Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

07 March 2024 - 10:03PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: March 7, 2024

Commission File Number: 001-39570

TIM S.A.

(Exact name of Registrant as specified in its Charter)

João

Cabral de Melo Neto Avenue, 850 – North Tower – 12th floor

22775-057 Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form

20-F ☒ Form

40-F ☐

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1).

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7).

Yes ☐ No ☒

|

TIM S.A.

Publicly-Held Company

Corporate Taxpayer's ID (CNPJ/MF): 02.421.421/0001-11

Corporate Registry (NIRE): 33.300.324.631 |

MATERIAL FACT

STRATEGIC PLAN 2024-2026:

GUIDANCE UPDATE

TIM S.A. (“Company” or “TIM)

(B3: TIMS3; NYSE: TIMB), in compliance with Article 157 of Law No 6,404 and the provisions of CVM Resolution N. 44, and, in addition to

the Relevant Fact disclosed on February 6, 2024, inform its shareholders, the market in general and other interested parties about the

updated projections disclosed on that date, complementing the projections with estimates regarding Shareholder Remuneration.

Reiterating the material fact disclosed by

the Company on February 6, 2024, for this new three-year period, TIM intends to continue developing and executing this strategy with adjustments

to Brazil's macro-economic and business environment. For its main line of business, mobile, it projects a continuous and sustainable improvement

in the market, driven by: (i) a new, more rational, market dynamic with customers focused on value and quality, (ii) essentiality of the

service mobile, (iii) opportunity to increase usage with increased demand for data, and (iv) price accessibility.

This scenario projects sustainable growth in Service Revenue above

inflation and an expansion of EBITDA with positive evolution in the margin. This dynamic combined with maintaining the level of investments

that benefit from the efficiency of new technologies, should promote an improvement in the EBITDA-AL minus CAPEX indicator, which is a

relevant driver for TIM's Operating Cash Flow. All of this will enable the Company to continue evolving its shareholder remuneration strategy

and reinvesting in growth avenues such as B2B and Broadband.

Therefore, the Company projects around R$12

billion in shareholder remuneration for the 2024-26 period, following the continuous evolution proposal previously announced.

This completes the table with all the Company's

projections for the next three years:

| Projections 2024 - 2026 |

|

| Objectives |

Short-term

2024 |

Mid-term

(Until 2026) |

|

| |

| Revenue |

Service Revenue Growth (Y/Y):

5% - 7% |

Service Revenue Growth (CAGR 23-26):

5% - 6% |

|

| EBITDA |

EBITDA Growth (A/A):

7% - 9% |

EBITDA Growth (CAGR 23-26):

6% - 8% |

|

| Investments (Capex) |

Nominal Capex:

R$ 4.4 Bln – 4.6 Bi |

Nominal Capex:

R$ 4.4 Bi – 4.6 Bln (per year) |

|

| Operating Cash Flow (EBITDA-AL1 minus Capex) |

EBITDA-AL growth minus Capex (Y/Y):

Double-Digit2 |

EBITDA-AL growth minus Capex (CAGR 23-26):

Double-Digit2 |

|

| Shareholder Remuneration |

∑ 24-263: R$ 11.8 – 12.2 Bi |

|

Notes:

| • | The numbers considered for

the projections consider normalizations for non-recurring effects. |

| • | Investments exclude possible

3rd license renewals or new frequency auctions. |

| • | Shareholder remuneration includes

Interest on Equity (IOE), dividends, share buybacks or other applicable instruments. This projection is subject to business performance

and the deliberation of the Board of Directors. |

| • | All projections assume no

major change to the actual regulatory and tax framework. |

Finally, TIM informs that the other indicators

and projections previously released by the Company were not changed for the 2024-2026 Strategic Plan and its guidance.

Rio de Janeiro, March 07th, 2024.

| TIM S.A. |

|

Alberto Mario Griselli

Chief Executive Officer and

Investor Relations Officer

|

1

EBITDA-AL: Earnings Before Interests, Taxes, Depreciation and Amortization After Leases. The indicator reflects

EBITDA discounted from lease payments

2

Reference scales: Double-digit = ≥10% and <100%

3

∑ 24-26 = sum of absolute values for the years 2024, 2025 and 2026

SIGNATURES

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

|

TIM S.A. |

| Date:

March 7, 2024 |

|

By: |

/s/ Alberto

Mario Griselli |

| |

|

|

Alberto

Mario Griselli |

| |

|

|

Chief

Executive Officer, Chief Financial Officer and Investor Relations Officer |

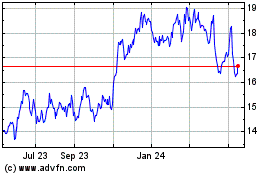

TIM (NYSE:TIMB)

Historical Stock Chart

From Dec 2024 to Jan 2025

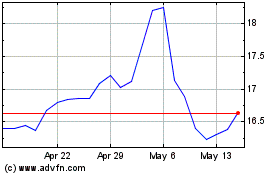

TIM (NYSE:TIMB)

Historical Stock Chart

From Jan 2024 to Jan 2025