Philip Morris International Presents at 2025 CAGNY Conference; Reaffirms 2025 Full-Year Forecast

20 February 2025 - 12:45AM

Business Wire

Regulatory News:

Philip Morris International Inc.’s (PMI) (NYSE: PM) Chief

Executive Officer, Jacek Olczak, and Chief Financial Officer,

Emmanuel Babeau, will address investors today at the 2025 Consumer

Analyst Group of New York (CAGNY) Conference.

The event will be webcast live in listen-only mode, beginning at

approximately 1:00 p.m. ET, at www.pmi.com/2025cagny and on the PMI

Investor Relations Mobile Application (www.pmi.com/irapp).

Presentation slides will also be available on the same site and the

App. An archived copy of the webcast will be available until

Friday, March 21, 2025.

The presentation will cover:

- PMI’s progress over the past decade to deliver a smoke-free

future;

- the financial model underlying the company’s delivery of

superior returns to shareholders;

- the success and future opportunities for the company’s

smoke-free brands led by consumer insights and harm reduction.

2025 Full-Year Forecast

PMI reaffirms its 2025 full-year reported diluted EPS forecast,

announced on February 6th, of $6.55 to $6.68. Excluding a total

2025 adjustment of $0.49 per share, the forecast range for adjusted

diluted EPS of $7.04 - $7.17 represents a projected increase of

7.2% to 9.1% versus $6.57 in 2024. Excluding an adverse currency

impact, at then prevailing exchange rates, of $0.22 per share, this

represents growth of 10.5% to 12.5%, as shown below.

The assumptions underlying this forecast remain unchanged versus

those communicated by PMI in its earnings release of February 6,

2025.

Factors described in the Forward-Looking and Cautionary

Statements section of this release represent continuing risks to

these projections.

Full-Year

2025 Forecast

2024

Growth

Reported Diluted EPS

$6.55

-

$6.68

$ 4.52

Adjustments:

Restructuring charges

—

0.10

Impairment of goodwill and other

intangibles

—

0.01

Amortization of intangibles(1)

0.49

0.40

Loss on sale of Vectura Group

—

0.13

Egypt sales tax charge

—

0.03

Megapolis localization tax impact

—

0.05

Income tax impact associated with Swedish

Match AB financing

—

0.14

Impairment related to the RBH equity

investment

—

1.49

Fair value adjustment for equity security

investments

—

(0.27)

Tax items

—

(0.03)

Total Adjustments

0.49

2.05

Adjusted Diluted EPS

$7.04

-

$7.17

$ 6.57

7.2%

-

9.1%

Less: Currency

(0.22)

Adjusted Diluted EPS, excluding

currency

$7.26

-

$7.39

$ 6.57

10.5%

-

12.5%

(1) See forecast assumptions section in

Q4’24 Earnings Release for details

Forward-Looking & Cautionary Statements

The presentation, related discussion and this press release

contain projections of future results and goals and other

forward-looking statements, including statements regarding expected

financial or operational performance; capital allocation plans;

investment strategies; regulatory outcomes; market expectations;

business plans and strategies; the likelihood and impact to PMI of

the proposed CCAA plan; and the likelihood and impact of RBH

remaining deconsolidated. Achievement of future results is subject

to risks, uncertainties and inaccurate assumptions. In the event

that risks or uncertainties materialize, or underlying assumptions

prove inaccurate, actual results could vary materially from those

contained in such forward-looking statements. Pursuant to the “safe

harbor” provisions of the Private Securities Litigation Reform Act

of 1995, PMI is identifying important factors that, individually or

in the aggregate, could cause actual results and outcomes to differ

materially from those contained in any forward-looking statements

made by PMI.

