0001522727false00015227272024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 5, 2024

USA Compression Partners, LP

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-35779 | | 75-2771546 |

| (State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

111 Congress Avenue, Suite 2400

Austin, Texas 78701

(Address of principal executive offices) (zip code)

Registrant’s telephone number, including area code: (512) 473-2662

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of exchange on which registered |

| Common units representing limited partner interests | | USAC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

ITEM 2.02. RESULTS OF OPERATIONS AND FINANCIAL CONDITION.

On November 5, 2024, USA Compression Partners, LP issued a press release with respect to its financial and operating results for third-quarter 2024. The press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

In accordance with General Instruction B.2 of Form 8-K, the information in this report, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall such information, including Exhibit 99.1, be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

ITEM 9.01. FINANCIAL STATEMENTS AND EXHIBITS.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | USA COMPRESSION PARTNERS, LP |

| | | |

| | By: | USA Compression GP, LLC, |

| | | its General Partner |

| | | |

| Date: | November 5, 2024 | By: | /s/ Christopher W. Porter |

| | | Christopher W. Porter |

| | | Vice President, General Counsel and Secretary |

| | | | | |

| Exhibit 99.1 |

| News Release |

| USA Compression Partners, LP |

| 111 Congress Avenue, Suite 2400 |

| Austin, Texas 78701 |

| usacompression.com |

USA Compression Partners Reports Third-Quarter 2024 Results; Confirms 2024 Outlook

AUSTIN, Texas, November 5, 2024 — USA Compression Partners, LP (NYSE: USAC) (“USA Compression” or the “Partnership”) announced today its financial and operating results for third-quarter 2024.

Financial Highlights

•Record total revenues of $240.0 million for third-quarter 2024, compared to $217.1 million for third-quarter 2023.

•Net income was $19.3 million for third-quarter 2024, compared to $20.9 million for third-quarter 2023.

•Net cash provided by operating activities was $48.5 million for third-quarter 2024, compared to $50.1 million for third-quarter 2023.

•Adjusted EBITDA was $145.7 million for third-quarter 2024, compared to $130.2 million for third-quarter 2023.

•Distributable Cash Flow was $86.6 million for third-quarter 2024, compared to $71.6 million for third-quarter 2023.

•Distributable Cash Flow Coverage was 1.41x for third-quarter 2024, compared to 1.39x for third-quarter 2023.

•Paid cash distribution of $0.525 per common unit for third-quarter 2024, consistent with third-quarter 2023.

Operational Highlights

•Record average revenue-generating horsepower of 3.56 million for third-quarter 2024, compared to 3.36 million for third-quarter 2023.

•Record average revenue per revenue-generating horsepower per month of $20.60 for third-quarter 2024, compared to $19.10 for third-quarter 2023.

•Average horsepower utilization of 94.6% for third-quarter 2024, compared to 93.6% for third-quarter 2023.

“Our third-quarter financial results represented another record-setting quarter of revenues and Adjusted EBITDA. These financial results were underpinned by strong operational execution as we achieved record revenue-generating horsepower and record average revenue per-horsepower, reflective of the continued tightening in the compression service space, which we expect to continue for the foreseeable future,” commented Clint Green, USA Compression’s President and Chief Executive Officer.

“I want to thank Eric Long, who navigated USA Compression through many cycles of our industry and grew it into one of the leading and largest independent compression services companies. The culture and focus on delivering safe and excellent customer service at USA Compression has been clear during my time here so far, and I look forward to building on where he left off.”

“Lastly, we are increasing our expansion capital expenditures for the full-year 2024 to between $240.0 million and $250.0 million, primarily due to cost associated with preparing active compression units that are returned by a customer for redeployment and the increased cost on the idle to active fleet conversion.”

Expansion capital expenditures were $34.1 million, maintenance capital expenditures were $9.1 million, and cash interest expense, net was $47.1 million for third-quarter 2024.

On October 10, 2024, the Partnership announced a third-quarter cash distribution of $0.525 per common unit, which corresponds to an annualized distribution rate of $2.10 per common unit. The distribution was paid on November 1, 2024, to common unitholders of record as of the close of business on October 21, 2024.

