neighborhoods, the company is one of the industry’s most versatile homebuilders able to meet the needs of multiple buyer groups and respond to changing consumer demand. PulteGroup’s purpose is building incredible places where people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup brands, go to pultegroup.com; pulte.com; centex.com; delwebb.com; divosta.com; jwhomes.com; and americanwesthomes.com. Follow PulteGroup, Inc. on X: @PulteGroupNews.

# # #

PulteGroup, Inc.

Consolidated Results of Operations

($000's omitted, except per share data)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues: | | | | | | | |

| Homebuilding | | | | | | | |

| Home sale revenues | $ | 4,707,540 | | | $ | 4,165,231 | | | $ | 17,318,521 | | | $ | 15,598,707 | |

| Land sale and other revenues | 99,108 | | | 34,540 | | | 195,435 | | | 142,116 | |

| 4,806,648 | | | 4,199,771 | | | 17,513,956 | | | 15,740,823 | |

| Financial Services | 115,146 | | | 93,881 | | | 432,994 | | | 320,755 | |

| Total revenues | 4,921,794 | | | 4,293,652 | | | 17,946,950 | | | 16,061,578 | |

| | | | | | | |

| Homebuilding Cost of Revenues: | | | | | | | |

| Home sale cost of revenues | (3,413,930) | | | (2,961,920) | | | (12,311,766) | | | (11,030,206) | |

| Land sale and other cost of revenues | (88,690) | | | (32,139) | | | (189,893) | | | (124,607) | |

| (3,502,620) | | | (2,994,059) | | | (12,501,659) | | | (11,154,813) | |

| | | | | | | |

| Financial Services expenses | (64,471) | | | (50,036) | | | (224,086) | | | (187,280) | |

| Selling, general, and administrative expenses | (195,640) | | | (308,319) | | | (1,321,276) | | | (1,312,642) | |

| Equity income from unconsolidated entities, net | 1,625 | | | 213 | | | 44,201 | | | 4,561 | |

| | | | | | | |

| | | | | | | |

| Other income, net | 22,040 | | | 5,367 | | | 61,749 | | | 37,863 | |

| Income before income taxes | 1,182,728 | | | 946,818 | | | 4,005,879 | | | 3,449,267 | |

| Income tax expense | (269,489) | | | (235,825) | | | (922,617) | | | (846,895) | |

| Net income | $ | 913,239 | | | $ | 710,993 | | | $ | 3,083,262 | | | $ | 2,602,372 | |

| | | | | | | |

| Net income per share: | | | | | | | |

| Basic | $ | 4.47 | | | $ | 3.30 | | | $ | 14.82 | | | $ | 11.79 | |

| Diluted | $ | 4.43 | | | $ | 3.28 | | | $ | 14.69 | | | $ | 11.72 | |

| Cash dividends declared | $ | 0.22 | | | $ | 0.20 | | | $ | 0.82 | | | $ | 0.68 | |

| | | | | | | |

| Number of shares used in calculation: | | | | | | | |

| Basic | 204,339 | | | 214,399 | | | 208,107 | | | 219,958 | |

| Effect of dilutive securities | 1,841 | | | 1,364 | | | 1,722 | | | 1,205 | |

| Diluted | 206,180 | | | 215,763 | | | 209,829 | | | 221,163 | |

PulteGroup, Inc.

Condensed Consolidated Balance Sheets

($000's omitted)

(Unaudited)

| | | | | | | | | | | |

| December 31,

2024 | | December 31,

2023 |

| | | |

| ASSETS | | | |

| | | |

| Cash and equivalents | $ | 1,613,327 | | | $ | 1,806,583 | |

| Restricted cash | 40,353 | | | 42,594 | |

| Total cash, cash equivalents, and restricted cash | 1,653,680 | | | 1,849,177 | |

| House and land inventory | 12,665,813 | | | 11,795,370 | |

| Land held for sale | 27,007 | | | 23,831 | |

| Residential mortgage loans available-for-sale | 629,582 | | | 516,064 | |

| Investments in unconsolidated entities | 215,416 | | | 166,913 | |

| Other assets | 2,001,991 | | | 1,545,667 | |

| Goodwill | 68,930 | | | 68,930 | |

| Intangible assets | 46,303 | | | 56,338 | |

| Deferred tax assets | 55,041 | | | 64,760 | |

| $ | 17,363,763 | | | $ | 16,087,050 | |

| | | |

| | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | |

| | | |

| Liabilities: | | | |

| Accounts payable | $ | 727,995 | | | $ | 619,012 | |

| Customer deposits | 512,580 | | | 675,091 | |

| Deferred tax liabilities | 443,566 | | | 302,155 | |

Accrued and other liabilities | 1,412,166 | | | 1,645,690 | |

| | | |

| | | |

| Financial Services debt | 526,906 | | | 499,627 | |

| Notes payable | 1,618,586 | | | 1,962,218 | |

| Total liabilities | 5,241,799 | | | 5,703,793 | |

| Shareholders' equity | 12,121,964 | | | 10,383,257 | |

| $ | 17,363,763 | | | $ | 16,087,050 | |

PulteGroup, Inc.

