0000016918false00000169182025-01-082025-01-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) January 8, 2025

CONSTELLATION BRANDS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-08495 | 16-0716709 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

50 East Broad Street, Rochester, NY 14614

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code (585) 678-7100

| | |

| Not Applicable |

| (Former name or former address, if changed since last report.) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Each Class | Trading Symbol(s) | Name of Each Exchange on Which Registered |

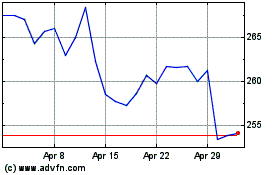

| Class A Common Stock | STZ | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition. |

On January 10, 2025, Constellation Brands, Inc. (“Constellation” or the “Company”), a Delaware corporation, issued a news release (the “release”) announcing its financial condition and results of operations as of and for the third fiscal quarter ended November 30, 2024. A copy of the release is attached hereto as Exhibit 99.1 and incorporated herein by reference. The projections constituting the guidance included in the release involve risks and uncertainties, the outcome of which cannot be foreseen at this time; therefore, actual results may vary materially from these forecasts. In this regard, see the information included in the release under the caption “Forward-Looking Statements.”

The information in the release is “furnished” and not “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

The release contains non-GAAP financial measures; in the release these are referred to as “comparable,” “adjusted,” or “comparable Canopy EIE” measures. For purposes of Regulation G, a non-GAAP financial measure is a numerical measure of a registrant’s historical or future financial performance, financial position, or cash flows that excludes amounts, or is subject to adjustments that have the effect of excluding amounts, that are included in the most directly comparable measure calculated and presented in accordance with GAAP in the statement of income, balance sheet, or statement of cash flows (or equivalent statements) of the registrant; or includes amounts, or is subject to adjustments that have the effect of including amounts, that are excluded from the most directly comparable measure so calculated and presented. In this regard, GAAP refers to generally accepted accounting principles in the United States. Pursuant to the requirements of Regulation G, the Company has provided reconciliations within the release of the non-GAAP financial measures to the most directly comparable GAAP financial measures.

Comparable measures, including those presenting the impact of the Company’s former equity method investment in Canopy Growth Corporation and adjusted measures are provided because management uses this information in monitoring and evaluating the results and underlying business trends of the core operations of the Company and/or in internal goal setting. In addition, the Company believes this information provides investors, financial analysts covering the Company, rating agencies, and other external users valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance.

| | | | | |

| Item 7.01 | Regulation FD Disclosure. |

On January 10, 2025, Constellation issued a news release regarding its third fiscal quarter ended November 30, 2024, a copy of which is furnished herewith as Exhibit 99.1 and is incorporated herein by reference.

On January 8, 2025, the Company’s Board of Directors declared a quarterly cash dividend in the amount of $1.01 per issued and outstanding share of the Company’s Class A Common Stock and $0.91 per issued and outstanding share of the Company’s Class 1 Convertible Common Stock, in each case payable on February 21, 2025, to stockholders of record of each respective class as of the close of business on February 7, 2025. On January 9, 2025, Constellation issued a news release regarding the quarterly cash dividend declared on the Company’s Class A Common Stock, a copy of which is furnished herewith as Exhibit 99.2 and is incorporated herein by reference.

References to Constellation’s website and/or other social media sites or platforms in the news releases do not incorporate by reference the information on such websites, social media sites, or platforms into this Current Report on Form 8-K, and Constellation disclaims any such incorporation by reference. The information in the news releases attached as Exhibit 99.1 and Exhibit 99.2 is incorporated by reference into this Item 7.01 in satisfaction of the public disclosure requirements of Regulation FD. This information is “furnished” and not “filed” for purposes of

Section 18 of the Securities Exchange Act of 1934 and is not otherwise subject to the liabilities of that section. Such information may be incorporated by reference in another filing under the Securities Exchange Act of 1934 or the Securities Act of 1933 only if and to the extent such subsequent filing specifically references the information incorporated by reference herein.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | |

| Exhibit No. | Description |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| 99.1 | |

| |

| 99.2 | |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

| |

| |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: | January 10, 2025 | CONSTELLATION BRANDS, INC. |

| | |

| | By: | /s/ Garth Hankinson |

| | | Garth Hankinson |

| | | Executive Vice President and

Chief Financial Officer |

Beer Business Continues to Deliver Volume Growth, Disciplined Pricing Actions, and Additional Cost Savings While Driving Incremental Marketing Investments

Company Returns Another ~$220 Million to Shareholders in Share Repurchases

While Continuing to Advance Broader Disciplined Capital Allocation Priorities

Updates Fiscal 2025 Outlook With Reduced Growth Expectations for Net Sales and Operating Income of Enterprise and Businesses; Lowers Reported EPS and Lower-End of Comparable EPS Guidance; Increases Operating Cash Flow and Free Cash Flow Targets

| | | | | | | | | | | | | | | | | | |

| Net

Sales | Operating

Income (Loss) | Net Income (Loss)

Attributable to CBI | Adjusted Earnings Before

Interest & Taxes | Diluted Net Income (Loss) Per Share Attributable to CBI (EPS) | |

Third Quarter Fiscal Year 2025 Financial Highlights (1) | In millions, except per share data |

| Reported | $2,464 | $793 | $616 | $778 | $3.39 | |

| % Change | (0%) | (0%) | 21% | 3% | 23% | |

| Comparable | $2,464 | $802 | $591 | $826 | $3.25 | |

| % Change | (0%) | (2%) | (1%) | (2%) | 0% | |

(1) Definitions of reported, comparable, and adjusted as well as reconciliations of non-GAAP financial measures, are contained elsewhere in this news release. Comparable and adjusted amounts are non-GAAP financial measures.

HIGHLIGHTS

•Generates reported EPS of $3.39 and comparable EPS of $3.25

•Beer Business achieves 59th consecutive quarter of depletion volume growth; continues to outperform total beverage industry and combined beverage alcohol categories in dollar sales growth across Circana tracked channels

•Wine and Spirits Business completes in January the previously announced divestiture of SVEDKA and continues to advance commercial and operational actions expected to drive performance improvements

•Generates year-to-date operating cash flow of $2.6 billion, a 9% increase, and free cash flow of $1.6 billion, a 13% increase

•Updates fiscal 2025 reported EPS outlook to $3.90 - $4.30 and comparable EPS outlook to $13.40 - $13.80, including $668 million of shares repurchased through November 2024

•Raises fiscal 2025 operating cash flow target to $2.9 - $3.1 billion and free cash flow projection to $1.6 - $1.8 billion

•Declares quarterly cash dividend of $1.01 per share Class A Common Stock

| | | | | | | | | | | | | | | | | | | | | | | |

CONSTELLATION BRANDS GROWTH OUTPACES CPG SECTOR BY 3.7 PERCENTAGE POINTS IN DOLLAR SALES | | | BEER BUSINESS DELIVERS 3RD HIGHEST SHARE GAIN IN BEVERAGE INDUSTRY IN DOLLAR SALES | | | CRAFT SPIRITS PORTFOLIO ACHIEVES DOUBLE-DIGIT GROWTH IN DOLLAR SALES, OUTPERFORMING HIGHER-END SPIRITS SEGMENT | |

