2025 Outlook, second section, third bullet of release should

read: Same-Store Sales Change of approximately (5)-(3)% (instead of

Same-Store Sales Change of approximately 5-3%).

The updated release reads:

SWEETGREEN, INC. ANNOUNCES FOURTH QUARTER

AND FISCAL YEAR 2024 FINANCIAL RESULTS

Sweetgreen, Inc. (NYSE: SG) (the “Company”), the mission-driven,

next-generation restaurant and lifestyle brand that serves healthy

food at scale, today announced financial results for its fourth

fiscal quarter and fiscal year ended December 29, 2024.

Fourth Quarter 2024 Financial

Highlights

For the fourth quarter of fiscal year 2024, compared to the

fourth quarter of fiscal year 2023:

- Total revenue was $160.9 million versus $153.0 million in the

prior year period, an increase of 5%.

- Same-Store Sales Change of 4%, versus Same-Store Sales Change

of 6% in the prior year period.

- AUV of $2.9 million was consistent with the prior year

period.

- Total Digital Revenue Percentage of 56% and Owned Digital

Revenue Percentage of 29%, versus Total Digital Revenue Percentage

of 58% and Owned Digital Revenue Percentage of 34% in the prior

year period.

- Loss from operations was $(31.4) million and loss from

operations margin was (20)%, versus loss from operations of $(29.3)

million and loss from operations margin of (19)% in the prior year

period.

- Restaurant-Level Profit1 was $28.0 million and Restaurant-Level

Profit Margin was 17%, versus Restaurant-Level Profit of $24.8

million and Restaurant-Level Profit Margin of 16% in the prior year

period.

- Net loss was $(29.0) million and net loss margin was (18)%,

versus net loss of $(27.4) million and net loss margin of (18)% in

the prior year period.

- Adjusted EBITDA1 was $(0.6) million and Adjusted EBITDA Margin

was 0%, versus Adjusted EBITDA of $(1.8) million and Adjusted

EBITDA Margin of (1)% in the prior year period.

- 10 Net New Restaurant Openings versus 1 Net New Restaurant

Opening in the prior year period.

Full Year Fiscal 2024 Financial

Highlights

For fiscal year 2024 compared to fiscal year 2023:

- Total revenue was $676.8 million, versus $584.0 million in the

prior fiscal year, an increase of 16%.

- Same-Store Sales Change of 6%, versus Same-Store Sales Change

of 4% in the prior fiscal year.

- AUV of $2.9 million was consistent with the prior year

period.

- Total Digital Revenue Percentage of 56% and Owned Digital

Revenue Percentage of 30%, versus Total Digital Revenue Percentage

of 59% and Owned Digital Revenue Percentage of 36% in the prior

fiscal year.

- Loss from operations was $(95.7) million and loss from

operations margin was (14)%, versus loss from operations of

$(122.3) million and loss from operations margin of (21)% in the

prior fiscal year.

- Restaurant-Level Profit1 was $132.9 million and

Restaurant-Level Profit Margin was 20%, versus Restaurant-Level

Profit of $101.9 million and Restaurant-Level Profit Margin of 17%

in the prior fiscal year.

- Net loss was $(90.4) million and net loss margin was (13)%,

versus net loss of $(113.4) million and net loss margin of (19)% in

the prior fiscal year.

- Adjusted EBITDA1 was $18.7 million versus Adjusted EBITDA of

$(2.8) million in the prior fiscal year and Adjusted EBITDA Margin

was 3% versus 0% in the prior year period.

- 25 Net New Restaurant Openings versus 35 Net New Restaurant

Openings in the prior fiscal year.

1 Restaurant-Level Profit,

Restaurant-Level Profit Margin, Adjusted EBITDA and Adjusted EBITDA

Margin are non-GAAP measures. Reconciliations of Restaurant-Level

Profit, Restaurant-Level Profit Margin, Adjusted EBITDA, and

Adjusted EBITDA Margin to the most directly comparable financial

measures presented in accordance with GAAP, are set forth in the

schedules accompanying this release. See “Reconciliation of GAAP to

Non-GAAP Measures.”

“Our 2024 results exceeded our initial expectations, thanks to

the strength of our menu innovation, technology, and overall guest

experience,” said Jonathan Neman, Co-Founder and CEO. “In 2025,

we’re rolling out a new and improved loyalty program, introducing

exciting new menu items, and strategically investing more in

marketing to bring more people into our restaurants. By staying

focused on delivering an exceptional experience, we’re setting

Sweetgreen up to lead—and redefine—fast food for the future.”

