TrueBlue (NYSE:TBI) today announced its third quarter results

for 2024.

Third Quarter 2024 Financial Highlights

- Revenue of $382 million compared to $473 million in the prior

year period

- Net loss of $8 million compared to net loss of $0 million in

the prior year period

- SG&A expense reduced by 17 percent to $100 million compared

to $121 million in the prior year period

- Adjusted EBITDA1 of $5 million compared to $10 million in the

prior year period

- Zero debt, cash of $15 million and $133 million of borrowing

availability at period end

- $4 million in share repurchases with $34 million remaining

under authorization

Commentary

“As expected, market conditions remained challenging but we

continue to manage through the cycle with the discipline and

agility needed to ensure we are even better positioned as

conditions improve,” said Taryn Owen, President and CEO of

TrueBlue. “Given the labor dynamics at play, we are focused on the

areas we can control. Our teams are staying highly engaged with

clients and we are scaling our operating structure to align with

current market demand while ensuring we are ready to capitalize as

customer volumes return.”

“We continue to leverage our deep expertise and expansive

service offerings to address clients’ immediate and evolving needs

and we remain committed to advancing our strategic priorities to

capture market share and enhance our long-term profitability,”

continued Ms. Owen. “We made significant progress during the

quarter accelerating our digital transformation, expanding our

presence in attractive end markets and simplifying our

organizational structure. These strategic priorities allow us to

better leverage our inherent strengths and position us for even

stronger growth and profitability when industry demand

rebounds.”

Results

Third quarter revenue was $382 million, a decrease of 19 percent

compared to revenue of $473 million in the third quarter of 2023.

Net loss per diluted share was $0.26 compared to net loss per

diluted share of $0.00 in the prior year period. Adjusted net loss1

per diluted share was $0.11 compared to adjusted net income per

diluted share of $0.16 in the prior year period.

2024 Outlook

TrueBlue is providing certain forward-looking information to

help investors form their own estimates, which can be found in the

quarterly earnings presentation filed today.

Management will discuss third quarter 2024 results on a webcast

at 2:00 p.m. PT (5:00 p.m. ET), today, Monday, Nov. 4,

2024.

The quarterly earnings presentation and webcast can be accessed

on the Investor Relations section of the TrueBlue website:

investor.trueblue.com.

About TrueBlue

TrueBlue (NYSE: TBI) is a leading provider of specialized

workforce solutions that help clients achieve business growth and

improve productivity. In 2023, TrueBlue served approximately 67,000

clients and connected approximately 464,000 people with work. Its

PeopleReady segment offers on-demand, industrial staffing,

PeopleScout offers recruitment process outsourcing (RPO) and

managed service provider (MSP) solutions, and PeopleManagement

offers contingent, on-site industrial staffing and commercial

driver services. Learn more at www.trueblue.com.

1 Refer to the financial statements accompanying this release

for more information regarding non-GAAP terms.

Forward-looking statements and non-GAAP financial

measures

This document contains forward-looking statements relating to

our plans and expectations including, without limitation,

statements regarding the future performance and operations of our

business, expectations regarding stabilization in demand, and

expected growth from our digital investments, all of which are

subject to risks and uncertainties. Such statements are based on

management’s expectations and assumptions as of the date of this

release and involve many risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in our forward-looking statements including: (1) national and

