UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

December 18, 2024

(Commission File Number: 001-15128)

United Microelectronics Corporation

(Translation of registrant’s name into English)

No. 3 Li-Hsin 2nd Road

Hsinchu Science Park

Hsinchu, Taiwan, R.O.C.

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F Form 40-F

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101 (b) (7):

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereto duly authorized.

|

|

United Microelectronics Corporation |

|

|

|

By: |

Chitung Liu |

Name: |

Chitung Liu |

Title: |

CFO |

Date: December 18, 2024

EXHIBIT INDEX

www.umc.com

www.umc.com

Exhibit

Exhibit Description

99.1 Announcement on 2024/12/18: The board meeting approved capital budget execution

99.2 Announcement on 2024/12/18: The Company signs Corporate Power Purchase Agreement with Fengmiao Wind Power Co., Ltd.

Exhibit 99.1

The board meeting approved capital budget execution

1. Date of the resolution of the board of directors or shareholders meeting: 2024/12/18

2. Content of the investment plan: capital budget execution

3. Projected monetary amount of the investment: NT$ 18,498 million

4. Projected date of the investment: by capital budget plan

5. Source of capital funds: working capital

6. Specific purpose: capacity deployment

7. Any other matters that need to be specified: none

Exhibit 99.2

The Company signs Corporate Power Purchase Agreement with Fengmiao Wind Power Co., Ltd.

1. Date of occurrence of the event: 2024/12/18

2. Counterparty to the contract or commitment: Fengmiao Wind Power Co., Ltd.

3. Relationship with the Company: NA

4. Starting and ending dates (or rescission date) of the contract or commitment: According to the contractual provisions

5. Major content (not applicable where rescinded):

UMC Signs 30-Year, 30 Billion kWh Offshore Wind Power Agreement with CIP’s Fengmiao I Offshore Wind Farm

6. Restrictive covenants (not applicable where rescinded): According to the contractual provisions

7. Commitment (not applicable where rescinded): According to the contractual provisions

8. Any other important agreement (not applicable where rescinded): According to the contractual provisions

9. Effect on company finances and business: A positive impact on the Company’s long-term operations

10. Concrete purpose/objective: To acquire renewable energy

11. Any other matters that need to be specified (the information disclosure also meets the requirements of Article 7, subparagraph 8 of the Securities and Exchange Act Enforcement Rules, which brings forth a significant impact on shareholders rights or the price of the securities on public companies.):

UMC Signs 30-Year, 30 Billion kWh Offshore Wind Power Agreement with CIP’s Fengmiao I Offshore Wind Farm

HSINCHU, Taiwan, December 18, 2024 - United Microelectronics Corporation (NYSE: UMC; TWSE: 2303)(“UMC”), today announced the signing of a Corporate Power Purchase Agreement (CPPA) with Fengmiao I Offshore Wind Farm (“Fengmiao I”), developed by Copenhagen Infrastructure Partners’ (“CIP”) flagship fund, CI V. UMC will purchase more than 30 billion kilowatt-hours of power from Fengmiao I over least 30 years, marking the largest renewable energy transaction in UMC’s history. This agreement will help UMC achieve its goal of 50% renewable energy use by 2030 as part of the company’s roadmap to net zero emissions and 100% renewable energy by 2050.

TS Wu, Vice President of UMC, said, “UMC is pleased to sign this landmark power purchase agreement with CIP’s Fengmiao I, marking UMC’s largest renewable energy deal to date and a significant milestone in our net zero journey. This agreement demonstrates our commitment to sustainable development to our stakeholders, and also contributes to UMC’s carbon reduction goals and ESG vision. As a responsible corporate citizen, UMC actively works on cutting emissions and energy consumption by installing high efficiency greenhouse gas abatement equipment and improving the energy efficiency of our manufacturing processes. At the same time, we will continue to expand renewable energy use as we advance towards our 2050 net zero goal.”

Thomas Wibe Poulsen, APAC Regional Partner for CIP’s Flagship Funds and Chairman of Fengmiao Offshore Wind Farm, said, “The decision of UMC, a leading global semiconductor company, to cooperate with Fengmiao I underscores the market’s high confidence in CIP’s technical and financial capability to deliver offshore wind projects.”

UMC follows its net zero roadmap, defined by science-based targets, by taking three key actions: persistent and proactive carbon emission reduction, 100% renewable energy usage, and investment in net- zero technologies. In 2023, UMC Group achieved a 26% reduction in scope 1 and scope 2 greenhouse gas emissions from 2020 base levels, reaching its 2030 target ahead of schedule. Therefore, UMC has revised its original 2030 target of 25% reduction to a more ambitious 42% reduction goal to accelerate the pace of its net zero transition.

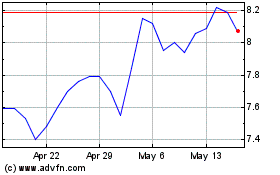

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Jan 2025 to Feb 2025

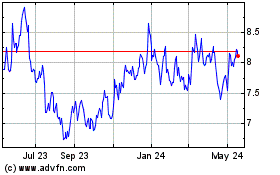

United Microelectronics (NYSE:UMC)

Historical Stock Chart

From Feb 2024 to Feb 2025