false

0000095552

0000095552

2024-08-29

2024-08-29

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

August 29, 2024

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

(Exact Name of Registrant as Specified in Its

Charter)

| Delaware |

|

001-6615 |

|

95-2594729 |

|

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

26600 Telegraph Road, Suite 400

Southfield, Michigan |

48033 |

| (Address of Principal Executive Offices) |

(Zip Code) |

Registrant’s Telephone Number, Including

Area Code: (248) 352-7300

Not Applicable

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if

the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to

Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under

the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share |

|

SUP |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election

of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On August 29, 2024, C. Timothy Trenary, 68, Executive

Vice President, Chief Financial Officer of Superior Industries International, Inc. (the “Company” or “Superior”),

notified the Company of his intent to retire from his position at Superior effective September 30, 2024. Mr. Trenary’s retirement

is due to personal reasons, and his retirement was not the result of any disagreement relating to the Company’s operations, policies

or practices or dispute with the Company. The Company thanks Mr. Trenary for his commitment and service to Superior.

Mr. Trenary entered into a consulting agreement

with Superior, effective as of his retirement date (the “Consulting Agreement”), in order to ensure the seamless transition

of his responsibilities. The Consulting Agreement has a term of nine months, which may be extended upon mutual consent, and provides for

Mr. Trenary to receive compensation of $40,000 per month, plus an additional amount for the cost of continued medical coverage pursuant

to COBRA for up to nine months. Mr. Trenary will also be entitled to coverage of reasonable expenses that he incurs under the Consulting

Agreement, including travel expenses in accordance with the Company’s policy.

The Consulting Agreement contains customary protections

regarding confidentiality, intellectual property, and a non-compete and non-solicitation restriction that runs during the term of the

Consulting Agreement and for 12 months thereafter. The Consulting Agreement may be terminated by either party upon thirty days prior written

notice.

A copy of the Consulting Agreement is attached

hereto as Exhibit 10.1. The description of the Consulting Agreement set forth above is qualified in its entirety by reference to Exhibit

10.1.

Mr. Trenary’s retirement benefits will otherwise

consist of those benefits provided for under the standard terms and conditions of the plans in which he participates. No additional compensation

or equity has been awarded to Mr. Trenary in connection with his retirement.

Dan Lee, Superior’s Vice President of Finance

and CFO Europe, has been appointed to serve as the Company’s Senior Vice President, Chief Financial Officer beginning on October

1, 2024.

Mr. Lee, 54, was previously the Company’s

Vice President of Finance and CFO Europe, a position he held since July 2023. He also served as the Company’s Interim Corporate

Controller from January through June 2024. Prior to joining Superior, Mr. Lee served as Vice President, Finance Performance Solutions

of Tenneco, Inc., a global automotive components original equipment manufacturer and distributor to the aftermarket, from October 2019

to June 2023. He was previously the Senior Vice President, Finance Less-than-Truckload of XPO, Inc., a global provider of freight transportation

services, from July 2018 to September 2019. Prior to that, Mr. Lee was the Vice President, Global Finance, Aftermarket, and Vice President,

Finance, Aptiv Electrical Distribution Systems, North America of Aptiv PLC, a global technology and mobility architecture company primarily

serving the automotive sector, from October 2015 to May 2017 and May 2017 to June 2018, respectively. In addition, he has previously served

in various executive positions with both public and private companies. Mr. Lee holds a Bachelor of Science degree in Accounting from Northern

Illinois University and a Master of Business Administration degree from the University of Tennessee, Knoxville. In addition, he is a certified

public accountant (inactive).

There are no transactions since the beginning

of the Company’s last fiscal year in which the Company is a participant and in which Mr. Lee or any members of his immediate family

have any interests that are required to be reported under Item 404(a) of Regulation S-K. No family relationships exist between Mr. Lee

and any of Superior’s directors or executive officers. The appointment of Mr. Lee was not pursuant to any arrangement or understanding

between him and any person, other than a director or executive officer of Superior acting in his or her official capacity.

