Notice of Exempt Solicitation

NAME OF REGISTRANT: Restaurant Brands International Inc.

NAME OF PERSON RELYING ON EXEMPTION: Province of St. Joseph

of the Capuchin Order

ADDRESS OF PERSON RELYING ON EXEMPTION: 1820 Mt. Elliott Street,

Detroit MI 48207

Written materials are submitted pursuant to Rule 14(a)-6(g)(1) promulgated

under the Securities and Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule, but is made voluntarily

in the interest of public disclosure and consideration of these important issues.

Vote FOR Item #6

Shareholder Proposal Regarding Water Risk

SUMMARY:

Restaurant Brands International Inc. (“RBI”

or “the Company”) is one of the world's largest quick service restaurant (QSR) companies with more than $40 billion in annual

system-wide sales and over 30,000 restaurants in more than 100 countries1 making it uniquely exposed to water related climate

risk, potentially impacting its ability to operate. RBI states it is committed to “doing our part with respect to energy, water

and waste2”, but the Company has failed to indicate how it is analyzing water risk across its operations and supply chain

and has not shown how it is managing water-related supply chain impacts and disruptions that could lead to increased input prices and

a reduction in revenue.

|

RESOLVED: Considering the growing pressure on water supplies

posed by climate change, shareholders request that RBI conduct and report to shareholders, using quantitative indicators where appropriate,

an assessment to identify the water risk exposure of its supply chain, and its responsive policies and practices to reduce this risk and

prepare for water supply uncertainties associated with climate change.

SUPPORTING STATEMENT: Proponents request the report disclose,

at management’s discretion:

• Identification of water assessment tools used by RBI or its

suppliers to assess supply chain water related risk

• Results of water risk assessments across its agricultural supply

chain, including identifying the regions of at-risk ingredient production and supply chains

• Any additional monitoring of supply chain water resources

• Water scarcity planning and responsive actions

• A description of how water management is integrated into governance

mechanisms

• A description of water-related engagement with value chain

partners |

RATIONALE: FOR A YES VOTE

_____________________________

1 https://www.rbi.com/English/about-us/overview/default.aspx

2 https://s26.q4cdn.com/317237604/files/doc_downloads/governance/Code-of-Business-Ethics-and-Conduct-for-Vendors.pdf

| 1. | Financial risk – Diminishing water resources pose financial, regulatory, and reputational

risks for companies like RBI which depend on water intensive agricultural commodities. |

| 2. | Lagging peers and investor expectations for disclosure – Many peer companies––including

Yum! Brands, McDonald’s, Starbucks, Domino’s, and Chipotle––conduct supply chain water risk assessments and investors

increasingly expect companies to conduct this fundamental analysis. |

| 3. | Investors have exhausted other engagement pathways – Since 2019, investors have regularly

engaged RBI on water stewardship through letters and dialogue; despite consistent engagement from investors, the company has failed to

take meaningful action to address water risk. |

1. Financial Risk

Supply chain water-related risks include greater

commodity price volatility and decreasing reliability of supplies. Research on food companies has shown the potential financial impacts

due to water scarcity could be three times higher than carbon related risks, with agricultural exposure identified as the key determinant

of financial risk.3

A MSCI analysis of food companies in its All-Country World Index (ACWI)

found that $459 billion in revenue may be at risk from lack of water availability for irrigation or animal consumption, and $198 billion

could be at risk from changing precipitation patterns affecting current crop production areas.4

For companies in the food sector, the majority of their water footprint

comes from agricultural supply chains. A 2022 report from Ceres revealing how industry practices are driving critical threats to freshwater

globally identifies the food industry as one of the most responsible for undermining the functionality of global freshwater systems.5

The report states that “Agriculture is the leading driver of water degradation globally, and industries that rely extensively on

agricultural supply chains are at higher risk than others.”

It is clear from climate disclosures that RBI has a significant agricultural

supply chain that overlaps areas of high water stress and sources key commodities that are water intensive. For example, the Company reports

that its scope 3 emissions account for 99% of its total emissions and of that 84% are due to purchased goods and services. The Company

categorizes emissions from beef, chicken, pork, grains, and dairy among other sources.

_____________________________

3 https://www.cnbc.com/2021/06/29/water-scarcity-why-some-of-the-worlds-biggest-companies-are-worried.html

4 https://www.ceres.org/sites/default/files/reports/Ceres_InvestWaterToolkit.pdf

5

https://www.ceres.org/resources/reports/global-assessment-private-sector-impacts-water

RBI also notes an increase in sourcing from Brazil, where 15% of the

world's beef is produced. Beef production is the most water intensive agricultural commodity. “Raising beef cattle consumes the

most water, using an estimated 15,000 liters of water per kilogram of beef6.” In the Brazilian Amazon, where 65% of deforestation

can be attributed to cattle ranching, tillage and other farming land-use activities worsen soil erosion and salinity, polluting water

bodies. This region faces unprecedented drought and experts have called for the development of a drought-mitigation plan.7,8

