UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

--------------

FORM S-8

REGISTRATION STATEMENT UNDER THE

SECURITIES ACT OF 1933

--------------

ProAssurance Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | | |

| Delaware | | 63-1261433 |

| | | | | |

(State or other jurisdiction of

incorporation or organization) | | (IRS Employer Identification No.) |

| | | | | |

100 Brookwood Place, | Birmingham, | AL | | 35209 |

| | | | | |

| (Address of Principal Executive Offices) | | (Zip Code) |

PROASSURANCE CORPORATION AMENDED AND RESTATED

2024 EQUITY INCENTIVE PLAN

(Full title of plan)

| | |

| Edward L. Rand, Jr., 100 Brookwood Place, Birmingham, Alabama 35209 |

| (Name and address of agent for service) |

|

| (205) 877-4400 |

| (Telephone number, including area code, of agent for service) |

Copies to:

Jennifer Mercier Moseley, Esq.

Burr & Forman LLP

1075 Peachtree Street NE, Suite 3000

Atlanta, Georgia 30309

(404) 685-4322

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

Large accelerated filer | ☒ | | Accelerated filer ☐ | | Non-accelerated filer ☐

(Do not check if a smaller reporting company) | | Smaller reporting company | ☐ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

PART I

INFORMATION REQUIRED IN SECTION 10(a) PROSPECTUS

The document(s) containing the information specified in Part I of Form S-8 will be sent or given to participants as specified by Rule 428(b)(1) of the Act. This Registration Statement relates to 4,000,000 shares of ProAssurance Common Stock that are reserved for issuance under the ProAssurance Corporation 2024 Equity Incentive Plan. The common stock of the Registrant is listed on the New York Stock Exchange.

The document(s) containing the information specified in Part I of Form S-8 and any of the documents incorporated by reference in this registration statement-prospectus are available from ProAssurance without charge, excluding any exhibits to those documents unless the exhibit is specifically incorporated by reference as an exhibit in this registration statement-prospectus. All documents available from ProAssurance, including those incorporated by reference in this registration statement-prospectus, may be obtained by requesting them in writing or by telephone at the following address or number:

Attention: Heather J. Wietzel, SVP - Investor Relations

100 Brookwood Place

Birmingham, Alabama 35209

(205) 877-4400

PART II

INFORMATION REQUIRED IN THE REGISTRATION STATEMENT

ITEM 3. INCORPORATION OF DOCUMENTS BY REFERENCE

The following documents filed by Registrant with the Securities and Exchange Commission are incorporated by reference in this Registration Statement:

(1) The Registrant's Annual Report on Form 10-K for the year ended December 31, 2023;

(2) The Registrant's Quarterly Reports on Form 10-Q for the quarter ended March 31, 2024;

(3) The Registrant’s Definitive Proxy Statement on Schedule 14A filed on April 12, 2024, to the extent incorporated by reference in the Annual Report on Form 10-K for the year ended December 30, 2023; and

(4) The description of the Registrant's Common Stock contained in the Registration Statement on Form S-3ASR filed with the Securities and Exchange Commission on May 23, 2022.

All documents subsequently filed by the Registrant pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Securities Exchange Act of 1934, prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters all such securities then remaining unsold, shall be deemed to be incorporated by reference in and to be a part hereof from the date of filing of such documents.

Any statements contained in a document incorporated by reference herein shall be deemed to be modified or superseded for purposes hereof to the extent that a statement contained herein (or in any other subsequently filed document which is also incorporated by reference herein) modifies or supersedes such statement. Any statement so modified or superseded shall not be deemed to constitute a part hereof except as so modified or superseded.

ITEM 4. DESCRIPTION OF SECURITIES

Not applicable.

ITEM 5. INTERESTS OF NAMED EXPERTS AND COUNSEL

Not applicable.

ITEM 6. INDEMNIFICATION OF DIRECTORS AND OFFICERS

As permitted by Delaware law, the Registrant's certificate of incorporation provides that the directors of the Registrant will not be held personally liable for a breach of fiduciary duty as a director, except that a director may be liable for (1) a breach of the director's duty of loyalty to the corporation or its shareholders, (2) acts made in bad faith or which involve intentional misconduct or a knowing violation of the law, (3) illegal payment of dividends under Section 174 of the Delaware General Corporation Law; or (4) for any transaction from which the director derives an improper personal benefit. The Registrant's certificate of incorporation further provides that if Delaware law is amended to authorize corporate action further eliminating or limiting the personal liability of directors, then the liability of a director of the Registrant shall be eliminated or limited to the fullest extent permitted by Delaware law, as so amended.

The by-laws of the Registrant provide that the Registrant will indemnify any person involved in litigation brought by a third party or by or in the right of the Registrant by reason of the fact that he or she is or was a director, officer, employee or agent of the Registrant or is or was serving at the request of the Registrant as a director, officer, employee or agent of another entity. The Registrant will only indemnify such a person if that person acted in good faith and in a manner he or she reasonably believed to be lawful and in the best interests of the Registrant, except that the person will not be entitled to indemnification in an action in which he or she is found to be liable to the corporation unless the Delaware Court of Chancery deems indemnification under these circumstances proper.

The Registrant maintains in effect directors' and officers' liability insurance which provides coverage against certain liabilities. The Registrant has entered into indemnification agreements with each of its directors and executive officers which requires the Registrant to use reasonable efforts to maintain such insurance during the term of the agreement so long as the Board of Directors in the exercise of its business judgment determines that the cost is not excessive and is reasonably related to the amount of coverage and that the coverage provides a reasonable benefit for such cost. The indemnity agreements have terms that will automatically renew for successive one year terms each year unless sooner terminated by Registrant on 60 days notice or upon the indemnitee's termination as an officer, director or employee of Registrant or its subsidiaries.

The indemnity agreement requires the Registrant to indemnify the executive officers and directors to the fullest extent permitted under Delaware law to the extent not covered by liability insurance, including advances of expenses in the defense of claims against the executive officer or director while acting in such capacity. It is a condition to such indemnification that the indemnitee acted in good faith and in a manner that he or she believed to be in or not opposed to the interest of the Registrant or its shareholders, and with respect to a criminal action had no reasonable cause to believe his or her conduct was unlawful. Indemnification is not available from the Registrant:

(a) in respect to remuneration that is determined to be in violation of law;

(b) on account of any liability arising from a suit for an accounting of profits for the purchase and sale of Registrant's common stock pursuant to Section 16(b) of the Securities Exchange Act of 1934, as amended;

(c) on account of conduct that is determined to have been knowingly fraudulent, deliberately dishonest or willful misconduct;

(d) if indemnification is prohibited by the applicable laws of the State of Delaware;

(e) if the indemnitee is found to be liable to the Registrant or its subsidiaries unless the Delaware Court of Chancery determines that the indemnitee is fairly and reasonably entitled to indemnification for expenses that the court deems proper; or

(f) if a court should determine that such indemnification is not lawful.

The indemnity agreement requires the indemnitee to reimburse the Registrant for all reasonable expenses incurred or advanced in defending any criminal or civil suit or proceedings against the indemnitee if the Registrant determines that indemnity is not available.

ITEM 7. EXEMPTION FROM REGISTRATION CLAIMED

Not applicable.

ITEM 8. EXHIBITS

The exhibits to this registration statement are listed in the Exhibit Index to this registration statement, which Exhibit Index is hereby incorporated by reference.

