Form 8-K - Current report

27 August 2024 - 6:05AM

Edgar (US Regulatory)

false

0001870143

00-0000000

0001870143

2024-08-26

2024-08-26

0001870143

RCFA:UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember

2024-08-26

2024-08-26

0001870143

RCFA:ClassOrdinarySharesParValue0.0001ParValueMember

2024-08-26

2024-08-26

0001870143

RCFA:RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareEachAtExercisePriceOf11.50PerShareMember

2024-08-26

2024-08-26

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 26, 2024

PERCEPTION CAPITAL CORP. IV

(Exact name of registrant as specified in its charter)

| Cayman Islands |

|

001-41039 |

|

N/A |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

3109 W. 50th Street, #207

Minneapolis, MN 55410

(Address of principal executive offices, including

zip code)

Registrant’s telephone number, including

area code: (952) 456-5300

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

RCFA.U |

|

The New York Stock Exchange |

| Class A ordinary shares, par value $0.0001 par value |

|

RCFA |

|

The New York Stock Exchange |

| Redeemable warrants, each warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

RCFA WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the

Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item

4.02. Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

In connection with the preparation of the financial

statements of Perception Capital Corp. IV (the “Company”) as of and for the quarterly period ended June 30, 2024, the Company’s

management identified an error in amounts reported in certain previously issued financial statements as of and for the year ended December

31, 2023 and as of and for the three months ended March 31, 2024 related to the deferred underwriting fee resulting from the Company’s

initial public offering. The Company had incorrectly continued to report the deferred underwriting fee as a liability although the underwriters

had entered into agreements in October and November 2023 waiving their right to receive the deferred underwriting fee. As a result, the

Company’s management determined that the Company had overstated its liabilities by $8,050,000 at December 31, 2023 and March 31,

2024.

Based on an analysis of quantitative and qualitative

factors in accordance with SEC Staff Accounting Bulletins 99, Materiality and 108, Considering the Effects of Prior Year Misstatements

when Quantifying Misstatements in Current Year Financial Statements, the Company and the Audit Committee of the Board of Directors

(the “Audit Committee”), determined that the error was material to its previously issued financial statements, as included

in the Annual Report on Form 10-K for the year ended December 31, 2023 and in the Quarterly Report on Form 10-Q for the quarter ended

March 31, 2024 (the “Prior Period Financial Statements”). The Company along with the Audit Committee has discussed with Withum

Smith+Brown, PC (“Withum”), its independent registered public accounting firm, the matters described herein.

As a result of the foregoing, on August 26, 2024,

the Company and the Audit Committee determined that the Prior Period Financial Statements, as well as any reports, related earnings releases,

investor presentations or similar communications of the Prior Period Financial Statements, should no longer be relied upon.

The Company does not expect any of the above changes

will have any impact on its cash and cash equivalents.

The Company expects to file an amendment to the

Annual Report on Form 10-K for the year ended December 31, 2023 (the “2023 Form 10-K/A”) in a timely manner following the

filing of this Current Report on Form 8-K to restate its financial statements included in the Annual Report on Form 10-K for the year

ended December 31, 2023. The Company will also be restating its financial statements included in the Quarterly Report on Form 10-Q for

the quarter ended March 31, 2024 within the Form 10-Q for the quarterly period ended June 30, 2024 (the “Q2 Form 10-Q”), which

will be filed with the SEC in a timely manner following the filing of this Current Report on Form 8-K.

The Company’s management has concluded that

in light of the error described above, a material weakness exists in the Company’s internal control over financial reporting and

that the Company’s disclosure controls and procedures were not effective as of December 31, 2023, March 31, 2024 and June 30, 2024.

Such material weakness will be described in detail in the 2023 Form 10-K/A and the Q2 Form 10-Q.

SIGNATURE

Under the requirements of

the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the duly authorized undersigned.

| Date: August 26, 2024 |

PERCEPTION CAPITAL CORP. IV |

| |

|

|

| |

By: |

/s/ Rick Gaenzle |

| |

Name: |

Rick Gaenzle |

| |

Title: |

Chief Executive Officer |

2

v3.24.2.u1

Cover

|

Aug. 26, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 26, 2024

|

| Entity File Number |

001-41039

|

| Entity Registrant Name |

PERCEPTION CAPITAL CORP. IV

|

| Entity Central Index Key |

0001870143

|

| Entity Tax Identification Number |

00-0000000

|

| Entity Incorporation, State or Country Code |

E9

|

| Entity Address, Address Line One |

3109 W. 50th Street

|

| Entity Address, Address Line Two |

#207

|

| Entity Address, City or Town |

Minneapolis

|

| Entity Address, State or Province |

MN

|

| Entity Address, Postal Zip Code |

55410

|

| City Area Code |

952

|

| Local Phone Number |

456-5300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant |

|

| Title of 12(b) Security |

Units, each consisting of one Class A ordinary share, $0.0001 par value, and one-half of one redeemable warrant

|

| Trading Symbol |

RCFA.U

|

| Security Exchange Name |

NYSE

|

| Class A ordinary shares, par value $0.0001 par value |

|

| Title of 12(b) Security |

Class A ordinary shares, par value $0.0001 par value

|

| Trading Symbol |

RCFA

|

| Security Exchange Name |

NYSE

|

| Redeemable warrants, each warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share |

|

| Title of 12(b) Security |

Redeemable warrants, each warrant exercisable for one Class A ordinary share, each at an exercise price of $11.50 per share

|

| Trading Symbol |

RCFA WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RCFA_UnitsEachConsistingOfOneClassOrdinaryShare0.0001ParValueAndOnehalfOfOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RCFA_ClassOrdinarySharesParValue0.0001ParValueMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=RCFA_RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareEachAtExercisePriceOf11.50PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

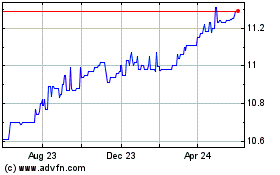

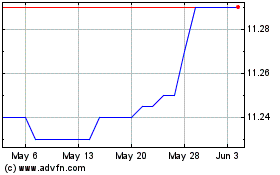

Perception Capital Corp IV (NYSE:RCFA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Perception Capital Corp IV (NYSE:RCFA)

Historical Stock Chart

From Nov 2023 to Nov 2024