UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of June 2023

Commission File Number: 001-41253

Super Group (SGHC) Limited

(Translation of registrant’s name into English)

Super Group (SGHC) Limited

Bordeaux Court, Les Echelons

St. Peter Port, Guernsey, GY1 1AR

Telephone: +44 (0) 14 8182-2939

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

CONTENTS

On August 17, 2023, Super Group (SGHC) Limited issued a press release announcing its financial results for the second quarter of 2023. A copy of the press release, which includes an unaudited condensed consolidated statement of financial position as at June 30, 2023 and unaudited condensed consolidated statements of profit or loss and other comprehensive income for the three and six months ended June 30, 2023 and 2022, is attached hereto as Exhibit 99.1.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | SUPER GROUP (SGHC) LIMITED |

| | | |

Date: August 17, 2023 | | By: | /s/ Robert James Dutnall |

| | Name: | Robert James Dutnall |

| | Title: | Authorized Signatory |

EXHIBIT INDEX

| | | | | | | | |

| | |

Exhibit No. | | Description |

| |

99.1 | | Press Release, dated August 17, 2023. |

Super Group Reports Second Quarter 2023 Financial Results

Second Quarter Highlights:

| | | | | | | | |

• | | Revenue of €380.8 million |

| | | | | | | | |

• | | Profit for the period of €27.6 million includes a non-cash charge of €6.1 million arising from the change in fair value of option liability |

| | | | | | | | |

• | | Operational EBITDA ex-US of €82.6 million and a loss of €12.6 million from the US amounted to Operational EBITDA of €70.0 million |

New York, NY – August 17, 2023 – Super Group (SGHC) Limited (NYSE: SGHC) (“SGHC” or “Super Group”), the parent company of Betway, a leading online sports betting and gaming business, and Spin, the multi-brand online casino, today announced second quarter 2023 consolidated financial results.

Neal Menashe, Chief Executive Officer of Super Group, commented: “Super Group has delivered financial results that reflect our ongoing focus on both an optimized global footprint and investment in long-term growth. This quarter's strong revenue performance has delivered enhanced economies of scale in multiple markets, resulting in significant year-over-year growth in Operational EBITDA, ex-US. We remain confident in our business model and focused in our search for future growth opportunities in the global online casino and sports betting industry.”

Alinda van Wyk, Chief Financial Officer of Super Group, stated: “Our second quarter results, ex-US included record revenue and solid Operational EBITDA of €82.6 million. Our monthly active customer numbers continue to show momentum reaching 3.7 million which we believe is a key driver for future growth. Achieving scale in each of our markets, combined with driving cost efficiencies throughout the business remain our focus for long-term growth and bringing us back to consistent ex-US EBITDA margin from operations of greater than 20%. With regards to the US, the business is tracking in-line with expectations and we are confident in our strategy."

Financial Highlights

•Revenue increased by 19% to €380.8 million for the second quarter 2023 from €320.8 million in the same period from the prior year driven by growth from Africa and Middle East and European markets partially offset by declines from North America (predominantly in Canada due to regulatory changes in Ontario) and Asia-Pacific markets.

•Profit for the period for the second quarter 2023 was €27.6 million, which included a non-cash charge of €6.1 million related to the increase in fair value of a liability for a call option granted to a third-party to purchase the B2B division of Digital Gaming Corporation Limited ("DGC"), which Super Group acquired in January 2023. Profit for the period of €298.6 million for the second quarter of 2022 included the positive impact of non-cash adjustments of €283.3 million related to the business combination and SGHC's public listing on January 27, 2022.

•Operational EBITDA was €70.0 million for the second quarter 2023 compared to €53.6 million in the second quarter of 2022. The measure for the second quarter 2023 was comprised of €82.6 million ex-US and a loss of €12.6 million in the US.

•Monthly Active Customers increased 40% to 3.7 million during the second quarter 2023 from 2.7 million in the second quarter of 2022.