ITEM 9. UNDERTAKINGS

(a) The undersigned registrant hereby undertakes:

(1) To file, during any period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) to include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

(ii) to reflect in the prospectus any facts or events arising after the effective date of this registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20% change in the maximum aggregate offering price set forth in the “Calculation of Registration Fee” table in the effective registration statement; and

(iii) to include any material information with respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement;

provided, however, that the undertakings set forth in clauses (i) and (ii) above do not apply if the information required to be included in a post-effective amendment by those clauses is contained in periodic reports filed by the registrant pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in this registration statement;

(2) That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof;

(3) To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The registrant undertakes that for purposes of determining any liability under the Securities Act of 1933, each filing of the registrant's annual report pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934 (and, where applicable, each filing of an employee benefit plan's annual report pursuant to section 15(d) of the Securities Exchange Act of 1934) that is incorporated by reference in this registration statement shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(c) Insofar as indemnification for liabilities arising under the Securities Act of 1933 may be permitted to directors, officers and controlling persons of the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Securities Act of 1933 and is, therefore, unenforceable. In the event that a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director, officer, or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by it is against public policy as expressed in the Securities Act of 1933 and will be governed by the final adjudication of such issue.

[SIGNATURES ON FOLLOWING PAGE]

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the Registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8, and has duly caused this Registration Statement to be signed on its behalf by the undersigned, thereunto duly authorized in the City of Homewood, State of Alabama, on May 22, 2024.

| | | | | |

| PROASSURANCE CORPORATION |

| |

| By: | /S/ EDWARD L. RAND, JR. |

| Edward L. Rand, Jr. |

POWER OF ATTORNEY

KNOW ALL MEN BY THESE PRESENTS, that each person whose signature appears below hereby constitutes and appoints Jeffrey P. Lisenby, and Edward L. Rand, Jr. as his true and lawful attorney-in-fact and agent, with full power of substitution and resubstitution, for him, and on his behalf and in his name, place and stead, in any and all capacities, to sign, execute and file this Registration Statement under the Securities Act of 1933, as amended, and any or all amendments (including, without limitation, post-effective amendments), with all exhibits and any and all documents required to be filed with respect thereto, with the Securities and Exchange Commission or any regulatory authority, granting unto such attorney-in-fact and agent full power and authority to do and perform each and every act and thing requisite and necessary to be done in and about the premises in order to effectuate the same, as fully to all intents and purposes as he himself might or could do if personally present, hereby ratifying and confirming that such attorney-in-fact and agent, or their substitute, may lawfully do or cause to be done.

Pursuant to the requirements of the Securities Act of 1933, this Registration Statement has been signed by the following persons in the capacities and on the dates indicated.

| | | | | | | | | | | | | | |

| Signature | | Title | | Date |

| | | | |

/s/ Edward L. Rand, Jr. | | Chief Executive Officer, President and Director | | May 22, 2024 |

Edward L. Rand, Jr. | | (Principal Executive Officer) | | |

| | | | |

/s/ Dana S. Hendricks | | Executive Vice President, Chief Financial Officer | | May 22, 2024 |

| Dana S. Hendricks | | (Principal Financial and Accounting Officer) | | |

| | | | |

/s/ Kedrick D. Adkins, Jr. | | Director | | May 22, 2024 |

| Kedrick D. Adkins, Jr. | | | | |

| | | | |

/s/ Richard J. Bielen | | Director | | May 22, 2024 |

| Richard J. Bielen | | | | |

| | | | |

/s/ Bruce D. Angiolillo | | Director | | May 22, 2024 |

| Bruce D. Angiolillo | | | | |

| | | | |

/s/ Fabiola Cobarrubias | | Director | | May 22, 2024 |

| Fabiola Cobarrubias | | | | |

| | | | |

/s/ Samuel A. Di Piazza, Jr. | | Director | | May 22, 2024 |

| Samuel A. Di Piazza, Jr. | | | | |

| | | | |

/s/ Maye Head Frei | | Director | | May 22, 2024 |

| Maye Head Frei | | | | |

| | | | |

/s/ Staci M. Pierce | | Director | | May 22, 2024 |

| Staci M. Pierce | | | | |

| | | | |

/s/ Scott C. Syphax | | Director | | May 22, 2024 |

| Scott C. Syphax | | | | |

| | | | |

/s/ Katisha T. Vance | | Director | | May 22, 2024 |

| Katisha T. Vance | | | | |

EXHIBIT INDEX

| | | | | | | | |

| EXHIBIT NUMBER | | DESCRIPTION |

| | ProAssurance Corporation 2024 Equity Incentive Plan |

| | |

| | Opinion of Burr & Forman LLP |

| | |

| | Consent of Ernst & Young, LLP |

| | |

| | Consent of Burr & Forman LLP (included in Exhibit 5.1) |

| | |

| | Power of Attorney (included in signature page) |

| | |

| | Filing Fee Table |

Calculation of Filing Fee Tables

Form S-8

(Form Type)

ProAssurance Corporation

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

| | | | | | | | | | | | | | | | | | | | | | | |

| Security Type | Security Class Title | Fee Calculation Rule | Amount Registered(2) | Proposed Maximum Offering Price Per Unit | Maximum Aggregate Offering Price | Fee rate | Amount of Registration Fee |

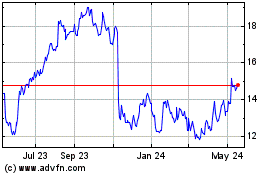

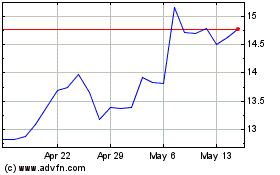

| Equity | Common Stock, par value $0.01 per share (1) | Other(1) | 4,000,000 | $14.79(1) | $59,160,000(1) | 0.0001476 | $8,732.02 |

| Total Offerings Amounts | | $59,160,000 | | $8,732.02 |

| Total Fee Offsets | | | | N/A |

| Net Fee Due | | | | $8,732.02 |

(1) Estimated solely for the purpose of calculating the amount of the registration fee pursuant to Rule 457(c) and (h) under the Securities Act, based upon the average of the high and low prices of the Common Stock as reported by the New York Stock Exchange on May 16, 2024, which date is within five business days prior to the filing of this Registration Statement.

(2) Represents common stock, par value $0.01 per share ("Common Stock"), of ProAssurance Corporation, issuable pursuant to the ProAssurance Corporation 2024 Incentive Plan (the "Plan"). Pursuant to Rule 416 under the Securities Act of 1933 (the "Securities Act"), this Registration Statement also covers, in addition to the number shown in the table above, an indeterminate number of such additional shares of Common Stock as may be issued or become issuable pursuant to the Plan.

PROASSURANCE CORPORATION

2024 EQUITY INCENTIVE PLAN

1.Purpose. The purpose of the ProAssurance Corporation 2024 Equity Incentive Plan is to further corporate profitability and growth in share value of ProAssurance Corporation (the “Company”) by offering proprietary interests in the Company to those key officers, employees, consultants and directors who will be largely responsible for such growth, and to enhance the Company's ability to recruit and retain qualified executives and key employees through long-term incentive compensation in the form of proprietary interests in the Company.

2.Definitions.

“Award” shall mean any grant or award under the Plan.

“Award Notice” shall mean a document or other record, in such form as the Committee prescribes from time to time, setting forth the terms and conditions of an Award. Award Notices may be in the form of individual award notices, agreements or certificates or a program document describing the terms and provisions of Awards or series of Awards under the Plan. An Award Notice and the acceptance thereof by a Participant shall be in a written document unless the Committee, in its discretion, provides for the use of electronic, internet or other non-paper Award Notices, and the use of electronic, internet or other non-paper means for the acceptance thereof and actions thereunder by a Participant.