RBI clearly recognizes the materiality of water to its business, noting

in its 2024 10-K that “We, our franchisees, and our supply chain are subject to risks and costs arising from the effects of climate

change, greenhouse gases, and diminishing energy and water resources9”

Within RBI’s supplier code, vendors are encouraged to establish

procedures to manage, measure and, where possible, reduce factors related to their environmental impact, including energy usage, fossil

fuel usage, water usage, wastewater and solid waste (including byproducts and hazardous waste), air emissions (including greenhouse gases)

and handling of hazardous substances, and to provide reports on such procedures to RBI as RBI may request.10 However, these

are not mandatory requirements, and the Company does not report on the assessment of suppliers' water management so it is unknown if supplier

water risk is being properly mitigated. The company was a founding member and responder to CDP‘s forests questionnaire, however

they do not respond to CDP's water questionnaire, leaving investors unaware of water use and management practices. Overall, RBI does not

have sufficient disclosure of water risk within its supply chain and business.

RBI argues in its opposition statement that water risk can be better

assessed through a TCFD aligned report. If the company included the requested disclosures in its TCFD aligned report instead of a standalone

water risk report, investors would find that sufficient. However, the company’s current climate reporting does not disclose water

risks and impacts related to water quality or availability. For instance, RBI’s opposition statement mentions conducting a TCFD-aligned

climate risk analysis for its coffee supply chain, however, the Company fails to disclose any meaningful findings from this assessment

related to water risk. Furthermore, the Company fails to identify how it is measuring water-related risks for its other priority ingredients

including beef, chicken, and dairy, all of which the Company notes are “subject to risks and costs arising from the effects of climate

change, greenhouse gases, and diminishing energy and water resources.”11

To ensure management’s response is effective, cost efficient,

and reduces risks to the greatest extent possible, companies’ risk mitigation strategies must align with the scale and scope of

the water dependency and resource security of their value chain. Without thorough supply chain assessments, local water problems could

go undetected and cause major disruptions to business practices. The Company and investors alike will be unable to evaluate whether suppliers

are sufficiently handling these risks, what impending concerns may arise, and if they are taking a proactive approach to sustainable water

management.

_____________________________

6 https://www.ceres.org/resources/reports/global-assessment-private-sector-impacts-water

7

https://www.reuters.com/business/environment/brazil-sets-up-task-force-unprecedented-drought-amazon-minister-2023-09-27/

8 https://www.nature.com/articles/d41586-021-03625-w

9 https://d18rn0p25nwr6d.cloudfront.net/CIK-0001618756/ff672f2e-6fcc-4299-8d30-5cbfef712132.html

10 https://s26.q4cdn.com/317237604/files/doc_downloads/governance/Code-of-Business-Ethics-and-Conduct-for-Vendors.pdf

11 https://www.sec.gov/ix?doc=/Archives/edgar/data/98362/000009836224000042/tkr-20231231.htm

RBI should understand the water risk exposure

of its supply chain as it directly connects to RBI’s climate impact and business impact. Having responsive policies and practices

to mitigate and prepare for water supply uncertainties associated with climate change will both help achieve sustainable water management

as well as reduce business risk as a whole.

2. Lagging peers and investor expectations

for disclosure

RBI lags its competitors in assessing and disclosing

supply chain water related risk. Many of the Company’s primary competitors have taken steps to identify and report supply chain

water-related risks, set time-bound reduction targets, and integrate those risks and goals into governance and oversight strategies. Many

peer quick service restaurant companies - including Starbucks, Yum! Brands, McDonald’s. Domino’s, and Chipotle, conduct supply

chain water risk assessments.

As water stress heightens around the globe, consumers,

investors, and the public are demanding better action on water throughout industry supply chains. If RBI does not take proactive action

to evaluate and mitigate water risk, the Company could be at risk for severe financial and market share losses. Without a full value chain

water risk assessment, disclosure of quantitative performance metrics and best practice strategies for water management, investors and

consumers cannot gauge whether RBI is adequately managing its water risk.

Further, over 240 companies have endorsed the

UN Global Compact CEO Water Mandate following the six commitment areas: Direct Operations, Supply Chain and Watershed Management, Collective

Action, Public Policy, Community Engagement, and Transparency. 12

Investors increasingly expect companies to disclose

information about their environmental risks and impacts, including water.

| ● | A resolution at McDonalds this year asking the company to assess the feasibility of implementing targets for reducing water consumption

in its supply chain was withdrawn when the company agreed to additional water disclosures in the short-term and a timeline for developing

a strategy to address its impact on water scarcity in water stressed areas.13 |

| ● | A 2023 resolution at Domino’s asking the company to conduct an assessment to identify the water risk exposure of its supply

chain was withdrawn. The company has completed a water risk assessment using the World Resources Institute’s Aqueduct tool and the

