UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August, 2023

Commission File Number 001-15214

TRANSALTA

CORPORATION

(Translation of registrant's name into English)

110-12th Avenue S.W., Box 1900, Station “M”,

Calgary, Alberta, Canada, T2P 2M1

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ¨

Form 40-F þ

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

TRANSALTA CORPORATION

| By: |

/s/ Todd Stack |

| |

Name: Todd Stack |

| |

Title: Chief Financial Officer |

Date: August 4, 2023

EXHIBIT INDEX

Exhibit 99.1

TransAlta Reports Second Quarter 2023 Results

and Raises 2023 Financial Guidance

CALGARY, AB, Aug. 4, 2023 /CNW/ -

Second Quarter 2023 Financial Highlights

| • | Adjusted EBITDA(1) of $387 million, an increase

of 39 per cent over the same period in 2022 |

| • | Free Cash Flow ("FCF")(1) of $278 million,

or $1.05 per share, an increase of 94 per cent on a per-share basis from the same period in 2022 |

| • | Earnings before income taxes of $79 million, an improvement

of $101 million from the same period in 2022 |

| • | Net earnings attributable to common shareholders of $62 million,

an increase of $142 million from the same period in 2022 |

| • | Cash flow from operating activities of $11 million, an increase

of $140 million from the same period in 2022 |

Other Business Highlights

| • | Entered into a definitive arrangement agreement with TransAlta

Renewables to acquire all of the outstanding common shares of TransAlta Renewables subject to the approval of TransAlta Renewables shareholders |

| • | Entered into an automatic share purchase plan ("ASPP")

to facilitate repurchases of common shares through the normal course issuer bid during blackout period. The Company returned $71 million

of capital to common shareholders in the first and second quarter of 2023 through buybacks of 6.1 million common shares |

| • | Kent Hills rehabilitation program on track with 27 turbines

fully reassembled. Turbines are being returned to service as commissioning activities are completed and, to date, 10 turbines have been

fully placed back in operation. The remaining turbines are expected to return to service in the second half of 2023 |

| • | Northern Goldfields Solar project has entered its commissioning

phase. All major equipment has been installed and construction work is largely complete. Energization and testing processes have commenced

and the facility is expected to achieve full commercial operations in the second half of 2023 |

| • | Mount Keith 132kV expansion project is well advanced. The

gas-insulated switchgear will be installed in August and the project will achieve commercial operations in the second half of 2023 |

| • | Construction at the Horizon Hill wind project in Oklahoma

is advancing well with all major equipment now delivered to site. Turbine erection activities are underway with 27 of the 34 wind turbines

fully assembled. Construction of the transmission interconnection is also underway. Based on the schedule to complete the transmission

line, we have updated our schedule to reflect commercial operations in the first half of 2024 |

| • | Equipment deliveries at White Rock East and West projects

are well advanced with the final blade sets due to arrive in August. Tower assembly has commenced as well as the construction of the transmission

interconnection |

| • | Acquired a 50 per cent interest in the 320 MW Tent Mountain

early-stage pumped hydro development project |

2023 Revised Outlook

| • | Increased 2023 annual financial guidance as set out below: |

| • | Adjusted EBITDA range of $1.7 billion to $1.8 billion, an

increase of 17 per cent at the midpoint of prior guidance |

| • | FCF range of $850 million to $950 million, an increase of

29 per cent at the midpoint of prior guidance |

TransAlta Corporation ("TransAlta" or the

"Company") (TSX: TA) (NYSE: TAC) today reported its financial results for the three and six months ended June 30, 2023.

"Our second quarter results continue to demonstrate

the value of our strategically diversified fleet, which benefited from our strong asset optimization and hedging activities. With our

performance across the fleet and our continuing positive expectations for the balance of year, we have revised our 2023 full year financial

guidance upwards for both adjusted EBITDA and free cash flow, with revised midpoints exceeding the top end of our original targets to

reflect stronger market conditions and solid operational performance," said John Kousinioris, President and Chief Executive Officer

of TransAlta.

"We continue to advance our growth plan and are

progressing several opportunities, with 418 MW of projects in an advanced stage of development and set to reach final investment decisions.

The cash flows from our legacy fleet are positioning us well to realize our Clean Electricity Growth Plan."

"As we continue the execution of our Clean Electricity

Growth Plan, I am pleased that we have reached an agreement with TransAlta Renewables for the acquisition of the common shares of TransAlta

Renewables not already owned by TransAlta. It is clear that the strategies of both TransAlta and TransAlta Renewables have converged

and we are excited to bring these two companies back together. The combined company's greater scale and enhanced positioning will drive

value for all of our shareholders," added Mr. Kousinioris.

Key Business Developments

TransAlta Corporation to Acquire TransAlta Renewables

Inc. to Simplify Structure and Enhance Strategic Position

On July 10, 2023, the Company and TransAlta Renewables

entered into a definitive arrangement agreement (the "Arrangement Agreement") under which the Company will acquire all of the

outstanding common shares of TransAlta Renewables not already owned, directly or indirectly, by TransAlta and certain of its affiliates,

subject to the approval of TransAlta Renewables shareholders.

The transaction will provide shareholders of the combined

company with a single strategy and a clear and compelling opportunity for long-term growth, with greater clarity around the execution

of the Clean Electricity Growth Plan. TransAlta Renewables shareholders will benefit from a fair offer reflecting an attractive premium,

a clear and sustainable path going forward, ownership in an expanded pool of assets and exposure to the Alberta electricity market. For

TransAlta shareholders, the transaction will provide an enhanced strategic position, sustainable and attractive transition metrics, and

increased liquidity and synergies, while maintaining the Company's financial strength.

Under the terms of the Agreement, each TransAlta Renewables

share will be exchanged for, at the election of each holder of TransAlta Renewables shares, (i) 1.0337 common shares of TransAlta or (ii)

$13.00 in cash. The consideration payable to TransAlta Renewables shareholders is subject to pro-rationing based on a maximum aggregate

number of TransAlta shares that may be issued to TransAlta Renewables shareholders of 46,441,779 and a maximum aggregate cash amount of

$800 million.

The consideration payable to TransAlta Renewables

shareholders represents an 18.3 per cent premium based on the closing price of TransAlta Renewables shares on the Toronto Stock Exchange

("TSX") as of July 10, 2023, and a 13.6 per cent premium relative to TransAlta Renewables' 20-day volume-weighted average price

per share as of July 10, 2023. The total consideration paid to TransAlta Renewables shareholders is valued at $1.4 billion on July 10,

2023, of which $800 million will be paid in cash, and the remaining balance in common shares of TransAlta. The combined company will operate

as TransAlta and remain listed on the TSX and the New York Stock Exchange ("NYSE"), under the symbols "TA" and "TAC",

respectively.