Mr. Lee will receive an annual base salary of

$500,000. He may receive annual bonuses based on the attainment of performance goals, determined by the Company’s independent Human

Capital and Compensation Committee, with a target amount of 65% of annual base salary. Mr. Lee will also be eligible to receive a long-term

cash performance bonus with a target amount of 90% of his base salary. He is entitled to participate in all benefit plans generally made

available to executive officers of the Company.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

|

|

|

|

SUPERIOR INDUSTRIES INTERNATIONAL, INC. |

| |

|

|

|

|

|

(Registrant) |

| |

|

|

|

| Date: August 30, 2024 |

|

|

|

|

|

/s/ David M. Sherbin |

| |

|

|

|

|

|

David M. Sherbin |

| |

|

|

|

|

|

Senior Vice President, General Counsel, Secretary and Chief Compliance Officer |

Exhibit 10.1

CONSULTING

AGREEMENT

This

Consulting Agreement (the "Agreement"), by and between Superior Industries International, Inc. (the "Company"), a

Delaware corporation with an address at 26600 Telegraph Road, Suite 400, Southfield, MI 48033, and Tim Trenary (the "Consultant")

with an address at 1220 Sandringham Way, Bloomfield Hills, MI 48301, is effective as of the date of Consultant’s retirement from

Company (“Effective Date”).

RECITALS

WHEREAS,

the Company desires to retain the Consultant as an independent contractor to perform consulting services, and Consultant is willing to

perform such services, on the terms set forth below.

NOW

THEREFORE, , in consideration of the mutual promises contained herein, and for other good and valuable consideration, the receipt and

adequacy of which are hereby acknowledged, the parties agree as follows:

AGREEMENT

| 1. | Engagement

of Consultant. The Company hereby engages the Consultant to act as a consultant to the

Company subject to the terms and conditions of this Agreement, and the Consultant hereby

accepts such engagement. |

| a. | Scope

of Services and Deliverables. Consultant shall perform the services to the Company described

in the Statement of Work, attached hereto as Attachment A, , and as may be requested by the

Company (collectively, the "Services"). Any information (written or oral), ideas,

concepts, or contemporaneous discussion provided to Company by Consultant while rendering

these Services are considered the Deliverables (defined in Section 5(e) below) to the Company

in accordance with the terms of this Agreement. |

| b. | Manner

of Provision of Services. The Company will not control the manner or means by which Consultant

performs the Services, but Consultant is expected to timely perform the Services and to provide

the Deliverables in accordance with the terms of this Agreement. Consultant is expected to

provide the Services on a remote basis, unless otherwise reasonably requested from time-to-time. |

| 3. | Compensation;

Costs/Expenses; Travel Expenses. |

| a. | Compensation.

The Company shall compensate Consultant for performance of the Services and provision of

the Deliverables as described in the attached Statement of Work. e Consultant acknowledges

and agrees that such compensation, plus the sum of $2000 per month for group |

medical

coverage pursuant to COBRA for so long as Consultant elects COBRA coverage, but in no event longer than nine months, shall be Consultant’s

sole compensation hereunder, and e Consultant will not, under any circumstances, be eligible for any other compensation or benefits extended

to the Company’s employees including, but not limited to, vacation, group medical or life insurance, disability, or 401k plan.

The Company will not be responsible for withholding or paying any income, payroll, Social Security, or other federal, state, or local

taxes, making any insurance contributions, including for unemployment or disability, or obtaining workers’ compensation insurance

on Consultant’s behalf. Consultant shall havefull and exclusive liability for and shall pay and indemnify Company for any and all

taxes arising out of this Agreement.

| b. | Costs/Expenses.

The Company shall reimburse Consultant for his reasonable and pre-approved out-of-pocket

costs and expenses arising under this Agreement. |

| c. | Travel

Expenses. All travel expenses, including hotel accommodations that Consultant may incur

must be in compliance with the Company's travel policies and approved in advance by the Company.