Circana, total U.S. Multi-Outlet + Convenience, 12 weeks ended on December 1, 2024. |

| | | | | | | | | | | | | | |

| "While we continue to face the subdued spend and value seeking behaviors that emerged among legal drinking age consumers in Q2, our Beer Business delivered a sequential increase in our depletions growth rate in Q3. This was supported by our relentless focus on executing against the key growth drivers of our Beer Business, including incremental marketing investments. That said, given near-term uncertainty on when consumers will revert to more normalized spending, we have prudently lowered our growth outlook for | | | "Our strong year-to-date cash flow generation in fiscal 2025 has enabled us to: reach and maintain a net leverage ratio below our stated target, return over $1.2 billion to shareholders in dividends and share repurchases through November 2024, and continue to advance our brewery investments in a disciplined and agile manner. As we look to the remainder of the 2025 fiscal year, we now expect to deliver annual operating cash flow and free cash flow above our initial targets, and to continue to deploy that cash |

net sales and operating income in fiscal 2025, and have also revised the lower-end of our comparable EPS growth guidance." | | with a balanced and thoughtful approach to capital allocation." |

| Bill Newlands | | Garth Hankinson |

President and Chief Executive Officer | | Executive Vice President and Chief Financial Officer |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 1 |

| | | | | | | | | | | | | | | | | | | |

| beer |

| Shipments | | Depletions | Net Sales | | Operating Income (Loss) |

Three Months Ended | In millions; branded product, 24-pack, 12-ounce case equivalents |

| November 30, 2024 | 102.7 | | | $2,032.4 | | $769.9 |

| November 30, 2023 | 101.1 | | | $1,968.5 | | $757.3 |

| % Change | 1.6% | | 3.2% | 3% | | 2% |

HIGHLIGHTS•Our Beer Business achieved a net sales increase of 3% supported by a 1.6% rise in shipment volumes.

•Depletions grew 3.2% largely driven by growth for Modelo Especial of more than 3%, Pacifico of approximately 20%, and the Modelo Chelada brands of approximately 4%; while Corona Extra declined approximately 1%.

•Our Beer Business was the #1 dollar share gainer and had 6 of the top 15 dollar share gaining brands in Circana channels across the entire U.S. beer category as:

◦Modelo Especial maintained its position as the #1 brand dollar share gainer and the #1 brand in dollar sales;

◦Corona Extra remains a top 5 brand in dollar sales and continued to gain share;

◦Pacifico continues to grow and remains a #4 dollar share gainer; and

◦Modelo Chelada Limón y Sal was a top 15 overall dollar share and volume share gainer.

•Operating margin decreased 60 basis points to 37.9% primarily due to higher marketing spend and increased depreciation expense, partially offset by favorable pricing.

•The Beer Business now expects net sales growth of 4 - 7% and operating income growth outlook of 9 - 12% for fiscal 2025.

CAPITAL EXPANSION

The company had approximately 48 million hectoliters of capacity across its existing facilities in Mexico at the end of fiscal 2024. From fiscal 2025 to fiscal 2028, the company expects approximately $3 billion of capital expenditures to continue the development of modular additions at existing facilities in Mexico and its third brewery site at Veracruz. We currently anticipate our next modular addition at our existing facilities in Mexico to come online in fiscal 2026 and our initial production at our third brewery site at Veracruz to be in late fiscal 2026 or early fiscal 2027.

| | | | | | | | | | | | | | | | | | | | | |

| wine and spirits |

| Shipments | | | Depletions | Net Sales | | | Operating Income (Loss) |

| Three Months Ended | In millions; branded product, 9-liter case equivalents |

| November 30, 2024 | 5.1 | | | | $431.4 | | | $95.2 |

| November 30, 2023 | 6.1 | | | | $502.4 | | | $127.6 |

| % Change | (16.4%) | | | (4.3%) | (14%) | | | (25%) |

HIGHLIGHTS

•Our Wine and Spirits net sales declined 14% driven by a 16.4% decrease in shipment volumes, mostly driven by ongoing weaker consumer demand and continued retailer inventory destocking across most price segments in the U.S. wholesale market.

•The divestiture of SVEDKA further aligns our Wine and Spirits portfolio with higher-growth, higher-margin brands driven by consumer-led premiumization trends.

◦Our remaining spirits portfolio, which is focused on higher-end craft spirits brands, delivered depletion growth of approximately 9%, driven by Mi CAMPO posting growth over 30%.

•Operating margin decreased 333 basis points to 22.1% as the decline in net sales exceeded the decreases in COGS and SG&A expenses.

•The Wine and Spirits Business expects organic net sales decline of 5 - 8% and operating income decline of 17 - 19%; see fiscal 2025 Guidance Assumptions under Outlook for more information, including adjustments related to the divestiture of SVEDKA.

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 2 |

| | | | | | | | | | | | | | | | | | | | | |

outlook |

The table sets forth management's current EPS expectations for fiscal 2025 compared to fiscal 2024 actual results. Enterprise growth assumptions and Wine and Spirits decline assumptions for fiscal 2025 exclude $23 million of net sales and $10 million of gross profit less marketing for the January 2024 to February 2024 period that are no longer expected to be part of year-over-year results following the divestiture of SVEDKA. For the March 2024 to November 2024 period, SVEDKA delivered $84 million of net sales and $30 million of gross profit less marketing. |

| Reported | | Comparable |

| FY25 Estimate | FY24 Actual | | FY25 Estimate | FY24 Actual | |

| Fiscal Year Ending February 28/29 | $3.90 - $4.30 | $9.39 | | $13.40 - $13.80 | $12.38 | |

Fiscal 2025 Guidance Assumptions: |

•Enterprise: organic net sales growth of 2 - 5% ◦Beer: net sales growth of 4 - 7% ◦Wine and Spirits: organic net sales decline of 5 - 8% •Enterprise: operating income growth (decline): reported of (65%) - (62%) and comparable of 6 - 9% ◦Beer: operating income growth of 9 - 12% ◦Wine and Spirits: operating income decline of 17 - 19% ◦Corporate expense: $250 million •Interest expense, net: $410 million

| •Tax rate: reported approximately 8%; comparable approximately 18.5% •Weighted average diluted shares outstanding: approximately 182.5 million; inclusive of share repurchases •Operating cash flow: $2.9 - $3.1 billion •Capital expenditures: approximately $1.3 billion, including approximately $1.0 billion targeted for Mexico beer operations activities •Free cash flow: $1.6 - $1.8 billion |

QUARTERLY DIVIDEND

On January 8, 2025, Constellation’s board of directors declared a quarterly cash dividend of $1.01 per share of Class A Common Stock payable on February 21, 2025, to stockholders of record as of the close of business on February 7, 2025.

† A copy of this news release, including the attachments and other financial information that may be discussed during the call, will be available on our investor relations website, ir.cbrands.com, prior to the call.

| | |

ABOUT CONSTELLATION BRANDS Constellation Brands (NYSE: STZ) is a leading international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, and Italy. Our mission is to build brands that people love because we believe elevating human connections is Worth Reaching For. It’s worth our dedication, hard work, and calculated risks to anticipate market trends and deliver more for our consumers, shareholders, employees, and industry. This dedication is what has driven us to become one of the fastest-growing, large CPG companies in the U.S. at retail, and it drives our pursuit to deliver what’s next.

Every day, people reach for our high-end, iconic imported beer brands such as those in the Corona brand family like the flagship Corona Extra, Modelo Especial and the flavorful lineup of Modelo Cheladas, Pacifico, and Victoria; our fine wine and craft spirits brands, including The Prisoner Wine Company, Robert Mondavi Winery, Casa Noble Tequila, and High West Whiskey; and our premium wine brands such as Kim Crawford and Meiomi.

As an agriculture-based company, we have a long history of operating sustainably and responsibly. Our ESG strategy is embedded into our business and our work focuses on serving as good stewards of the environment, enhancing social equity within our industry and communities, and promoting responsible beverage alcohol consumption. These commitments ground our aspirations beyond driving the bottom line as we work to create a future that is truly Worth Reaching For.

