Urban Edge Properties (NYSE: UE) (the "Company") today announced

its results for the quarter ended June 30, 2024 and raised the low

end of its FFO as Adjusted guidance for the full-year.

"Our second quarter results reflect continued momentum from

strong operating fundamentals and the benefits of our recent

capital recycling activity," said Jeff Olson, Chairman and CEO. "We

are especially pleased with our leasing progress, as shop occupancy

grew to 89.8% in the quarter, up 520 bps compared to the second

quarter of 2023. In addition, we continue to pursue exciting

external growth opportunities, with a focus on acquiring attractive

shopping centers that further expand our presence in our core

markets between Washington, D.C. and Boston. We remain focused on

executing our strategic plan to grow earnings and cash flow while

continuing to simplify our business."

Financial Results(1)(2)

(in thousands, except per share

amounts)

2Q24

2Q23

YTD 2024

YTD 2023

Net income (loss) attributable to common

shareholders

$

30,759

$

10,262

$

33,362

$

(8,856

)

Net income (loss) per diluted share

0.26

0.09

0.28

(0.08

)

Funds from Operations ("FFO")

58,397

35,918

97,447

74,520

FFO per diluted share

0.47

0.29

0.79

0.61

FFO as Adjusted

40,156

37,180

80,974

76,153

FFO as Adjusted per diluted share

0.32

0.30

0.66

0.62

Net income for the three months ended June 30, 2024 included a

$21.7 million, or $0.18 per diluted share, gain on extinguishment

of debt related to the foreclosure settlement of Kingswood Center

and a $13.4 million, or $0.11 per diluted share, gain on sale of

real estate, primarily related to the disposition of our industrial

property in Lodi, NJ. FFO as Adjusted for the three months ended

June 30, 2024 increased by 7% as compared to the prior year period

and benefited from rent commencements on new leases and growth from

acquisitions.

Same-Property Operating Results Compared to the Prior Year

Period(3)

2Q24

YTD 2024

Same-property Net Operating Income ("NOI")

growth

3.6

%

2.9

%

Same-property NOI growth, including

properties in redevelopment

4.0

%

3.9

%

Increases in same-property NOI metrics for the three and six

months ended June 30, 2024 were primarily driven by rent

commencements on new leases from our signed but not open

pipeline.

Operating Results(1)

- Achieved same-property portfolio leased occupancy of 96.5%, an

increase of 150 basis points compared to June 30, 2023, and 30

basis points compared to March 31, 2024.

- Reported consolidated portfolio leased occupancy, excluding

Sunrise Mall, of 96.4%, an increase of 160 basis points compared to

June 30, 2023, and 30 basis points compared to March 31, 2024.

- Increased retail shop leased occupancy to 89.8%, up 520 basis

points compared to June 30, 2023, and 140 basis points compared to

March 31, 2024.

- Executed 47 new leases, renewals and options totaling 506,000

sf during the quarter. New leases totaled 166,000 sf, of which

38,000 sf was on a same-space basis and generated an average cash

spread of 18.7%. New leases, renewals and options totaled 378,000

sf on a same-space basis and generated an average cash spread of

12.3%.

- Published the Company's 2023 Corporate Responsibility Report on

June 26, 2024.

Acquisition and Disposition Activity

On April 5, 2024, the Company closed on the $83 million

acquisition of Ledgewood Commons, a 448,000 sf grocery anchored

shopping center located in Roxbury Township, NJ. The initial

capitalization rate on the transaction was 7.9% with an expected

first-year cash yield in excess of 10%.

On April 26, 2024, the Company closed on the sale of its 127,000

sf industrial property located in Lodi, NJ for a price of $29.2

million, representing a 5.4% capitalization rate. This transaction

was structured as part of a Section 1031 exchange, allowing for the

deferral of capital gains resulting from the sale for income tax

purposes. As a result of this transaction, the Company recognized a

$13.1 million gain on sale of real estate.

The Company is in advanced negotiations to acquire several

shopping centers in our core markets between Washington, D.C. and

Boston.

Financing Activity

On April 3, 2024, the Company borrowed $60 million on its

unsecured $800 million line of credit to partially finance the

acquisition of Ledgewood Commons discussed above. During the

quarter, the Company repaid $63 million of the outstanding balance

on its line of credit using proceeds from the sale of its property

in Lodi, NJ and proceeds from a $50 million, 5-year mortgage on

Ledgewood Commons bearing interest at a fixed rate of 6.03%,

reducing the balance outstanding as of June 30, 2024 to $150

million. Subsequent to the quarter, the Company repaid an

additional $45 million on the outstanding balance primarily from

proceeds generated from equity issuances under its ATM program.

On June 27, 2024, the property foreclosure process was completed

for Kingswood Center, located in Brooklyn, NY. In connection with

the foreclosure settlement, the lender took possession of the

property and the Company recognized a $21.7 million gain on debt

extinguishment, eliminating a $68.6 million mortgage liability that

was due to mature in February 2028.