Consolidated Statements of Cash Flows

($000's omitted)

(Unaudited)

| | | | | | | | | | | |

| Year Ended |

| December 31, |

| 2024 | | 2023 |

| Cash flows from operating activities: | | | |

| Net income | $ | 3,083,262 | | | $ | 2,602,372 | |

| Adjustments to reconcile net income to net cash from operating activities: | | | |

| Deferred income tax expense | 151,097 | | | 104,266 | |

| Land-related charges | 34,572 | | | 43,115 | |

| | | |

| | | |

| Depreciation and amortization | 89,162 | | | 80,824 | |

| Equity income from unconsolidated entities | (44,201) | | | (4,561) | |

| Distributions of earnings from unconsolidated entities | 2,557 | | | 4,564 | |

| Share-based compensation expense | 54,690 | | | 48,200 | |

| Other, net | (13,460) | | | (1,421) | |

| Increase (decrease) in cash due to: | | | |

| Inventories | (787,475) | | | (354,016) | |

| Residential mortgage loans available-for-sale | (113,327) | | | 160,934 | |

| Other assets | (489,623) | | | (290,631) | |

| Accounts payable, accrued and other liabilities | (286,460) | | | (196,884) | |

| Net cash provided by operating activities | 1,680,794 | | | 2,196,762 | |

| Cash flows from investing activities: | | | |

| | | |

| Capital expenditures | (118,545) | | | (92,201) | |

| Investments in unconsolidated entities | (16,037) | | | (23,403) | |

| Distributions of capital from unconsolidated entities | 9,179 | | | 3,265 | |

| | | |

| Other investing activities, net | 30,927 | | | (16,756) | |

| Net cash used in investing activities | (94,476) | | | (129,095) | |

| Cash flows from financing activities: | | | |

| Repayments of notes payable | (355,826) | | | (123,290) | |

| | | |

| | | |

| Financial Services borrowings (repayments), net | 27,279 | | | (87,084) | |

| Debt issuance costs | (1,534) | | | (1,572) | |

| Proceeds from liabilities related to consolidated inventory not owned | 50,047 | | | 129,656 | |

| Payments related to consolidated inventory not owned | (105,787) | | | (76,303) | |

| | | |

| Share repurchases | (1,199,999) | | | (1,000,000) | |

| Excise tax on share repurchases | (9,691) | | | — | |

| Cash paid for shares withheld for taxes | (18,597) | | | (11,991) | |

| Dividends paid | (167,707) | | | (142,459) | |

| Net cash used in financing activities | (1,781,815) | | | (1,313,043) | |

| Net increase (decrease) | (195,497) | | | 754,624 | |

| Cash, cash equivalents, and restricted cash at beginning of period | 1,849,177 | | | 1,094,553 | |

| Cash, cash equivalents, and restricted cash at end of period | $ | 1,653,680 | | | $ | 1,849,177 | |

| | | |

| Supplemental Cash Flow Information: | | | |

| Interest paid (capitalized), net | $ | 26,052 | | | $ | 10,786 | |

| Income taxes paid, net | $ | 739,680 | | | $ | 784,453 | |

PulteGroup, Inc.

Segment Data

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| HOMEBUILDING: | | | | | | | |

| Home sale revenues | $ | 4,707,540 | | | $ | 4,165,231 | | | $ | 17,318,521 | | | $ | 15,598,707 | |

| Land sale and other revenues | 99,108 | | | 34,540 | | | 195,435 | | | 142,116 | |

| Total Homebuilding revenues | 4,806,648 | | | 4,199,771 | | | 17,513,956 | | | 15,740,823 | |

| | | | | | | |

| Home sale cost of revenues | (3,413,930) | | | (2,961,920) | | | (12,311,766) | | | (11,030,206) | |

| Land sale cost of revenues | (88,690) | | | (32,139) | | | (189,893) | | | (124,607) | |

| Selling, general, and administrative expenses | (195,640) | | | (308,319) | | | (1,321,276) | | | (1,312,642) | |

| Equity income from unconsolidated entities | 1,625 | | | 213 | | | 43,151 | | | 3,506 | |

| | | | | | | |

| | | | | | | |

| Other income, net | 22,043 | | | 5,367 | | | 61,752 | | | 39,201 | |

| Income before income taxes | $ | 1,132,056 | | | $ | 902,973 | | | $ | 3,795,924 | | | $ | 3,316,075 | |

| | | | | | | |

| FINANCIAL SERVICES: | | | | | | | |

| Income before income taxes | $ | 50,672 | | | $ | 43,845 | | | $ | 209,955 | | | $ | 133,192 | |

| | | | | | | |

| CONSOLIDATED: | | | | | | | |

| Income before income taxes | $ | 1,182,728 | | | $ | 946,818 | | | $ | 4,005,879 | | | $ | 3,449,267 | |

PulteGroup, Inc.

