false000181141400018114142024-10-232024-10-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 23, 2024

QuantumScape Corporation

(Exact name of registrant as specified in its charter)

|

|

|

Delaware |

001-39345 |

85-0796578 |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

1730 Technology Drive, San Jose, California |

|

95110 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (408) 452-2000

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Class A common stock, par value $0.0001 per share |

|

QS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On October 23, 2024, QuantumScape Corporation (the “Company”) announced its business and financial results for its third quarter of 2024, which ended September 30. A copy of the Company’s Shareholder Letter is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On October 23, 2024, the Company issued a press release announcing the release of its business and financial results. A copy of the press release is attached as Exhibit 99.2 to this Current Report on Form 8-K.

The information contained in this Item 2.02 and in the accompanying Exhibits 99.1 and 99.2 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

QUANTUMSCAPE CORPORATION |

|

|

|

|

Date: October 23, 2024 |

|

By: |

/s/ Kevin Hettrich |

|

|

|

Kevin Hettrich |

|

|

|

Chief Financial Officer (Principal Financial and Accounting Officer) |

Exhibit 99.1

Q3 Fiscal 2024 Letter to Shareholders October 23, 2024

Dear shareholders,

We’d like to present an update on our progress toward commercialization of our disruptive next-generation solid-state battery technology:

QSE-5 B Samples

We’re excited to report that we have begun producing low volumes of our first B-sample cells, accomplishing our most important goal for 2024, and we have begun shipping these cells for automotive customer testing. These are B samples of QuantumScape’s first product, QSE-5, with energy density of over 800 Wh/L and <15 minute 10% to 80% fast-charging capability.

QSE-5 represents an important milestone for our company and the battery industry as a whole. These cells are, to the best of our knowledge, the first anode-free solid-state lithium-metal cell design ever produced for automotive applications. This cell is capable of simultaneously delivering exceptional performance with respect to energy density, discharge power, charging speed, low-temperature performance, and safety.

This milestone marks a new stage of rigorous development and production efforts. Now that the product design and performance profile is set and we have established a baseline process, we will continue to ship samples, get customer feedback, and iterate to refine our processes. During this B-sample phase, iterations of these samples will be subject to extensive product testing, which will take many months to complete. We have to substantially improve on metrics such as cell reliability, yield and equipment productivity, among others. We need higher volumes to achieve these targets, and that requires bringing our advanced Cobra separator process into production, which we continue to target for 2025.

We encourage shareholders to read more on the QSE-5 cell here and take a first look at our B-sample cells here.

844 Wh/L, 301 Wh/kg < 15 min fast charge QSE-5 B-Sample product specs Measured cell energy (C/5, 25 °C) 21.6 Wh Cell dimensions 84.5mm x 65.6mm x 4.6mm Mass 71.8 g Nominal voltage 3.8V Cathode loading 6.2 mAh/cm2 Operating pressure < 3.4 atm Values rounded. Volume at 100% SoC under operating pressure, excluding tabbing area Fast charging: QSE-5 is capable of charging from 10- 80% state-of-charge in <15 minutes at 45 °C Low temperature performance: QSE-5 is capable of low temperature performance down to -30 °C. Discharge power: QSE-5 is capable of high-power discharge up to 10 rate. Safety: Preliminary safety tests pass safety standards with hazard levels (HL).

The tests and measurements described above were conducted on a limited number of QSE-5 B samples and commercial Li-ion energy cells in our labs. Not all tests and measurements were performed on every sample. Specifications and performance characteristics of final QSE-5 product will depend on the final design of the battery package and will likely differ from those of initial low-volume samples.

PowerCo Collaboration

As we announced in July, we signed a landmark agreement with PowerCo, the battery manufacturing subsidiary of the Volkswagen Group, to bring our QSE-5 technology platform into mass production at the gigawatt-hour scale. The first phase includes intensive collaboration between PowerCo and QuantumScape, with PowerCo contributing skilled personnel to aid the industrialization of the QSE-5 technology platform. Upon satisfactory technical progress in this phase, QuantumScape will grant PowerCo a license to mass produce battery cells based on QuantumScape’s technology platform in exchange for royalties, including a $130M prepayment.