During the quarter ended June 30, 2024, the Company issued

1,607,353 common shares at a weighted average price of $18.21 per

share under its ATM Program, generating net cash proceeds of $28.9

million. Subsequent to the quarter, the Company issued an

additional 891,643 common shares at a weighted average price of

$18.23 per share, generating net cash proceeds of $16.0

million.

The Company has limited debt maturities coming due through

December 31, 2026 of $188.3 million in the aggregate, which

represents approximately 11% of outstanding debt.

Leasing, Development and Redevelopment

During the quarter, the Company executed 166,000 sf of new

leases, including leases with BJ's Wholesale Club, Chipotle, Bank

of America, and First Watch.

In June, the Company executed a new 112,000 sf lease with BJ's

Wholesale Club at Bruckner Commons to take over a portion of the

former Kmart space and entered into a lease termination agreement

with Target at the same property. The Target termination agreement

releases Target from its obligations under the previously-executed

10-year, 139,000 sf lease, providing the Company the opportunity to

enter into the new 20-year lease with BJ's at a comparable project

yield.

The Company commenced two redevelopment projects with estimated

aggregate costs of $5.1 million during the quarter and now has

$170.1 million of active redevelopment projects underway, with

estimated remaining costs to complete of $109.2 million. The active

redevelopment projects are expected to generate an approximate 15%

yield. The Company also stabilized one project aggregating $13.3

million with the rent commencement of Prime Urgent Care in June

2024, completing the second phase of its Huntington Commons center

redevelopment.

As of June 30, 2024, the Company had signed leases that have not

yet rent commenced that are expected to generate an additional

$28.6 million of future annual gross rent, representing

approximately 11% of current annualized NOI. Approximately $2.8

million of this amount is expected to be recognized in the

remainder of 2024.

Balance Sheet and Liquidity(1)(4)

Balance sheet highlights as of June 30, 2024 include:

- Total liquidity of approximately $721 million, consisting of

$101 million of cash on hand and $620 million available under the

Company's $800 million revolving credit agreement, including

undrawn letters of credit.

- Mortgages payable of $1.5 billion, with a weighted average term

to maturity of 4.8 years, all of which is fixed rate or

hedged.

- $150 million drawn on our $800 million revolving credit

agreement that matures on February 9, 2027, with two six-month

extension options. Subsequent to the quarter, the Company repaid

$45 million of the credit facility, reducing the outstanding

balance to $105 million.

- Total market capitalization of approximately $4.0 billion,

comprised of 127.2 million fully-diluted common shares valued at

$2.3 billion and $1.7 billion of debt.

- Net debt to total market capitalization of 39%.

2024 Outlook

The Company has updated its 2024 full-year guidance ranges for

net income and FFO based on recent results and transactions and the

expected ongoing strength in business fundamentals, and is

increasing the low end of the guidance range for FFO as Adjusted,

estimating net income of $0.28 to $0.31 per diluted share, FFO of

$1.42 to $1.45 per diluted share, and FFO as Adjusted of $1.29 to

$1.32 per diluted share. A reconciliation of the range of estimated

earnings, FFO and FFO as Adjusted, as well as the assumptions used

in our guidance can be found on page 4 of this release.

Earnings Conference Call Information

The Company will host an earnings conference call and audio

webcast on July 31, 2024 at 8:30am ET. All interested parties can

access the earnings call by dialing 1-877-407-9716 (Toll Free) or

1-201-493-6779 (Toll/International) using conference ID 13747085.

The call will also be webcast and available in listen-only mode on

the investors page of our website: www.uedge.com. A replay will be

available at the webcast link on the investors page for one year

following the conclusion of the call. A telephonic replay of the

call will also be available starting July 31, 2024 at 11:30am ET

through August 14, 2024 at 11:59pm ET by dialing 1-844-512-2921

(Toll Free) or 1-412-317-6671 (Toll/International) using conference

ID 13747085.

(1)

Refer to "Non-GAAP Financial Measures" and "Operating Metrics" for

definitions and additional detail.

(2)

Refer to page 11 for a reconciliation of net income to FFO and FFO

as Adjusted for the quarter ended June 30, 2024.

(3)

Refer to page 12 for a reconciliation of net income to NOI and

Same-Property NOI for the quarter ended June 30, 2024.

(4)

Net debt as of June 30, 2024 is calculated as total consolidated

debt of $1.7 billion less total cash and cash equivalents,

including restricted cash, of $101 million.

2024 Earnings Guidance

The Company has updated its 2024 full-year guidance ranges for

net income and FFO based on recent results and transactions and the

expected ongoing strength in business fundamentals, and is

increasing the low end of the guidance range for FFO as Adjusted,

estimating net income of $0.28 to $0.31 per diluted share, FFO of

$1.42 to $1.45 per diluted share, and FFO as Adjusted of $1.29 to

$1.32 per diluted share. Below is a summary of the Company's 2024

outlook, assumptions used in our forecasting, and a reconciliation

of the range of estimated earnings, FFO, and FFO as Adjusted per

diluted share.