Operational and Financial Data

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 |

| Operational data: | | | | | |

| Fleet horsepower (at period end) (1) | 3,862,445 | | | 3,851,970 | | | 3,735,490 | |

| Revenue-generating horsepower (at period end) (2) | 3,570,508 | | | 3,538,683 | | | 3,395,630 | |

| Average revenue-generating horsepower (3) | 3,560,891 | | | 3,515,483 | | | 3,356,008 | |

| Revenue-generating compression units (at period end) | 4,270 | | | 4,251 | | | 4,251 | |

| Horsepower utilization (at period end) (4) | 94.4 | % | | 95.0 | % | | 93.9 | % |

| Average horsepower utilization (for the period) (4) | 94.6 | % | | 94.7 | % | | 93.6 | % |

| | | | | |

| Financial data ($ in thousands, except per horsepower data): | | | | | |

| Contract operations revenue | $ | 233,919 | | | $ | 229,091 | | | $ | 209,841 | |

| Total revenues | $ | 239,968 | | | $ | 235,313 | | | $ | 217,085 | |

| Average revenue per revenue-generating horsepower per month (5) | $ | 20.60 | | | $ | 20.29 | | | $ | 19.10 | |

| Net income | $ | 19,327 | | | $ | 31,238 | | | $ | 20,902 | |

| Operating income | $ | 75,676 | | | $ | 77,372 | | | $ | 60,954 | |

| Net cash provided by operating activities | $ | 48,481 | | | $ | 96,741 | | | $ | 50,072 | |

| Gross margin | $ | 90,917 | | | $ | 91,838 | | | $ | 78,056 | |

| Adjusted gross margin (6) | $ | 158,154 | | | $ | 157,151 | | | $ | 142,157 | |

| Adjusted gross margin percentage (7) | 65.9 | % | | 66.8 | % | | 65.5 | % |

| Adjusted EBITDA (6) | $ | 145,690 | | | $ | 143,673 | | | $ | 130,164 | |

| Adjusted EBITDA percentage (7) | 60.7 | % | | 61.1 | % | | 60.0 | % |

| Distributable Cash Flow (6) | $ | 86,606 | | | $ | 85,863 | | | $ | 71,574 | |

| Distributable Cash Flow Coverage Ratio (6) | 1.41 | x | | 1.40 | x | | 1.39 | x |

____________________________________

(1)Fleet horsepower is horsepower for compression units that have been delivered to the Partnership.

(2)Revenue-generating horsepower is horsepower under contract for which the Partnership is billing a customer.

(3)Calculated as the average of the month-end revenue-generating horsepower for each of the months in the period.

(4)Horsepower utilization is calculated as (i) the sum of (a) revenue-generating horsepower; (b) horsepower in the Partnership’s fleet that is under contract but is not yet generating revenue; and (c) horsepower not yet in the Partnership’s fleet that is under contract but not yet generating revenue and that is expected to be delivered, divided by (ii) total available horsepower less idle horsepower that is under repair.

Horsepower utilization based on revenue-generating horsepower and fleet horsepower was 92.4%, 91.9%, and 90.9% at September 30, 2024, June 30, 2024, and September 30, 2023, respectively.

Average horsepower utilization based on revenue-generating horsepower and fleet horsepower was 92.3%, 91.2%, and 90.0% for the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, respectively.

(5)Calculated as the average of the result of dividing the contractual monthly rate, excluding standby or other temporary rates, for all units at the end of each month in the period by the sum of the revenue-generating horsepower at the end of each month in the period.

(6)Adjusted gross margin, Adjusted EBITDA, Distributable Cash Flow, and Distributable Cash Flow Coverage Ratio are all non-U.S. generally accepted accounting principles (“Non-GAAP”) financial measures. For the definition of each measure, as well as reconciliations of each measure to its most directly comparable financial measures calculated and presented in accordance with GAAP, see “Non-GAAP Financial Measures” below.

(7)Adjusted gross margin percentage and Adjusted EBITDA percentage are calculated as a percentage of revenue.

Liquidity and Long-Term Debt

As of September 30, 2024, the Partnership was in compliance with all covenants under its $1.6 billion revolving credit facility. As of September 30, 2024, the Partnership had outstanding borrowings under the revolving credit facility of $803.2 million and, after accounting for outstanding letters of credit in the amount of $0.5 million, $796.3 million of remaining unused availability, of which, due to restrictions related to compliance with the applicable financial covenants, $641.8 million was available to be drawn. As of September 30, 2024, the outstanding aggregate principal amount of the Partnership’s 6.875% senior notes due 2027 and 7.125% senior notes due 2029 was $750.0 million and $1.0 billion, respectively.