The TransAlta Renewables Board (with abstentions by

TransAlta-nominated directors) unanimously determined that the Agreement is in the best interests of TransAlta Renewables and is fair

to its shareholders, approved the execution and delivery of the Agreement and unanimously recommends that TransAlta Renewables shareholders

vote in favour of the Agreement.

A special meeting for TransAlta Renewables shareholders

to consider the transaction will be held on or about Sept. 26, 2023. If all approvals are received and other closing conditions satisfied,

the transaction is expected to be completed in early October 2023.

Normal Course Issuer Bid

On May 26, 2023, the TSX accepted the notice filed

by the Company to implement a normal course issuer bid ("NCIB") for a portion of its common shares. Pursuant to the NCIB, TransAlta

may repurchase up to a maximum of 14,000,000 common shares, representing approximately 7.29 per cent of its public float of common shares

as at May 17, 2023. Purchases under the NCIB may be made through open market transactions on the TSX and any alternative Canadian trading

platforms on which the common shares are traded, based on the prevailing market price. Any common shares purchased under the NCIB will

be cancelled. The period during which TransAlta is authorized to make purchases under the NCIB commenced on May 31, 2023 and ends on May

30, 2024, or such earlier date on which the maximum number of common shares are purchased under the NCIB or the NCIB is terminated at

the Company's election.

The NCIB provides the Company with a capital allocation

alternative with a view to ensuring long-term shareholder value. TransAlta's Board of Directors and management believe that, from time

to time, the market price of the common shares might not be reflective of the underlying value and purchases of common shares for cancellation

under the NCIB may provide an opportunity to enhance shareholder value.

Tent Mountain Pumped Hydro Development Project

On April 24, 2023, the Company acquired a 50 per cent

interest in the Tent Mountain Renewable Energy Complex ("Tent Mountain"), an early-stage 320 MW pumped hydro energy storage

development project, located in southwest Alberta, from Montem Resources Limited ("Montem"). The acquisition includes the land

rights, fixed assets and intellectual property associated with the pumped hydro development project. The Company paid Montem approximately

$8 million on closing of the transaction and additional contingent payments of up to $17 million (approximately $25 million total) may

become payable to Montem based on the achievement of specific development and commercial milestones. The Company and Montem own the Tent

Mountain project within a special purpose partnership that is jointly managed, with the Company acting as project developer. The partnership

is actively seeking an offtake agreement for the energy and environmental attributes generated by the facility.

Second Quarter 2023 Highlights

| $ millions, unless otherwise stated |

Three Months Ended |

Six Months Ended |

| June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

| Adjusted availability (%) |

84.6 |

87.3 |

88.2 |

88.2 |

| Production (GWh) |

4,596 |

4,461 |

10,568 |

9,820 |

| Revenues |

625 |

458 |

1,714 |

1,193 |

| Adjusted EBITDA(1) |

387 |

279 |

890 |

538 |

| FFO(1) |

391 |

220 |

765 |

399 |

| FCF(1) |

278 |

145 |

541 |

253 |

| Earnings (loss) before income taxes |

79 |

(22) |

462 |

220 |

Net earnings (loss) attributable to common

shareholders |

62 |

(80) |

356 |

106 |

| Cash flow from (used in) operating activities |

11 |

(129) |

473 |

322 |

Net earnings (loss) per share attributable to

common shareholders, basic and diluted |

0.23 |

(0.30) |

1.34 |

0.39 |

| FFO per share(1),(2) |

1.48 |

0.81 |

2.88 |

1.47 |

| FCF per share(1),(2) |

1.05 |

0.54 |

2.03 |

0.93 |

Second Quarter Financial Results Summary

Adjusted EBITDA(1) for the three and six

months ended June 30, 2023, increased by $108 million and $352 million, respectively, compared to the same periods in 2022. These results

were largely due to higher revenue from the Alberta Electricity Portfolio, as a result of higher merchant prices realized primarily by

the gas and hydro facilities. The Hydro segment also benefited from higher ancillary service prices in the Alberta market. Adjusted EBITDA

was further improved by higher revenue in the Energy Transition segment due to higher merchant pricing and higher production, and lower

input costs in the Gas segment. These increases were partially offset by higher carbon compliance costs in the Gas segment, lower production

in the Wind and Solar segment and higher OM&A in the Corporate segment.

FCF(1) for the three and six months ended

June 30, 2023, totaled $278 million and $541 million, respectively, compared to $145 million and $253 million, respectively, in the

same periods in 2022. For the three and six months ended June 30, 2023, this represented an increase of $133 million and $288 million,

respectively, primarily due to higher adjusted EBITDA, lower interest expense mainly driven by higher interest income due to higher interest

rates, higher interest capitalized on construction capital expenditures and lower income tax expense due to a current income tax recovery

in the second quarter of 2023. This was partially offset by higher distributions paid to subsidiaries' non-controlling interests, higher

sustaining capital expenditures and higher realized foreign exchange losses compared to 2022.

Net earnings (loss) attributable to common shareholders

for the three and six months ended June 30, 2023, were $62 million and $356 million compared to a net loss of $80 million and net earnings

of $106 million in the same periods in 2022. For the three and six months ended June 30, 2023, the Company benefited from higher revenues,

lower natural gas prices, higher income tax recoveries, largely due to realized current income tax benefits from an internal reorganization

that occurred in the second quarter and higher asset impairment reversals. This was partially offset by higher depreciation due to the

acceleration of useful lives on certain facilities in the third quarter of 2022, higher carbon compliance costs resulting from the previous

years obligation being settled partially with emission credits, higher OM&A costs related to the Corporate and Energy Marketing segments

and higher net earnings allocated to non-controlling interests. In the six months ended June 30, 2023, the Gas segment had higher production

which resulted in higher fuel usage and higher carbon compliance costs and the Energy Transition segment had higher power purchases during

planned outages.

Cash flow from operating activities for the three

and six months ended June 30, 2023, increased by $140 million and $151 million, respectively, compared with the same periods in 2022,

primarily due to higher revenues net of unrealized gains and losses from risk management activities. This was partially offset by higher

unfavourable changes in working capital and higher fuel and purchased power, OM&A and carbon compliance costs.