Previous Guidance

Revised Guidance

Net income per diluted share

$0.12 - $0.17

$0.28 - $0.31

Net income attributable to common

shareholders per diluted share

$0.11 - $0.16

$0.27 - $0.30

FFO per diluted share

$1.22 - $1.27

$1.42 - $1.45

FFO as Adjusted per diluted share

$1.27 - $1.32

$1.29 - $1.32

The Company's 2024 full year FFO outlook is based on the

following assumptions:

- Same-property NOI growth, including properties in

redevelopment, of 4.5% to 6.0%, reflecting an increase from our

previous assumption of 4.0% to 6.0%.

- Acquisitions of $117 million and dispositions of $37 million,

both reflecting activity completed year-to-date.

- Recurring G&A expenses ranging from $35.5 million to $37.0

million, a decrease from our previous assumption of $35.5 million

to $37.5 million.

- Interest and debt expense ranging from $83.0 million to $86.0

million, a decrease from our previous assumption of $86.0 million

to $88.5 million, reflecting the recent foreclosure of Kingswood

Center.

- Excludes items that impact FFO comparability, including gains

and/or losses on extinguishment of debt, transaction, severance,

litigation, or any one-time items outside of the ordinary course of

business.

Guidance 2024E

Per Diluted Share(1)

(in thousands, except per share

amounts)

Low

High

Low

High

Net income

$

35,200

$

39,000

$

0.28

$

0.31

Less net (income) loss attributable to

noncontrolling interests in:

Operating partnership

(2,100

)

(2,100

)

(0.02

)

(0.02

)

Consolidated subsidiaries

1,100

1,100

0.01

0.01

Net income attributable to common

shareholders

34,200

38,000

0.27

0.30

Adjustments:

Rental property depreciation and

amortization

155,800

155,800

1.25

1.25

Gain on sale of real estate

(15,300

)

(15,300

)

(0.12

)

(0.12

)

Limited partnership interests in operating

partnership

2,100

2,100

0.02

0.02

FFO Applicable to diluted common

shareholders

176,800

180,600

1.42

1.45

Adjustments to FFO:

Impact of property in foreclosure

2,300

2,300

0.02

0.02

Non-cash adjustments

2,300

2,300

0.02

0.02

Transaction, severance, litigation and

other expenses

600

600

—

—

Gain on extinguishment of debt, net

(21,400

)

(21,400

)

(0.17

)

(0.17

)

FFO as Adjusted applicable to diluted

common shareholders

$

160,600

$

164,400

$

1.29

$

1.32

(1)

Amounts may not foot due to rounding.

The following table is a reconciliation bridging our 2023 FFO

per diluted share to the Company's estimated 2024 FFO per diluted

share:

Per Diluted Share(1)

Low

High

2023 FFO applicable to diluted common

shareholders

$

1.51

$

1.51

2023 Items impacting FFO

comparability(2)

(0.26

)

(0.26

)

2024 Items impacting FFO

comparability(2)

0.15

0.15

2024 impact of property in foreclosure

(0.02

)

(0.02

)

Same-property NOI growth, including

redevelopment

0.08

0.10

Acquisitions net of dispositions NOI

growth

0.07

0.07

Interest and debt expense(3)

(0.10

)

(0.09

)

Recurring general and administrative

(0.01

)

(0.01

)

2024 FFO applicable to diluted common

shareholders

$

1.42

$

1.45

(1)

Amounts may not foot due to rounding.

(2)

Includes adjustments to FFO for fiscal year 2023 and expected

adjustments for fiscal year 2024 which impact comparability. See

"Reconciliation of net income to FFO and FFO as Adjusted" on page

11 for actual adjustments year-to-date and our fourth quarter 2023

Supplemental Disclosure Package for 2023 adjustments.

(3)

Excludes the impact of Kingswood Center which was foreclosed on in

June 2024.

The Company is providing a projection of anticipated net income

solely to satisfy the disclosure requirements of the Securities and

Exchange Commission ("SEC"). The Company's projections are based on

management’s current beliefs and assumptions about the Company's

business, and the industry and the markets in which it operates;

there are known and unknown risks and uncertainties associated with

these projections. There can be no assurance that our actual

results will not differ from the guidance set forth above. The

Company assumes no obligation to update publicly any

forward-looking statements, including its 2024 earnings guidance,

whether as a result of new information, future events or otherwise.

Please refer to the “Forward-Looking Statements” disclosures on

page 8 of this document and “Risk Factors” disclosed in the

Company's annual and quarterly reports filed with the SEC for more

information.