The collaboration phase kicked off in Q3 with joint development activities between groups from both sides at QuantumScape’s San Jose facilities. During this phase of the project, we combine our QSE-5 platform and deep knowledge of solid-state battery technology with PowerCo’s expertise in scaling up high-volume manufacturing processes. The teams are proceeding on solving specific high-leverage challenges with experts from PowerCo contributing their industrialization expertise.

Process Update

Raptor, the first implementation of our disruptively fast separator production process, is now part of our baseline production process. We set this out as a key annual goal because Raptor is a major improvement from our last-generation technology in film quality and performance, heat-treatment time, and energy consumption. We expect that Raptor will continue to support our QSE-5 sample output into 2025.

Beyond enabling B samples, Raptor serves as a learning platform and transitional step to our Cobra process, which we continue to see as our best pathway to gigawatt-hour scale separator production. We are preparing for Cobra production to enter our baseline in 2025 – we expect Cobra heat treatment equipment will be in place by the end of 2024 and, with the addition of higher-volume downstream automated equipment, this line will enable a significant increase in separator production.

Financial Outlook

As announced last quarter, we extended our cash runway forecast by 18 months into 2028. The agreement with PowerCo released $134M previously earmarked for the joint venture and includes a $130M royalty prepayment from PowerCo contingent on satisfactory technical progress. We have made progress toward this more capital-efficient profile announced in July and reiterate our forecast for cash runway into 2028. Any additional funds raised from capital markets activity, including under our ATM prospectus supplement, would further extend this cash runway.

Capital expenditures in the third quarter were $17.9M, in line with expectations. Q3 capex primarily supported equipment purchases for low-volume QSE-5 prototype production, as well as the Cobra process and other equipment as we prepare for higher-volume QSE-5 prototype production in 2025. GAAP operating expenses and GAAP net loss were $130.2M and $119.7M, respectively; Adjusted EBITDA loss was $71.6M in Q3 and in line with expectations. A table reconciling GAAP net loss and Adjusted EBITDA loss is available in the financial statements at the end of this shareholder letter. We ended Q3 with $841M in liquidity.

We continue to track to full-year guidance for Adjusted EBITDA loss. We now tighten our full-year forecast for Adjusted EBITDA loss to be between $280M and $300M—within original guidance but at the higher end of the original range, primarily due to higher legal fees and settlement accruals in 2024 that we do not expect to reoccur in 2025. We are lowering our 2024 forecast for capital expenditures to be between $60M and $75M, driven by realized PowerCo deal-related efficiencies, non-deal related savings, and a shift in timing of certain payments originally planned for late 2024 into 2025.

As always, we encourage investors to read more on our financial information, business outlook and risk factors in our quarterly and annual SEC filings on our investor relations website.

Board Update

As the company transitions from research and development to a focus on product and industrialization, our board of directors is welcoming two new members: Dennis Segers and Dr. Günther Mendl.

Mr. Segers has served in several notable leadership positions over his long career, including as chairman of the board of Xilinx, a leading provider of programmable logic solutions, and as president, CEO and director of Matrix Semiconductor.

Dr. Mendl has been the Head of the Battery Center of Excellence at Volkswagen AG since 2022 and holds a PhD in mechanical engineering from the Technical University of Munich. Dr. Mendl will assume one of the two board positions designated for the Volkswagen Group.

The Chairman of QuantumScape, Jagdeep Singh, who co-founded the company in 2010, will be retiring from the board at the end of 2024 after almost 15 years of service. As part of this planned transition, Dennis will succeed Jagdeep as chairman at the beginning of 2025.

Jagdeep is the visionary behind the growth of QuantumScape leading up to the critical achievement of shipping B samples of our first commercial product. We are deeply grateful for his inspired guidance and will continue striving toward the ambitious goals he has set for the company.

Strategic Outlook

This is a proud moment for the entire QuantumScape team. We have achieved our most important goal to date – we have started producing B samples of our QSE-5 product and begun shipping them for customer testing. We believe these cells represent a new high-water mark for the battery industry.

