Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

23 November 2024 - 8:15AM

Edgar (US Regulatory)

FORM 6 - K

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d - 16 of

the Securities Exchange Act of 1934

As of November 22, 2024

TENARIS, S.A.

(Translation of Registrant's name into English)

26, Boulevard Royal, 4th floor

L-2449 Luxembourg

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or 40-F.

Form 20-F ✓ Form 40-F

The attached material is being furnished to the Securities and Exchange

Commission pursuant to Rule 13a-16 and Form 6-K under the Securities Exchange Act of 1934, as amended. This report contains Tenaris’s

Press Release announcing Repurchased own ordinary shares reached 5% of Tenaris’s voting rights.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly

caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: November 22, 2024

Tenaris, S.A.

By: /s/ Giovanni Sardagna

Giovanni Sardagna

Investor Relations Officer

Giovanni Sardagna

Tenaris

1-888-300-5432

www.tenaris.com

Repurchased own ordinary

shares reached 5% of Tenaris’s voting rights

Luxembourg, November 22, 2024. - Pursuant to applicable Luxembourg

Transparency Law requirements, Tenaris S.A. (NYSE and Mexico: TS and EXM Italy: TEN) announces that on November 20, 2024, the proportion

of own ordinary shares acquired under the share buyback programs and currently held in treasury has reached a threshold of 5.01% of Tenaris’s

voting rights. Ordinary shares repurchased under the programs are being held in treasury (their voting rights are suspended) and

will be cancelled in due course. Reporting of share buyback transactions in accordance with Market Abuse Regulation is available at: https://ir.tenaris.com/share-buyback-program.

Some of the statements contained in this press release are “forward-looking

statements”. Forward-looking statements are based on management’s current views and assumptions and involve known and unknown

risks that could cause actual results, performance or events to differ materially from those expressed or implied by those statements.

These risks include but are not limited to risks arising from uncertainties as to future oil and gas prices and their impact on investment

programs by oil and gas companies.

Tenaris is a leading global supplier of steel tubes and related services

for the world’s energy industry and certain other industrial applications.

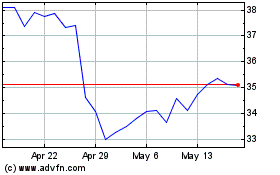

Tenaris (NYSE:TS)

Historical Stock Chart

From Feb 2025 to Mar 2025

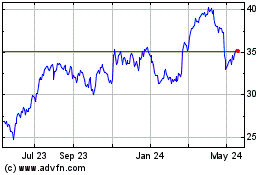

Tenaris (NYSE:TS)

Historical Stock Chart

From Mar 2024 to Mar 2025