PMI's business risks include: excise tax increases and

discriminatory tax structures; increasing marketing and regulatory

restrictions that could reduce our competitiveness, eliminate our

ability to communicate with adult consumers, or ban certain of our

products in certain markets or countries; health concerns relating

to the use of tobacco and other nicotine-containing products and

exposure to environmental tobacco smoke; litigation related to

tobacco and/or nicotine use and intellectual property; intense

competition; the effects of global and individual country economic,

regulatory and political developments, natural disasters and

conflicts; the impact and consequences of Russia's invasion of

Ukraine; changes in adult smoker behavior; the impact of natural

disasters and pandemics on PMI's business; lost revenues as a

result of counterfeiting, contraband and cross-border purchases;

governmental investigations; unfavorable currency exchange rates

and currency devaluations, and limitations on the ability to

repatriate funds; adverse changes in applicable corporate tax laws;

adverse changes in the cost, availability, and quality of tobacco

and other agricultural products and raw materials, as well as

components and materials for our electronic devices; and the

integrity of its information systems and effectiveness of its data

privacy policies. PMI's future profitability may also be adversely

affected should it be unsuccessful in its attempts to introduce,

commercialize, and grow smoke-free products or if regulation or

taxation do not differentiate between such products and cigarettes;

if it is unable to successfully introduce new products, promote

brand equity, enter new markets or improve its margins through

increased prices and productivity gains; if it is unable to expand

its brand portfolio internally or through acquisitions and the

development of strategic business relationships; if it is unable to

attract and retain the best global talent, including women or

diverse candidates; or if it is unable to successfully integrate

and realize the expected benefits from recent transactions and

acquisitions. Future results are also subject to the lower

predictability of our smoke-free products performance.

PMI is further subject to other risks detailed from time to time

in its publicly filed documents, including PMI's Annual Report on

Form 10-K for the fourth quarter and year ended December 31, 2024.

PMI cautions that the foregoing list of important factors is not a

complete discussion of all potential risks and uncertainties. PMI

does not undertake to update any forward-looking statement that it

may make from time to time, except in the normal course of its

public disclosure obligations.

Philip Morris International: Delivering a Smoke-Free

Future

Philip Morris International is a leading international tobacco

company, actively delivering a smoke-free future and evolving its

portfolio for the long term to include products outside of the

tobacco and nicotine sector. The company’s current product

portfolio primarily consists of cigarettes and smoke-free products.

Since 2008, PMI has invested over $14 billion to develop,

scientifically substantiate and commercialize innovative smoke-free

products for adults who would otherwise continue to smoke, with the

goal of completely ending the sale of cigarettes. This includes the

building of world-class scientific assessment capabilities, notably

in the areas of pre-clinical systems toxicology, clinical and

behavioral research, as well as post-market studies. In 2022, PMI

acquired Swedish Match – a leader in oral nicotine delivery –

creating a global smoke-free champion led by the companies’ IQOS

and ZYN brands. Following a robust science-based review, the U.S.

Food and Drug Administration has authorized the marketing of

Swedish Match’s General snus and ZYN nicotine pouches and versions

of PMI’s IQOS devices and consumables - the first-ever such

authorizations in their respective categories. Versions of IQOS

devices and consumables and General snus also obtained the

first-ever Modified Risk Tobacco Product authorizations from the

FDA. As of December 31, 2024, PMI's smoke-free products were

available for sale in 95 markets, and PMI estimates that 38.6

million adults around the world use PMI's smoke-free products. The

smoke-free business accounted for approximately 39% of PMI’s total

full-year 2024 net revenues. With a strong foundation and

significant expertise in life sciences, PMI has a long-term

ambition to expand into wellness and healthcare areas and aims to

enhance life through the delivery of seamless health experiences.

References to “PMI”, “we”, “our” and “us” mean Philip Morris

International Inc., and its subsidiaries. For more information,

please visit www.pmi.com and

www.pmiscience.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250218021966/en/

Philip Morris International Investor Relations: Stamford,

CT: +1 (203) 904 2413 Lausanne: +41 582 424 666 Email:

InvestorRelations@pmi.com

Media: David Fraser Lausanne: +41 582 424 500 Email:

David.Fraser@pmi.com

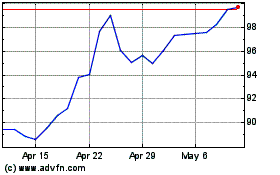

Philip Morris (NYSE:PM)

Historical Stock Chart

From Jan 2025 to Feb 2025

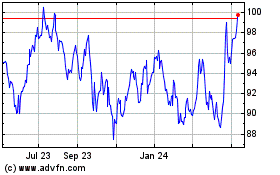

Philip Morris (NYSE:PM)

Historical Stock Chart

From Feb 2024 to Feb 2025