Sensata Technologies (NYSE: ST), a global industrial technology

company and leading provider of sensors, sensor-rich solutions and

electrical protection devices used in mission-critical systems that

create valuable business insights for customers, today announced

financial results for its first quarter ended March 31, 2024.

“We are pleased to report a solid start to 2024, with first

quarter revenue and adjusted operating margins towards the high end

of our guidance range,” said Jeff Cote, CEO and President of

Sensata. "We are the trusted electrification partner of choice as

evidenced by more than $1.3 billion in electrification wins during

the past three years and our safe and efficient capabilities remain

a durable, proven, and profitable business driving value for our

shareholders."

Operating Results - First Quarter

Operating results for the first quarter of 2024 compared to the

first quarter of 2023 are summarized below. These results include

non-GAAP financial measures, each of which is defined and

reconciled to the most directly comparable GAAP measure later in

this press release.

Revenue:

- Revenue was $1,006.7 million, an increase of $8.5 million, or

0.9%, compared to $998.2 million in the first quarter of 2023.

- On a constant currency basis, revenue increased 2.3% as

compared to the first quarter of 2023.

Operating income:

- Operating income was $144.8 million, or 14.4% of revenue, a

decrease of $4.1 million, or 2.7%, compared to operating income of

$148.8 million, or 14.9% of revenue, in the first quarter of

2023.

- Adjusted operating income was $188.5 million, or 18.7% of

revenue ($197.6 million or 19.4% of revenue on a constant currency

basis), a decrease of $4.4 million, or 2.3%, compared to adjusted

operating income of $192.9 million, or 19.3% of revenue, in the

first quarter of 2023.

Earnings per share:

- Earnings per share was $0.50, a decrease of $0.06, or 10.7%,

compared to earnings per share of $0.56 in the first quarter of

2023.

- Adjusted earnings per share was $0.89, a decrease of $0.03, or

3.3% ($0.93 or an increase of 1.1% on a constant currency basis),

compared to adjusted earnings per share of $0.92 in the first

quarter of 2023.

Sensata generated $106.5 million of operating cash flow in the

first quarter of 2024, compared to $96.9 million in the prior year

period. Sensata's free cash flow totaled $64.4 million in the first

quarter of 2024, compared to $60.0 million in the prior year

period.

During the first quarter of 2024, Sensata returned approximately

$28.1 million to shareholders, including $18.1 million through its

quarterly dividend of $0.12 per share paid on February 28, 2024,

and approximately $10.1 million of shares repurchased.

Guidance

For the second quarter of 2024, Sensata expects revenue of

$1,025 to $1,055 million and adjusted EPS of $0.89 to $0.95.

Q2-2024 Guidance

$ in millions, except EPS

Q2-24 Guidance

Q2-23

Y/Y Change

Revenue

$1,025 - $1,055

$1,062.1

(3%) - (1%)

organic growth

(2%) - 1%

Adjusted Operating Income

$192 - $202

$205.7

(7%) - (2%)

Adjusted Net Income

$134 - $144

$149.2

(10%) - (4%)

Adjusted EPS

$0.89 - $0.95

$0.97

(8%) - (2%)

Versus the prior year period, Sensata expects that changes in

foreign currency exchange rates will decrease revenue by

approximately $13 million at the midpoint and decrease adjusted EPS

by approximately $0.02 at the midpoint in the second quarter of

2024.

Conference Call and Webcast

Sensata will conduct a conference call today at 4:30 p.m.

Eastern Time to discuss its first quarter 2024 financial results

and its outlook for the second quarter of 2024. The dial-in numbers

for the call are 1-844-784-1726 or 1-412-380-7411. Callers should

reference the "Sensata Q1 2024 Financial Results Conference Call."

A live webcast of the conference call will also be available on the

investor relations page of Sensata’s website at

http://investors.sensata.com. Additionally, a replay of the call

will be available until May 6, 2024. To access the replay, dial

1-877-344-7529 or 1-412-317-0088 and enter confirmation code:

2357389.

