0001320695false00013206952024-02-162024-02-16

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): February 16, 2024

TREEHOUSE FOODS, INC.

(Exact Name of Registrant as Specified in Charter)

Commission File Number: 001-32504 | | | | | | | | | | | | | | |

| Delaware | | | | 20-2311383 |

(State or Other Jurisdiction

of Incorporation) | | | | (IRS Employer

Identification No.) |

2021 Spring Road, Suite 600 |

Oak Brook, IL 60523 |

| (Address of Principal Executive Offices) (Zip Code) |

Registrant’s telephone number, including area code: (708) 483-1300

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| |

Securities registered pursuant to section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $0.01 par value | THS | NYSE |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| | | | |

| Emerging growth company | ☐ | | | |

| | | | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐ |

Item 2.02. Results of Operations and Financial Condition

On February 16, 2024, TreeHouse Foods, Inc. (NYSE: THS) issued a press release announcing its financial and operating results for the fiscal quarter ended December 31, 2023 and providing information relating to its previously announced webcast being held to discuss such results. A copy of this press release is furnished as Exhibit 99.1 to this report and is incorporated herein by reference.

The information in this Form 8-K under Item 2.02 and Exhibit 99.1 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as expressly set forth by specific referencing in such filing.

Item 9.01. Financial Statements and Exhibits

(d)Exhibits: | | | | | | | | |

Exhibit

Number | | Exhibit Description |

| | | |

| 99.1 | | | |

| 104 | | | Cover Page Interactive Data File (formatted as Inline XBRL) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | |

| | | | TreeHouse Foods, Inc. |

| | | | |

| Date: | February 16, 2024 | | By: | /s/ Kristy N. Waterman |

| | | | Kristy N. Waterman |

| | | | |

| | | | Executive Vice President, Chief Human Resources Officer, General Counsel, and Corporate Secretary |

Exhibit 99.1

TreeHouse Foods, Inc. Reports Fourth Quarter and Full Year 2023 Results

•TreeHouse delivered strong improvement in fiscal year 2023 results:

◦Net sales of $3,431.6 million increased by 4.1% versus the prior year

◦Net income from continuing operations of $59.0 million increased by $68.2 million versus the prior year

◦Adjusted EBITDA1 of $365.9 million increased by $74.2 million versus the prior year

•Fourth quarter results were in-line with guidance:

◦Net sales of $910.8 million

◦Net income from continuing operations of $6.4 million

◦Adjusted EBITDA1 of $108.4 million

•The Company made strong improvement to its leverage profile and balance sheet.

•The Company completed the repurchase of approximately $50 million of shares during the fourth quarter; share repurchases totaled approximately $100 million during full year 2023.

•Issued fiscal year 2024 outlook for net sales of $3.43 to $3.50 billion, adjusted EBITDA2 of $360 to $390 million, and free cash flow2 of at least $130 million. The restart of one of the Company's broth facilities in the first half of 2024 is expected to adversely impact net sales and adjusted EBITDA.

Oak Brook, IL, February 16, 2024 — TreeHouse Foods, Inc. (NYSE: THS) ("the Company") today reported results for the fourth quarter and full year ended December 31, 2023.

"TreeHouse Foods made important progress in 2023 to advance our portfolio strategy focused on higher-growth, higher-margin categories, enhance our supply chain capabilities, and improve our service levels," said Steve Oakland, Chairman, Chief Executive Officer and President. "I want to emphasize that our performance this year is a testament to the dedication and diligence of our entire TreeHouse team, whose efforts enabled the Company to deliver on our commitments to both our stakeholders and shareholders."

Mr. Oakland continued, "As we enter 2024, despite a difficult consumer environment in the food and beverage industry, I am confident in the positioning of our business. The continued strength of the private brands market, which saw unit share reach an all-time high of over 20% within our categories during the fourth quarter, illustrates the ongoing importance of our products to both consumers and retailers. Given this backdrop, we have developed as robust a net sales pipeline as we've had during my tenure. We expect these opportunities should contribute significant net sales growth in the second half of 2024 and beyond. While we expect our first half performance to be constrained by our broth business, we believe we've made the appropriate investments to maintain our path to our long-term targets and strengthen our position as a leading private brands food and beverage supplier in North America."

FOURTH QUARTER 2023 FINANCIAL RESULTS

Net Sales — Net sales for the fourth quarter of 2023 totaled $910.8 million compared to $956.7 million for the same period last year, a decrease of 4.8%. The change in net sales from 2022 to 2023 was due to the following: | | | | | | | | | | | | | | |

| | | Three Months | | Twelve Months |

| | | | |

| | | (unaudited) | | (unaudited) |

| Pricing | | 0.1 | % | | 7.3 | % |

| Volume/mix impacted by supply chain disruption | | (4.2) | | | (1.7) | |

| Volume/mix | | (3.9) | | | (3.4) | |

| | | | |

Total change in organic net sales1 | | (8.0) | % | | 2.2 | % |

| | | | |

| | | | |

| Volume/mix related to acquisitions | | 3.2 | | | 2.1 | |

| Foreign currency | | — | | | (0.2) | |

| Total change in net sales | | (4.8) | % | | 4.1 | % |

The net sales decrease of 4.8% was primarily driven by volume/mix in the retail business, which was impacted by our previously disclosed supply chain disruption at one of our broth facilities and in our pretzels and cookies categories. Additionally, planned distribution exits primarily in our in-store bakery and coffee categories contributed to the decrease. These items were partially offset by volume/mix from the acquisition of the Coffee Roasting Capability.

Gross Profit — Gross profit as a percentage of net sales was 16.7% in the fourth quarter of 2023, compared to 18.3% in the fourth quarter of 2022, a decrease of 1.6 percentage points. The decrease is primarily due to supply chain disruption at one of our broth facilities and from a packaging quality matter within our cookies and pretzels categories, unfavorable fixed cost absorption due to lower volume, increased costs for labor and manufacturing plant maintenance, and unfavorable category mix. This was partially offset by favorable commodity costs.

Total Operating Expenses — Total operating expenses were $109.7 million in the fourth quarter of 2023 compared to $105.5 million in the fourth quarter of 2022, an increase of $4.2 million. The increase in expense was primarily due to a decrease of $16.2 million of TSA income as a result of exiting of certain TSA services, and higher severance expense. This was partially offset by lower professional fees for strategic growth initiatives, lower freight costs, lower brokerage commissions, and lower retention bonus expense.

Total Other Expense — Total other expense was $31.3 million in the fourth quarter of 2023 compared to $16.9 million in the fourth quarter of 2022, an increase of $14.4 million. The increase was primarily due to a $12.3 million change in non-cash mark-to-market impacts from hedging activities, largely driven by an unfavorable decrease in interest rate swaps. Additionally, interest income decreased $7.2 million, as the Note Receivable was repaid in the fourth quarter of 2023. This was partially offset by a non-recurring loss on extinguishment of debt of $4.5 million in the fourth quarter of 2022.

