false

0001465128

0001465128

2024-12-17

2024-12-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 17, 2024

Starwood Property Trust, Inc.

(Exact name of registrant as specified in

its charter)

Maryland

(State or other jurisdiction of

incorporation) |

|

001-34436

(Commission File Number) |

|

27-0247747

(IRS Employer Identification No.) |

591 West Putnam Avenue

Greenwich, CT |

|

06830 |

(Address of principal

executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (203) 422-7700

(Former name or former address, if changed

since last report.)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ | Written communications pursuant to Rule 425 under

the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting material pursuant to Rule 14a-12 under

the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under

the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading

Symbol(s) |

Name of each exchange on which

registered |

| Common stock, $0.01 par value per share |

STWD |

New York Stock Exchange |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this

chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging

growth company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with

any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD.

In connection with the below described private

financing transaction, Starwood Property Trust, Inc. (the “Company”) anticipates disclosing to prospective investors the below

information that has not been previously publicly reported.

The Company currently expects to enter into amendments

to (i) its term loan agreement with Morgan Stanley Senior Funding, Inc., as administrative agent, and the lenders party thereto from time

to time, dated as of November 18, 2022 (the “MS Term Loan Credit Agreement”), and (ii) its term loan agreement with JPMorgan

Chase Bank, N.A., as administrative agent, and the lenders party thereto from time to time, dated as July 26, 2019 (the “JPM Term

Loan Credit Agreement”), on or about December 23, 2024 and January 2, 2025, respectively. With respect to the MS Term Loan Credit

Agreement, the Company expects that the amendment will increase the size of the term loan facility by $100 million, to $689.5 million,

and reduce the annual interest rate from SOFR + 2.75% to SOFR + 2.25%, with the repriced loans and incremental loans thereunder priced

at par. With respect to the JPM Term Loan Credit Agreement, the Company expects that the amendment will increase the size of the term

loan facility by $133.2 million, to $900 million, reduce the annual interest rate to SOFR + 2.25% (from an annual interest rate of SOFR

+ 2.60% with respect to an existing tranche of $380.0 million and an annual interest rate of SOFR + 3.35% with respect to the other existing

tranche of $386.8 million), and extend the maturity date from July 2026 to January 2030, with the repriced loans and incremental loans

thereunder priced at 99.75% of par. The closing of each of these amendments is subject to the completion of documentation and customary

closing conditions, and there can be no assurance that these amendments will be entered into on the terms described herein, or at all.

Following the anticipated closings of the amendments

to the MS Term Loan Credit Agreement and the JPM Term Loan Credit Agreement described above, the Company also anticipates entering into

an amendment to its revolving credit facility agreement with JPMorgan Chase Bank, N.A., as administrative

agent and swing line lender, and the other lenders party thereto from time to time, dated as of July 26, 2019 (the “Revolving

Facility Credit Agreement”). The Company currently expects that the amendment to the Revolving Facility Credit Agreement will increase

the size of the revolving credit facility by $50 million, to $200 million, and extend the maturity date from April 2026 to January 2030

(or such earlier date that is 91 days prior to the date on which any of the Company’s term loans with more than $75 million outstanding

is scheduled to mature). The closing of this amendment is subject to the completion of documentation and customary closing conditions,

and there can be no assurance that this amendment will be entered into on the terms described herein, or at all.

The information in this Item 7.01 is being furnished

and shall not be deemed to be filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject

to the liabilities of that section, nor shall it be incorporated by reference into any of the Company’s filings under the Securities

Act of 1933, as amended (the “Securities Act”), unless expressly set forth as being incorporated by reference into such filing.

Item 8.01 Other Events.

On December 17, 2024, the Company issued a press

release announcing that it had commenced a private offering of $400 million aggregate principal amount of its unsecured senior notes due

2030 (the “Notes”). A copy of such press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

The Company intends to allocate an amount equal

to the net proceeds from the offering to finance or refinance, in whole or in part, recently completed or future eligible green and/or

social projects. Net proceeds allocated to previously incurred costs associated with eligible green and/or social projects will be available

for the repayment of indebtedness previously incurred. Pending full allocation of an amount equal to the net proceeds to eligible green

and/or social projects, the Company intends to use the net proceeds to repay the Company’s $400 million outstanding aggregate principal

amount of 3.750% Senior Notes due 2024.

The Notes will be offered only to persons reasonably

believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act, and non-U.S. persons outside the United

States pursuant to Regulation S under the Securities Act. The Notes will not initially be registered under the Securities Act or any state

securities laws and may not be offered or sold in the United States absent an effective registration statement or an applicable exemption

from the registration requirements of the Securities Act or any state securities laws.