This is the start of the climb toward industrialization. To make the kind of impact on electric transportation we believe this technology is capable of, we will need enhanced manufacturing processes which can make millions of cells per year, with defectivity rates on the order of a few cells per million or lower. It will require a sustained effort and deep collaboration with partners, including the Volkswagen Group and PowerCo, to achieve such a massive scale.

With those long-term goals in mind, shareholders should take a balanced view of the achievement we have announced today. It is no more than the first shipment of early low-volume QSE-5 B samples. But at the same time, we believe it is no less than a true world first: an anode-free solid-state lithium-metal battery cell capable of revolutionizing electric vehicle performance.

Thank you for your continued support, and we look forward to updating you on further progress in the months to come.

|

|

|

|

Dr. Siva Sivaram President, CEO and Director |

Kevin Hettrich CFO |

QuantumScape Corporation

Condensed Consolidated Balance Sheets (Unaudited)

(In Thousands)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

Assets |

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

174,705 |

|

|

$ |

142,524 |

|

Marketable securities |

|

|

666,309 |

|

|

|

928,284 |

|

Prepaid expenses and other current assets |

|

|

12,700 |

|

|

|

12,709 |

|

Total current assets |

|

|

853,714 |

|

|

|

1,083,517 |

|

Property and equipment, net |

|

|

317,509 |

|

|

|

313,164 |

|

Right-of-use assets - finance lease |

|

|

22,985 |

|

|

|

25,140 |

|

Right-of-use assets - operating lease |

|

|

52,689 |

|

|

|

55,863 |

|

Other assets |

|

|

25,080 |

|

|

|

24,294 |

|

Total assets |

|

$ |

1,271,977 |

|

|

$ |

1,501,978 |

|

Liabilities, redeemable non-controlling interest and stockholders’ equity |

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

Accounts payable |

|

$ |

9,635 |

|

|

$ |

12,959 |

|

Accrued liabilities |

|

|

19,674 |

|

|

|

10,180 |

|

Accrued compensation and benefits |

|

|

22,848 |

|

|

|

26,043 |

|

Operating lease liability, short-term |

|

|

5,387 |

|

|

|

5,006 |

|

Finance lease liability, short-term |

|

|

3,149 |

|

|

|

2,907 |

|

Total current liabilities |

|

|

60,693 |

|

|

|

57,095 |

|

Operating lease liability, long-term |

|

|

54,374 |

|

|

|

57,622 |

|

Finance lease liability, long-term |

|

|

32,710 |

|

|

|

35,098 |

|

Other liabilities |

|

|

13,575 |

|

|

|

11,986 |

|

Total liabilities |

|

|

161,352 |

|

|

|

161,801 |

|

Redeemable non-controlling interest |

|

|

— |

|

|

|

1,770 |

|

Stockholders’ equity |

|

|

|

|

|

|

Preferred stock |

|

|

— |

|

|

|

— |

|

Common stock |

|

|

51 |

|

|

|

49 |

|

Additional paid-in-capital |

|

|

4,353,487 |

|

|

|

4,221,892 |

|

Accumulated other comprehensive income (loss) |

|

|

939 |

|

|

|

(2,877 |

) |

Accumulated deficit |

|

|

(3,243,852 |

) |

|

|

(2,880,657 |

) |

Total stockholders’ equity |

|

|

1,110,625 |

|

|

|

1,338,407 |

|

Total liabilities, redeemable non-controlling interest and stockholders’ equity |

|

$ |

1,271,977 |

|

|

$ |

1,501,978 |

|

QuantumScape Corporation

Condensed Consolidated Statements of Operations and Comprehensive Loss (Unaudited)

(In Thousands, Except per Share Amounts)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