Income Taxes — Income taxes were recognized at an effective rate of 40.7% in the fourth quarter of 2023 compared to 24.5% recognized in the fourth quarter of 2022. The change in the Company’s effective tax rate is primarily the result of a change in the amount of non-deductible executive compensation and deemed U.S. taxable income related to controlled foreign subsidiaries incurred in 2023.

Net Income from Continuing Operations and Adjusted EBITDA — Net income from continuing operations for the fourth quarter of 2023 was $6.4 million, compared to $39.7 million in the fourth quarter of 2022. Adjusted EBITDA1 from continuing operations was $108.4 million in the fourth quarter of 2023, compared to $118.5 million in the fourth quarter of 2022, a decrease of $10.1 million. The decrease is primarily due to supply chain disruption at one of our broth facilities and from a packaging quality matter within our cookies and pretzels categories, a decrease of TSA income, unfavorable fixed cost absorption due to lower volume, increased costs for labor and manufacturing plant maintenance, and unfavorable category mix. This was partially offset by favorable commodity costs, lower freight costs, and lower brokerage commissions.

Discontinued Operations — Net income from discontinued operations was $1.1 million in the fourth quarter of 2023 compared to a $63.1 million net loss from discontinued operations in the fourth quarter of 2022, a change of $64.2 million. This is primarily due to a non-recurring expected loss on disposal adjustment of $54.7 million recognized in the fourth quarter of 2022 as a result of the divestiture of a significant portion of the Meal Preparation business on October 3, 2022.

Net Cash Provided By (Used In) Operating Activities From Continuing Operations — Net cash provided by operating activities from continuing operations was $157.3 million in 2023 compared to net cash used in operating activities from continuing operations of $67.7 million in 2022, an increase of $225.0 million in cash provided. The cash flow increase was primarily attributable to higher cash earnings reflecting the Company's pricing actions to recover commodity and freight inflation experienced in prior periods.

Share Repurchase — During the fourth quarter of 2023, the Company repurchased approximately 1.2 million shares of common stock for a total of $50.0 million, excluding excise tax. The Company repurchased a total of 2.3 million shares of common stock for a total of $100.0 million during the year ended December 31, 2023. At the end of the fourth quarter, the Company had $166.7 million available under its share repurchase authorization.

OUTLOOK2

TreeHouse issued the following outlook and guidance for fiscal year 2024:

•Net sales are expected in the range of $3.43 to $3.50 billion, which represents growth of approximately 0% to 2% year-over-year. Organic volume and mix are expected to be slightly positive for the year, offset by modest, targeted deflationary pricing. The Company expects a slight volume and mix benefit from the recently completed acquisitions.

•Adjusted EBITDA from continuing operations is expected in the range of $360 to $390 million.

•The Company estimates a net sales and adjusted EBITDA impact of roughly $60 million and $20 million, respectively, as a result of its ongoing efforts to restart one of its broth facilities.

•Net interest expense is expected in the range of $56 to $62 million.

•The Company expects capital expenditures of approximately $145 million.

•The Company expects free cash flow of at least $130 million.

In regard to the first quarter, TreeHouse expects the following:

•Net sales are expected in the range of $780 to $810 million, which is down approximately 7% year-over-year at the mid-point of the range. Organic volume and mix are anticipated to be down mid-single-digits year-over-year primarily due to the capacity constraints at one of the Company's broth facilities. The Company also expects targeted deflationary pricing will contribute to the decline. Volume and mix from the recently completed acquisitions is expected to contribute low-single-digit growth.

•Adjusted EBITDA from continuing operations is expected in a range of $45 to $55 million.

________________________________________________

1 Adjusted EBITDA, free cash flow and organic net sales are non-GAAP financial measures. See "Comparison of Adjusted Information to GAAP Information" for the definitions of the Non-GAAP measures, information concerning certain items affecting comparability, and reconciliations of GAAP to Non-GAAP measures.

2 The Company is not able to reconcile prospective adjusted EBITDA from continuing operations or free cash flow, which are Non-GAAP financial measures, to the most comparable GAAP financial measures without unreasonable effort due to the inherent uncertainty and difficulty of predicting the occurrence, financial impact, and timing of certain items impacting GAAP results. These items include, but are not limited to, mark-to-market adjustments of derivative contracts, foreign currency exchange on the re-measurement of intercompany notes, or other non-recurring events or transactions that may significantly affect reported GAAP results.

CONFERENCE CALL WEBCAST

A webcast to discuss the Company’s fourth quarter earnings will be held at 8:30 a.m. (Eastern Time) today. The live audio webcast and a supporting slide deck will be available on the Company’s website at www.treehousefoods.com/investors/investor-overview/default.aspx

DISCONTINUED OPERATIONS

On October 3, 2022, the Company completed the sale of a significant portion of the Company’s Meal Preparation business, including pasta, pourable and spoonable dressing, preserves, red sauces, syrup, dry blends and baking, dry dinners, pie filling, pita chips and other sauces (the "Transaction"). Beginning in the third quarter of 2022, the business of the Transaction is presented as discontinued operations, and, as such, has been excluded from continuing operations for all periods presented.

On September 29, 2023, the Company completed the sale of its Snack Bars business (the "Snack Bars Transaction" or the "Snack Bars Business"). The Snack Bars Transaction represents a component of the single plan of disposal from the Company’s strategic review process, which also resulted in the divestiture of a significant portion of the Meal Preparation business during the fourth quarter of 2022. Beginning in the third quarter of 2023, the Snack Bars Business is presented as a component of discontinued operations and has been excluded from continuing operations for all periods presented.

COMPARISON OF NON-GAAP INFORMATION TO GAAP INFORMATION

The Company has included in this release measures of financial performance that are not defined by GAAP ("Non-GAAP"). A Non-GAAP financial measure is a numerical measure of financial performance that excludes or includes amounts so as to be different than the most directly comparable measure calculated and presented in accordance with GAAP in the Company’s Consolidated Balance Sheets, Consolidated Statements of Operations, Consolidated Statements of Comprehensive Income (Loss), Consolidated Statements of Stockholders' Equity, and the Consolidated Statements of Cash Flows. As described further below, the Company believes these measures provide useful information to the users of the financial statements.

For each of these Non-GAAP financial measures, the Company provides a reconciliation between the most directly comparable GAAP measure and the Non-GAAP measure, an explanation of why management believes the Non-GAAP measure provides useful information to financial statement users, and any additional purposes for which management uses the Non-GAAP measure. This Non-GAAP financial information is provided as additional information for the financial statement users and is not in accordance with, or an alternative to, GAAP. These Non-GAAP measures may be different from similar measures used by other companies.