“Award Period” shall mean the period of one or more calendar years fixed by the Committee with respect to Awards of Performance Shares with the same Date of Grant (but no more than five years) commencing with each Date of Grant, except that the Award Period for a recently hired employee may be for such lesser period (but not less than one calendar year) as determined by the Committee.

“Beneficial Ownership” is used as such term is used within the meaning of Rule 13d-3 promulgated under the Exchange Act.

“Board” shall mean the Board of Directors of the Company.

“Business Days” means any day other than Saturday, Sunday or any holiday observed by banks in the United States.

“Cause” shall mean (i) the Participant has been convicted in a federal or state court of a crime classified as a felony; (ii) action or inaction by the Participant (A) that constitutes embezzlement, theft, misappropriation or conversion of assets of the Company or a Subsidiary which, alone or together with related actions or inactions, involve assets of more than a de minimis amount, or that constitutes intentional fraud, gross malfeasance of duty, or grossly inappropriate conduct, and (B) such action or inaction has adversely affected or is likely to adversely affect the business of the Company and its Subsidiaries, taken as a whole, or has resulted or is intended to result in direct or indirect gain or personal enrichment of the Participant to the detriment of the Company and its Subsidiaries; or (iii) the Participant has been grossly inattentive to, or in a grossly negligent manner failed to competently perform, Participant's job duties and the failure was not cured within 45 days after written notice from the Company.

“Change in Control” shall mean the occurrence of any one of the following events during the term of this Agreement: (i) a change in the ownership of the Company as defined in the regulations under

Code Section 409A; or (ii) a change in the effective control of the Company as defined in the regulations under Code Section 409A; or (iii) a change in the ownership of a substantial portion of the assets of the Company as defined in the regulations under Code Section 409A.

“Code” shall mean the Internal Revenue Code of 1986, as amended, and the regulations thereunder.

“Committee” shall mean the Compensation Committee of the Board (or such other committee of the Board that the Board shall designate from time to time) or any subcommittee thereof comprised of two or more directors each of whom shall be determined by the Board to be independent in accordance with the requirements of the New York Stock Exchange and shall be an “outside director” within the meaning of Section 162(m) of the Code and a “non-employee director” within the meaning of Rule 16b-3, as promulgated under Section 16 of the Exchange Act.

“Common Stock” shall mean the common stock, par value $0.01 per share, of the Company.

“Company” shall mean ProAssurance Corporation, a Delaware corporation.

“Consultant” shall mean any natural person engaged by the Company to provide services as a consultant or advisor, if such consultant or advisor provides bona fide services to the Company that are not in connection with the offer or sale of securities in a capital-raising transaction and do not directly or indirectly promote or maintain a market for the Company's securities.

“Covered Employee” means a Participant designated by the Committee to receive an Award as qualified performance based compensation within the meaning of Code Section 162(m) and the regulations promulgated thereunder. Any Participant who is granted Qualified Performance Shares shall be deemed to be designated as a Covered Employee.

“Date of Grant” shall mean with respect to an Award under the Plan (other than Performance Shares) the date specified by the Board or if no date of grant is specified, the date that the Board or the Committee takes action or is deemed to take action to grant such Award; provided that the date of grant for an Award of Performance Shares made within the first 90 days of a calendar year shall be January 1 of such calendar year unless the Committee specifies another date.

“Director” shall mean a person who is elected and is currently serving as a member of the Board of Directors of the Company or a Subsidiary.

“Disability” means that the Participant is (i) unable to engage in any substantial gainful activity by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months, or (ii) by reason of any medically determinable physical or mental impairment that can be expected to result in death or can be expected to last for a continuous period of not less than twelve (12) months, receiving income replacement benefits for a period of not less than three (3) months under the disability insurance, if any, covering employees of the Companies, or (iii) determined to be totally disabled by the Social Security Administration. Notwithstanding the foregoing, for Awards that are subject to Code Section 409A, “Disability” shall mean that a Participant is disabled under Code Section 409A(a)(2)(C)(i) or (ii).

“Dividend Equivalent” means an amount equal to any dividends paid by the Company with respect to a share of Common Stock during the Award Period or Interim Period in the case of Performance Shares or during the Restricted Period in the case of Restricted Stock and Restricted Units.

“Employee” shall mean any natural person (including any officer) employed by the Company or a Subsidiary in a continuous and regular salaried employment relationship, which shall include (unless the Committee otherwise determines) periods of vacation, approved leaves of absence, and any salary continuation or severance pay period.

“Exchange Act” shall mean the Securities Exchange Act of 1934, as amended.

“Executive Officer” shall mean the Corporation’s chief executive officer, chief financial officer, all Section 16(b) officers, and all other senior officers whose compensation is individually reviewed by the Corporation’s Compensation Committee.

“Fair Market Value” on any date shall mean (i) if the Shares are actively traded on any national securities exchange or reported on NASDAQ/NMS on a basis which reports closing prices, the closing sales price of the Shares on the day the value is to be determined or, if such exchange was not open for trading on such date, the next preceding day on which it was open; (ii) if the Shares are not traded on any national securities exchange, the average of the closing high bid and low asked prices of the Shares on the over-the-counter market on the day such value is to be determined, or in the absence of closing bids on such day, the closing bid on the next preceding day on which there were bids; or (iii) if the Shares also are not traded on the over-the-counter market, the Fair Market Value as determined in good faith by the Committee based on such relevant facts as may be available to the Committee, which may include opinions of independent experts, the price at which recent sales have been made, the book value of the Shares, and the Company's current and future earnings.

“Freestanding SAR” means an SAR that is granted independently of any Options as described in Section 8 herein.

“Good Reason” (or a similar term denoting constructive termination) has the meaning, if any, assigned such term in the employment, severance or similar agreement, if any, between a Participant and the Company or a Subsidiary; provided, however, that if there is no such employment, severance or similar agreement in which such term is defined, “Good Reason” shall have the meaning, if any, given such term in the applicable Award Notice. If not defined in any such document, the term “Good Reason” as used herein shall not apply to a particular Award.

“Incentive Stock Option” shall mean an Option which is intended to meet the requirements of Section 422 of the Code.

“Interim Period” shall mean a period of calendar months (which must be for at least one year) fixed by the Committee with respect to Awards of Performance Shares with the same Date of Grant, which period is less than the full Award Period commencing on the Date of Grant.

“Nonqualified Stock Option” shall mean an Option which is not intended to be an Incentive Stock Option.

“Normal Retirement” shall mean retirement at or after the Participant reaches the later of either (i) sixty (60) years of age or (ii) the earliest age at which the Participant may retire and receive a retirement benefit without penalty under any qualified retirement plan maintained by the Company or any of its Subsidiaries in which such Participant participates.

“Option” shall mean the right to purchase the number of shares of Common Stock specified by the Committee, at a price and for the term fixed by the Committee granted in accordance with Section 7 hereof and subject to any other limitations and restrictions imposed by the Plan or the Committee.

“Other Stock-Based Awards” shall mean an Award granted under Section 10 hereof.

“Participant” shall mean an Employee, Consultant or Director who is selected by the Committee to receive an Award under the Plan as herein provided.

“Performance Share” shall mean the equivalent of one share of Common Stock granted under Section 6 which becomes vested and nonforfeitable upon the attainment, in whole or in part, of performance objectives determined by the Committee. References to Performance Shares shall include Qualified Performance Shares where no distinction is required.

