PROSPECTUS SUPPLEMENT

TO

THE SHORT FORM BASE SHELF PROSPECTUS DATED JANUARY 17, 2025

| New Issue | January

24, 2025 |

Filed

pursuant to General Instruction II.L of Form F-10

File No. 333-283616

PROSPECTUS

SUPPLEMENT

(To Prospectus dated January 17, 2025)

SEABRIDGE GOLD INC.

Up to US$100,000,000

Common Shares

This prospectus supplement (the “Prospectus

Supplement”) of Seabridge Gold Inc. (“Seabridge” or the “Company”), together with the

accompanying short form base shelf prospectus dated January 17, 2025 (the “Prospectus”), qualifies the distribution

(the “Offering”) of common shares (each, an “Offered Share”) of the Company, having an aggregate

offering price of up to US$100,000,000 (or C$143,710,000, based on the exchange rate on January 23, 2025 reported by the Bank of Canada).

The Company has entered into a Controlled Equity OfferingSM Sales Agreement dated January 24, 2025 (the “Sales Agreement”)

with Cantor Fitzgerald & Co. (the “Lead Agent”), RBC Capital Markets, LLC, Cantor Fitzgerald Canada Corporation

and RBC Dominion Securities Inc. (together with the Lead Agent, the “Agents”) in respect of the Offering, pursuant

to which the Company may distribute Offered Shares from time to time through the Agents, as agent for the distribution of the Offered

Shares, in accordance with the terms of the Sales Agreement. The Offering is being made in the United States under the terms of a registration

statement on Form F-10 (SEC File No. 333-283616) (the “Registration Statement”) filed and effective with the United

States Securities and Exchange Commission (the “SEC”). See “Plan of Distribution”.

The outstanding common shares of the Company (“Common

Shares”) are listed for trading on the Toronto Stock Exchange (the “TSX”) under the symbol “SEA”

and on the New York Stock Exchange (the “NYSE”) under the symbol “SA”. On January 23, 2025, the last day

before the filing of this Prospectus Supplement, the closing trading price of the Common Shares on the TSX was C$17.56 per Common Share

and the closing trading price of the Common Shares on the NYSE was US$12.24 per Common Share. The Company has applied to the TSX for the

listing of the Offered Shares offered hereunder and such listing is subject to the approval of the TSX in accordance with its applicable

listing requirements. NYSE approval is not required for the listing of the Offered Shares offered hereunder.

Sales of Offered Shares, if any, under this Prospectus

Supplement and the accompanying Prospectus are anticipated to be made in transactions that are deemed to be “at-the-market distributions”

as defined in National Instrument 44-102 - Shelf Distributions (“NI 44-102”), including sales made directly

on the NYSE or on any other recognized marketplace outside of Canada upon which the Common Shares are listed, quoted or traded in the

United States. No Offered Shares will be offered or sold in Canada on the TSX or other trading markets in Canada. The Offered Shares will

be distributed at market prices prevailing at the time of the sale. As a result, prices may vary as between purchasers and during the

period of any distribution. There is no minimum amount of funds that must be raised under the Offering. This means that the Company

may terminate the Offering after raising only a small portion of the offering amount set out above, or none at all. See “Plan

of Distribution”.

The Company will pay the Agents compensation,

or allow a discount, for their services in acting as agents in connection with the sale of Offered Shares pursuant to the terms of the

Sales Agreement an amount equal to 2.0% of the gross sales price per Offered Share sold.

No underwriter of the at-the-market distribution,

and no person or company acting jointly or in concert with an underwriter, may, in connection with the distribution, enter into any transaction

that is intended to stabilize or maintain the market price of the securities or securities of the same class as the securities distributed

under this Prospectus Supplement, including selling an aggregate number or principal amount of securities that would result in the underwriter

creating an over-allocation position in the securities. As sales agents, the Agents will not engage in any transactions to stabilize the

price of the Common Shares. See “Plan of Distribution”.

Since the Offering is only being made in the

United States, only Cantor Fitzgerald & Co. and RBC Capital Markets, LLC will sell the Offered Shares in the United States and will

not, directly or indirectly, solicit offers to purchase or sell the Offered Shares in Canada. Cantor Fitzgerald Canada Corporation

and RBC Dominion Securities Inc. are only registered in Canada and their only role in the Offering is to sign this Prospectus Supplement.

Accordingly, they will not, directly or indirectly, solicit offers to purchase or sell the Offered Shares in Canada.

The purchase and ownership of Offered Shares

is subject to certain risks that should be considered carefully by prospective purchasers. Please see “Risk Factors” in this

Prospectus Supplement and the accompanying Prospectus and the risk factors in the AIF (as herein defined) and the other documents incorporated

herein and therein by reference, for a description of risks involved in an investment in Offered Shares. This Prospectus Supplement should

be read in conjunction with and may not be delivered or utilized without the accompanying short form base shelf Prospectus.

The Offering is being made by a Canadian issuer

that is permitted, under a multijurisdictional disclosure system adopted by the United States and Canada (“MJDS”) to prepare

this Prospectus Supplement in accordance with Canadian disclosure requirements. Prospective investors in the United States should be aware

that such requirements are different from those of the United States. Financial statements included or incorporated by reference herein

have been prepared in accordance with International Financial Reporting Standards, as issued by the International Accounting Standards

Board, (“IFRS”) and may not be comparable to financial statements of United States companies, which are prepared under United

States generally accepted accounting principles, or “US GAAP”. Such financial statements are subject to the standards of the

Public Company Accounting Oversight Board (United States) and the United States Securities and Exchange Commission (“SEC”)

independence standards.

Prospective investors should be aware that

the acquisition, holding and disposition of the Offered Shares described herein may have tax consequences both in the United States and

in Canada. Such consequences for investors who are resident in, or citizens of, the United States are not described fully herein. Prospective

investors should read the tax discussion contained in this Prospectus Supplement under the headings “Certain United States Federal

Income Tax Considerations” and “Certain Canadian Federal Income Tax Considerations” and should consult their own tax

advisor with respect to their own particular circumstances.

Some of the directors and officers of the

Company and some of the experts named under “Interests of Experts” in the Prospectus are resident outside of Canada. Purchasers

are advised that it may not be possible for investors to enforce judgments obtained in Canada against any person or company that is incorporated,

continued or otherwise organized under the laws of a foreign jurisdiction or resides outside of Canada, even if the party has appointed

an agent for service of process. See “Enforceability of Certain Civil Liabilities”.

The enforcement by investors of civil liabilities

under the United States federal securities laws may be affected adversely by the fact that the Company is incorporated or organized under

the laws of Canada, that some or all of its officers and directors may be residents outside the United States, that some or all of the

underwriters or experts named in the registration statement may be residents of a foreign country, and that all or a substantial portion

of the assets of the Registrant and said persons may be located outside the United States. See “Enforceability of Certain Civil

Liabilities.”

THESE SECURITIES HAVE NOT BEEN APPROVED OR

DISAPPROVED BY THE SECURITIES AND EXCHANGE COMMISSION NOR HAS THE SEC OR THE COMMISSIONS PASSED UPON THE ACCURACY OR ADEQUACY OF THIS

PROSPECTUS SUPPLEMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The Company’s head office is at 106 Front

Street East, Suite 400, Toronto, Ontario, Canada, M5A 1E1 and its registered office is at 1111 West Hastings Street, 15th Floor,

Vancouver, BC V6E 2J3.

Table of Contents

IMPORTANT NOTICE ABOUT INFORMATION IN THIS

PROSPECTUS SUPPLEMENT AND THE ACCOMPANYING PROSPECTUS

This Prospectus Supplement and the accompanying

Prospectus dated January 17, 2025 are part of a registration statement that we filed with the Securities and Exchange Commission, or SEC,

utilizing a “shelf” registration process.