To learn more, visit www.cbrands.com and follow us on X, Instagram, and LinkedIn. |

| | | | | | | | | | | | | | | | | |

| MEDIA CONTACTS | INVESTOR RELATIONS CONTACTS |

| Amy Martin | 585-678-7141 | amy.martin@cbrands.com | Joseph Suarez | 773-551-4397 | joseph.suarez@cbrands.com |

Carissa Guzski | 315-525-7362 | carissa.guzski@cbrands.com | Snehal Shah | 847-385-4940 | snehal.shah@cbrands.com |

| | | David Paccapaniccia | 585-282-7227 | david.paccapaniccia@cbrands.com |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 3 |

SUPPLEMENTAL INFORMATION

Reported basis (“reported”) are derived from amounts as reported under generally accepted accounting principles in the U.S. Comparable basis (“comparable”) are amounts which exclude items that affect comparability (“comparable adjustments”), as they are not reflective of core operations of the segments. The company’s measure of segment profitability excludes comparable adjustments, which is consistent with the measure used by management to evaluate results. The company discusses various non-GAAP measures in this news release (“release”). Financial statements, as well as supplemental schedules and tables reconciling non-GAAP measures, together with definitions of these measures and the reasons management uses these measures, are included in this release.

FORWARD-LOOKING STATEMENTS

The statements made under the heading Outlook and all statements other than statements of historical fact set forth in this release, including statements regarding our business strategy, growth plans, operational and commercial execution initiatives, innovation, new products, future operations, financial position, expected net sales, expenses, marketing investments, cost savings and efficiency initiatives, operating income, capital expenditures, effective tax rates, anticipated tax liabilities, operating cash flow, and free cash flow, estimated diluted EPS and shares outstanding, expected volume, inventory, supply and demand levels, balance, and trends, macroeconomic headwinds and consumer behaviors, future payments of dividends, amount, manner, and timing of share repurchases under the share repurchase authorizations, access to capital markets, liquidity and capital resources, value creation efforts, and prospects, plans, and objectives of management, as well as information concerning expected actions of third parties, are forward-looking statements (collectively, “Projections”) that involve risks and uncertainties that could cause actual results to differ materially from those set forth in, or implied, by the Projections.

When used in this release, the words “anticipate,” “expect,” “intend,” “will,“ and similar expressions are intended to identify Projections, although not all Projections contain such identifying words. All Projections speak only as of the date of this release. We undertake no obligation to update or revise any Projections, whether as a result of new information, future events, or otherwise. The Projections are based on management’s current expectations and, unless otherwise noted, do not take into account the impact of any future acquisition, investment, merger, or other business combination, divestiture (including any associated amount of incremental contingent consideration payment paid or received), restructuring or other strategic business realignment, or financing or share repurchase that may be completed after the issuance of this release. Although we believe that the expectations reflected in the Projections are reasonable, we can give no assurance that such expectations will prove to be correct. In addition to the risks and uncertainties of ordinary business operations and conditions in the general economy and markets in which we compete, the Projections contained in this release are also subject to the risk, uncertainty, and possible variance from our current expectations regarding:

•water, agricultural and other raw material, and packaging material supply, production, and/or shipment difficulties which could adversely affect our ability to supply our customers;

•the ability to respond to anticipated inflationary pressures, including reductions in consumer discretionary income and our ability to pass along rising costs through increased selling prices;

•actual impact to supply, production levels, and costs from global supply chain disruptions and constraints, transportation challenges (including from labor strikes or other labor activities), shifting consumer behaviors, wildfires, and severe weather events;

•reliance on complex information systems and third-party global networks as well as risks associated with cybersecurity and artificial intelligence;

•economic and other uncertainties associated with our international operations, including potential new tariffs;

•dependence on limited facilities for production of our Mexican beer brands, including beer operations expansion, optimization, and/or construction activities, scope, capacity, supply, costs (including impairments), capital expenditures, and timing;

•operational disruptions or catastrophic loss to our breweries, wineries, other production facilities, or distribution systems;

•the impact of military conflicts, geopolitical tensions, and responses, including on inflation, supply chains, commodities, energy, and cybersecurity;

•climate change, ESG regulatory compliance, failure to meet emissions, stewardship, and other ESG targets, objectives, or ambitions, and timing changes for our ESG reporting;

•reliance on wholesale distributors, major retailers, and government agencies;

•contamination and degradation of product quality from diseases, pests, weather, and other conditions;

•communicable disease outbreaks, pandemics, or other widespread public health crises and associated governmental containment actions;

•effects of employee labor activities that could increase our costs;

•a potential decline in the consumption of products we sell and our dependence on sales of our Mexican beer brands;

•impacts of our acquisition, divestiture, investment, and new product development strategies and activities, including from the SVEDKA divestiture;

•the success of operational and commercial execution, cost savings, and efficiency initiatives;

•dependence upon our trademarks and proprietary rights, including the failure to protect our intellectual property rights;

•potential damage to our reputation;

•competition in our industry and for talent;

•our indebtedness and interest rate fluctuations;

•our international operations, worldwide and regional economic trends and financial market conditions, including macroeconomic headwinds, geopolitical uncertainty, or other governmental rules and regulations;

•class action or other litigation we may face;

•potential write-downs of our intangible assets, such as goodwill and trademarks, including potential future impairments of our Wine and Spirits goodwill;

•changes to tax laws, fluctuations in our effective tax rate, accounting for tax positions, the resolution of tax disputes, changes to accounting standards, elections, assertions, or policies, and the impact of a global minimum tax rate;

•amount, timing, and source of funds for any share repurchases;

•amount and timing of future dividends;

•Sands family members' ownership of our Class A Common Stock and Board of Director nomination rights as well as the choice-of-forum provision in our Amended and Restated By-laws; and

•other factors and uncertainties disclosed in our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended February 29, 2024, and our Quarterly Report on Form 10-Q for the fiscal quarter ended August 31, 2024, which could cause actual future performance to differ materially from our current expectations.

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 4 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS

(in millions)

(unaudited)

| | | | | | | | | | | |

| November 30,

2024 | | February 29,

2024 |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 73.7 | | | $ | 152.4 | |

| Accounts receivable | 836.2 | | | 832.8 | |

| Inventories | 2,129.6 | | | 2,078.3 | |

| Prepaid expenses and other | 590.0 | | | 666.0 | |

| | | |

| Total current assets | 3,629.5 | | | 3,729.5 | |

| Property, plant, and equipment | 7,785.3 | | | 8,055.2 | |

| Goodwill | 5,612.4 | | | 7,980.3 | |

| Intangible assets | 2,718.2 | | | 2,731.7 | |

| | | |

| | | |

| Deferred income taxes | 1,914.7 | | | 2,055.0 | |

| | | |

| Other assets | 1,146.1 | | | 1,140.0 | |

| Total assets | $ | 22,806.2 | | | $ | 25,691.7 | |

| | | |

| LIABILITIES AND STOCKHOLDER’S EQUITY | | | |

| Current liabilities: | | | |

| Short-term borrowings | $ | 890.1 | | | $ | 241.4 | |

| Current maturities of long-term debt | 503.3 | | | 956.8 | |

| Accounts payable | 1,055.9 | | | 1,107.1 | |

| Other accrued expenses and liabilities | 839.7 | | | 836.4 | |

| Total current liabilities | 3,289.0 | | | 3,141.7 | |

| Long-term debt, less current maturities | 10,185.7 | | | 10,681.1 | |

| | | |

| Deferred income taxes and other liabilities | 1,259.8 | | | 1,804.3 | |

| Total liabilities | 14,734.5 | | | 15,627.1 | |

| CBI stockholders’ equity | 7,817.8 | | | 9,743.1 | |

| Noncontrolling interests | 253.9 | | | 321.5 | |

| Total stockholders’ equity | 8,071.7 | | | 10,064.6 | |

| Total liabilities and stockholders’ equity | $ | 22,806.2 | | | $ | 25,691.7 | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 5 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF OPERATIONS