“Since our IPO in 2021, we have delivered 4 years of double

digit revenue growth and 4 consecutive years of restaurant level

margin expansion. In 2024, restaurant-level margin expanded over

200 basis points, and Adjusted EBITDA of $18.7 million improved by

$21.5 million over the prior year period,” said Mitch Reback, Chief

Financial Officer. “This marks our first full year of Adjusted

EBITDA profitability in Sweetgreen’s history, providing a solid

foundation to grow and expand in the years to come.”

Results for the fourth quarter ended

December 29, 2024:

Total revenue in the fourth quarter of 2024 was $160.9 million,

an increase of 5% versus the prior year period, primarily due to

additional revenue associated with 26 Net New Restaurant Openings

during or subsequent to the fourth quarter of 2023 through the end

of the fourth fiscal quarter of 2024 and Same-Store Sales Change of

4% due to menu price increases that were implemented subsequent to

the prior year period. These increases were partially offset by a

decrease in fiscal year-over-year comparable restaurant sales,

which would have been reflected in our Same-Store Sales Change had

we not adjusted for the misalignment in our comparable weeks

resulting from fiscal year 2023 being a 53-week year.

Our loss from operations margin was (20)% for the fourth quarter

of 2024 versus (19)% in the prior year period. Restaurant-Level

Profit Margin was 17%, an increase of over 100 basis points versus

the prior year period, due to the impact of menu price increases

and continued labor optimization, partially offset by the impact of

the additional week of revenue in fiscal year 2023.

General and administrative expense was $37.1 million, or 23% of

revenue for the fourth quarter of 2024, as compared to $35.5

million, or 23% of revenue in the prior year period. The increase

in general and administrative expense was primarily due to an

increase in legal settlements, an increase in payroll taxes related

to the vesting of the Founders’ performance stock units released

during the current year, and an increase in spend across the

Sweetgreen Support Center to support our restaurant growth. These

increases were partially offset by a decrease in stock-based

compensation expense primarily related to the decrease in expense

associated with restricted stock units and performance-based

restricted stock units issued prior to our IPO.

Net loss for the fourth quarter of 2024 was $(29.0) million, as

compared to $(27.4) million in the prior year period. The change

was primarily attributable to a $1.7 million increase in impairment

and closure costs, a $1.2 million increase in pre-opening costs

related to the 10 Net New Restaurant Openings in the current year

period versus 1 Net New Restaurant Opening in the prior year

period, an increase in general administrative expenses as described

above, and an increase in depreciation and amortization associated

with additional restaurants. These increases were partially offset

by a $3.2 million increase in our Restaurant-Level Profit as

described above. Adjusted EBITDA, which excludes stock-based

compensation expense and certain other adjustments, was $(0.6)

million for the fourth quarter of 2024, as compared to $(1.8)

million in the prior year period. This change was primarily due to

an increase in Restaurant-Level Profit, as described above.

2025 Outlook

For fiscal year 2025, we are anticipating the following:

- At least 40 Net New Restaurant Openings, with 20 featuring the

Infinite Kitchen

- Revenue ranging from $760 million to $780 million

- Same-Store Sales Change between 1-3%

- Restaurant-Level Profit Margin of 19.8%-20.5%

- Adjusted EBITDA between $32 million to $38 million

For the first quarter of fiscal year 2025, we are anticipating

the following:

- 5 Net New Restaurant Openings

- Revenue ranging from $163 million to $166 million

- Same-Store Sales Change of approximately (5)-(3)%

- Restaurant-Level Profit Margin of 16.4%-16.8%

- Adjusted EBITDA between $(3) million to $(1) million

We have not reconciled our expectations as to Restaurant-Level

Profit Margin and Adjusted EBITDA to their most directly comparable

GAAP measures as a result of uncertainty regarding, and the

potential variability of, reconciling items. Accordingly,

reconciliation is not available without unreasonable effort,

although it is important to note that these factors could be

material to our results computed in accordance with GAAP.

Conference Call

Sweetgreen will host a conference call to discuss its financial

results and financial outlook today, February 26, 2025, at 2:00

p.m. Pacific Time. A live webcast of the call can be accessed from

Sweetgreen’s Investor Relations website at investor.sweetgreen.com.

An archived version of the webcast will be available from the same

website after the call.