Non-GAAP Financial Measures

The Company uses certain non-GAAP performance measures, in

addition to the primary GAAP presentations, as we believe these

measures improve the understanding of the Company's operational

results. We continually evaluate the usefulness, relevance,

limitations, and calculation of our reported non-GAAP performance

measures to determine how best to provide relevant information to

the investing public, and thus such reported measures are subject

to change. The Company's non-GAAP performance measures have

limitations as they do not include all items of income and expense

that affect operations, and accordingly, should always be

considered as supplemental financial results. Additionally, the

Company's computation of non-GAAP metrics may not be comparable to

similarly titled non-GAAP metrics reported by other real estate

investment trusts ("REITs") or real estate companies that define

these metrics differently and, as a result, it is important to

understand the manner in which the Company defines and calculates

each of its non-GAAP metrics. The following non-GAAP measures are

commonly used by the Company and investing public to understand and

evaluate our operating results and performance:

- FFO: The Company believes FFO is a useful, supplemental measure

of its operating performance that is a recognized metric used

extensively by the real estate industry and, in particular REITs.

FFO, as defined by the National Association of Real Estate

Investment Trusts ("Nareit") and the Company, is net income

(computed in accordance with GAAP), excluding gains (or losses)

from sales of depreciable real estate and land when connected to

the main business of a REIT, impairments on depreciable real estate

or land related to a REIT's main business, earnings from

consolidated partially owned entities and rental property

depreciation and amortization expense. The Company believes that

financial analysts, investors and shareholders are better served by

the presentation of comparable period operating results generated

from FFO primarily because it excludes the assumption that the

value of real estate assets diminishes predictably. FFO does not

represent cash flows from operating activities in accordance with

GAAP, should not be considered an alternative to net income as an

indication of our performance, and is not indicative of cash flow

as a measure of liquidity or our ability to make cash

distributions.

- FFO as Adjusted: The Company provides disclosure of FFO as

Adjusted because it believes it is a useful supplemental measure of

its core operating performance that facilitates comparability of

historical financial periods. FFO as Adjusted is calculated by

making certain adjustments to FFO to account for items the Company

does not believe are representative of ongoing core operating

results, including non-comparable revenues and expenses. The

Company's method of calculating FFO as Adjusted may be different

from methods used by other REITs and, accordingly, may not be

comparable to such other REITs.

- NOI: The Company uses NOI internally to make investment and

capital allocation decisions and to compare the unlevered

performance of our properties to our peers. The Company believes

NOI is useful to investors as a performance measure because, when

compared across periods, NOI reflects the impact on operations from

trends in occupancy rates, rental rates, operating costs and

acquisition and disposition activity on an unleveraged basis,

providing perspective not immediately apparent from net income. The

Company calculates NOI using net income as defined by GAAP

reflecting only those income and expense items that are incurred at

the property level, adjusted for non-cash rental income and

expense, impairments on depreciable real estate or land, and income

or expenses that we do not believe are representative of ongoing

operating results, if any. In addition, the Company uses NOI

margin, calculated as NOI divided by total property revenue, which

the Company believes is useful to investors for similar

reasons.

- Same-property NOI: The Company provides disclosure of NOI on a

same-property basis, which includes the results of properties that

were owned and operated for the entirety of the reporting periods

being compared, which total 66 properties for the three and six

months ended June 30, 2024 and 2023. Information provided on a

same-property basis excludes properties under development,

redevelopment or that involve anchor repositioning where a

substantial portion of the gross leasable area ("GLA") is taken out

of service and also excludes properties acquired, sold, or that are

in the foreclosure process during the periods being compared. As

such, same-property NOI assists in eliminating disparities in net

income due to the development, redevelopment, acquisition,

disposition, or foreclosure of properties during the periods

presented, and thus provides a more consistent performance measure

for the comparison of the operating performance of the Company's

properties. While there is judgment surrounding changes in

designations, a property is removed from the same-property pool

when it is designated as a redevelopment property because it is

undergoing significant renovation or retenanting pursuant to a

formal plan that is expected to have a significant impact on its

operating income. A development or redevelopment property is moved

back to the same-property pool once a substantial portion of the

NOI growth expected from the development or redevelopment is

reflected in both the current and comparable prior year period,

generally one year after at least 80% of the expected NOI from the

project is realized on a cash basis. Acquisitions are moved into

the same-property pool once we have owned the property for the

entirety of the comparable periods and the property is not under

significant development or redevelopment. The Company has also

provided disclosure of NOI on a same-property basis adjusted to

include redevelopment properties. Same-property NOI may include

other adjustments as detailed in the Reconciliation of Net Income

to NOI and same-property NOI included in the tables accompanying

this press release. We also present this metric excluding the

collection of amounts previously deemed uncollectible.