$ |

96,994 |

|

|

$ |

88,154 |

|

|

$ |

278,587 |

|

|

$ |

251,548 |

|

General and administrative |

|

|

33,164 |

|

|

|

32,716 |

|

|

|

117,929 |

|

|

|

102,842 |

|

Total operating expenses |

|

|

130,158 |

|

|

|

120,870 |

|

|

|

396,516 |

|

|

|

354,390 |

|

Loss from operations |

|

|

(130,158 |

) |

|

|

(120,870 |

) |

|

|

(396,516 |

) |

|

|

(354,390 |

) |

Other income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense |

|

|

(550 |

) |

|

|

(593 |

) |

|

|

(1,684 |

) |

|

|

(1,795 |

) |

Interest income |

|

|

11,347 |

|

|

|

10,479 |

|

|

|

35,428 |

|

|

|

24,075 |

|

Other income (loss) |

|

|

(338 |

) |

|

|

382 |

|

|

|

(508 |

) |

|

|

370 |

|

Total other income |

|

|

10,459 |

|

|

|

10,268 |

|

|

|

33,236 |

|

|

|

22,650 |

|

Net loss |

|

|

(119,699 |

) |

|

|

(110,602 |

) |

|

|

(363,280 |

) |

|

|

(331,740 |

) |

Less: Net income (loss) attributable to non-controlling interest, net of tax of $0 |

|

|

(127 |

) |

|

|

15 |

|

|

|

(85 |

) |

|

|

45 |

|

Net loss attributable to common stockholders |

|

$ |

(119,572 |

) |

|

$ |

(110,617 |

) |

|

$ |

(363,195 |

) |

|

$ |

(331,785 |

) |

Net loss |

|

$ |

(119,699 |

) |

|

$ |

(110,602 |

) |

|

$ |

(363,280 |

) |

|

$ |

(331,740 |

) |

Other comprehensive income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on marketable securities |

|

|

1,458 |

|

|

|

3,392 |

|

|

|

3,816 |

|

|

|

11,550 |

|

Total comprehensive loss |

|

|

(118,241 |

) |

|

|

(107,210 |

) |

|

|

(359,464 |

) |

|

|

(320,190 |

) |

Less: Comprehensive income (loss) attributable to non-controlling interest |

|

|

(127 |

) |

|

|

15 |

|

|

|

(85 |

) |

|

|

45 |

|

Comprehensive loss attributable to common stockholders |

|

$ |

(118,114 |

) |

|

$ |

(107,225 |

) |

|

$ |

(359,379 |

) |

|

$ |

(320,235 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted net loss per share |

|

$ |

(0.23 |

) |

|

$ |

(0.23 |

) |

|

$ |

(0.72 |

) |

|

$ |

(0.73 |

) |

Basic and Diluted weighted-average common shares outstanding |

|

|

508,957 |

|

|

|

471,752 |

|

|

|

502,136 |

|

|

|

452,503 |

|

QuantumScape Corporation

Condensed Consolidated Statements of Cash Flows (Unaudited)

(In Thousands)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Operating activities |