global economic conditions, which can be negatively impacted by

factors such as rising interest rates, inflation, political

instability, epidemics and global trade uncertainty, (2) our

ability to maintain profit margins, (3) our ability to successfully

execute on business strategies and further digitalize our business

model, (4) our ability to attract sufficient qualified candidates

and employees to meet the needs of our clients, (5) our ability to

attract and retain clients, (6) our ability to access sufficient

capital to finance our operations, including our ability to comply

with covenants contained in our revolving credit facility, (7) new

laws, regulations, and government incentives that could affect our

operations or financial results, (8) any reduction or change in tax

credits we utilize, including the Work Opportunity Tax Credit, and

(9) the timing and amount of common stock repurchases, if any,

which will be determined at management’s discretion and depend upon

several factors, including market and business conditions, the

trading price of our common stock and the nature of other

investment opportunities. Other information regarding factors that

could affect our results is included in our Securities and Exchange

Commission (SEC) filings, including the company’s most recent

reports on Forms 10-K and 10-Q, copies of which may be obtained by

visiting our website at www.trueblue.com under the Investor

Relations section or the SEC’s website at www.sec.gov. We assume no

obligation to update or revise any forward-looking statement,

whether as a result of new information, future events, or

otherwise, except as required by law. Any other references to

future financial estimates are included for informational purposes

only and subject to risk factors discussed in our most recent

filings with the SEC.

In addition, we use several non-GAAP financial measures when

presenting our financial results in this document. Please refer to

the reconciliations between our U.S. GAAP and non-GAAP financial

measures in the appendix to this document and on our website at

www.trueblue.com under the Investor Relations section for

additional information on both current and historical periods. The

presentation of these non-GAAP financial measures is used to

enhance the understanding of certain aspects of our financial

performance. It is not meant to be considered in isolation,

superior to, or as a substitute for the directly comparable

financial measures prepared in accordance with U.S. GAAP, and may

not be comparable to similarly titled measures of other

companies.

TRUEBLUE, INC.

SUMMARY CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

13 weeks ended

39 weeks ended

(in thousands, except per share

data)

Sep 29, 2024

Sep 24, 2023

Sep 29, 2024

Sep 24, 2023

Revenue from services

$

382,357

$

473,196

$

1,181,440

$

1,414,072

Cost of services

282,320

349,023

877,594

1,036,295

Gross profit

100,037

124,173

303,846

377,777

Selling, general and administrative

expense

99,973

120,715

303,928

364,642

Depreciation and amortization

6,967

6,184

22,616

18,875

Goodwill and intangible asset impairment

charge

—

—

59,674

9,485

Loss from operations

(6,903)

(2,726)

(82,372)

(15,225)

Interest and other income (expense),

net

521

390

3,861

1,982

Loss before tax expense

(benefit)

(6,382)

(2,336)

(78,511)

(13,243)

Income tax expense (benefit)

1,253

(2,326)

35,532

(1,621)

Net loss

$

(7,635)

$

(10)

$

(114,043)

$

(11,622)

Net loss per common share:

Basic

$

(0.26)

$

0.00

$

(3.75)

$

(0.37)

Diluted

$

(0.26)

$

0.00

$

(3.75)

$

(0.37)

Weighted average shares

outstanding:

Basic

29,704

30,932

30,384

31,397

Diluted

29,704

30,932

30,384

31,397

TRUEBLUE, INC.

SUMMARY CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(in thousands)

Sep 29, 2024

Dec 31, 2023

ASSETS

Cash and cash equivalents

$

14,505

$

61,885

Accounts receivable, net

225,376

252,538

Other current assets

45,419

40,570

Total current assets

285,300

354,993

Property and equipment, net

91,078

104,906

Restricted cash, cash equivalents and

investments

180,124

192,985

Goodwill and intangible assets, net

31,713

94,639

Other assets, net

114,161

151,860

Total assets

$

702,376

$

899,383

LIABILITIES AND SHAREHOLDERS’

EQUITY

Accounts payable and other accrued

expenses

$

35,770

$

56,401

Accrued wages and benefits

64,888

80,120

Current portion of workers’ compensation

claims reserve

36,971

44,866

Other current liabilities

16,952

22,712

Total current liabilities

154,581

204,099

Workers’ compensation claims reserve, less

current portion

129,475

151,649

Other long-term liabilities

91,168

85,762

Total liabilities

375,224

441,510

Shareholders’ equity

327,152

457,873

Total liabilities and shareholders’

equity

$

702,376

$

899,383

TRUEBLUE, INC.

