Stryker announces definitive agreement to acquire Inari Medical, Inc., providing entry into high-growth peripheral vascular segment

07 January 2025 - 8:08AM

Stryker (NYSE: SYK), a global leader in medical technologies,

announced today a definitive agreement to acquire all of the issued

and outstanding shares of common stock of Inari Medical, Inc.

(NASDAQ: NARI) for $80 per share in cash, representing a total

fully diluted equity value of approximately $4.9 billion. Inari,

which was founded in 2011, will bring a leading peripheral vascular

position in the fast-growing segment of venous thromboembolism

(VTE) to Stryker. Inari’s innovative product portfolio is highly

complementary to Stryker’s Neurovascular business and includes

mechanical thrombectomy solutions for peripheral vascular diseases

such as deep vein thrombosis and pulmonary embolism.

Each year, VTE impacts up to 900,000 lives in the United States,

with even more affected worldwide.1 People are at particularly high

risk for this condition during or just after a hospitalization

(with or without surgery), during cancer treatment and during or

just after pregnancy.1 Inari provides solutions for VTE clot

removal without the use of thrombolytic drugs.

“The acquisition of Inari expands Stryker's portfolio to provide

life-saving solutions to patients who suffer from peripheral

vascular diseases,” said Kevin Lobo, Chair and Chief Executive

Officer, Stryker. “These innovations elevate the standard of care

for venous thromboembolism patients and will accelerate Stryker’s

impact in endovascular procedures.”

“Inari has positively impacted the lives of hundreds of

thousands of patients through the development of purpose-built

tools that address unmet patient needs,” said Drew Hykes, Chief

Executive Officer, Inari. “With Stryker’s capabilities and global

infrastructure, we will be even better positioned to accelerate the

development of innovative new solutions and expand our

footprint.”

Under the terms of the definitive agreement, Stryker will

commence a tender offer for all outstanding shares of common stock

of Inari for $80 per share in cash. The boards of directors of both

Stryker and Inari have unanimously approved the transaction.

Consummation of the tender offer is subject to a minimum tender of

at least a majority of then-outstanding Inari common shares, the

expiration or termination of the waiting period under the

Hart-Scott-Rodino Antitrust Improvements Act and other customary

conditions. Following successful completion of the tender offer,

Stryker will acquire all remaining shares not tendered in the offer

through a second step merger at the same price as in the tender

offer. The transaction is anticipated to close by the end of the

first quarter of 2025, subject to customary closing conditions.

Expected impacts to 2025 financial results will be discussed on

Stryker’s upcoming fourth quarter 2024 earnings call scheduled for

January 28, 2025.

Additional information about this transaction is available on

the Investor Relations section of Stryker.com

https://investors.stryker.com/.

About StrykerStryker is a global leader in medical

technologies and, together with its customers, is driven to make

healthcare better. The company offers innovative products and

services in MedSurg, Neurotechnology, Orthopaedics and Spine that

help improve patient and healthcare outcomes. Alongside its

customers around the world, Stryker impacts more than 150 million

patients annually. More information is available at

www.stryker.com.

About Inari Medical, Inc.

Patients first. No small plans. Take care of

each other. These are the guiding principles that form the ethos of

Inari Medical. We are committed to improving lives in extraordinary

ways by creating innovative solutions for both unmet and

underserved health needs. In addition to our purpose-built

solutions, we leverage our capabilities in education, clinical

research, and program development to improve patient outcomes. We

are passionate about our mission to establish our treatments as the

standard of care for venous thromboembolism and four other targeted

disease states. We are just getting started. Learn more at

www.inarimedical.com and connect with us on LinkedIn, X (Twitter),

and Instagram.

Forward-Looking StatementsThis

press release contains information that includes or is based on

forward-looking statements within the meaning of the federal

securities law that are subject to various risks and uncertainties

that could cause our actual results to differ materially from those

expressed or implied in such statements, including statements

regarding the anticipated benefits to Stryker of the acquisition of

Inari and the anticipated timeline to closing the transaction. Such

risks and uncertainties include, but are not limited to:

uncertainties as to the timing of the offer and the subsequent

merger; uncertainties as to how many of Inari’s stockholders will

tender their shares in the offer; the failure to satisfy any of the

closing conditions to the acquisition of Inari, including the

expiration or termination of the Hart-Scott-Rodino Antitrust

Improvements Act waiting period (and the risk that such

governmental approval may result in the imposition of conditions

that could adversely affect the expected benefits of the

transaction); delays in consummating the acquisition of Inari or

the risk that the transaction may not close at all; unexpected

liabilities, costs, charges or expenses in connection with the

acquisition of Inari; the effects of the proposed Inari transaction

(or the announcement thereof) on the parties’ relationships with

employees, customers, other business partners or governmental

entities; weakening of economic conditions, or the anticipation

thereof, that could adversely affect the level of demand for our

products; geopolitical risks, including from international

conflicts and elections in the United States and other countries,

which could, among other things, lead to increased market

volatility; pricing pressures generally, including cost-containment

measures that could adversely affect the price of or demand for our

products; changes in foreign currency exchange markets; legislative

and regulatory actions; unanticipated issues arising in connection

with clinical studies and otherwise that affect approval of new

products, including Inari products, by the United States Food and

Drug Administration and foreign regulatory agencies; inflationary

pressures; increased interest rates or interest rate volatility;