This Prospectus Supplement and the accompanying Prospectus

relate to the offer by us of our Offered Shares to certain investors. We provide information to you about this offering of Offered Shares

in two separate documents: (1) this Prospectus Supplement, which describes the specific details regarding the Offering; and (2) the accompanying

Prospectus, which provides general information, some of which may not apply to this Offering. If information in this Prospectus Supplement

is inconsistent with the accompanying Prospectus, you should rely on this Prospectus Supplement. However, if any statement in one of these

documents is inconsistent with a statement in another document having a later date—for example, a document incorporated by reference

in this Prospectus Supplement or the accompanying Prospectus—the statement in the document having the later date modifies or supersedes

the earlier statement as our business, financial condition, results of operations and prospects may have changed since the earlier dates.

You should read this Prospectus Supplement, the accompanying Prospectus and the documents and information incorporated by reference in

this Prospectus Supplement and the accompanying Prospectus when making your investment decision. You should also read and consider the

information in the documents we have referred you to under the headings “Additional Information” and “Documents Incorporated

by Reference.” These documents contain information you should consider when making your investment decision.

You should rely only on information contained

in or incorporated by reference into this Prospectus Supplement and the accompanying Prospectus. We have not, and the Agents have not,

authorized anyone to provide you with information that is different. We are offering to sell and seeking offers to buy our Offered Shares

only in jurisdictions where offers and sales are permitted. The information contained in this Prospectus Supplement, the accompanying

Prospectus and the documents and information that have been filed with the SEC and the securities regulatory authorities in the jurisdictions

in Canada in which the Company is a reporting issuer incorporated by reference in this Prospectus Supplement and the accompanying Prospectus

are accurate only as of their respective dates, regardless of the time of delivery of this Prospectus Supplement or of any sale of Offered

Shares.

This Prospectus Supplement does not constitute,

and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities offered by this Prospectus

Supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer or solicitation.

This Prospectus Supplement is deemed to be incorporated

by reference into the Prospectus solely for the purposes of the Offering. Other documents are also incorporated or deemed to be incorporated

by reference into this Prospectus Supplement and into the Prospectus. See “Documents Incorporated by Reference”.

Unless the context otherwise requires, references

in this Prospectus Supplement and the accompanying Prospectus to “Seabridge”, the “Company”, “we”,

“us” and “our” includes Seabridge Gold Inc. and each of its material subsidiaries, as the context requires.

CURRENCY PRESENTATION AND EXCHANGE RATE INFORMATION

Unless stated otherwise or as the context otherwise

requires, all references to dollar amounts in this Prospectus Supplement and the accompanying Prospectus are references to Canadian dollars.

Unless stated otherwise, references to “$” or “C$” are to Canadian dollars and references to “US dollars”

or “US$” are to United States dollars. On January 23, 2025, the exchange rate as reported by the Bank of Canada for the conversion

of one Canadian dollar into United States dollars was C$1.00 equals US$0.6958.

The high, low, average and closing rates for the

United States dollar in terms of Canadian dollars for each of the financial periods of the Company ended September 30, 2024, December

31, 2023 and December 31, 2022, as quoted by the Bank of Canada, were as follows:

| | |

Period from January 1, 2024 to

September 30, | | |

Year Ended

December 31 | |

| | |

2024 | | |

2023 | | |

2022 | |

| | |

(expressed in Canadian dollars) | |

| Highest rate during period | |

| 1.3858 | | |

| 1.3875 | | |

| 1.3856 | |

| Lowest rate during period | |

| 1.3316 | | |

| 1.3128 | | |

| 1.2451 | |

| Average rate during period | |

| 1.3604 | | |

| 1.3497 | | |

| 1.3011 | |

| Rate at the end of period | |

| 1.3499 | | |

| 1.3226 | | |

| 1.3544 | |

The average exchange rate is calculated using

the average of the daily rate on the last business day of each month during the applicable fiscal year or interim period. The Canadian

dollar/U.S. dollar exchange rate has varied significantly over the last several years and investors are cautioned not to assume that

the exchange rates presented here are necessarily indicative of future exchange rates.

FINANCIAL INFORMATION

Unless otherwise indicated, all financial information

included and incorporated by reference in this Prospectus Supplement and the accompanying Prospectus is determined using IFRS, which differs

from United States generally accepted accounting principles and therefore may not be comparable in all material respects to financial

information prepared in accordance with United States generally accepted accounting principles.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This Prospectus Supplement and the accompanying

Prospectus, and the documents incorporated by reference herein and therein, contain forward-looking statements within the meaning of the

United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of Canadian securities

laws concerning future events or future performance with respect to the Company’s projects, business approach and plans, including

the completion of the Offering; the use of proceeds and the expected timing of the Offering; the receipt of all necessary regulatory and

stock exchange approvals pertaining to the Offering; production, capital, operating and cash flow estimates relating to the existing assets

of the Company; business transactions such as the potential sale or joint venture of either or both of the Company’s KSM Project

and Courageous Lake Project (each as defined in the AIF (as defined herein)) and the acquisition or disposition of interests in mineral

properties; requirements for additional capital; the estimation of mineral resources and reserves; and the timing of completion and success

of exploration and advancement activities, community relations, required regulatory and third party consents, permitting and related programs

in relation to the KSM Project, Iskut Project, Snowstorm Project, 3 Aces Project or Courageous Lake Project. Any statements that express

or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives or future events or performance

(often, but not always, using words or phrases such as “expects”, “anticipates”, “believes”, “plans”,

“projects”, “estimates”, “intends”, “strategy”, “goals”, “objectives”

or variations thereof or stating that certain actions, events or results “may”, “could”, “would”,

“might” or “will” be taken, occur or be achieved, or the negative of any of these terms and similar expressions)

are not statements of historical fact and may be forward-looking statements and forward-looking information (collectively referred to

in the following information simply as “forward-looking statements”). In addition, statements concerning mineral reserve

and mineral resource estimates constitute forward-looking statements to the extent that they involve estimates of the mineralization expected

to be encountered if a mineral property is developed and the economics of developing a property and producing minerals.

Forward-looking statements are necessarily based

on estimates and assumptions made by the Company in light of its experience and perception of historical trends, current conditions and

expected future developments. In making the forward-looking statements in this Prospectus Supplement and the accompanying Prospectus,

the Company has applied several material assumptions including, but not limited to, the assumption that: (1) market fundamentals will

result in sustained demand and prices for gold and copper, and to a much lesser degree, silver and molybdenum; (2) the potential for production

at its mineral projects will continue operationally, legally and economically; (3) any additional financing needed will be available on

reasonable terms; (4) estimated mineral resources and reserves at the Company’s projects have merit and there is continuity of mineralization

as reflected in such estimates; (5) the Company will receive and maintain all required regulatory approvals required in respect of its

projects and the Offering; and (6) the Company will receive all required regulatory approvals required in respect of this Prospectus Supplement.

