UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________

FORM 6-K

_______________________________

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File No. 001-36675

_______________________________

STELLANTIS N.V.

(Translation of Registrant’s Name Into English)

_______________________________

Taurusavenue 1

2132LS, Hoofddorp

The Netherlands

Tel. No.: +31 237001511

(Address of Principal Executive Offices)

_______________________________

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(1): o

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule101(b)(7): o

The following exhibit is furnished herewith:

| | | | | |

| Exhibit 99.1 | Press release issued by Stellantis N.V. dated September 6, 2024. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | |

Date: September 9, 2024 | STELLANTIS N.V. |

| | | |

| | | |

| By: | /s/ Giorgio Fossati |

| | Name: Giorgio Fossati |

| | Title: General Counsel |

Index of Exhibits

| | | | | |

Exhibit Number | Description of Exhibit |

| |

| 99.1 | Press release issued by Stellantis N.V. dated September 6, 2024. |

Weekly Report (August 30-September 5, 2024) Third Tranche

of Stellantis 2024 Share Buyback Program

AMSTERDAM, September 6, 2024 - Stellantis N.V. (“Stellantis” or the “Company”) announced today that pursuant to its Third Tranche of the 2024 Share Buyback Program announced on August 1, 2024, covering up to €1 billion to be executed in the open market during the period between August 1, 2024 and November 29, 2024, it has repurchased the following common shares in the period between August 30 up to and including September 5, 2024:

| | | | | | | | | | | | | | |

Date | Number of Shares Repurchased | Average Market Purchase Price in € per share | Repurchased Volume in € (excluding fees) | Venues |

30/08/2024 | 50 000 | €15.1403 | €757 013 | CEUX |

30/08/2024 | 736 400 | €15.1212 | €11 135 283 | MILE |

02/09/2024 | 200 000 | €14.9469 | €2 989 374 | CEUX |

02/09/2024 | 1 883 999 | €14.9381 | €28 143 286 | MILE |

03/09/2024 | 543 784 | €14.6247 | €7 952 655 | CEUX |

03/09/2024 | 2 376 194 | €14.6458 | €34 801 196 | MILE |

03/09/2024 | 46 648 | €14.5626 | €679 317 | TQEX |

03/09/2024 | 233 374 | €14.5796 | €3 402 510 | XPAR |

04/09/2024 | 332 676 | €14.4235 | €4 798 363 | CEUX |

04/09/2024 | 1 912 261 | €14.4282 | €27 590 519 | MILE |

04/09/2024 | 24 983 | €14.4486 | €360 970 | TQEX |

04/09/2024 | 200 000 | €14.4486 | €2 889 722 | XPAR |

05/09/2024 | 80 100 | €14.4609 | €1 158 322 | CEUX |

05/09/2024 | 1 613 900 | €14.3740 | €23 198 222 | MILE |

Total | 10 234 319 | €14.6426 | €149 856 750 | |

Since August 1, 2024 up to and including September 5, 2024, the Company has purchased a total of 30,698,535 common shares for a total consideration of € 446,893,312.

As of September 5, 2024, the Company held in treasury No. 112,798,709 common shares equal to 2.88% of the total issued share capital including the common shares and the special voting shares.

A comprehensive overview of the transactions carried out under the buyback program, as well as the details of the above transactions, are available on Stellantis’ corporate website under the Share Buyback Program Section www.stellantis.com/en/investors/stock-and-shareholder-info/share-buyback-program.

###

About Stellantis

Stellantis N.V. (NYSE: STLA / Euronext Milan: STLAM / Euronext Paris: STLAP) is one of the world’s leading automakers aiming to provide clean, safe and affordable freedom of mobility to all. It’s best known for its unique portfolio of iconic and innovative brands including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall, Free2move and Leasys. Stellantis is executing its Dare Forward 2030, a bold strategic plan that paves the way to achieve the ambitious target of becoming a carbon net zero mobility tech company by 2038, with single-digit percentage compensation of the remaining emissions, while creating added value for all stakeholders. For more information, visit www.stellantis.com.

| | | | | | | | | | | |

@Stellantis @Stellantis |  Stellantis Stellantis |  Stellantis Stellantis |  Stellantis Stellantis |

| | |

For more information, contact:

|

communications@stellantis.com |

www.stellantis.com |

FORWARD-LOOKING STATEMENTS

This communication contains forward-looking statements. In particular, statements regarding future events and anticipated results of operations, business strategies, the anticipated benefits of the proposed transaction, future financial and operating results, the anticipated closing date for the proposed transaction and other anticipated aspects of our operations or operating results are forward-looking statements. These statements may include terms such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “outlook”, “prospects”, “plan”, or similar terms. Forward-looking statements are not guarantees of future performance. Rather, they are based on Stellantis’ current state of knowledge, future expectations and projections about future events and are by their nature, subject to inherent risks and uncertainties. They relate to events and depend on circumstances that may or may not occur or exist in the future and, as such, undue reliance should not be placed on them.

Actual results may differ materially from those expressed in forward-looking statements as a result of a variety of factors, including: the ability of Stellantis to launch new products successfully and to maintain vehicle shipment volumes; changes in the global financial markets, general economic environment and changes in demand for automotive products, which is subject to cyclicality; Stellantis’ ability to successfully manage the industry-wide transition from internal combustion engines to full electrification; Stellantis’ ability to offer innovative, attractive products and to develop, manufacture and sell vehicles with advanced features including enhanced electrification, connectivity and autonomous-driving characteristics; Stellantis’ ability to produce or procure electric batteries with competitive performance, cost and at required volumes; Stellantis’ ability to successfully launch new businesses and integrate acquisitions; a significant malfunction, disruption or security breach compromising information technology systems or the electronic control systems contained in Stellantis’ vehicles; exchange rate fluctuations, interest rate changes, credit risk and other market risks; increases in costs, disruptions of supply or shortages of raw materials, parts, components and systems used in Stellantis’ vehicles; changes in local economic and political conditions; changes in trade policy, the imposition of global and regional tariffs or tariffs targeted to the automotive industry, the enactment of tax reforms or other changes in tax laws and regulations; the level of governmental economic incentives available to support the adoption of battery electric vehicles; the impact of increasingly stringent regulations regarding fuel efficiency requirements and reduced greenhouse gas and tailpipe emissions; various types of claims, lawsuits, governmental investigations and other contingencies, including product liability and warranty claims and environmental claims, investigations and lawsuits; material operating expenditures in relation to compliance with environmental, health and safety regulations; the level of competition in the automotive industry, which may increase due to consolidation and new entrants; Stellantis’ ability to attract and retain experienced management and employees; exposure to shortfalls in the funding of Stellantis’ defined benefit pension plans; Stellantis’ ability to provide or arrange for access to adequate financing for dealers and retail customers and associated risks related to the operations of financial services companies; Stellantis’ ability to access funding to execute its business plan; Stellantis’ ability to realize anticipated benefits from joint venture arrangements; disruptions arising from political, social and economic instability; risks associated with Stellantis’ relationships with employees, dealers and suppliers; Stellantis’ ability to maintain effective internal controls over financial reporting; developments in labor and industrial relations and developments in applicable labor laws; earthquakes or other disasters; risks and other items described in Stellantis’ Annual Report on Form 20-F for the year ended December 31, 2023 and Current Reports on Form 6-K and amendments thereto filed with the SEC; and other risks and uncertainties.

Any forward-looking statements contained in this communication speak only as of the date of this document and Stellantis disclaims any obligation to update or revise publicly forward-looking statements. Further information concerning Stellantis and its businesses, including factors that could materially affect Stellantis’ financial results, is included in Stellantis’ reports and filings with the U.S. Securities and Exchange Commission and AFM.

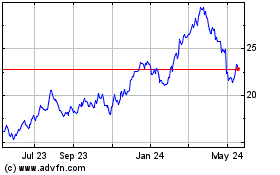

Stellantis NV (NYSE:STLA)

Historical Stock Chart

From Oct 2024 to Nov 2024

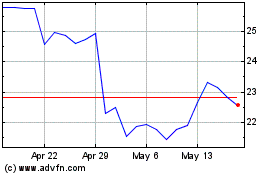

Stellantis NV (NYSE:STLA)

Historical Stock Chart

From Nov 2023 to Nov 2024