supply chain disruptions; changes in labor markets; changes in

reimbursement levels from third-party payors; a significant

increase in product liability claims; the ultimate total cost with

respect to recall-related and other regulatory and quality matters;

the impact of investigative and legal proceedings and compliance

risks; resolution of tax audits; changes in tax laws and

regulations; the impact of legislation to reform the healthcare

system in the United States or other countries; costs to comply

with medical device regulations; changes in financial markets;

changes in our credit ratings; changes in the competitive

environment; our ability to integrate and realize the anticipated

benefits of acquisitions in full or at all or within the expected

timeframes, including the acquisition of Inari; our ability to

realize anticipated cost savings; potential negative impacts

resulting from climate change or other environmental, social and

governance and sustainability related matters; the impact on our

operations and financial results of any public health emergency and

any related policies and actions by governments or other third

parties; and breaches or failures of our or our vendors' or

customers' information technology systems or products, including by

cyber-attack, data leakage, unauthorized access or theft.

Additional information concerning these and other factors is

contained in our filings with the U.S. Securities and Exchange

Commission (the “SEC”), including our Annual Report on Form 10-K

and Quarterly Reports on Form 10-Q. The foregoing factors should

also be read in conjunction with the risks and cautionary

statements discussed or identified in Inari’s filings with the SEC,

including Inari’s Annual Report on Form 10-K and Quarterly Reports

on Form 10-Q. The parties disclaim any intention or obligation to

publicly update or revise any forward-looking statement to reflect

any change in expectations or in events, conditions or

circumstances on which those expectations may be based, or that

affect the likelihood that actual results will differ from those

contained in the forward-looking statements, except to the extent

required by law.

Additional Information and Where to Find ItThe

tender offer for the outstanding shares of common stock of Inari

referenced in this communication has not yet commenced. This

communication is for informational purposes only, is not a

recommendation and is neither an offer to purchase nor a

solicitation of an offer to sell shares of common stock of Inari or

any other securities. At the time the tender offer is commenced,

Stryker will file with the “SEC” a Tender Offer Statement on

Schedule TO, and Inari will file with the SEC a

Solicitation/Recommendation Statement on Schedule 14D-9. INARI

STOCKHOLDERS ARE URGED TO READ THE TENDER OFFER MATERIALS

(INCLUDING AN OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL

AND THE OTHER TENDER OFFER DOCUMENTS), AND THE

SOLICITATION/RECOMMENDATION STATEMENT, AS MAY BE AMENDED FROM TIME

TO TIME, WHEN SUCH DOCUMENTS BECOME AVAILABLE, BECAUSE THEY WILL

CONTAIN IMPORTANT INFORMATION THAT SHOULD BE READ CAREFULLY BEFORE

ANY DECISION IS MADE WITH RESPECT TO THE TENDER OFFER. Inari

stockholders and other investors can obtain the Tender Offer

Statement, the Solicitation/Recommendation Statement and other

filed documents for free at the SEC’s website at www.sec.gov.

Copies of the documents filed with the SEC by Stryker will be

available free of charge on Stryker’s

website, www.stryker.com, or by contacting Stryker’s Investor

Relations department at jason.beach@stryker.com. Copies of the

documents filed with the SEC by Inari will be available free of

charge on Inari’s website, https://ir.inarimedical.com, or by

contacting Inari Investor Relations at IR@inarimedical.com. In

addition, Inari stockholders may obtain free copies of the tender

offer materials by contacting the information agent for the tender

offer that will be named in the Tender Offer Statement.

Stryker’s ContactsJason Beach, Vice President,

Investor Relations at 269-385-2600 or jason.beach@stryker.com Yin

Becker, Vice President, Chief Corporate Affairs Officer at

269-385-2600 or yin.becker@stryker.com

Inari’s ContactNeil Bhalodkar, Vice President,

Investor Relations at neil.bhalodkar@inarimedical.com

1

https://www.cdc.gov/blood-clots/data-research/facts-stats/index.html

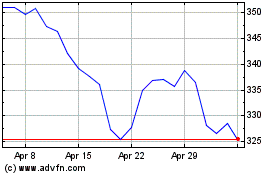

Stryker (NYSE:SYK)

Historical Stock Chart

From Jan 2025 to Feb 2025

Stryker (NYSE:SYK)

Historical Stock Chart

From Feb 2024 to Feb 2025