CONSOLIDATED STATEMENTS OF

CASH FLOWS

(Unaudited)

39 weeks ended

(in thousands)

Sep 29, 2024

Sep 24, 2023

Cash flows from operating

activities:

Net loss

$

(114,043)

$

(11,622)

Adjustments to reconcile net loss to

net cash (used in) provided by operating activities:

Depreciation and amortization

22,616

18,875

Goodwill and intangible asset impairment

charge

59,674

9,485

Provision for credit losses

1,577

3,254

Stock-based compensation

5,676

10,219

Deferred income taxes

34,694

(3,344)

Non-cash lease expense

9,145

9,449

Other operating activities

(5,052)

(1,661)

Changes in operating assets and

liabilities:

Accounts receivable

25,802

34,790

Income taxes receivable and payable

219

(3,001)

Other assets

8,719

26,795

Accounts payable and other accrued

expenses

(18,771)

(26,879)

Accrued wages and benefits

(15,640)

(5,156)

Workers’ compensation claims reserve

(30,069)

(33,558)

Operating lease liabilities

(9,236)

(9,498)

Other liabilities

1,500

1,421

Net cash (used in) provided by

operating activities

(23,189)

19,569

Cash flows from investing

activities:

Capital expenditures

(18,874)

(23,095)

Proceeds from business divestiture,

net

2,928

—

Payments for company-owned life

insurance

(4,000)

(2,347)

Proceeds from company-owned life

insurance

—

1,662

Purchases of restricted held-to-maturity

investments

(10,180)

(26,894)

Maturities of restricted held-to-maturity

investments

28,688

24,118

Net cash used in investing

activities

(1,438)

(26,556)

Cash flows from financing

activities:

Purchases and retirement of common

stock

(21,301)

(34,178)

Net proceeds from employee stock purchase

plans

564

704

Common stock repurchases for taxes upon

vesting of restricted stock

(2,221)

(3,759)

Other

(1,807)

(96)

Net cash used in financing

activities

(24,765)

(37,329)

Effect of exchange rate changes on cash,

cash equivalents and restricted cash and cash equivalents

(638)

(757)

Net change in cash, cash equivalents,

and restricted cash and cash equivalents

(50,030)

(45,073)

Cash, cash equivalents and restricted

cash and cash equivalents, beginning of period

99,306

135,631

Cash, cash equivalents and restricted

cash and cash equivalents, end of period

$

49,276

$

90,558

TRUEBLUE, INC.

SEGMENT DATA

(Unaudited)

13 weeks ended

(in thousands)

Sep 29, 2024

Sep 24, 2023

Revenue from services:

PeopleReady

$

214,792

$

283,187

PeopleScout

36,713

52,944

PeopleManagement

130,852

137,065

Total company

$

382,357

$

473,196

Segment profit (1):

PeopleReady

$

3,043

$

9,656

PeopleScout

2,542

6,272

PeopleManagement

3,278

2,134

Total segment profit

8,863

18,062

Corporate unallocated expense

(4,184)

(8,122)

Total company Adjusted EBITDA

(2)

4,679

9,940

Third-party processing fees for hiring tax

credits (3)

30

(90)

Amortization of software as a service

assets (4)

(1,615)

(1,064)

PeopleReady technology upgrade costs

(5)

(65)

(696)

COVID-19 government subsidies, net

—

(525)

Executive leadership transition costs

—

(2,492)

Other adjustments, net (6)

(2,965)

(1,615)

EBITDA (2)

64

3,458

Depreciation and amortization

(6,967)

(6,184)

Interest and other income (expense),

net

521

390

Loss before tax (expense) benefit

(6,382)

(2,336)

Income tax (expense) benefit

(1,253)

2,326

Net loss

$

(7,635)

$

(10)

(1) We evaluate performance based on segment revenue and segment

profit. Segment profit includes revenue, related cost of services,

and ongoing operating expenses directly attributable to the

reportable segment. Segment profit excludes depreciation and

amortization expense, unallocated corporate general and

administrative expense, interest expense, other income, income

taxes, and other adjustments not considered to be ongoing.