- EBITDAre and Adjusted EBITDAre: EBITDAre and Adjusted EBITDAre

are supplemental, non-GAAP measures utilized by us in various

financial ratios. The White Paper on EBITDAre, approved by Nareit's

Board of Governors in September 2017, defines EBITDAre as net

income (computed in accordance with GAAP), adjusted for interest

expense, income tax (benefit) expense, depreciation and

amortization, losses and gains on the disposition of depreciated

property, impairment write-downs of depreciated property and

investments in unconsolidated joint ventures, and adjustments to

reflect the entity's share of EBITDAre of unconsolidated joint

ventures. EBITDAre and Adjusted EBITDAre are presented to assist

investors in the evaluation of REITs, as a measure of the Company's

operational performance as they exclude various items that do not

relate to or are not indicative of our operating performance and

because they approximate key performance measures in our debt

covenants. Accordingly, the Company believes that the use of

EBITDAre and Adjusted EBITDAre, as opposed to income before income

taxes, in various ratios provides meaningful performance measures

related to the Company's ability to meet various coverage tests for

the stated periods. Adjusted EBITDAre may include other adjustments

not indicative of operating results as detailed in the

Reconciliation of Net Income to EBITDAre and Adjusted EBITDAre

included in the tables accompanying this press release. The Company

also presents the ratio of net debt (net of cash) to annualized

Adjusted EBITDAre as of June 30, 2024, and net debt (net of cash)

to total market capitalization, which it believes is useful to

investors as a supplemental measure in evaluating the Company's

balance sheet leverage. The presentation of EBITDAre and Adjusted

EBITDAre is consistent with EBITDA and Adjusted EBITDA as presented

in prior periods.

The Company believes net income is the most directly comparable

GAAP financial measure to the non-GAAP performance measures

outlined above. Reconciliations of these measures to net income

have been provided in the tables accompanying this press

release.

Operating Metrics

The Company presents certain operating metrics related to our

properties, including occupancy, leasing activity and rental rates.

Operating metrics are used by the Company and are useful to

investors in facilitating an understanding of the operational

performance for our properties.

Occupancy metrics represent the percentage of occupied gross

leasable area based on executed leases (including properties in

development and redevelopment) and include leases signed, but for

which rent has not yet commenced. Same-property portfolio leased

occupancy includes properties that have been owned and operated for

the entirety of the reporting periods being compared, which total

66 properties for the three and six months ended June 30, 2024 and

2023. Occupancy metrics presented for the Company's same-property

portfolio exclude properties under development, redevelopment or

that involve anchor repositioning where a substantial portion of

the gross leasable area is taken out of service and also excludes

properties acquired within the past 12 months or properties sold,

and properties that are in the foreclosure process during the

periods being compared.

Executed new leases, renewals and exercised options are

presented on a same-space basis. Same-space leases represent those

leases signed on spaces for which there was a previous lease.

The Company occasionally provides disclosures by tenant

categories which include anchors, shops and

industrial/self-storage. Anchors and shops are further broken down

by local, regional and national tenants. We define anchor tenants

as those who have a leased area of >10,000 sf. Local tenants are

defined as those with less than five locations. Regional tenants

are those with five or more locations in a single region. National

tenants are defined as those with five or more locations and

operate in two or more regions.

ADDITIONAL INFORMATION

For a copy of the Company’s supplemental disclosure package,

please access the "Investors" section of our website at

www.uedge.com. Our website also includes other financial

information, including our Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q, Current Reports on Form 8-K, and any

amendments to those reports.

The Company uses, and intends to continue to use, the

“Investors” page of its website, which can be found at

www.uedge.com, as a means of disclosing material nonpublic

information and of complying with its disclosure obligations under

Regulation FD, including, without limitation, through the posting

of investor presentations that may include material nonpublic

information. Accordingly, investors should monitor the “Investors”

page, in addition to following the Company's press releases, SEC

filings, public conference calls, presentations and webcasts. The

information contained on, or that may be accessed through, our

website is not incorporated by reference into, and is not a part

of, this document.

ABOUT URBAN EDGE

Urban Edge Properties is a NYSE listed real estate investment

trust focused on owning, managing, acquiring, developing, and

redeveloping retail real estate in urban communities, primarily in

the Washington, D.C. to Boston corridor. Urban Edge owns 75

properties totaling 17.2 million square feet of gross leasable

area.

FORWARD-LOOKING STATEMENTS

Certain statements contained herein constitute forward-looking

statements as such term is defined in Section 27A of the Securities

Act of 1933, as amended, and Section 21E of the Securities Exchange

Act of 1934, as amended. Forward-looking statements are not

guarantees of future performance. They represent our intentions,

plans, expectations and beliefs and are subject to numerous

assumptions, risks and uncertainties. Our future results, financial

condition, business and targeted occupancy may differ materially

from those expressed in these forward-looking statements. You can

identify many of these statements by words such as “approximates,”

“believes,” “expects,” “anticipates,” “estimates,” “intends,”