“Plan” shall mean the ProAssurance Corporation 2024 Equity Incentive Plan as set forth herein and as may be further amended from time to time.

“Qualified Business Measures” means one or more of the performance criteria listed in Section 6(b) hereof upon which performance goals for Qualified Performance Shares may be established by the Committee.

“Qualified Performance Shares” means an Award of Performance Shares that is intended to qualify under Section 162(m) and is made subject to performance goals based upon Qualified Business Measures.

“Restricted Period” shall mean the period during which the transfer of Restricted Stock or Restricted Units is limited in some way (based upon the passage of time, the achievement of performance objectives, or the occurrence of other events as determined by the Committee) and the Restricted Stock or Restricted Units are subject to a substantial risk of forfeiture.

“Restricted Stock” shall mean any Award of Common Stock granted under Section 9 which becomes vested and nonforfeitable, in whole or in part, upon the satisfaction of such conditions as shall be determined by the Committee.

“Restricted Unit” shall mean any Award of a contractual right granted under Section 9 to receive Common Stock (or, at the discretion of the Committee, cash based on the Fair Market Value of a Share of the Common Stock) which becomes vested and nonforfeitable, in whole or in part, upon the satisfaction of such conditions as shall be determined by the Committee.

“Section 16 Reporting Person” shall mean any person who is an officer or director of the Company within the meaning of Section 16 of the Exchange Act and the rules and regulations promulgated thereunder.

“Section 162(m)” shall mean Code Section 162(m).

“Section 409A” shall mean Code Section 409A.

“Securities Act” shall mean the Securities Act of 1933, as amended.

“Shares” shall mean shares of the Common Stock of the Company reserved under Section 4 hereof for Awards under the Plan, or such other securities as may become subject to Awards pursuant to an adjustment pursuant to Section 13 of the Plan.

“Stock Appreciation Right” or “SAR” shall mean any Award of a contractual right granted under Section 8 to receive cash, Common Stock or a combination thereof.

“Subsidiary” shall mean any corporation of which the Company possesses directly or indirectly eighty percent (80%) or more of the total combined voting power of all classes of stock of such corporation and any other business organization, regardless of form, in which the Company possesses directly or indirectly eighty percent (80%) or more of the total combined equity interests in such organization.

“Tandem SAR” means an SAR that is granted in connection with a related Option pursuant to Section 8 herein, the exercise of which shall require forfeiture of the right to purchase a Share under the related Option (and when a Share is purchased under the related Option, the Tandem SAR shall be similarly cancelled).

“Termination” shall mean the end of a Participant's relationship with the Company or a Subsidiary as an Employee, Consultant or Director if at such time the Participant has no other relationship as an Employee, Consultant or Director of the Company or a Subsidiary.

“2 ½ Month Period” shall mean the period ending on the later of either the 15th day of the third month following the Participant's first taxable year in which the amount is no longer subject to a substantial risk of forfeiture or the 15th day of the third month following the end of the Company's first taxable year in which the amount is no longer subject to a substantial risk of forfeiture; Performance Shares, if earned, shall be considered no longer subject to a risk of forfeiture on the last day of the Award Period or Interim Period for which they are earned.

3.Administration of the Plan.

The Plan shall be administered by the Committee which, subject to the provisions of the Plan, shall have the authority

(a)to select the Participants in the Plan;

(b)to determine the Awards to be made to each Participant selected to participate in the Plan;

(c)to determine the conditions subject to which Awards will become payable under the Plan;

(d)to determine whether and to what extent and under what circumstances an Award may be settled in, or the exercise price may be paid in cash, Common Stock, other Awards, or other property;

(e)to prescribe the form of each Award Notice, which need not be identical for each Participant;

(f)to make all decisions and determinations that may be required under the Plan or as the Committee deems necessary or advisable to administer the Plan;

(g)to amend the Plan or any Award Notice as provided herein; and

(h)generally, to exercise such powers and to perform such acts as the Committee deems necessary or expedient to promote the best interests of the Company that are not in conflict with the provisions of the Plan.

The Committee shall have full power to administer and interpret the Plan and to adopt such rules, regulations, guidelines and procedures consistent with the terms of the Plan as the Committee deems necessary or advisable in order to carry out the provisions of the Plan. Except as otherwise provided in the Plan, the Committee's interpretation and construction of the Plan and its determination of any conditions applicable to Awards or the granting of Awards to specific Participants shall be conclusive and binding on all Participants.

The Committee may delegate to one or more of its members or to one or more officers of the Company or a Subsidiary or to one or more agents or advisors such administrative duties or powers as it may deem advisable, and the Committee or any individuals to whom it has delegated duties or powers as aforesaid may employ such legal counsel, consultants and agents (including counsel or agents who are employees of the Company or a Subsidiary) to render advice with respect to any responsibility the Committee or such individuals may have under the Plan, and may rely upon any opinion received from any such counsel, consultant or agent and any computation received from any such consultant or agent. All expenses incurred in the administration of the Plan, including, without limitation, for the engagement of any counsel, consultant or agent, shall be paid by the Company. No member or former member of the Board or the Committee shall be liable for any act, omission, interpretation, construction or determination made in connection with the Plan other than as a result of such individual's willful misconduct.

To the maximum extent permitted by applicable law and the Company’s organizational documents and to the extent not covered by insurance directly insuring such person, each member or former member of the Committee or the Board shall be indemnified and held harmless by the Company against any cost or expense (including reasonable fees of counsel reasonably acceptable to the Committee) or liability (including any sum paid in settlement of a claim with the approval of the Committee), and advanced amounts necessary to pay the foregoing at the earliest time and to the fullest extent permitted, arising out of any act or omission to act in connection with the administration of the Plan, except to the extent arising out of such officer’s, employee’s, member’s or former member’s own willful misconduct, fraud or bad faith. Such indemnification shall be in addition to any rights of indemnification the employees, officers, directors or members or former officers, directors or members may have under applicable law or under the organizational documents of the Company. Notwithstanding anything else herein, this indemnification will not apply to the actions or determinations made by an individual with regard to Awards granted to him or her under the Plan.

Each Award shall be evidenced by an Award Notice. Each Award Notice shall include such provisions, not inconsistent with the Plan, as may be specified by the Committee.

4.Maximum Amount of Shares Available for Awards; Minimum Vesting.

(a)Maximum Number of Shares; Minimum Vesting. The number of Shares that may be distributed as Awards under the Plan shall be a total of 2,400,000 shares of Common Stock

subject to adjustment under Section 13 of the Plan. Notwithstanding the foregoing, but subject to the provisions of Section 13, the maximum number of Shares which may be subject to Awards granted to a Participant in any calendar year shall be 250,000 shares of Common Stock. All Awards under the Plan shall be subject to a minimum vesting period of 12 months from the date such Award is granted.

(b)Shares Available for Issuance. Shares may be made available from the authorized but unissued shares of Common Stock, from shares of Common Stock held in the Company's treasury and not reserved for another purpose, or from shares of Common Stock purchased on the open market. If any Award is payable solely in cash, no shares shall be deducted from the number of shares available for issuance under Section 4(a) by reason of such Award except in the case of the exercise of a Stock Appreciation Right. If any Award in respect of Shares is canceled or forfeited for any reason without delivery of the Shares (with the exception of the termination of a Tandem SAR upon exercise of the related Option or the termination of the related Option upon exercise of the corresponding Tandem SAR), the Shares subject to such Award shall thereafter again be available for an Award pursuant to the Plan. Whenever Shares are received by the Company in connection with the exercise of or payment for any Award granted under the Plan, only the net number of shares actually issued shall be counted against the limit in Section 4(a) hereof and the Shares not issued shall be treated in the same manner as Shares subject to cancelled or forfeited Awards.