Alberta Electricity Portfolio

For the three and six months ended June 30, 2023,

the Alberta electricity portfolio generated 2,525 GWh and 5,680 GWh of energy, respectively. This was a decrease of 157 GWh and an increase

of 422 GWh, respectively, compared to the same periods in 2022. Lower production in the three months ended June 30, 2023, was primarily

due to lower wind resources and slightly lower merchant production from the Gas assets due to lower availability, partially offset by

strong generation from the Hydro assets due to precipitation and snowpack melt. For the six months ended June 30, 2023, generation was

higher overall due to increased merchant production in the Gas segment driven by market opportunities as well as higher production from

the Hydro segment in the second quarter of 2023.

Gross margin for the three and six months ended June

30, 2023, was $302 million and $651 million, respectively, an increase of $134 million and $319 million compared to the

same periods in 2022. Higher gross margin was the result of higher merchant prices for our Gas segment, strong production and realized

prices from the Hydro assets, as well as hedging contributions. The six months ended June 30, 2023, benefited from increased merchant

production from our Gas assets.

For the three and six months ended June 30, 2023,

the realized merchant power price per MWh of production increased by $70 per MWh and $68 per MWh, respectively, compared with the same

periods in 2022. The realized merchant power price per MWh of production for the three and six months ended was $175 per MWh and $174

per MWh, respectively, compared to $105 per MWh and $106 per MWh, for the same periods in 2022. Higher realized merchant power pricing

for energy across the portfolio was due to higher market prices and optimization of our available capacity across all fuel types. The

segment spot prices exclude gains and losses from hedging positions that are entered into in order to mitigate the impact of unfavourable

market pricing.

For the three and six months ended June 30, 2023,

the fuel and purchased power cost per MWh of production decreased by $26 per MWh and $12 per MWh, respectively, compared with the same

periods in 2022 primarily due to lower natural gas prices.

For the three and six months ended June 30, 2023,

carbon compliance costs per MWh of production increased by $7 per MWh, compared with the same periods in 2022, due to an increase in carbon

compliance prices from $50 per tonne in 2022 to $65 per tonne in 2023. In 2023, the 2022 carbon compliance obligation was settled with

cash. In 2022, the Company utilized emission credits to settle a portion of the 2021 carbon compliance obligation resulting in a lower

carbon cost per MWh.

Hedged volumes for the three and six months ended

June 30, 2023 were 1,667 GWh and 3,713 GWh at an average price of $91 per MWh and $116 per MWh, respectively, compared to 1,901 GWh and

3,639 GWh at an average price of $73 per MWh and $78 per MWh, respectively, in 2022.

Increased 2023 Financial Guidance

The Company increased its 2023 outlook for adjusted

EBITDA to between $1.7 billion and $1.8 billion. The midpoint of the range represents a 17 per cent increase over the Company's previous

revised 2023 outlook as at the first quarter of 2023 of $1.45 billion and $1.55 billion.

FCF outlook has also been increased and is now expected

to be between $850 million and $950 million. The midpoint of the range represents a 29 per cent increase over the Company's previous 2023

revised outlook of $650 to $750 million.

The following table provides additional details pertaining

to the 2023 outlook:

| Measure |

Updated Target 2023 |

Original Target 2023 |

2022 Actuals |

| Adjusted EBITDA(1) |

$1,700 million - $1,800 million |

$1,200 million -$1,320 million |

$1,634 million |

| FCF(1) |

$850 million - $950 million |

$560 million - $660 million |

$961 million |

Range of key 2023 power and gas price assumptions:

| Market |

Updated 2023 Assumptions |

2023 Original Assumptions |

| Alberta Spot ($/MWh) |

$150 to $170 |

$105 to $135 |

| Mid-C Spot (US$/MWh) |

US$90 to US$100 |

US$75 to US$85 |

| AECO Gas Price ($/GJ) |

$2.50 |

$4.60 |

| |

| Alberta spot price sensitivity: a +/- $1 per MWh change in spot price is expected to have a +/- $4 million impact on adjusted EBITDA for 2023. |

Range of Alberta hedging assumptions:

| Range of hedging assumptions |

Q3 2023 |

Q4 2023 |

Full year 2024 |

Full year 2025 |

| Hedged production (GWh) |

2,012 |

1,558 |

4,506 |

2,423 |

| Hedge price ($/MWh) |

$116 |

$84 |

$82 |

$83 |

| Hedged gas volumes (GJ) |

18 million |

15 million |

44 million |

22 million |

| Hedge gas prices ($/GJ) |

$2.27 |

$2.26 |

$2.64 |

$3.62 |

Liquidity and Financial Position

The Company continues to maintain a strong financial

position in part due to long-term contracts and hedged positions. As at June 30, 2023, TransAlta had access to $2.3 billion in liquidity,

including $0.9 billion in cash and cash equivalents.

Normal Course Issuer Bid

During the three and six months ended June 30, 2023,

the Company purchased and cancelled a total of 6,112,900 common shares, including those purchased under the ASPP, at an average price

of $11.62 per common share, for a total cost of $71 million.

Segmented Financial Performance

|

($ millions) |

Three Months Ended |

Six Months Ended |

| June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

| Hydro |

147 |

88 |

253 |

149 |

| Wind and Solar |

50 |

88 |

138 |

177 |

| Gas |

166 |

65 |

406 |

170 |

| Energy Transition |

13 |

11 |

67 |

16 |

| Energy Marketing |

43 |

50 |

82 |

67 |

| Corporate |

(32) |

(23) |

(56) |

(41) |

| Adjusted EBITDA(1) |

387 |

279 |

890 |

538 |

|

Earnings (loss) before

income taxes |

79 |

(22) |

462 |

220 |

Hydro:

| • | Adjusted EBITDA(1) for the three and six months

ended June 30, 2023, increased by $59 million and $104 million, respectively, compared to the same periods in 2022, primarily due

to higher realized energy and ancillary service prices in the Alberta market and higher production. The three months ended June 30, 2023,

further benefited from higher energy production, partially offset by lower revenues from lower ancillary service volumes. The six months

ended June 30, 2023, benefited from higher sales of environmental attributes and the Company captured revenue through forward hedging

for the Alberta hydro assets and realized gains from the hedging strategy. OM&A in both periods increased primarily due to higher

insurance costs, salary escalations and incentive accruals, and higher legal fees. |