“plans,” “would,” “may” or other similar expressions in this Press

Release. Many of the factors that will determine the outcome of

forward-looking statements are beyond our ability to control or

predict and include, among others: (i) macroeconomic conditions,

including geopolitical conditions and instability, which may lead

to rising inflation and disruption of, or lack of access to, the

capital markets, as well as potential volatility in the Company’s

share price; (ii) the economic, political and social impact of, and

uncertainty relating to, epidemics and pandemics; (iii) the loss or

bankruptcy of major tenants; (iv) the ability and willingness of

the Company’s tenants to renew their leases with the Company upon

expiration and the Company’s ability to re-lease its properties on

the same or better terms, or at all, in the event of non-renewal or

in the event the Company exercises its right to replace an existing

tenant; (v) the impact of e-commerce on our tenants’ business; (vi)

the Company’s success in implementing its business strategy and its

ability to identify, underwrite, finance, consummate and integrate

diversifying acquisitions and investments; (vii) changes in general

economic conditions or economic conditions in the markets in which

the Company competes, and their effect on the Company’s revenues,

earnings and funding sources, and on those of its tenants; (viii)

increases in the Company’s borrowing costs as a result of changes

in interest rates, rising inflation, and other factors; (ix) the

Company’s ability to pay down, refinance, hedge, restructure or

extend its indebtedness as it becomes due and potential limitations

on the Company’s ability to borrow funds under its existing credit

facility as a result of covenants relating to the Company’s

financial results; (x) potentially higher costs associated with the

Company’s development, redevelopment and anchor repositioning

projects, and the Company’s ability to lease the properties at

projected rates; (xi) the Company’s liability for environmental

matters; (xii) damage to the Company’s properties from catastrophic

weather and other natural events, and the physical effects of

climate change; (xiii) the Company’s ability and willingness to

maintain its qualification as a REIT in light of economic, market,

legal, tax and other considerations; (xiv) information technology

security breaches; (xv) the loss of key executives; and (xvi) the

accuracy of methodologies and estimates regarding our

environmental, social and governance (“ESG”) metrics, goals and

targets, tenant willingness and ability to collaborate towards

reporting ESG metrics and meeting ESG goals and targets, and the

impact of governmental regulation on our ESG efforts. For further

discussion of factors that could materially affect the outcome of

our forward-looking statements, see “Risk Factors” in Part I, Item

1A, of the Company's Annual Report on Form 10-K for the year ended

December 31, 2023.

We claim the protection of the safe harbor for forward-looking

statements contained in the Private Securities Litigation Reform

Act of 1995 for any forward-looking statements included in this

Press Release. You are cautioned not to place undue reliance on

forward-looking statements, which speak only as of the date of this

Press Release. All subsequent written and oral forward-looking

statements attributable to us or any person acting on our behalf

are expressly qualified in their entirety by the cautionary

statements contained or referred to in this section. We do not

undertake any obligation to release publicly any revisions to our

forward-looking statements to reflect events or circumstances

occurring after the date of this Press Release.

URBAN EDGE PROPERTIES

CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

and per share amounts)

June 30,

December 31,

2024

2023

ASSETS

Real estate, at cost:

Land

$

666,774

$

635,905

Buildings and improvements

2,741,636

2,678,076

Construction in progress

232,690

262,275

Furniture, fixtures and equipment

10,446

9,923

Total

3,651,546

3,586,179

Accumulated depreciation and

amortization

(864,210

)

(819,243

)

Real estate, net

2,787,336

2,766,936

Operating lease right-of-use assets

55,575

56,988

Cash and cash equivalents

78,615

101,123

Restricted cash

22,591

73,125

Tenant and other receivables

25,077

14,712

Receivable arising from the

straight-lining of rents

60,159

60,775

Identified intangible assets, net of

accumulated amortization of $58,266 and $51,399, respectively

114,526

113,897

Deferred leasing costs, net of accumulated

amortization of $21,628 and $21,428, respectively

27,223

27,698

Prepaid expenses and other assets

64,594

64,555

Total assets

$

3,235,696

$

3,279,809

LIABILITIES AND EQUITY

Liabilities:

Mortgages payable, net

$

1,503,030

$

1,578,110

Unsecured credit facility

150,000

153,000

Operating lease liabilities

52,556

53,863

Accounts payable, accrued expenses and

other liabilities

88,523

102,997

Identified intangible liabilities, net of

accumulated amortization of $48,718 and $46,610, respectively

175,837

170,411

Total liabilities

1,969,946

2,058,381

Commitments and contingencies

Shareholders’ equity:

Common shares: $0.01 par value;

500,000,000 shares authorized and 120,444,011 and 117,652,656

shares issued and outstanding, respectively

1,203

1,175

Additional paid-in capital

1,052,199

1,011,942

Accumulated other comprehensive income

689

460

Accumulated earnings

130,033

137,113

Noncontrolling interests:

Operating partnership

66,092

55,355

Consolidated subsidiaries

15,534

15,383

Total equity

1,265,750

1,221,428

Total liabilities and equity

$

3,235,696

$

3,279,809

URBAN EDGE PROPERTIES

CONSOLIDATED STATEMENTS OF

INCOME

(In thousands, except per

share amounts)