Forward-Looking

Statements

This press release and the related conference call, webcast and

presentation contain forward-looking statements within the meaning

of the Private Securities Litigation Reform Act of 1995. These

statements may relate to, but are not limited to, statements

regarding our financial outlook for the first fiscal quarter and

full fiscal year 2025, including our expectations regarding the

number of Net New Restaurant Openings, revenue, Same-Store Sales

Change, Restaurant-Level Profit Margin and Adjusted EBITDA; and our

plans to introduce a new loyalty program, innovate new menu items

and increase paid media. Forward-looking statements are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. In some cases, you can identify

forward-looking statements because they contain words such as

“anticipate,” “are confident that,” “believe,” “contemplate,”

“continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potential,” “predict,” “project,” “should,” “target,” “will,” or

“would,” or the negative of these words or other similar terms or

expressions. You should not put undue reliance on any

forward-looking statements. Forward-looking statements should not

be read as a guarantee of future performance or results and will

not necessarily be accurate indications of the times at, or by,

which such performance or results will be achieved, if at all.

Forward-looking statements are based on information available at

the time those statements are made and are based on current

expectations, estimates, forecasts, and projections as well as the

beliefs and assumptions of management as of that time with respect

to future events. These statements are subject to risks and

uncertainties, many of which involve factors or circumstances that

are beyond our control, that could cause actual performance or

results to differ materially from those expressed in or suggested

by the forward-looking statements. In addition, new risks and

uncertainties emerge from time to time, and it is not possible for

us to predict all risks and uncertainties that could have an impact

on the forward-looking statements. In light of these risks and

uncertainties, the forward-looking events and circumstances

discussed in this press release and the related conference call may

not occur and actual results could differ materially from those

described in the forward-looking statements. These risks and

uncertainties include our ability to compete effectively,

uncertainties regarding changes in economic conditions and

macroeconomic, geopolitical and other major events, which may

include pandemics and disease outbreaks, and the customer behavior

trends they drive, our ability to open new restaurants, our ability

to effectively identify and secure appropriate sites for new

restaurants, our ability to expand into new markets and the risks

such expansion presents, the impact of severe weather conditions or

natural disasters on our restaurant sales and results of

operations, the profitability of new restaurants we may open, and

the impact of any such openings on sales at our existing

restaurants, our ability to preserve the value of our brand, food

safety and foodborne illness concerns, our ability to achieve

profitability in the future, our ability to build, deploy, and

maintain our proprietary kitchen automation technology, known as

the Infinite Kitchen, in a timely and cost-effective manner, the

effect on our business of increases in labor costs, labor

shortages, and difficulties in hiring, training, rewarding and

retaining a qualified workforce, our ability to identify, complete,

and integrate acquisitions, the effect on our business of

governmental regulation and changes in employment laws, the effect

on our business of expenses and potential management distraction

associated with litigation, potential privacy and cybersecurity

incidents, the effect on our business of restrictions and costs

imposed by privacy, data protection, and data security laws,

regulations, and industry standards, and our ability to enforce our

rights in our intellectual property. Additional information

regarding these and other risks and uncertainties that could cause

actual results to differ materially from the Company's expectations

is included in our SEC reports, including in our Annual Report on

Form 10-K to be filed for the fiscal year ended December 29, 2024

and subsequently filed quarterly reports on Form 10-Q. Except as

required by law, we do not undertake any obligation to publicly

update or revise any forward-looking statement, whether as a result

of new information, future developments, or otherwise.

Additional information regarding these and other factors that

could affect the Company’s results is included in the Company’s SEC

filings, which may be obtained by visiting the SEC's website at

www.sec.gov. Information contained on, or that is referenced or can

be accessed through, our website does not constitute part of this

document and inclusions of any website addresses herein are

inactive textual references only.

Glossary

- Average Unit Volume (“AUV”) - AUV is defined as

the average trailing revenue for the prior four fiscal quarters for

all restaurants in the Comparable Restaurant Base.

- Comparable Restaurant Base - Comparable

Restaurant Base for any measurement period is defined as all

restaurants that have operated for at least twelve full months as

of the end of such measurement period, other than any restaurants

that had a material, temporary closure during the relevant

measurement period. A restaurant is considered to have had a

material, temporary closure if it had no operations for a

consecutive period of at least 30 days. Fiscal year 2023 was a

53-week year, in order to provide a measurement period that is

consistent with comparable periods that span a 52-week year, rather

than simply excluding the extra week, we applied an averaging

methodology to the last period of fiscal 2023 to adjust for the

extra week. One restaurant was excluded from our Comparable

Restaurant Base as of the end of fiscal year 2024. Such adjustment

did not result in a material change to our key performance metrics.

No restaurants were excluded from our Comparable Restaurant Base as

of the end of fiscal year 2023.

- Net New Restaurant Openings - Net New Restaurant

Openings reflect the number of new Sweetgreen restaurant openings

during a given reporting period, net of any permanent Sweetgreen

restaurant closures during the same period.