The information contained in this Current Report

on Form 8-K, including the exhibit hereto, is neither an offer to sell nor a solicitation of an offer to purchase any of the Notes or

any other securities.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Dated: December 17, 2024 |

STARWOOD PROPERTY TRUST, INC. |

| |

|

| |

By: |

/s/ Jeffrey F. DiModica |

| |

Name: |

Jeffrey F. DiModica |

| |

Title: |

President |

Exhibit 99.1

Starwood Property Trust Announces Private Offering

of Sustainability Bonds

GREENWICH, Conn., December 17, 2024/PRNewswire/

-- Starwood Property Trust, Inc. (NYSE: STWD) (the “Company”) today announced that, subject to market and other conditions,

it is offering $400 million aggregate principal amount of its unsecured senior notes due 2030 (the “Notes”) in a private offering.

The Company intends to allocate an amount equal

to the net proceeds from the offering to finance or refinance, in whole or in part, recently completed or future eligible green and/or

social projects. Net proceeds allocated to previously incurred costs associated with eligible green and/or social projects will be available

for the repayment of indebtedness previously incurred. Pending full allocation of an amount equal to the net proceeds to eligible green

and/or social projects, the Company intends to use the net proceeds to repay the Company’s $400 million outstanding aggregate principal

amount of 3.750% Senior Notes due 2024.

The Notes will be offered only to persons reasonably

believed to be qualified institutional buyers in reliance on Rule 144A under the Securities Act of 1933, as amended (the “Securities

Act”), and non-U.S. persons outside the United States pursuant to Regulation S under the Securities Act. The Notes will not initially

be registered under the Securities Act or any state securities laws and may not be offered or sold in the United States absent an effective

registration statement or an applicable exemption from the registration requirements of the Securities Act or any state securities laws.

This press release shall not constitute an offer

to sell, or the solicitation of an offer to buy, these securities, nor shall there be any sale of these securities in any state or jurisdiction

in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such

state or jurisdiction.

About Starwood Property Trust, Inc.

Starwood Property Trust, Inc. (NYSE: STWD), an

affiliate of global private investment firm Starwood Capital Group, is a leading diversified finance company with a core focus on the

real estate and infrastructure sectors. As of September 30, 2024, the Company has successfully deployed over $100 billion of capital since

inception and manages a portfolio of $26 billion across debt and equity investments. Starwood Property Trust’s investment objective

is to generate attractive and stable returns for shareholders, primarily through dividends, by leveraging a premiere global organization

to identify and execute on the best risk adjusted returning investments across its target assets.

Forward-Looking Statements

Statements

in this press release which are not historical fact may be deemed forward-looking statements within the meaning of Section 27A of

the Securities Act and Section 21E of the Securities Exchange Act of 1934, as amended, including statements with respect to the

anticipated offering and the use of proceeds. Although the Company believes the expectations reflected in any forward-looking

statements are based on reasonable assumptions, it can give no assurance that its expectations will be attained. Factors that could

cause actual results to differ materially from the Company’s expectations include: (i) factors described in the

Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and its Quarterly Reports on Form 10-Q for

the quarters ended March 31, 2024, June 30, 2024 and September 30, 2024 including those set forth under the captions “Risk

Factors”, “Business”, and “Management’s Discussion and Analysis of Financial Condition and Results of

Operations”; (ii) defaults by borrowers in

paying debt service on outstanding indebtedness; (iii) impairment in the value of real estate property securing the Company’s

loans or in which the Company invests; (iv) availability of mortgage origination and acquisition opportunities acceptable to the

Company; (v) potential mismatches in the timing of asset repayments and the maturity of the associated financing agreements;

(vi) the Company’s ability to achieve the benefits that it anticipates from the prior acquisition of the project finance

origination, underwriting and capital markets business of GE Capital Global Holdings, LLC; (vii) national and local economic and

business conditions, including as a result of the impact of public health emergencies; (viii) the occurrence of certain

geo-political events (such as wars, terrorist attacks and tensions between states) that affect the normal and peaceful course of

international relations; (ix) general and local commercial and residential real estate property conditions; (x) changes in federal

government policies; (xi) changes in federal, state and local governmental laws and regulations; (xii) increased competition from

entities engaged in mortgage lending and securities investing activities; (xiii) changes in interest rates; and (xiv) the

availability of, and costs associated with, sources of liquidity.

Contact:

Zachary Tanenbaum

Starwood Property Trust

Phone: 203-422-7788

Email: ztanenbaum@starwood.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

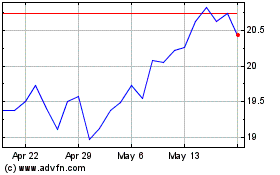

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Nov 2024 to Dec 2024

Starwood Property (NYSE:STWD)

Historical Stock Chart

From Dec 2023 to Dec 2024