Three Months Ended June

30,

Six Months Ended

June 30,

2024

2023

2024

2023

REVENUE

Rental revenue

$

106,358

$

98,773

$

215,905

$

198,127

Other income

188

292

267

379

Total revenue

106,546

99,065

216,172

198,506

EXPENSES

Depreciation and amortization

39,679

25,513

78,253

50,597

Real estate taxes

17,472

16,121

34,475

31,798

Property operating

18,260

15,708

38,766

33,134

General and administrative

9,368

9,907

18,414

18,965

Real estate impairment loss

—

—

—

34,055

Lease expense

3,115

3,156

6,243

6,311

Total expenses

87,894

70,405

176,151

174,860

Gain on sale of real estate

13,447

—

15,349

356

Interest income

661

564

1,349

1,075

Interest and debt expense

(21,896

)

(18,131

)

(42,473

)

(33,424

)

(Gain) loss on extinguishment of debt,

net

21,699

(489

)

21,427

(489

)

Income (loss) before income taxes

32,563

10,604

35,673

(8,836

)

Income tax expense

(539

)

(41

)

(1,204

)

(747

)

Net income (loss)

32,024

10,563

34,469

(9,583

)

Less net (income) loss attributable to

noncontrolling interests in:

Operating partnership

(1,739

)

(444

)

(1,857

)

344

Consolidated subsidiaries

474

143

750

383

Net income (loss) attributable to common

shareholders

$

30,759

$

10,262

$

33,362

$

(8,856

)

Earnings (loss) per common share -

Basic:

$

0.26

$

0.09

$

0.28

$

(0.08

)

Earnings (loss) per common share -

Diluted:

$

0.26

$

0.09

$

0.28

$

(0.08

)

Weighted average shares outstanding -

Basic

118,859

117,482

118,466

117,466

Weighted average shares outstanding -

Diluted

118,971

117,578

118,575

117,466

Reconciliation of Net Income to FFO and FFO as

Adjusted

The following table reflects the reconciliation of net income to

FFO and FFO as Adjusted for the three and six months ended June 30,

2024 and 2023. Net income is considered the most directly

comparable GAAP measure. Refer to "Non-GAAP Financial Measures" on

page 5 for a description of FFO and FFO as Adjusted.

Three Months Ended June

30,

Six Months Ended June

30,

(in thousands, except per share

amounts)

2024

2023

2024

2023

Net income (loss)

$

32,024

$

10,563

$

34,469

$

(9,583

)

Less net (income) loss attributable to

noncontrolling interests in:

Consolidated subsidiaries

474

143

750

383

Operating partnership

(1,739

)

(444

)

(1,857

)

344

Net income (loss) attributable to common

shareholders

30,759

10,262

33,362

(8,856

)

Adjustments:

Rental property depreciation and

amortization

39,346

25,212

77,577

50,021

Limited partnership interests in operating

partnership

1,739

444

1,857

(344

)

Gain on sale of real estate

(13,447

)

—

(15,349

)

(356

)

Real estate impairment loss(2)

—

—

—

34,055

FFO Applicable to diluted common

shareholders

58,397

35,918

97,447

74,520

FFO per diluted common share(1)

0.47

0.29

0.79

0.61

Adjustments to FFO:

Impact of property in foreclosure(3)

1,455

773

2,276

773

Non-cash adjustments(4)

1,731

(208

)

2,307

(244

)

Transaction, severance and litigation

expenses

272

992

381

1,399

(Gain) loss on extinguishment of debt,

net(5)

(21,699

)

489

(21,427

)

489

Tenant bankruptcy settlement income

—

(100

)

(10

)

(100

)

Income tax refund related to prior

periods

—

(684

)

—

(684

)

FFO as Adjusted applicable to diluted

common shareholders

$

40,156

$

37,180

$

80,974

$

76,153

FFO as Adjusted per diluted common

share(1)

$

0.32

$

0.30

$

0.66

$

0.62

Weighted Average diluted common

shares(1)

123,885

122,656

123,218

122,552

(1)

Weighted average diluted shares

used to calculate FFO per share and FFO as Adjusted per share for

the three and six months ended June 30, 2024 and 2023,

respectively, are higher than the GAAP weighted average diluted

shares as a result of the dilutive impact of LTIP and OP units

which may be redeemed for our common shares.

(2)

During the six months ended June

30, 2023, the Company recognized an impairment charge reducing the

carrying value of Kingswood Center, an office and retail property

located in Brooklyn, NY.

(3)

In April 2023, the Company

notified the lender of its mortgage secured by Kingswood Center

that the cash flows generated by the property are insufficient to

cover the debt service and that the Company is unwilling to fund

future shortfalls. As such, the Company defaulted on the loan and

adjusted for the default interest incurred for the second quarter

of 2023. The Company determined it is appropriate to exclude the

operating results of Kingswood Center from FFO as Adjusted as the

property was in the foreclosure process. In June of 2024, the

foreclosure process was completed and the lender took possession of

the property.

(4)

Includes the acceleration and

write-off of lease intangibles related to tenant terminations,

bankruptcies, and write-offs and reinstatements of receivables

arising from the straight-lining of rents for tenants moved to and

from the cash basis of accounting.