- Same-Store Sales Change - Same-Store Sales Change

reflects the percentage change in year-over-year revenue for the

relevant fiscal period for all restaurants that have operated for

at least 13 full fiscal months as of the end of such fiscal period

excluding the 53rd week in any 53-week fiscal year; provided, that

for any restaurant that has had a temporary closure (which

historically has been defined as a closure of at least five days

during which the restaurant would have otherwise been open) during

any prior or current fiscal month, such fiscal month, as well as

the corresponding fiscal month for the prior or current fiscal

year, as applicable, will be excluded when calculating Same-Store

Sales Change for that restaurant. Fiscal year 2023 was a 53-week

year, which resulted in a misalignment in our comparable weeks in

fiscal year 2024. To adjust for this misalignment, in calculating

Same-Store Sales Change for each fiscal quarter and the full fiscal

year 2024, we shifted each week within fiscal year 2023 forward by

one week to better align with the 2024 calendar year, specifically

to match the timing of holidays and achieve a more accurate

comparable Same-Store Sales Change to the prior period. During

fiscal year 2024, we excluded eight restaurants from our Same-Store

Sales Change to reflect the temporary closure of such restaurants.

During fiscal year 2023, we excluded two restaurants from our

Same-Store Sales Change to reflect the temporary closure of such

restaurants. These adjustments, did not result in a material change

to Same-Store Sales Change for fiscal years 2024 or 2023.

- Total Digital Revenue Percentage and Owned Digital Revenue

Percentage - Our Total Digital Revenue Percentage is the

percentage of our revenue attributed to purchases made through our

Total Digital Channels. Our Owned Digital Revenue Percentage is the

percentage of our revenue attributed to purchases made through our

Owned Digital Channels.

Non-GAAP Financial

Measures

In addition to our consolidated financial statements, which are

presented in accordance with GAAP, we present certain non-GAAP

financial measures, including Restaurant-Level Profit,

Restaurant-Level Profit Margin, Adjusted EBITDA, and Adjusted

EBITDA Margin. We believe these measures are useful to investors

and others in evaluating our performance because these

measures:

- facilitate operating performance comparisons from period to

period by isolating the effects of some items that vary from period

to period without any correlation to core operating performance or

that vary widely among similar companies. These potential

differences may be caused by variations in capital structures

(affecting interest expense), tax positions (such as the impact on

periods or companies of changes in effective tax rates or NOL), and

the age and book depreciation of facilities and equipment

(affecting relative depreciation expense);

- are widely used by analysts, investors, and competitors to

measure a company’s operating performance; are used by our

management and board of directors for various purposes, including

as measures of performance and as a basis for strategic planning

and forecasting; and

- are used internally for a number of benchmarks including to

compare our performance to that of our competitors.

We define Restaurant-Level Profit as loss from operations

adjusted to exclude general and administrative expense,

depreciation and amortization, pre-opening costs, loss on disposal

of property and equipment, and, in certain periods, impairment and

closure costs and restructuring charges. Restaurant-Level Profit

Margin is Restaurant-Level Profit as a percentage of revenue. As it

excludes general and administrative expense, which is primarily

attributable to our corporate headquarters, which we refer to as

our Sweetgreen Support Center, we evaluate Restaurant-Level Profit

and Restaurant-Level Profit Margin as a measure of profitability of

our restaurants.

We define Adjusted EBITDA as net loss adjusted to exclude income

tax (benefit) expense, interest income, interest expense,

depreciation and amortization, stock-based compensation expense,

loss on disposal of property and equipment, other (income) expense,

Spyce acquisition costs, our enterprise resource planning system

(“ERP”) implementation and related costs, legal settlements, and

certain other expenses during the period that management determines

are not indicative of ongoing operating performance and, in certain

periods, impairment and closure costs, restructuring charges, and

employer portion of founder performance stock unit payroll taxes.

Adjusted EBITDA Margin is Adjusted EBITDA as a percentage of

revenue.

Restaurant-Level Profit, Restaurant-Level Profit Margin,

Adjusted EBITDA, and Adjusted EBITDA Margin have limitations as

analytical tools, and you should not consider them in isolation or

as substitutes for analysis of our results as reported under GAAP.