|

|

|

|

|

|

|

|

|

|

|

|

Net loss |

|

$ |

(119,699 |

) |

|

$ |

(110,602 |

) |

|

$ |

(363,280 |

) |

|

$ |

(331,740 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

|

14,943 |

|

|

|

11,644 |

|

|

|

39,795 |

|

|

|

31,177 |

|

Amortization of right-of-use assets and non-cash lease expense |

|

|

2,013 |

|

|

|

1,950 |

|

|

|

5,980 |

|

|

|

5,825 |

|

Amortization of premiums and accretion of discounts on marketable securities |

|

|

(7,445 |

) |

|

|

(5,343 |

) |

|

|

(23,124 |

) |

|

|

(10,855 |

) |

Stock-based compensation expense |

|

|

43,359 |

|

|

|

40,391 |

|

|

|

110,471 |

|

|

|

128,373 |

|

Write-off of property and equipment |

|

|

283 |

|

|

|

6,342 |

|

|

|

1,533 |

|

|

|

6,342 |

|

Other |

|

|

84 |

|

|

|

(27 |

) |

|

|

186 |

|

|

|

474 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

Prepaid expenses and other current assets and other assets |

|

|

21,933 |

|

|

|

(4,118 |

) |

|

|

(777 |

) |

|

|

(3,985 |

) |

Accounts payable, accrued liabilities and accrued compensation and benefits |

|

|

(47,335 |

) |

|

|

(1,527 |

) |

|

|

15,984 |

|

|

|

(5,544 |

) |

Operating lease liability |

|

|

(1,184 |

) |

|

|

(1,019 |

) |

|

|

(3,717 |

) |

|

|

(2,270 |

) |

Other liabilities |

|

|

246 |

|

|

|

(248 |

) |

|

|

1,051 |

|

|

|

(348 |

) |

Net cash used in operating activities |

|

|

(92,802 |

) |

|

|

(62,557 |

) |

|

|

(215,898 |

) |

|

|

(182,551 |

) |

Investing activities |

|

|

|

|

|

|

|

|

|

|

|

|

Purchases of property and equipment |

|

|

(17,926 |

) |

|

|

(17,976 |

) |

|

|

(50,969 |

) |

|

|

(70,708 |

) |

Proceeds from maturities of marketable securities |

|

|

252,744 |

|

|

|

249,645 |

|

|

|

1,146,587 |

|

|

|

702,128 |

|

Proceeds from sales of marketable securities |

|

|

— |

|

|

|

— |

|

|

|

1,245 |

|

|

|

1,477 |

|

Purchases of marketable securities |

|

|

(168,686 |

) |

|

|

(440,681 |

) |

|

|

(858,921 |

) |

|

|

(731,461 |

) |

Net cash provided by (used in) investing activities |

|

|

66,132 |

|

|

|

(209,012 |

) |

|

|

237,942 |

|

|

|

(98,564 |

) |

Financing activities |

|

|

|

|

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options and employee stock purchase plan |

|

|

7,398 |

|

|

|

2,297 |

|

|

|

13,968 |

|

|

|

9,930 |

|

Proceeds from issuance of common stock, net of issuance costs paid |

|

|

— |

|

|

|

288,431 |

|

|

|

— |

|

|

|

288,431 |

|

Principal payment for finance lease |

|

|

(726 |

) |

|

|

(650 |

) |

|

|

(2,146 |

) |

|

|

(1,290 |

) |

Dissolution of joint venture |

|

|

(1,685 |

) |

|

|

— |

|

|

|

(1,685 |

) |

|

|

— |

|

Net cash provided by financing activities |

|

|

4,987 |

|

|

|

290,078 |

|

|

|

10,137 |

|

|

|

297,071 |

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

(21,683 |

) |

|

|

18,509 |

|

|

|

32,181 |

|

|

|

15,956 |

|

Cash, cash equivalents and restricted cash at beginning of period |

|

|

214,436 |

|

|

|

250,363 |

|

|

|

160,572 |

|

|

|

252,916 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

192,753 |

|

|

$ |

268,872 |

|

|

$ |

192,753 |

|

|

$ |

268,872 |

|

Supplemental disclosure of cash flow information |

|

|

|

|

|

|

|

|

|

|

|

|

Cash paid for interest |

|

$ |

550 |

|

|

$ |

593 |

|

|

$ |

1,684 |

|

|

$ |

1,195 |

|

Purchases of property and equipment, not yet paid |

|

$ |

4,702 |

|

|

$ |

7,289 |

|

|

$ |

4,702 |

|

|

$ |

7,289 |

|

Common stock issuance costs, accrued but not paid |

|

$ |

— |

|

|

$ |

277 |

|

|

$ |

— |

|

|

$ |

277 |

|

Net Loss to Adjusted EBITDA

Adjusted EBITDA is a non-GAAP supplemental measure of operating performance that does not represent and should not be considered an alternative to operating loss or cash flow from operations, as determined by GAAP. Adjusted EBITDA is defined as net income (loss) before interest expense, non-controlling interest, revaluations, impairments, stock-based compensation, depreciation and amortization expense, and other non-recurring charges. We use Adjusted EBITDA to measure the operating performance of our business, excluding specifically identified items that we do not believe directly reflect our core operations and may not be indicative of our recurring operations. Adjusted EBITDA may not be comparable to similarly titled measures provided by other companies due to potential differences in methods of calculations. A reconciliation of Adjusted EBITDA to net loss is as follows:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in Thousands) |