About Sensata Technologies

Sensata Technologies is a global industrial technology company

striving to create a cleaner, more efficient, electrified and

connected world. Through its broad portfolio of sensors, electrical

protection components and sensor-rich solutions which create

valuable business insights, Sensata helps its customers address

increasingly complex engineering and operating performance

requirements. With more than 21,000 employees and global operations

in 16 countries, Sensata serves customers in the automotive, heavy

vehicle & off-road, industrial, and aerospace markets. Learn

more at www.sensata.com and follow Sensata on LinkedIn, Facebook, X

and Instagram.

Non-GAAP Financial Measures

We supplement the reporting of our financial information

determined in accordance with U.S. generally accepted accounting

principles (“GAAP”) with certain non-GAAP financial measures. We

use these non-GAAP financial measures internally to make operating

and strategic decisions, including the preparation of our annual

operating plan, evaluation of our overall business performance, and

as a factor in determining compensation for certain employees. We

believe presenting non-GAAP financial measures is useful for

period-over-period comparisons of underlying business trends and

our ongoing business performance. We also believe presenting these

non-GAAP measures provides additional transparency into how

management evaluates the business.

Non-GAAP financial measures should be considered as supplemental

in nature and are not meant to be considered in isolation or as a

substitute for the related financial information prepared in

accordance with U.S. GAAP. In addition, our non-GAAP financial

measures may not be the same as, or comparable to, similar non-GAAP

measures presented by other companies.

The non-GAAP financial measures referenced by Sensata in this

release include: adjusted net income, adjusted earnings per share

(“EPS”), adjusted operating income, adjusted operating margin, free

cash flow, organic revenue growth, market outgrowth, adjusted

earnings before interest, taxes, depreciation and amortization

("EBITDA"), net debt, and net leverage ratio. We also refer to

changes in certain non-GAAP measures, usually reported either as a

percentage or number of basis points, between two periods. Such

changes are also considered non-GAAP measures.

Adjusted net income (or loss) is defined as net income

(or loss), determined in accordance with U.S. GAAP, excluding

certain non-GAAP adjustments which are detailed in the accompanying

reconciliation tables. Adjusted EPS is calculated by

dividing adjusted net income (or loss) by the number of diluted

weighted-average ordinary shares outstanding in the period. We

believe that these measures are useful to investors and management

in understanding our ongoing operations and in analysis of ongoing

operating trends.

Adjusted operating income (or loss) is defined as

operating income (or loss), determined in accordance with U.S.

GAAP, excluding certain non-GAAP adjustments which are detailed in

the accompanying reconciliation tables. Adjusted operating

margin is calculated by dividing adjusted operating income (or

loss) by net revenue. We believe that these measures are useful to

investors and management in understanding our ongoing operations

and in analysis of ongoing operating trends.

Free cash flow is defined as net cash provided by/(used

in) operating activities less additions to property, plant and

equipment and capitalized software. We believe that this measure is

useful to investors and management as a measure of cash generated

by business operations that will be used to repay scheduled debt

maturities and can be used to fund acquisitions, repurchase

ordinary shares, or for the accelerated repayment of debt

obligations.

Organic revenue growth (or decline) is defined as the

reported percentage change in net revenue calculated in accordance

with U.S. GAAP, excluding the period-over-period impact of foreign

exchange rate differences as well as the net impact of material

acquisitions and divestitures for the 12-month period following the

respective transaction date(s). We believe that this measure is

useful to investors and management in understanding our ongoing

operations and in analysis of ongoing operating trends.

Adjusted EBITDA is defined as net income (or loss),

determined in accordance with U.S. GAAP, excluding interest

expense, net, provision for (or benefit from) income taxes,

depreciation expense, amortization of intangible assets, and the

following non-GAAP adjustments, if applicable: (1) restructuring

related and other, (2) financing and other transaction costs, and

(3) deferred gain or loss on derivative instruments. We believe

that this measure is useful to investors and management in

understanding our ongoing operations and in analysis of ongoing

operating trends.

Gross leverage ratio is defined as gross debt divided by

last twelve months (LTM) adjusted EBITDA. We believe that gross

leverage ratio is a useful measure to management and investors in

understanding trends in our overall financial condition.

Net debt is defined as total debt, finance lease, and

other financing obligations less cash and cash equivalents. We

believe net debt is a useful measure to management and investors in

understanding trends in our overall financial condition.