5.Eligibility and Participation.

(a)Eligibility. Persons eligible to participate in this Plan include all Employees, Consultants and Directors; provided that Directors and Consultants shall not be eligible to receive Performance Shares under the Plan.

(b)Participation. Subject to the provisions of the Plan, the Committee may, from time to time, select from all eligible Employees, Consultants and Directors, Participants to whom Awards shall be granted and shall determine the nature of such Awards. Selection of Participants may be made individually or by group or class of similarly situated persons who are eligible to participate in the Plan. The Committee shall select Participants, who in the judgment of the Committee have an opportunity to influence the long-term profitability of the Company. No individual shall have any right to participate in the Plan (i) unless selected by the Committee and (ii) until such employee has properly executed such additional documentation and agreements as prescribed by the Committee as a condition of participation. Such designation shall not entitle the Participant to receive payment with respect to any Award unless and until the other conditions specified in the Plan and Award agreement (or similar document) are satisfied.

6.Performance Shares.

(a)Performance Share Awards. The Committee shall have the authority to grant Awards of Performance Shares to Employees on such terms and conditions as may be determined by the Committee. Performance Shares shall be deemed to be received by an Employee as of the Date of Grant in the year the related Performance Share Award is granted. At the time of grant of each Performance Share Award, the Committee shall decide the Award Period and whether there will be an Interim Period. Any Employee may be granted more than one Performance Share Award under the Plan.

A Participant shall not be entitled to receive any dividends with respect to Performance Shares and shall not have any voting or other rights of a Company stockholder with respect to Performance Shares; and no Participant shall have any interest in or right to receive Shares prior to the time the Committee determines the form of payment of Performance Shares in accordance with this Section 6. The Committee may determine at the Date of Grant whether and to what extent to credit to the account of a recipient of Performance Shares, an amount equal to the Dividend Equivalent on a number of Shares corresponding to the Performance Shares subject to an Award.

The Committee may establish performance goals for Performance Shares which may be based on any criteria selected by the Committee. Such performance goals may be described in terms of Company-wide objectives or in terms of objectives that relate to the performance of the Participant, a Subsidiary or a division, region, department or function within the Company or a Subsidiary and may relate to relative performance as compared to an outside reference or peer group.

(b)Qualified Performance Shares. The Committee may designate an Award of Performance Shares as Qualified Performance Shares based upon a determination that the recipient is or may be a Covered Employee with respect to such Award, and the Committee wishes such Award to qualify as performance based compensation under Section 162(m). If an Award is so designated, the Committee shall establish performance goals for such Performance Shares within the time period prescribed by Section 162(m), based on one or more of the following Qualified Business Measures, which performance goals may be expressed in terms of Company-wide objectives or in terms of objectives that relate to the performance of a Subsidiary or a division, region, department or function within the Company or a Subsidiary:

•Combined ratio, operating ratio or any component thereof such as loss ratio, underwriting expense ratio, investment income ratio or a combination of any thereof;'

•Retention rate measured by premium or unit count for all insureds or any subset of insureds;

•Total return (stock price appreciation divided by beginning share price, plus dividends paid during the year);

•Growth in book value;

•Premium revenue, whether new or renewal, for all or a subset of the Company's book of business;

•Profit (net profit, gross profit, operating profit, economic profit, profit margins or other corporate profit measures);

•Earnings (earnings per share or other corporate earnings measures);

•Net income (before or after taxes, operating income or other income measures);

•Cash (cash flow, cash generation or other cash measures);

•Economic value added;

•Return measures (including, but not limited to, return on assets, capital, equity, investments or sales, and cash flow return on assets, capital, equity, or sales);

•Market share;

•Improvements in capital structure;

•Business expansion (acquisitions);

•Total Revenue;

•Investment Income;

•Cost reduction measures; or

•Strategic plan development and implementation.

Performance goals with respect to the foregoing Qualified Business Measures may be specified in absolute terms, in percentages, or in terms of growth from period to period or growth rates over time, as well as measured relative to the performance of a group of peer companies, or a published or special index, or a stock market index, that the Committee deems appropriate. Performance goals need not be based upon an increase or positive result under a business criterion and could include, for example, the maintenance of the status quo or the limitation of economic losses (measured, in each case, by reference to a specific business criterion).

In determining whether a performance goal has been satisfied, the Committee shall include a credit or allowance for dividends declared during an Award Period. In addition, the Committee may provide in any Award of Performance Shares that any evaluation of performance may include or exclude any of the following described events that occur during an Award Period: (i) changes in capital structure as described in Section 13 hereof; (ii) the effect of changes in tax laws, accounting principles or other laws and provisions affecting reported results; or (iii) acquisitions or divestitures. To the extent such inclusions and exclusions affect Awards to Covered Employees, they shall be prescribed in a form that meets the requirements of Section 162(m) for deductibility.

Qualified Performance Shares shall be earned, vested and payable (as applicable) only upon the achievement of performance goals established by the Committee based upon one or more of the Qualified Business Measures, together with the satisfaction of any other conditions, such as continued employment, as the Committee may determine to be appropriate. Any payment of Qualified Performance Shares shall be conditioned on the written certification of the Committee in each case that the performance goals and any other material conditions were satisfied. No Qualified Performance Shares held by a Covered Employee or by an employee who in the reasonable judgment of the Committee may be a Covered Employee on the date of payment, may be amended, nor may the Committee exercise any discretionary authority it may otherwise have under the Plan with respect to Qualified Performance Shares, in any manner to waive the achievement of the applicable performance goal based on Qualified Business Measures or to increase the amount payable pursuant thereto or the value thereof, or otherwise in a manner that would cause the Qualified Performance Shares to cease to qualify as performance based compensation under Section 162(m). The Committee shall retain the discretion to adjust such Awards downward, either on a formula or discretionary basis or any combination, as the Committee determines.

Section 4 sets forth the maximum number of Shares that may be granted in any one-year period to a Participant in Qualified Performance Shares.

(c)Payment of Performance Share Awards. Each Participant who is granted an Award of Performance Shares shall be entitled to payment of the Award if and after the Committee has determined that the conditions for payment of the Award set by the Committee have been satisfied during the Award Period. If the Committee determines that there shall be an Interim Period for the Award to any Participant, each such Participant granted a Performance Share Award with an Interim Period shall be entitled to partial payment on account thereof as of the close of the Interim Period, but only if and after the Committee has determined that the conditions for partial payment of the Award set by the Committee have been satisfied. Performance Shares paid to a Participant for an Interim Period may be retained by the Participant and shall not be repaid to the Company, notwithstanding that based on the conditions set for payment at the end of the Award Period, such Participant would not have been entitled to payment of some or any of the Award; provided that all Awards to Executives shall be subject to the Executive Officer Recoupment Policy set forth in Section 14(h) hereof. Any Performance Shares paid to a Participant for the Interim Period during an Award Period shall be deducted from the Performance Shares to which such Participant is entitled at the end of the Award Period.