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 30,

2024 | | November 30,

2023 | | November 30,

2024 | | November 30,

2023 |

| Sales | $ | 2,644.4 | | | $ | 2,658.2 | | | $ | 8,644.2 | | | $ | 8,410.7 | |

| Excise taxes | (180.6) | | | (187.3) | | | (599.7) | | | (588.1) | |

| Net sales | 2,463.8 | | | 2,470.9 | | | 8,044.5 | | | 7,822.6 | |

| Cost of product sold | (1,179.5) | | | (1,200.3) | | | (3,844.6) | | | (3,844.3) | |

| Gross profit | 1,284.3 | | | 1,270.6 | | | 4,199.9 | | | 3,978.3 | |

| Selling, general, and administrative expenses | (491.3) | | | (473.7) | | | (1,444.7) | | | (1,438.0) | |

Goodwill impairment | — | | | — | | | (2,250.0) | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Operating income (loss) | 793.0 | | | 796.9 | | | 505.2 | | | 2,540.3 | |

| Income (loss) from unconsolidated investments | (15.0) | | | (41.8) | | | 65.8 | | | (477.4) | |

Interest expense, net | (104.4) | | | (104.2) | | | (311.2) | | | (333.7) | |

| | | | | | | |

| Income (loss) before income taxes | 673.6 | | | 650.9 | | | 259.8 | | | 1,729.2 | |

| (Provision for) benefit from income taxes | (44.5) | | | (130.0) | | | 79.7 | | | (368.4) | |

| Net income (loss) | 629.1 | | | 520.9 | | | 339.5 | | | 1,360.8 | |

| Net (income) loss attributable to noncontrolling interests | (13.2) | | | (11.8) | | | (45.6) | | | (25.8) | |

| Net income (loss) attributable to CBI | $ | 615.9 | | | $ | 509.1 | | | $ | 293.9 | | | $ | 1,335.0 | |

| | | | | | | |

Class A Common Stock: | | | | | | | |

Net income (loss) per common share attributable to CBI – basic | $ | 3.40 | | | $ | 2.77 | | | $ | 1.61 | | | $ | 7.28 | |

Net income (loss) per common share attributable to CBI – diluted | $ | 3.39 | | | $ | 2.76 | | | $ | 1.61 | | | $ | 7.25 | |

| | | | | | | |

Weighted average common shares outstanding – basic | 181.243 | | | 183.525 | | | 181.988 | | | 183.431 | |

Weighted average common shares outstanding – diluted | 181.753 | | | 184.170 | | | 182.555 | | | 184.096 | |

| | | | | | | |

Cash dividends declared per common share | $ | 1.01 | | | $ | 0.89 | | | $ | 3.03 | | | $ | 2.67 | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 6 |

| | | | | | | | | | | |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) (unaudited)

|

| Nine Months Ended |

| November 30,

2024 | | November 30,

2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net income (loss) | $ | 339.5 | | | $ | 1,360.8 | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | |

| Unrealized net (gain) loss on securities measured at fair value | 2.5 | | | 85.4 | |

| Deferred tax provision (benefit) | (184.2) | | | 28.2 | |

| Depreciation | 339.8 | | | 321.8 | |

| Stock-based compensation | 60.7 | | | 49.5 | |

| Equity in (earnings) losses of equity method investees and related activities, net of distributed earnings | (25.8) | | | 257.3 | |

| Noncash lease expense | 85.2 | | | 62.9 | |

| | | |

| | | |

Impairment of equity method investments | 2.4 | | | 136.1 | |

| | | |

Net gain in connection with Canopy exchangeable shares | (44.7) | | | — | |

Goodwill impairment | 2,250.0 | | | — | |

| | | |

| | | |

| | | |

| | | |

| Change in operating assets and liabilities, net of effects from purchase and sale of business: | | | |

| Accounts receivable | (7.7) | | | 6.9 | |

| Inventories | (54.2) | | | (90.4) | |

| Prepaid expenses and other current assets | (47.2) | | | (49.1) | |

| Accounts payable | 117.4 | | | 24.5 | |

| | | |

| Other accrued expenses and liabilities | (117.4) | | | 37.1 | |

| Other | (158.8) | | | 115.8 | |

| Total adjustments | 2,218.0 | | | 986.0 | |

| Net cash provided by (used in) operating activities | 2,557.5 | | | 2,346.8 | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchase of property, plant, and equipment | (931.5) | | | (911.9) | |

| Purchase of business, net of cash acquired | (158.7) | | | (7.5) | |

| Investments in equity method investees and securities | (31.1) | | | (34.6) | |

| Proceeds from sale of assets | 34.8 | | | 21.8 | |

| | | |

| Proceeds from sale of business | — | | | 5.4 | |

| Other investing activities | (11.7) | | | (3.1) | |

| Net cash provided by (used in) investing activities | (1,098.2) | | | (929.9) | |

| | | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 7 |

| | | | | | | | | | | |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (in millions) (unaudited)

|

| Nine Months Ended |

| November 30,

2024 | | November 30,

2023 |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from issuance of long-term debt | — | | | 744.8 | |

| Principal payments of long-term debt | (956.0) | | | (807.5) | |

| Net proceeds from (repayments of) short-term borrowings | 648.7 | | | (706.4) | |

| Dividends paid | (551.3) | | | (491.1) | |

| Purchases of treasury stock | (668.1) | | | (249.7) | |

| Proceeds from shares issued under equity compensation plans | 66.2 | | | 89.0 | |

| Payments of minimum tax withholdings on stock-based payment awards | (13.8) | | | (11.2) | |

| Payments of debt issuance, debt extinguishment, and other financing costs | (0.1) | | | (5.3) | |

| Distributions to noncontrolling interests | (47.5) | | | (35.0) | |

| Payment of contingent consideration | (0.7) | | | — | |

Purchase of noncontrolling interest | (16.2) | | | — | |

| | | |

| | | |

| | | |

| | | |

| Net cash provided by (used in) financing activities | (1,538.8) | | | (1,472.4) | |

| | | |

| Effect of exchange rate changes on cash and cash equivalents | 0.8 | | | 0.7 | |

| | | |

| Net increase (decrease) in cash and cash equivalents | (78.7) | | | (54.8) | |

| Cash and cash equivalents, beginning of period | 152.4 | | | 133.5 | |

| Cash and cash equivalents, end of period | $ | 73.7 | | | $ | 78.7 | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 8 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUMMARIZED SEGMENT, INCOME (LOSS) FROM UNCONSOLIDATED INVESTMENTS,

AND DEPRECIATION AND AMORTIZATION INFORMATION

(in millions)

(unaudited)