Organic Net Sales

Organic net sales is defined as net sales excluding the impacts of acquisitions, divestitures, and foreign currency. This information is provided in order to allow investors to make meaningful comparisons of the Company's sales between periods and to view the Company's business from the same perspective as Company management.

Adjusted Net Sales

Adjusted net sales is defined as net sales excluding the impacts related to product recall. This information is provided in order to allow investors to make meaningful comparisons of the Company's sales between periods and to view the Company's business from the same perspective as Company management.

Net Income (Loss) from Continuing Operations Margin, EBITDA from Continuing Operations, EBITDA from Continuing Operations Margin, Adjusted EBITDA from Continuing Operations, and Adjusted EBITDA from Continuing Operations Margin, Adjusting for Certain Items Affecting Comparability

Net income (loss) from continuing operations margin, EBITDA from continuing operations margin, and adjusted EBITDA from continuing operations margin are defined as net income (loss) from continuing operations, EBITDA from continuing operations, and adjusted EBITDA from continuing operations as a percentage of net sales. EBITDA from continuing operations represents net income (loss) from continuing operations before interest expense, interest income, income tax expense, and depreciation and amortization expense. Adjusted EBITDA from continuing operations reflects adjustments to EBITDA from continuing operations to identify items that, in management’s judgment, significantly affect the assessment of earnings results between periods. This information is provided in order to allow investors to make meaningful comparisons of the Company’s earnings performance between periods and to view the Company’s business from the same perspective as Company management. As the Company cannot predict the timing and amount of charges that include, but are not limited to, items such as divestiture, acquisition, integration, and related costs, mark-to-market adjustments on derivative contracts, foreign currency exchange impact on the re-measurement of intercompany notes, growth, reinvestment, and restructuring programs, impairment of assets, and other items that may arise from time to time that would impact comparability, management does not consider these costs when evaluating the Company’s performance, when making decisions regarding the allocation of resources, in determining incentive compensation, or in determining earnings estimates. EBITDA from continuing operations, and adjusted EBITDA from continuing operations are performance measures commonly used by management to assess operating performance and incentive compensation, and the Company believes they are commonly reported and widely used by investors and other interested parties as a measure of a company’s operating performance between periods and as a component of our debt covenant calculations.

Adjusted Gross Profit, Adjusted Total Operating Expenses, Adjusted Operating Income (Loss), Adjusted Total Other Expense (Income), Adjusted Income Tax Expense (Benefit), Adjusted Net Income from Continuing Operations, and Adjusted Diluted Earnings (Loss) Per Share from Continuing Operations, Adjusting for Certain Items Affecting Comparability

Adjusted gross profit, adjusted total operating expenses, adjusted operating income (loss), adjusted total other expense (income), adjusted income tax expense (benefit), and adjusted net income from continuing operations represent their respective GAAP presentation line item adjusted for items such as divestiture, acquisition, integration, and related costs, mark-to-market adjustments on derivative contracts, foreign currency exchange impact on the re-measurement of intercompany notes, growth, reinvestment, and restructuring programs, impairment of assets, and other items that may arise from time to time that would impact comparability. Management does not consider these costs when evaluating the Company’s performance, when making decisions regarding the allocation of resources, in determining incentive compensation, or in determining earnings estimates. This information is provided in order to allow investors to make meaningful comparisons of the Company’s earnings performance between periods and to view the Company’s business from the same perspective as Company management. The Company has presented each of these adjusted Non-GAAP measures as a percentage of Net Sales compared to its respective reported GAAP presentation line item as a percentage of net sales. Adjusted diluted earnings (loss) per share from continuing operations ("Adjusted diluted EPS") is determined by dividing adjusted net income from continuing operations by the weighted average diluted common shares outstanding. Adjusted diluted EPS reflects adjustments to GAAP earnings (loss) per diluted share to identify items that, in management's judgment, significantly affect the assessment of earnings results between periods.

A full reconciliation between the relevant GAAP measure of reported net income (loss) from continuing operations for the three and twelve month periods ended December 31, 2023 and 2022 calculated according to GAAP, adjusted net income from continuing operations, and adjusted EBITDA from continuing operations is presented in the attached tables. Given the inherent uncertainty regarding adjusted items in any future period, a reconciliation of forward-looking financial measures to the most directly comparable GAAP measure is not feasible.

Free Cash Flow from Continuing Operations

In addition to measuring our cash flow generation and usage based upon the operating, investing, and financing classifications included in the Consolidated Statements of Cash Flows, we also measure free cash flow from continuing operations (a Non-GAAP measure) which represents net cash provided by operating activities from continuing operations less capital expenditures. We believe free cash flow is an important measure of operating performance because it provides management and investors a measure of cash generated from operations that is available for mandatory payment obligations and investment opportunities such as funding acquisitions, repaying debt, repurchasing public debt, and repurchasing our common stock. A reconciliation between the relevant GAAP measure of cash provided by (used in) operating activities from continuing operations for the twelve months ended December 31, 2023 and 2022 calculated according to GAAP and free cash flow from continuing operations is presented in the attached tables.

ABOUT TREEHOUSE FOODS

TreeHouse Foods, Inc. is a leading private label food and beverage manufacturer in North America. Our purpose is to engage and delight - one customer at a time. Through our customer focus and category experience, we strive to deliver excellent service and build capabilities and insights to drive mutually profitable growth for TreeHouse and for our customers. Our purpose is supported by investment in depth, capabilities and operational efficiencies which are aimed to capitalize on the long-term growth prospects in the categories in which we operate.

Additional information, including TreeHouse’s most recent Forms 10-Q and 10-K, may be found at TreeHouse’s website, http://www.treehousefoods.com.