•Cash and cash equivalents was €228.7 million at June 30, 2023, down from €254.8 million at December 31, 2022. This net reduction during the second quarter 2023 was the result of:

◦Inflows from operating activities amounting to €53.2 million;

◦Inflows from investing activities of €54.1 million. This was mainly attributable to a transfer of €138.5 million of restricted cash for the DGC bank lending facility into the available cash balance, reduced by a preceding injection into the facility of €18.6 million. There was an additional increase of €3.9 million resulting from interest and receipts from loans receivable. These increases were offset by the further investment in tangible and intangible assets of €25.7 million, predominantly due to the capitalization expenditure on software; issuance of

loans of €39.8 million to Apricot Investments Limited; as well as the cash paid on the acquisition of DGC of €11.7 million net of €7.7 million acquired from DGC;

◦Outflows from financing activities of €125.2 million was primarily due to DGC settling its bank lending facility of €139.5 million, offset by proceeds from interest-bearing borrowings of €18.5 million; and

◦A loss of €8.1 million was a result of foreign currency fluctuations on foreign cash balances held over this period.

Revenue by Geographical Region for the Three Months Ended June 30, 2023 in € ‘000s:

| | | | | | | | | | | |

| |

Betway

|

Spin

|

Total

|

| Africa and Middle East | 110,029 | 298 | 110,327 |

| Asia-Pacific | 41,142 | 27,973 | 69,115 |

| Europe | 36,519 | 20,608 | 57,127 |

| North America | 37,590 | 99,514 | 137,104 |

| South/Latin America | 3,657 | 3,459 | 7,116 |

| Total revenue | 228,937 | 151,852 | 380,789 |

| | % | % | % |

| Africa and Middle East | 48 | % | — | % | 29 | % |

| Asia-Pacific | 18 | % | 18 | % | 18 | % |

| Europe | 16 | % | 14 | % | 15 | % |

| North America | 16 | % | 66 | % | 36 | % |

| South/Latin America | 2 | % | 2 | % | 2 | % |

Revenue by Geographical Region for the Three Months Ended June 30, 2022 in € ‘000s:

| | | | | | | | | | | |

| |

Betway

|

Spin

|

Total

|

| Africa and Middle East | 62,914 | 660 | 63,574 |

| Asia-Pacific | 50,756 | 26,632 | 77,388 |

| Europe | 28,516 | 1,993 | 30,509 |

| North America | 32,616 | 109,513 | 142,129 |

| South/Latin America | 3,893 | 3,323 | 7,216 |

| Total revenue | 178,695 | 142,121 | 320,816 |

| | % | % | % |

| Africa and Middle East | 35 | % | — | % | 20 | % |

| Asia-Pacific | 28 | % | 19 | % | 24 | % |

| Europe | 16 | % | 1 | % | 10 | % |

| North America | 19 | % | 78 | % | 44 | % |

| South/Latin America | 2 | % | 2 | % | 2 | % |

Revenue by Geographical Region for the Six Months Ended June 30, 2023 in € ‘000s:

| | | | | | | | | | | |

| |

Betway

|

Spin

|

Total

|

| Africa and Middle East | 197,453 | 752 | 198,205 |

| Asia-Pacific | 76,190 | 50,922 | 127,112 |

| Europe | 71,008 | 41,946 | 112,954 |

| North America | 75,245 | 192,065 | 267,310 |

| South/Latin America | 7,333 | 6,396 | 13,729 |

| Total revenue | 427,229 | 292,081 | 719,310 |

| | % | % | % |

| Africa and Middle East | 46 | % | — | % | 28 | % |

| Asia-Pacific | 17 | % | 18 | % | 17 | % |

| Europe | 17 | % | 14 | % | 16 | % |

| North America | 18 | % | 66 | % | 37 | % |

| South/Latin America | 2 | % | 2 | % | 2 | % |

Revenue by Geographical Region for the Six Months Ended June 30, 2022 in € ‘000s:

| | | | | | | | | | | |

| |

Betway

|

Spin

|

Total

|

| Africa and Middle East | 126,700 | 1,996 | 128,696 |

| Asia-Pacific | 105,410 | 50,620 | 156,030 |

| Europe | 58,708 | 4,520 | 63,228 |

| North America | 67,679 | 225,498 | 293,177 |

| South/Latin America | 7,178 | 6,986 | 14,164 |

| Total revenue | 365,675 | 289,620 | 655,295 |

| | % | % | % |

| Africa and Middle East | 35 | % | 1 | % | 20 | % |

| Asia-Pacific | 29 | % | 17 | % | 24 | % |

| Europe | 16 | % | 2 | % | 10 | % |

| North America | 18 | % | 78 | % | 44 | % |

| South/Latin America | 2 | % | 2 | % | 2 | % |

Revenue by product line for the Three Months Ended June 30, 2023 in € ‘000s:

| | | | | | | | | | | |

| | Betway | Spin | Total |

Online casino1 | 72,028 | | 151,620 | | 223,648 | |

Sports betting1 | 143,012 | | 1 | | 143,013 | |

Brand licensing2 | 8,316 | | — | | 8,316 | |

Other3 | 5,581 | | 231 | | 5,812 | |

| Total revenue | 228,937 | | 151,852 | | 380,789 | |

Revenue by product line for the Three Months Ended June 30, 2022 in € ‘000s:

| | | | | | | | | | | |

| | Betway | Spin | Total |

Online casino1 | 62,139 | | 142,174 | | 204,313 | |

Sports betting1 | 110,740 | | (53) | | 110,687 | |

Brand licensing2 | 5,766 | | — | | 5,766 | |

Other3 | 50 | | — | | 50 | |

| Total revenue | 178,695 | | 142,121 | | 320,816 | |

1 Sports betting and online casino revenues are not within the scope of IFRS 15 ‘Revenue from Contracts with Customers’ and are treated as derivatives under IFRS 9 ‘Financial Instruments’.

2 Brand licensing revenues are within the scope of IFRS 15 ‘Revenue from Contracts with Customers’.

3 Other relates to profit share, royalties and outsource fees from external customers.

Revenue by product line for the Six Months Ended June 30, 2023 in € ‘000s:

| | | | | | | | | | | |

| | Betway | Spin | Total |

Online casino1 | 138,172 | | 291,595 | | 429,767 | |

Sports betting1 | 261,294 | | 46 | | 261,340 | |

Brand licensing2 | 17,148 | | — | | 17,148 | |

Other3 | 10,615 | | 440 | | 11,055 | |

| Total revenue | 427,229 | | 292,081 | | 719,310 | |

Revenue by product line for the Six Months Ended June 30, 2022 in € ‘000s:

| | | | | | | | | | | |

| | Betway | Spin | Total |

Online casino1 | 119,595 | | 289,220 | | 408,815 | |

Sports betting1 | 219,777 | | 400 | | 220,177 | |

Brand licensing2 | 25,656 | | — | | 25,656 | |

Other3 | 647 | | — | | 647 | |

| Total revenue | 365,675 | | 289,620 | | 655,295 | |

1 Sports betting and online casino revenues are not within the scope of IFRS 15 ‘Revenue from Contracts with Customers’ and are treated as derivatives under IFRS 9 ‘Financial Instruments’.

2 Brand licensing revenues are within the scope of IFRS 15 ‘Revenue from Contracts with Customers’.

3 Other relates to profit share, royalties and outsource fees from external customers.

Non-GAAP Financial Information

This press release includes non-GAAP financial information not presented in accordance with the International Financial Reporting Standards (“IFRS”).

EBITDA, Adjusted EBITDA and Operational EBITDA are non-GAAP company-specific performance measures that Super Group uses to supplement the Company’s results presented in accordance with IFRS. EBITDA is defined as profit before depreciation, amortization, financial income, financial expense and income tax expense/credit. Adjusted EBITDA is defined as EBITDA less gain on derivative contracts and gain on bargain purchase plus transaction costs, share listing expense, change in fair value of option, adjusted RSU expense and change in fair value of warrant liabilities and earnout liabilities, associated foreign exchange movements and unrealized foreign currency gains and losses. Operational EBITDA is Adjusted EBITDA further adjusted to exclude other non-recurring adjustments outside of the current year’s operations as may be deemed appropriate by the company’s audit committee.