In particular, Restaurant-Level Profit and Adjusted EBITDA should

not be viewed as substitutes for, or superior to, loss from

operations or net loss prepared in accordance with GAAP as a

measure of profitability. Some of these limitations are:

- although depreciation and amortization are non-cash charges,

the assets being depreciated and amortized may have to be replaced

in the future, and Restaurant-Level Profit and Adjusted EBITDA do

not reflect all cash capital expenditure requirements for such

replacements or for new capital expenditure requirements;

- Restaurant-Level Profit and Adjusted EBITDA do not reflect

changes in, or cash requirements for, our working capital

needs;

- Restaurant-Level Profit and Adjusted EBITDA do not reflect the

impact of the recording or release of valuation allowances or tax

payments that may represent a reduction in cash available to

us;

- Restaurant-Level Profit and Adjusted EBITDA do not consider the

potentially dilutive impact of stock-based compensation;

- Restaurant-Level Profit is not indicative of overall results of

the Company and does not accrue directly to the benefit of

stockholders, as corporate-level expenses are excluded;

- Adjusted EBITDA does not take into account any income or costs

that management determines are not indicative of ongoing operating

performance, such as stock-based compensation; loss on disposal of

property and equipment; other (income) expense; Spyce acquisition

costs; ERP implementation and related costs; legal settlements;

and, certain other expenses during the period that management

determines are not indicative of ongoing operating performance;

and

- other companies, including those in our industry, may calculate

Restaurant-Level Profit and Adjusted EBITDA differently, which

reduces their usefulness as comparative measures.

Because of these limitations, you should consider

Restaurant-Level Profit, Restaurant-Level Profit Margin, Adjusted

EBITDA and Adjusted EBITDA Margin alongside other financial

performance measures, loss from operations, net loss, and our other

GAAP results.

About Sweetgreen

Sweetgreen (NYSE: SG) is on a mission to build healthier

communities by connecting people to real food. Sweetgreen sources

the best quality ingredients from farmers and suppliers they trust

to cook food from scratch that is both delicious and nourishing.

They plant roots in each community by building a transparent supply

chain, investing in local farmers and growers, and enhancing the

total experience with innovative technology. Since opening its

first 560-square-foot location in 2007, Sweetgreen has scaled to

over 245 locations across the United States, and their vision is to

lead the next generation of restaurants and lifestyle brands built

on quality, community and innovation. To learn more about

Sweetgreen, its menu, and its loyalty program, visit

www.Sweetgreen.com. Follow @Sweetgreen on Instagram, Facebook and X

(formerly Twitter).

SWEETGREEN, INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

(UNAUDITED)

(in thousands, except share and

per share amounts)

December 29,

2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

214,789

$

257,230

Accounts receivable

5,034

3,502

Inventory

1,987

2,069

Prepaid expenses

7,844

5,767

Current portion of lease acquisition

costs

93

93

Other current assets

4,790

7,450

Total current assets

234,537

276,111

Operating lease assets

257,496

243,992

Property and equipment, net

296,485

266,902

Goodwill

35,970

35,970

Intangible assets, net

24,040

27,407

Security deposits

1,419

1,406

Lease acquisition costs, net

333

426

Restricted cash

2,640

125

Other assets

3,838

4,218

Total assets

$

856,758

$

856,557

LIABILITIES AND STOCKHOLDERS’ (DEFICIT)

EQUITY

Current liabilities:

Current portion of operating lease

liabilities

41,773

31,426

Accounts payable

18,698

17,380

Accrued expenses

26,564

20,845

Accrued payroll

14,716

13,131

Gift cards and loyalty liability

4,413

2,797

Other current liabilities

9,663

6,000

Total current liabilities

115,827

91,579

Operating lease liabilities, net of

current portion

288,941

271,439

Contingent consideration liability

5,311

8,350

Other non-current liabilities

173

819

Deferred income tax liabilities

361

1,773

Total liabilities

$

410,613

$

373,960

Stockholders’ (deficit) equity:

Common stock, $0.001 par value,

2,000,000,000 Class A shares authorized, 105,200,553 and 99,700,052

Class A shares issued and outstanding as of December 29, 2024 and

December 31, 2023, respectively; 300,000,000 Class B shares

authorized and 11,915,758 and 12,939,094 Class B shares issued and

outstanding as of December 29, 2024 and December 31, 2023,

respectively.