Full-Year 2024 Outlook

USA Compression is confirming its full-year 2024 guidance as follows:

•Net income range of $105.0 million to $125.0 million;

•A forward-looking estimate of net cash provided by operating activities is not provided because the items necessary to estimate net cash provided by operating activities, in particular the change in operating assets and liabilities, are not accessible or estimable at this time. The Partnership does not anticipate changes in operating assets and liabilities to be material, but changes in accounts receivable, accounts payable, accrued liabilities, and deferred revenue could be significant, such that the amount of net cash provided by operating activities would vary substantially from the amount of projected Adjusted EBITDA and Distributable Cash Flow;

•Adjusted EBITDA range of $565.0 million to $585.0 million; and

•Distributable Cash Flow range of $345.0 million to $365.0 million.

Conference Call

The Partnership will host a conference call today beginning at 11:00 a.m. Eastern Time (10:00 a.m. Central Time) to discuss third-quarter 2024 performance. The call will be broadcast live over the internet. Investors may participate by audio webcast, or if located in the U.S. or Canada, by phone. A replay will be available shortly after the call via the “Events” page of USA Compression’s Investor Relations website.

| | | | | | | | |

| By Webcast: | | Connect to the webcast via the “Events” page of USA Compression’s Investor Relations website at https://investors.usacompression.com. Please log in at least 10 minutes in advance to register and download any necessary software. |

| | |

| By Phone: | | Dial (888) 440-5655 at least 10 minutes before the call and ask for the USA Compression Partners Earnings Call or conference ID 8970064. |

About USA Compression Partners, LP

USA Compression Partners, LP is one of the nation’s largest independent providers of natural gas compression services in terms of total compression fleet horsepower. USA Compression partners with a broad customer base composed of producers, processors, gatherers, and transporters of natural gas and crude oil. USA Compression focuses on providing midstream natural gas compression services to infrastructure applications primarily in high-volume gathering systems, processing facilities, and transportation applications. More information is available at usacompression.com.

Non-GAAP Financial Measures

This news release includes the Non-GAAP financial measures of Adjusted gross margin, Adjusted EBITDA, Distributable Cash Flow, and Distributable Cash Flow Coverage Ratio.

Adjusted gross margin is defined as revenue less cost of operations, exclusive of depreciation and amortization expense. Management believes Adjusted gross margin is useful to investors as a supplemental measure of the Partnership’s operating profitability. Adjusted gross margin primarily is impacted by the pricing trends for service operations and cost of operations, including labor rates for service technicians, volume, and per-unit costs for lubricant oils, quantity and pricing of routine preventative maintenance on compression units, and property tax rates on compression units. Adjusted gross margin should not be considered an alternative to, or more meaningful than, gross margin or any other measure presented in accordance with GAAP. Moreover, the Partnership’s Adjusted gross margin, as presented, may not be comparable to similarly titled measures of other companies. Because the Partnership capitalizes assets, depreciation and amortization of equipment is a necessary element of its cost structure. To compensate for the limitations of

Adjusted gross margin as a measure of the Partnership’s performance, management believes it important to consider gross margin determined under GAAP, as well as Adjusted gross margin, to evaluate the Partnership’s operating profitability.

Management views Adjusted EBITDA as one of its primary tools for evaluating the Partnership’s results of operations, and the Partnership tracks this item on a monthly basis as an absolute amount and as a percentage of revenue compared to the prior month, year-to-date, prior year, and budget. The Partnership defines EBITDA as net income (loss) before net interest expense, depreciation and amortization expense, and income tax expense (benefit). The Partnership defines Adjusted EBITDA as EBITDA plus impairment of compression equipment, impairment of goodwill, interest income on capital leases, unit-based compensation expense (benefit), severance charges, certain transaction expenses, loss (gain) on disposition of assets, loss on extinguishment of debt, loss (gain) on derivative instrument, and other. Adjusted EBITDA is used as a supplemental financial measure by management and external users of the Partnership’s financial statements, such as investors and commercial banks, to assess:

•the financial performance of the Partnership’s assets without regard to the impact of financing methods, capital structure, or the historical cost basis of the Partnership’s assets;

•the viability of capital expenditure projects and the overall rates of return on alternative investment opportunities;

•the ability of the Partnership’s assets to generate cash sufficient to make debt payments and pay distributions; and

•the Partnership’s operating performance as compared to those of other companies in its industry without regard to the impact of financing methods and capital structure.

Management believes Adjusted EBITDA provides useful information to investors because, when viewed in conjunction with the Partnership’s GAAP results and the accompanying reconciliations, it may provide a more complete assessment of the Partnership’s performance as compared to considering solely GAAP results. Management also believes that external users of the Partnership’s financial statements benefit from having access to the same financial measures that management uses to evaluate the results of the Partnership’s business.