(2) See the Non-GAAP Financial Measures table on the next page

for definitions of EBITDA and Adjusted EBITDA.

(3) These third-party processing fees are associated with

generating hiring tax credits.

(4) Amortization of software as a service assets is reported in

selling, general and administrative expense.

(5) Costs associated with upgrading legacy PeopleReady

technology.

(6) Other adjustments for the 13 weeks ended September 29, 2024

and September 24, 2023 primarily include workforce reduction costs

of $2.8 million ($0.2 million in cost of services and $2.6 million

in selling, general and administrative expense) and $1.5 million

($0.8 million in cost of services and $0.7 million in selling,

general and administrative expense), respectively.

TRUEBLUE, INC. NON-GAAP FINANCIAL

MEASURES AND NON-GAAP RECONCILIATIONS

In addition to financial measures presented in accordance with

U.S. GAAP, we monitor certain non-GAAP key financial measures. The

presentation of these non-GAAP financial measures is used to

enhance the understanding of certain aspects of our financial

performance. It is not meant to be considered in isolation,

superior to, or as a substitute for the directly comparable

financial measures prepared in accordance with U.S. GAAP, and may

not be comparable to similarly titled measures of other

companies.

Non-GAAP measure

Definition

Purpose of adjusted

measures

Adjusted net income (loss) and

Adjusted net income (loss) per diluted share

Net loss and net loss per diluted share,

excluding:

– gain on divestiture,

– amortization of intangibles,

– PeopleReady technology upgrade

costs,

– COVID-19 government subsidies, net,

– Executive leadership transition

costs,

– other adjustments, net, and

– tax effect of the adjustments and

deferred tax asset valuation allowance.

– Enhances comparability on a consistent

basis and provides investors with useful insight into the

underlying trends of the business.

– Used by management to assess performance

and effectiveness of our business strategies.

– Provides a measure, among others, used

in the determination of incentive compensation for management.

EBITDA and Adjusted

EBITDA

EBITDA excludes from net loss:

– income tax expense (benefit),

– interest and other (income) expense,

net, and

– depreciation and amortization.

Adjusted EBITDA further excludes:

– third-party processing fees for hiring

tax credits,

– amortization of software as a service

assets,

– PeopleReady technology upgrade

costs,

– COVID-19 government subsidies, net,

– Executive leadership transition costs,

and

– other adjustments, net.

– Enhances comparability on a consistent

basis and provides investors with useful insight into the

underlying trends of the business.

– Used by management to assess performance

and effectiveness of our business strategies.

– Provides a measure, among others, used

in the determination of incentive compensation for management.

Adjusted SG&A expense

Selling, general and administrative

expense excluding:

– third-party processing fees for hiring

tax credits,

– amortization of software as a service

assets,

– PeopleReady technology upgrade

costs,

– COVID-19 government subsidies, net,

– Executive leadership transition costs,

and

– other adjustments, net.

– Enhances comparability on a consistent

basis and provides investors with useful insight into the

underlying trends of the business.

1. RECONCILIATION OF U.S. GAAP NET LOSS TO ADJUSTED NET

INCOME (LOSS) AND ADJUSTED NET INCOME (LOSS) PER DILUTED SHARE

(Unaudited)

13 weeks ended

(in thousands, except for per share

data)

Sep 29, 2024

Sep 24, 2023

Net loss

$

(7,635)

$

(10)

Gain on divestiture

29

—

Amortization of intangible assets

672

1,276

PeopleReady technology upgrade costs

(1)

65

696

COVID-19 government subsidies, net

—

525

Executive leadership transition costs

—

2,492

Other adjustments, net (2)