117

113

Additional paid-in capital

1,321,386

1,267,469

Accumulated deficit

(875,358

)

(784,985

)

Total stockholders’ (deficit) equity

446,145

482,597

Total liabilities and stockholders’

(deficit) equity

$

856,758

$

856,557

SWEETGREEN, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

(in thousands, except share and

per share amounts)

Fiscal Quarter Ended

December 29, 2024(1)

December 31, 2023(1)

Revenue

$

160,904

100

%

$

153,026

100

%

Restaurant operating costs (exclusive of

depreciation and amortization presented separately below):

Food, beverage, and packaging

44,060

27

%

43,392

28

%

Labor and related expenses

45,913

29

%

44,800

29

%

Occupancy and related expenses

15,013

9

%

14,164

9

%

Other restaurant operating costs

27,966

17

%

25,889

17

%

Total restaurant operating costs

132,952

83

%

128,245

84

%

Operating expenses:

General and administrative

37,098

23

%

35,542

23

%

Depreciation and amortization

17,277

11

%

16,181

11

%

Pre-opening costs

2,321

1

%

1,073

1

%

Impairment and closure costs

1,830

1

%

145

—

%

Loss on disposal of property and

equipment

77

—

%

140

—

%

Restructuring charges

779

—

%

989

1

%

Total operating expenses

59,382

37

%

54,070

35

%

Loss from operations

(31,430

)

(20

)%

(29,289

)

(19

)%

Interest income

(2,252

)

(1

)%

(3,248

)

(2

)%

Interest expense

14

—

%

70

—

%

Other expense

1,409

1

%

1,878

1

%

Net loss before income taxes

(30,601

)

(19

)%

(27,989

)

(18

)%

Income tax (benefit) expense

(1,571

)

(1

)%

(575

)

—

%

Net loss

$

(29,030

)

(18

)%

$

(27,414

)

(18

)%

Earnings per share:

Net loss per share, basic and diluted

$

(0.25

)

$

(0.24

)

Weighted average shares used in computing

net loss per share, basic and diluted

116,055,620

112,519,663

(1)

We operate on a 52/53 week fiscal year end

that ends on the last Sunday of the calendar year. Fiscal year 2024

contained 52 weeks. Fiscal year 2023 was a 53-week year with the

extra operating week (the “53rd week”) falling in our fourth fiscal

quarter.

SWEETGREEN, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

(UNAUDITED)

(in thousands, except share and

per share amounts)

Fiscal Year Ended

December 29, 2024(1)

December 31, 2023(1)

Revenue

$

676,826

100

%

$

584,041

100

%

Restaurant operating costs (exclusive of

depreciation and amortization presented separately below):

Food, beverage, and packaging

185,367

27

%

161,725

28

%

Labor and related expenses

188,867

28

%

171,306

29

%

Occupancy and related expenses

59,536

9

%

54,281

9

%

Other restaurant operating costs

110,107

16

%

94,809

16

%

Total restaurant operating costs

543,877

80

%

482,121

83

%

Operating expenses:

General and administrative

149,942

22

%

146,762

25

%

Depreciation and amortization

67,346

10

%

59,491

10

%

Pre-opening costs

6,616

1

%

9,263

2

%

Impairment and closure costs

2,218

—

%

624

—

%

Loss on disposal of property and

equipment

255

—

%

687

—

%

Restructuring charges

2,276

—

%

7,437

1

%

Total operating expenses

228,653

34

%

224,264

38

%

Loss from operations

(95,704

)

(14

)%

(122,344

)

(21

)%

Interest income

(10,942

)

(2

)%

(12,942

)

(2

)%

Interest expense

256

—

%

128

—

%

Other expense

6,656

1

%

3,475

1

%

Net loss before income taxes

(91,674

)

(14

)%

(113,005

)

(19

)%

Income tax (benefit) expense

(1,301

)

—

%

379

—

%

Net loss

$

(90,373

)

(13

)%

$

(113,384

)

(19

)%

Earnings per share:

Net loss per share, basic and diluted

$

(0.79

)

$

(1.01

)

Weighted average shares used in computing

net loss per share, basic and diluted

114,321,672

111,907,675

(1)

We operate on a 52/53 week fiscal year end

that ends on the last Sunday of the calendar year. Fiscal year 2024

contained 52 weeks. Fiscal year 2023 was a 53-week year with the

53rd week falling in our fourth fiscal quarter.

SWEETGREEN, INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(UNAUDITED)

(in thousands)

Fiscal Year Ended

December 29, 2024

December 31, 2023

Cash flows from operating activities:

Net loss

$

(90,373

)

$

(113,384

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

67,346

59,491

Amortization of lease acquisition

costs

93

92

Amortization of loan origination fees

71

55

Amortization of cloud computing

arrangements

914

880

Non-cash operating lease cost

31,475

29,113

Loss on disposal of property and

equipment

255

687

Stock-based compensation

39,024

49,532

Impairment and closure costs

1,835

90

Non-cash restructuring charges

701

5,281

Deferred income tax (benefit) expense

(1,412

)

358

Change in fair value of contingent

consideration

6,624

3,475

Changes in operating assets and

liabilities:

Account receivable

(1,532

)

(258

)

Inventory

82

(686

)

Prepaid expenses and other current

assets

(22

)

(3,789

)

Operating lease liabilities

(18,318

)

(22,290

)

Accounts payable

759

9,871

Accrued payroll and benefits

1,585

6,551

Accrued expenses

3,313

1,163

Gift card and loyalty liability

1,616

781

Other non-current liabilities

(646

)

(533

)

Net cash provided by (used in) operating

activities

43,390

26,480

Cash flows from investing activities:

Purchase of property and equipment

(84,457

)

(89,672

)

Purchase of intangible assets

(7,741

)

(6,115

)

Security and landlord deposits

(13

)

122

Net cash used in investing activities

(92,211

)

(95,665

)

Cash flows from financing activities:

Proceeds from stock option exercise

12,765

5,388

Payment of contingent consideration

(3,868

)

(10,421

)

Payment of loan origination fees

—

—

Payment associated to shares repurchased

for tax withholding

(2

)

(166

)

Net cash (used in) provided by financing

activities

8,895

(5,199

)

Net decrease in cash and cash equivalents

and restricted cash

(39,926

)

(74,384

)

Cash and cash equivalents and restricted

cash—beginning of year

$

257,355

331,739

Cash and cash equivalents and restricted

cash—end of year

$

217,429

$

257,355

Supplemental disclosure of cash

flow:

Cash paid for interest

$

184

$

50

Non-cash investing and financing

activities:

Purchase of property and equipment accrued

in accounts payable and accrued expenses

$

9,791

$

6,824

Non-cash issuance of common stock

associated with Spyce milestone achievement

$

2,132

$

—

SWEETGREEN INC. AND

SUBSIDIARIES

SUPPLEMENTAL FINANCIAL AND

OTHER DATA

(UNAUDITED)

(dollars in thousands)

Fiscal Quarter Ended

Fiscal Year Ended

December 29, 2024(1)

December 31, 2023(1)

December 29, 2024(1)

December 31, 2023(1)

(unaudited)

(unaudited)

(unaudited)

(unaudited)

SELECTED OPERATING DATA:

Net New Restaurant Openings

10

1

25

35

Average Unit Volume (as

adjusted)(2)(4)

$

2,924

$

2,877

$

2,924

$

2,877

Same-Store Sales Change (%)(3)(4)

4

%

6

%

6

%

4

%

Total Digital Revenue Percentage

56

%

58

%

56

%

59

%

Owned Digital Revenue Percentage

29

%

34

%

30

%

36

%

(1)

We operate on a 52/53 week fiscal year end

that ends on the last Sunday of the calendar year. Fiscal year 2024

contained 52 weeks. Fiscal year 2023 was a 53-week year with the

53rd week falling in our fourth fiscal quarter.

(2)

Our results for the fiscal year ended

December 29, 2024 have been adjusted to reflect the temporary

closures of one restaurant which was excluded from the Comparable

Restaurant Base. Such adjustment did not result in a material

change to AUV. No restaurants were excluded from the Comparable

Restaurant Base as of the end of fiscal year 2023.

(3)

Our results for the fiscal quarters ended

December 29, 2024 and December 31, 2023, have been adjusted to

reflect the temporary closures of three and two restaurants,

respectively, which did not have a material impact on our

Same-Store Sales Change. Our results for the fiscal years ended

December 29, 2024 and December 31, 2023, have been adjusted to

reflect the temporary closures of eight and two restaurants,

respectively, which did not have a material impact on our

Same-Store Sales Change.

(4)

For fiscal year 2023, average unit volume

and same-store sales change were adjusted to exclude the 53rd week

of operations.

SWEETGREEN, INC. AND SUBSIDIARIES

RECONCILIATION OF GAAP TO NON-GAAP MEASURES

(Unaudited) (dollars in thousands)

The following table sets forth a reconciliation of our loss from

operations to Restaurant-Level Profit, as well as the calculation

of loss from operations margin and Restaurant-Level Profit Margin

for each of the periods indicated:

Fiscal Quarter Ended

Fiscal Year Ended

December 29, 2024(1)

December 31, 2023(1)

December 29, 2024(1)

December 31, 2023(1)

Loss from operations

$

(31,430

)

$

(29,289

)

$

(95,704

)

$

(122,344

)

Add back:

General and administrative

37,098

35,542

149,942

146,762

Depreciation and amortization

17,277

16,181

67,346

59,491

Pre-opening costs

2,321

1,073

6,616

9,263

Impairment and closure costs

1,830

145

2,218

624

Loss on disposal of property and

equipment(2)

77

140

255

687

Restructuring charges(3)

779

989

2,276

7,437

Restaurant-Level Profit

$

27,952

$

24,781

$

132,949

$

101,920

Loss from operations margin

(20

)%

(19

)%

(14

)%

(21

)%

Restaurant-Level Profit Margin

17

%

16

%

20

%

17

%

(1)

We operate on a 52/53 week fiscal year end

that ends on the last Sunday of the calendar year. Fiscal year 2024

contained 52 weeks. Fiscal year 2023 was a 53-week year with the

53rd week falling in our fourth fiscal quarter.