Except for payment of Awards of Performance Shares under subparagraphs (d) or (e) of this Section 6 or in Section 11 hereof, payment of Awards of Performance Shares shall be made to the Participant (or his or her personal representative), as promptly as possible, by the Company after the determination by the Committee that payment has been earned, but in no event later than the end of the 2 ½ Month Period; provided that in the event of either voluntary Termination by a Participant without Good Reason or involuntary Termination of a Participant for Cause after the close of the Award Period, any portion of an Award of Performance Shares that has not been paid on or before the date of Termination shall be forfeited and cancelled automatically and all rights of the Participant with respect to such cancelled Awards of Performance Shares shall terminate. Unless otherwise directed by the Committee, all payments on Awards of Performance Shares to Participants shall be made partly in Shares and partly in cash, with the cash portion being approximately equal to the amount of federal, state, and local taxes which the Participant's employer is required to withhold on account of such payment. To the extent provided by the Committee at the Date of Grant, the Participant may be paid the sum of all Dividend Equivalents on a number of shares of Common Stock equal to the number of Performance Shares to which the Participant is entitled to be paid for an Award Period or Interim Period. The payment for the Dividend Equivalent, if any, shall be added to any cash payment to be made to a Participant with respect to the subject Performance Shares. There shall be deducted from the cash payment for Performance Shares, all taxes to be withheld with respect to the Performance Shares.

For payment of each Performance Share Award, the number of Shares to be distributed to the Participant shall equal the Fair Market Value of the total Performance Shares determined by the Committee to have been earned by the Participant less the portion of the Award that was paid in cash, divided by the Fair Market Value of a Performance Share. Unless otherwise provided in subparagraphs (d) or (e) of this Section 6 or in Section 11 hereof, the Fair Market Value shall be determined on the date specified by the Committee which must be on or after the date of the Committee's determination of the Award and prior to the payment date for the Award.

(d)Termination Upon Death or Disability. Upon Termination by reason of death or Disability of a Participant prior to the close of an Award Period, outstanding Awards of Performance Shares shall be deemed to be earned at the target level and payment of such Performance Shares shall be

made on the first regularly scheduled payroll payment date following the expiration of a thirty (30) day period commencing on the date of death or the date of the determination of Disability, whichever is applicable. For purposes of this Section 6(d), the Fair Market Value of the Shares shall be determined as of the date of death or the date of the determination of Disability.

(e)Termination Upon Retirement or For Good Reason. Upon Termination of a Participant, prior to the close of an Award Period, by reason of his or her (i) Normal Retirement, or (ii) early retirement before the Normal Retirement age with the consent of the Committee, or (iii) resignation for Good Reason, then, payment of such Performance Shares shall be made on the first regularly scheduled payroll payment date following the expiration of the thirty (30) day period commencing on the date of Termination, and the number of Performance Shares for each Award to be paid shall be computed by (x) determining the number of Performance Shares that would have been paid if the subject Award Period had ended on the December 31 immediately preceding the date of Termination (based on the conditions set by the Committee for payment of Performance Share Awards for the subject Award Period); (y) multiplying the number determined pursuant to clause (x) by a fraction, the numerator of which is the number of whole months during the subject Award Period that the Participant was an active Employee, and the denominator of which is the number of whole months in the Award Period; provided that in the event such computation results in a fractional share of a Performance Share, such fractional share shall be eliminated and not paid. For purposes of this Section 6(e), the Fair Market Value of the Shares shall be determined as of the date of Termination. The term “whole month” shall refer to a calendar month in which the Participant was an Employee for at least 12 Business Days. Notwithstanding the foregoing, any Performance Shares awarded to a Participant in the same year that the Participant's Termination occurs for the reasons set forth in this Section 6(e) shall be automatically cancelled and all rights of Participant with respect to the cancelled Performance Shares shall forthwith terminate.

(f)Other Termination. In the event of Termination of a Participant prior to the close of an Award Period for any reason other than those described in subparagraph (d) or (e) of this Section 6, then, unless the Committee shall otherwise determine at the Date of Grant or pursuant to Section 11 hereof, all outstanding Awards of Performance Shares that have not been paid on or before the date of Termination shall be automatically cancelled and all rights of the Participant with respect to such cancelled Awards of Performance Shares shall forthwith terminate.

(g)Interpretation. Any Plan provision to the contrary notwithstanding, if any Award of Performance Shares is intended, at the time of grant, to be Qualified Performance Shares, to the extent required to so qualify any Award hereunder, the Committee shall not be entitled to exercise any discretion otherwise authorized under the Plan with respect to such Award if the ability to exercise such discretion (as opposed to the exercise of such discretion) would cause such Award to fail to qualify as performance-based compensation within the meaning of Section 162(m)(4)(C) of the Code.

7.Stock Options.

(a)Grant. Subject to the provisions of the Plan, the Committee shall have the authority to grant Awards of Options to Participants and to determine (i) the number of Shares to be covered by each Option, (ii) the exercise price therefor and (iii) the conditions and limitations applicable to the exercise of the Option. The Committee shall have the authority to grant Incentive Stock Options and Nonqualified Stock Options; provided that Incentive Stock Options may not be granted to any

Participant who is not an Employee at the time of grant. In the case of Incentive Stock Options, the terms and conditions of such grants shall be subject to and comply with Section 422 of the Code.

(b)Option Price. The Committee shall establish the exercise price at the time each Option is granted, which price shall not be less than 100% of the Fair Market Value of a Share at the Date of Grant.

(c)Exercise. Each Option may be exercised at such times and subject to such terms and conditions as the Committee may specify on Date of Grant; provided, however, that if the Committee does not establish a different exercise schedule at the Date of Grant of an Option, such Option shall become exercisable in five (5) equal installments on each of the first five anniversaries of the Date of Grant of the Option. The Committee may impose such conditions with respect to the exercise of Options as it shall deem appropriate, including, without limitation, any conditions relating to the application of federal or state securities laws; provided that Options shall not be exercisable after the expiration of ten years from the Date of Grant.

An Option shall be exercised by (i) notice of exercise with respect to a specified number of Shares to be delivered in such form and in such manner as may be directed by the Committee, and (ii) payment to the Company of the exercise price for such number of Shares as herein provided; provided that in the absence of direction by the Committee, the notice of exercise shall be in writing and delivered to the Secretary of the Company at the principal office of the Company. The date of exercise shall be as determined by the Committee; provided that in the absence of a determination by the Committee, the date of exercise shall be the date the notice of exercise is received in the form required herein.

The exercise price is to be paid in full in cash upon the exercise of the Option and the Company shall not be required to deliver the Shares purchased until such payment has been made; provided, however, that in lieu of cash, all or any portion of the exercise price may be paid by exchanging shares of Common Stock owned by the Participant (which are not the subject of any pledge or security interest), or by authorization to the Company to withhold Shares otherwise issuable upon exercise of the Option, in each case, to be credited against the exercise price at the Fair Market Value of such shares on the date of exercise. No fractional shares may be so transferred in payment of the exercise price, and the Company shall not be obligated to make any cash payments in consideration of any excess of the aggregate Fair Market Value of Shares transferred over the aggregate exercise price.

In addition to and at the time of payment of the exercise price, the Participant shall pay to the Company in cash the full amount of any federal, state, and local income, employment, or other withholding taxes applicable to the taxable income of such Participant resulting from such exercise; provided, however, that in the discretion of the Committee, all or any portion of such tax obligations, together with additional taxes not exceeding the actual additional taxes to be owed by the Participant as a result of such exercise, may, upon the irrevocable election of the Participant, be paid by exchanging whole shares of Common Stock duly endorsed for transfer and owned by the Participant, or by authorization to the Company to withhold Shares otherwise issuable upon exercise of the Option, in either case in that number of shares having a Fair Market Value on the date of exercise equal to the amount of such taxes thereby being paid.