|

Three Months Ended

September 30, |

|

|

Nine Months Ended

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

GAAP net loss attributable to Common Stockholders |

|

$ |

(119,572 |

) |

|

$ |

(110,617 |

) |

|

$ |

(363,195 |

) |

|

$ |

(331,785 |

) |

Interest expense (income), net |

|

|

(10,797 |

) |

|

|

(9,886 |

) |

|

|

(33,744 |

) |

|

|

(22,280 |

) |

Other expense (income), net |

|

|

338 |

|

|

|

(382 |

) |

|

|

508 |

|

|

|

(370 |

) |

Net gain (loss) attributable to non-controlling interests |

|

|

(127 |

) |

|

|

15 |

|

|

|

(85 |

) |

|

|

45 |

|

Stock-based compensation |

|

|

43,359 |

|

|

|

40,391 |

|

|

|

110,471 |

|

|

|

128,373 |

|

Litigation settlement accrual and legal fees, net (1) |

|

|

— |

|

|

|

— |

|

|

|

24,455 |

|

|

|

— |

|

Non-GAAP operating loss |

|

$ |

(86,799 |

) |

|

$ |

(80,479 |

) |

|

$ |

(261,590 |

) |

|

$ |

(226,017 |

) |

Depreciation and amortization expense (2) |

|

|

15,226 |

|

|

|

17,986 |

|

|

|

41,328 |

|

|

|

37,519 |

|

Adjusted EBITDA |

|

$ |

(71,573 |

) |

|

$ |

(62,493 |

) |

|

$ |

(220,262 |

) |

|

$ |

(188,498 |

) |

|

(1) This amount is with respect to the pending settlement of the securities class action litigation, which litigation was previously disclosed in our annual report filed on February 27, 2024. |

(2) Depreciation and amortization expense includes accelerated depreciation and write-off of property and equipment no longer in use. |

Management’s Use of Non-GAAP Financial Measures

This letter includes certain non-GAAP financial measures as defined by SEC rules. These non-GAAP financial measures are in addition to, and not a substitute for or superior to, measures of financial performance prepared in accordance with U.S. GAAP. There are a number of limitations related to the use of these non-GAAP financial measures versus their nearest GAAP equivalents. For example, other companies may calculate non-GAAP financial measures differently or may use other measures to evaluate their performance, all of which could reduce the usefulness of our non-GAAP financial measures as tools for comparison. We urge you to review the reconciliations of our non-GAAP financial measures to the most directly comparable U.S. GAAP financial measures set forth in this letter, and not to rely on any single financial measure to evaluate our business.

Forward-Looking Statements

This letter contains forward-looking statements within the meaning of the federal securities laws and information based on management’s current expectations as of the date of this letter. All statements other than statements of historical fact contained in this letter, including statements regarding the future development of the Company’s battery technology, the anticipated benefits of the Company’s technologies and the performance of its batteries, plans and objectives for future operations, forecasted cash usage, including spending and investment, are forward-looking statements. When used in this letter, the words “may,” “will,” “can,” “estimate,” “when,” “aim,” “pro forma,” “expect,” “plan,” “believe,” “focus,” “potential,” “predict,” “target,” “forecast,” “should,” “would,” “could,” “continue,” “capable,” “aid,” “ongoing,” “project,” “intend,” “anticipate,” “seek,” “enable,” “promising,” “working toward,” “progress toward,” “prospective” the negative of such terms and other similar expressions are intended to identify forward-looking statements, although not all forward-looking statements contain such identifying words. These forward-looking statements are based on management’s current expectations, assumptions, hopes, beliefs, intentions, and strategies regarding future events and are based on currently available information as to the outcome and timing of future events.