Super Group believes that these non-GAAP measures are useful in evaluating the Company’s operating performance as they are similar to measures reported by the Company’s public competitors and are regularly used by securities analysts, institutional investors and other interested parties in analyzing operating performance and prospects.

Management does not consider these non-GAAP measures in isolation or as an alternative to financial measures determined in accordance with IFRS. The principal limitation of these non-GAAP financial measures is that they exclude significant expenses that are required by IFRS to be recorded in Super Group’s financial statements. In order to compensate for these limitations, management presents non-GAAP financial measures together with IFRS results. Non-GAAP measures should be considered in addition to results and guidance prepared in accordance with IFRS, but should not be considered a substitute for, or superior to, IFRS results.

Reconciliation tables of the most comparable IFRS financial measure to the non-GAAP financial measures used in this press release and supplemental materials are included below. Super Group urges investors to review the reconciliation and not to rely on any single financial measure to evaluate its business. In addition, other companies, including companies in our industry, may calculate similarly named non-GAAP measures differently than we do, which limits their usefulness in comparing our financial results with theirs.

Reconciliation of Profit after tax to EBITDA and Adjusted EBITDA and Operational EBITDA

in € ‘000s:

| | | | | | | | | | | | | | |

| Three Months ended June 30, | Six Months ended June 30, |

| 2023 | 2022 | 2023 | 2022 |

| Profit for the period | 27,559 | | 298,561 | | 25,636 | | 135,337 | |

| Income tax expense | 14,203 | | 5,623 | | 20,640 | | 14,582 | |

| Finance income | (2,070) | | (352) | | (3,266) | | (665) | |

| Finance expense | 537 | | 314 | | 1,084 | | 663 | |

| Depreciation and amortization expense | 20,311 | | 15,175 | | 41,755 | | 31,169 | |

| EBITDA | 60,540 | | 319,321 | | 85,849 | | 181,086 | |

| Transaction fees | — | | 207 | | — | | 21,611 | |

| Gain on derivative contracts | — | | — | | — | | (1,712) | |

| | | | |

| Share listing expense | — | | — | | — | | 126,252 | |

| Foreign exchange on revaluation of warrants and earnouts | — | | 24,029 | | — | | 24,029 | |

| Change in fair value of warrant liability | — | | (63,988) | | — | | (34,614) | |

| Change in fair value of earnout liability | — | | (219,321) | | — | | (194,936) | |

| Change in fair value of option | 6,087 | | — | | 8,278 | | — | |

| Adjusted RSU expense | 2,671 | | 3,376 | | 5,778 | | 3,376 | |

Unrealized foreign exchange1 | 725 | | (10,827) | | 4,074 | | (10,677) | |

| Adjusted EBITDA | 70,023 | | 52,797 | | 103,979 | | 114,415 | |

| Non recurring and non operational adjustments | 6 | | 818 | | 722 | | 2,377 | |

| Operational EBITDA | 70,029 | | 53,615 | | 104,701 | | 116,792 | |

| | | | |

| Operational EBITDA, ex-US | 82,674 | | 53,615 | | 133,929 | | 116,792 | |

| Operational EBITDA, US | (12,645) | | — | | (29,228) | | — | |

1 Unrealized foreign exchange movements has been reclassified in the Adjusted EBITDA calculation. This has resulted in a restatement of Adjusted EBITDA for all prior periods.

Webcast Details

The Company will host a webcast at 8:30 a.m. ET today to discuss the second quarter 2023 financial results. Participants may access the live webcast and supplemental earnings presentation on the events & presentations page of the Super Group Investor Relations website at: https://investors.sghc.com/events-and-presentations/default.aspx.

