RLI Corp. (NYSE: RLI) – RLI Corp. reported fourth quarter 2024

net earnings of $40.9 million ($0.44 per share), compared to $114.6

million ($1.24 per share) for the fourth quarter of 2023. Operating

earnings(1) for the fourth quarter of 2024 were $38.4 million

($0.41 per share), compared to $71.1 million ($0.77 per share) for

the same period in 2023.

On January 15, 2025, RLI executed a two-for-one stock split of

common stock. All share and per share data in this release reflect

the stock split.

Fourth Quarter

Year to Date

Earnings Per Diluted Share

2024

2023

2024

2023

Net earnings

$

0.44

$

1.24

$

3.74

$

3.31

Operating earnings (1)

$

0.41

$

0.77

$

2.87

$

2.47

(1) See discussion below: Non-GAAP and

Performance Measures.

Highlights for the quarter included:

- Underwriting income(1) of $22.2 million on a combined ratio(1)

of 94.4.

- 9% increase in gross premiums written and 19% increase in net

investment income.

- Favorable development in prior years’ loss reserves resulted in

a $8.7 million net increase in underwriting income.

- Losses from Hurricane Milton, resulting in a $42.4 million net

decrease in underwriting income.

- Special dividend of $2.00 per share, representing $183.5

million returned to shareholders.

Highlights for the year included:

- Underwriting income(1) of $210.7 million on a combined ratio(1)

of 86.2.

- 11% increase in gross premiums written and 18% increase in net

investment income.

- Net cash flow provided by operations of $560.2 million, an

increase of 21%.

- Favorable development in prior years’ loss reserves resulted in

a $84.1 million net increase in underwriting income.

- Book value per share of $16.59, an increase of 24% (inclusive

of dividends) from year-end 2023.

“Our customer service, consistent financial performance and

prudent capital management distinguished RLI in 2024,” said RLI

Corp. President & CEO Craig Kliethermes. “Despite an active

hurricane season and highly competitive environment, we achieved an

86 combined ratio, marking our 29th consecutive year of

underwriting profitability. Gross premiums written grew by 11%,

surpassing $2 billion for the first time, with all three product

segments contributing to this growth. Our positive underwriting and

investment results allowed us to return $236 million to

shareholders through special and regular dividends. I want to thank

our associate-owners for their contributions throughout the year,

which helped differentiate RLI.”

Underwriting Income

RLI achieved $22.2 million of underwriting income in the fourth

quarter of 2024 on a 94.4 combined ratio, compared to $59.8 million

on an 82.7 combined ratio in 2023.

For the year, RLI achieved $210.7 million of underwriting income

on an 86.2 combined ratio, compared to $173.2 million on an 86.6

combined ratio in 2023. Results for both years include favorable

development in prior years’ loss reserves, which resulted in an

$84.1 million and $95.3 million net increase to underwriting income

in 2024 and 2023, respectively. The favorable development was

offset by a $93.6 million net reduction to underwriting income for

losses from Hurricanes Beryl, Helene and Milton, as well as other

storm losses, in 2024. This compares to $81.2 million for losses

from Hawaiian wildfires and other storm losses in 2023.

The following table highlights underwriting income and combined

ratios by segment for the year.

Underwriting Income(1)

Combined Ratio(1)

(in millions)

2024

2023

2024

2023

Casualty

$

17.8

$

59.5

Casualty

97.9

92.2

Property

167.6

86.3

Property

68.5

78.5

Surety

25.3

27.4

Surety

82.2

79.6

Total

$

210.7

$

173.2

Total

86.2

86.6

(1) See discussion below: Non-GAAP and

Performance Measures.

Other Income(2)

Net investment income for the quarter increased 19% to $38.8

million, compared to the same period in 2023. For the year ended

December 31, 2024, net investment income was $142.3 million,

compared to $120.4 million for the same period in 2023. The

investment portfolio’s total return was -1.1% for the quarter and

6.4% for the year.

RLI’s comprehensive loss was $26.3 million for the quarter

(-$0.28 per share), compared to comprehensive earnings of $216.2

million ($2.35 per share) for the same quarter in 2023. In addition

to net earnings, comprehensive loss included after-tax unrealized

losses from the fixed income portfolio in the fourth quarter of

2024, due to increasing interest rates. Full-year comprehensive

earnings were $338.4 million ($3.66 per share), compared to $367.4

million ($3.99 per share) in 2023.

