- New data from the Phase 1/1b ARC-20 study showed that

casdatifan improved upon the rate of primary progression, overall

response rate (ORR) and progression-free survival (PFS) relative to

published data from studies with HIF-2a inhibitors to date

- Initiation of the Phase 3 study for PEAK-1 evaluating

casdatifan in combination with cabozantinib versus cabozantinib in

immuno-oncology (IO)-experienced patients with clear cell renal

cell carcinoma (ccRCC) is expected in the first half of 2025;

initial data from the cohort of ARC-20 evaluating casdatifan plus

cabozantinib are expected to be presented in mid-2025

- Arcus completed a $150 million financing and continues to be

well positioned to advance its pipeline with $992 million in cash,

cash equivalents and marketable securities as of December 31, 2024

(excluding proceeds from the offering)

Arcus Biosciences, Inc. (NYSE:RCUS), a clinical-stage, global

biopharmaceutical company focused on developing differentiated

molecules and combination therapies for patients with cancer, today

reported financial results for the fourth quarter and full year

ended December 31, 2024, and provided a pipeline update on its

clinical-stage investigational molecules across multiple common

cancers.

“Last week, we presented data from nearly 90 ccRCC patients

demonstrating casdatifan’s potential best-in-class profile,” said

Terry Rosen, Ph.D., chief executive officer of Arcus. “Given the

strong efficacy and preferable safety profile relative to

standard-of-care VEGFR tyrosine kinase inhibitors, we believe

casdatifan can play an important role in the treatment of every

patient diagnosed with ccRCC. Arcus now has full developmental and

commercial control of casdatifan, and we are pursuing a robust

development plan in multiple ccRCC settings, which include our

first Phase 3 trial, PEAK-1, expected to initiate next quarter, as

well as our clinical collaboration with AstraZeneca. We are

extremely well capitalized to execute on these plans, and we

continue to evaluate and pursue opportunities to conserve capital

and allocate greater resources to maximizing the potential of

casdatifan.”

Pipeline Highlights:

Casdatifan (HIF-2a inhibitor)

Casdatifan Updates:

- New clinical data from three monotherapy expansion cohorts in

ARC-20 were presented in a rapid oral session at the 2025 American

Society of Clinical Oncology (ASCO) Genitourinary (GU) Cancers

Symposium in February. At the time of data cut-off (DCO, January 3,

2025), the efficacy-evaluable population included a total of 87

patients with ccRCC who had received at least two prior lines of

therapy, including both an anti-PD-1 and a VEGFR tyrosine kinase

inhibitor (TKI) therapy. These data support the potential for

casdatifan to be a best-in-class HIF-2a inhibitor for the treatment

of ccRCC:

- Despite limited follow-up, two of the cohorts exceeded 30%

confirmed ORR (inclusive of one partial response that confirmed

after the DCO)

- Rates of primary progressive disease (progression at or before

their first disease assessment) ranged from 14% to 19%

- Most patients (81-87%) experienced disease control with either

a partial response or stable disease

- Only two confirmed responders out of the 26 across all cohorts

had discontinued due to progression, indicating the potential for a

long duration of response

- A 9.7-month median PFS was reached for the 50mg twice-daily

casdatifan monotherapy cohort; median PFS was not yet reached for

other cohorts

- No unexpected safety signals were observed at the time of DCO,

and casdatifan had an acceptable and manageable safety profile

across all doses

Planned Data Readouts:

- Mid-2025: Safety and initial efficacy data for the ARC-20

cohort evaluating casdatifan plus cabozantinib in IO-experienced

patients.

- Fall 2025: More mature data from the cohorts evaluating

casdatifan monotherapy in patients who had progressed on both an

anti-PD-1 and a TKI therapy.

- 2026: More mature data from the casdatifan + cabozantinib

cohort and initial data from the new ARC-20 cohorts evaluating

casdatifan in the first-line (1L) and IO-experienced

settings.

Upcoming Study and Cohort Initiations:

- Three new expansion cohorts within ARC-20 will be initiated in

the first quarter of 2025:

- Casdatifan plus zimberelimab in all-comer 1L ccRCC

- Casdatifan monotherapy in favorable-risk 1L ccRCC

- Casdatifan monotherapy in the IO-experienced setting for

patients with ccRCC who have not received a VEGFR-TKI therapy

- The Phase 3 PEAK-1 study evaluating casdatifan in combination

with cabozantinib versus cabozantinib in IO-experienced ccRCC is

expected to initiate in the second quarter of 2025.

- A Phase 1b study, part of AstraZeneca’s eVOLVE portfolio of

trials, evaluating casdatifan in combination with volrustomig,

AstraZeneca’s investigational PD-1/CTLA-4 bispecific antibody, in

IO-naive patients, is expected to initiate in 2025. AstraZeneca is

operationalizing this study.

