PACT Capital Partners Launches as an Independent GP Stakes Investment Firm with Strategic Anchor Investments from Reinsurance Group of America and Sackville Capital

15 January 2025 - 4:45AM

Business Wire

Firm co-founded by Christian von Schimmelmann,

formerly Global Co-Head of the GP Stakes Business at Goldman Sachs

Asset Management, and Brian Vickery, formerly Partner at McKinsey

& Company

PACT Capital LLC (“PACT” or “PACT Capital

Partners”) launched today as an independent investment firm focused

on providing capital and strategic support to middle-market

alternative asset managers.

PACT will seek to partner with high-performing private capital

firms and help them to achieve their strategic objectives.

Headquartered in New York, PACT will utilize its proprietary imPACT

platform to assist established and emerging firms in accelerating

capital formation, designing and launching new products, improving

operations, attracting and retaining talent, leveraging

cutting-edge technology, and improving outcomes for underlying

portfolio companies.

Christian von Schimmelmann, Managing Partner and Co-Founder of

PACT Capital Partners, said: “We are excited to launch PACT with

the goal of becoming the preferred strategic partner for middle

market firms. We believe that, as the private equity industry

continues to evolve, there is a growing opportunity in the middle

market to provide strategic capital solutions. Our team combines

deep investment experience with a passion for helping

high-performing asset management firms achieve their goals, and, in

doing so, seeks to deliver on its differentiated investment

strategy.”

Mr. von Schimmelmann is a veteran GP stakes investor who

previously spent nearly 25 years at Goldman Sachs, where he served

as Global Co-Head and Investment Committee Co-Chair of the GP

Stakes and Seeding Business (“Petershill”). During his tenure at

Petershill, the group raised over $10 billion of capital across

several GP stakes funds, launched a seeding strategy, completed

over 30 investments in private market firms, and created

realizations through several creative and innovative transactions.

Earlier in his career at Goldman Sachs, Mr. von Schimmelmann

created a direct lending program specifically designed for

insurance companies and was a senior member of the Secondary

Private Equity Team (“Vintage”). Prior to Goldman Sachs, Mr. von

Schimmelmann worked at McKinsey & Company (“McKinsey”) in the

Financial Services Practice and at Salomon Brothers Inc. in the

Investment Banking Division.

In addition to Mr. von Schimmelmann, PACT’s leadership team

includes Brian Vickery, Partner and Co-Founder, who will lead the

imPACT platform. Prior to founding PACT, Mr. Vickery was a Partner

in McKinsey’s Private Capital Practice, where he served GPs, LPs,

and portfolio companies. He also led McKinsey’s research and

communications efforts in private markets, and, in that capacity,

he was the chair of the private markets editorial board, a frequent

author and speaker on industry trends, and the host of McKinsey’s

private markets podcast, Deal Volume. Prior to joining McKinsey,

Mr. Vickery began his career at Cambridge Associates before helping

to found the investment office at Boston University.

Joining Mr. von Schimmelmann and Mr. Vickery as Chief Financial

Officer and Chief Compliance Officer is Jonathan Snider, who most

recently served as CFO of GTIS Partners, a global private equity

real estate investment firm. Prior to GTIS, he spent more than a

decade at Goldman Sachs in the Alternative Investments and Manager

Selection group.

As part of the launch, each of Reinsurance Group of America,

Incorporated (“RGA”) and Sackville Capital Ltd. (“Sackville

Capital”) made a significant strategic anchor investment in

PACT.

Leslie Barbi, Executive Vice President and Chief Investment

Officer of RGA, said: “We believe that the current opportunity to

provide capital to asset management firms is highly attractive and

that PACT’s industry experience, extensive network, and innovative

imPACT platform will position it well to deliver comprehensive

services that extend beyond providing funding to middle market

firms. RGA has a history of identifying and supporting

differentiated asset management businesses, and we are excited to

support the launch of PACT with our anchor investment. We believe

PACT’s leadership team will be able to create a highly successful

platform offering strategic capital solutions, and RGA looks

forward to continuing to support PACT in the future.”

In addition, Nasir Alsharif, Executive Chairman of Sackville

Capital, commented: “GP stakes is an emerging asset class in which

we see positive structural tailwinds and significant long-term

potential. Backing experienced teams to create successful

middle-market firms is one of Sackville Capital’s strategic

priorities. We are delighted to be an anchor investor in PACT,

supporting one of the most experienced teams led by two industry

veterans. This team has significant experience in the GP stakes

industry, an innovative approach to building successful investment

platforms, and an extensive network with strong sourcing

capabilities. We also plan to bring Sackville’s strategic and

operational experience alongside access to our international

network to support the success of our partnership with PACT.”

About PACT Capital

PACT Capital is an independent investment firm focused on

providing capital and strategic support to middle-market

alternative asset management firms. PACT seeks to partner with

high-performing established and emerging private capital firms and

help them to achieve their strategic objectives. Headquartered in

New York, PACT utilizes its proprietary imPACT platform to assist

partner firms in accelerating capital formation, designing and

launching new products, improving operations, attracting and

retaining talent, leveraging cutting-edge technology, and improving

outcomes for underlying portfolio companies. For more information,

please visit https://www.pactcapitalpartners.com/.

About RGA

Reinsurance Group of America, Incorporated (NYSE: RGA) is a

global industry leader specializing in life and health reinsurance

and financial solutions that help clients effectively manage risk

and optimize capital. Founded in 1973, RGA is today one of the

world’s largest and most respected reinsurers and remains guided by

a powerful purpose: to make financial protection accessible to all.

As a global capabilities and solutions leader, RGA empowers

partners through bold innovation, relentless execution, and

dedicated client focus — all directed toward creating sustainable

long-term value. RGA has approximately $4.0 trillion of life

reinsurance in force and assets of $120.3 billion as of September

30, 2024. To learn more about RGA and its businesses, please visit

https://www.rgare.com/ or follow RGA on LinkedIn and Facebook.

Investors can learn more at https://investor.rgare.com/.

About Sackville Capital

Sackville Capital is a global investment firm based in London.

The firm manages capital across three distinct investment

strategies: private equity, platform partnerships, and an endowment

programme. Sackville combines investment and entrepreneurial

expertise with an international network to create value in its

strategic partnerships. https://www.sackvillecapital.com/.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114722984/en/

Media Contacts: PACT Capital Mike Geller Prosek

Partners mgeller@prosek.com RGA Lizzie Curry Executive

Director, Public Relations 636-736-8521 lizzie.curry@rgare.com

Sackville Capital Peter Hewer, Sofia Newitt Greenbrook

Advisory Sackvillecapital@greenbrookadvisory.com

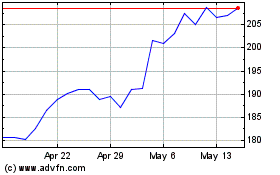

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Reinsurance Group of Ame... (NYSE:RGA)

Historical Stock Chart

From Feb 2024 to Feb 2025