All travel arrangements will be handled by the Company travel system. |

| 4. | Term

and Termination. This Agreement shall commence as of the Effective Date and terminate

nine months thereafter, unless extended by mutual written agreement of the parties. Either

party may terminate this Agreement with 30 days written notice, or immediately and without

prior written notice if the other party is in breach of any material provision of this Agreement

and such breach is not cured within five (5) business days of its occurrence. |

| 5. | Confidentiality;

Intellectual Property. |

| a. | Company

Materials. Consultant acknowledges that he has been given access to information and materials

the Company treats as confidential and proprietary, including without limitation information

pertaining to the Company’s business, operations, strategies, customers, pricing, marketing,

finances, sourcing, personnel or those of its affiliates, vendors or customers, all of which

shall be considered “Confidential Information” as defined in Section 5(b) below.

Consultant shall have no right to use, copy, or disclose any Company information, in whole

or in part, except as authorized herein. All tangible Confidential Information (as defined

below), including memos, documents, or any other information provided to Consultant for use

in performing the Services or otherwise, shall be promptly returned to the Company or destroyed,

at the Company's option, upon the Company's request or upon termination or expiration of

this Agreement. |

| b. | Confidential

Information. "Confidential Information" means any of the Company's proprietary

information, technical data, trade secrets or know-how, including, but not limited to, research,

product plans, products, services, customers, customer lists, markets, developments, inventions,

processes, formulas, technology, designs, drawings, engineering, marketing, finances or other

business information disclosed by the Company or accessible to Consultant before, on or after

the Effective Date, either directly or indirectly in writing, visually, orally, by drawings

or inspection, or through any other medium. “Confidential Information” also includes

the Deliverables. Confidential Information does not include information which: (1) has become

publicly known and made generally available through no wrongful act of Consultant; or (2)

has been rightfully received by Consultant from a third party who is authorized to make such

disclosure. |

| c. | Third-Party

Confidential Information. The Company does not desire to acquire from Consultant any

secret or confidential know-how or information which Consultant may have acquired from others

and which Consultant is not authorized or permitted to divulge to the Company. Accordingly,

Consultant represents and warrants that he is free to divulge to the Company, without any

obligation to, or violation of any right of others, any and all information, practices or

techniques which Consultant will describe, demonstrate, divulge or in any other manner make

known to the Company during Consultant’s performance of the Services. Consultant shall

indemnify and hold harmless the Company from and against any and all liability, loss, cost,

expense damage, claims or demands for actual or alleged violation of the rights of others

in any trade secret, know how or other confidential information by reason of the Company’s

receipt or use of the Services, Deliverables or information described above, or otherwise

in connection therewith. |

| d. | Non-Use

and Non-Disclosure. Consultant shall not, during or subsequent to the term of this Agreement,

use the Company's Confidential Information for any purpose whatsoever other than the performance

of the Services on behalf of the Company, or disclose the Company's Confidential Information

to any third party without the prior written consent of the Company. Without the Company's

prior written approval, Consultant shall not directly or indirectly disclose to anyone the

existence of this Agreement or the fact that he has this arrangement with the Company. |

| e. | Ownership

of Deliverables. The Company is and shall be, the sole and exclusive owner of all right,

title, and interest throughout the world in and to all the deliverables and all the results,

work product, and tangible materials prepared by Consultant in the course of providing the

Services or otherwise performing his/her obligations under this Agreement (collectively,

the "Deliverables"), including all patents, copyrights, trademarks, trade secrets,

and other intellectual property rights therein. |

| 6. | Representations

and Warranties: Consultant represents and warrants that: (i) he has the power to enter

into this Agreement, to grant the rights granted herein and to perform fully all of his obligations

under this Agreement, (ii) Consultant’s entering into this Agreement with the Company

and Consultant’s performance of the Services do not and will not conflict with or result

in any breach or default under any other agreement to which Consultant is subject, (iii)

he has the required skill, experience, and qualifications to perform the Services, he shall

perform the Services in a professional and workmanlike manner in accordance with generally

recognized standards for similar services, and he shall devote sufficient resources to ensure

the Services are performed, and the Deliverables are delivered, in a timely and reliable

manner, (iv) he shall perform the Services and all other obligations under this Agreement

in compliance with Company policies, the Code of Conduct, and all applicable international,

federal, state, and local laws and regulations, including without limitation the Foreign