Wind and Solar:

| • | Adjusted EBITDA(1) for the three and six months

ended June 30, 2023, decreased by $38 million and $39 million, respectively, compared to the same periods in 2022, primarily due to lower

production due to lower wind resource, lower environmental attribute revenue, lower realized merchant prices in Alberta in the second

quarter, and lower liquidated damages recognized at the Windrise wind facility. During the six months ended June 30, 2023, lower adjusted

EBITDA was partially offset by higher realized merchant prices in Alberta. OM&A in both periods increased due to salary escalations,

higher insurance costs and long-term service agreement escalations. |

Gas:

| • | Adjusted EBITDA(1) for the three and six months

ended June 30, 2023, increased by $101 million and $236 million, respectively, compared to the same periods in 2022, mainly due to higher

realized energy prices for our Alberta gas merchant assets, net of hedging, and lower natural gas prices, partially offset by higher carbon

compliance costs and higher OM&A from higher contract labour related to planned major maintenance in Australia. The six months ended

June 30, 2023, benefited from higher production due to stronger market conditions in Alberta partially offset by higher carbon costs and

fuel usage related to production. |

Energy Transition:

| • | Adjusted EBITDA(1) increased by $2 million and

$51 million, respectively, for the three and six months ended June 30, 2023, compared to the same periods in 2022, primarily due to higher

merchant pricing and higher production, partially offset by higher fuel usage. During the six months ended June 30, 2023, adjusted EBITDA

was negatively impacted by higher purchased power costs required to fulfill contractual obligations during planned outages. OM&A decreased

due to the retirement of Sundance Unit 4 in the first quarter of 2022. |

Energy Marketing:

| • | Adjusted EBITDA(1) for the three and six months

ended June 30, 2023, , decreased by $7 million and increased by $15 million, respectively, compared to the same periods in 2022. Year-to-date

results exceeded segment expectations from short-term trading of both physical and financial power and gas products across all North American

deregulated markets. The Company was able to capitalize on short-term volatility in the trading markets while maintaining the overall

risk profile of the business unit. |

Corporate:

| • | Adjusted EBITDA(1) for the three and six months

ended June 30, 2023, decreased by $9 million and $15 million, respectively, compared to the same periods in 2022, primarily due to higher

incentive accruals reflecting the Company's performance, increased spending to support strategic and growth initiatives and increased

costs due to inflationary pressures. |

Conference call

TransAlta will hold a conference call and webcast

at 9:00 a.m. MST (11:00 a.m. EST) today, August 4, 2023, to discuss our second quarter 2023 results. The call will begin with a short

address by John Kousinioris, President and Chief Executive Officer, and Todd Stack, EVP Finance and Chief Financial Officer, followed

by a question and answer period for investment analysts and investors. A question and answer period for the media will immediately follow.

Dial-in number - Second Quarter

2023 Conference Call

Toll-free North American participants

call: 1-888-664-6392

A link to the live webcast will be available on the

Investor Centre section of TransAlta's website at https://transalta.com/investors/presentations-and-events/. If you are unable to

participate in the call, the instant replay is accessible at 1-888-390-0541 (Canada and USA toll free) with TransAlta pass code 650793

followed by the # sign. A transcript of the broadcast will be posted on TransAlta's website once it becomes available.

Notes

| (1) |

These items are not defined and have no standardized meaning under IFRS. Presenting these items from period to period provides management and investors with the ability to evaluate earnings (loss) trends more readily in comparison with prior periods' results. Please refer to the Non-IFRS Measures section of this earnings release for further discussion of these items, including, where applicable, reconciliations to measures calculated in accordance with IFRS. |

| (2) |

Funds from operations per share and free cash flow per share are calculated using the weighted average number of common shares outstanding during the period. The weighted average number of common shares outstanding for June 30, 2023, was 266 million shares (June 30, 2022 - 271 million). Please refer to the Non-IFRS Measures section in this earnings release for the purpose of these non-IFRS ratios. |

Non-IFRS financial measures and other specified

financial measures

We use a number of financial measures to evaluate

our performance and the performance of our business segments, including measures and ratios that are presented on a non-IFRS basis, as

described below. Unless otherwise indicated, all amounts are in Canadian dollars and have been derived from our audited annual 2022 consolidated

financial statements and the unaudited interim condensed consolidated statements of earnings (loss) for the three and six months ended

June 30, 2023, prepared in accordance with IFRS. We believe that these non-IFRS amounts, measures and ratios, read together with our IFRS

amounts, provide readers with a better understanding of how management assesses results.

Non-IFRS amounts, measures and ratios do not have

standardized meanings under IFRS. They are unlikely to be comparable to similar measures presented by other companies and should not be

viewed in isolation from, as an alternative to, or more meaningful than, our IFRS results.

Adjusted EBITDA

Each business segment assumes responsibility for its

operating results measured by adjusted EBITDA. Adjusted EBITDA is an important metric for management that represents our core business

profitability. Interest, taxes, depreciation and amortization are not included, as differences in accounting treatments may distort our

core business results. In addition, certain reclassifications and adjustments are made to better assess results, excluding those items

that may not be reflective of ongoing business performance. This presentation may facilitate the readers' analysis of trends.

Funds From Operations ("FFO")

FFO is an important metric as it provides a proxy

for cash generated from operating activities before changes in working capital and provides the ability to evaluate cash flow trends in

comparison with results from prior periods. FFO is a non-IFRS measure.

Free Cash Flow ("FCF")

FCF is an important metric as it represents the amount

of cash that is available to invest in growth initiatives, make scheduled principal repayments on debt, repay maturing debt, pay common

share dividends or repurchase common shares. Changes in working capital are excluded so FFO and FCF are not distorted by changes that

we consider temporary in nature, reflecting, among other things, the impact of seasonal factors and timing of receipts and payments. FCF

is a non-IFRS measure.

Non-IFRS Ratios

FFO per share, FCF per share and adjusted net debt

to adjusted EBITDA are non-IFRS ratios that are presented in the MD&A. Refer to the Reconciliation of Cash Flow from Operations to

FFO and FCF and Key Non-IFRS Financial Ratios sections of the MD&A for additional information.

FFO per share and FCF per share

FFO per share and FCF per share are calculated using

the weighted average number of common shares outstanding during the period. FFO per share and FCF per share are non-IFRS ratios.

Reconciliation of these non-IFRS financial measures

to the most comparable IFRS measure are provided below.