World Wildlife Fund’s Water Risk Atlas and the company is continuing to evaluate and reduce water risk.14 |

| ● | Chipotle created a water risk assessment implementation timeline in 2022 outlining how the company will measure and begin to reduce

risk across its restaurants, ingredients, and supply chain. 15 |

_____________________________

12 https://ceowatermandate.org/about/what-is-the-mandate/#endorser-commitments

13 https://www.pggm.nl/en/blogs/pggm-and-mcdonald-s-sign-a-resolution-withdrawal-agreement/

14 https://biz.dominos.com/stewardship/environmental-footprint/

15 https://www.chipotle.com/content/dam/chipotle/pages/sustainability/us/2023/updated-2021-annual-cmg-report-update-11-17-22.pdf

| ● | Yum! Brands conducted a water risk assessment of its top 1,450 suppliers of chicken, beef, dairy, and packaging categories, leveraging

WRI Aqueduct and supplier management tools. The company disclosed the percent of its supply chain exposed to varying levels of water risk

and plans to conduct this review approximately every two years. 16 |

| ● | Starbucks has committed to become resource positive and cut water usage in half by 2030 while prioritizing high-risk water basins

across its value chain.17 |

| ● | Other companies such as Unilever, General Mills, Mars, Cargill, and Pepsi Co. have conducted water assessments in their supply chain

as well as set time-bound reduction targets.18 |

RBI’s lagging performance could create bottom-line concerns;

businesses that lack contingency plans and that fail to take proactive steps to address supplier and local water challenges may find it

difficult to avoid or respond quickly to unexpected occurrences.

RBI contends in its opposition statement that disclosing the results

of a supply chain risk assessment would not be appropriate. Investors disagree with this position given that peers and suppliers disclose

details about the percentage of commodities sourced from high risk regions and maps of priority regions identified by supply chain water

risk assessments. 19,20,21

3. Investors have exhausted other engagement pathways

Since 2019, investors have regularly engaged RBI on water stewardship

through letters and dialogue. Despite consistent and good faith engagements from investors, the company has failed to take meaningful

action.

In their 2020 sustainability report, the company stated “In 2020,

we measured our supply chain water use for the first time, which we will use to inform our stewardship strategy.”22 However,

after a 2021 engagement through the Global Investor Engagement on Meat Sourcing, organized by FAIRR and Ceres, the Company disclosed it

was working to reduce water use in its restaurants and offices globally, but it did not disclose further information nor did they disclose

having conducted a comprehensive water risk assessment that includes its agricultural supply chain.23

During a subsequent dialogue in November 2023, the company had not

progressed on conducting the water risk assessment and was unable to provide clear details on how it plans to measure and disclose material

water risks. Having exhausted alternative engagement pathways, this resolution was filed.

_____________________________

16 https://www.yum.com/wps/wcm/connect/yumbrands/5c5d560b-8d77-4ea2-bdc0-bc9f595bdc2c/R4G-Report-2021.pdf?MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE.Z18_2Q82H202O02550QCJUO2J60000-5c5d560b-8d77-4ea2-bdc0-bc9f595bdc2c-o9EO5zQ

17 stories.starbucks.com/press/2021/starbucks-expands-commitment-to-water-and-outlines-comprehensive-strategy/

18 https://feedingourselvesthirsty.ceres.org/key-findings#toc-water-risk-assessments

19 https://www.yum.com/wps/wcm/connect/yumbrands/5c5d560b-8d77-4ea2-bdc0-bc9f595bdc2c/R4G-Report-2021.pdf?MOD=AJPERES&CONVERT_TO=url&CACHEID=ROOTWORKSPACE.Z18_2Q82H202O02550QCJUO2J60000-5c5d560b-8d77-4ea2-bdc0-bc9f595bdc2c-o9EO5zQ

20 https://www.chipotle.com/content/dam/chipotle/pages/sustainability/us/2024/2023%20Report.pdf

21 https://www.cargill.com/sustainability/priorities/water

22 https://s26.q4cdn.com/317237604/files/doc_downloads/2021/04/RBI-RB4G-2021-ENGLISH.pdf

23 https://www.fairr.org/resources/reports/global-investor-engagement-on-meat-sourcing-phase-3

Accordingly, investors are encouraged to vote “FOR” proposal

number 6 on Restaurant Brands International’s proxy statement.

If you have any questions or

need additional information, contact Natalie Wasek, Seventh Generation Interfaith Inc., at Natalie@sgicri.org.

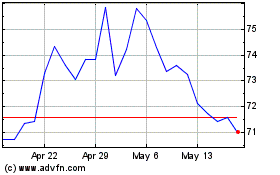

Restaurant Brands (NYSE:QSR)

Historical Stock Chart

From May 2024 to Jun 2024

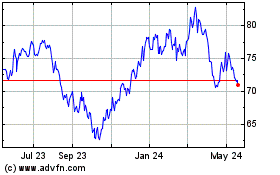

Restaurant Brands (NYSE:QSR)

Historical Stock Chart

From Jun 2023 to Jun 2024