Forward-looking statements are subject to a variety

of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or

implied by the forward-looking statements, including, without limitation:

| ● | the Company’s history of net losses and

negative cash flows from operations and expectation of future losses and negative cash flows from operations; |

| | | |

| ● | risks related to the Company’s ability

to continue its exploration activities and future advancement activities, and to continue to maintain corporate office support of these

activities, which are dependent on the Company’s ability to enter into joint ventures, to sell property interests or to obtain suitable

financing; |

| | | |

| ● | the Company’s indebtedness requires payment

of quarterly interest and, in certain circumstances, may require repayment of principal and the Company’s principal sources for

funds for such payments or repayment are capital markets and asset sales, although payment in shares of the Company is possible to a certain

point; |

| | | |

| ● | risks related to fluctuations in the market price

of gold, copper and other metals; |

| | | |

| ● | uncertainty of whether the reserves estimated

on the Company’s mineral properties will be brought into production; |

| ● | risks related to unsettled First Nations rights

and title and settled Treaty Nations’ rights and uncertainties relating to the implementation of the concepts in the United Nations

Declaration on the Rights of Indigenous Peoples in Canadian jurisdictions; |

| | | |

| ● | risks related to obtaining and maintaining all

necessary permits and governmental approvals, or extensions or renewals thereof, for exploration and development activities, including

in respect of environmental regulation and the KSM environmental assessment certificate; |

| | | |

| ● | the possible inability to advance with project

activities in a timely manner or at all if such permits or approvals are not obtained or if a non-compliance event leads to further restrictions

or loss of permits or approvals; |

| | | |

| ● | uncertainties relating to the assumptions underlying

the Company’s reserve and resource estimates; |

| | | |

| ● | uncertainty of estimates of capital costs, operating

costs, production and economic returns; |

| | | |

| ● | risks relating to the commencement of site access

and early site preparation construction activities at the KSM Project; |

| | | |

| ● | risks related to commercially producing precious

metals and copper from the Company’s mineral properties; |

| | | |

| ● | risks related to fluctuations in foreign exchange

rates; |

| | | |

| ● | mining, exploration and development risks that

could result in damage to mineral properties, plant and equipment, personal injury, environmental damage and delays in mining, which may

be uninsurable or not insurable in adequate amounts; |

| | | |

| ● | uncertainty related to title to the Company’s

mineral properties and rights of access over or through lands subject to third party rights, interests and mineral tenures; |

| | | |

| ● | risks related to increases in demand for exploration,

development and construction services equipment, and related cost increases following metals price increases; |

| | | |

| ● | increased competition in the mining industry; |

| | | |

| ● | regulatory initiatives and ongoing concerns regarding

carbon emissions and the impacts of measures taken to induce or mandate lower carbon emissions on the ability to secure permits, finance

projects and generate profitability at a project; |

| | | |

| ● | the Company’s current and proposed operations

are subject to risks relating to climate and climate change that may adversely impact its ability to conduct operations, increase operating

costs, delay execution or reduce profitability of a future mining operation |

| ● | the Company’s reliance on key personnel

and the need to attract and retain qualified management and personnel; |

| | | |

| ● | risks associated with the use of information

technology systems and cybersecurity; |

| | | |

| ● | risks related to some of the Company’s

directors’ and officers’ involvement with other natural resource companies; |

| | | |

| ● | the Company’s classification as a “passive

foreign investment company” under the United States tax code; |

| | | |

| ● | uncertainty surrounding an audit by the Canada

Revenue Agency of the Company’s refund claim in respect of the British Columbia Mining Exploration Tax Credit; |

| | | |

| ● | uncertainty surrounding an audit by the Canada

Revenue Agency of the Company’s 2014 to 2016 inclusive Canadian exploration expenses, which were renounced to investors in flow-through

shares in respect of the 2013 to 2015 tax years; |

| | | |

| ● | risks related to the dilution of shareholders’

interest; |

| | | |

| ● | risks related to the perception of the significant

number of Common Shares in the public market; |

| | | |

| ● | the

ability of the Company to raise proceeds under the Offering; |

| | | |

| ● | risks related to the Company’s broad discretion

in the use of the net proceeds of the Offering; and |

| ● | risks related to the potential for a tariff war between the

United States and Canada and the potential impacts it may have on the Company’s ability to raise funds and obtain supplies needed

for work programs. |

This list is not exhaustive of the factors that

may affect any of the Company’s forward-looking statements. Forward-looking statements are statements about the future and are inherently

uncertain, and actual achievements of the Company or other future events or conditions may differ materially from those reflected in the

forward-looking statements due to a variety of risks, uncertainties and other factors, including, without limitation, those referred to

in this Prospectus Supplement and the annual information form of the Company dated March 27, 2024 for the year ended December

31, 2023 and filed on SEDAR+ on March 27, 2024 under National Instrument 51-102 – Continuous Disclosure Obligations

(the “AIF”), each under the heading “Risk Factors”, elsewhere in this Prospectus Supplement and the accompanying

Prospectus and in documents incorporated by reference herein and therein. In addition, although the Company has attempted to identify

important factors that could cause actual achievements, events or conditions to differ materially from those identified in the forward-looking

statements, there may be other factors that cause achievements, events or conditions not to be as anticipated, estimated or intended.

Many of the foregoing factors are beyond the Company’s ability to control or predict. It is also noted that while the Company engages

in exploration and advancement of its properties, including site work in preparation for feasibility study work or early construction

work, it will not undertake production activities by itself.

These forward-looking statements are based on

the beliefs, expectations and opinions of management on the date the statements are made and the Company does not assume any obligation

to update forward-looking statements, except as required by applicable securities laws, if circumstances or management’s beliefs,

expectations or opinions should change. For the reasons set forth above, forward-looking statements are inherently unreliable, and investors

should not place undue reliance on forward-looking statements.

The forward-looking statements contained in this

Prospectus Supplement and the documents incorporated by reference herein and therein are qualified by the foregoing cautionary statements.

CAUTIONARY NOTE TO UNITED STATES INVESTORS

CONCERNING MINERAL RESERVE AND RESOURCE ESTIMATES

This Prospectus Supplement, accompanying Prospectus

and the documents incorporated by reference herein have been prepared in accordance with the requirements of Canadian securities laws

in effect in Canada, which differ from the requirements of U.S. securities laws. Unless otherwise indicated, all mineral resource and

reserve estimates included in this Prospectus and any Prospectus Supplement have been prepared in accordance with Canadian National Instrument 43-101 –

Standards of Disclosure for Mineral Projects (“NI 43-101”) and the Canadian Institute of Mining, Metallurgy

and Petroleum Definition Standards for Mineral Resources and Mineral Reserves (the “CIM Definition Standards”). NI 43-101 is

a rule developed by the Canadian securities regulatory authorities which establishes standards for all public disclosure an issuer makes

of scientific and technical information concerning mineral projects. As a foreign private issuer that files its Annual Report on Form 40-F with

the SEC pursuant to the MJDS adopted by the U.S. and Canada, the Company is not required to prepare disclosure on its mineral projects

under Regulation S-K 1300 (as defined below) and instead prepares such disclosure in accordance with NI 43-101 and

the CIM Definition Standards.

The SEC has adopted mining disclosure rules under sub-part 1300

of Regulation S-K promulgated under the U.S. Securities Act (“Regulation S-K 1300”).

Under Regulation S-K 1300, the SEC now recognizes estimates of “Measured Mineral Resources”, “Indicated

Mineral Resources” and “Inferred Mineral Resources”. In addition, the SEC has amended its definitions of “Proven

Mineral Reserves” and “Probable Mineral Reserves” to be substantially similar to international standards.

Readers are cautioned that despite efforts to

harmonize U.S. mining disclosure rules with NI 43-101 and other international requirements, there are differences between the

terms and definitions used in Regulation S-K 1300 and mining terms defined in the CIM Definition Standards, which definitions

have been adopted by NI 43-101, and there is no assurance that any mineral reserves or mineral resources that the Company may report as

“proven mineral reserves”, “probable mineral reserves”, “measured mineral resources”, “indicated

mineral resources” and “inferred mineral resources” under NI 43-101 would be the same had the Company prepared

the reserve or resource estimates under Regulation S-K 1300.