Adjusted EBITDA should not be considered an alternative to, or more meaningful than, net income (loss), operating income (loss), cash flows from operating activities, or any other measure presented in accordance with GAAP. Moreover, the Partnership’s Adjusted EBITDA, as presented, may not be comparable to similarly titled measures of other companies.

Distributable Cash Flow is defined as net income (loss) plus non-cash interest expense, non-cash income tax expense (benefit), depreciation and amortization expense, unit-based compensation expense (benefit), impairment of compression equipment, impairment of goodwill, certain transaction expenses, severance charges, loss (gain) on disposition of assets, loss on extinguishment of debt, change in fair value of derivative instrument, proceeds from insurance recovery, and other, less distributions on Preferred Units and maintenance capital expenditures.

Distributable Cash Flow should not be considered an alternative to, or more meaningful than, net income (loss), operating income (loss), cash flows from operating activities, or any other measure presented in accordance with GAAP. Moreover, the Partnership’s Distributable Cash Flow, as presented, may not be comparable to similarly titled measures of other companies.

Management believes Distributable Cash Flow is an important measure of operating performance because it allows management, investors, and others to compare the cash flows that the Partnership generates (after distributions on Preferred Units but prior to any retained cash reserves established by the Partnership’s general partner and the effect of the Distribution Reinvestment Plan) to the cash distributions that the Partnership expects to pay its common unitholders.

Distributable Cash Flow Coverage Ratio is defined as the period’s Distributable Cash Flow divided by distributions declared to common unitholders in respect of such period. Management believes Distributable Cash Flow Coverage Ratio is an important measure of operating performance because it permits management, investors, and others to assess the Partnership’s ability to pay distributions to common unitholders out of the cash flows the Partnership generates. The Partnership’s Distributable Cash Flow Coverage Ratio, as presented, may not be comparable to similarly titled measures of other companies.

This news release also contains a forward-looking estimate of Adjusted EBITDA and Distributable Cash Flow projected to be generated by the Partnership for its 2024 fiscal year. A forward-looking estimate of net cash provided by operating activities and reconciliations of the forward-looking estimates of Adjusted EBITDA and Distributable Cash Flow to net cash provided by operating activities are not provided because the items necessary to estimate net cash provided by operating activities, in particular the change in operating assets and liabilities, are not accessible or estimable at this time. The Partnership does not anticipate changes in operating assets and liabilities to be material, but changes in accounts receivable, accounts payable, accrued liabilities, and deferred revenue could be significant, such that the amount of net cash provided by operating activities would vary substantially from the amount of projected Adjusted EBITDA and Distributable Cash Flow.

See “Reconciliation of Non-GAAP Financial Measures” for Adjusted gross margin reconciled to gross margin, Adjusted EBITDA reconciled to net income and net cash provided by operating activities, and net income and net cash provided by operating activities reconciled to Distributable Cash Flow and Distributable Cash Flow Coverage Ratio.

Forward-Looking Statements

Some of the information in this news release may contain forward-looking statements. These statements can be identified by the use of forward-looking terminology including “may,” “believe,” “expect,” “intend,” “anticipate,” “estimate,” “continue,” “if,” “project,” “outlook,” “will,” “could,” “should,” or other similar words or the negatives thereof, and include the Partnership’s expectation of future performance contained herein, including as described under “Full-Year 2024 Outlook.” These statements discuss future expectations, contain projections of results of operations or of financial condition, or state other “forward-looking” information. You are cautioned not to place undue reliance on any forward-looking statements, which can be affected by assumptions used or by known risks or uncertainties. Consequently, no forward-looking statements can be guaranteed. When considering these forward-looking statements, you should keep in mind the risk factors noted below and other cautionary statements in this news release. The risk factors and other factors noted throughout this news release could cause actual results to differ materially from those contained in any forward-looking statement. Known material factors that could cause the Partnership’s actual results to differ materially from the results contemplated by such forward-looking statements include:

•changes in economic conditions of the crude oil and natural gas industries, including any impact from the ongoing military conflict involving Russia and Ukraine or the conflict in the Middle East;

•changes in general economic conditions, including inflation or supply chain disruptions;

•changes in the long-term supply of and demand for crude oil and natural gas, including as a result of, actions taken by governmental authorities and other third parties in response to world health events, and the resulting disruption in the oil and gas industry and impact on demand for oil and gas;

•competitive conditions in the Partnership’s industry, including competition for employees in a tight labor market;

•changes in the availability and cost of capital, including changes to interest rates;