Management excludes items that affect comparability from its evaluation of the results of each operating segment as these comparable adjustments are not reflective of core operations of the segments. Segment operating performance and the incentive compensation of segment management are evaluated based on core segment operating income (loss) which does not include the impact of these comparable adjustments.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Nine Months Ended | | |

| November 30, 2024 | | November 30, 2023 | | Percent

Change | | November 30, 2024 | | November 30, 2023 | | Percent

Change |

| Consolidated | | | | | | | | | | | |

| Net sales | $ | 2,463.8 | | | $ | 2,470.9 | | | (0 | %) | | $ | 8,044.5 | | | $ | 7,822.6 | | | 3 | % |

| Gross profit | $ | 1,284.3 | | | $ | 1,270.6 | | | 1 | % | | $ | 4,199.9 | | | $ | 3,978.3 | | | 6 | % |

| | | | | | | | | | | |

| Operating income (loss) | $ | 793.0 | | | $ | 796.9 | | | (0 | %) | | $ | 505.2 | | | $ | 2,540.3 | | | (80 | %) |

| % Net sales | 32.2 | % | | 32.3 | % | | | | NM | | 32.5 | % | | |

Income (loss) from unconsolidated investments | $ | (15.0) | | | $ | (41.8) | | | 64 | % | | $ | 65.8 | | | $ | (477.4) | | | 114 | % |

Depreciation and amortization | $ | 119.3 | | | $ | 108.4 | | | 10 | % | | $ | 340.8 | | | $ | 322.8 | | | 6 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

Comparable adjustments (1) | | | | | | | | | | | |

| Gross profit | $ | 2.3 | | | $ | (12.2) | | | NM | | $ | 5.7 | | | $ | (23.1) | | | NM |

| | | | | | | | | | | |

| Operating income (loss) | $ | (9.2) | | | $ | (22.9) | | | NM | | $ | (2,310.8) | | | $ | (74.5) | | | NM |

| Income (loss) from unconsolidated investments | $ | (38.9) | | | $ | (61.0) | | | NM | | $ | 39.9 | | | $ | (452.8) | | | NM |

| | | | | | | | | | | |

| Beer | | | | | | | | | | | |

| Net sales | $ | 2,032.4 | | | $ | 1,968.5 | | | 3 | % | | $ | 6,835.4 | | | $ | 6,459.8 | | | 6 | % |

| Segment gross profit | $ | 1,076.7 | | | $ | 1,039.1 | | | 4 | % | | $ | 3,656.2 | | | $ | 3,366.5 | | | 9 | % |

| % Net sales | 53.0 | % | | 52.8 | % | | | | 53.5 | % | | 52.1 | % | | |

| | | | | | | | | | | |

| Segment operating income (loss) | $ | 769.9 | | | $ | 757.3 | | | 2 | % | | $ | 2,770.6 | | | $ | 2,509.0 | | | 10 | % |

| % Net sales | 37.9 | % | | 38.5 | % | | | | 40.5 | % | | 38.8 | % | | |

Segment depreciation and amortization | $ | 93.4 | | | $ | 82.0 | | | 14 | % | | $ | 262.3 | | | $ | 242.2 | | | 8 | % |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| Wine net sales | $ | 374.6 | | | $ | 435.8 | | | (14 | %) | | $ | 1,040.1 | | | $ | 1,180.7 | | | (12 | %) |

| Spirits net sales | 56.8 | | | 66.6 | | | (15 | %) | | 169.0 | | | 182.1 | | | (7 | %) |

Net sales | $ | 431.4 | | | $ | 502.4 | | | (14 | %) | | $ | 1,209.1 | | | $ | 1,362.8 | | | (11 | %) |

| Segment gross profit | $ | 205.3 | | | $ | 243.7 | | | (16 | %) | | $ | 538.0 | | | $ | 634.9 | | | (15 | %) |

| % Net sales | 47.6 | % | | 48.5 | % | | | | 44.5 | % | | 46.6 | % | | |

| | | | | | | | | | | |

| Segment operating income (loss) | $ | 95.2 | | | $ | 127.6 | | | (25 | %) | | $ | 225.4 | | | $ | 287.6 | | | (22 | %) |

| % Net sales | 22.1 | % | | 25.4 | % | | | | 18.6 | % | | 21.1 | % | | |

Segment income (loss) from unconsolidated investments | $ | 25.6 | | | $ | 27.5 | | | (7 | %) | | $ | 31.4 | | | $ | 38.1 | | | (18 | %) |

Segment depreciation and amortization | $ | 20.5 | | | $ | 22.5 | | | (9 | %) | | $ | 63.3 | | | $ | 68.1 | | | (7 | %) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Corporate Operations and Other | | | | | | | | | | | |

| | | | | | | | | | | |

| Segment operating income (loss) | $ | (62.9) | | | $ | (65.1) | | | 3 | % | | $ | (180.0) | | | $ | (181.8) | | | 1 | % |

Segment income (loss) from unconsolidated investments | $ | (1.7) | | | $ | (8.3) | | | 80 | % | | $ | (5.5) | | | $ | (62.7) | | | 91 | % |

Segment depreciation and amortization | $ | 5.4 | | | $ | 3.9 | | | 38 | % | | $ | 15.2 | | | $ | 12.5 | | | 22 | % |

| | | | | | | | | | | |

| NM = Not Meaningful | | | | | | | | | | | |

(1)See page 12 for further information on comparable adjustments. | | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 9 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

SUPPLEMENTAL SHIPMENT AND DEPLETION INFORMATION

(in millions)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Nine Months Ended | | |

| November 30,

2024 | | November 30,

2023 | | Percent

Change | | November 30,

2024 | | November 30,

2023 | | Percent

Change |

| Beer | | | | | | | | | | | |

| (branded product, 24-pack, 12-ounce case equivalents) | | | | | | | | | | |

| Shipments | 102.7 | | | 101.1 | | | 1.6 | % | | 346.4 | | | 331.1 | | | 4.6 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

Depletions (1) (2) | | | | | 3.2 | % | | | | | | 3.9 | % |

| | | | | | | | | | | |

| Wine and Spirits | | | | | | | | | | | |

| (branded product, 9-liter case equivalents) | | | | | | | | | | |

| Shipments | 5.1 | | | 6.1 | | | (16.4 | %) | | 16.2 | | | 18.1 | | | (10.5 | %) |

| | | | | | | | | | | |

U.S. Wholesale shipments | 4.3 | | | 5.4 | | | (20.4 | %) | | 14.1 | | | 15.9 | | | (11.3 | %) |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Depletions (1) | | | | | (4.3 | %) | | | | | | (11.6 | %) |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

(1) | Depletions represent U.S. distributor shipments of our respective branded products to retail customers, based on third-party data. |

(2) | Includes an adjustment to remove volumes associated with the craft beer brand divestitures for the period March 1, 2023, through May 31, 2023, included in the nine months ended November 30, 2023. |

| |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 10 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES

(in millions, except per share data)

(unaudited)

We report our financial results in accordance with GAAP. However, non-GAAP financial measures, as defined in the reconciliation tables below, are provided because we use this information in evaluating the results of our core operations and/or internal goal setting. In addition, we believe this information provides our investors valuable insight on underlying business trends and results in order to evaluate year-over-year financial performance. See the tables below for supplemental financial data and corresponding reconciliations of these non-GAAP financial measures to GAAP financial measures for the periods presented. Non-GAAP financial measures should be considered in addition to, not as a substitute for, or superior to, our reported results prepared in accordance with GAAP.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Nine Months Ended | | |

| November 30,

2024 | | November 30,

2023 | | Percent

Change | | November 30,

2024 | | November 30,

2023 | | Percent

Change |

| Operating income (loss) (GAAP) | $ | 793.0 | | | $ | 796.9 | | | (0 | %) | | $ | 505.2 | | | $ | 2,540.3 | | | (80 | %) |

