PennyMac Mortgage Investment Trust (NYSE: PMT) announced today

the pricing of a private offering of secured term notes (the

“Notes”) in an aggregate principal amount of $355 million issued by

the Company’s indirect subsidiary, PMT ISSUER TRUST – FMSR. The

Notes mature on December 27, 2027 and were priced at SOFR + 2.75%.

The majority of the Notes were placed with funds and accounts

managed by PGIM Fixed Income, a Prudential Financial (NYSE: PRU)

company. Proceeds are expected to be used to redeem $305 million of

previously-issued term notes priced at SOFR + 4.19% due to mature

on June 25, 2027.

“I am very pleased with the attractive terms and successful

execution of this transaction, which highlights both our deep

access to the secured financing markets and strong relationships

with leading asset-based lenders like PGIM,” said Chairman and

Chief Executive Officer David Spector. “PGIM, with their strength

and experience in securitized products, has been a long-standing

partner of Pennymac and we are pleased to have them lead this

transaction.”

“We are excited to be long-standing partners to Pennymac across

a variety of mortgage financing solutions including MSR (Mortgage

Servicing Rights) and private CRT (Credit Risk Transfer). Our

flexible capital and extensive structuring capabilities provide

creative solutions for our financing partners as well as

differentiated asset-based finance investments for our clients,”

said Gabe Rivera, Managing Director and co-head of securitized

products at PGIM Fixed Income.

The Notes will not be registered under the Securities Act of

1933 (the “Securities Act”) or offered or sold in the United States

absent registration or an applicable exemption from the

registration requirements of the Securities Act. This press release

shall not constitute an offer to sell or a solicitation of an offer

to buy nor shall there be any sale of these securities in any state

in which such offer, solicitation or sale would be unlawful prior

to registration or qualification under the securities laws of any

state.

About PennyMac Mortgage Investment Trust

PennyMac Mortgage Investment Trust is a mortgage real estate

investment trust (REIT) that invests primarily in residential

mortgage loans and mortgage-related assets. PMT is externally

managed by PNMAC Capital Management, LLC, a wholly-owned subsidiary

of PennyMac Financial Services, Inc. (NYSE: PFSI). Additional

information about PennyMac Mortgage Investment Trust is available

at pmt.pennymac.com.

About PGIM Fixed Income

PGIM Fixed Income is a global asset manager offering active

solutions across all fixed income markets. The company has offices

in Newark, NJ, London, Amsterdam, Paris, Sydney, Singapore, Munich,

Zurich, Hong Kong, and Tokyo. As of March 31, 2024, the PGIM Fixed

Income has $821 billion of assets under management including $403

billion in institutional assets, $175 billion in retail assets, and

$243 billion in proprietary assets. Over 1,000 institutional

clients have entrusted PGIM Fixed Income with their assets.

About PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (PFI). PFI has a history that dates back over 145

years and through more than 30 market cycles. With 41 offices in 19

different countries (as of March 31, 2024), our more than 1,450

investment professionals are located in key financial centers

around the world.

Our firm comprises multi-managers that collaborate with each

other and specialize in a particular asset class with a focused

investment approach. This gives our clients diversified solutions

with global depth and scale across public and private asset

classes, including fixed income, equities, real estate, private

credit, and other alternatives. As a leading global asset manager

with $1.34 trillion in assets under management (as of March 31,

2024), PGIM is built on a foundation of strength, stability and

disciplined risk management.

For more information, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not

affiliated in any manner with Prudential plc, incorporated in the

United Kingdom, or with Prudential Assurance Company, a subsidiary

of M&G plc, incorporated in the United Kingdom. For more

information please visit news.prudential.com.

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 21E of the Securities Exchange Act of 1934,

as amended, regarding management’s beliefs, estimates, projections

and assumptions with respect to, among other things, the Company’s

financial results, future operations, business plans and investment

strategies, as well as industry and market conditions, all of which

are subject to change. Forward-looking statements are generally

identifiable by use of forward-looking terminology like “may,”

“will,” “should,” “potential,” “intend,” “expect,” “seek,”

“anticipate,” “estimate,” “approximately,” “believe,” “could,”

“project,” “predict,” “continue,” “plan” or other similar words or

expressions. Forward-looking statements are based on certain

assumptions, discuss future expectations, describe future plans and

strategies, contain financial and operating projections or state

other forward-looking information. Examples of forward-looking

statements include: (i) projections of the Company’s revenues,

income, earnings per share, capital structure or other financial

items; (ii) descriptions of the Company’s plans or objectives for

future operations, products or services; (iii) forecasts of the

Company’s future economic performance, interest rates, profit

margins and the Company’s share of future markets; and (iv)