(2)

Loss on disposal of property and equipment

includes the loss on disposal of assets related to retirements and

replacement or write-off of leasehold improvements or

equipment.

(3)

Restructuring charges are expenses that

are paid in connection with reorganization of our operations. These

costs primarily include lease and related costs associated with our

vacated former Sweetgreen Support Center, including the impairment

and the amortization of the operating lease asset.

The following table sets forth a reconciliation of our net loss

to Adjusted EBITDA, as well as the calculation of net loss margin

and Adjusted EBITDA Margin for each of the periods indicated:

Fiscal Quarter Ended

Fiscal Year Ended

December 29, 2024(1)

December 31, 2023(1)

December 29, 2024(1)

December 31, 2023(1)

Net loss

$

(29,030

)

$

(27,414

)

$

(90,373

)

$

(113,384

)

Non-GAAP adjustments:

Income tax expense

(1,571

)

(575

)

(1,301

)

379

Interest income

(2,252

)

(3,248

)

(10,942

)

(12,942

)

Interest expense

14

70

256

128

Depreciation and amortization

17,277

16,181

67,346

59,491

Stock-based compensation(2)

8,810

9,399

39,024

49,532

Loss on disposal of property and

equipment(3)

77

140

255

687

Impairment and closure costs(4)

1,830

145

2,218

624

Other expense/(income)(5)

1,409

1,878

6,656

3,475

Spyce acquisition costs(6)

—

2

—

472

Restructuring charges(7)

779

989

2,276

7,437

ERP implementation and related

costs(8)

232

224

914

881

Legal settlements(9)

1,290

360

1,326

425

Employer portion of the founder

performance stock unit payroll taxes(10)

562

—

1,053

—

Adjusted EBITDA

$

(573

)

$

(1,849

)

$

18,708

$

(2,795

)

Net loss margin

(18

)%

(18

)%

(13

)%

(19

)%

Adjusted EBITDA Margin

—

%

(1

)%

3

%

—

%

(1)

We operate on a 52/53 week fiscal year end

that ends on the last Sunday of the calendar year. Fiscal year 2024

contained 52 weeks. Fiscal year 2023 was a 53-week year with the

53rd week falling in our fourth fiscal quarter.

(2)

Includes non-cash, stock-based

compensation.

(3)

Loss on disposal of property and equipment

includes the loss on disposal of assets related to retirements and

replacement or write-off of leasehold improvements or

equipment.

(4)

Includes costs related to impairment of

long-lived and operating lease assets and store closures.

(5)

Other expense includes the change in fair

value of the contingent consideration issued as part of the Spyce

acquisition.

(6)

Spyce acquisition costs includes one-time

costs we incurred in order to acquire Spyce including, severance

payments, retention bonuses, and valuation and legal expenses.

(7)

Restructuring charges are expenses that

are paid in connection with the reorganization of our operations.

These costs primarily include lease and related non-cash expenses

associated with our vacated former Sweetgreen Support Center,

including the impairment and amortization of the operating lease

asset.

(8)

Represents the amortization costs

associated with the implementation of our cloud computing

arrangements in relation to our ERP system.

(9)

Expenses recorded for accruals related to

the settlements of legal matters.

(10)

Includes the employer portion of payroll

taxes related to the vesting of 600,000 performance stock units

released to each founder during the fiscal year ended December 29,

2024.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250226726640/en/

Sweetgreen Contact, Investor Relations: Rebecca Nounou

ir@sweetgreen.com

Sweetgreen Contact, Media: Jenny Seltzer

press@sweetgreen.com

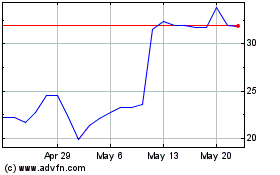

Sweetgreen (NYSE:SG)

Historical Stock Chart

From Feb 2025 to Mar 2025

Sweetgreen (NYSE:SG)

Historical Stock Chart

From Mar 2024 to Mar 2025