Form SCHEDULE 13D - General Statement of Acquisition of Beneficial Ownership

28 February 2025 - 1:13PM

Edgar (US Regulatory)

EXHIBIT 99.1

JOINT FILING AGREEMENT

The undersigned acknowledge and agree that the

foregoing statement on Schedule 13D is filed on behalf of each of the undersigned and that all subsequent amendments to this statement

on Schedule 13D shall be filed on behalf of each of the undersigned without the necessity of filing additional joint filing agreements.

The undersigned acknowledge that each shall be responsible for the timely filing of such amendments, and for the completeness and accuracy

of the information concerning it contained therein, but shall not be responsible for the completeness and accuracy of the information

concerning the other, except to the extent that such person or entity knows or has reason to believe that such information is inaccurate.

This agreement may be executed in any number of counterparts and all of such counterparts taken together shall constitute one and the

same instrument.

Dated: February 27, 2025

| |

SELECT EQUITY GROUP, L.P. |

| |

|

| |

By: Select Equity GP, LLC, its General

Partner |

| |

|

| |

By: |

/s/ George S. Loening |

| |

Name: George S. Loening |

| |

Title: Managing Member |

| |

|

| |

GEORGE S. LOENING |

| |

|

| |

/s/ George S. Loening |

| |

George S. Loening, an individual |

EXHIBIT 99.2

LETTER TO THE BOARD

To the Board of Signet Jewelers,

Select Equity has had a long history as a major shareholder of Signet,

most recently establishing a large stake in the business in April of 2020. We currently hold just under 10% of the outstanding shares.

We have studied the business over the course of the last decade and

we believe the company should enjoy numerous advantages given that it is by far the largest middle market specialty jeweler in North

America with the greatest retail footprint, largest marketing budget, and the biggest global product sourcing network. We believe those

advantages should translate into market share gains and better-than-industry-level profitability.

We were supportive of the changes the prior CEO, Gina Drosos, made

to refresh the brands and capitalize on Signet’s competitive strengths but we have been disappointed with recent performance including

operational missteps and management changes.

The business has generated positive free cash flow in each of the

last 20 years (including the Global Financial Crisis of 2008 and the COVID shutdowns of 2020) and generated an average of more than $700M

in free cash flow annually over the last 10 years. We expect the business will finish the fiscal year ending January 31, 2025 with an

unlevered balance sheet, following typical seasonal cash generation in Q4.

Despite this, the public market’s perception of and confidence

in Signet’s future prospects are clearly poor given the enterprise value today of approximately $2 billion. Investors appear convinced

that the Board and management team will erode the company’s cash, competitive position and franchise. As such, we believe that

the Board is obligated to explore all strategic alternatives for Signet including its sale.

Recent performance and governance shortfalls have included the following:

| |

· | The business has suffered same-store-sales declines in each

of the last 11 quarters, well below the industry overall, an extraordinary run given Signet’s inherent franchise advantages; |

| |

· | Operating profit has declined in each of the last three years

and fallen short of guidance in each of the last two years; |

| |

· | Management further hurt organic and online sales by botching

the transition of James Allen and the recently acquired Blue Nile business onto a new technology platform just prior to the 2023 holiday

selling season, which caused sales of those subsidiaries to drop by significant double-digit amounts for six consecutive quarters; |

| |

· | Management and the Board have a poor record of capital allocation,

wasting nearly half a billion dollars in purchasing unprofitable businesses, including Blue Nile, as well as deploying cash in purchasing

shares well above their current level; |

| |

· | Most

recently, the CEO, Gina Drosos, departed with little warning. The Board communicated that

Ms. Drosos would stay through the holiday season as a consultant to guarantee continuity,

however, she was notably absent from any calls, investor meetings and public appearances,

while the business badly missed its holiday guidance and continued to flounder; and, |

| |

· | At the same time, the Board has poorly aligned pay and performance,

agreeing to large, multi-million-dollar payouts to the existing management team to retain them for a surprisingly short period of time

(3-6 months) and paying an outsized signing bonus and compensation package to hire a CEO with no jewelry or fashion experience and a

mixed track record at the past two private equity-owned companies he ran. |

All of this has contributed to a loss of confidence among shareholders

and the extreme undervaluation of a business that should be uniquely positioned to succeed in the specialty jewelry market, which is

currently growing.

In summary, Signet managed to generate $7.2B of free cash flow over

the last decade and yet we estimate that it has an enterprise value today of $2 billion. The company is trading at less than 6x this

and next year’s estimated cash earnings. The public market clearly does not endorse the company’s current strategy or the

strength of its leadership. As a result, we believe that the Board is obligated to explore strategic options for the business, including

its sale, in order to realize for Signet’s owners the underlying value of their investment.

Sincerely

Select Equity Group, L.P.

