SABA Announces $0.058 Dividend

03 December 2024 - 12:45AM

Business Wire

Saba Capital Income & Opportunities Fund II (NYSE: SABA)

(the “Fund”), a registered closed-end management investment company

listed on the New York Stock Exchange, declared a monthly dividend

of $0.058 per share on November 29, 2024, payable on December 31,

2024 to shareholders of record as of December 10, 2024.

Managed Distribution Plan. The above distribution was

declared in accordance with the Fund’s currently effective managed

distribution plan (the “Plan”), whereby the Fund will make monthly

distributions to shareholders at a fixed amount of $0.058 per

share. Thus, the distribution amount shown excludes special

dividends (which are not paid pursuant to the plan), including the

special dividend paid during the current fiscal period in December

2023. The Fund will generally distribute amounts necessary to

satisfy the Fund’s Plan and the requirements prescribed by excise

tax rules and Subchapter M of the Internal Revenue Code. The Plan

is intended to provide shareholders with a constant, but not

guaranteed, fixed minimum rate of distribution each month and is

intended to narrow the discount between the market price and the

net asset value of the Fund’s common shares, but there is no

assurance that the Plan will be successful in doing so.

Under the Plan, to the extent that sufficient investment income

is not available on a monthly basis, the Fund will distribute

long-term capital gains and/or return of capital in order to

maintain its managed distribution rate. As a result, long-term

capital gains and/or return of capital may be a material source of

any distribution. No conclusions should be drawn about the Fund’s

investment performance from the amount of the Fund’s distributions

or from the terms of the Fund’s Plan. The Board of Trustees (the

“Board”) may amend the terms of the Plan or terminate the Plan at

any time without prior notice to Fund shareholders. No level of

distribution can be guaranteed. The amendment or termination of the

Plan could have an adverse effect on the market price of the Fund’s

common shares. The Plan is subject to the periodic review by the

Board, including a yearly review of the annual minimum fixed rate

to determine if an adjustment should be made.

In compliance with Rule 19a-1 of the Investment Company Act of

1940, shareholders will receive a notice that details the source of

income for the above dividend, such as net investment income, gain

from the sale of securities and return of principal; however,

determination of the actual source of the foregoing dividend can

only be made at year-end. The actual source amounts of all Fund

dividends will be included in the Fund’s annual or semiannual

reports. In addition, the tax treatment may differ from the

accounting treatment used to calculate the source of the Fund’s

dividends as shown on shareholders’ statements. Shareholders should

refer to their Form 1099-DIV for the character and amount of

distributions for income tax reporting purposes. Since each

shareholder’s tax situation is unique, it may be advisable to

consult a tax advisor as to the appropriate treatment of Fund

distributions.

Past Performance is No Assurance of Future Results.

Investment return and principal value of an investment in the Fund

will fluctuate. Shares, when sold, may be worth more or less than

their original cost. Investors should consider the investment

objective, risks and expenses carefully. You can obtain the Fund’s

most recent periodic reports and filings by visiting

https://www.sec.gov/edgar/browse/?CIK=828803&owner=exclude.

Other Information and Certain Risk Factors: The Fund’s

investment objective is to provide investors with high current

income, with a secondary goal of capital appreciation. There can be

no assurance that the Fund will meet its investment objective. The

Fund seeks to achieve this objective by investing globally in debt

and equity securities of public and private companies, which

includes, among other things, investments in closed-end funds,

special purpose acquisition companies (“SPACs”), reinsurance, and

public and private debt instruments. The Fund also may utilize

derivatives including but not limited to total return swaps, credit

default swaps, options (including but not limited to index options)

and futures, in seeking to enhance returns and/or to reduce

portfolio risk. In addition, on an opportunistic basis, the Fund

may also invest up to 15% of its total assets in private funds that

focus on debt, equity or other investments consistent with the

Fund’s investment objective.