About Super Group (SGHC) Limited

Super Group (SGHC) Limited is the holding company for leading global online sports betting and gaming businesses: Betway, a premier online sports betting brand, and Spin, a multi-brand online casino offering. The group is licensed in multiple jurisdictions, with leading positions in key markets throughout Europe, the Americas and Africa. The group’s sports betting and online gaming offerings are underpinned by its scale and leading technology, enabling fast and effective entry into new markets. Its proprietary marketing and data analytics engine empowers it to responsibly provide a unique and personalized customer experience. For more information, visit www.sghc.com.

Contacts:

Investors:

investors@sghc.com

Media:

media@sghc.com

Source: Super Group

Forward-Looking Statements

Certain statements made in this press release are “forward looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995.

These forward-looking statements include, but are not limited to, expectations and timing related to market entries and expansion, projections of market opportunity, growth and profitability expected growth of Super Group’s customer base, expansion into new markets.

These forward-looking statements generally are identified by the words “believe,” “project,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “opportunity,” “plan,” “pipeline,” “may,” “should,” “will,” “would,” “will be,” “will continue,” “will likely result,” and similar expressions. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties. Many factors could cause actual future events to differ materially from the forward-looking statements in this press release, including but not limited to: (i) the ability to implement business plans, forecasts and other expectations, and identify and realize additional opportunities; (ii) the ability to maintain the listing of Super Group’s securities on a national securities exchange; (iii) changes in the competitive and regulated industries in which Super Group operates; (iv) variations in operating performance across competitors; (v) changes in laws and regulations affecting Super Group’s business; (vi) Super Group’s inability to meet or exceed its financial projections; (vii) changes in general economic conditions; (viii) changes in domestic and foreign business, market, financial, political and legal conditions; (ix) future global, regional or local economic and market conditions affecting the sports betting and gaming industry; (x) changes in existing laws and regulations, or their interpretation or enforcement, or the regulatory climate with respect to the sports betting and gaming industry; (xi) the ability of Super Group’s customers to deposit funds in order to participate in Super Group’s gaming products; (xii) compliance with regulatory requirements in a particular regulated jurisdiction, or Super Group’s ability to successfully obtain a license or permit applied for in a particular regulated jurisdiction, or maintain, renew or expand existing licenses; (xiii) the technological solutions Super Group has in place to block customers in certain jurisdictions, including jurisdictions where Super Group’s business is illegal, or which are sanctioned by countries in which Super Group operates from accessing its offerings; (xiv) Super Group’s ability to restrict and manage betting limits at the individual customer level based on individual customer profiles and risk level to the enterprise; (xv) the ability by Super Group’s key executives, certain employees or other individuals related to the business, including significant shareholders, to obtain the necessary licenses or comply with individual regulatory obligations in certain jurisdictions; (xvi) protection or enforcement of Super Group’s intellectual property rights, the confidentiality of its trade secrets and confidential information, or the costs involved in protecting or enforcing Super Group’s intellectual property rights and confidential information; (xvii) compliance with applicable data protection and privacy laws in Super Group’s collection, storage and use, including sharing and international transfers, of personal data; (xviii) failures, errors, defects or disruptions in Super Group’s information technology and other systems and platforms; (xix) Super Group’s ability to develop new products, services, and solutions, bring them to market in a timely manner, and make enhancements to its platform; (xx) Super Group’s ability to maintain and grow its market share, including its ability to enter new markets and acquire and retain paying customers; (xxi) the success, including win or hold rates, of existing and future online betting and gaming products; (xxii) competition within the broader entertainment industry; (xxiii) Super Group’s reliance on strategic relationships with land based casinos, sports teams, event planners, local licensing partners and advertisers; (xxiv) events or media coverage relating to, or the popularity of, online betting and gaming industry; (xxv) trading, liability management and pricing risk related to Super Group’s participation in the sports betting and gaming industry; (xxvi) accessibility to the services of banks, credit card issuers and payment processing services providers due to the nature of Super Group’s business; (xxvii) the regulatory approvals related to proposed acquisitions and the integration of the acquired businesses; and (xxviii) other risks and uncertainties indicated from time to time for Super Group including those under the heading “Risk Factors” in our Annual Report on Form 20-F filed with the SEC on April 27, 2023, and in Super Group’s other filings with the SEC. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described in other documents filed or that may be filed by Super Group from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and Super Group assumes no obligation and does not intend to update or revise these forward-looking statements, whether as a result of new information, future events, or otherwise. Super Group does not give any assurance that it will achieve its expectations.