Domvanalimab (Fc-silent anti-TIGIT

antibody) plus Zimberelimab (anti-PD-1 antibody)

- Overall survival data from the Phase 2 EDGE-Gastric study,

evaluating domvanalimab plus zimberelimab and chemotherapy in upper

gastrointestinal (GI) adenocarcinomas, are expected to be presented

in the fall of 2025.

- The first Phase 3 data readout for domvanalimab plus

zimberelimab will be from the ongoing Phase 3 study STAR-221

evaluating domvanalimab plus zimberelimab and chemotherapy in PD-L1

all-comer 1L metastatic upper GI adenocarcinomas and is expected in

2026.

CD73-Adenosine Axis: Quemliclustat

(small-molecule CD73 inhibitor) and Etrumadenant (A2a/A2b receptor

antagonist)

Quemliclustat:

- In the fourth quarter of 2024, Arcus initiated PRISM-1, a Phase

3 trial of quemliclustat combined with gemcitabine/nab-paclitaxel

versus gemcitabine/nab-paclitaxel in pancreatic cancer. In February

2025, Arcus’s partner, Taiho, dosed their first patient in Japan

for PRISM-1.

Etrumadenant:

- Arcus plans to meet with the FDA in the first half of 2025 to

clarify next steps for ARC-9, evaluating etrumadenant plus

zimberelimab, FOLFOX, chemotherapy and bevacizumab (EZFB) versus

regorafenib in third-line metastatic colorectal cancer (mCRC).

Early Clinical Programs

- Evaluation of AB801, a potent and highly selective

small-molecule AXL inhibitor, in the dose-escalation phase of a

Phase 1/1b study in patients is ongoing. Arcus anticipates

advancing this molecule into expansion cohorts in non-small cell

lung cancer (NSCLC) in the second half of 2025.

Financial Results for Fourth Quarter and Full Year

2024:

- Cash, Cash Equivalents and Marketable Securities were

$992 million as of December 31, 2024, compared to $866 million as

of December 31, 2023. The increase during the period is primarily

due to the receipt of $320 million in cash from Gilead for their

January 2024 equity investment, the receipt of the $100 million

option continuation payment from Gilead in July 2024 and proceeds

from our $50 million term loan, partially offset by the use of cash

in research and development activities. Arcus expects its cash and

investments, together with the proceeds from the equity financing

in February 2025, will provide funding through our initial pivotal

read-outs for domvanalimab, quemliclustat and casdatifan including

STAR-221, PRISM-1 and PEAK-1.

- Revenues were $36 million for the fourth quarter 2024,

compared to $31 million for the same period in 2023. In the fourth

quarter 2024, Arcus recognized $28 million in License and

development service revenues related to the advancement of programs

under the Gilead collaboration, as well as $8 million in Other

collaboration revenue related to Gilead’s ongoing rights to access

Arcus’s research and development pipeline in accordance with the

Gilead collaboration agreement.

- Research and Development (R&D) Expenses were $111

million for the fourth quarter 2024, compared to $93 million for

the same period in 2023. The net increase of $18 million was

primarily driven by higher costs associated with our early-stage

R&D and preclinical program activities, driven by higher

enrollment in our studies for casdatifan, higher expense incurred

on Gilead-led studies for domvanalimab, as well as increases in

compensation cost related to our growing headcount. Non-cash

stock-based compensation expense was $9 million for each of the

fourth quarter 2024 and 2023. For the fourth quarter 2024 and 2023,

Arcus recognized gross reimbursements of $41 million and $42

million, respectively, for shared expenses from its collaborations,

primarily the Gilead collaboration. Gross reimbursements were $165

million for the full year 2024, compared to $162 million for 2023.

Our partnership reimbursements were flat compared to the prior year

despite the increases in gross costs, due to increases in

Gilead-led activities and programs fully funded by us. R&D

expense by quarter may fluctuate due to the timing of clinical

manufacturing and standard-of-care therapeutic purchases with a

corresponding impact on reimbursements.

- General and Administrative (G&A) Expenses were $28

million for the fourth quarter 2024, compared to $29 million for

the same period in 2023. Non-cash stock-based compensation expense

was $8 million for the fourth quarter 2024, compared to $9 million

for the same period in 2023.

- Net Loss was $94 million for the fourth quarter 2024,

compared to $81 million for the same period in 2023.

Arcus Ongoing and Announced Clinical Studies:

Trial Name

Arms

Setting

Status

NCT No.