Special and Regular Dividends(2)

On December 20, 2024, the company paid a special cash dividend

of $2.00 per share and a regular quarterly dividend of $0.145 per

share for a combined total of $196.8 million. RLI has paid

dividends for 194 consecutive quarters and increased regular

dividends in each of the last 49 years. Over the last 10 years, the

company has returned nearly $1.5 billion to shareholders and the

regular dividend has grown an average of 4.9% per year.

Non-GAAP and Performance Measures

Management has included certain non-generally accepted

accounting principles (non-GAAP) financial measures in presenting

the company’s results. Management believes that these non-GAAP

measures further explain the company’s results of operations and

allow for a more complete understanding of the underlying trends in

the company’s business. These measures should not be viewed as a

substitute for those determined in accordance with generally

accepted accounting principles (GAAP). In addition, our definitions

of these items may not be comparable to the definitions used by

other companies.

Operating earnings and operating earnings per share (EPS)

consist of our GAAP net earnings adjusted by net realized

gains/(losses), net unrealized gains/(losses) on equity securities

and taxes related thereto. Net earnings and net earnings per share

are the GAAP financial measures that are most directly comparable

to operating earnings and operating EPS. A reconciliation of the

operating earnings and operating EPS to the comparable GAAP

financial measures is included in the 2024 financial highlights

below.

Underwriting income or profit represents the pretax

profitability of our insurance operations and is derived by

subtracting loss and settlement expenses, policy acquisition costs

and insurance operating expenses from net premium earned, which are

all GAAP financial measures. The combined ratio, which is derived

from components of underwriting income, is a performance measure

commonly used by property and casualty insurance companies and is

calculated as the sum of loss and settlement expenses, policy

acquisition costs and insurance operating expenses, divided by net

premiums earned, which are all GAAP measures.

Other News

At 10 a.m. central standard time (CST) on January 23, 2025, RLI

management will hold a conference call to discuss quarterly results

with insurance industry analysts. Interested parties may listen to

the discussion at https://events.q4inc.com/attendee/436980475.

(2) All share and per share data reflect the 2-for-1 stock split

that occurred on January 15, 2025.

Except for historical information, this news release may include

forward-looking statements (within the meaning of Section 27A of

the Securities Act of 1933 and Section 21E of the Securities

Exchange Act of 1934) including, without limitation, statements

reflecting our current expectations about the future performance of

our company or our business segments or about future market

conditions. These statements are subject to certain risk factors

that could cause actual results to differ materially. Various risk

factors that could affect future results are listed in the

company's filings with the Securities and Exchange Commission,

including the Form 10-K Annual Report for the year ended December

31, 2023.

About RLI

RLI Corp. (NYSE: RLI) is a specialty insurer serving niche

property, casualty and surety markets. The company provides deep

underwriting expertise and superior service to commercial and

personal lines customers nationwide. RLI’s products are offered

through its insurance subsidiaries – RLI Insurance Company, Mt.

Hawley Insurance Company and Contractors Bonding and Insurance

Company. All of RLI’s insurance subsidiaries are rated A+

(Superior) by AM Best Company. RLI has paid and increased regular

dividends for 49 consecutive years and delivered underwriting

profits for 29 consecutive years. To learn more about RLI, visit

www.rlicorp.com.

Supplemental disclosure regarding the earnings impact of

specific items:

Reserve Development(1) and

Catastrophe Losses,

Net of Reinsurance

Three Months Ended

Twelve Months Ended

December 31,

December 31,

(Dollars in millions, except per share

amounts)

2024

2023

2024

2023

Favorable development in casualty prior

years' reserves

$

11.5

$

9.0

$

51.4

$

76.0

Favorable development in property prior

years' reserves

$

0.1

$

2.0

$

28.6

$

16.2

Favorable (unfavorable) development in

surety prior years' reserves

$

(1.7

)

$

0.6

$

9.3

$

8.9

Net incurred losses related to:

2024 storms

$

—

$

—

$

(30.0

)

$

—

Hurricanes Beryl, Helene and Milton

$

(39.0

)

$

—

$

(76.0

)

