Rubicon Receives Notice of Non-Compliance with NYSE Trading Share Price and Market Capitalization Listing Rules

23 March 2024 - 7:10AM

Business Wire

Rubicon Technologies, Inc. (“Rubicon” or the “Company”) (NYSE:

RBT), a leading provider of technology solutions for waste,

recycling, and fleet operations, today announced that on March 18,

2024 it received a notice (the “Notice”) from the New York Stock

Exchange (the “NYSE”) informing the Company that it is no longer in

compliance with Sections 802.01B and 802.01C of the NYSE Listed

Company Manual. The Company was notified by the NYSE that it was

not in compliance with Section 802.01B (the “Market Cap

Deficiency”) because it had an average global market

capitalization, over a consecutive 30 trading-day period, that is

less than $50,000,000 and, at the same time, its stockholders’

equity is less than $50,000,000. The Company was concurrently

notified by the NYSE that it was also not in compliance with

Section 802.01C (the “Share Price Deficiency”, together with the

Market Cap Deficiency, the “Deficiencies”) because the average

closing price of the Company’s Class A common stock was less than

$1.00 over a consecutive 30 trading-day period. The Notice does not

result in the immediate delisting of the Company’s Class A common

stock from the NYSE. The Company plans to notify the NYSE by no

later than April 1, 2024 (ten business days after receipt of the

Notice) that it intends to cure the Deficiencies and return to

compliance with the NYSE continued listing standard.

Share Price Deficiency

The NYSE provides a period of six months (the “Share Price Cure

Period”) following receipt of the Notice to regain compliance with

the minimum stock price requirement for continued listing on the

NYSE. Rubicon can regain compliance at any time during the Share

Price Cure Period if, on the last trading day of any calendar month

during the Share Price Cure Period, Rubicon has: (i) a closing

stock price of at least $1.00 and (ii) an average closing stock

price of at least $1.00 over the 30-day trading period ending on

the last trading day of that month.

The Company intends to consider available alternatives no later

than at the Company's annual meeting of stockholders, if necessary,

to cure the stock price non-compliance. Under the NYSE’s rules, if

the Company determines that it will cure the Share Price Deficiency

by taking an action that will require stockholder approval at its

next annual meeting of stockholders, the price condition will be

deemed cured if the price promptly exceeds $1.00 per share, and the

price remains above that level for at least the following 30

trading days.

Market Cap Deficiency

In accordance with applicable NYSE procedures, the Company has

45 days from receipt of the Notice to submit a business plan

advising the NYSE of the definitive action(s) the Company has

taken, or is taking, that would bring it into compliance with

continued listing standards within 18 months of receipt of the

Notice (the “Market Cap Cure Period,” together with the Share Price

Cure Period, the “Cure Periods”). The NYSE will review the plan

and, within 45 days of its receipt, determine whether the Company

has made a reasonable demonstration of an ability to conform to the

relevant standards in the 18-month period. If the NYSE accepts the

plan, the Company's Class A common stock will continue to be listed

and traded on the NYSE during the 18-month period, subject to the

Company's compliance with the other continued listing standards of

the NYSE and continued periodic review by the NYSE of the Company's

progress with respect to its plan. Rubicon is currently evaluating

its available options and developing a plan to regain compliance

with the minimum global market capitalization requirement.

The Company’s Class A common stock will continue to be listed

and trade on the NYSE during the Cure Periods, subject to the

Company’s compliance with other NYSE continued listing

standards.

About Rubicon

Rubicon builds AI-enabled technology products and provides

expert sustainability solutions to waste generators, fleet

operators, and material processors to help them understand, manage,

and reduce waste. As a mission-driven company, Rubicon helps its

customers improve operational efficiency, unlock economic value,

and deliver better environmental outcomes. To learn more, visit

rubicon.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240322353823/en/

Investor Contact: Alexandra Clark

Director of Finance & Investor Relations

alexandra.clark@rubicon.com

Media Contact: Benjamin Spall Sr.

Manager, Corporate Communications benjamin.spall@rubicon.com

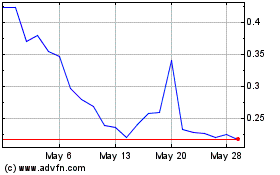

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Nov 2024 to Dec 2024

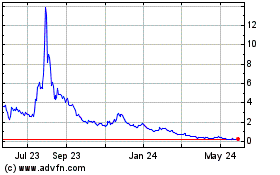

Rubicon Technologies (NYSE:RBT)

Historical Stock Chart

From Dec 2023 to Dec 2024