Kidney Cancer

PEAK-1

cas + cabo vs. cabo

Post-IO ccRCC

Planned Phase 3

TBD

AstraZeneca Collaboration (part of eVOLVE

portfolio)

cas + volru

2L+ IO-Naive ccRCC

Planned Phase 1b

TBD

ARC-20

cas, cas + cabo

2L+ Cancer Patients/ccRCC

Ongoing Phase 1/1b

NCT05536141

Upper Gastrointestinal Cancers

STAR-221

dom + zim + chemo vs. nivo + chemo

1L Gastric, GEJ and EAC

Ongoing Registrational Phase 3

NCT05568095

EDGE-Gastric (ARC-21)

dom +/- zim +/- chemo

1L/2L Upper GI Malignancies

Ongoing

Randomized Phase 2

NCT05329766

Lung Cancer

STAR-121

dom + zim + chemo vs. pembro + chemo

1L NSCLC (PD-L1 all-comers)

Ongoing Registrational Phase 3

NCT05502237

PACIFIC-8

dom + durva vs. durva

Unresectable Stage 3 NSCLC

Ongoing Registrational Phase 3

NCT05211895

EDGE-Lung

dom +/- zim +/- quemli +/- chemo

1L/2L NSCLC (lung cancer platform

study)

Ongoing Randomized Phase 2

NCT05676931

VELOCITY-Lung

dom +/- zim +/- sacituzumab govitecan-hziy

or other combos

1L/2L NSCLC (lung cancer platform

study)

Ongoing Randomized Phase 2

NCT05633667

Pancreatic Cancer

PRISM-1

quemli + gem/nab-pac vs. gem/nab-pac

1L PDAC

Ongoing Randomized Phase 3

NCT06608927

ARC-8

quemli + zim + gem/nab-pac vs. quemli +

gem/nab-pac

1L PDAC

Ongoing Randomized Phase 1/1b

NCT04104672

Colorectal Cancer

ARC-9

etruma + zim + mFOLFOX vs. SOC

2L/3L/3L+ CRC

Ongoing

Randomized Phase 2

NCT04660812

Other

ARC-25

AB598

Gastric Cancer

Ongoing Phase 1

NCT05891171

ARC-27

AB801

NSCLC

Ongoing Phase 1

NCT06120075

cabo: cabozantinib; cas: casdatifan; ccRCC: clear cell renal

cell carcinoma; CRC: colorectal cancer; dom: domvanalimab; durva:

durvalumab; EAC: esophageal adenocarcinoma; etruma: etrumadenant;

GEJ: gastroesophageal junction; gem/nab-pac:

gemcitabine/nab-paclitaxel; GI: gastrointestinal; nivo: nivolumab;

NSCLC: non-small cell lung cancer; PDAC: pancreatic ductal

adenocarcinoma; pembro: pembrolizumab; quemli: quemliclustat; SOC:

standard of care; zim: zimberelimab

About Arcus Biosciences

Arcus Biosciences is a clinical-stage, global biopharmaceutical

company developing differentiated molecules and combination

medicines for people with cancer. In partnership with industry

collaborators, patients and physicians around the world, Arcus is

expediting the development of first- or best-in-class medicines

against well-characterized biological targets and pathways and

studying novel, biology-driven combinations that have the potential

to help people with cancer live longer. Founded in 2015, the

company has expedited the development of multiple investigational

medicines into clinical studies, including new combination

approaches that target TIGIT, PD-1, HIF-2a, CD73, A2a/A2b

receptors, CD39 and AXL. For more information about Arcus

Biosciences’s clinical and preclinical programs, please visit

www.arcusbio.com.

Domvanalimab, etrumadenant, quemliclustat and zimberelimab are

investigational molecules, and neither Gilead nor Arcus has

received approval from any regulatory authority for any use

globally, and their safety and efficacy have not been established.

Casdatifan, AB598 and AB801 are also investigational molecules, and

Arcus has not received approval from any regulatory authority for

any use globally, and their safety and efficacy have not been

established.

About the Gilead Collaboration

In May 2020, Arcus established a 10-year collaboration with

Gilead to strategically advance our portfolio. Under this

collaboration, Gilead obtained time-limited exclusive option rights

to all of our clinical programs arising during the collaboration

term. Arcus and Gilead are co-developing four investigational

products, including zimberelimab (Arcus’s anti-PD-1 molecule),

domvanalimab (Arcus’s anti-TIGIT antibody), etrumadenant (Arcus’s

adenosine receptor antagonist) and quemliclustat (Arcus’s CD73

inhibitor). The collaboration was expanded in November 2021 and May

2023 to include research directed to two targets for oncology and

two targets for inflammatory diseases.

Forward-Looking Statements

This press release contains forward-looking statements. All

statements regarding events or results to occur in the future

contained herein are forward-looking statements reflecting the

current beliefs and expectations of management made pursuant to the

safe harbor provisions of the Private Securities Litigation Reform

Act of 1995, including, but not limited to, the statements in Dr.