EXHIBIT 99.3

60 DAY TRADING HISTORY

| Date |

Number

of Shares of Common Stock Purchased (Sold) |

Weighted

Average ($) Price Per Share1 |

Range

of Per Share ($) Prices |

| Lowest

($) Price in Range |

Highest

($) Price in Range |

| 12/26/2024 |

(4,872.00) |

80.76 |

80.76 |

80.98 |

| 12/27/2024 |

14.00 |

82.05 |

82.05 |

82.05 |

| 12/27/2024 |

(102.00) |

82.05 |

82.05 |

82.05 |

| 12/30/2024 |

4.00 |

80.10 |

80.10 |

80.10 |

| 12/30/2024 |

(746.00) |

80.08 |

80.08 |

80.08 |

| 12/31/2024 |

(15.00) |

81.02 |

81.02 |

81.02 |

| 1/2/2025 |

5,699.00 |

80.80 |

80.80 |

80.80 |

| 1/2/2025 |

(120,600.00) |

78.44 |

78.44 |

78.44 |

| 1/3/2025 |

(22,918.00) |

77.14 |

77.14 |

77.14 |

| 1/3/2025 |

(216.00) |

78.32 |

78.32 |

78.32 |

| 1/6/2025 |

(4,400.00) |

79.06 |

79.06 |

79.06 |

| 1/7/2025 |

(7,108.00) |

76.96 |

76.75 |

77.62 |

| 1/8/2025 |

(36.00) |

76.11 |

76.11 |

76.11 |

| Date |

Number

of Shares of Common Stock Purchased (Sold) |

Weighted

Average ($) Price Per Share1 |

Range

of Per Share ($) Prices |

| Lowest

($) Price in Range |

Highest

($) Price in Range |

| 1/10/2025 |

(21,968.00) |

74.54 |

73.84 |

74.58 |

| 1/13/2025 |

(482.00) |

75.47 |

75.47 |

75.47 |

| 1/14/2025 |

(854,628.00) |

56.54 |

56.26 |

56.94 |

| 1/14/2025 |

(98,681.00) |

58.45 |

58.00 |

58.46 |

| 1/14/2025 |

(100,132.00) |

60.67 |

60.35 |

61.18 |

| 1/15/2025 |

(43.00) |

58.69 |

58.69 |

58.69 |

| 1/16/2025 |

(2,357.00) |

58.62 |

58.47 |

58.63 |

| 1/17/2025 |

(429.00) |

57.09 |

57.09 |

57.09 |

| 1/21/2025 |

(1,162.00) |

58.49 |

58.47 |

58.51 |

| 1/22/2025 |

(747.00) |

57.26 |

57.26 |

57.26 |

| 1/22/2025 |

(5,623.00) |

58.65 |

58.65 |

58.65 |

| 1/23/2025 |

365.00 |

59.48 |

59.48 |

59.48 |

| 1/23/2025 |

(546.00) |

59.40 |

59.40 |

59.40 |

| 1/27/2025 |

(3,109.00) |

59.45 |

59.45 |

59.45 |

| 1/28/2025 |

(614.00) |

59.12 |

59.12 |

59.12 |

| 1/29/2025 |

(1,199.00) |

58.58 |

58.58 |

58.58 |

| Date |

Number

of Shares of Common Stock Purchased (Sold) |

Weighted

Average ($) Price Per Share1 |

Range

of Per Share ($) Prices |

| Lowest

($) Price in Range |

Highest

($) Price in Range |

| 1/30/2025 |

(2,939.00) |

58.87 |

58.87 |

58.87 |

| 1/31/2025 |

(170.00) |

59.99 |

59.99 |

59.99 |

| 2/3/2025 |

145,647.00 |

58.04 |

58.04 |

58.04 |

| 2/3/2025 |

(723.00) |

57.76 |

57.76 |

57.76 |

| 2/5/2025 |

(3,791.00) |

56.08 |

56.08 |

56.08 |

| 2/6/2025 |

5,571.00 |

56.72 |

56.72 |

56.72 |

| 2/6/2025 |

(2,173.00) |

57.03 |

57.03 |

57.03 |

| 2/7/2025 |

(271.00) |

54.44 |

54.44 |

54.44 |

| 2/10/2025 |

(915.00) |

52.76 |

52.76 |

52.76 |

| 2/12/2025 |

(70.00) |

54.26 |

54.26 |

54.26 |

| 2/13/2025 |

(974.00) |

55.14 |

55.09 |

55.20 |

| 2/14/2025 |

(737.00) |

53.33 |

53.33 |

53.33 |

| 2/18/2025 |

(252.00) |

54.01 |

54.01 |

54.01 |

| 2/18/2025 |

(8,102.00) |

55.47 |

55.47 |

55.47 |

| Date |

Number

of Shares of Common Stock Purchased (Sold) |

Weighted

Average ($) Price Per Share1 |

Range

of Per Share ($) Prices |

| Lowest

($) Price in Range |

Highest

($) Price in Range |

| 2/19/2025 |

(504.00) |

55.05 |

55.05 |

55.05 |

| 2/20/2025 |

488.00 |

55.62 |

55.62 |

55.62 |

| 2/20/2025 |

(73,521.00) |

53.66 |

53.32 |

53.82 |

| 2/21/2025 |

7.00 |

54.65 |

54.65 |

54.65 |

| 2/21/2025 |

(74,468.00) |

52.91 |

52.91 |

52.91 |

| 2/21/2025 |

(636.00) |

54.65 |

54.65 |

54.65 |

| 2/24/2025 |

15.00 |

52.92 |

52.92 |

52.92 |

| 2/24/2025 |

(67,163.00) |

51.00 |

51.00 |

51.00 |

| 2/24/2025 |

(52.00) |

52.92 |

52.92 |

52.92 |

| 2/25/2025 |

148.00 |

51.35 |

51.35 |

51.35 |

| 2/25/2025 |

(586.00) |

51.28 |

51.28 |

51.28 |

| 2/26/2025 |

(674.00) |

52.56 |

52.56 |

52.56 |

1. Upon request by the staff of the Securities and

Exchange Commission, full information regarding the number of shares bought or sold (as the case may be) at each separate price will be

provided.

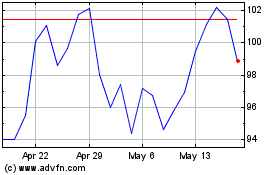

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Feb 2025 to Mar 2025

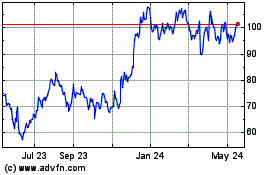

Signet Jewelers (NYSE:SIG)

Historical Stock Chart

From Mar 2024 to Mar 2025