Reconciliation of Non-IFRS Measures on a Consolidated

Basis

The following table reflects adjusted EBITDA by segment

and provides reconciliation to earnings before income taxes for the three months ended June 30, 2023:

|

Three months ended June 30, 2023

$ millions |

Hydro |

Wind &

Solar(1) |

Gas |

Energy

Transition |

Energy

Marketing |

Corporate |

Total |

Equity

accounted

investments(1) |

Reclass

adjustments |

IFRS

financials |

| Revenues |

168 |

86 |

251 |

121 |

3 |

1 |

630 |

(5) |

- |

625 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market

(gain) loss |

(1) |

(8) |

56 |

(3) |

93 |

- |

137 |

- |

(137) |

- |

|

Realized loss on closed

exchange positions |

- |

- |

(4) |

- |

(48) |

- |

(52) |

- |

52 |

- |

|

Decrease in finance lease

receivable |

- |

- |

13 |

- |

- |

- |

13 |

- |

(13) |

- |

| Finance lease income |

- |

- |

4 |

- |

- |

- |

4 |

- |

(4) |

- |

|

Unrealized foreign

exchange loss on

commodity |

- |

- |

- |

- |

1 |

- |

1 |

- |

(1) |

- |

| Adjusted revenues |

167 |

78 |

320 |

118 |

49 |

1 |

733 |

(5) |

(103) |

625 |

| Fuel and purchased power |

5 |

7 |

85 |

90 |

- |

1 |

188 |

- |

- |

188 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

| Australian interest income |

- |

- |

(1) |

- |

- |

- |

(1) |

- |

1 |

- |

|

Adjusted fuel and purchased

power |

5 |

7 |

84 |

90 |

- |

1 |

187 |

- |

1 |

188 |

| Carbon compliance |

- |

- |

25 |

- |

- |

- |

25 |

- |

- |

25 |

| Gross margin |

162 |

71 |

211 |

28 |

49 |

- |

521 |

(5) |

(104) |

412 |

| OM&A |

14 |

18 |

50 |

14 |

6 |

32 |

134 |

- |

- |

134 |

| Taxes, other than income taxes |

1 |

4 |

4 |

1 |

- |

- |

10 |

(1) |

- |

9 |

| Net other operating income |

- |

(1) |

(9) |

- |

- |

- |

(10) |

- |

- |

(10) |

| Adjusted EBITDA(2) |

147 |

50 |

166 |

13 |

43 |

(32) |

387 |

|

|

|

| Equity income |

|

|

|

|

|

|

|

|

|

(1) |

| Finance lease income |

|

|

|

|

|

|

|

|

|

4 |

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

(173) |

| Asset impairment reversals |

|

|

|

|

|

|

|

|

|

13 |

| Net interest expense |

|

|

|

|

|

|

|

|

|

(56) |

| Foreign exchange loss |

|

|

|

|

|

|

|

|

|

8 |

|

Gain on sale of assets and

other |

|

|

|

|

|

|

|

|

|

5 |

| Earnings before income taxes |

|

|

|

|

|

|

|

|

|

79 |

| |

|

| (1) The Skookumchuck wind facility has been included on a proportionate basis in the Wind and Solar segment. |

| (2) Adjusted EBITDA is not defined and has no standardized meaning under IFRS. Refer to the Non-IFRS financial measures and other specified financial measures section in this earnings release. |

| |

|

|

|

|

|

|

|

|

|

|

|

The following table reflects adjusted EBITDA by segment

and provides reconciliation to loss before income taxes for the three months ended June 30, 2022:

|

Three months ended June 30, 2022

$ millions |

Hydro |

Wind &

Solar(1) |

Gas |

Energy

Transition |

Energy

Marketing |

Corporate |

Total |

Equity

accounted

investments(1) |

Reclass

adjustments |

IFRS

financials |

| Revenues |

105 |

96 |

127 |

96 |

36 |

1 |

461 |

(3) |

- |

458 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market

(gain) loss |

- |

15 |

128 |

- |

(56) |

- |

87 |

- |

(87) |

- |

|

Realized gain (loss) on

closed exchange

positions |

- |

- |

(10) |

- |

75 |

- |

65 |

- |

(65) |

- |

|

Decrease in finance lease

receivable |

- |

- |

11 |

- |

- |

- |

11 |

- |

(11) |

- |

| Finance lease income |

- |

- |

6 |

- |

- |

- |

6 |

- |

(6) |

- |

|

Unrealized foreign

exchange loss on

commodity |

- |

- |

- |

- |

2 |

- |

2 |

- |

(2) |

- |

| Adjusted revenues |

105 |

111 |

262 |

96 |

57 |

1 |

632 |

(3) |

(171) |

458 |

| Fuel and purchased power |

6 |

6 |

147 |

71 |

- |

1 |

231 |

- |

- |

231 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

| Australian interest income |

- |

- |

(1) |

- |

- |

- |

(1) |

- |

1 |

- |

|

Adjusted fuel and purchased

power |

6 |

6 |

146 |

71 |

- |

1 |

230 |

- |

1 |

231 |

| Carbon compliance |

- |

1 |

12 |

(4) |

- |

- |

9 |

- |

- |

9 |

| Gross margin |

99 |

104 |

104 |

29 |

57 |

- |

393 |

(3) |

(172) |

218 |

| OM&A |

10 |

15 |

45 |

17 |

7 |

23 |

117 |

- |

- |

117 |

|

Taxes, other than income

taxes |

1 |

4 |

4 |

1 |

- |

- |

10 |

(1) |

- |

9 |

| Net other operating income |

- |

(10) |

(10) |

- |

- |

- |

(20) |

- |

- |

(20) |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

| Insurance recovery |

- |

7 |

- |

- |

- |

- |

7 |

- |

(7) |

- |

|

Adjusted net other operating

income |

- |

(3) |

(10) |

- |

- |

- |

(13) |

- |

(7) |

(20) |

| Adjusted EBITDA(2) |

88 |

88 |

65 |

11 |

50 |

(23) |

279 |

|

|

|

| Equity income |

|

|

|

|

|

|

|

|

|

2 |

| Finance lease income |

|

|

|

|

|

|

|

|

|

6 |

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

(115) |

| Asset impairment reversals |

|

|

|

|

|

|

|

|

|

24 |

| Net interest expense |

|

|

|

|

|

|

|

|

|

(62) |

| Foreign exchange gain |

|

|

|

|

|

|

|

|

|

9 |

| Gain on sale of assets and other |

|

|

|

|

|

|

|

|

|

2 |

| Loss before income taxes |

|

|

|

|

|

|

|

|

|

(22) |

| |

|

| (1) The Skookumchuck wind facility has been included on a proportionate basis in the Wind and Solar segment. |