Readers are also cautioned that while the SEC

will now recognize mineral resource estimates, readers should not assume that all or any part of the mineralization that the Company may

report as “measured mineral resources”, “indicated mineral resources” or “inferred mineral resources”

will ever be converted into a higher category of mineral resources or into mineral reserves. Mineralization described using these terms

has a greater amount of uncertainty as to its existence and feasibility than mineralization that has been characterized as reserves. Accordingly,

readers are cautioned not to assume that any “measured mineral resources”, “indicated mineral resources” or “inferred

mineral resources” that the Company reports are or will be economically or legally mineable. Further, “inferred mineral resources”

have a greater amount of uncertainty as to their existence and as to whether they can be mined economically or legally. Therefore, readers

are also cautioned not to assume that all or any part of “inferred mineral resources” exist. In accordance with Canadian securities

laws, estimates of “inferred mineral resources” cannot form the basis of feasibility or other economic studies, except in

limited circumstances where permitted under NI 43-101.

DOCUMENTS INCORPORATED BY REFERENCE

Under the multi-jurisdictional disclosure system

adopted by Canada and the United States, information has been incorporated by reference in this Prospectus Supplement from documents filed

by the Company with securities commissions or similar authorities in Ontario, British Columbia, Alberta, Manitoba Saskatchewan, Nova Scotia

and the Yukon (the “Commissions”) and filed with the SEC. Copies of the documents incorporated herein by reference

may be obtained on request without charge from the Assistant Corporate Secretary of Seabridge at 106 Front Street East, Suite 400, Toronto,

Ontario, Canada M5A 1E1, Telephone (416) 367-9292 and are also available electronically on SEDAR+, which can be accessed electronically

at www.sedarplus.ca, and on EDGAR, which can be accessed electronically at www.sec.gov. This Prospectus Supplement should be read in conjunction

with and may not be delivered or utilized without the accompanying short form base shelf Prospectus, including the documents incorporated

by reference therein.

Any material change reports (excluding confidential

material change reports), any interim and annual consolidated financial statements and related management’s discussion and analysis,

proxy circulars (excluding those portions that, pursuant to National Instrument 44-101 – Short Form Prospectus Distributions

of the Canadian Securities Administrators, are not required to be incorporated by reference herein), any business acquisition reports,

and any other disclosure documents required to be filed pursuant to an undertaking to a provincial or territorial securities regulatory

authority that are filed by the Company with various securities commissions or similar authorities in Canada after the date of this Prospectus

Supplement and prior to the termination of this offering, shall be deemed to be incorporated by reference in this Prospectus Supplement.

Any statement contained in this Prospectus

Supplement or in the accompanying Prospectus or in a document incorporated or deemed to be incorporated by reference herein shall be deemed

to be modified or superseded for purposes of this Prospectus Supplement to the extent that a statement contained herein or in any other

subsequently filed document which also is, or is deemed to be, incorporated by reference herein, modifies or supersedes such statement.

The modifying or superseding statement need not state that it has modified or superseded a prior statement or include any other information

set forth in the document it modifies or supersedes. The making of a modifying or superseding statement shall not be deemed an admission

for any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material

fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in

light of the circumstances in which it was made. Any statement so modified or superseded shall not constitute a part of this Prospectus

Supplement or accompanying Prospectus, except as so modified or superseded.

References to the Company’s website in any

documents that are incorporated by reference into this Prospectus Supplement do not incorporate by reference the information on such website

into this Prospectus Supplement, and the Company disclaims any such incorporation by reference.

Upon a new annual information form and the related

audited annual financial statements and management’s discussion and analysis being filed by the Company with, and, where required,

accepted by, the applicable securities commissions or similar regulatory authorities during the currency of this Prospectus Supplement,

the previous annual information form, the previous audited annual financial statements and related management’s discussion and analysis,

and all interim financial statements and related management’s discussion and analysis, material change reports and business acquisition

reports filed prior to the commencement of the Company’s financial year in which the new annual information form and the related

annual financial statements and management’s discussion and analysis are filed shall be deemed no longer to be incorporated into

this Prospectus Supplement and accompanying Prospectus for purposes of future offers and sales of securities hereunder. Upon new interim

financial statements and related management’s discussion and analysis being filed by us with the applicable securities commissions

or similar regulatory authorities during the currency of this Prospectus Supplement, all interim financial statements and related management’s

discussion and analysis filed prior to the new interim consolidated financial statements and related management’s discussion and

analysis shall be deemed no longer to be incorporated into this Prospectus Supplement and accompanying Prospectus for purposes of future

offers and sales of securities hereunder. Upon a new information circular relating to an annual general meeting of holders of Common Shares

being filed by us with the applicable securities commissions or similar regulatory authorities during the currency of this Prospectus

Supplement, the information circular for the preceding annual general meeting of holders of Common Shares shall be deemed no longer to

be incorporated into this Prospectus Supplement and accompanying Prospectus for purposes of future offers and sales of securities hereunder.

DOCUMENTS FILED AS PART OF THE REGISTRATION

STATEMENT

The following documents referred to in the accompanying

Prospectus or in this Prospectus Supplement have been or will (through post-effective amendment or incorporation by reference) be filed

with the SEC as part of the U.S. registration statement on Form F-10 (File No. 333-283616) of which this Prospectus Supplement and the

accompanying Prospectus form a part: (i) the documents referred to under the heading “Documents Incorporated by Reference”

in this Prospectus Supplement and in the accompanying Prospectus; (ii) powers of attorney from certain of the Company’s officers

and directors; and (iii) the Sales Agreement.

PROSPECTUS SUPPLEMENT SUMMARY

This summary highlights certain information

about the Company, the Offering and selected information contained elsewhere in or incorporated by reference into this Prospectus Supplement

or the accompanying Prospectus. This summary is not complete and does not contain all of the information that you should consider before

deciding whether to invest in the Offered Shares. For a more complete understanding of the Company and the Offering, we encourage you

to read and consider carefully the more detailed information in this Prospectus Supplement and the accompanying Prospectus, including

the information incorporated by reference into this Prospectus Supplement and the accompanying Prospectus, and in particular, the information

under the heading “Risk Factors” in this Prospectus Supplement and the documents incorporated by reference into this Prospectus

Supplement and the accompanying Prospectus. All capitalized terms used in this summary refer to definitions contained elsewhere in this

Prospectus Supplement or the accompanying Prospectus, as applicable.

The Company

Seabridge is a gold resource company whose principal

property is the KSM project (for Kerr-Sulphurets-Mitchell) located in Northwestern British Columbia, Canada (the “KSM Project”).

It also owns the Courageous Lake project located in the Northwest Territories, Canada (the “Courageous Lake Project”),

amongst other mineral properties. The Company exists under the Canada Business Corporations Act.

The Company presently has twelve wholly-owned

subsidiaries: KSM Mining ULC, (“KSMCo”) Seabridge Gold (KSM) Inc., SnipGold Corp., Hattrick Resources Corp. (“Hattrick”)

and Tuksi Mining & Development Company Ltd. (“Tuksi”), companies incorporated under the laws of British Columbia,

Canada; Seabridge Gold (NWT) Inc., a company incorporated under the laws of the Northwest Territories of Canada; Seabridge Gold (Yukon)

Inc., a company incorporated under the laws of Yukon; Seabridge Gold Corporation, Pacific Intermountain Gold, Corporation, 5555 Gold Inc.

and 5555 Silver Inc., each Nevada Corporations; and Snowstorm Exploration LLC, a Delaware limited liability corporation. The following

diagram illustrates the inter-corporate relationship between the Company, its active subsidiaries and its projects as of December 31,

2023.