Net leverage ratio is defined as net debt divided by last

twelve months (LTM) adjusted EBITDA. We believe the net leverage

ratio is a useful measure to management and investors in

understanding trends in our overall financial condition.

In discussing trends in our performance, we may refer to certain

non-GAAP financial measures or the percentage change of certain

non-GAAP financial measures in one period versus another,

calculated on a constant currency basis. Constant currency

is determined by stating revenues and expenses at prior period

foreign currency exchange rates and excludes the impact of foreign

currency exchange rates on all hedges and, as applicable, net

monetary assets. We believe these measures are useful to investors

and management in understanding our ongoing operations and in

analysis of ongoing operating trends.

Safe Harbor Statement

This earnings release includes "forward-looking statements"

within the meaning of the Private Securities Litigation Reform Act

of 1995. These forward-looking statements may be identified by

terminology such as "may," "will," "could," "should," "expect,"

"anticipate," "believe," "estimate," "predict," "project,"

"forecast," "continue," "intend," "plan," "potential,"

"opportunity," "guidance," and similar terms or phrases.

Forward-looking statements involve, among other things,

expectations, projections, and assumptions about future financial

and operating results, objectives, business and market outlook,

megatrends, priorities, growth, shareholder value, capital

expenditures, cash flows, demand for products and services, share

repurchases, and Sensata’s strategic initiatives, including those

relating to acquisitions and dispositions and the impact of such

transactions on our strategic and operational plans and financial

results. These statements are subject to risks, uncertainties, and

other important factors relating to our operations and business

environment, and we can give no assurances that these

forward-looking statements will prove to be correct.

A wide variety of potential risks, uncertainties, and other

factors could materially affect our ability to achieve the results

either expressed or implied by these forward-looking statements,

including, but not limited to, risks related to public health

crises, instability and changes in the global markets, supplier

interruption or non-performance, the acquisition or disposition of

businesses, adverse conditions or competition in the industries

upon which we are dependent, intellectual property, product

liability, warranty, and recall claims, market acceptance of new

product introductions and product innovations, labor disruptions or

increased labor costs, and changes in existing environmental or

safety laws, regulations, and programs.

Investors and others should carefully consider the foregoing

factors and other uncertainties, risks, and potential events

including, but not limited to, those described in Item 1A: Risk

Factors in our most recent Annual Report on Form 10-K and as may be

updated from time to time in Item 1A: Risk Factors in our quarterly

reports on Form 10-Q or other subsequent filings with the United

States Securities and Exchange Commission. All such forward-looking

statements speak only as of the date they are made, and we do not

undertake any obligation to update these statements other than as

required by law.

SENSATA TECHNOLOGIES HOLDING

PLC

Condensed Consolidated

Statements of Operations

(In thousands, except per share

amounts)

(Unaudited)

For the three months ended

March 31,

2024

2023

Net revenue

$

1,006,709

$

998,175

Operating costs and expenses:

Cost of revenue

689,260

670,471

Research and development

45,314

45,939

Selling, general and administrative

88,046

86,150

Amortization of intangible assets

38,515

40,774

Restructuring and other charges, net

782

5,999

Total operating costs and expenses

861,917

849,333

Operating income

144,792

148,842

Interest expense

(38,395

)

(48,791

)

Interest income

3,738

8,700

Other, net

(11,544

)

1,392

Income before taxes

98,591

110,143

Provision for income taxes

22,570

23,726

Net income

$

76,021

$

86,417

Net income per share:

Basic

$

0.51

$

0.57

Diluted

$

0.50

$

0.56

Weighted-average ordinary shares

outstanding:

Basic

150,480

152,518

Diluted

150,921

153,324

SENSATA TECHNOLOGIES HOLDING

PLC

Condensed Consolidated Balance

Sheets

(In thousands)

(Unaudited)

March 31, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

460,359

$

508,104

Accounts receivable, net of allowances

760,092

744,129

Inventories

720,628

713,485

Prepaid expenses and other current

assets

157,441

136,686

Total current assets

2,098,520

2,102,404

Property, plant and equipment, net

883,851

886,010

Goodwill

3,542,725

3,542,770

Other intangible assets, net

845,555

883,671

Deferred income tax assets

127,491

131,527

Other assets

117,808

134,605

Total assets

$

7,615,950

$

7,680,987

Liabilities and shareholders'

equity

Current liabilities:

Current portion of long-term debt, finance

lease and other financing obligations

$

2,340

$

2,276

Accounts payable

469,342

482,301

Income taxes payable

33,762

32,139

Accrued expenses and other current

liabilities

288,525

307,002

Total current liabilities

793,969

823,718

Deferred income tax liabilities

361,172

359,073

Pension and other post-retirement benefit

obligations

38,053

38,178

Finance lease and other financing

obligations, less current portion

22,587

22,949

Long-term debt, net

3,375,511

3,373,988

Other long-term liabilities

49,824

66,805

Total liabilities

4,641,116

4,684,711

Total shareholders' equity

2,974,834

2,996,276

Total liabilities and shareholders'

equity

$

7,615,950

$

7,680,987

SENSATA TECHNOLOGIES HOLDING

PLC

Condensed Consolidated

Statements of Cash Flows

(In thousands)

(Unaudited)

For the three months ended

March 31,

2024

2023

Cash flows from operating

activities:

Net income

$

76,021

$

86,417

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation

33,523

30,948

Amortization of debt issuance costs

1,562

1,734

Gain on sale of business

—

(5,877

)

Share-based compensation

8,133

7,206

Loss on debt financing

—

485

Amortization of intangible assets

38,515

40,774

Deferred income taxes

2,574

6,491

Loss on equity investments, net

13,287

—

Unrealized (gain)/loss on derivative

instruments and other

(4,184

)

3,107

Changes in operating assets and

liabilities, net of effects of acquisitions

(62,944

)

(71,397

)

Acquisition-related compensation

payments

—

(3,000

)

Net cash provided by operating

activities

106,487

96,888

Cash flows from investing

activities:

Additions to property, plant and equipment

and capitalized software

(42,130

)

(36,882

)

Proceeds from the sale of business, net of

cash sold

—

14,000

Net cash used in investing activities

(42,130

)

(22,882

)

Cash flows from financing

activities:

Proceeds from exercise of stock options

and issuance of ordinary shares

—

2,762

Payment of employee restricted stock tax

withholdings

(129

)

(123

)

Payments on debt

(279

)

(250,944

)

Dividends paid

(18,056

)

(16,777

)

Payments to repurchase ordinary shares

(10,052

)

—

Purchase of noncontrolling interest in

joint venture

(79,393

)

—

Payments of debt financing costs

(39

)

(308

)

Net cash used in financing activities

(107,948

)

(265,390

)

Effect of exchange rate changes on cash

and cash equivalents

(4,154

)

—

Net change in cash and cash

equivalents

(47,745

)

(191,384

)

Cash and cash equivalents, beginning of

period

508,104

1,225,518

Cash and cash equivalents, end of

period

$

460,359

$

1,034,134

Segment Performance

For the three months ended

March 31,

$ in 000s

2024

2023

Performance Sensing (1)

Revenue

$

713,318

$

667,762

Operating income

$

185,132

$

169,066

% of Performance Sensing revenue

26.0

%

25.3

%

Sensing Solutions

Revenue

$

257,839

$

283,450

Operating income

$

72,479

$

84,020

% of Sensing Solutions revenue

28.1

%

29.6

%

Other (1)

Revenue

$

35,552

$

46,963

Operating income

$

6,781

$

4,970

% of Other revenue

19.1

%

10.6

%

(1)

In the first quarter of 2024, we moved

Insights from Performance Sensing, creating another operating

segment, which is reported in "Other". We recast Performance

Sensing to exclude Insights. Prior year amounts in the above table

have been recast to reflect this realignment, which was effective

as of January 1, 2024.