Comparable adjustments (1) | 9.2 | | | 22.9 | | | | | 2,310.8 | | | 74.5 | | | |

| Comparable operating income (loss) (Non-GAAP) | $ | 802.2 | | | $ | 819.8 | | | (2 | %) | | $ | 2,816.0 | | | $ | 2,614.8 | | | 8 | % |

| % Net sales | 32.6 | % | | 33.2 | % | | | | 35.0 | % | | 33.4 | % | | |

| | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| Net income (loss) attributable to CBI (GAAP) | $ | 615.9 | | | $ | 509.1 | | | 21 | % | | $ | 293.9 | | | $ | 1,335.0 | | | (78 | %) |

| | | | | | | | | | | |

Net income (loss) attributable to

noncontrolling interests (GAAP) | 13.2 | | | 11.8 | | | | | 45.6 | | | 25.8 | | | |

| Provision for (benefit from) income taxes (GAAP) | 44.5 | | | 130.0 | | | | | (79.7) | | | 368.4 | | | |

| | | | | | | | | | | |

| Interest expense, net (GAAP) | 104.4 | | | 104.2 | | | | | 311.2 | | | 333.7 | | | |

| Adjusted EBIT (Non-GAAP) | 778.0 | | | 755.1 | | | 3 | % | | 571.0 | | | 2,062.9 | | | (72 | %) |

Comparable adjustments (1) | 48.1 | | | 83.9 | | | | | 2,270.9 | | | 527.3 | | | |

Comparable Canopy EIE (Non-GAAP) (2) | — | | | 6.5 | | | | | — | | | 56.8 | | | |

| Comparable EBIT (Non-GAAP) | $ | 826.1 | | | $ | 845.5 | | | (2 | %) | | $ | 2,841.9 | | | $ | 2,647.0 | | | 7 | % |

| | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

| Net income (loss) attributable to CBI (GAAP) | $ | 615.9 | | | $ | 509.1 | | | 21 | % | | $ | 293.9 | | | $ | 1,335.0 | | | (78 | %) |

Comparable adjustments (1) | (25.0) | | | 79.3 | | | | | 1,739.1 | | | 469.7 | | | |

Comparable Canopy EIE (Non-GAAP) (2) | — | | | 8.8 | | | | | — | | | 50.9 | | | |

| Comparable net income (loss) attributable to CBI (Non-GAAP) | $ | 590.9 | | | $ | 597.2 | | | (1 | %) | | $ | 2,033.0 | | | $ | 1,855.6 | | | 10 | % |

| | | | | | | | | | | |

| | | | | | | |

| | | | | | | | | | | |

EPS (GAAP) | $ | 3.39 | | | $ | 2.76 | | | 23 | % | | $ | 1.61 | | | $ | 7.25 | | | (78 | %) |

Comparable adjustments (1) | (0.14) | | | 0.43 | | | | | 9.53 | | | 2.55 | | | |

Comparable Canopy EIE (Non-GAAP) (2) | — | | | 0.05 | | | | | — | | | 0.28 | | | |

Comparable EPS (Non-GAAP) (3) | $ | 3.25 | | | $ | 3.24 | | | 0 | % | | $ | 11.14 | | | $ | 10.08 | | | 11 | % |

| | | | | | | | | | | |

Weighted average common shares outstanding - diluted (3) | 181.753 | | | 184.170 | | | | | 182.555 | | | 184.096 | | | |

(1)See page 12 for further information on comparable adjustments. (2)See page 14 for further information on comparable Canopy EIE. (3)Comparable basis diluted net income (loss) per share (“comparable EPS”) may not sum due to rounding as each item is computed independently.

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 11 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

The comparable adjustments that impacted comparability in our results for each period are as follows: | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 30,

2024 | | November 30,

2023 | | November 30,

2024 | | November 30,

2023 |

| Settlements of undesignated commodity derivative contracts | $ | 8.3 | | | $ | 2.3 | | | $ | 23.8 | | | $ | 8.5 | |

| Flow through of inventory step-up | (5.2) | | | (1.2) | | | (7.6) | | | (2.7) | |

| Net gain (loss) on undesignated commodity derivative contracts | (0.8) | | | (13.3) | | | (10.5) | | | (28.9) | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Comparable adjustments, Gross profit | 2.3 | | | (12.2) | | | 5.7 | | | (23.1) | |

| | | | | | | |

| | | | | | | |

| Transition services agreements activity | (8.3) | | | (5.2) | | | (15.9) | | | (17.9) | |

| Restructuring and other strategic business development costs | (3.6) | | | (5.3) | | | (29.9) | | | (23.6) | |

| Transaction, integration, and other acquisition-related costs | (0.1) | | | — | | | (0.9) | | | (0.6) | |

| Goodwill impairment | — | | | — | | | (2,250.0) | | | — | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| Other gains (losses) | 0.5 | | | (0.2) | | | (19.8) | | | (9.3) | |

| Comparable adjustments, Operating income (loss) | (9.2) | | | (22.9) | | | (2,310.8) | | | (74.5) | |

| | | | | | | |

| Comparable adjustments, Income (loss) from unconsolidated investments | (38.9) | | | (61.0) | | | 39.9 | | | (452.8) | |

| Comparable adjustments, Adjusted EBIT | (48.1) | | | (83.9) | | | (2,270.9) | | | (527.3) | |

| | | | | | | |

Comparable adjustments, Interest expense, net | — | | | (1.0) | | | (0.3) | | | (1.7) | |

| | | | | | | |

| Comparable adjustments, (Provision for) benefit from income taxes | 73.1 | | | 5.6 | | | 532.1 | | | 59.3 | |

| Comparable adjustments, Net income (loss) attributable to CBI | $ | 25.0 | | | $ | (79.3) | | | $ | (1,739.1) | | | $ | (469.7) | |

Undesignated commodity derivative contracts

Net gain (loss) on undesignated commodity derivative contracts represents a net gain (loss) from the changes in fair value of undesignated commodity derivative contracts. The net gain (loss) is reported outside of segment operating results until such time that the underlying exposure is recognized in the segment operating results. At settlement, the net gain (loss) from the changes in fair value of the undesignated commodity derivative contracts is reported in the appropriate operating segment, allowing the results of our operating segments to reflect the economic effects of the commodity derivative contracts without the resulting unrealized mark to fair value volatility.

Flow through of inventory step-up

In connection with acquisitions, the allocation of purchase price in excess of book value for certain inventories on hand at the date of acquisition is referred to as inventory step-up. Inventory step-up represents an assumed manufacturing profit attributable to the acquired business prior to acquisition.

Transition services agreements activity

We recognized costs in connection with transition services agreements related to the previous sale of a portion of our wine and spirits business.

Restructuring and other strategic business development costs

We recognized costs in connection with certain activities which are intended to streamline, increase efficiencies, and reduce our cost structure primarily within our Wine and Spirits segment.

Transaction, integration, and other acquisition-related costs

We recognized costs in connection with our investments, acquisitions, and divestitures.

Goodwill impairment

We recognized a goodwill impairment in connection with negative trends within our Wine and Spirits business.