Notes:

| 1. | Certain of the Company’s subsidiaries have been omitted from the chart as they own no mineral property

and are inactive. |

| 2. | SnipGold, through Hattrick, owns 95% of 12 of the claims covering an area of approximately 4,339 ha. The

Snip North zone lies approximately 50% on claims owned 100% by SnipGold and 50% on claims in which SnipGold’s ownership interest

is 95%. The Bronson Slope and Quartz Rise areas of the Iskut Project are 100% owned by SnipGold. |

| 3. | The Company has entered into an option agreement under which a 100% interest in the Quartz Mountain Project

may be acquired by a third party. |

The Company owns 7 properties, 4 of which have

gold resources, and it has one material property: the KSM Project. Today, the KSM Project hosts the largest publicly disclosed undeveloped

gold resource in the world, with measured and indicated gold resources totaling more than 88 million ounces (5.419 billion tonnes at 0.51

g/t).1 The Company’s exploration success at KSM has also defined a world class copper and silver deposit containing

19.6 billion pounds of copper and 417.2 million ounces of silver in the measured and indicated resource categories (5.419 billion tonnes

at 0.16% copper and 2.4 g/t silver). These resource estimates have an effective date of March 31, 2022 for the Mitchell and East Mitchell

deposits, December 31, 2019 for the Sulphurets deposit and January 10, 2024 in respect of the Kerr and Iron Cap deposits. These combined

measured and indicated resource estimates are derived from the most current resource estimates of each KSM deposit as set forth on page

12 of the AIF. More detailed information in respect of the KSM resource estimates is set forth in the AIF. The combined gold, copper and

silver, resources constitute a significant economic opportunity, and environmental assessment approvals and certain permits are in place

to permit the Company to advance early construction.

The Company holds a 100% interest in each of its

properties, other than a portion of the Snip North zone to the north of the Iskut Project in which it owns a 95% interest. The Quartz

Mountain project is subject to an option agreement under which the optionee may acquire a 100% interest in such project.

In July 2024, KSMCo received its “substantially

started” designation from the BC Government for the KSM Project. This designation affirms the validity of the BC Environmental Assessment

Certificate (“EAC”). Under the B.C. Environmental Assessment Act, a project’s EAC expires if the project has

not been substantially started by the deadline specified in its EAC. However, the B.C. Minister of Environment and Climate Change Strategy

(the “Minister”) may determine that a project has been “substantially started” before the deadline, in

which case the EAC is no longer subject to expiry. KSMCo’s EAC deadline was July 29, 2026.

Two Petitions have been filed in the British Columbia

Supreme Court seeking orders quashing the “substantially started” determination (the “SSD”). (See “The

Company – Summary Description of Business” and “Risk Factors – Risks Relating to the Company”

in the Prospectus). The SSD is unaffected by the filing of the Petitions and will remain in place if the Minister successfully defends

the SSD. Even if the Petitioners are successful, a typical order in these circumstances would require a resumption of the “substantially

started” determination process, either to expand consultation of one of the Petitioners or to reconsider the reasons for the Minister’s

determination, and then a fresh determination would be issued (which may or may not reaffirm the SSD).

The Company has spent over $1 billion since acquiring

the KSM Project in 2001, of which in excess of $800 million has been spent to advance the project after the issuance of the EAC in July

2014.

In 2025, the Company is planning exploration programs at its Iskut

and 3 Aces Projects and to continue early construction works at its KSM Project. The largest component of the early construction works

at the KSM Project in 2025 will be the continued construction of the Treaty Creek Switching Station (the “TCT”), the

connection point of the KSM power lines to British Columbia’s Northwest Transmission Line. KSMCo recently signed an amendment agreement

amending its Facilities Agreement with British Columbia Hydro and Power Authority (“BC Hydro”) for construction of

the TCT. Amounts payable by KSMCo under the amended Facilities Agreement in respect of planning, design and construction costs of the

TCT are estimated to be $160,900,000 of which $106,527,000 was paid prior to November 30, 2024, and an additional $15,600,000 was paid

on January 24, 2025 (which was considered a discretionary expenditure at the time of the Prospectus). An additional $24,400,000 is due

on or before April 1, 2025 and $14,373,000 is due on or before July 1, 2025. Of the total amount to be paid, $74,700,000 is paid as security

for BC Hydro system reinforcement and, subject to certain conditions, can be offset against future power consumption.

The documents incorporated by

reference herein, including the Prospectus, and documents incorporated by reference into the Prospectus, including the AIF, contain further

details regarding the business of Seabridge. See “Documents Incorporated by Reference.”

| 1 | Statements made comparing KSM’s size to other mineral

deposits globally are made against, and based on, mineral resource and mineral reserve estimates disclosed by all publicly traded mining

and exploration companies in North America, the United Kingdom, Australia, New Zealand and Singapore. |

THE OFFERING

| Common Shares offered by us |

Common Shares having an aggregate offering price of up to US$100,000,000 (or C$143,710,000, based on the exchange rate on January 23, 2025 reported by the Bank of Canada). |

| |

|

| Plan of Distribution |

“At-the-market distributions” as defined in NI 44-102, including sales made directly on the NYSE or on any other existing trading market for the Common Shares in the United States. No Offered Shares will be offered or sold in Canada on the TSX or other trading markets in Canada. The Offered Shares will be distributed at market prices prevailing at the time of the sale of such Offered Shares. See “Plan of Distribution”. |

| |

|

| Use of Proceeds |

The Company intends to use the net proceeds from the Offering towards the exploration and advancement of the Company’s projects and for general working capital purposes but may also use it for acquisitions. See “Use of Proceeds”. |

| |

|

| Risk Factors |

See “Risk Factors” in this Prospectus Supplement and the risk factors discussed or referred to in the documents incorporated by reference (including the AIF) into this Prospectus Supplement and the accompanying Prospectus for a discussion of factors that should be read and considered before investing in the Offered Shares. |

| |

|

| Tax considerations |

Purchasing Offered Shares may have tax consequences. This Prospectus Supplement and the accompanying Prospectus may not describe these consequences fully for all investors. Investors should read the tax discussion in this Prospectus Supplement and the accompanying Prospectus and consult with their tax advisor. See “Certain United States Federal Income Tax Considerations” and “Certain Canadian Federal Income Tax Considerations” in this Prospectus Supplement. |

| |

|

| Listing symbol |

The Common Shares are listed for trading on the TSX under the symbol “SEA” and on the NYSE under the symbol “SA”. |

RISK FACTORS

Investing in the Common Shares is speculative

and involves a high degree of risk. The following risk factors, as well as risks currently unknown to the Company, could materially adversely

affect the Company’s future business, operations and financial condition and could cause them to differ materially from the estimates

described in this Prospectus Supplement, the accompanying Prospectus or the documents incorporated by reference herein or therein, each

of which could cause purchasers of Offered Shares to lose part or all of their investment. Before deciding to invest in the Offered Shares,

investors should carefully consider the risk factors set out below, in addition to the other information contained in this Prospectus

Supplement, the accompanying Prospectus and the documents incorporated by reference herein and therein.

In addition to the other information contained

in this Prospectus Supplement, the accompanying Prospectus and the documents incorporated by reference herein and therein, prospective

investors should carefully consider the factors set out under “Risk Factors” in the AIF and the Company’s annual and

interim management’s discussion and analysis for the year ended December 31, 2023 and the nine months ended September 30, 2024 (as

well as any future such documents incorporated by reference herein) in evaluating the Company and its business before making an investment

in the Offered Shares.

Risks relating to the Offering

Shareholders’ interest may be diluted

in the future

The Company requires additional funds for exploration

and advancement programs or potential acquisitions. If it raises additional funding by issuing additional equity securities or other securities

that are convertible into equity securities, such financings may substantially dilute the interests of existing or future shareholders.

Sales or issuances of a substantial number of securities, or the perception that such sales could occur, may adversely affect the prevailing

market price for the Common Shares. With any additional sale or issuance of equity securities, investors will suffer dilution of their

voting power and may experience dilution in ownership of the Company’s assets.