Segment Data, continued

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Home sale revenues | $ | 4,707,540 | | | $ | 4,165,231 | | | $ | 17,318,521 | | | $ | 15,598,707 | |

| | | | | | | |

| Closings - units | | | | | | | |

| Northeast | 464 | | | 421 | | | 1,518 | | | 1,417 | |

| Southeast | 1,413 | | | 1,337 | | | 5,697 | | | 5,201 | |

| Florida | 1,855 | | | 1,940 | | | 7,906 | | | 7,742 | |

| Midwest | 1,370 | | | 1,262 | | | 4,750 | | | 3,955 | |

| Texas | 1,167 | | | 1,265 | | | 5,452 | | | 5,295 | |

| West | 1,834 | | | 1,390 | | | 5,896 | | | 4,993 | |

| 8,103 | | | 7,615 | | | 31,219 | | | 28,603 | |

| Average selling price | $ | 581 | | | $ | 547 | | | $ | 555 | | | $ | 545 | |

| | | | | | | |

| Net new orders - units | | | | | | | |

| Northeast | 340 | | | 349 | | | 1,566 | | | 1,510 | |

| Southeast | 1,233 | | | 1,264 | | | 5,363 | | | 5,541 | |

| Florida | 1,510 | | | 1,507 | | | 6,909 | | | 6,893 | |

| Midwest | 1,088 | | | 871 | | | 4,860 | | | 4,297 | |

| Texas | 900 | | | 1,073 | | | 4,763 | | | 5,143 | |

| West | 1,096 | | | 1,150 | | | 5,765 | | | 5,196 | |

| 6,167 | | | 6,214 | | | 29,226 | | | 28,580 | |

| Net new orders - dollars | $ | 3,507,496 | | | $ | 3,359,733 | | | $ | 16,493,524 | | | $ | 15,244,353 | |

| | | | | | | |

| | | | | December 31, |

| | | | | 2024 | | 2023 |

| Unit backlog | | | | | | | |

| Northeast | | | | | 615 | | | 567 | |

| Southeast | | | | | 1,912 | | | 2,246 | |

| Florida | | | | | 2,795 | | | 3,792 | |

| Midwest | | | | | 1,802 | | | 1,692 | |

| Texas | | | | | 948 | | | 1,637 | |

| West | | | | | 2,081 | | | 2,212 | |

| | | | | 10,153 | | | 12,146 | |

| Dollars in backlog | | | | | $ | 6,494,718 | | | $ | 7,319,714 | |

| | | | | | | |

PulteGroup, Inc.

Segment Data, continued

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| MORTGAGE ORIGINATIONS: | | | | | | | |

| Origination volume | 5,328 | | | 4,657 | | | 19,770 | | | 17,427 | |

| Origination principal | $ | 2,342,489 | | | $ | 1,871,531 | | | $ | 8,340,836 | | | $ | 6,924,910 | |

| Capture rate | 85.9 | % | | 84.6 | % | | 85.9 | % | | 81.6 | % |

Supplemental Data

($000's omitted)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Three Months Ended | | Year Ended |

| December 31, | | December 31, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Interest in inventory, beginning of period | $ | 146,097 | | | $ | 140,010 | | | $ | 139,078 | | | $ | 137,262 | |

| Interest capitalized | 26,069 | | | 30,652 | | | 112,416 | | | 126,040 | |

| Interest expensed | (32,206) | | | (31,584) | | | (111,534) | | | (124,224) | |

| Interest in inventory, end of period | $ | 139,960 | | | $ | 139,078 | | | $ | 139,960 | | | $ | 139,078 | |

| | | | | | | |

PulteGroup, Inc.

Reconciliation of Non-GAAP Financial Measures

(Unaudited)

This report contains information about our debt-to-capital ratios. These measures could be considered non-GAAP financial measures under the SEC's rules and should be considered in addition to, rather than as a substitute for, comparable GAAP financial measures. We calculate total net debt by subtracting total cash, cash equivalents, and restricted cash from notes payable to present the amount of assets needed to satisfy the debt. We use the debt-to-capital and net debt-to-capital ratios as indicators of our overall leverage and believe they are useful financial measures in understanding the leverage employed in our operations. We believe that these measures provide investors relevant and useful information for evaluating the comparability of financial information presented and comparing our profitability and liquidity to other companies in the homebuilding industry. Although other companies in the homebuilding industry report similar information, the methods used may differ. We urge investors to understand the methods used by other companies in the homebuilding industry to calculate these measures and any adjustments thereto before comparing our measures to those of such other companies.