(d)Termination on Death or Disability. In the event of Termination of a Participant by reason of his or her death or Disability, then, unless the Committee shall otherwise determine at the Date of Grant, all Options held by such Participant at the time of such Termination shall be fully

exercisable, and such Participant (or the Participant's beneficiary or legal representative) may exercise any of such Options for a period of 180 days after the date of Termination (or such greater or lesser period as the Committee shall determine at or after the Date of Grant), but in no event after the date the Option otherwise expires.

(e)Termination on Retirement or Good Reason. In the event of Termination of a Participant by reason of his or her (i) Normal Retirement, or (ii) early retirement before the Normal Retirement age with the consent of the Committee, or (iii) resignation for Good Reason, then, unless the Committee shall otherwise determine at the Date of Grant, all Options held by such Participant at the time of such Termination shall be fully exercisable, and such Participant may exercise any of such Options for a period of 180 days after the date of Termination (or such greater or lesser period as the Committee shall determine at the Date of Grant), but in no event after the date the Option otherwise expires.

(f)Other Termination. In the event of Termination of a Participant for any reason other than those described in subparagraphs (d) and (e) of this Section 7, then, unless the Committee shall otherwise determine at the Date of Grant or pursuant to Section 11 hereof, all vested and unvested Options then held by such Participant, whether or not exercisable at the time of such Termination, shall be automatically cancelled and all rights of the Participant with respect to such cancelled Options shall forthwith terminate.

(g)Nontransferability of Options. No Option granted under the Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution. Further, all Options granted to a Participant under the Plan shall be exercisable during his or her lifetime only by such Participant.

8.Stock Appreciation Rights.

(a)Grant of Stock Appreciation Rights. Subject to the provisions of the Plan, the Committee may grant Awards of Stock Appreciation Rights to Participants at such times and in such amounts and subject to such other terms and conditions not inconsistent with the Plan as it shall determine. The Committee may grant Awards of Freestanding SARS or Tandem SARS or any combination thereof. Tandem SARS may be granted either at the same time the Option is granted or at a later time. Freestanding SARS shall have a base price that is not less than 100% of the Fair Market Value of a share of Common Stock on Date of Grant. Tandem SARS shall have a base price equal to the option price of the related Option.

(b)Exercise of Stock Appreciation Rights. A Stock Appreciation Right shall entitle the Participant to receive from the Company an amount equal to the excess of the Fair Market Value of a Share on the date of exercise of the Stock Appreciation Right over the base price thereof. Each Stock Appreciation Right may be exercised at such times and subject to such terms and conditions as the Committee may prescribe on the Date of Grant; provided, however, that Tandem SARS shall be exercisable only at the same time or times as the related Option is exercisable upon surrender of the right to exercise the equivalent number of Shares subject to the related Option; and provided further that unless the Committee shall establish a different exercise schedule at the Date of Grant, Freestanding SARS shall become exercisable in five (5) equal installments on each of the first five (5) anniversaries of the Date of

Grant. Stock Appreciation Rights shall not be exercisable after the expiration of ten years from the date of grant.

A Stock Appreciation Right shall be exercised by (i) notice of exercise with respect to the specified number of Stock Appreciation Rights to be delivered in such form and in such manner as may be directed by the Committee at the Date of Grant; provided that in the absence of direction by the Committee, the notice of exercise shall be in writing and delivered to the Secretary of the Company at its principal office. The date of exercise shall be at such time as may be determined by the Committee; provided that in the absence of a determination by the Committee, the date of exercise shall be the date the notice is received by the Company in the form required herein. The Committee shall determine at the Date of Grant whether a Stock Appreciation Right shall be settled in cash, Shares, or a combination of cash and Shares. At the time of exercise of a Stock Appreciation Right, the Participant shall pay to the Company in cash the full amount of any federal, state and local income, employment or other withholding taxes applicable to the taxable income of the Participant resulting from such exercise; provided that in the discretion of the Committee, the amount of taxes to be paid by the Participant may be withheld from the cash payment due to Participant on exercise or at the irrevocable election of Participant, the taxes to be paid by Participant may be paid by authorization to the Company to withhold Shares otherwise issuable upon the exercise of the Stock Appreciation Right having a Fair Market Value on the date of exercise equal to the amount of the taxes thereby being paid.

(c)Termination on Death or Disability. In the event of Termination of a Participant by reason of his or her death or Disability, then, unless the Committee shall otherwise determine at the Date of Grant, all SARs held by such Participant at the time of such Termination shall be fully exercisable, and such Participant (or the Participant's beneficiary or legal representative) may exercise any of such SARs for a period of 180 days after the date of Termination (or such greater or lesser period as the Committee shall determine at the Date of Grant), but in no event after the date the SAR otherwise expires.

(d)Termination on Retirement or Good Reason. In the event of Termination of a Participant by reason of his or her (i) Normal Retirement, or (ii) early retirement before the Normal Retirement age with the consent of the Committee, or (iii) resignation for Good Reason, then, unless the Committee shall otherwise determine at the Date of Grant, all SARs held by such Participant at the time of such Termination shall be fully exercisable, and such Participant may exercise any such SARs for a period of 180 days after the date of Termination (or such greater or lesser period as the Committee shall determine at the Date of Grant), but in no event after the date the SAR otherwise expires.

(e)Other Termination. In the event of Termination of a Participant for any reason other than those described in subparagraphs (c) and (d) of this Section 8, then, unless the Committee shall otherwise determine at the Date of Grant or pursuant to Section 11 hereof, all vested and unvested SARs then held by such Participant, whether or not exercisable at the time of such Termination, shall be automatically cancelled and all rights of the Participant with respect to such cancelled SARs shall forthwith terminate.

(f)Nontransferability of Stock Appreciation Rights. No Stock Appreciation Right granted under the Plan may be sold, transferred, pledged, assigned, or otherwise alienated or hypothecated, other than by will or by the laws of descent and distribution. Further, all Stock

Appreciation Rights granted to a Participant under the Plan shall be exercisable during his or her lifetime only by such Participant.

9.Restricted Stock and Restricted Units.

(a)Grant of Restricted Stock or Restricted Units. Subject to the provisions of the Plan, the Committee may grant Awards of Restricted Stock or Restricted Units to Participants at such times and in such amounts, and subject to such other terms and conditions not inconsistent with the Plan, as it shall determine. Each grant of Restricted Stock or Restricted Units shall be evidenced by an Award Notice setting forth the terms, conditions and restrictions applicable to the Award. Unless the Committee provides otherwise at the Date of Grant, any shares of Restricted Stock so granted shall be held in the custody of the Company, as provided in Section 9(f) in certificated or book entry form until the Restricted Period lapses, and, as a condition to the grant of any Award of shares of Restricted Stock, the Participant shall have delivered to the Secretary of the Company a certificate or stock power, endorsed in blank, relating to the Shares covered by such Award.

(b)Termination upon Death or Disability. Upon Termination by reason of death or Disability of a Participant prior to the close of a Restricted Period, any restrictions and conditions on outstanding Awards of Restricted Stock and Restricted Units shall lapse and be deemed to be satisfied and payment of such Restricted Stock and Restricted Units shall be made as promptly as practicable after the date of death or the date of the determination of Disability, whichever is applicable, but in no event shall payment of the Restricted Stock or Restricted Units be later than the end of the 2 ½ Month Period. For purposes of this Section 9(b), the Fair Market Value of Shares shall be determined as of the date of death or date of determination of Disability.