| (2) Adjusted EBITDA is not defined and has no standardized meaning under IFRS. Refer to the Non-IFRS financial measures and other specified financial measures section in this earnings release. |

| |

|

|

|

|

|

|

|

|

|

|

|

The following table reflects adjusted EBITDA by segment

and provides reconciliation to earnings before income taxes for the six months ended June 30, 2023:

|

Six months ended June 30, 2023

$ millions |

Hydro |

Wind &

Solar(1) |

Gas |

Energy

Transition |

Energy

Marketing |

Corporate |

Total |

Equity

accounted

investments(1) |

Reclass

adjustments |

IFRS

financials |

| Revenues |

293 |

201 |

746 |

388 |

95 |

1 |

1,724 |

(10) |

- |

1,714 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market (gain)

loss |

(2) |

(8) |

(8) |

(17) |

109 |

- |

74 |

- |

(74) |

- |

Realized loss on closed exchange

positions |

- |

- |

(17) |

- |

(103) |

- |

(120) |

- |

120 |

- |

| Decrease in finance lease receivable |

- |

- |

26 |

- |

- |

- |

26 |

- |

(26) |

- |

| Finance lease income |

- |

- |

8 |

- |

- |

- |

8 |

- |

(8) |

- |

|

Unrealized foreign exchange

loss on commodity |

- |

- |

- |

- |

1 |

- |

1 |

- |

(1) |

- |

| Adjusted revenues |

291 |

193 |

755 |

371 |

102 |

1 |

1,713 |

(10) |

11 |

1,714 |

| Fuel and purchased power |

10 |

16 |

215 |

271 |

- |

1 |

513 |

- |

- |

513 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

| Australian interest income |

- |

- |

(2) |

- |

- |

- |

(2) |

- |

2 |

- |

|

Adjusted fuel and purchased

power |

10 |

16 |

213 |

271 |

- |

1 |

511 |

- |

2 |

513 |

| Carbon compliance |

- |

- |

57 |

- |

- |

- |

57 |

- |

- |

57 |

| Gross margin |

281 |

177 |

485 |

100 |

102 |

- |

1,145 |

(10) |

9 |

1,144 |

| OM&A |

26 |

35 |

91 |

31 |

20 |

56 |

259 |

(1) |

- |

258 |

| Taxes, other than income taxes |

2 |

7 |

8 |

2 |

- |

- |

19 |

(1) |

- |

18 |

| Net other operating income |

- |

(3) |

(20) |

- |

- |

- |

(23) |

- |

- |

(23) |

| Adjusted EBITDA(2) |

253 |

138 |

406 |

67 |

82 |

(56) |

890 |

|

|

|

| Equity income |

|

|

|

|

|

|

|

|

|

1 |

| Finance lease income |

|

|

|

|

|

|

|

|

|

8 |

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

(349) |

| Asset impairment reversals |

|

|

|

|

|

|

|

|

|

16 |

| Net interest expense |

|

|

|

|

|

|

|

|

|

(115) |

| Foreign exchange loss |

|

|

|

|

|

|

|

|

|

5 |

|

Gain on sale of assets and

other |

|

|

|

|

|

|

|

|

|

5 |

| Earnings before income taxes |

|

|

|

|

|

|

|

|

|

462 |

| |

|

| (1) The Skookumchuck wind facility has been included on a proportionate basis in the Wind and Solar segment. |

| (2) Adjusted EBITDA is not defined and has no standardized meaning under IFRS. Refer to the Non-IFRS financial measures and other specified financial measures section in this earnings release. |

| |

|

|

|

|

|

|

|

|

|

|

|

The following table reflects adjusted EBITDA by segment

and provides reconciliation to earnings before income taxes for the six months ended June 30, 2022:

Six months ended June 30, 2022

$ millions |

Hydro |

Wind &

Solar(1) |

Gas |

Energy

Transition |

Energy

Marketing |

Corporate |

Total |

Equity

accounted

investments(1) |

Reclass

adjustments |

IFRS

financials |

| Revenues |

182 |

191 |

561 |

202 |

62 |

2 |

1,200 |

(7) |

- |

1,193 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

Unrealized mark-to-market (gain)

loss |

- |

28 |

(34) |

11 |

(46) |

- |

(41) |

- |

41 |

- |

Realized gain (loss) on closed

exchange positions |

- |

- |

(7) |

- |

65 |

- |

58 |

- |

(58) |

- |

|

Decrease in finance lease

receivable |

- |

- |

22 |

- |

- |

- |

22 |

- |

(22) |

- |

| Finance lease income |

- |

- |

11 |

- |

- |

- |

11 |

- |

(11) |

- |

| Adjusted revenues |

182 |

219 |

553 |

213 |

81 |

2 |

1,250 |

(7) |

(50) |

1,193 |

| Fuel and purchased power |

10 |

14 |

278 |

165 |

- |

2 |

469 |

- |

- |

469 |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

| Australian interest income |

- |

- |

(2) |

- |

- |

- |

(2) |

- |

2 |

- |

|

Adjusted fuel and purchased

power |

10 |

14 |

276 |

165 |

- |

2 |

467 |

- |

2 |

469 |

| Carbon compliance |

- |

1 |

30 |

(3) |

- |

- |

28 |

- |

- |

28 |

| Gross margin |

172 |

204 |

247 |

51 |

81 |

- |

755 |

(7) |

(52) |

696 |

| OM&A |

21 |

31 |

89 |

33 |

14 |

41 |

229 |

- |

- |

229 |

| Taxes, other than income taxes |

2 |

6 |

8 |

2 |

- |

- |

18 |

(1) |

- |

17 |

| Net other operating income |

- |

(17) |

(20) |

- |

- |

- |

(37) |

- |

- |

(37) |

| Reclassifications and adjustments: |

|

|

|

|

|

|

|

|

|

| Insurance recovery |

- |

7 |

- |

- |

- |

- |

7 |

- |

(7) |

- |

|

Adjusted net other operating

income |

- |

(10) |

(20) |

- |

- |

- |

(30) |

- |

(7) |

(37) |

| Adjusted EBITDA(2) |

149 |

177 |

170 |

16 |

67 |

(41) |

538 |

|

|

|

| Equity income |

|

|

|

|

|

|

|

|

|

4 |

| Finance lease income |

|

|

|

|

|

|

|

|

|

11 |

| Depreciation and amortization |

|

|

|

|

|

|

|

|

|

(232) |

| Asset impairment reversals |

|

|

|

|

|

|

|

|

|

66 |

| Net interest expense |

|

|

|

|

|

|

|

|

|

(129) |

| Foreign exchange gain |

|

|

|

|

|

|

|

|

|

11 |

|

Gain on sale of assets and

other |

|

|

|

|

|

|

|

|

|

2 |

| Earnings before income taxes |

|

|

|

|

|

|

|

|

|

220 |

| |

|

| (1) The Skookumchuck wind facility has been included on a proportionate basis in the Wind and Solar segment. |

| (2) Adjusted EBITDA is not defined and has no standardized meaning under IFRS. Refer to the Non-IFRS financial measures and other specified financial measures in this earnings release. |

| |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Cash flow from operations to