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 12 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

Other gains (losses)

Primarily includes the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 30,

2024 | | November 30,

2023 | | November 30,

2024 | | November 30,

2023 |

| | | | | | | |

Net loss on foreign currency as a result of the resolution of various tax examinations and assessments | $ | — | | | $ | — | | | $ | (20.7) | | | $ | — | |

| | | | | | | |

| Gain (loss) on sale of business | $ | — | | | $ | (0.2) | | | $ | — | | | $ | (15.1) | |

Recognition of a previously deferred gain upon release of a related indemnity | $ | — | | | $ | — | | | $ | — | | | $ | 5.6 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

Comparable adjustments, Income (loss) from unconsolidated investments

Primarily includes the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 30,

2024 | | November 30,

2023 | | November 30,

2024 | | November 30,

2023 |

Unrealized gain (loss) from the changes in fair value of securities measured at fair value | $ | — | | | $ | (11.0) | | | $ | (2.5) | | | $ | (85.4) | |

Impairment of equity method investments | $ | (0.3) | | | $ | (0.3) | | | $ | (2.4) | | | $ | (136.1) | |

Net gain (loss) in connection with Canopy exchangeable shares | $ | (38.6) | | | $ | — | | | $ | 44.7 | | | $ | — | |

Comparable adjustments to Canopy EIE (see page 14 for further information) | $ | — | | | $ | (50.0) | | | $ | — | | | $ | (231.5) | |

| | | | | | | |

Comparable adjustments, Interest expense, net

We (i) wrote-off accrued interest income related to convertible notes issued to certain equity method investments for the nine months ended November 30, 2024, and November 30, 2023, and the three months November 30, 2023, and (ii) recognized losses from the write-off of an unamortized discount and debt issuance costs in connection with the repayment of outstanding term loan facility borrowings for the nine months ended November 30, 2023.

Comparable adjustments, (Provision for) benefit from income taxes

The effective tax rate applied to each comparable adjustment amount is generally based upon the jurisdiction in which the comparable adjustment was recognized. We recognized a benefit from income taxes for the nine months ended November 30, 2024, resulting from the goodwill impairment, net of the non-deductible portion. Comparable adjustments, (Provision for) benefit from income taxes also include items solely impacting income taxes and largely consist of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| November 30,

2024 | | November 30,

2023 | | November 30,

2024 | | November 30,

2023 |

| Net income tax benefit recognized for adjustments to valuation allowances | $ | 54.0 | | | $ | — | | | $ | 58.4 | | | $ | — | |

Net income tax benefit recognized as a result of the sale of the remaining assets at the Mexicali Brewery | $ | 15.4 | | | $ | — | | | $ | 5.8 | | | $ | — | |

Net income tax benefit recognized as a result of the resolution of various tax examinations and assessments related to prior periods | $ | — | | | $ | — | | | $ | 129.7 | | | $ | — | |

| Net income tax benefit recognized as a result of a change in tax entity classification | $ | — | | | $ | — | | | $ | — | | | $ | 31.2 | |

| Net income tax benefit recognized as a result of a legislative update in Switzerland | $ | — | | | $ | — | | | $ | — | | | $ | 4.7 | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 13 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

Canopy Equity Earnings (Losses) and Related Activities (“Canopy EIE”)

Non-GAAP Canopy EIE financial measures for the three months and nine months ended November 30, 2023, are provided because management used this information to separately monitor our former equity method investment in Canopy. Financial measures excluding Canopy EIE are non-GAAP and are provided because management used this information to evaluate the results of our core operations which management determined did not include our former equity method investment in Canopy. In addition, we believe this information provides our investors valuable insight to understand how management views the Company’s performance and on underlying business trends and results in order to evaluate year-over-year financial performance of our ongoing core business, including relative to industry competitors.

| | | | | | | | | | | |

| For the Three Months Ended November 30, 2023 | | For the Nine Months Ended November 30, 2023 |

| (in millions) | | | |

Equity earnings (losses) and related activities, Canopy EIE (GAAP) (1) | $ | (56.5) | | | $ | (288.3) | |

(Provision for) benefit from income taxes (2) | 0.4 | | | 8.6 | |

Net income (loss) attributable to CBI, Canopy EIE (GAAP) (1) | $ | (56.1) | | | $ | (279.7) | |

| | | |

Equity earnings (losses) and related activities, Canopy EIE (GAAP) (1) | $ | (56.5) | | | $ | (288.3) | |

| | | |

| Net (gain) loss on fair value financial instruments | 16.3 | | | 8.2 | |

| (Gain) loss on dilution of Canopy stock ownership | 8.7 | | | 16.5 | |

| Acquisition costs | 1.6 | | | 4.3 | |

| Restructuring and other strategic business development costs | (4.7) | | | 156.3 | |

| Goodwill impairment | — | | | 14.1 | |

Net loss on discontinued operations | 25.0 | | | 25.0 | |

| Other (gains) losses | 3.1 | | | 7.1 | |

Comparable adjustments, Canopy EIE | 50.0 | | | 231.5 | |

Comparable equity earnings (losses), Canopy EIE (Non-GAAP) (1) | (6.5) | | | (56.8) | |

Comparable (provision for) benefit from income taxes (Non-GAAP) (2) | (2.3) | | | 5.9 | |

Comparable net income (loss) attributable to CBI, Canopy EIE (Non-GAAP) (1) | $ | (8.8) | | | $ | (50.9) | |

| | | |

| | | |

| | | | | | | | | | | |

| For the Three Months Ended November 30, 2023 | | For the Nine Months Ended November 30, 2023 |

| EPS, Canopy EIE (GAAP) | $ | (0.30) | | | $ | (1.52) | |

Comparable adjustments, Canopy EIE | 0.26 | | | 1.24 | |

Comparable EPS, Canopy EIE (Non-GAAP) (3) | $ | (0.05) | | | $ | (0.28) | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 14 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended |

| November 30, 2024 | | November 30, 2023 |

| Income (loss) before income taxes | | (Provision for) benefit from income taxes (2) | | Effective tax rate (4) | | Income (loss) before income taxes | | (Provision for) benefit from income taxes (2) | | Effective tax rate (4) |

| Reported basis (GAAP) | $ | 673.6 | | | $ | (44.5) | | | 6.6 | % | | $ | 650.9 | | | $ | (130.0) | | | 20.0 | % |

Comparable adjustments | 48.1 | | | (73.1) | | | | | 84.9 | | | (5.6) | | | |

Comparable Canopy EIE (Non-GAAP) | — | | | — | | | | | 6.5 | | | 2.3 | | | |

| Comparable basis (Non-GAAP) | $ | 721.7 | | | $ | (117.6) | | | 16.3 | % | | $ | 742.3 | | | $ | (133.3) | | | 18.0 | % |

| | | | | | | | | | | |

| | | | | | | | | | | |

(1)Equity earnings (losses) and related activities are included in income (loss) from unconsolidated investments.

(2)The benefit from income taxes effective tax rate applied to our Canopy EIE is generally based on the tax rates of the legal entities that hold our investment. The comparable adjustment effective tax rate applied to each comparable adjustment amount is generally based upon the jurisdiction in which the adjustment was recognized.

(3)May not sum due to rounding as each item is computed independently. The comparable adjustments and comparable EPS are calculated on a fully dilutive basis.