Corrupt Practices Act, the Economic Espionage Act, and all applicable anti-bribery and anti-corruption

laws, (v) the Company will receive good and valid title to all Deliverables, free and clear

of all encumbrances and liens of any kind, and (vi) all Deliverables are and shall be Consultant’s

original work and do not and will not violate or infringe upon the intellectual property

or any other rights of any person or entity. |

| 7. | Indemnification:

Consultant agrees to indemnify and hold harmless the Company and its directors, officers

and employees from and against all taxes, losses, damages, liabilities, costs and expenses,

including attorneys' fees and other legal expenses, arising directly or indirectly from or

in connection with (i) any gross negligence, reckless or intentionally wrongful act of the

Consultant, (ii) any breach by Consultant of any of the covenants, representations, or warranties

contained in this Agreement, (iii) any failure of Consultant to perform the Services in accordance

with all applicable laws, rules and |

regulations,

or (iv) any violation or claimed violation of a third party's rights resulting in whole or in part from the Company's use of the Deliverables

or other information and documentation provided by Consultant under this Agreement.

| 8. | Limitation

of Liability. NEITHER THE COMPANY NOR CONSULTANT WILL BE LIABLE TO THE OTHER OR ANY THIRD

PARTY AGENT FOR ANY INCIDENTAL, CONSEQUENTIAL, SPECIAL, INDIRECT, EXEMPLARY, OR PUNITIVE

DAMAGES (INCLUDING, WITHOUT LIMITATION, LOST PROFITS, LOST REVENUES, OR LOSS OF BUSINESS

OPPORTUNITY) THAT THE COMPANY OR CONSULTANT MAY INCUR IN CONNECTION WITH THIS AGREEMENT OR

ANY STATEMENT OF WORK, HOWEVER CAUSED AND UNDER WHATEVER THEORY OF LIABILITY (INCLUDING,

WITHOUT LIMITATION, BREACH OF CONTRACT, TORT, STRICT LIABILITY AND NEGLIGENCE) EVEN IF THE

COMPANY AND CONSULTANT HAVE BEEN ADVISED OF THE POSSIBILITY OF SUCH DAMAGES AND DIRECT DAMAGES

DO NOT SATISFY A REMEDY. THE COMPANY’S AND THE CONSULTANT’S TOTAL CUMULATIVE

LIABILITY UNDER OR RELATING TO THIS AGREEMENT, REGARDLESS OF THE NATURE OF THE OBLIGATION,

FORM OF ACTION OR THEORY OF LIABILITY, SHALL BE LIMITED IN ALL CASES TO AN AMOUNT WHICH SHALL

NOT EXCEED, IN THE AGGREGATE, FEES PAID TO THE CONSULTANT DURING THE TERM OF THIS AGREEMENT. |

| 9. | Relationship

of the Parties. The Company and Consultant acknowledge and agree that nothing contained

in this Agreement is intended to constitute them as employer/employee, principal/agent, joint

venture or partners, it being their intention that Consultant is an independent contractor.

Consultant acknowledges and agrees that he is obligated to report as income all compensation

received by him pursuant to this Agreement, and Consultant acknowledges his/ obligation to

pay all self-employment and other taxes thereon. |

| 10. | No

Obligation to offer Employment: The Company and Consultant acknowledge and agree that

the Company is not obligated to offer employment and Consultant is under no obligation to

accept an offer of employment from Company. |

| 11. | Non-Compete:

Consultant acknowledges and agrees that for a period of 12 months after the expiration

of this Agreement, Consultant may not commence employment with an original equipment manufacturer

that competes with Company, without prior written consent of Company. |

| 12. | Non-Solicitation:

Consultant acknowledges and agrees that for a period of 12 months following the expiration

of this Agreement, Consultant will not, directly or indirectly, induce any of the employees

of Company to leave the employ of Company for participation, directly or indirectly, with

any existing or future business venture associated with Consultant. |

| 13. | Entire

Agreement; Assignment. This Agreement is intended by the parties as a final expression

of their agreement regarding Consultant's consulting services. No waiver, modification, change

or amendment of any of the provisions of this Agreement shall be valid, unless in writing

and signed by the party against whom such claimed waiver, modification, change or amendment

is sought to be enforced. Consultant will not assign this Agreement or Consultant’s

rights, duties or obligations under this Agreement without the prior written consent of the

Company. Any attempt by the Consultant to assign or transfer this Agreement or any of the

rights, duties or obligations under this Agreement without the prior written consent of the

Company shall be void. |

| 14. | Governing

Law. This Agreement shall be governed by and construed in accordance with the internal

laws of the United States, State of Michigan without giving effect to any choice or conflict

of law provision or rule. Any legal suit, action or proceeding arising out of this Agreement

or the matters contemplated hereunder brought by Consultant shall be instituted exclusively

in the circuit court in Oakland County, Michigan, and Consultant irrevocably submits to the

exclusive jurisdiction of such court in any such suit, action or proceeding and waives any

objection based on improper venue or inconvenient forum. |

| 15. | Survival.

The provisions of paragraphs 5-8 and 10-16 shall survive the termination of this Agreement. |

| 16. | Severability.

Should any part of this Agreement be declared invalid, void or unenforceable, all remaining

parts shall remain in full force and effect and shall in no way be invalidated or affected. |

IN

WITNESS WHEREOF, the parties have caused this Agreement to be executed as of the date set forth below.

SUPERIOR

INDUSTRIES INTERNATIONAL, INC. |

|

CONSULTANT

|

| |

|

|

|

|

| By: |

/s/

Kevin M. Burke |

|

By: |

/s/ Tim Trenary |

| |

|

|

|

|

| Name: |

Kevin M. Burke |

|

Name: |

Tim Trenary |

| |

|

|

|

|

| Title: |

Chief Human Resources Officer |

|

Date: |

|

| |

|

|

|

|

| Date: |

|

|

|

|

ATTACHMENT

A STATEMENT OF WORK

| 1. | Description

of Services: Consultation as reasonably requested by Company as follows: |

| · | Onboard

the new Chief Financial Officer with external parties; |

| · | Provide

coaching and advice to the Chief Financial Officer; |

| · | Review

projects and documents and advise as needed; |

| · | Review

and provide advice regarding financial planning and analysis materials; and |

| · | Assist

with development of presentations and materials for external parties, including earnings

call materials and other investor events. |

| 2. | Deliverables:

Analyses, advise and documentation to support the services described above |

| 3. | Compensation:

$40,000 per month, payable semi-monthly in accordance with the Company’s regular pay

periods. |

v3.24.2.u1

Cover

|

Aug. 29, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 29, 2024

|

| Entity File Number |

001-6615

|

| Entity Registrant Name |

SUPERIOR INDUSTRIES INTERNATIONAL, INC.

|

| Entity Central Index Key |

0000095552

|

| Entity Tax Identification Number |

95-2594729

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

26600 Telegraph Road

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Southfield

|

| Entity Address, State or Province |

MI

|

| Entity Address, Postal Zip Code |

48033

|

| City Area Code |

248

|

| Local Phone Number |

352-7300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

SUP

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

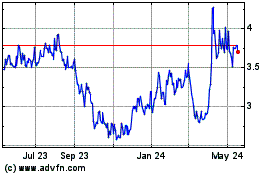

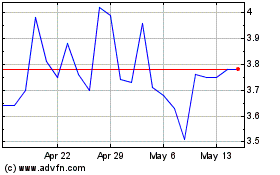

Superior Industries (NYSE:SUP)

Historical Stock Chart

From Dec 2024 to Dec 2024

Superior Industries (NYSE:SUP)

Historical Stock Chart

From Dec 2023 to Dec 2024