FFO and FCF

The table below reconciles our cash flow from operating

activities to our FFO and FCF:

| |

Three Months Ended |

Six Months Ended |

| $ millions unless otherwise stated |

June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

Cash flow from (used in) operating

activities(1) |

11 |

(129) |

473 |

322 |

Change in non-cash operating working

capital balances |

408 |

260 |

366 |

(24) |

Cash flow from operations before

changes in working capital |

419 |

131 |

839 |

298 |

| Adjustments |

|

|

|

|

Share of adjusted FFO from joint

venture(1) |

5 |

2 |

8 |

5 |

| Decrease in finance lease receivable |

13 |

11 |

26 |

22 |

Clean energy transition provisions and

adjustments(2) |

7 |

8 |

7 |

8 |

Realized gain (loss) on closed positions

with same counterparty |

(52) |

65 |

(120) |

58 |

| Other(3) |

(1) |

3 |

5 |

8 |

| FFO(4) |

391 |

220 |

765 |

399 |

| Deduct: |

|

|

|

|

| Sustaining capital(1) |

(44) |

(31) |

(64) |

(48) |

| Productivity capital |

(1) |

(1) |

(1) |

(2) |

| Dividends paid on preferred shares |

(12) |

(10) |

(25) |

(20) |

Distributions paid to subsidiaries' non-

controlling interests |

(53) |

(30) |

(129) |

(72) |

| Principal payments on lease liabilities |

(3) |

(3) |

(5) |

(4) |

| FCF(4) |

278 |

145 |

541 |

253 |

Weighted average number of common

shares outstanding in the period |

264 |

271 |

266 |

271 |

| FFO per share(4) |

1.48 |

0.81 |

2.88 |

1.47 |

| FCF per share(4) |

1.05 |

0.54 |

2.03 |

0.93 |

| |

|

| (1) Includes our share of amounts for Skookumchuck wind facility, an equity accounted joint venture. |

| (2) Includes amounts related to onerous contracts recognized in 2021. |

| (3) Other consists of production tax credits, which is a reduction to tax equity debt, less distributions from equity accounted joint venture. |

| (4) These items are not defined and have no standardized meaning under IFRS. Refer to the Non-IFRS Measures section in this earnings release. |

The table below provides a reconciliation of our adjusted

EBITDA to our FFO and FCF:

| |

Three Months Ended |

Six Months Ended |

| |

June 30, 2023 |

June 30, 2022 |

June 30, 2023 |

June 30, 2022 |

| Adjusted EBITDA(1)(4) |

387 |

279 |

890 |

538 |

| Provisions |

1 |

- |

4 |

10 |

| Interest expense |

(38) |

(50) |

(83) |

(104) |

Current income tax recovery

(expense)(2) |

42 |

(13) |

(18) |

(25) |

Realized foreign exchange gain

(loss) |

1 |

13 |

(6) |

15 |

Decommissioning and restoration

costs settled |

(9) |

(7) |

(16) |

(14) |

| Other non-cash items |

7 |

(2) |

(6) |

(21) |

| FFO(3)(4) |

391 |

220 |

765 |

399 |

| Deduct: |

|

|

|

|

| Sustaining capital(4) |

(44) |

(31) |

(64) |

(48) |

| Productivity capital |

(1) |

(1) |

(1) |

(2) |

Dividends paid on preferred

shares |

(12) |

(10) |

(25) |

(20) |

Distributions paid to subsidiaries'

non-controlling interests |

(53) |

(30) |

(129) |

(72) |

Principal payments on lease

liabilities |

(3) |

(3) |

(5) |

(4) |

| FCF(3) |

278 |

145 |

541 |

253 |

| |

|

| (1) Adjusted EBITDA is defined in the Non-IFRS financial measures and other specified financial measures section in this earnings release and reconciled to earnings (loss) before income taxes above. |

| (2) The Company incurred lower current tax expense for 2023, due to the Company completing an internal reorganization during the second quarter of 2023, which allowed the Company to apply tax attributes, previously unavailable due to Canadian tax limitations, against taxable income in Canada. |

| (3) These items are not defined and have no standardized meaning under IFRS. FFO and FCF are defined in the Non-IFRS financial measures and other specified financial measures section of in this earnings release and reconciled to cash flow from operating activities above. |

| (4) Includes our share of amounts for Skookumchuck wind facility, an equity accounted joint venture. |

TransAlta is in the process of filing its unaudited

interim Consolidated Financial Statements and accompanying notes, as well as the associated Management's Discussion & Analysis ("MD&A").

These documents will be available today on the Investors section of TransAlta's website at www.transalta.com or through SEDAR at www.sedarplus.ca.

About TransAlta Corporation:

TransAlta owns, operates and develops a diverse fleet

of electrical power generation assets in Canada, the United States and Australia with a focus on long-term shareholder value. TransAlta

provides municipalities, medium and large industries, businesses and utility customers with clean, affordable, energy efficient and reliable

power. Today, TransAlta is one of Canada's largest producers of wind power and Alberta's largest producer of hydro-electric power. For

over 111 years, TransAlta has been a responsible operator and a proud member of the communities where we operate and where our employees

work and live. TransAlta aligns its corporate goals with the UN Sustainable Development Goals and its climate change strategy with CDP

(formerly Climate Disclosure Project) and the Task Force on Climate-related Financial Disclosures (TCFD) recommendations. TransAlta has

achieved a 68 per cent reduction in GHG emissions or 22 million tonnes since 2015 and has received scores of A- from CDP and A from MSCI.

For more information about TransAlta, visit our

web site at transalta.com.