(4)Effective tax rate is not considered a GAAP financial measure, for purposes of this reconciliation, we derived the reported GAAP measure based on GAAP results, which serves as the basis for the reconciliation to the comparable non-GAAP financial measure.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Operating Income Guidance | Guidance Range for the Year Ending February 28, 2025 | | Actual for the Year Ended February 29, 2024 | | Percentage Change |

Operating income (GAAP) | $ | 1,112 | | | $ | 1,209 | | | $ | 3,169.7 | | | (65) | % | | (62) | % |

Comparable adjustments (1) | 2,318 | | | 2,318 | | | 75.8 | | | | | |

SVEDKA divestiture (2) | — | | | — | | | (10.0) | | | | | |

Comparable operating income (Non-GAAP) | $ | 3,430 | | | $ | 3,527 | | | $ | 3,235.5 | | | 6 | % | | 9 | % |

| | | | | | | | | | | | | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

(1) | Comparable adjustments include: (3) (4) | Estimated for the Year Ending February 28, 2025 | | Actual for the Year Ended February 29, 2024 |

| Goodwill impairment | $ | 2,250 | | | $ | — | |

| Restructuring and other strategic business development costs | $ | 30 | | | $ | 46.3 | |

| Transition services agreements activity | $ | 22 | | | $ | 24.9 | |

| Other (gains) losses | $ | 20 | | | $ | 11.2 | |

| Net (gain) loss on undesignated commodity derivative contracts | $ | 11 | | | $ | 44.2 | |

| Flow through of inventory step-up | $ | 9 | | | $ | 3.6 | |

| Transaction, integration, and other acquisition-related costs | $ | 1 | | | $ | 0.6 | |

| Settlements of undesignated commodity derivative contracts | $ | (24) | | | $ | (15.0) | |

| (Gain) loss on sale of business | $ | — | | | $ | 15.1 | |

| Insurance recoveries | $ | — | | | $ | (55.1) | |

(2) | Amount reflects gross profit less marketing attributable to the SVEDKA divestiture for the period January 7, 2024, through February 29, 2024. |

(3) | See page 12 for further information on comparable adjustments. | | |

(4) | May not sum due to rounding. | | | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 15 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | | | | | | | |

| EPS Guidance | Range for the Year Ending February 28, 2025 | | Actual for the Year Ended February 29, 2024 |

| Forecasted EPS (GAAP) | $ | 3.90 | | | $ | 4.30 | | | $ | 9.39 | |

Comparable adjustments (1) | 9.50 | | | 9.50 | | | 2.67 | |

| Comparable basis, Canopy EIE (Non-GAAP) | — | | | — | | | 0.32 | |

Forecasted comparable EPS (Non-GAAP) (2) | $ | 13.40 | | | $ | 13.80 | | | $ | 12.38 | |

| | | | | | | | | | | | | | | | |

(1) | Comparable adjustments include: (2)(3) | Estimated for the Year Ending February 28, 2025 | | Actual for the Year Ended February 29, 2024 | | |

| Goodwill impairment | $ | 10.53 | | | $ | — | | | |

| Restructuring and other strategic business development costs | $ | 0.12 | | | $ | 0.20 | | | |

| Other (gains) losses | $ | 0.11 | | | $ | 0.06 | | | |

| Transition services agreements activity | $ | 0.09 | | | $ | 0.10 | | | |

| Flow through of inventory step-up | $ | 0.04 | | | $ | 0.01 | | | |

| Net (gain) loss on undesignated commodity derivative contracts | $ | 0.04 | | | $ | 0.18 | | | |

| Net income tax benefit recognized as a result of the resolution of various tax examinations and assessments related to prior periods | $ | (0.71) | | | $ | — | | | |

| Net income tax benefit recognized for adjustments to valuation allowances | $ | (0.32) | | | $ | — | | | |

| (Income) loss from unconsolidated investments | $ | (0.22) | | | $ | 2.58 | | | |

| Settlements of undesignated commodity derivative contracts | $ | (0.10) | | | $ | (0.06) | | | |

| Net income tax expense recognized as a result of the sale of the remaining assets at the Mexicali Brewery | $ | (0.10) | | | $ | — | | | |

| (Gain) loss on sale of business | $ | — | | | $ | 0.06 | | | |

| Loss of interest income on write-off of a convertible note | $ | — | | | $ | 0.01 | | | |

| Insurance recoveries | $ | — | | | $ | (0.25) | | | |

| Net income tax benefit recognized as a result of a change in tax entity classification | $ | — | | | $ | (0.17) | | | |

| Net income tax benefit recognized as a result of a legislative update in Switzerland | $ | — | | | $ | (0.05) | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

(2) | May not sum due to rounding as each item is computed independently. The comparable adjustments and comparable EPS are calculated on a fully dilutive basis. | | |

(3) | See page 12 for further information on comparable adjustments. | | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 16 |

CONSTELLATION BRANDS, INC. AND SUBSIDIARIES

RECONCILIATIONS OF GAAP TO NON-GAAP FINANCIAL MEASURES (continued)

(in millions, except per share data)

(unaudited)

| | | | | | | | | | | |

Free Cash Flow Guidance Free cash flow, as defined in the reconciliation below, is considered a liquidity measure and is considered to provide useful information to investors about the amount of cash generated, which can then be used, after required debt service and dividend payments, for other general corporate purposes. A limitation of free cash flow is that it does not represent the total increase or decrease in the cash balance for the period. Free cash flow should be considered in addition to, not as a substitute for, or superior to, cash flow from operating activities prepared in accordance with GAAP. |

| Range for the Year

Ending February 28, 2025 |

| Net cash provided by operating activities (GAAP) | $ | 2,900 | | | $ | 3,100 | |

| Purchase of property, plant, and equipment | (1,300) | | | (1,300) | |

| Free cash flow (Non-GAAP) | $ | 1,600 | | | $ | 1,800 | |

| | | |

| Nine Months Ended |

| November 30,

2024 | | November 30,

2023 |

| Net cash provided by operating activities (GAAP) | $ | 2,557.5 | | | $ | 2,346.8 | |

| Purchase of property, plant, and equipment | (931.5) | | | (911.9) | |

| Free cash flow (Non-GAAP) | $ | 1,626.0 | | | $ | 1,434.9 | |

| | | | | |

Constellation Brands, Inc. Q3 FY 2025 Earnings Release | #WORTHREACHINGFOR I 17 |

CONSTELLATION BRANDS DECLARES QUARTERLY DIVIDEND

ROCHESTER, N.Y., Jan. 9, 2025 – Constellation Brands, Inc. (NYSE: STZ), a leading beverage alcohol company, announced today that on January 8, 2025, its Board of Directors declared a quarterly cash dividend of $1.01 per share of Class A Common Stock payable on February 21, 2025, to stockholders of record as of the close of business on February 7, 2025.

ABOUT CONSTELLATION BRANDS

Constellation Brands (NYSE: STZ) is a leading international producer and marketer of beer, wine, and spirits with operations in the U.S., Mexico, New Zealand, and Italy. Our mission is to build brands that people love because we believe elevating human connections is Worth Reaching For. It’s worth our dedication, hard work, and calculated risks to anticipate market trends and deliver more for our consumers, shareholders, employees, and industry. This dedication is what has driven us to become one of the fastest-growing, large CPG companies in the U.S. at retail, and it drives our pursuit to deliver what’s next.

Every day, people reach for our high-end, iconic imported beer brands such as those in the Corona brand family like the flagship Corona Extra, Modelo Especial and the flavorful lineup of Modelo Cheladas, Pacifico, and Victoria; our fine wine and craft spirits brands including The Prisoner Wine Company, Robert Mondavi Winery, Casa Noble Tequila, and High West Whiskey; and our premium wine brands such as Kim Crawford and Meiomi.

As an agriculture-based company, we have a long history of operating sustainably and responsibly. Our ESG strategy is embedded into our business and our work focuses on serving as good stewards of the environment, enhancing social equity within our industry and communities, and promoting responsible beverage alcohol consumption. These commitments ground our aspirations beyond driving the bottom line as we work to create a future that is truly Worth Reaching For.

To learn more, visit www.cbrands.com and follow us on X, Instagram, and LinkedIn.

| | | | | |

| MEDIA CONTACTS | INVESTOR RELATIONS CONTACTS |

Amy Martin 585-678-7141 / amy.martin@cbrands.com Carissa Guzski 315-525-7362 / carissa.guzski@cbrands.com | Joseph Suarez 773-551-4397 / joseph.suarez@cbrands.com Snehal Shah 847-385-4940 / snehal.shah@cbrands.com David Paccapaniccia 585-282-7227 / david.paccapaniccia@cbrands.com |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |