UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

January 21, 2025

(Commission File Number: 001-15128)

United Microelectronics Corporation

(Translation of registrant’s name into English)

No. 3 Li-Hsin 2nd Road

Hsinchu Science Park

Hsinchu, Taiwan, R.O.C.

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

United Microelectronics Corporation |

|

|

|

By: |

Chitung Liu |

Name: |

Chitung Liu |

Title: |

CFO |

Date: January 21, 2025

EXHIBIT INDEX

www.umc.com

www.umc.com

Exhibit

Exhibit Description

99 Announcement on 2025/01/21: UMC announced its operating results for the fourth quarter of 2024

Exhibit 99

UMC announced its operating results for the fourth quarter of 2024

1. Date of occurrence of the event: 2025/01/21

2. Company name: UNITED MICROELECTRONICS CORPORATION

3. Relationship to the Company (please enter “head office” or “subsidiaries”): head office

4. Reciprocal shareholding ratios: N/A

5. Cause of occurrence:

UMC Reports Fourth Quarter 2024 Results

Robust 22nm pipeline to fuel growth in 2025, strengthening company’s foundry competitiveness

Fourth Quarter 2024 Overview:

‧Revenue: NT$60.39 billion (US$1.84 billion)

‧Gross margin: 30.4%; Operating margin: 19.8%

‧Revenue from 22/28nm: 34%

‧Capacity utilization rate: 70%

‧Net income attributable to shareholders of the parent: NT$8.50 billion (US$259 million)

‧Earnings per share: NT$0.68; earnings per ADS: US$0.104

Taipei, Taiwan, ROC – January 21, 2025 – United Microelectronics Corporation (NYSE: UMC; TWSE: 2303) (“UMC” or “The Company”), a leading global semiconductor foundry, today announced its consolidated operating results for the fourth quarter of 2024.

Fourth quarter consolidated revenue was NT$60.39 billion, decreasing 0.2% from NT$60.49 billion in 3Q24. Compared to a year ago, 4Q24 revenue increased 9.9%. Consolidated gross margin for 4Q24 was 30.4%. Net income attributable to the shareholders of the parent was NT$8.50 billion, with earnings per ordinary share of NT$0.68.

Jason Wang, co-president of UMC, said, “Our fourth-quarter results met guidance, with wafer shipments and utilization slightly exceeding expectations. For full year 2024, revenue grew 4.4% year-on-year, reflecting a steady improvement in demand across communication, consumer, and computer segments. Our 22/28nm portfolio remained the largest contributor, with revenue increasing 15% in 2024. Notably, customers are showing strong interest in migrating to our 22nm specialty platforms for next-generation networking and display driver applications, which offer significant power savings and performance advantages over 28nm solutions. Tape-outs for 22nm products are accelerating and we expect to see higher revenue contribution from 2025 onwards.”

Co-president Wang commented, “Looking into 2025, the semiconductor market is poised for another year of growth, driven by strong demand for AI servers as well as increasing semiconductor content in smartphones, PCs, and other electronic devices. To capture opportunities in this fast-moving market, UMC continues to invest in technology innovation, developing industry-leading specialty solutions to ride the next wave of system upgrades and stay ahead of the competition. Building on our technology foundation, UMC is also actively expanding our advanced packaging offering to help unleash the potential of AI in the coming years. In conjunction with technology development, our key capacity expansion projects are progressing as planned. Our new Singapore Phase 3 fab will enhance customers’ supply chain resilience, while the 12nm collaboration with our U.S. partner will offer customers a migration path beyond 22nm.”

Co-president Wang added, “In the fourth quarter of 2024, we signed a major offshore wind purchase agreement, which is UMC’s largest renewable energy transaction to date. This agreement puts UMC well on track to achieving our goal of 50% renewable energy use by 2030

as part of our roadmap to net zero emissions and 100% renewable energy by 2050. Our commitment to best practices in sustainable development continued to be recognized by key ESG benchmarks. In the 2024 Dow Jones Sustainability Indices (DJSI) results announced in December, UMC is proud to achieve the top ranking in the semiconductor industry, marking UMC’s 17th consecutive year of being recognized as one of the most sustainable companies globally.”

First Quarter 2025 Outlook & Guidance

‧Wafer Shipments: Will remain flat

‧ASP in USD: Will decrease by mid-single digit %

‧Gross Profit Margin: Will be higher than 25% with 0121 earthquake impact

‧Capacity Utilization: approximately 70%

‧2025 CAPEX: US$1.8 billion

6. Countermeasures: N/A

7. Any other matters that need to be specified (the information disclosure also meets the requirements of Article 7, subparagraph 9 of the Securities and Exchange Act Enforcement Rules, which brings forth a significant impact on shareholders rights or the price of the securities on public companies.): N/A

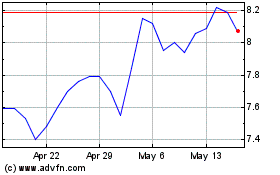

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Dec 2024 to Jan 2025

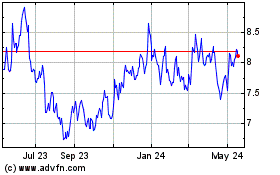

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Jan 2024 to Jan 2025