The value of the Fund’s investments in equity securities of

public and private, listed and unlisted companies and equity

derivatives generally varies with the performance of the issuer and

movements in the equity markets more generally. As a result, the

Fund may suffer losses if it invests in equity instruments of

issuers whose performance diverges from the Fund’s investment

manager’s expectations or if equity markets generally move in a

single direction and the Fund has not hedged against such a general

move. The Fund may invest in closed-end funds and SPACs, which are

subject to additional risks and considerations. The performance of

reinsurance-related securities and the reinsurance industry itself

are tied to the occurrence of various triggering events, including

but not limited to weather, natural disasters (hurricanes,

earthquakes, etc.), non-natural large catastrophes and other

specified events causing physical and/or economic loss. To the

extent the Fund invests in reinsurance-related securities for which

a triggering event occurs, losses associated with such event could

result in losses to the Fund’s investment, and a series of major

triggering events affecting a large portion of the

reinsurance-related securities held by the Fund could result in

substantial losses to the Fund’s investment. The Fund may invest in

high yield securities, which are speculative in nature and are

subject to additional risk factors such as increased possibility of

default, illiquidity of the security, and changes in value based on

changes in interest rates. Changes in short-term market interest

rates may directly affect the yield on the Fund’s common shares. If

such rates fall, the Fund’s yield may also fall. If interest rate

spreads on bonds and loans owned by the Fund decline in general,

the yield on the bonds and loans will likely fall and the value of

such bonds and loans may decrease. When short-term market interest

rates rise, because of the lag between changes in such short-term

rates and the resetting of the floating rates on bonds and loans in

the Fund’s portfolio, the impact of rising rates will be delayed to

the extent of such lag. Because of the limited secondary market for

certain bonds and loans, the Fund’s ability to sell such securities

in a timely fashion and/or at a favorable price may be limited. An

increase in the demand for bonds and loans may adversely affect the

rate of interest payable on new bonds and loans acquired by the

Fund, and it may also increase the price of bonds and loans

purchased by the Fund in the secondary market. A decrease in the

demand for bonds and loans may adversely affect the price of bonds

and loans in the Fund’s portfolio, which would cause the Fund’s net

asset value to decrease. Investment in foreign borrowers involves

special risks, including but not limited to potentially less

rigorous accounting requirements, differing legal systems and

potential political, social and economic adversity. The Fund may

engage in currency exchange transactions to seek to hedge, as

closely as practicable, all of the economic impact to the Fund

arising from foreign currency fluctuations. Other risks include,

but are not limited to, the use of derivatives, the potential lack

of diversification in the Fund’s portfolio, and the fact that the

Fund’s portfolio may be concentrated in a small group of industries

or industry sectors from time to time. Investors should consult the

Fund’s filings with the Securities and Exchange Commission as well

as the materials on the Fund’s website for a more detailed

discussion of these or other risk factors that affect the Fund.

About Saba Capital Income & Opportunities Fund II.

Saba Capital Income & Opportunities Fund II is a

publicly-traded registered closed-end management investment

company. The Fund’s common shares trade on the New York Stock

Exchange under the ticker symbol “SABA”. The Fund is managed by

Saba Capital Management, L.P.

Forward-Looking Statements. This press release contains

forward-looking statements subject to the inherent uncertainties in

predicting future results and conditions. Any statements that are

not statements of historical fact (including but not limited to

statements containing the words “believes,” “plans,” “anticipates,”

“expects,” “estimates” and similar expressions) should also be

considered to be forward-looking statements. These statements are

not guarantees of future performance, conditions or results and

involve a number of risks and uncertainties. Certain factors could

cause actual results and conditions to differ materially from those

projected in these forward-looking statements. These factors,

including but not limited to the “Certain Risk Factors” noted

above, are identified from time to time in the Fund’s filings with

the Securities and Exchange Commission as well as the materials on

the Fund’s website. The Fund undertakes no obligation to update

such statements to reflect subsequent events, except as may be

required by law.

For further information on Saba Capital Income &

Opportunities Fund II, please visit our website at:

www.sabacef.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241202080612/en/

888-888-0319

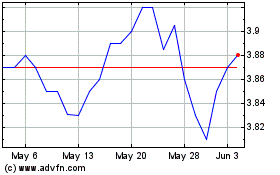

Saba Capital Income and ... (NYSE:SABA)

Historical Stock Chart

From Feb 2025 to Mar 2025

Saba Capital Income and ... (NYSE:SABA)

Historical Stock Chart

From Mar 2024 to Mar 2025