Super Group (SGHC) Limited

Unaudited Consolidated Statements of Profit or Loss and Other Comprehensive Income

for the Three Months and Six Months Ended June 30, 2023 and 2022

(€ in '000s, except for share and profit per share)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three months ended June 30, | | Six Months Ended June 30 |

| 2023 | | 2022 | | 2023 | | 2022 |

| Revenue | 380,789 | | | 320,816 | | | 719,310 | | | 655,295 | |

| Direct and marketing expenses | (277,329) | | | (225,700) | | | (553,039) | | | (466,417) | |

| Other operating income | 1,028 | | | 2,886 | | | 2,309 | | | 5,293 | |

| General and administrative expenses | (37,861) | | | (37,754) | | | (74,453) | | | (72,455) | |

| Transaction fees | — | | | (207) | | | — | | | (21,611) | |

| Depreciation and amortization expense | (20,311) | | | (15,175) | | | (41,755) | | | (31,169) | |

| Profit from operations | 46,316 | | | 44,866 | | | 52,372 | | | 68,936 | |

| Finance income | 2,070 | | | 352 | | | 3,266 | | | 665 | |

| Finance expense | (537) | | | (314) | | | (1,084) | | | (663) | |

| Gain on derivative contracts | — | | | — | | | — | | | 1,712 | |

| Foreign exchange on revaluation of warrants and earnout liabilities | — | | | (24,029) | | | — | | | (24,029) | |

| Share listing expense | — | | | — | | | — | | | (126,252) | |

| Change in fair value of warrant liability | — | | | 63,988 | | | — | | | 34,614 | |

| Change in fair value of earnout liability | — | | | 219,321 | | | — | | | 194,936 | |

| Change in fair value of option | (6,087) | | | — | | | (8,278) | | | — | |

| | | | | | | |

| Profit before taxation | 41,762 | | | 304,184 | | | 46,276 | | | 149,919 | |

| Income tax expense | (14,203) | | | (5,623) | | | (20,640) | | | (14,582) | |

| Profit for the period | 27,559 | | | 298,561 | | | 25,636 | | | 135,337 | |

| | | | | | | |

| Profit for the period attributable to: | | | | | | | |

| Owners of the parent | 26,578 | | | 298,561 | | | 24,173 | | | 135,337 | |

| Non-controlling interest | 981 | | | — | | | 1,463 | | | — | |

| 27,559 | | | 298,561 | | | 25,636 | | | 135,337 | |

| Other comprehensive income items that may be reclassified subsequently to profit | | | | | | | |

| Foreign currency translation | 1,190 | | | (3,492) | | | (792) | | | (2,375) | |

| Other comprehensive income for the period | 1,190 | | | (3,492) | | | (792) | | | (2,375) | |

| Total comprehensive income for the period | 28,749 | | | 295,069 | | | 24,844 | | | 132,962 | |

| | | | | | | |

| Total comprehensive profit for the period attributable to: | | | | | | | |

| Owners of the parent | 27,768 | | | 295,069 | | | 23,381 | | | 132,962 | |

| Non-controlling interest | 981 | | | — | | | 1,463 | | | — | |

| 28,749 | | | 295,069 | | | 24,844 | | | 132,962 | |

| | | | | | | |

| Weighted average shares outstanding, basic | 498,517,588 | | | 490,197,468 | | | 498,337,223 | | | 489,266,292 | |