Contact:

Investor Relations

708.483.1331

FORWARD-LOOKING STATEMENTS

This press release contains "forward-looking" statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements and other information are based on our beliefs, as well as assumptions made by us, using information currently available. The words "believe," "estimate," "project," "expect," "anticipate," "plan," "intend," "foresee," "should," "would," "could," and similar expressions, as they relate to us, are intended to identify forward-looking statements. Such statements reflect our current views with respect to future events and are subject to certain risks, uncertainties, and assumptions. Should one or more of these risks or uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described herein as anticipated, believed, estimated, expected, or intended. We do not intend to update these forward-looking statements following the date of this press release. Such forward-looking statements, because they relate to future events, are by their very nature subject to many important factors that could cause actual results to differ materially from those contemplated by the forward-looking statements contained in this press release and other public statements we make. Such factors include, but are not limited to: risks related to quality issues, disruptions, or inefficiencies in our supply chain and/or operations; loss or consolidation of key suppliers; raw material and commodity costs due to inflation; labor strikes or work stoppages; multiemployer pension plans; labor shortages and increased competition for labor; success of our growth, reinvestment, and restructuring programs; our level of indebtedness and related obligations; disruptions in the financial markets; interest rates; changes in foreign currency exchange rates; customer concentration and consolidation; competition; our ability to execute on our business strategy; our ability to continue to make acquisitions and execute on divestitures or effectively manage the growth from acquisitions; impairment of goodwill or long lived assets; changes and developments affecting our industry, including customer preferences and the prevalence of weight loss drugs; the outcome of litigation and regulatory proceedings to which we and/or our customers may be a party; product recalls; changes in laws and regulations applicable to us; shareholder activism; disruptions in or failures of our information technology systems; geopolitical events; changes in weather conditions, climate changes, and natural disasters; and other risks that are set forth in the Risk Factors section, the Legal Proceedings section, the Management’s Discussion and Analysis of Financial Condition and Results of Operations section, and other sections of our Annual Report on Form 10-K for the year ended December 31, 2022, and from time to time in our filings with the Securities and Exchange Commission. You are cautioned not to unduly rely on such forward-looking statements, which speak only as of the date made when evaluating the information presented in this press release. TreeHouse expressly disclaims any obligation or undertaking to disseminate any updates or revisions to any forward-looking statement contained herein, to reflect any change in its expectations with regard thereto, or any other change in events, conditions or circumstances on which any statement is based.

FINANCIAL INFORMATION

TREEHOUSE FOODS, INC.

CONSOLIDATED BALANCE SHEETS

(Unaudited, in millions, except per share data) | | | | | | | | | | | | | | |

| | December 31, 2023 | | December 31, 2022 |

| ASSETS | | | | |

| Current assets: | | | | |

| Cash and cash equivalents | | $ | 320.3 | | | $ | 43.0 | |

| | | | |

| Receivables, net of allowance for credit losses of $0.4 in both 2023 and 2022 | | 175.6 | | | 158.8 | |

| Inventories | | 534.0 | | | 554.0 | |

| Prepaid expenses and other current assets | | 24.9 | | | 23.2 | |

| | | | |

| Assets of discontinued operations | | — | | | 60.4 | |

| Total current assets | | 1,054.8 | | | 839.4 | |

| Property, plant, and equipment, net | | 737.6 | | | 641.6 | |

| Operating lease right-of-use assets | | 193.0 | | | 184.4 | |

| Goodwill | | 1,824.7 | | | 1,817.6 | |

| Intangible assets, net | | 257.4 | | | 296.0 | |

| Note receivable, net of allowance for credit losses of $0.0 in both 2023 and 2022 | | — | | | 427.0 | |

| Other assets, net | | 39.1 | | | 47.9 | |

| Total assets | | $ | 4,106.6 | | | $ | 4,253.9 | |

| LIABILITIES AND STOCKHOLDERS' EQUITY | | | | |

| Current liabilities: | | | | |

| Accounts payable | | $ | 534.9 | | | $ | 618.7 | |

| Accrued expenses | | 169.0 | | | 208.5 | |

| Current portion of long-term debt | | 0.4 | | | 0.6 | |

| | | | |

| Total current liabilities | | 704.3 | | | 827.8 | |

| Long-term debt | | 1,396.0 | | | 1,394.0 | |

| Operating lease liabilities | | 165.0 | | | 159.1 | |

| Deferred income taxes | | 111.4 | | | 108.7 | |

| Other long-term liabilities | | 65.1 | | | 77.3 | |

| Total liabilities | | 2,441.8 | | | 2,566.9 | |

| Commitments and contingencies | | | | |

| Stockholders’ equity: | | | | |

| Preferred stock, par value $0.01 per share, 10.0 shares authorized, none issued | | — | | | — | |

| Common stock, par value $0.01 per share, 90.0 shares authorized, 54.1 and 56.1 shares outstanding as of December 31, 2023 and 2022, respectively | | 0.6 | | | 0.6 | |

| Treasury stock | | (234.2) | | | (133.3) | |

| Additional paid-in capital | | 2,223.4 | | | 2,205.4 | |

| Accumulated deficit | | (248.9) | | | (302.0) | |

| Accumulated other comprehensive loss | | (76.1) | | | (83.7) | |

| Total stockholders’ equity | | 1,664.8 | | | 1,687.0 | |

| Total liabilities and stockholders’ equity | | $ | 4,106.6 | | | $ | 4,253.9 | |

TREEHOUSE FOODS, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, in millions, except per share data) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended

December 31, | | Twelve Months Ended

December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net sales | | $ | 910.8 | | | $ | 956.7 | | | $ | 3,431.6 | | | $ | 3,297.1 | |

| Cost of sales | | 759.0 | | | 781.7 | | | 2,855.5 | | | 2,774.7 | |

| Gross profit | | 151.8 | | | 175.0 | | | 576.1 | | | 522.4 | |

| Operating expenses: | | | | | | | | |

| Selling and distribution | | 42.7 | | | 50.9 | | | 171.6 | | | 217.8 | |

| General and administrative | | 49.3 | | | 46.0 | | | 204.1 | | | 206.5 | |

| Amortization expense | | 12.1 | | | 12.2 | | | 48.2 | | | 47.9 | |

| | | | | | | | |

| Other operating expense (income), net | | 5.6 | | | (3.6) | | | 5.3 | | | 62.8 | |

| Total operating expenses | | 109.7 | | | 105.5 | | | 429.2 | | | 535.0 | |

| Operating income (loss) | | 42.1 | | | 69.5 | | | 146.9 | | | (12.6) | |

| Other expense (income): | | | | | | | | |

| Interest expense | | 16.9 | | | 18.7 | | | 74.8 | | | 69.9 | |

| Interest income | | (3.9) | | | (11.1) | | | (40.1) | | | (15.5) | |

| Loss on extinguishment of debt | | — | | | 4.5 | | | — | | | 4.5 | |

| (Gain) loss on foreign currency exchange | | (2.1) | | | (1.3) | | | (1.4) | | | 1.7 | |

| Other expense (income), net | | 20.4 | | | 6.1 | | | 30.2 | | | (74.3) | |

| Total other expense (income) | | 31.3 | | | 16.9 | | | 63.5 | | | (13.7) | |

| Income before income taxes | | 10.8 | | | 52.6 | | | 83.4 | | | 1.1 | |

| Income tax expense | | 4.4 | | | 12.9 | | | 24.4 | | | 10.3 | |

| Net income (loss) from continuing operations | | 6.4 | | | 39.7 | | | 59.0 | | | (9.2) | |