These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results. Many of these factors are outside the Company’s control and are difficult to predict. Factors that may cause such differences include but are not limited to ones listed here. The Company faces significant challenges in its attempts to develop a solid-state battery cell and produce it at high volumes and may not be able to successfully develop its solid-state battery cell or build high volumes of multilayer cells for commercialization, including under its Collaboration Agreement. The Company could encounter significant delays and/or technical challenges in replicating and scaling up the performance seen in its single-layer, early multilayer and low volume sample cells, in achieving the high quality, consistency, reliability, safety, cost, and throughput required for commercial production and sale, and in developing a cell architecture that meets all the technical requirements. The Company has encountered and may encounter delays and other obstacles in acquiring, installing and operating new manufacturing equipment for automated and/or continuous-flow processes such as Raptor and Cobra, including vendor delays and other supply chain disruptions and challenges in optimizing its complex manufacturing processes. The Company may encounter delays and cost overruns in hiring and retaining the engineers it needs to expand its development and production efforts, including as a result of management changes or as part of the Collaboration Agreement, delays in building out or scaling up QS-0, and delays in establishing supply relationships for necessary materials, components or equipment. Delays in increasing production of engineering samples have slowed the Company’s development efforts in the past. These or other sources of delay could impact our delivery of samples and delay or prevent successful commercialization of our products or the entry into the IP License Agreement. Our relationship with Volkswagen is subject to various risks which could adversely affect our business and future prospects. The Company may encounter delays, difficulties and technical challenges in its collaboration with PowerCo to industrialize its solid-state lithium-metal battery technology. Delays or difficulties in meeting technical milestones, including under the Collaboration Agreement required to trigger the IP License Agreement and related royalty prepayment, or scaling up QS-0 could cause prospective customers and collaboration partners not to purchase cells from us or not to proceed with the IP License Agreement. If the Company does not enter into the IP License Agreement, it will not receive the royalty prepayment and realize any of the other benefits expected from such agreement. Certain agreements and relationships currently restrict or in the future may restrict our business operations, commercialization opportunities, and revenue generation. The Company may be unable to adequately control the costs associated with its operations and the components necessary to build its solid-state battery cells at competitive prices. The Company’s spending may be higher than currently anticipated and the Company may need to raise additional funds, including in the public markets, and this may cause dilution in the stock ownership of our investors. The Company may encounter difficulties, including due to challenges related to the management transition, the building out of high-volume processes, the achievement of the quality, consistency, reliability, safety, cost and throughput required for commercial production and sale, changes in economic and financial conditions, and not be successful in competing in the battery market industry or establishing and maintaining confidence in its long-term business prospects among current and future partners and customers. The Company is at an early stage of testing its battery technology for use in consumer electronics applications, and we may discover technical or other hurdles that impede our ability to serve that market. If the Company is unable to protect or assert its intellectual property, its business and competitive position would be harmed. The Company cautions that the foregoing list of factors is not exclusive. The Company cautions readers not to place undue reliance upon any forward-looking statements, which speak only as of the date made.

Except as otherwise required by applicable law, the Company disclaims any duty to update any forward-looking statements. Should underlying assumptions prove incorrect, actual results and projections could differ materially from those expressed in any forward-looking statements. Additional information concerning these and other factors that could materially affect the Company’s actual results can be found in the Company’s periodic filings with the SEC. The Company’s SEC filings are available publicly on the SEC’s website at www.sec.gov.

Exhibit 99.2

QuantumScape Reports Third Quarter 2024 Business and Financial Results

SAN JOSE, Calif. – October 23, 2024 – QuantumScape Corporation (NYSE: QS), a leader in developing next-generation solid-state lithium-metal batteries, today announced its business and financial results for the third quarter of 2024, which ended September 30.

The company posted a letter to shareholders on its Investor Relations website, ir.quantumscape.com, that details third-quarter financial results and provides a business update.

QuantumScape will host a live webcast today at 2 p.m. Pacific Time (5 p.m. Eastern Time), accessible via its IR Events page. Siva Sivaram, chief executive officer, and Kevin Hettrich, chief financial officer, will participate on the call.

An archive of the webcast will be available shortly after the call for 12 months.

About QuantumScape Corporation

QuantumScape is on a mission to revolutionize energy storage to enable a sustainable future. The company’s next-generation batteries are designed to enable greater energy density, faster charging and enhanced safety to support the transition away from legacy energy sources toward a lower carbon future. For more information, visit www.quantumscape.com.

For Investors

ir@quantumscape.com

For Media

media@quantumscape.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

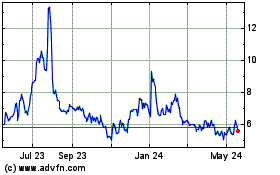

Quantumscape (NYSE:QS)

Historical Stock Chart

From Oct 2024 to Nov 2024

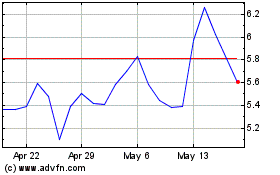

Quantumscape (NYSE:QS)

Historical Stock Chart

From Nov 2023 to Nov 2024