Sonida Announces Planned Acquisition of High-Quality, Eight-Asset Senior Housing Portfolio Located in Florida and South Carolina for $103 Million

16 August 2024 - 6:15AM

Business Wire

Portfolio will continue to strengthen Sonida’s

asset mix with the addition of newer vintage, high-quality real

estate at significant discounts to replacement cost

Solidifies presence in the Southeast in

submarkets with strong demographic tailwinds and limited supply

growth

New planned acquisition, combined with recently

closed acquisitions, will total 17 communities added to Sonida’s

owned senior living portfolio in 2024

Sonida Senior Living, Inc. (“Sonida” or the “Company”) (NYSE:

SNDA), a leading owner, operator and investor in communities and

services for seniors, today announced that the Company is under

contract to acquire eight senior living communities strategically

located in attractive submarkets within the Southeast. This

transaction further densifies the Company’s footprint in northern

Florida and South Carolina and creates operating efficiencies given

the meaningful regional scale. The transaction includes 555 units

with Assisted Living and Memory Care offerings.

“With Sonida’s multi-faceted sourcing channels, we continue to

identify accretive investment opportunities and firmly execute on

our focused external growth strategy,” said Brandon Ribar,

President and Chief Executive Officer. “With this planned

acquisition, Sonida will further broaden its high-quality and

regionally-focused real estate portfolio with newer vintage

communities in mid-to-large metropolitan areas with favorable

growth prospects. By successfully integrating Sonida’s

best-in-class operating platform into these communities, and with

occupancy growth, ongoing rent rate improvement and effective

expense management, these investments can ultimately generate

meaningful value creation for our shareholders.”

The eight communities are located primarily in high growth

primary and secondary metropolitan areas: Jacksonville, Orlando and

Daytona Beach (Florida); Hilton Head, Charleston and Florence

(South Carolina). The portfolio follows Sonida’s acquisition

strategy, which aims to further upgrade and modernize its portfolio

through densification across its current geographic footprint to

fully leverage operating scale and efficiencies. The portfolio,

with an attractive average asset age of 5 years, compares to an

average asset age of 19 years when looking at comparable inventory

within a 10-mile radius. The purchase price of $103 million, or

$185k per unit, reflects a significant discount to the Company’s

estimate of replacement cost.

The portfolio’s in-place occupancy is approximately 83% with an

average RevPOR of more than $6,000. The Company anticipates that

multi-year stabilization of net operating income margin should

result in an accretive effective cap rate.

As of today, Sonida’s total operating portfolio is comprised of

83 communities, inclusive of a new management contract that closed

in August. Upon the closing of this acquisition, which is targeted

for late Q3 or early Q4, Sonida’s total operating portfolio will

grow to 91 communities.

Safe Harbor

The forward-looking statements in this press release, including,

but not limited to, statements relating to the Company’s

acquisitions, are subject to certain risks and uncertainties that

could cause the Company’s actual results and financial condition to

differ materially, including, but not limited to the Company’s

ability to recognize the anticipated benefits of such acquisitions;

the impact of such acquisitions on the Company’s business; any

legal proceedings that may be brought related to such acquisitions;

and other risks and factors identified from time to time in the

Company’s reports filed with the SEC, including the Company’s

ability to generate sufficient cash flows from operations, proceeds

from equity issuances and debt financings, and proceeds from the

sale of assets to satisfy its short- and long-term debt obligations

and to fund the Company’s acquisitions and capital improvement

projects to expand, redevelop, and/or reposition its senior living

communities; increases in market interest rates that increase the

cost of certain of our debt obligations; increased competition for,

or a shortage of, skilled workers, including due to general labor

market conditions, along with wage pressures resulting from such

increased competition, low unemployment levels, use of contract

labor, minimum wage increases and/or changes in overtime laws; the

Company’s ability to obtain additional capital on terms acceptable

to it; the Company’s ability to extend or refinance its existing

debt as such debt matures; the Company’s compliance with its debt

agreements, including certain financial covenants, and the risk of

cross-default in the event such non-compliance occurs; the

Company’s ability to complete acquisitions and dispositions upon

favorable terms or at all, including the possibility that the

expected benefits and our projections related to such acquisitions

may not materialize as expected; the risk of oversupply and

increased competition in the markets which the Company operates;

the Company’s ability to improve and maintain controls over

financial reporting and remediate the identified material weakness

discussed in its recent Quarterly and Annual Reports filed with the

SEC; the cost and difficulty of complying with applicable

licensure, legislative oversight, or regulatory changes; risks

associated with current global economic conditions and general

economic factors such as inflation, the consumer price index,

commodity costs, fuel and other energy costs, competition in the

labor market, costs of salaries, wages, benefits, and insurance,

interest rates, and tax rates; the impact from or the potential

emergence and effects of a future epidemic, pandemic, outbreak of

infectious disease or other health crisis; and changes in

accounting principles and interpretations.

About Sonida

Dallas-based Sonida Senior Living, Inc. is a leading owner,

operator and investor in independent living, assisted living and

memory care communities and services for senior adults. The Company

provides compassionate, resident-centric services and care as well

as engaging programming operating 83 senior housing communities in

20 states with an aggregate capacity of approximately 9,000

residents, including 70 communities which the Company owns

(including eight communities in which the Company owns varying

interests through two separate joint ventures), and 13 communities

that the Company manages on behalf of a third-party.

For more information, visit www.sonidaseniorliving.com or

connect with the Company on Facebook, Twitter or LinkedIn.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240815569719/en/

Investor Relations Jason Finkelstein Ignition Investor

Relations ir@sonidaliving.com

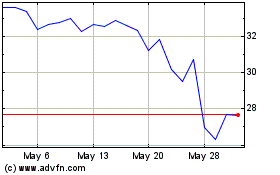

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sonida Senior Living (NYSE:SNDA)

Historical Stock Chart

From Dec 2023 to Dec 2024