| Net income (loss) from discontinued operations | | 1.1 | | | (63.1) | | | (5.9) | | | (137.1) | |

| Net income (loss) | | $ | 7.5 | | | $ | (23.4) | | | $ | 53.1 | | | $ | (146.3) | |

| | | | | | | | |

| Earnings (loss) per common share - basic: | | | | | | | | |

| Continuing operations | | $ | 0.12 | | | $ | 0.71 | | | $ | 1.06 | | | $ | (0.16) | |

| Discontinued operations | | 0.02 | | | (1.12) | | | (0.11) | | | (2.45) | |

Earnings (loss) per share basic (1) | | $ | 0.14 | | | $ | (0.42) | | | $ | 0.95 | | | $ | (2.61) | |

| | | | | | | | |

| Earnings (loss) per common share - diluted: | | | | | | | | |

| Continuing operations | | $ | 0.12 | | | $ | 0.70 | | | $ | 1.05 | | | $ | (0.16) | |

| Discontinued operations | | 0.02 | | | (1.11) | | | (0.10) | | | (2.45) | |

Earnings (loss) per share diluted (1) | | $ | 0.14 | | | $ | (0.41) | | | $ | 0.94 | | | $ | (2.61) | |

| | | | | | | | |

| Weighted average common shares: | | | | | | | | |

| Basic | | 54.8 | | | 56.1 | | | 55.8 | | | 56.0 | |

| Diluted | | 55.3 | | | 56.7 | | | 56.4 | | | 56.0 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

(1) The sum of the individual per share amounts may not add due to rounding.

TREEHOUSE FOODS, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS

(Unaudited, in millions)

| | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | |

| Cash flows from operating activities: | | | | | |

| Net income (loss) | $ | 53.1 | | | $ | (146.3) | | | |

| Net (loss) income from discontinued operations | (5.9) | | | (137.1) | | | |

| Net income (loss) from continuing operations | 59.0 | | | (9.2) | | | |

| Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: | | | | | |

| Depreciation and amortization | 141.9 | | | 139.6 | | | |

| | | | | |

| Stock-based compensation | 24.8 | | | 19.8 | | | |

| Loss on extinguishment of debt | — | | | 4.5 | | | |

| | | | | |

| Unrealized loss (gain) on derivative contracts | 15.1 | | | (75.1) | | | |

| Deferred income taxes | 3.5 | | | 9.1 | | | |

| Deferred TSA income | (12.3) | | | (22.7) | | | |

| Other, net | 8.9 | | | 6.4 | | | |

| Changes in operating assets and liabilities, net of acquisitions and divestitures: | | | | | |

| Receivables | (15.2) | | | (8.9) | | | |

| Inventories | 51.6 | | | (128.3) | | | |

| Prepaid expenses and other assets | 5.3 | | | 43.6 | | | |

| Accounts payable | (82.4) | | | (14.8) | | | |

| Accrued expenses and other liabilities | (42.9) | | | (31.7) | | | |

| Net cash provided by (used in) operating activities - continuing operations | 157.3 | | | (67.7) | | | |

Net cash used in operating activities - discontinued operations | — | | | (83.0) | | | |

| Net cash provided by (used in) operating activities | 157.3 | | | (150.7) | | | |

| Cash flows from investing activities: | | | | | |

| Additions to property, plant, and equipment | (137.0) | | | (85.8) | | | |

| Additions to intangible assets | (3.8) | | | (7.7) | | | |

| | | | | |

| Proceeds from sale of fixed assets | — | | | 4.8 | | | |

| Acquisitions, net of cash acquired | (100.6) | | | — | | | |

| | | | | |

| | | | | |

| | | | | |

| Net cash used in investing activities - continuing operations | (241.4) | | | (88.7) | | | |

| Net cash provided by investing activities - discontinued operations | 468.1 | | | 500.7 | | | |

Net cash provided by investing activities | 226.7 | | | 412.0 | | | |

| Cash flows from financing activities: | | | | | |

| Borrowings under Revolving Credit Facility | 2,935.3 | | | 855.9 | | | |

| Payments under Revolving Credit Facility | (2,935.3) | | | (855.9) | | | |

| | | | | |

| | | | | |

| | | | | |

| | | | | |

| Payments on finance lease obligations | (0.6) | | | (1.1) | | | |

| Payment of deferred financing costs | — | | | (2.7) | | | |

| Payments on Term Loans | — | | | (514.3) | | | |

| | | | | |

| | | | | |

| | | | | |

| Repurchases of common stock | (100.0) | | | — | | | |

| Receipts related to stock-based award activities | — | | | 0.4 | | | |

| Payments related to stock-based award activities | (6.9) | | | (4.7) | | | |

| | | | | |

| Net cash used in financing activities - continuing operations | (107.5) | | | (522.4) | | | |

| Net cash used in financing activities - discontinued operations | — | | | (0.3) | | | |

| Net cash used in financing activities | (107.5) | | | (522.7) | | | |

| Effect of exchange rate changes on cash and cash equivalents | 0.8 | | | (4.2) | | | |

| Net increase (decrease) in cash and cash equivalents | 277.3 | | | (265.6) | | | |

| Add: Cash and cash equivalents of discontinued operations, beginning of period | — | | | 4.1 | | | |

| | | | | |

| Cash and cash equivalents, beginning of year | 43.0 | | | 304.5 | | | |

| Cash and cash equivalents, end of year | $ | 320.3 | | | $ | 43.0 | | | |

| | | | | | | | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 | | |

| Supplemental cash flow disclosures: | | | | | |

| Interest paid | $ | 93.7 | | | $ | 68.1 | | | |

| Net income taxes paid (refunded) | 19.3 | | | (3.0) | | | |

| | | | | |

| Non-cash investing activities: | | | | | |

| Accrued purchase of property and equipment | $ | 17.1 | | | $ | 20.3 | | | |

| Accrued other intangible assets | 0.3 | | | 1.1 | | | |

| Right-of-use assets obtained in exchange for lease obligations | 45.1 | | | 86.8 | | | |

| Note receivable issued in exchange for the sale of business net assets | — | | | 425.9 | | | |

| Note receivable increase from paid in kind interest | 3.2 | | | 1.1 | | | |

| Note receivable purchase price adjustment reduction | (5.1) | | | — | | | |

| Deferred payment from acquisition of seasoned pretzel capability | 4.0 | | | — | | | |

The following table reconciles the Company’s net income (loss) from continuing operations to EBITDA and adjusted EBITDA from continuing operations, for the three and twelve months ended December 31, 2023 and 2022.

TREEHOUSE FOODS, INC.