There is no certainty regarding the net

proceeds to the Company

There is no certainty that US$100,000,000 will

be raised under the Offering. The Agents have agreed to use their commercially reasonable efforts to sell the Offered Shares when and

to the extent requested by the Company, but the Company is not required to request the sale of the maximum amount offered or any amount

and, if the Company requests a sale, the Agents are not obligated to purchase any Offered Shares that are not sold. As a result of the

Offering being made on a commercially reasonable efforts basis with no minimum, and only as requested by the Company, the Company may

raise substantially less than the maximum total offering amount or nothing at all.

Sales of a significant number of Common

Shares in the public markets, or the perception of such sales, could depress the market price of the Common Shares

Sales of a substantial number of Common Shares

or other equity-related securities in the public markets by the Company or its significant shareholders could depress the market price

of the Common Shares and impair Seabridge’s ability to raise capital through the sale of additional equity securities. Seabridge

cannot predict the effect that future sales of the Common Shares or other equity-related securities would have on the market price of

the Common Shares. The price of the Common Shares could be affected by possible sales of the Common Shares or by hedging or arbitrage

trading activity which the Company expects to occur involving the Common Shares.

The Company has broad discretion in the

use of the net proceeds from the Offering and may use them in ways other than as described herein

The Company has discretion concerning the application

of net proceeds received by the Company under the Offering, if any, and securityholders may not agree with the manner in which the Company

elects to allocate and spend such proceeds. The results and effectiveness of the application of these funds is uncertain. The failure

by the Company to apply such proceeds effectively could have a material adverse effect on the business of the Company. Management of the

Company will have discretion with respect to the use of the net proceeds and investors will be relying on the judgment of management regarding

the application of these proceeds. Prospective investors will not have the opportunity, as part of their investment in the Common Shares,

to influence the manner in which the net proceeds are used. Because of the number and variability of factors that will determine the Company’s

use of such proceeds, if any, the Company’s ultimate use might vary substantially from its planned use. You may not agree with how

the Company allocates or spend the proceeds from the Offering, if any.

Risks relating to the Company

The Company has a history of net losses

and negative cash flows from operations and expects losses and negative cash flows from operations to continue for the foreseeable future.

The Company has a history of net losses and negative

cash flows from operations and the Company expects to incur net losses and negative cash flows from operations for the foreseeable future.

As of December 31, 2023, the Company’s deficit totaled approximately $187 million. None of the Company’s properties

has advanced to the production stage and the Company has no history of earnings or positive cash flow from operations.

The Company expects to continue to incur net losses

unless and until such time as one or more of its projects enters into commercial production and generates sufficient revenues to fund

continuing operations or until such time as the Company is able to offset its expenses against the sale of one or more of its projects,

if applicable. The development of the Company’s projects to achieve production will require the commitment of substantial financial

resources. The amount and timing of expenditures in any year on any project will depend on a number of factors, including the availability

of financing to fund expenditures, the progress of ongoing exploration and development, the results of consultant analysis and recommendations,

and the execution of any sale or joint venture agreements with strategic partners, some of which are beyond the Company’s control.

Therefore the level of expenditures to be incurred in any year may differ significantly from the level of expenditures in the previous

year. There is no assurance that the Company will be profitable in the future.

If we fail to maintain an effective system

of internal control over financial reporting in the future, we may not be able to accurately report our financial condition, results of

operations, cash flows or prevent fraud.

We are subject to National Instrument 52-109 –

Certification of Disclosure in Issuers’ Annual and Interim Filings of the Canadian Securities Administrators and Section 404 of

the Sarbanes-Oxley Act (collectively the “ICOFR Requirements”) requiring that effective internal controls for financial

reporting and disclosure controls and procedures be maintained. We are required to furnish a report by management on, among other things,

the effectiveness of internal control over financial reporting. This report will include disclosure of any material weaknesses identified

by management in our internal control over financial reporting. A material weakness is a deficiency, or combination of deficiencies, in

internal control over financial reporting that results in more than a reasonable possibility that a material misstatement of annual or

interim financial statements will not be prevented or detected on a timely basis. Any testing by us conducted in connection with the ICOFR

Requirements, or any subsequent testing by our independent registered public accounting firm, may reveal deficiencies in our internal

controls over financial reporting that are deemed to be material weaknesses or that may require prospective or retroactive changes to

our financial statements or identify other areas for further attention or improvement. In addition, undetected material weaknesses in

our internal controls over financial reporting could lead to restatements of our financial statements and require us to incur the expense

of remediation. Failure to remedy any material weakness in our internal control over financial reporting, or to implement or maintain

other effective control systems required of public companies, could also undermine investor confidence in the accuracy and completeness

of our financial reports and adversely impact our share price and future access to the capital markets.

If high US tariffs are imposed on Canadian

products and the Canadian government retaliates with import tariffs on US products, the consequences on the capital markets could adversely

impact the Company’s ability to raise funds and the cost of the supplies the Company relies on to perform its planned work programs

could be adversely affected or be unavailable altogether, impairing its ability to complete work programs.

The new President of the United States of America

has repeatedly stated that he intends to impose a 25% tariff on all Canadian exports to the US. The eventuality, timing and rates of potential

tariffs are difficult to predict at this time. The Company does not export products to the US and would not be directly impacted by the

imposition of new tariffs on goods imported into the US. However, the economic impact of tariffs on the Canadian economy and the US economy

could negatively impact capital markets and the Company’s ability to raise funds to undertake its work programs. In addition, the

Canadian government may respond to the imposition of US tariffs by imposing tariffs on US goods imported into Canada. Canadian tariffs

on supplies needed for exploration programs or early construction work at the KSM Project that are imported from the US would increase

their cost and might impact their availability, which could impair the Company’s ability to undertake all of the work it plans to

perform. The Company has some flexibility to adjust the timing, scale of, or even cancel, many of its work programs in response to increasing

costs or unavailability of supplies. The details of Canada’s plans to retaliate, if necessary, are unknown and the indirect effects

of tariffs imposed by the US or by both countries are difficult to assess, but the potential for tariffs represents a risk to the Company’s

ability to fulfill some of its key objectives.

CONSOLIDATED CAPITALIZATION

Since the date of the unaudited condensed interim

consolidated financial statements of the Company for the three and nine months ended September 30, 2024 which are incorporated by reference

in this Prospectus Supplement, there have been no material changes to the share and loan capital of the Company on a consolidated basis,

except for the issuance of securities set forth under “Prior Sales”.

Assuming the entire Offering is sold, total equity capitalization will

increase by approximately US$97,575,000 being the aggregate proceeds of US$100,000,000, less commissions of US$2,000,000 and estimated

total offering expenses of approximately US$425,000. The number of Offered Shares issued will depend upon the at-the-market prices at

which they are sold.

USE OF PROCEEDS

The net proceeds from the Offering are not determinable

in light of the nature of the distribution. The net proceeds of any given distribution of Offered Shares through the Agents in an “at-the-market

distribution” will be the gross proceeds after deducting the applicable compensation payable to the Agents under the Sales Agreement

and the expenses of the distribution.

The Company expects to use the net proceeds from

the Offering for general corporate purposes, including funding future exploration and advancement work on the Company’s mineral

properties. The Company’s business objectives in 2025 to which net proceeds of the Offering may be directed include early construction

and data collection activities at the KSM Project, including funding the continued construction by BC Hydro of the TCT, and the completion

of exploration programs at the Company’s Iskut and 3 Aces Projects. Presently the Company plans to pay interest payable under the

Secured Notes issued by KSMCo (see “General Description of Capital Structure – Secured Notes” in the AIF) by

issuing Common Shares of the Company, but it may decide to make certain interest payments in cash with net proceeds from the Offering.