The following table sets forth a reconciliation of the debt-to-capital ratios ($000's omitted):

| | | | | | | | | | | | | | |

| Debt-to-Capital Ratios |

| | December 31, |

| | 2024 | | 2023 |

| Notes payable | | $ | 1,618,586 | | | $ | 1,962,218 | |

| Shareholders' equity | | 12,121,964 | | | 10,383,257 | |

| Total capital | | $ | 13,740,550 | | | $ | 12,345,475 | |

| Debt-to-capital ratio | | 11.8 | % | | 15.9 | % |

| | | | |

| Notes payable | | $ | 1,618,586 | | | $ | 1,962,218 | |

| Less: Total cash, cash equivalents, and restricted cash | | (1,653,680) | | | (1,849,177) | |

| Total net debt | | $ | (35,094) | | | $ | 113,041 | |

| Shareholders' equity | | 12,121,964 | | | 10,383,257 | |

| Total net capital | | $ | 12,086,870 | | | $ | 10,496,298 | |

| Net debt-to-capital ratio | | (0.3) | % | | 1.1 | % |

| | | | | |

| FOR IMMEDIATE RELEASE | Company Contact |

| Investors: Jim Zeumer |

| (404) 978-6434 |

| Email: jim.zeumer@pultegroup.com |

| |

PULTEGROUP ANNOUNCES $1.5 BILLION INCREASE TO

SHARE REPURCHASE AUTHORIZATION

ATLANTA – January 30, 2025 – PulteGroup, Inc. (NYSE: PHM) announced today that its Board of Directors has approved a $1.5 billion increase to the Company’s share repurchase authorization. This increase brings the Company’s remaining share repurchase authorization to $2.1 billion.

“Following another year of record earnings and strong cash flows from operations, we are increasing our share repurchase authorization by $1.5 billion,” said Ryan Marshall, PulteGroup President and CEO. “This latest increase, along with the 10% increase in our dividend in the fourth quarter of 2024, reflects our well established commitment to return excess funds to our shareholders.”

The Company returned $1.4 billion to shareholders through dividends and share purchases in 2024, and has returned over $8.4 billion to its shareholders over the past decade. Since initiating the program in 2013, the Company has repurchased over 50% of its shares outstanding.

About PulteGroup

PulteGroup, Inc. (NYSE: PHM), based in Atlanta, Georgia, is one of America’s largest homebuilding companies with operations in more than 45 markets throughout the country. Through its brand portfolio that includes Centex, Pulte Homes, Del Webb, DiVosta Homes, American West and John Wieland Homes and Neighborhoods, the company is one of the industry’s most versatile homebuilders able to meet the needs of multiple buyer groups and respond to changing consumer demand. PulteGroup’s purpose is building incredible places where people can live their dreams.

For more information about PulteGroup, Inc. and PulteGroup brands, go to pultegroup.com; pulte.com; centex.com; delwebb.com; divosta.com; jwhomes.com; and americanwesthomes.com. Follow PulteGroup, Inc. on X: @PulteGroupNews.

# # #

v3.24.4

Document and Entity Information

|

Jan. 29, 2025 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jan. 29, 2025

|

| Entity Registrant Name |

PULTEGROUP, INC.

|

| Entity Incorporation, State or Country Code |

MI

|

| Entity File Number |

1-9804

|

| Entity Tax Identification Number |

38-2766606

|

| Entity Address, Address Line One |

3350 Peachtree Road NE, Suite 1500

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

404

|

| Local Phone Number |

978-6400

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0000822416

|

| Amendment Flag |

false

|

| Common Shares, par value $0.01 |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Shares, par value $0.01

|

| Trading Symbol |

PHM

|

| Security Exchange Name |

NYSE

|

| Series A Junior Participating Preferred Share Purchase Rights |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Series A Junior Participating Preferred Share Purchase Rights

|

| Security Exchange Name |

NYSE

|

| No Trading Symbol Flag |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true only for a security having no trading symbol.

| Name: |

dei_NoTradingSymbolFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:trueItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=phm_SeriesAJuniorParticipatingPreferredSharePurchaseRightsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

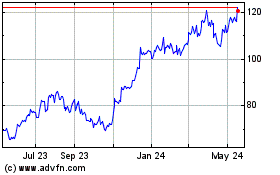

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Jan 2025 to Feb 2025

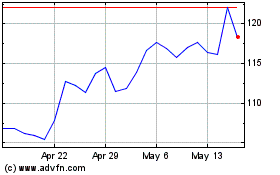

PulteGroup (NYSE:PHM)

Historical Stock Chart

From Feb 2024 to Feb 2025