RB Global, Inc. (NYSE: RBA) (TSX: RBA), the trusted global

marketplace for insights, services and transaction solutions for

commercial assets and vehicles, today announced that Ritchie Bros.

Auctioneers’ Feb. 17-21 premier global auction event in Orlando

will feature 16,000+ items listed online, with inventory continuing

to be added daily. Bidders can browse listings online with

high-resolution photos and videos, or attend preview days onsite

starting today, Feb. 13. Priority bidding and Timed Auction Lot

bidding opened Feb. 8.

Equipment highlights in the Orlando auction include 2,000+

construction equipment lots, 1,100+ transport trucks, 70+ units of

aggregate equipment, 400+ lifting and material handling assets, and

so much more. Bids in the auction can be made in-person, online in

real time at rbauction.com, or via Ritchie Bros.' mobile app.

Customers who attend the auction in person are encouraged to

connect with the Ritchie Bros. team onsite to learn more about the

complete offering of services and solutions, including:

- Creating an online profile at rbauction.com to explore

listings

- Discussing financing options with a member of the Ritchie Bros.

Financial Services team

- Coordinating with VeriTread and uShip on transportation of

purchased assets

- Browsing the latest assets in Marketplace-E Buy Now and Make

Offer platform

- Previewing the upcoming improvements to the auction platform

with the Ritchie Bros. product team

- Getting to know Boom & Bucket®, our newest online

marketplace offering a vast selection of ready-to-work equipment –

backed by Powerhouse Protection®, extended warranties, flexible

financing options and nationwide shipping

"We’re looking forward to welcoming customers once again to our

highly anticipated, premier global auction event in Orlando. With

200 acres quickly filling up with heavy industrial equipment and

transportation assets ready to be purchased and taken home by new

owners, plus online inventory listed through our Virtual Sales

Option featuring IronClad Assurance, this year’s auction event

offers an unmatched selection for buyers worldwide," said Jeff

Jeter, Chief Revenue Officer for RB Global. "At Ritchie Bros., we

want our buyers to have all the information they need to bid with

confidence. Check out the equipment online or visit our Orlando

site in person to inspect and test equipment."

For more information about the February 2025 Orlando auction,

including details about how to consign today or how to view and

register to bid on the largest selection of available inventory in

one place, visit rbauction.com/Orlando25.

About RB Global

RB Global, Inc. (NYSE: RBA) (TSX: RBA) is a leading, omnichannel

marketplace that provides value-added insights, services and

transaction solutions for buyers and sellers of commercial assets

and vehicles worldwide. Through its auction sites in 14 countries

and digital platform, RB Global serves customers in more than 170

countries across a variety of asset classes, including automotive,

commercial transportation, construction, government surplus,

lifting and material handling, energy, mining and agriculture. The

company’s marketplace brands include Ritchie Bros., the world’s

largest auctioneer of commercial assets and vehicles offering

online bidding, and IAA, a leading global digital marketplace

connecting vehicle buyers and sellers. RB Global’s portfolio of

brands also includes Rouse Services, which provides a complete

end-to-end asset management, data-driven intelligence and

performance benchmarking system; SmartEquip, an innovative

technology platform that supports customers’ management of the

equipment lifecycle and integrates parts procurement with both OEMs

and dealers; and VeriTread, an online marketplace for heavy haul

transport.

Forward-Looking Statements

Certain statements contained in this release contain include

forward-looking information within the meaning of Canadian

securities legislation and forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

Section 21E of the Securities Exchange Act of 1934, as amended, and

the Private Securities Litigation Reform Act of 1995 (collectively,

“forward-looking statements”). Forward-looking statements may

include statements relating to future events and anticipated

results of operations, business strategies, the expected timing and

associated benefits with respect to the planned February 2025

Orlando Auction Event and other subjects of this release on our

business and plans regarding our growth strategies, and to our

customers and company generally, and other aspects of RBA’s or

IAA’s respective businesses, operations, financial condition or

operating results and other statements that are not historical

facts. Words such as “should,” “may,” “will,” “anticipates,”

“expects,” “intends,” “plans,” “believes,” “seeks,” “estimates”

“could,” “can,” “intends,” “target,” “goal,” “projects,”