RECONCILIATION OF NET INCOME (LOSS) FROM CONTINUING OPERATIONS TO EBITDA AND ADJUSTED EBITDA FROM CONTINUING OPERATIONS

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) from continuing operations (GAAP) | | | $ | 6.4 | | | $ | 39.7 | | | $ | 59.0 | | | $ | (9.2) | |

| Interest expense | | | 16.9 | | | 18.7 | | | 74.8 | | | 69.9 | |

| Interest income | | | (3.9) | | | (11.1) | | | (40.1) | | | (15.5) | |

| Income tax expense | | | 4.4 | | | 12.9 | | | 24.4 | | | 10.3 | |

| Depreciation and amortization | | | 36.2 | | | 36.0 | | | 141.9 | | | 139.6 | |

| EBITDA from continuing operations (Non-GAAP) | | | 60.0 | | | 96.2 | | | 260.0 | | | 195.1 | |

Growth, reinvestment, and restructuring programs, excluding accelerated depreciation(1) | | | 12.2 | | | 18.1 | | | 46.1 | | | 84.5 | |

Product recall and related costs(2) | | | 18.0 | | | — | | | 29.2 | | | — | |

Divestiture, acquisition, integration, and related costs(3) | | | 3.2 | | | (4.6) | | | 16.7 | | | 13.8 | |

Mark-to-market adjustments(4) | | | 16.6 | | | 4.3 | | | 15.1 | | | (75.1) | |

Shareholder activism(5) | | | — | | | 0.6 | | | 0.3 | | | 2.7 | |

Tax indemnification(6) | | | (0.1) | | | — | | | 0.2 | | | — | |

Foreign currency (gain) loss on remeasurement of intercompany notes(7) | | | (1.5) | | | (0.6) | | | (1.7) | | | 0.8 | |

Central services and conveyed employee costs(8) | | | — | | | — | | | — | | | 65.0 | |

Loss on extinguishment of debt(9) | | | — | | | 4.5 | | | — | | | 4.5 | |

Litigation matter(10) | | | — | | | — | | | — | | | 0.4 | |

| | | | | | | | | |

| | | | | | | | | |

| Adjusted EBITDA from continuing operations (Non-GAAP) | | | $ | 108.4 | | | $ | 118.5 | | | $ | 365.9 | | | $ | 291.7 | |

| | | | | | | | | |

| % of net sales | | | | | | | | | |

Net income (loss) from continuing operations margin | | | 0.7 | % | | 4.1 | % | | 1.7 | % | | (0.3) | % |

EBITDA from continuing operations margin | | | 6.6 | % | | 10.1 | % | | 7.6 | % | | 5.9 | % |

Adjusted EBITDA from continuing operations margin | | | 11.9 | % | | 12.4 | % | | 10.7 | % | | 8.8 | % |

During the three and twelve months ended December 31, 2023 and 2022, the Company entered into transactions that affected the year-over-year comparison of its financial results from continuing operations as follows:

| | | | | |

| (1) | The Company’s growth, reinvestment, and restructuring activities are part of an enterprise-wide transformation to improve long-term growth and profitability for the Company. For the three and twelve months ended December 31, 2022, the Company recognized $0.6 million of accelerated depreciation within the Company's growth, reinvestment, and restructuring activities as depreciation expense. |

| |

| (2) | On September 22, 2023, the Company initiated a voluntary recall of certain broth products produced at its Cambridge, Maryland facility. These broth products may have the potential for non-pathogenic microbial contamination due to lack of sterility assurance. The Company recognized costs of $18.3 million and $27.0 million for the three and twelve months ended December 31, 2023, respectively.

For the three months ended December 31, 2023, these costs include non-cash plant shutdown charges of $9.5 million, non-cash inventory write-offs of $8.8 million, and other costs which include a $(1.7) million adjustment to product return reserves and $1.7 million of third-party costs. For the twelve months ended December 31, 2023, these costs include non-cash plant shutdown charges of $12.5 million, non-cash inventory write-offs of $10.4 million, and other costs, including product returns and logistics, of $4.1 million.

Additionally, the Company recognized inventory write-off adjustments of $(0.3) million and $2.2 million for a packaging quality matter for the three and twelve months ended December 31, 2023, respectively. |

| |

| (3) | Divestiture, acquisition, integration, and related costs represent costs associated with completed and potential divestitures, completed and potential acquisitions, and the related integration of the acquisitions. During the three and twelve months ended December 31, 2022, divestiture related activities included consulting and legal fees as well as additional information technology ("IT") costs associated with the set-up of the Transition Services Agreement ("TSA"). The Company recognized deferred income of $9.0 million related to the TSA Credit taken to cover the initial TSA set-up, which included IT migration costs, during the three and twelve months ended December 31, 2022. |

| |

| (4) | The Company's derivative contracts are marked-to-market each period. The non-cash unrealized changes in fair value recognized in Other expense (income), net, net within the Consolidated Statements of Operations are treated as Non-GAAP adjustments. As the contracts are settled, realized gains and losses are recognized, and only the mark-to-market impacts are treated as Non-GAAP adjustments. |

| |

| (5) | The Company incurred fees related to shareholder activism which include directly applicable third-party advisory and professional service fees. |

| |

| (6) | Tax indemnification represents the non-cash write off of indemnification assets that were recorded in connection with acquisitions from prior years. These write-offs arose as a result of the related uncertain tax position being released due to the statute of limitation lapse or settlement with taxing authorities. |

| |

| (7) | The Company has foreign currency denominated intercompany loans and incurred foreign currency gains/losses to re-measure the loans at quarter end. These amounts are non-cash and the loans are eliminated in consolidation. |

| |

| | | | | |

| (8) | As a result of the sale of a significant portion of the Meal Preparation business in the fourth quarter of 2022, the Company identified two items affecting comparability – 1) central service costs and 2) conveyed employee costs.

1) The Company has historically provided central services to the Meal Preparation business including, but not limited to, IT and financial shared services, procurement and order processing, customer service, warehousing, logistics, and customs. These costs were historically incurred by TreeHouse and include employee and non-employee expenses to support the services. For the twelve months ended December 31, 2022, central service costs were approximately $40.2 million.

2) Conveyed employee costs represent compensation costs for employees that were not historically dedicated to the sold business and transferred to the buyer after the sale. For the twelve months ended December 31, 2022, conveyed employee costs were approximately $24.8 million. |

| |

| (9) | For the three and twelve months ended December 31, 2022, the Company incurred a loss on extinguishment of debt totaling $4.5 million representing the write-off of deferred financing costs in connection with the debt prepayment and revolving credit commitment reduction in October 2022. |

| |

| (10) | During the twelve months ended December 31, 2022, the Company recognized $0.4 million incremental expense for the settlement payment of the $9.0 million accrual related to a litigation matter challenging wage and hour practices at three former manufacturing facilities in California. |

The following table reconciles the Company's net sales to adjusted net sales for the three and twelve months ended December 31, 2023 and 2022:

TREEHOUSE FOODS, INC.