The Company may also use net proceeds to fund all or a portion of the price of an acquisition. None of the proceeds have been allocated

to a specific expense, capital expenditure or future acquisition. The Company reserves the right, for sound business reasons and at the

sole discretion of the Company’s management, to reallocate the proceeds of the Offering in response to developments in the Company’s

business and other factors.

PLAN OF DISTRIBUTION

The Company has entered into the Sales Agreement

with the Agents under which it may issue and sell from time to time Offered Shares through the Agents having an aggregate sales amount

of up to US$100,00,000 (or C$143,710,000, based on the exchange rate on January 23, 2025 reported by the Bank of Canada). Sales of Offered

Shares, if any, will be made in transactions that are deemed to be “at-the-market distributions” as defined in NI 44-102,

including sales made directly on the NYSE or other existing trading markets for the Common Shares in the United States. No Offered Shares

will be offered or sold in Canada through the TSX or any other trading market in Canada.

The Agents will offer the Offered Shares subject

to the terms and conditions of the Sales Agreement on a daily basis or as otherwise agreed upon by the Company and the Agents. The Company

will designate the maximum amount of Offered Shares to be sold pursuant to any single placement instruction to the Agents.

Subject to the terms and conditions of the Sales

Agreement, the Agents will use its commercially reasonable efforts to sell on the Company’s behalf, all of the Offered Shares requested

to be sold by the Company. The Company may instruct the Agents not to sell the Offered Shares if the sales cannot be effected at or above

the price designated by the Company in any such instruction.

Either the Company or the Agents may suspend the

Offering of the Offered Shares being made through the Agents under the Sales Agreement upon proper notice to the other party. The Company

and the Agents each have the right, by giving written notice as specified in the Sales Agreement, to terminate the Sales Agreement in

each party’s sole discretion at any time.

The Company will pay the Agents compensation,

or allow a discount, for its services in acting as agents or in the sale of the Offered Shares pursuant to the terms of the Sales Agreement

equal to 2.0% of the gross sales price per Offered Share sold. The Company has also agreed to reimburse the Agents for certain specified

expenses, including the fees and disbursements of their legal counsel, in an amount not to exceed US$75,000 in connection with the execution

of the Sales Agreement and for certain ongoing fees and disbursements of their legal counsel, plus applicable taxes. The remaining sales

proceeds, after deducting any expenses payable by the Company and any transaction, listing or filing fees imposed by any governmental,

regulatory or self-regulatory organization in connection with the sales, will equal the net proceeds to the Company for the sale of such

Offered Shares.

The Agents will provide written confirmation to

the Company following the close of trading on the NYSE on each day in which Offered Shares are sold through them as agent under the Sales

Agreement. Each confirmation will include the number of Offered Shares sold on that day, the average price realized from the sale of the

Offered Shares on the NYSE, the compensation payable to the Agents and the net proceeds to the Company.

Settlement for the sales of the Offered Shares

will occur, unless the parties agree otherwise, on the first trading day following the date on which any sales were made in return for

payment of the net proceeds to the Company. There is no agreement for funds to be received in an escrow, trust or similar arrangement.

Sales of Offered Shares as contemplated in this Prospectus Supplement will be settled through the facilities of The Depository Trust Company

in the United States, or by such other means as the Company and the Agents may agree upon.

Cantor Fitzgerald & Co. and RBC Capital Markets,

LLC are not registered as investment dealers in any Canadian jurisdiction and, accordingly, will only sell the Offered Shares in the United

States, and will not, directly or indirectly, solicit offers to purchase or sell the Offered Shares in Canada. Subject to applicable laws,

the Agents may offer the Offered Shares outside of Canada and the United States.

In connection with the sales of the Offered Shares on the Company’s

behalf, each of the Agents will be deemed to be an “underwriter” within the meaning of the U.S. Securities Act, and the compensation

paid to the Agents will be deemed to be underwriting commissions or discounts. The Company has agreed in the Sales Agreement to provide

indemnification and contribution to the Agent against certain liabilities, including liabilities under the U.S. Securities Act. In addition,

the Company has agreed, under certain circumstances, to reimburse the reasonable fees and disbursements of the Agents’ legal counsel

and the Agents’ other advisors in connection with this Offering. The expenses of the Offering, excluding commissions payable to

the Agents under the Sales Agreement, are estimated to be approximately US$425,000.

The Agents will not engage in any transactions

that stabilize the price of the Common Shares. No underwriter or dealer involved in the distribution, no affiliate of such an underwriter

or dealer and no person or company acting jointly or in concert with such an underwriter or dealer has over-allotted, or will over allot,

securities in connection with the distribution or has effected, or will effect, any other transactions that are intended to stabilize

or maintain the market price of the Common Shares.

The Offering pursuant to the Sales Agreement will

terminate on the earlier of: (i) the termination of the Sales Agreement; (ii) the issuance and sale of all the Offered Shares subject

to the Sales Agreement; or (iii) the date the receipt for the Prospectus ceases to be effective. The Company and the Agents may each terminate

the Sales Agreement at any time upon ten days’ prior notice or by the Agents at any time in certain circumstances, including the

occurrence of a material and adverse change in the Company’s business or financial condition that makes it impractical or inadvisable

to market the Company’s common shares or to enforce contracts for the sale of the Company’s common shares.

This Prospectus Supplement and the Prospectus

may be made available in electronic format on the websites maintained by the Agents or their U.S. affiliates participating in the Offering.

Other than the Prospectus Supplement and Prospectus in electronic format, the information on these websites is not part of this Prospectus

Supplement or the Registration Statement of which this Prospectus Supplement forms a part, has not been approved or endorsed by the Company

or the Agents in their capacity as agents, and should not be relied upon by investors.

Certain of the Agents and its affiliates have

provided in the past to the Company and its affiliates, and may provide from time to time in the future, various investment banking, commercial

banking, financial advisory and other financial services for the Company and its affiliates, for which services they have received, and

may continue to receive in the future, customary fees and commissions. For example, RBC Capital Markets, LLC and its affiliates provide

various financial advisory services to the Company. To the extent required by Regulation M, the Agents will not engage in any market making

activities involving the Common Shares, while the Offering is ongoing under this Prospectus Supplement. However, from time to time, the

Agents and its U.S. affiliates may have effected transactions for their own account or the account of customers, and hold on behalf of

themselves or their customers, long or short positions in the Company’s equity securities, and may do so in the future.

The Company has applied to the TSX to conditionally

approve the listing of the Offered Shares offered by this Prospectus Supplement. Listing is subject to us fulfilling all of the requirements

of the TSX, which cannot be assured.

DESCRIPTION OF SECURITIES BEING DISTRIBUTED

The Company is authorized to issue an unlimited

number of Common Shares without par value and an unlimited number of preferred shares, issuable in series, of which at January 23, 2025,

91,954,369 Common Shares were issued and outstanding and no preferred shares were issued and outstanding.

The holders of the Common Shares are entitled

to receive notice of and to attend all meetings of the shareholders of the Company and each Common Share confers the right to one vote

in person or by proxy at all meetings of the shareholders of the Company. The holders of the Common Shares, subject to the prior rights,

if any, of the holders of any other class of shares of the Company, are entitled to receive such dividends in any financial year as the

board of directors of the Company may by resolution determine. In the event of the liquidation, dissolution or winding-up of the Company,

whether voluntary or involuntary, the holders of the Common Shares are entitled to receive, subject to the prior rights, if any, of the

holders of any other class of shares of the Company, the remaining property and assets of the Company.

The directors of the Company are authorized to

create series of preferred shares in such number and having such rights and restrictions with respect to dividends, rights of redemption,

conversion or repurchase and voting rights as may be determined by the directors and shall have priority over the Common Shares to the

property and assets of the Company in the event of liquidation, dissolution or winding-up of the Company.