“contemplates,” “believes,” “predicts,” “potential,” “continue,”

“foresees,” “forecasts,” “estimates,” “opportunity” and similar

expressions identify forward- looking statements. It is uncertain

whether any of the events anticipated by the forward-looking

statements will transpire or occur, or if any of them do, what

impact they will have on the results of operations and financial

condition of the combined companies or the price of RBA’s common

shares. Therefore, you should not place undue reliance on any such

statements and caution must be exercised in relying on

forward-looking statements. While RBA’s management believe the

assumptions underlying the forward-looking statements are

reasonable, these forward-looking statements involve certain risks

and uncertainties, many of which are beyond RBA’s control, that

could cause actual results to differ materially from those

indicated in such forward-looking statements, including but not

limited to: the effects of the business combination of RBA and IAA,

including the combined company’s future financial condition,

results of operations, strategy and plans; potential adverse

reactions or changes to business or employee relationships,

including those resulting from the completion of the merger; the

diversion of management time on transaction-related issues; the

response of competitors to the merger; the ultimate difficulty,

timing, cost and results of integrating the operations of RBA and

IAA; the fact that operating costs and business disruption may be

greater than expected following the consummation of the merger; the

effect of the consummation of the merger on the trading price of

RBA’s common shares; the ability of RBA to retain and hire key

personnel and employees; the significant costs associated with the

merger; the outcome of any legal proceedings that could be

instituted against RBA; the ability of the combined company to

realize anticipated synergies in the amount, manner or timeframe

expected or at all; the failure of the combined company to realize

potential revenue, EBITDA, growth, operational enhancement,

expansion or other value creation opportunities from the sources or

in the amount, manner or timeframe expected or at all; the failure

of the trading multiple of the combined company to normalize or

re-rate and other fluctuations in such trading multiple; changes in

capital markets and the ability of the combined company to generate

cash flow and/or finance operations in the manner expected or to

de-lever in the timeframe expected; the failure of RBA or the

combined company to meet financial forecasts and/or KPI targets;

legislative, regulatory and economic developments affecting the

business of RBA; general economic and market developments and

conditions; the evolving legal, regulatory and tax regimes under

which RBA operates; unpredictability and severity of catastrophic

events, including, but not limited to, pandemics, acts of terrorism

or outbreak of war or hostilities, as well as RBA’s response to any

of the aforementioned factors. Other risks that could cause actual

results to differ materially from those described in the

forward-looking statements are included in RBA’s periodic reports

and other filings with the Securities and Exchange Commission

(“SEC”) and/or applicable Canadian securities regulatory

authorities, including the risk factors identified under “Risk

Factors” and the section titled “Summary of Risk Factors” in RBA’s

most recent Annual Report on Form 10-K for the fiscal year ended

December 31, 2023, and other periodic reports and other filings

with the SEC. The forward-looking statements included in this

release are made only as of the date hereof. While the list of

factors presented here is considered representative, no such list

should be considered to be a complete statement of all potential

risks and uncertainties. Many of these risk factors are outside of

our control, and as such, they involve risks which are not

currently known that could cause actual results to differ

materially from those discussed or implied herein. RBA does not

undertake any obligation to update any forward-looking statements

to reflect actual results, new information, future events, changes

in its expectations or other circumstances that exist after the

date as of which the forward-looking statements were made, except

as required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250213712608/en/

Media Inquiries: Val Alitovska | RB Global, Inc.

Director, Corporate Communications (312) 505-9900

valitovska@rbglobal.com

Analyst Inquiries: Sameer Rathod | RB Global, Inc. VP,

Investor Relations/Market Intelligence (510) 381-7584

srathod@rbglobal.com

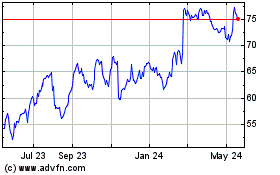

RB Global (NYSE:RBA)

Historical Stock Chart

From Jan 2025 to Feb 2025

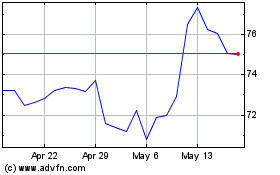

RB Global (NYSE:RBA)

Historical Stock Chart

From Feb 2024 to Feb 2025