$

—

2023 and prior events

$

—

$

1.3

$

6.0

$

(72.8

)

Reinstatement premium from events

$

—

$

2.6

$

—

$

(11.7

)

Operating Earnings Per Share

Three Months Ended

Twelve Months Ended

December 31,

December 31,

2024

2023

2024

2023

Operating Earnings Per Share(2)(3)

$

0.41

$

0.77

$

2.87

$

2.47

Specific items included in operating

earnings per share:(1) (4)

Net favorable development in casualty

prior years' reserves

$

0.09

$

0.06

$

0.37

$

0.57

Net favorable development in property

prior years' reserves

$

—

$

0.02

$

0.22

$

0.12

Net favorable (unfavorable) development in

surety prior years' reserves

$

(0.02

)

$

—

$

0.07

$

0.06

Net incurred losses related to:

2024 storms

$

—

$

—

$

(0.22

)

$

—

Hurricanes Beryl, Helene and Milton

$

(0.29

)

$

—

$

(0.56

)

$

—

2023 and prior events (incurred loss and

reinstatement premium)

$

—

$

0.03

$

0.04

$

(0.63

)

(1)

Reserve development reflects changes from

previously estimated losses.

(2)

See discussion above: Non-GAAP and

Performance Measures.

(3)

All share and per share data reflect the

2-for-1 stock split that occurred on January 15, 2025.

(4)

Items included in operating earnings per

share are after tax and incorporates incentive and profit

sharing-related impacts which affected policy acquisition,

insurance operating and general corporate expenses.

RLI CORP

2024 FINANCIAL

HIGHLIGHTS

(Unaudited)

(Dollars in thousands, except per

share amounts)

Three Months Ended December

31,

Twelve Months Ended December

31,

SUMMARIZED INCOME

STATEMENT DATA:

2024

2023

% Change

2024

2023

% Change

Net premiums earned

$

397,176

$

345,894

14.8

%

$

1,526,406

$

1,294,306

17.9

%

Net investment income

38,776

32,548

19.1

%

142,278

120,383

18.2

%

Net realized gains

8,744

5,760

51.8

%

19,966

32,518

(38.6

)

%

Net unrealized gains (losses) on equity

securities

(5,580

)

49,313

NM

81,734

64,787

26.2

%

Consolidated revenue

$

439,116

$

433,515

1.3

%

$

1,770,384

$

1,511,994

17.1

%

Loss and settlement expenses

225,512

146,424

54.0

%

739,253

604,413

22.3

%

Policy acquisition costs

121,854

111,242

9.5

%

464,040

418,325

10.9

%

Insurance operating expenses

27,568

28,381

(2.9

)

%

112,460

98,383

14.3

%

Interest expense on debt

1,492

1,373

8.7

%

6,331

7,301

(13.3

)

%

General corporate expenses

2,736

5,112

(46.5

)

%

15,880

15,917

(0.2

)

%

Total expenses

$

379,162

$

292,532

29.6

%

$

1,337,964

$

1,144,339

16.9

%

Equity in earnings of unconsolidated

investees

(12,522

)

2,441

NM

(4,869

)

9,610

NM

Earnings before income taxes

$

47,432

$

143,424

(66.9

)

%

$

427,551

$

377,265

13.3

%

Income tax expense

6,572

28,812

(77.2

)

%

81,772

72,654

12.5

%

Net earnings

$

40,860

$

114,612

(64.3

)

%

$

345,779

$

304,611

13.5

%

Other comprehensive earnings (loss), net

of tax

(67,199

)

101,621

NM

(7,420

)

62,773

NM

Comprehensive earnings (loss)

$

(26,339

)

$

216,233

NM

$

338,359

$

367,384

(7.9

)

%

Operating earnings(1):

Net earnings

$

40,860

$

114,612

(64.3

)

%

$

345,779

$

304,611

13.5

%

Less:

Net realized gains

(8,744

)

(5,760

)

51.8

%

(19,966

)

(32,518

)

(38.6

)

%

Income tax on realized gains

1,836

1,210

51.7

%

4,193

6,829

(38.6

)

%

Net unrealized (gains) losses on equity

securities

5,580

(49,313

)

NM

(81,734

)

(64,787

)

26.2

%

Income tax on unrealized gains (losses) on

equity securities

(1,171

)

