BOSTON BEER UPDATES 2024 FINANCIAL GUIDANCE TO REFLECT SUPPLIER CONTRACT AMENDMENT

21 December 2024 - 8:15AM

As part of its ongoing initiatives to optimize its supply chain,

The Boston Beer Company, Inc. (NYSE: SAM), today announced an

amendment and restatement in its entirety of an existing production

agreement with a third-party supplier, Rauch North America Inc

(‘Rauch’). This amendment adjusts the existing production agreement

to better match the Company’s future capacity requirements and

results in increased production flexibility and more favorable

termination rights to the company in exchange for a $26 million

cash payment to Rauch on or before December 23, 2024.

As a result of the payment, the Company expects to record a

pre-tax contract settlement expense of $26 million or $1.70 after

tax per diluted share impact in the fourth quarter of 2024. The

full anticipated impact of the payment on the Company’s prior

guidance is set forth in the chart below under Updated Full-Year

2024 Projections.

Updated Future Third Party Production Obligations

For the full year 2024, the Company continues to estimate

shortfall fees will negatively impact gross margin by 65 to 75

basis points and the non-cash expense of third-party production

pre- payments will negatively impact gross margins by 95 to 105

basis points.

The Company continues to work to finalize its 2025 financial

plan. The company does not expect this agreement to materially

impact its previously provided estimate of $14 million in 2025

shortfall fees disclosed in its third quarter 10-Q filed on October

24, 2024. The Company will provide further guidance on shortfall

fees and the non-cash expense of third-party productionpre-payments

along with its full year 2025 financial guidance in its fourth

quarter earnings report in February 2025.

The Company has regular discussions with its third-party

production suppliers related to its future capacity needs and the

terms of its contracts. Changes to volume estimates, future

amendments or cancellations of existing contracts could accelerate

or change total shortfall fees expected to be incurred.

Updated Full-Year 2024 Projections

The Company has updated its full year guidance to reflect the

estimated contract settlement expense discussed above. The

Company’s actual 2024 results could vary from the current

projection and are highly sensitive to changes in volume

projections and supply chain performance.

|

Full Year 2024 |

Current Guidance |

Prior Guidance |

|

Depletions and Shipments Percentage Decrease |

Down low single digits |

Down low single digits |

|

Price Increases |

2% |

2% |

|

Gross Margin |

44% to 45% |

44% to 45% |

|

Advertising, Promotion, and Selling Expense Year Over Year

Change ($million) |

($5) to $15 |

($5) to $15 |

|

Effective Tax Rate |

34% |

30% |

|

GAAP EPS |

$3.80 to $5.80 |

$5.50 to $7.50 |

|

Non-GAAP EPS |

$8.00 to $10.00 |

$8.00 to $10.00 |

|

Capital Spending ($ million) |

$80 to $95 |

$80 to $95 |

The non-GAAP earnings per share (Non-GAAP EPS) projection

excludes the contract settlement of $26 million or $1.70 per

diluted share and the impact of non-cash brand impairments of $42.6

million or $2.49 per diluted share, recognized in the third quarter

of fiscal 2024 relating primarily to the Dogfish Head brand.

The increase in the estimated full year effective tax rate is

due to the impact of the contract settlement which decreased

estimated full year pre-tax income but did not significantly change

estimated full year non-deductible expenses.

Use of Non-GAAP Measures

Non-GAAP EPS is not a defined term under U.S. generally accepted

accounting principles (“GAAP”). Non-GAAP EPS, or Non-GAAP earnings

per diluted share, excludes from projected GAAP EPS the estimated

impact of the contract settlement of $26 million or $1.70 per

diluted share to be recognized in the fourth quarter of fiscal 2024

and the impact of the non-cash asset impairment charge of $42.6

million, or $2.49 per diluted share, recognized in the third

quarter of fiscal 2024 relating primarily to the Dogfish Head

brand. This non-GAAP measure should not be considered in isolation

or as a substitute for diluted earnings per share prepared in

accordance with GAAP, and may not be comparable to calculations of

similarly titled measures by other companies. Management uses this

non-GAAP financial measure to make operating and strategic

decisions and to evaluate the Company’s underlying business

performance. Management believes this forward-looking non-GAAP

measure provides meaningful and useful information to investors and

analysts regarding the Company’s outlook for its ongoing financial

and business performance or trends and facilitates period to period

comparisons of its forecasted financial performance.

Forward-Looking Statements

Statements made in this press release that state the Company’s

or management’s intentions, hopes, beliefs, expectations or

predictions of the future are forward-looking statements. It

isimportant to note that the Company’s actual results could differ

materially from those projected in such forward-looking statements.

Additional information concerning factors that could cause actual

results to differ materially from those in the forward-looking

statements is contained from time to time in the Company’s SEC

filings, including, but not limited to, the Company’s report on

Form 10-K for the year ended December 30, 2023 and subsequent

reports filed by the Company with the SEC on Forms 10-Q and 8-K.

Copies of these documents are available from the SEC and may be

found on the Company’s website, www.bostonbeer.com. You should not

place undue reliance on forward-looking statements, which speak

only as of the date they are made. The Company undertakes no

obligation to publicly update or revise any forward-looking

statements.

About the Company

The Boston Beer Company, Inc. (NYSE: SAM) began brewing Samuel

Adams beer in 1984 and has since grown to become one of the largest

and most respected craft brewers in the United States. We

consistently offer the highest-quality products to our drinkers,

and we apply whatwe’ve learned from making great-tasting craft beer

to making great-tasting and innovative“beyond beer” products.

Boston Beer Company has pioneered not only craft beer but also hard

cider, hard seltzer and hard tea. Our core brands include household

names like Angry Orchard Hard Cider, Dogfish Head, Sun Cruiser,

Truly Hard Seltzer, Twisted Tea Hard Iced Tea, and Samuel Adams. We

have taprooms and hospitality locations in California, Delaware,

Massachusetts, New York and Ohio. For more information, please

visit our website at www.bostonbeer.com, which includes links to

our respective brand websites.

Jennifer Larson

Boston Beer Company

(617) 368-5152

jennifer.larson@bostonbeer.com

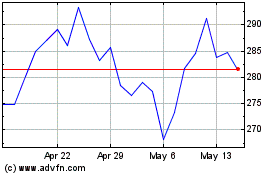

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Jan 2025 to Feb 2025

Boston Beer (NYSE:SAM)

Historical Stock Chart

From Feb 2024 to Feb 2025