Revenue by Business, Geography, and End Market

(Unaudited)

(percent of total revenue)

For the three months ended

March 31,

2024

2023

Performance Sensing (1)

70.9

%

66.9

%

Sensing Solutions

25.6

%

28.4

%

Other (1)

3.5

%

4.7

%

Total

100.0

%

100.0

%

(percent of total revenue)

For the three months ended

March 31,

2024

2023

Americas

42.6

%

45.3

%

Europe

28.3

%

27.2

%

Asia/Rest of World

29.1

%

27.5

%

Total

100.0

%

100.0

%

(percent of total revenue)

For the three months ended

March 31,

2024

2023

Automotive

55.9

%

52.6

%

Heavy vehicle and off-road(1)

18.8

%

17.5

%

Industrial

12.4

%

14.9

%

Appliance and HVAC

4.7

%

4.8

%

Aerospace

4.6

%

4.4

%

All other (1)

3.6

%

5.8

%

Total

100.0

%

100.0

%

(1)

Effective January 1, 2024 we moved

Insights from the Heavy vehicle off-road operating segment within

Performance Sensing, creating another operating segment, which is

reported in "Other". Additionally, we moved the Insights business

to the "other" end market. Prior year information in the tables

above has been recast to reflect this realignment.

GAAP to Non-GAAP Reconciliations

The following unaudited tables provide a reconciliation of the

difference between each of the non-GAAP financial measures

referenced herein and the most directly comparable U.S. GAAP

financial measure. Amounts presented in these tables may not appear

to recalculate due to the effect of rounding.

Operating income and margin, income tax,

net income, and earnings per share

($ in thousands, except per share

amounts)

For the three months ended

March 31, 2024

Operating Income

Operating Margin

Income Taxes

Net Income

Diluted EPS

Reported (GAAP)

$

144,792

14.4

%

$

22,570

$

76,021

$

0.50

Non-GAAP adjustments:

Restructuring related and other

2,394

0.2

%

(575

)

1,819

0.01

Financing and other transaction costs

(1)

4,351

0.4

%

110

17,748

0.12

Step-up depreciation and amortization

37,378

3.7

%

—

37,378

0.25

Deferred gain on derivative

instruments

(375

)

(0.0

%)

282

(1,192

)

(0.01

)

Amortization of debt issuance costs

—

—

%

—

1,562

0.01

Deferred taxes and other tax related

—

—

%

1,286

1,286

0.01

Total adjustments

43,748

4.3

%

1,103

58,601

0.39

Adjusted (non-GAAP)

$

188,540

18.7

%

$

21,467

$

134,622

$

0.89

(1)

Includes a $14.8 million mark-to-market

loss on an equity investment held under the measurement alternative

due to an observable marketplace transaction. This loss is

presented in other, net on the condensed consolidated statement of

operations

($ in thousands, except per share

amounts)

For the three months ended

March 31, 2023

Operating Income

Operating Margin

Income Tax

Net Income

Diluted EPS

Reported (GAAP)

$

148,842

14.9

%

$

23,726

$

86,417

$

0.56

Non-GAAP adjustments:

Restructuring related and other

2,941

0.3

%

(672

)

2,269

0.01

Financing and other transaction costs

4,248

0.4

%

2,874

7,607

0.05

Step-up depreciation and amortization

39,130

3.9

%

—

39,130

0.26

Deferred gain on derivative

instruments

(2,250

)

(0.2

%)

853

(3,296

)

(0.02

)

Amortization of debt issuance costs

—

—

%

—

1,734

0.01

Deferred taxes and other tax related

—

—

%

6,791

6,791

0.04

Total adjustments

44,069

4.4

%

9,846

54,235

0.35

Adjusted (non-GAAP)

$

192,911

19.3

%

$

13,880

$

140,652

$

0.92

Non-GAAP adjustments by location in

statements of operations

(in thousands)

For the three months ended

March 31,

2024

2023

Cost of revenue

$

1,154

$

(2,778

)

Selling, general and administrative

4,685

1,772

Amortization of intangible assets

37,127

39,076

Restructuring and other charges, net

782

5,999

Operating income adjustments

43,748

44,069

Interest expense, net

1,562

1,734

Other, net (1)

12,188

(1,414

)

Provision for income taxes

1,103

9,846

Net income adjustments

$

58,601

$

54,235

(1)

The three months ended March 31, 2024

includes a $14.8 million mark-to-market loss on an equity

investment held under the measurement alternative due to an

observable marketplace transactions.