2,965

1,615

Tax effect of adjustments and deferred tax

asset valuation allowance (3)

573

(1,717)

Adjusted net income (loss)

$

(3,331)

$

4,877

Adjusted net income (loss) per diluted

share

$

(0.11)

$

0.16

Diluted weighted average shares

outstanding

29,704

31,239

Margin / % of revenue:

Net loss

(2.0) %

— %

Adjusted net income (loss)

(0.9) %

1.0 %

2. RECONCILIATION OF U.S. GAAP NET LOSS TO EBITDA AND

ADJUSTED EBITDA (Unaudited)

13 weeks ended

(in thousands)

Sep 29, 2024

Sep 24, 2023

Net loss

$

(7,635)

$

(10)

Income tax expense (benefit)

1,253

(2,326)

Interest and other (income) expense,

net

(521)

(390)

Depreciation and amortization

6,967

6,184

EBITDA

64

3,458

Third-party processing fees for hiring tax

credits (4)

(30)

90

Amortization of software as a service

assets (5)

1,615

1,064

PeopleReady technology upgrade costs

(1)

65

696

COVID-19 government subsidies, net

—

525

Executive leadership transition costs

—

2,492

Other adjustments, net (2)

2,965

1,615

Adjusted EBITDA

$

4,679

$

9,940

Margin / % of revenue:

Net loss

(2.0) %

— %

Adjusted EBITDA

1.2 %

2.1 %

3. RECONCILIATION OF U.S. GAAP SELLING, GENERAL AND

ADMINISTRATIVE EXPENSE TO ADJUSTED SG&A EXPENSE

(Unaudited)

13 weeks ended

(in thousands)

Sep 29, 2024

Sep 24, 2023

Selling, general and administrative

expense

$

99,973

$

120,715

Third-party processing fees for hiring tax

credits (4)

30

(90)

Amortization of software as a service

assets (5)

(1,615)

(1,064)

PeopleReady technology upgrade costs

(1)

(65)

(696)

COVID-19 government subsidies, net

—

(525)

Executive leadership transition costs

—

(2,492)

Other adjustments, net (2)

(2,757)

(795)

Adjusted SG&A expense

$

95,566

$

115,053

% of revenue:

Selling, general and administrative

expense

26.1 %

25.5 %

Adjusted SG&A expense

25.0 %

24.3 %

(1) Costs associated with upgrading legacy PeopleReady

technology.

(2) Other adjustments for the 13 weeks ended September 29, 2024

and September 24, 2023 primarily include workforce reduction costs

of $2.8 million ($0.2 million in cost of services and $2.6 million

in selling, general and administrative expense) and $1.5 million

($0.8 million in cost of services and $0.7 million in selling,

general and administrative expense), respectively.

(3) The tax effect includes the application of our statutory

rate of 26% to all taxable / deductible adjustments. For the

thirteen weeks ended September 29, 2024, there was $0.6 million of

valuation allowance recorded against our foreign deferred tax

assets and no tax effect associated with the adjustments due to the

valuation allowance recorded against our U.S. federal, state and

foreign deferred tax assets.

(4) These third-party processing fees are associated with

generating hiring tax credits.

(5) Amortization of software as a service assets is reported in

selling, general and administrative expense.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241104295746/en/

Investor Relations InvestorRelations@trueblue.com

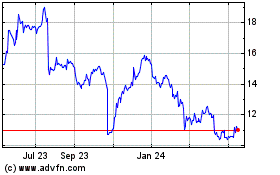

TrueBlue (NYSE:TBI)

Historical Stock Chart

From Feb 2025 to Mar 2025

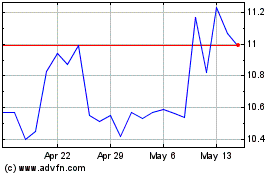

TrueBlue (NYSE:TBI)

Historical Stock Chart

From Mar 2024 to Mar 2025