10,355

NM

17,164

13,605

26.2

%

Operating earnings

$

38,361

$

71,104

(46.0

)

%

$

265,436

$

227,740

16.6

%

Return on Equity:

Net earnings

22.2

%

23.3

%

Comprehensive earnings

21.7

%

28.1

%

Per Share Data(2):

Diluted:

Weighted average shares outstanding (in

000's)

92,725

92,144

92,451

92,155

Net earnings per share

$

0.44

$

1.24

(64.5

)

%

$

3.74

$

3.31

13.0

%

Less:

Net realized gains

(0.09

)

(0.06

)

50.0

%

(0.22

)

(0.35

)

(37.1

)

%

Income tax on realized gains

0.02

0.01

100.0

%

0.05

0.07

(28.6

)

%

Net unrealized (gains) losses on equity

securities

0.06

(0.54

)

NM

(0.88

)

(0.70

)

25.7

%

Income tax on unrealized gains (losses) on

equity securities

(0.02

)

0.12

NM

0.18

0.14

28.6

%

Operating earnings per share(1)

$

0.41

$

0.77

(46.8

)

%

$

2.87

$

2.47

16.2

%

Comprehensive earnings (loss) per

share

$

(0.28

)

$

2.35

NM

$

3.66

$

3.99

(8.3

)

%

Cash dividends per share - ordinary

$

0.145

$

0.135

7.4

%

$

0.570

$

0.535

6.5

%

Cash dividends per share - special

$

2.00

$

1.00

100.0

%

$

2.00

$

1.00

100.0

%

Net cash flow provided by

operations

$

128,080

$

122,065

4.9

%

$

560,219

$

464,257

20.7

%

(1)

See discussion above: Non-GAAP and

Performance Measures.

(2)

All share and per share data reflect the

2-for-1 stock split that occurred on January 15, 2025.

NM = Not Meaningful

RLI CORP

2024 FINANCIAL

HIGHLIGHTS

(Unaudited)

(Dollars in thousands, except per

share amounts)

December 31,

December 31,

2024

2023

% Change

SUMMARIZED

BALANCE SHEET DATA:

Fixed income, at fair value

$

3,175,796

$

2,855,849

11.2

%

(amortized cost - $3,391,159 at

12/31/24)

(amortized cost - $3,054,391 at

12/31/23)

Equity securities, at fair value

736,191

590,041

24.8

%

(cost - $417,897 at 12/31/24)

(cost - $354,022 at 12/31/23)

Short-term investments

74,915

134,923

(44.5

)

%

Other invested assets

57,939

59,081

(1.9

)

%

Cash and cash equivalents

39,790

36,424

9.2

%

Total investments and cash

$

4,084,631

$

3,676,318

11.1

%

Accrued investment income

28,319

24,062

17.7

%

Premiums and reinsurance balances

receivable

230,534

221,206

4.2

%

Ceded unearned premiums

124,955

112,257

11.3

%

Reinsurance balances recoverable on unpaid

losses

755,425

757,349

(0.3

)

%

Deferred policy acquisition costs

166,214

146,566

13.4

%

Property and equipment

43,172

46,715

(7.6

)

%

Investment in unconsolidated investees

56,477

56,966

(0.9

)

%

Goodwill and intangibles

53,562

53,562

0.0

%

Income taxes - deferred

7,793

15,872

(50.9

)

%

Other assets

77,720

69,348

12.1

%

Total assets

$

5,628,802

$

5,180,221

8.7

%

Unpaid losses and settlement expenses

$

2,693,470

$

2,446,025

10.1

%

Unearned premiums

984,140

892,326

10.3

%

Reinsurance balances payable

44,681

71,507

(37.5

)

%

Funds held

97,380

101,446

(4.0

)

%

Income taxes - current

749

3,757

(80.1

)

%

Short-term debt

100,000

100,000

—

%

Accrued expenses

124,242

108,880

14.1

%

Other liabilities

62,173

42,766

45.4

%

Total liabilities

$

4,106,835

$

3,766,707

9.0

%

Shareholders' equity

1,521,967

1,413,514

7.7

%

Total liabilities & shareholders'

equity

$

5,628,802

$

5,180,221

8.7

%

OTHER

DATA(1):

Common shares outstanding (in 000's)

91,738

91,280

Book value per share

$

16.59

$

15.49

7.1

%

Closing stock price per share

$

82.42

$

66.56

23.8

%

Statutory surplus

$

1,787,312

$

1,520,135

17.6

%

(1)

All share and per share data reflect the

2-for-1 stock split that occurred on January 15, 2025.