PRIOR SALES

Common Shares

During the 12-month period before the date of

this Prospectus Supplement, the Company issued the following Common Shares:

| DATE OF ISSUE | |

TYPE OF SECURITY | |

NUMBER OF

SECURITIES | | |

ISSUE OR

EXERCISE

PRICE PER

SECURITY | | |

NATURE OF ISSUE |

| January 17, 2024 | |

Common Shares | |

| 58,066 | | |

| N/A | | |

Conversion of Restricted Share Units |

| March 8, 2024 | |

Common Shares | |

| 5,000 | | |

| N/A | | |

Conversion of Restricted Share Units |

| April 1, 2024 | |

Common Shares | |

| 289,233 | | |

$ | 17.05 | | |

Interest paid in shares |

| April 4, 2024 | |

Common Shares | |

| 25,000 | | |

$ | 17.72 | | |

Exercise of Stock Options |

| June 5, 2024 | |

Common Shares | |

| 575,000 | | |

$ | 31.256 | | |

Private placement of British Columbia critical mineral exploration flow-through Common Shares |

| June 24, 2024 | |

Common Shares | |

| 5,000 | | |

| N/A | | |

Royalty purchase |

| June 26, 2024 | |

Common Shares | |

| 25,000 | | |

$ | 17.72 | | |

Exercise of Stock Options |

| June 27, 2024 | |

Common Shares | |

| 266,558 | | |

$ | 18.77 | | |

Interest paid in shares |

| July 0, 2024 | |

Common Shares | |

| 5,000 | | |

| N/A | | |

Conversion of Restricted Share Units |

| July 29, 2024 | |

Common Shares | |

| 58,067 | | |

| N/A | | |

Conversion of Restricted Share Units |

| September 27, 2024 | |

Common Shares | |

| 220,728 | | |

$ | 22.60 | | |

Interest paid in shares |

| October 22, 2024 | |

Common Shares | |

| 80,500 | | |

$ | 31.08 | | |

Private placement of Canadian federal flow-through Common Shares |

| December 11, 2024 | |

Common Shares | |

| 13,154 | | |

| N/A | | |

Conversion of Restricted Share Units |

| December 12, 2024 | |

Common Shares | |

| 12,351 | | |

| N/A | | |

Conversion of Restricted Share Units |

| December 23, 2024 | |

Common Shares | |

| 195,500 | | |

$ | 25.67 | | |

Private placement of Canadian federal flow-through Common Shares |

| December 27, 2024 | |

Common Shares | |

| 324,884 | | |

$ | 15.70 | | |

Interest paid in shares |

| January 1, 2024 to Present | |

Common Shares | |

| 3,687,309 (1) | | |

$ | 21.21 | | |

At-The-Market Distributions(1) |

| (1) | During the period from January 1, 2024 to present, the Company issued 3,687,309 Common Shares, at an average

selling price of $21.21 per share, for net proceeds of $76.6 million under the Company’s At-The-Market offering. |

Stock Options

The Company has no stock options outstanding and

has terminated its Stock Option Plan.

Restricted Share Units (“RSUs”)

and Deferred Share Units (“DSUs”)

During the 12-month period before the date of

this Prospectus Supplement, the Company granted a total 370,920 RSUs and DSUs with varying terms and vesting criteria as follows:

| a. | 272,420 RSUs were granted to executive employees that will vest based on the following time table: |

| i. | one third of RSU grant to vest on positive construction decision at KSM; |

| ii. | one third of RSU grant to vest provided that on December 31, 2026 the Company’s share price has

outperformed the S&P/TSX Global Gold Index by greater than 10% over the previous 12 month period; and |

| iii. | one third of RSU grant to vest on December 8, 2027 provided the individual is still an employee of the

Company. |

| b. | 44,000 RUS were granted to non-executive employees that are subject to 3-year vesting, with one third

of each grant vesting on each anniversary of the grant. |

| c. | 54,400 DSUs were granted to members of the Board. |

Also, during the 12-month period before the date

of this Prospectus Supplement, 79,707 RSUs expired.

As of the date hereof, there are 837,301 RSUs

outstanding.

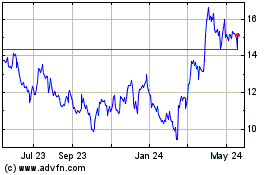

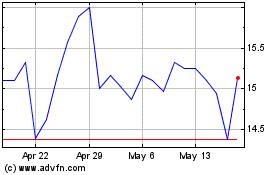

TRADING PRICE AND VOLUME

The Common Shares are listed on the TSX under

the symbol “SEA” and the NYSE under the symbol “SA”. The following table sets forth, for the 12 month period prior

to the date of this Prospectus Supplement, details of the trading prices and volume on a monthly basis of the Common Shares on the TSX

and NYSE, respectively:

| | |

Toronto Stock Exchange | | |

NYSE | |

| Period | |

Volume | | |

High

(CDN$) | | |

Low

(CDN$) | | |

Volume | | |

High

(US$) | | |

Low

(US$) | |

| 2024 | |

| |

| January | |

| 1,035,543 | | |

| 16.18 | | |

| 13.75 | | |

| 2,399,087 | | |

| 12.12 | | |

| 10.18 | |

| February | |

| 970,861 | | |

| 15.99 | | |

| 12.62 | | |

| 2,757,969 | | |

| 11.83 | | |

| 9.31 | |

| March | |

| 1,057,476 | | |

| 20.65 | | |

| 15.35 | | |

| 2,789,634 | | |

| 15.25 | | |

| 11.26 | |

| April | |

| 2,300,675 | | |

| 23.00 | | |

| 19.39 | | |

| 3,442,211 | | |

| 16.71 | | |

| 14.10 | |

| May | |

| 1,747,445 | | |

| 22.14 | | |

| 19.43 | | |

| 3,234,514 | | |

| 16.25 | | |

| 14.26 | |

| June | |

| 1,115,650 | | |

| 21.65 | | |

| 18.53 | | |

| 1,885,618 | | |

| 15.93 | | |

| 13.55 | |

| July | |

| 1,164,569 | | |

| 23.48 | | |

| 18.28 | | |

| 2,340,246 | | |

| 16.98 | | |

| 13.32 | |

| August | |

| 1,552,908 | | |

| 25.82 | | |

| 20.62 | | |

| 2,526,828 | | |

| 18.98 | | |

| 14.70 | |

| September | |

| 1,441,483 | | |

| 24.42 | | |

| 21.62 | | |

| 1,753,328 | | |

| 18.01 | | |

| 15.93 | |

| October | |

| 1,946,460 | | |

| 28.39 | | |

| 22.31 | | |

| 2,241,974 | | |

| 20.55 | | |

| 16.33 | |

| November | |

| 2,005,065 | | |

| 24.55 | | |

| 19.44 | | |

| 2,988,317 | | |

| 17.58 | | |

| 13.81 | |

| December | |

| 2,049,503 | | |

| 20.40 | | |

| 15.66 | | |

| 2,512,650 | | |

| 14.50 | | |

| 10.89 | |

| 2025 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| January 1 to 23 | |

| 1,268,657 | | |

| 17.94 | | |

| 16.60 | | |

| 2,061,006 | | |

| 12.35 | | |

| 11.54 | |

On January 23, 2025 the last trading day of the

Common Shares prior to the date of this Prospectus Supplement, the closing price of the Common Shares on the TSX was C$17.56 and on the

NYSE was US$12.24.

CERTAIN UNITED STATES FEDERAL INCOME TAX

CONSIDERATIONS

The following is a general summary of the U.S.

federal income tax considerations applicable to a U.S. Holder (as defined below) arising from the acquisition of Common Shares pursuant

to the Offering and the ownership and disposition of the Common Shares. This summary applies only to U.S. Holders who hold Common Shares