| Weighted average shares outstanding, diluted | 499,544,535 | | | 490,197,468 | | | 499,394,699 | | | 489,266,292 | |

| | | | | | | |

Profit per share, basic (cents) | 5.33 | | | 60.91 | | | 4.85 | | | 27.66 | |

Profit per share, diluted (cents) | 5.32 | | | 60.91 | | | 4.84 | | | 27.66 | |

Super Group (SGHC) Limited

Consolidated Statements of Financial Position

as at June 30, 2023 and December 31, 2022

(€ in '000s)

| | | | | | | | | | | | | | |

| | Unaudited | | |

| | 2023 | | 2022 |

| ASSETS | | | | |

| Non‐current assets | | | | |

| Intangible assets | | 202,788 | | | 164,676 | |

| Goodwill | | 122,050 | | | 61,553 | |

| Property, plant and equipment | | 13,921 | | | 14,031 | |

| Right-of-use assets | | 13,194 | | | 14,165 | |

| Deferred tax assets | | 24,915 | | | 23,294 | |

| Regulatory deposits | | 12,029 | | | 11,809 | |

| Loans receivable | | 64,711 | | | 25,524 | |

| Investments in non-listed equity | | 1,781 | | | 1,781 | |

| | | 455,389 | | | 316,833 | |

| Current assets | | | | |

| Trade and other receivables | | 125,959 | | | 116,800 | |

| Income tax receivables | | 12,104 | | | 40,349 | |

| Restricted cash | | 40,253 | | | 148,240 | |

| Cash and cash equivalents | | 228,689 | | | 254,778 | |

| Assets held for sale | | 31,724 | | | — | |

| | | 438,729 | | | 560,167 | |

| TOTAL ASSETS | | 894,118 | | | 877,000 | |

| | | | |

| Non-Current liabilities | | | | |

| Lease liabilities | | 8,548 | | | 10,308 | |

| Deferred tax liability | | 6,736 | | | 8,707 | |

| Derivative financial instruments | | — | | | 15,129 | |

| | | 15,284 | | | 34,144 | |

| Current liabilities | | | | |

| Lease liabilities | | 6,933 | | | 6,951 | |

| Interest-bearing loans and borrowings | | 98 | | | 1,203 | |

| Trade and other payables | | 160,425 | | | 155,304 | |

| Customer liabilities | | 46,721 | | | 50,246 | |

| Provisions | | 42,783 | | | 43,745 | |

| Income tax payables | | 23,609 | | | 50,761 | |

| Derivative liability associated with assets held for sale | | 23,226 | | | — | |

| Liabilities associated with assets held for sale | | 7,196 | | | — | |

| | | 310,991 | | | 308,210 | |

| TOTAL LIABILITIES | | 326,275 | | | 342,354 | |

| EQUITY | | | | |

| Issued capital | | 289,753 | | | 289,753 | |

| Treasury stock | | (377) | | | — | |

| Foreign exchange reserve | | (6,801) | | | (6,009) | |

| Retained profit | | 267,249 | | | 234,333 | |

| Equity attributable to owners of the parent | | 549,824 | | | 518,077 | |

| Non-controlling Interest | | 18,019 | | | 16,569 | |

| SHAREHOLDERS' EQUITY | | 567,843 | | | 534,646 | |

| TOTAL LIABILITIES AND SHAREHOLDERS' EQUITY | | 894,118 | | | 877,000 | |

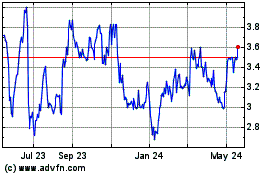

Super Group SGHC (NYSE:SGHC)

Historical Stock Chart

From Jan 2025 to Feb 2025

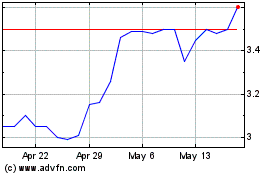

Super Group SGHC (NYSE:SGHC)

Historical Stock Chart

From Feb 2024 to Feb 2025