(5)

The gain on extinguishment of

debt for the three and six months ended June 30, 2024 relates to

the mortgage debt forgiven in the foreclosure settlement of

Kingswood Center.

Reconciliation of Net Income to NOI and Same-Property

NOI

The following table reflects the reconciliation of net income to

NOI, same-property NOI and same-property NOI including properties

in redevelopment for the three and six months ended June 30, 2024

and 2023. Net income is considered the most directly comparable

GAAP measure. Refer to "Non-GAAP Financial Measures" on page 5 for

a description of NOI and same-property NOI.

Three Months Ended June

30,

Six Months Ended June

30,

(in thousands)

2024

2023

2024

2023

Net income (loss)

$

32,024

$

10,563

$

34,469

$

(9,583

)

Depreciation and amortization

39,679

25,513

78,253

50,597

Interest and debt expense

21,896

18,131

42,473

33,424

General and administrative expense

9,368

9,907

18,414

18,965

(Gain) loss on extinguishment of debt,

net

(21,699

)

489

(21,427

)

489

Other expense

22

244

247

470

Income tax expense

539

41

1,204

747

Gain on sale of real estate

(13,447

)

—

(15,349

)

(356

)

Real estate impairment loss

—

—

—

34,055

Interest income

(661

)

(564

)

(1,349

)

(1,075

)

Non-cash revenue and expenses

(1,019

)

(2,787

)

(3,541

)

(5,050

)

NOI

66,702

61,537

133,394

122,683

Adjustments:

Sunrise Mall net operating loss

472

454

994

1,468

Non-same property NOI and other(1)

(12,817

)

(9,270

)

(25,312

)

(17,925

)

Tenant bankruptcy settlement income and

lease termination income

—

(250

)

(47

)

(258

)

Same-property NOI

$

54,357

$

52,471

$

109,029

$

105,968

NOI related to properties being

redeveloped

5,248

4,815

11,061

9,618

Same-property NOI including properties in

redevelopment

$

59,605

$

57,286

$

120,090

$

115,586

(1)

Non-same property NOI includes NOI related to properties being

redeveloped and properties acquired, disposed, or that are in the

foreclosure process during the periods being compared.

Reconciliation of Net Income to EBITDAre and Adjusted

EBITDAre

The following table reflects the reconciliation of net income to

EBITDAre and Adjusted EBITDAre for the three and six months ended

June 30, 2024 and 2023. Net income is considered the most directly

comparable GAAP measure. Refer to "Non-GAAP Financial Measures" on

page 5 for a description of EBITDAre and Adjusted EBITDAre.

Three Months Ended June

30,

Six Months Ended June

30,

(in thousands)

2024

2023

2024

2023

Net income (loss)

$

32,024

$

10,563

$

34,469

$

(9,583

)

Depreciation and amortization

39,679

25,513

78,253

50,597

Interest and debt expense

21,896

18,131

42,473

33,424

Income tax expense

539

41

1,204

747

Gain on sale of real estate

(13,447

)

—

(15,349

)

(356

)

Real estate impairment loss

—

—

—

34,055

EBITDAre

80,691

54,248

141,050

108,884

Adjustments for Adjusted EBITDAre:

Non-cash adjustments(1)

2,056

(208

)

2,754

(244

)

Transaction, severance and litigation

expenses

272

992

381

1,399

Impact of property in foreclosure(2)

64

—

(561

)

—

(Gain) loss on extinguishment of debt,

net

(21,699

)

489

(21,427

)

489

Tenant bankruptcy settlement income

—

(100

)

(10

)

(100

)

Adjusted EBITDAre

$

61,384

$

55,421

$

122,187

$

110,428

(1)

Includes the acceleration and write-off of lease intangibles

related to tenant terminations, bankruptcies, and write-offs and

reinstatements of receivables arising from the straight-lining of

rents for tenants moved to and from the cash basis of accounting.

The adjustment to EBITDAre in calculating Adjusted EBITDAre is

inclusive of the portion attributable to the noncontrolling

interest in Sunrise Mall.

(2)

Adjustment reflects the operating income for Kingswood Center for

the three and six months ended June 30, 2024, excluding $1.4

million and $2.8 million of interest and debt expense,

respectively, and $0.4 million and $0.8 million of depreciation and

amortization expense, respectively, that is already adjusted for

the purposes of calculating EBITDAre. See footnote 3 on page 11 for

additional information.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240731939775/en/

Mark Langer, EVP and Chief Financial Officer 212-956-2556

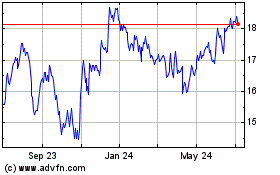

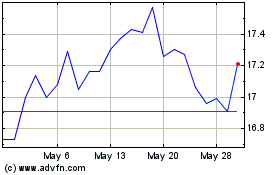

Urban Edge Properties (NYSE:UE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Urban Edge Properties (NYSE:UE)

Historical Stock Chart

From Nov 2023 to Nov 2024