Free cash flow

For the three months ended

March 31,

($ in thousands)

2024

2023

% △

Net cash provided by operating

activities

$

106,487

$

96,888

9.9

%

Additions to property, plant and equipment

and capitalized software

(42,130

)

(36,882

)

(14.2

%)

Free cash flow

$

64,357

$

60,006

7.3

%

Adjusted corporate and other

expenses

For the three months ended

March 31,

(in thousands)

2024

2023

Corporate and other expenses (GAAP)

$

(80,303

)

$

(62,441

)

Restructuring related and other

2,567

(1,429

)

Financing and other transaction costs

3,396

2,619

Step-up depreciation and amortization

251

54

Deferred gain on derivative

instruments

(375

)

(2,250

)

Total adjustments

5,839

(1,006

)

Adjusted corporate and other expenses

(non-GAAP)

$

(74,464

)

$

(63,447

)

Adjusted EBITDA

For the three months ended

March 31,

(in thousands)

LTM

2024

2023

Net income

$

(14,305

)

$

76,021

$

86,417

Interest expense, net

145,426

34,657

40,091

Provision for income taxes

20,595

22,570

23,726

Depreciation expense

135,680

33,523

30,948

Amortization of intangible assets

171,601

38,515

40,774

EBITDA

458,997

205,286

221,956

Non-GAAP Adjustments

Restructuring related and other

410,947

2,394

2,941

Financing and other transaction costs

34,397

17,638

4,733

Deferred loss/(gain) on derivative

instruments

669

(1,474

)

(4,149

)

Adjusted EBITDA

$

905,010

$

223,844

$

225,481

Net debt and leverage

As of

($ in thousands)

March 31, 2024

December 31, 2023

Current portion of long-term debt and

finance lease obligations

$

2,340

$

2,276

Finance lease obligations, less current

portion

22,587

22,949

Long-term debt, net

3,375,511

3,373,988

Total debt and finance lease

obligations

3,400,438

3,399,213

Less: discount, net of premium

(1,230

)

(1,568

)

Less: deferred financing costs

(23,259

)

(24,444

)

Total gross indebtedness

3,424,927

3,425,225

Adjusted EBITDA (LTM)

$

905,010

$

906,647

Gross leverage ratio

3.8

3.8

Total gross indebtedness

3,424,927

3,425,225

Less: cash and cash equivalents

460,359

508,104

Net debt

$

2,964,568

$

2,917,121

Adjusted EBITDA (LTM)

$

905,010

$

906,647

Net leverage ratio

3.3

3.2

Guidance

For the three months ending

June 30, 2024

($ in millions, except per share

amounts)

Operating Income

Net Income

EPS

Low

High

Low

High

Low

High

GAAP

$

140.5

$

145.0

$

77.0

$

80.3

$

0.50

$

0.53

Restructuring related and other

12.0

15.0

12.0

15.0

0.08

0.10

Financing and other transaction costs

2.5

4.0

2.5

4.0

0.02

0.03

Step-up depreciation and amortization

37.0

38.0

37.0

38.0

0.24

0.25

Deferred (gain)/loss on derivative

instruments(1)

—

—

—

—

—

—

Amortization of debt issuance costs

—

—

1.5

1.7

0.01

0.01

Deferred taxes and other tax related

—

—

4.0

5.0

0.03

0.03

Non-GAAP

$

192.0

$

202.0

$

134.0

$

144.0

$

0.89

$

0.95

Weighted-average diluted shares

outstanding (in millions)

151.3

151.3

(1)

We are unable to predict movements in

commodity prices and, therefore, the impact of mark-to-market

adjustments on our commodity forward contracts to our projected

operating results. In prior periods such adjustments have been

significant to our reported GAAP earnings.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240429705848/en/

Media & Investor Contact: Alexia Taxiarchos (508) 236-1761

ataxiarchos@sensata.com investors@sensata.com

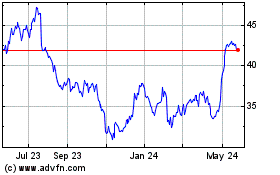

Sensata Technologies (NYSE:ST)

Historical Stock Chart

From Jan 2025 to Feb 2025

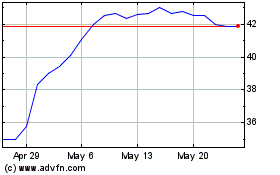

Sensata Technologies (NYSE:ST)

Historical Stock Chart

From Feb 2024 to Feb 2025