NM = Not Meaningful

RLI CORP

2024 FINANCIAL

HIGHLIGHTS

UNDERWRITING SEGMENT

DATA

(Unaudited)

(Dollars in thousands, except per

share amounts)

Three Months

Ended December 31,

GAAP

GAAP

GAAP

GAAP

Casualty

Ratios

Property

Ratios

Surety

Ratios

Total

Ratios

2024

Gross premiums written

$

282,204

$

153,295

$

37,711

$

473,210

Net premiums written

228,455

103,945

34,045

366,445

Net premiums earned

225,823

134,610

36,743

397,176

Net loss & settlement expenses

155,217

68.7

%

63,856

47.4

%

6,439

17.5

%

225,512

56.8

%

Net operating expenses

79,356

35.2

%

44,516

33.1

%

25,550

69.6

%

149,422

37.6

%

Underwriting income (loss)(1)

$

(8,750

)

103.9

%

$

26,238

80.5

%

$

4,754

87.1

%

$

22,242

94.4

%

2023

Gross premiums written

$

238,467

$

158,047

$

37,846

$

434,360

Net premiums written

191,626

104,154

35,117

330,897

Net premiums earned

195,962

115,934

33,998

345,894

Net loss & settlement expenses

121,399

62.0

%

22,554

19.5

%

2,471

7.3

%

146,424

42.3

%

Net operating expenses

72,562

37.0

%

40,653

35.0

%

26,408

77.6

%

139,623

40.4

%

Underwriting income (loss)(1)

$

2,001

99.0

%

$

52,727

54.5

%

$

5,119

84.9

%

$

59,847

82.7

%

Twelve Months

Ended December 31,

GAAP

GAAP

GAAP

GAAP

Casualty

Ratios

Property

Ratios

Surety

Ratios

Total

Ratios

2024

Gross premiums written

$

1,108,356

$

743,486

$

161,206

$

2,013,048

Net premiums written

915,625

542,997

146,899

1,605,521

Net premiums earned

852,837

531,384

142,185

1,526,406

Net loss & settlement expenses

524,490

61.5

%

198,806

37.4

%

15,957

11.2

%

739,253

48.4

%

Net operating expenses

310,559

36.4

%

165,042

31.1

%

100,899

71.0

%

576,500

37.8

%

Underwriting income (loss)(1)

$

17,788

97.9

%

$

167,536

68.5

%

$

25,329

82.2

%

$

210,653

86.2

%

2023

Gross premiums written

$

961,665

$

697,372

$

147,623

$

1,806,660

Net premiums written

788,982

500,057

138,708

1,427,747

Net premiums earned

758,346

401,530

134,430

1,294,306

Net loss & settlement expenses

418,032

55.1

%

172,062

42.9

%

14,319

10.7

%

604,413

46.7

%

Net operating expenses

280,835

37.1

%

143,152

35.6

%

92,721

68.9

%

516,708

39.9

%

Underwriting income (loss)(1)

$

59,479

92.2

%

$

86,316

78.5

%

$

27,390

79.6

%

$

173,185

86.6

%

(1)

See discussion above: Non-GAAP and

Performance Measures.

Category: Earnings Release

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250122553322/en/

Media Contact Aaron Diefenthaler Chief Investment Officer

& Treasurer 309-693-5846 Aaron.Diefenthaler@rlicorp.com

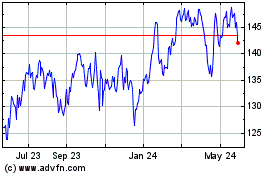

RLI (NYSE:RLI)

Historical Stock Chart

From Jan 2025 to Feb 2025

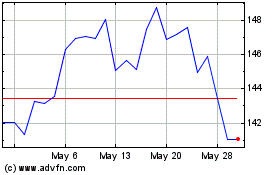

RLI (NYSE:RLI)

Historical Stock Chart

From Feb 2024 to Feb 2025