RECONCILIATION OF NET SALES TO ADJUSTED NET SALES

(Unaudited, in millions)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, | | Twelve Months Ended December 31, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| | | | | | | | |

| Net sales | | $ | 910.8 | | | $ | 956.7 | | | $ | 3,431.6 | | | $ | 3,297.1 | |

Product recall and related costs(2) | | (1.7) | | | — | | | 1.3 | | | — | |

| Adjusted net sales | | $ | 909.1 | | | $ | 956.7 | | | $ | 3,432.9 | | | $ | 3,297.1 | |

The following tables reconcile the Company’s adjusted gross profit, adjusted operating expenses, adjusted operating income (loss), adjusted total other expense (income), adjusted income tax expense (benefit), and adjusted net income to their most directly comparable GAAP measure, for three and twelve months ended December 31, 2023 and 2022.

TREEHOUSE FOODS, INC.

RECONCILIATION OF ADJUSTED GROSS PROFIT, ADJUSTED OPERATING EXPENSES, ADJUSTED OPERATING INCOME (LOSS), ADJUSTED TOTAL OTHER EXPENSE (INCOME), ADJUSTED INCOME TAX EXPENSE (BENEFIT), AND ADJUSTED NET INCOME (LOSS) FROM CONTINUING OPERATIONS

(Unaudited, in millions, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2023 |

| | Gross profit | | Total operating expenses | | Operating income | | Total other expense | | Income tax expense | | Net income from continuing operations |

| As reported (GAAP) | | $ | 151.8 | | | $ | 109.7 | | | $ | 42.1 | | | $ | 31.3 | | | $ | 4.4 | | | $ | 6.4 | |

| Adjustments: | | | | | | | | | | | | |

Growth, reinvestment, and restructuring programs, including accelerated depreciation(1) | | — | | | (12.2) | | | 12.2 | | | — | | | — | | | 12.2 | |

Product recall and related costs(2) | | 18.0 | | | — | | | 18.0 | | | — | | | — | | | 18.0 | |

Divestiture, acquisition, integration, and related costs(3) | | (0.2) | | | (3.4) | | | 3.2 | | | — | | | — | | | 3.2 | |

Mark-to-market adjustments(4) | | — | | | — | | | — | | | (16.6) | | | — | | | 16.6 | |

| | | | | | | | | | | | |

Tax indemnification(6) | | — | | | — | | | — | | | 0.1 | | | — | | | (0.1) | |

Foreign currency gain on remeasurement of intercompany notes(7) | | — | | | — | | | — | | | 1.5 | | | — | | | (1.5) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Taxes on adjusting items | | — | | | — | | | — | | | — | | | 12.0 | | | (12.0) | |

| As adjusted (Non-GAAP) | | $ | 169.6 | | | $ | 94.1 | | | $ | 75.5 | | | $ | 16.3 | | | $ | 16.4 | | | $ | 42.8 | |

| | | | | | | | | | | | |

| As reported (% of net sales) | | 16.7 | % | | 12.0 | % | | 4.6 | % | | 3.4 | % | | 0.5 | % | | 0.7 | % |

| As adjusted (% of net sales) | | 18.6 | % | | 10.3 | % | | 8.3 | % | | 1.8 | % | | 1.8 | % | | 4.7 | % |

| | | | | | | | | | | | |

| Earnings per share from continuing operations: | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | $ | 0.12 | |

| Adjusted diluted | | | | | | | | | | | | $ | 0.77 | |

| | | | | | | | | | | | |

| Weighted average common shares: | | | | | | | | | | | | |

| Diluted for net income from continuing operations | | | | | | | | | | | | 55.3 |

| Diluted for adjusted net income from continuing operations | | | | | | | | | | | | 55.3 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended December 31, 2022 |

| | Gross profit | | Total operating expenses | | Operating income | | Total other expense | | Income tax expense | | Net income from continuing operations |

| As reported (GAAP) | | $ | 175.0 | | | $ | 105.5 | | | $ | 69.5 | | | $ | 16.9 | | | $ | 12.9 | | | $ | 39.7 | |

| Adjustments: | | | | | | | | | | | | |

Growth, reinvestment, and restructuring programs, including accelerated depreciation(1) | | 0.5 | | | (18.2) | | | 18.7 | | | — | | | — | | | 18.7 | |

| | | | | | | | | | | | |

Divestiture, acquisition, integration, and related costs(3) | | — | | | 4.6 | | | (4.6) | | | — | | | — | | | (4.6) | |

Mark-to-market adjustments(4) | | — | | | — | | | — | | | (4.3) | | | — | | | 4.3 | |

Shareholder activism(5) | | — | | | (0.6) | | | 0.6 | | | — | | | — | | | 0.6 | |

| | | | | | | | | | | | |

Foreign currency gain on remeasurement of intercompany notes(7) | | — | | | — | | | — | | | 0.6 | | | — | | | (0.6) | |

| | | | | | | | | | | | |

Loss on extinguishment of debt(9) | | — | | | — | | | — | | | (4.5) | | | — | | | 4.5 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Taxes on adjusting items | | — | | | — | | | — | | | — | | | 7.5 | | | (7.5) | |

| As adjusted (Non-GAAP) | | $ | 175.5 | | | $ | 91.3 | | | $ | 84.2 | | | $ | 8.7 | | | $ | 20.4 | | | $ | 55.1 | |

| | | | | | | | | | | | |

| As reported (% of net sales) | | 18.3 | % | | 11.0 | % | | 7.3 | % | | 1.8 | % | | 1.3 | % | | 4.1 | % |

| As adjusted (% of net sales) | | 18.3 | % | | 9.5 | % | | 8.8 | % | | 0.9 | % | | 2.1 | % | | 5.8 | % |

| | | | | | | | | | | | |

| Earnings per share from continuing operations: | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | $ | 0.70 | |

| Adjusted diluted | | | | | | | | | | | | $ | 0.97 | |

| | | | | | | | | | | | |

| Weighted average common shares: | | | | | | | | | | | | |

| Diluted for net income from continuing operations | | | | | | | | | | | | 56.7 | |

| Diluted for adjusted net income from continuing operations | | | | | | | | | | | | 56.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, 2023 |

| | Gross profit | | Total operating expenses | | Operating income | | Total other expense | | Income tax expense | | Net income from continuing operations |

| As reported (GAAP) | | $ | 576.1 | | | $ | 429.2 | | | $ | 146.9 | | | $ | 63.5 | | | $ | 24.4 | | | $ | 59.0 | |

| Adjustments: | | | | | | | | | | | | |

Growth, reinvestment, and restructuring programs, including accelerated depreciation(1) | | — | | | (46.1) | | | 46.1 | | | — | | | — | | | 46.1 | |