Rosen’s quote and statements regarding: Arcus’s expectation that

its cash and investments are sufficient to provide funding through

its initial pivotal readouts for domvanalimab, quemliclustat and

casdatifan; the timing of future study milestones, including the

expected timing for data readout for STAR-221 and plans to disclose

or present study analyses or data, including any analyses or data

from ARC-20 or EDGE-Gastric; whether data and results from studies

validate our pipeline or support further development of a program;

the potency, efficacy or safety of Arcus’s investigational

products, including their potential for a best-in-class profile;

and the initiation, design of and associated timing for future

studies and cohorts, including statements about PEAK-1 and the new

cohorts in ARC-20. All forward-looking statements involve known and

unknown risks and uncertainties and other important factors that

may cause Arcus’s actual results, performance or achievements to

differ significantly from those expressed or implied by the

forward-looking statements. Factors that could cause or contribute

to such differences include, but are not limited to: risks

associated with preliminary and interim data not being guarantees

that future data will be similar; the unexpected emergence of

adverse events or other undesirable side effects in Arcus’s

investigational products; difficulties or delays in initiating or

conducting clinical trials due to difficulties or delays in the

regulatory process, enrolling subjects or manufacturing or

supplying product for such clinical trials; unfavorable global

economic, political and trade conditions; Arcus’s dependence on the

collaboration with third parties such as Gilead and Taiho for the

successful development and commercialization of its optioned

molecules; difficulties associated with the management of the

collaboration activities or expanded clinical programs; changes in

the competitive landscape for Arcus’s programs; and the inherent

uncertainty associated with pharmaceutical product development and

clinical trials. Risks and uncertainties facing Arcus are described

more fully in the “Risk Factors” section of Arcus’s most recent

periodic report filed with the U.S. Securities and Exchange

Commission. You are cautioned not to place undue reliance on the

forward-looking statements, which speak only as of the date of this

press release. Arcus disclaims any obligation or undertaking to

update, supplement or revise any forward-looking statements

contained in this press release except to the extent required by

law.

The Arcus name and logo are trademarks of Arcus Biosciences,

Inc. All other trademarks belong to their respective owners.

ARCUS BIOSCIENCES,

INC.

Consolidated Statements of

Operations

(unaudited)

(In millions, except per share

amounts)

Three Months Ended

December 31,

Years Ended December

31,

2024

2023

2024

2023

Revenues:

License and development service

revenue

$28

$22

$222

$80

Other collaboration revenue

8

9

36

37

Total revenues

36

31

258

117

Operating expenses:

Research and development

111

93

448

340

General and administrative

28

29

120

117

Impairment of long-lived assets

—

—

20

—

Total operating expenses

139

122

588

457

Loss from operations

(103)

(91)

(330)

(340)

Non-operating income (expense):

Interest and other income, net

12

11

52

41

Interest expense

(2)

—

(4)

(2)

Total non-operating income, net

10

11

48

39

Loss before income taxes

(93)

(80)

(282)

(301)

Income tax expense

(1)

(1)

(1)

(6)

Net loss

$(94)

$(81)

$(283)

$(307)

Net loss per share:

Basic and diluted

$(1.03)

$(1.08)

$(3.14)

$(4.15)

Shares used to compute net loss per

share:

Basic and diluted

91.7

72.6

90.1

74.0

Selected Consolidated Balance

Sheet Data

(unaudited)

(In millions)

December 31,

2024

December 31,

2023

Cash, cash equivalents and marketable

securities

$992

$866

Total assets

1,150

1,095

Total liabilities

665

633

Total stockholders’ equity

485

462

Derived from the audited financial

statements included in the Company’s Annual Report on Form 10-K

filed with the Securities and Exchange Commission on February 25,

2025.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250225681705/en/

Investor Inquiries: Pia Eaves VP of Investor Relations

& Strategy (617) 459-2006 peaves@arcusbio.com

Media Inquiries: Holli Kolkey VP of Corporate Affairs

(650) 922-1269 hkolkey@arcusbio.com

Maryam Bassiri AD, Corporate Communications (510) 406-8520

mbassiri@arcusbio.com

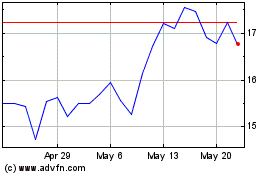

Arcus Biosciences (NYSE:RCUS)

Historical Stock Chart

From Feb 2025 to Mar 2025

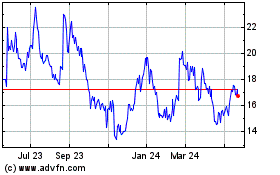

Arcus Biosciences (NYSE:RCUS)

Historical Stock Chart

From Mar 2024 to Mar 2025