(c)Termination for Good Reason. Upon Termination prior to the close of a Restricted Period by reason of resignation for Good Reason, any restrictions and conditions on outstanding Awards of Restricted Stock and Restricted Units shall lapse and be deemed to be satisfied with respect to a portion of the Restricted Stock or Restricted Units included in such Award with such portion to be computed by multiplying the number of shares of Restricted Stock or the number of Restricted Units by a fraction in which the numerator is the number of whole months during the subject Restricted Period that the Participant was an Employee and the denominator is the number of whole months in the subject Restricted Period; provided that in the event such computation results in a fractional share of Restricted Stock or a Restricted Unit, such fractional share shall be eliminated and not paid. Payment of such Restricted Stock or Restricted Units shall be made as promptly as practicable after the date of Termination, but in no event shall payment of the Restricted Stock or Restricted Units be later than the end of the 2 ½ Month Period. For purposes of this Section 9(c), the Fair Market Value of the Shares subject to the Award shall be determined as of the date of Termination and the term “whole month” shall refer to calendar months in which the Participant was an Employee for at least 12 Business Days. Notwithstanding the foregoing, any Restricted Stock or Restricted Unit awarded in the same year as the date of Termination shall be automatically cancelled and all rights of a Participant with respect to such cancelled Restricted Stock or Restricted Units shall forthwith terminate.

(d)Other Termination. In the event of Termination of a Participant for any reason other than those described in subparagraphs (b) or (c) of this Section 9, then, unless the Committee otherwise determines at the Date of Grant or pursuant to Section 11 hereof, all of such Participant's

Restricted Stock and Restricted Units that are subject to restrictions and/or conditions on date of Termination shall automatically be cancelled and all rights of the Participant with respect to the cancelled Restricted Stock and/or Restricted Units shall forthwith terminate.

(e)Payment of Restricted Stock and Restricted Units. Payment of Restricted Stock shall be made by the Company in Shares. Payment of Restricted Units may be made in Shares, cash or in any combination as determined by the Committee.

Unless otherwise provided in subparagraph (b) or (c) of this Section 9 or in Section 11 hereof, payment of Restricted Stock and Restricted Units shall be made to the Participant (or his or her personal representative), as promptly as practicable, after the Committee determines that that any restrictions and conditions on outstanding Awards of Restricted Stock and Restricted Units have lapsed and that payment is due to the Participant, but in no event shall payment of the Restricted Stock or Restricted Units be later than the end of the 2 ½ Month Period; provided that in the event of either voluntary Termination by a Participant without Good Reason or involuntary Termination of a Participant for Cause after the close of the Restricted Period, any portion of an Award of Restricted Stock or Restricted Units that has not been paid on or before the date of Termination shall be forfeited and cancelled automatically and all rights of the Participant with respect to such cancelled Awards of Restricted Stock or restricted Units shall terminate. Unless otherwise provided in subparagraph (b) or (c) of this Section 9 or in Section 11 hereof, the Fair Market Value of Restricted Stock and Restricted Units shall be determined at the on the date specified by the Committee which must be on or after the date of the Committee's determination of the Award and prior to the payment date for the Award. For payment of each Award of Restricted Units, the number of Shares to be distributed to the Participant, if any, shall be determined by dividing (i) the amount by which the Fair Market Value of the total Restricted Units earned by the Participant exceeds the portion of the Award to be paid in cash by (ii) the Fair Market Value of a Restricted Unit.

At the time of payment of an Award of Restricted Stock, the Participant shall either pay to the Company in cash the full amount of any federal, state and local income, employment or other withholding taxes applicable to the payment of the Award of Restricted Stock or authorize the Company to withhold a number of Shares subject to the Award of Restricted Stock having a Fair Market Value on the valuation date that is equal to the amount of taxes to be withheld and paid by the Company with respect to such Award. At the time of payment of Restricted Units, the Company shall deduct from the payment for Restricted Units the amount to be withheld for the payment of federal, state and local income, employment or other withholding taxes applicable to the payment of the Restricted Units.

(f)Restricted Period; Restrictions on Transferability during Restricted Period. Restricted Stock or Restricted Units may not be sold, assigned, pledged or otherwise encumbered, except as herein provided, during the Restricted Period. Any certificates issued during the Restricted Period in respect of Restricted Stock shall be registered in the name of the Participant and deposited by such Participant with the Company, and Shares issued in book entry form during the Restricted Period in respect to Restricted Stock shall be held for the account of the Participant in an account controlled by the Company. Upon the expiration or termination of the Restricted Period and the satisfaction (as determined by the Committee) of any other conditions established by the Committee, the restrictions applicable to the Restricted Stock or Restricted Units shall lapse. The Shares issued in respect to Restricted Stock or Restricted Units as to which the restrictions have lapsed shall be delivered to the Participant or the Participant's beneficiary or estate, as the case may be, in certificated or book entry form, free of all such restrictions, except any that may be imposed under Section 14(e) hereof or by law.

(g)Rights as a Stockholder; Dividend Equivalents. A Participant will be the beneficial owner of Restricted Stock awarded under the Plan. The Participant will have the right to direct the Company as to the voting of Restricted Stock held for the Participant, and the Participant will be entitled to all communications addressed by the Company to its stockholders. Participants will be entitled to receive dividends and other distributions paid with respect to Restricted Stock during the Restricted Period. Dividends paid on Restricted Stock shall be accrued for the account of the Participant subject to forfeiture and restrictions on transferability as apply to the Restricted Stock on which the dividends are paid. Dividends on Restricted Stock that are not forfeited shall be payable in cash at the time of payment of the Restricted Stock pursuant to Section 9(e) hereof, except that dividends paid in Shares or other property (other than cash) shall be paid in kind at the time of payment of the Restricted Stock.

A Participant shall have no voting or other rights of a Company stockholder with respect to Restricted Units, nor shall a Participant be entitled to receive any dividends or other distribution with respect to Restricted Units; and no Participant shall have any interest or right to receive Shares prior to the time the Committee determines the form of payment of Restricted Units in accordance with this Section 9. The Committee may determine at the Date of Grant whether and to what extent to credit to the account of a recipient of Restricted Units, with an amount equal to the Dividend Equivalent on a number of Shares corresponding to the Restricted Units subject to an Award. Dividend Equivalents on Restricted Units shall be subject to forfeiture and restrictions on transferability as apply to the Restricted Units with respect to which Dividend Equivalents are credited. Dividend Equivalents on Restricted Units that are not forfeited shall be payable in cash at the time of delivery of the payment for the Restricted Units in accordance with Section 9(e) hereof.

10.Other Stock-Based Awards. The Committee is authorized to grant to Participants Other Stock-Based Awards that are denominated or payable in, valued in whole or in part by reference to, or otherwise based on or related to Shares (including, without limitation, securities convertible into Shares), as are deemed by the Committee to be consistent with the purposes of the Plan. Subject to the terms of the Plan, the Committee shall determine the terms and conditions of such Other Stock-Based Awards. Shares or other securities delivered pursuant to a purchase right granted under this Section 10 shall be purchased for such consideration, which may be paid by such method or methods and in such form or forms, including, without limitation, cash, Shares, other securities, other Awards, other property, or any combination of the foregoing, as the Committee shall determine and shall provide in the Award Notice.

11.Change in Control. The provisions of this Section 11 shall apply in the case of a Change in Control, unless otherwise provided in the Award Notice or separate agreement with a Participant governing an Award.