descriptions of assumptions underlying or relating to any of the

foregoing expectations regarding the timing of generating any

revenues. The Company’s ability to predict results or the actual

effect of future events, actions, plans or strategies is inherently

uncertain. Although the Company believes that the expectations

reflected in such forward-looking statements are based on

reasonable assumptions, the Company’s actual results and

performance could differ materially from those set forth in the

forward-looking statements. There are a number of factors, many of

which are beyond the Company’s control, that could cause actual

results to differ significantly from its expectations. Some of

these factors are discussed below. Factors that could cause actual

results to differ materially from historical results or those

anticipated include, but are not limited to: changes in interest

rates and other macroeconomic conditions; the Company’s ability to

comply with various federal, state and local laws and regulations

that govern the Company’s business; changes in the Company’s

investment objectives or investment or operational strategies,

including any new lines of business or new products and services

that may subject it to additional risks; changes in real estate

values, housing prices and housing sales; the degree and nature of

the Company’s competition; volatility in the Company’s industry,

the debt or equity markets, the general economy or the real estate

finance and real estate markets specifically, whether the result of

market events or otherwise; events or circumstances which undermine

confidence in the financial and housing markets or otherwise have a

broad impact on financial and housing markets, such as the sudden

instability or collapse of large depository institutions or other

significant corporations, terrorist attacks, natural or man-made

disasters, or threatened or actual armed conflicts; changes in

general business, economic, market, employment and domestic and

international political conditions, or in consumer confidence and

spending habits from those expected; the availability of, and level

of competition for, attractive risk-adjusted investment

opportunities in loans and mortgage-related assets that satisfy the

Company’s investment objectives; the inherent difficulty in winning

bids to acquire loans, and the Company’s success in doing so; the

concentration of credit risks to which the Company is exposed; the

Company’s dependence on PFSI, PNMAC and PennyMac Loan Services, LLC

(“PLS”), potential conflicts of interest with such entities and

their affiliates, and the performance of such entities; changes in

personnel and lack of availability of qualified personnel at PFSI,

PNMAC and PLS, and their affiliates; the availability, terms and

deployment of short-term and long-term capital; the adequacy of the

Company’s cash reserves and working capital; the Company’s

substantial amount of debt; the Company’s ability to maintain the

desired relationship between its financing and the interest rates

and maturities of its assets; the timing and amount of cash flows,

if any, from the Company’s investments; the Company’s exposure to

risks of loss and disruptions in operations resulting from adverse

weather conditions, man-made or natural disasters, climate change

and pandemics such as the COVID-19 pandemic; unanticipated

increases or volatility in financing and other costs, including a

rise in interest rates; the performance, financial condition and

liquidity of borrowers; the ability of the Company’s servicer,

which also provides the Company with fulfillment services, to

approve and monitor correspondent sellers and underwrite loans to

investor standards; incomplete or inaccurate information or

documentation provided by customers or counterparties, or adverse

changes in the financial condition of the Company’s customers and

counterparties; the Company’s indemnification and repurchase

obligations in connection with loans it purchases and later sells

or securitizes; the quality and enforceability of the collateral

documentation evidencing the Company’s ownership and rights in the

assets in which it invests; increased rates of delinquency, default

and/or decreased recovery rates on the Company’s investments; the

performance of loans underlying mortgage-backed securities in which

the Company retains credit risk; the Company’s ability to foreclose

on its investments in a timely manner or at all; the degree to

which the Company’s hedging strategies may or may not protect it

from interest rate volatility; the effect of the accuracy of or

changes in the estimates the Company makes about uncertainties,

contingencies and asset and liability valuations when measuring and

reporting upon the Company’s financial condition and income; the

Company’s ability to maintain appropriate internal control over

financial reporting; technology failures, cybersecurity risks and

incidents, and the Company’s ability to mitigate cybersecurity

risks and cyber intrusions; the Company’s ability to obtain and/or

maintain licenses and other approvals in those jurisdictions where

required to conduct its business; the Company’s ability to detect

misconduct and fraud; changes in the Company’s credit risk transfer

arrangements and agreements; developments in the secondary markets

for the Company’s loan products; legislative and regulatory changes

that impact the loan industry or housing market; changes in

regulations that impact the business, operations or governance of

mortgage lenders and/or publicly-traded companies or such changes

that increase the cost of doing business with such entities; the

Consumer Financial Protection Bureau and its issued and future

rules and the enforcement thereof; changes in government support of

homeownership; the Company’s ability to effectively identify,

manage and hedge the Company’s credit, interest rate, prepayment,

liquidity and climate risks; changes in government or

government-sponsored home affordability programs; limitations

imposed on the Company’s business and its ability to satisfy

complex rules for it to qualify as a REIT for U.S. federal income

tax purposes and qualify for an exclusion from the Investment

Company Act of 1940 and the ability of certain of the Company’s

subsidiaries to qualify as REITs or as taxable REIT subsidiaries

for U.S. federal income tax purposes, as applicable, and the

Company’s ability and the ability of its subsidiaries to operate

effectively within the limitations imposed by these rules; changes

in governmental regulations, accounting treatment, tax rates and

similar matters (including changes to laws governing the taxation

of REITs, or the exclusions from registration as an investment

company); the Company’s ability to make distributions to its

shareholders in the future; the Company’s failure to deal

appropriately with issues that may give rise to reputational risk;

and the Company’s organizational structure and certain requirements

in its charter documents. These factors are not necessarily all of

the important factors that could cause the Company’s actual results

and performance to differ materially from those expressed in or

implied by any of the Company’s forward-looking statements. Other

unknown or unpredictable factors also could adversely affect the

Company’s actual results and performance. Consequently, there can

be no assurance that the results or performance anticipated by the

Company will be realized or, even if substantially realized, that

they will have the expected consequences to or effects on the

Company. You should not place undue reliance on any forward-looking

statement and should consider all of the uncertainties and risks

described above, as well as those more fully discussed in reports

and other documents filed by the Company with the Securities and

Exchange Commission from time to time. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements or any other information contained herein, and the

statements made in this press release are current as of the date of

this release only.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240703703379/en/

Media Lauren Padilla mediarelations@pennymac.com

805.225.8224

Investors Kevin Chamberlain Isaac Garden

investorrelations@pennymac.com 818.224.7028

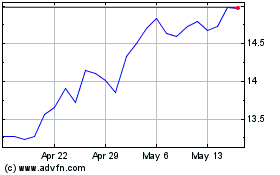

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Nov 2024 to Dec 2024

PennyMac Mortgage Invest... (NYSE:PMT)

Historical Stock Chart

From Dec 2023 to Dec 2024