Cautionary Statement Regarding Forward-Looking

Information

This news release contains "forward-looking

information", within the meaning of applicable Canadian securities laws, and "forward-looking statements", within the meaning

of applicable United States securities laws, including the United States Private Securities Litigation Reform Act of 1995 (collectively

referred to herein as "forward-looking statements). In some cases, forward-looking statements can be identified by terminology such

as "plans", "expects", "proposed", "will", "anticipates", "develop", "continue",

and similar expressions suggesting future events or future performance. In particular, this news release contains, without limitation,

statements pertaining to: acquisition by the Company of all of the outstanding common shares of TransAlta Renewables Inc. ("TransAlta

Renewables") not already owned by TransAlta pursuant to the definitive arrangement agreement dated July 10, 2023, including the benefits

of such transaction and the timing and completion of such transaction; the rehabilitation of the Kent Hills 1 and 2 wind facilities,

including the expected date that the facilities will fully return to service and capital expenditures; the development of the Tent Mountain

pumped hydro project; the Mount Keith transmission and Northern Goldfields projects under construction in Australia, including the expected

timing of commercial operations; our ability to progress 418 MW of advanced stage projects; and our revised 2023 financial guidance, including

expectations regarding adjusted EBITDA, free cash flow and gross margin from the Energy Marketing segment; expectations on power and gas

prices, including Alberta merchant spot prices; and Alberta hedging assumptions.

The forward-looking statements contained in this news

release are based on many assumptions including, but not limited to, the following material assumptions: no significant changes to applicable

laws and regulations beyond those that have already been announced; merchant power prices in Alberta and the Pacific Northwest; the Alberta

hedge position, including price and volume of hedged power; the availability and cost of labour, services and infrastructure; and the

satisfaction by third parties of their obligations, including under our power purchase agreements. Forward-looking statements are subject

to a number of significant risks, uncertainties and assumptions that could cause actual plans, performance, results or outcomes to differ

materially from current expectations. Factors that may adversely impact what is expressed or implied by forward-looking statements contained

in this news release include, but are not limited to: the completion and timing of the arrangement with TransAlta Renewables; the ability

of the Company and TransAlta Renewables to receive, in a timely manner, the necessary regulatory, court, shareholder, stock exchange and

other third-party approvals and to satisfy the other conditions to closing of the arrangement; fluctuations in merchant power prices,

including lower pricing in Alberta, Ontario and Mid-Columbia; changes in demand for electricity and capacity; our ability to contract

or hedge our electricity generation for prices and at volumes that will provide expected returns; risks relating to our early stage development

projects, including interconnection, offtake contracts and geotechnical and environmental conditions of such projects; long term commitments

on gas transportation capacity that may not be fully utilized over time; our ability to replace or renew contracts as they expire; risks

associated with our projects under construction and projects in development, namely as it pertains to capital costs, permitting, land

rights, engineering risks, and delays in the construction or commissioning of such projects; any difficulty raising needed capital in

the future, including debt, equity and tax equity, as applicable, on reasonable terms or at all; changes to the legislative, regulatory

and political environments in the jurisdictions in which we operate; environmental requirements and changes in, or liabilities under,

these requirements; operational risks involving our facilities, including unplanned outages; disruptions in the transmission and distribution

of electricity, including congestion and basis risk; restricted access to capital and increased borrowing costs; changes in short-term

and/or long-term electricity supply and demand; reductions in production; increased costs; a higher rate of losses on our accounts receivables

due to credit defaults; impairments and/or write-downs of assets; adverse impacts on our information technology systems and our internal

control systems, including increased cybersecurity threats; commodity risk management and energy trading risks, including the effectiveness

of the Company's risk management tools associated with hedging and trading procedures to protect against significant losses; reduced labour

availability and ability to continue to staff our operations and facilities; disruptions to our supply chains, including our ability to

secure necessary equipment on the expected timelines or at all; the effects of weather, including man made or natural disasters, as well

as climate-change related risks; unexpected increases in cost structure; reductions to our generating units' relative efficiency or capacity

factors; disruptions in the source of fuels, including natural gas and coal, as well as the extent of water, solar or wind resources required

to operate our facilities; general economic risks, including deterioration of equity markets, increasing interest rates or rising inflation;

failure to meet financial expectations; general domestic and international economic and political developments, including armed hostilities,

the threat of terrorism, diplomatic developments or other similar events; equipment failure and our ability to carry out or have completed

the repairs in a cost-effective manner timely manner or at all, including if the rehabilitation at the Kent Hills wind facilities is more

costly than expected; industry risk and competition; public health crises and the impacts of any restrictive directives of government

and public health authorities; fluctuations in the value of foreign currencies; structural subordination of securities; counterparty credit

risk; inadequacy or unavailability of insurance coverage; our provision for income taxes; legal, regulatory and contractual disputes and

proceedings involving the Company; reliance on key personnel; labour relations matters and other risks and uncertainties discussed in

the Company's materials filed with the securities regulatory authorities from time to time and as also set forth in the Company's MD&A

and Annual Information Form for the year ended December 31, 2022. Readers are cautioned not to place undue reliance on these forward-looking

statements, which reflect TransAlta's expectations only as of the date of this news release. TransAlta disclaims any intention or obligation

to update or revise these forward-looking statements, whether as a result of new information, future events or otherwise, except as required

by law.

Note: All financial figures are in Canadian dollars

unless otherwise indicated.

View original content:https://www.prnewswire.com/news-releases/transalta-reports-second-quarter-2023-results-and-raises-2023-financial-guidance-301893492.html

SOURCE TransAlta Corporation

View original content: http://www.newswire.ca/en/releases/archive/August2023/04/c4381.html

%CIK: 0001144800

For further information: Investor Inquiries: Phone: 1-800-387-3598

in Canada and U.S., Email: investor_relations@transalta.com; Media Inquiries: Phone: 1-855-255-9184, Email: ta_media_relations@transalta.com

CO: TransAlta Corporation

CNW 07:00e 04-AUG-23

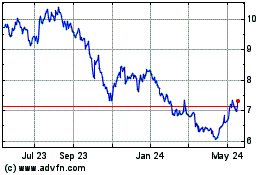

TransAlta (NYSE:TAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

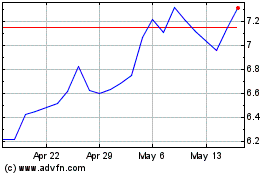

TransAlta (NYSE:TAC)

Historical Stock Chart

From Jan 2024 to Jan 2025