Product recall and related costs(2) | | 29.2 | | | — | | | 29.2 | | | — | | | — | | | 29.2 | |

Divestiture, acquisition, integration, and related costs(3) | | 0.8 | | | (15.9) | | | 16.7 | | | — | | | — | | | 16.7 | |

Mark-to-market adjustments(4) | | — | | | — | | | — | | | (15.1) | | | — | | | 15.1 | |

Shareholder activism(5) | | — | | | (0.3) | | | 0.3 | | | — | | | — | | | 0.3 | |

Tax indemnification(6) | | — | | | — | | | — | | | (0.2) | | | — | | | 0.2 | |

Foreign currency gain on remeasurement of intercompany notes(7) | | — | | | — | | | — | | | 1.7 | | | — | | | (1.7) | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Taxes on adjusting items | | — | | | — | | | — | | | — | | | 25.7 | | | (25.7) | |

| As adjusted (Non-GAAP) | | $ | 606.1 | | | $ | 366.9 | | | $ | 239.2 | | | $ | 49.9 | | | $ | 50.1 | | | $ | 139.2 | |

| | | | | | | | | | | | |

| As reported (% of net sales) | | 16.8 | % | | 12.5 | % | | 4.3 | % | | 1.9 | % | | 0.7 | % | | 1.7 | % |

| As adjusted (% of net sales) | | 17.7 | % | | 10.7 | % | | 7.0 | % | | 1.5 | % | | 1.5 | % | | 4.1 | % |

| | | | | | | | | | | | |

| Earnings per share from continuing operations: | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | $ | 1.05 | |

| Adjusted diluted | | | | | | | | | | | | $ | 2.47 | |

| | | | | | | | | | | | |

| Weighted average common shares: | | | | | | | | | | | | |

| Diluted for net income from continuing operations | | | | | | | | | | | | 56.4 |

| Diluted for adjusted net income from continuing operations | | | | | | | | | | | | 56.4 |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Twelve Months Ended December 31, 2022 |

| | Gross profit | | Total operating expenses | | Operating (loss) income | | Total other (income) expense | | Income tax expense | | Net (loss) income from continuing operations |

| As reported (GAAP) | | $ | 522.4 | | | $ | 535.0 | | | $ | (12.6) | | | $ | (13.7) | | | $ | 10.3 | | | $ | (9.2) | |

| Adjustments: | | | | | | | | | | | | |

Growth, reinvestment, and restructuring programs, including accelerated depreciation(1) | | 0.5 | | | (84.6) | | | 85.1 | | | — | | | — | | | 85.1 | |

| | | | | | | | | | | | |

Divestiture, acquisition, integration, and related costs(3) | | 1.6 | | | (12.2) | | | 13.8 | | | — | | | — | | | 13.8 | |

Mark-to-market adjustments(4) | | — | | | — | | | — | | | 75.1 | | | — | | | (75.1) | |

Shareholder activism(5) | | — | | | (2.7) | | | 2.7 | | | — | | | — | | | 2.7 | |

| | | | | | | | | | | | |

Foreign currency loss on remeasurement of intercompany notes(7) | | — | | | — | | | — | | | (0.8) | | | — | | | 0.8 | |

Central services and conveyed employee costs(8) | | 14.9 | | | (50.1) | | | 65.0 | | | — | | | — | | | 65.0 | |

Loss on extinguishment of debt(9) | | — | | | — | | | — | | | (4.5) | | | — | | | 4.5 | |

Litigation matter(10) | | — | | | (0.4) | | | 0.4 | | | — | | | — | | | 0.4 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Taxes on adjusting items | | — | | | — | | | — | | | — | | | 15.4 | | | (15.4) | |

| As adjusted (Non-GAAP) | | $ | 539.4 | | | $ | 385.0 | | | $ | 154.4 | | | $ | 56.1 | | | $ | 25.7 | | | $ | 72.6 | |

| | | | | | | | | | | | |

| As reported (% of net sales) | | 15.8 | % | | 16.2 | % | | (0.4) | % | | (0.4) | % | | 0.3 | % | | (0.3) | % |

| As adjusted (% of net sales) | | 16.4 | % | | 11.7 | % | | 4.7 | % | | 1.7 | % | | 0.8 | % | | 2.2 | % |

| | | | | | | | | | | | |

| (Loss) earnings per share from continuing operations: | | | | | | | | | | | | |

| Diluted | | | | | | | | | | | | $ | (0.16) | |

| Adjusted diluted | | | | | | | | | | | | $ | 1.28 | |

| | | | | | | | | | | | |

| Weighted average common shares: | | | | | | | | | | | | |

Diluted for net loss from continuing operations | | | | | | | | | | | | 56.0 |

| Diluted for adjusted net income from continuing operations | | | | | | | | | | | | 56.5 |

TREEHOUSE FOODS, INC.

RECONCILIATION OF NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES FROM CONTINUING OPERATIONS TO FREE CASH FLOW FROM CONTINUING OPERATIONS

(Unaudited, in millions) | | | | | | | | | | | | | | |

| | | Twelve Months Ended

December 31, |

| | | 2023 | | 2022 |

| Cash flow provided by (used in) operating activities from continuing operations | | $ | 157.3 | | | $ | (67.7) | |

| Less: Capital expenditures | | (140.8) | | | (93.5) | |

| Free cash flow from continuing operations | | $ | 16.5 | | | $ | (161.2) | |

v3.24.0.1

Cover Page

|

Feb. 16, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Feb. 16, 2024

|

| Entity Registrant Name |

TREEHOUSE FOODS, INC.

|

| Entity File Number |

001-32504

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

20-2311383

|

| Entity Address, Address Line Two |

Suite 600

|

| Entity Address, Address Line One |

2021 Spring Road,

|

| Entity Address, State or Province |

IL

|

| Entity Address, City or Town |

Oak Brook

|

| Entity Address, Postal Zip Code |

60523

|

| City Area Code |

708

|

| Local Phone Number |

483-1300

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, $0.01 par value

|

| Trading Symbol |

THS

|

| Security Exchange Name |

NYSE

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001320695

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

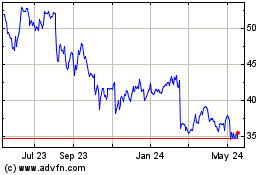

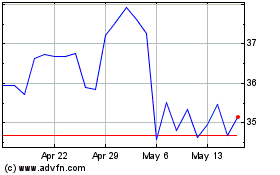

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Nov 2024 to Dec 2024

Treehouse Foods (NYSE:THS)

Historical Stock Chart

From Dec 2023 to Dec 2024