•renegotiation of material terms of customer contracts;

•actions taken by the Partnership’s customers, competitors, and third-party operators;

•operating hazards, natural disasters, epidemics, pandemics, weather-related impacts, casualty losses, and other matters beyond the Partnership’s control;

•the deterioration of the financial condition of the Partnership’s customers, which may result in the initiation of bankruptcy proceedings with respect to certain customers;

•the restrictions on the Partnership’s business that are imposed under the Partnership’s long-term debt agreements;

•information technology risks, including the risk from cyberattacks, cybersecurity breaches, and other disruptions to the Partnership’s information systems;

•the effects of existing and future laws and governmental regulations;

•the effects of future litigation;

•factors described in Part I, Item 1A (“Risk Factors”) of the Partnership’s Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which was filed with the Securities and Exchange Commission (the “SEC”) on February 13, 2024, and subsequently filed reports; and

•other factors discussed in the Partnership’s filings with the SEC.

All forward-looking statements speak only as of the date of this news release and are expressly qualified in their entirety by the foregoing cautionary statements. Unless legally required, the Partnership undertakes no obligation to update publicly any forward-looking statements, whether as a result of new information, future events, or otherwise. Unpredictable or unknown factors not discussed herein also could have material adverse effects on forward-looking statements.

Investor Contact:

USA Compression Partners, LP

Investor Relations

ir@usacompression.com

USA COMPRESSION PARTNERS, LP

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(In thousands, except for per unit amounts – Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 |

| Revenues: | | | | | |

| Contract operations | $ | 220,518 | | | $ | 223,643 | | | $ | 204,716 | |

| Parts and service | 5,756 | | | 5,827 | | | 7,153 | |

| Related party | 13,694 | | | 5,843 | | | 5,216 | |

| Total revenues | 239,968 | | | 235,313 | | | 217,085 | |

| Costs and expenses: | | | | | |

| Cost of operations, exclusive of depreciation and amortization | 81,814 | | | 78,162 | | | 74,928 | |

| Depreciation and amortization | 67,237 | | | 65,313 | | | 64,101 | |

| Selling, general, and administrative | 15,364 | | | 14,173 | | | 20,085 | |

| Gain on disposition of assets | (123) | | | (18) | | | (3,865) | |

| Impairment of compression equipment | — | | | 311 | | | 882 | |

| Total costs and expenses | 164,292 | | | 157,941 | | | 156,131 | |

| Operating income | 75,676 | | | 77,372 | | | 60,954 | |

| Other income (expense): | | | | | |

| Interest expense, net | (49,361) | | | (48,828) | | | (43,257) | |

| | | | | |

| Gain (loss) on derivative instrument | (6,218) | | | 3,131 | | | 3,437 | |

| Other | 23 | | | 26 | | | 23 | |

| Total other expense | (55,556) | | | (45,671) | | | (39,797) | |

| Net income before income tax expense | 20,120 | | | 31,701 | | | 21,157 | |

| Income tax expense | 793 | | | 463 | | | 255 | |

| Net income | 19,327 | | | 31,238 | | | 20,902 | |

| Less: distributions on Preferred Units | (4,388) | | | (4,387) | | | (12,188) | |

| Net income attributable to common unitholders’ interests | $ | 14,939 | | | $ | 26,851 | | | $ | 8,714 | |

| | | | | |

| Weighted-average common units outstanding – basic | 117,017 | | | 116,849 | | | 98,292 | |

| | | | | |

| Weighted-average common units outstanding – diluted | 118,256 | | | 117,972 | | | 100,263 | |

| | | | | |

| Basic and diluted net income per common unit | $ | 0.13 | | | $ | 0.23 | | | $ | 0.09 | |

| | | | | |

| | | | | |

| | | | | |

| Distributions declared per common unit for respective periods | $ | 0.525 | | | $ | 0.525 | | | $ | 0.525 | |

USA COMPRESSION PARTNERS, LP

SELECTED BALANCE SHEET DATA

(In thousands, except unit amounts – Unaudited)

| | | | | |

| September 30,

2024 |

| Selected Balance Sheet data: | |

| Total assets | $ | 2,803,627 | |

| Long-term debt, net | $ | 2,532,398 | |

| Total partners’ deficit | $ | (107,254) | |

| |

| Common units outstanding | 117,022,833 | |

USA COMPRESSION PARTNERS, LP

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands — Unaudited)

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 |

| Net cash provided by operating activities | $ | 48,481 | | | $ | 96,741 | | | $ | 50,072 | |

| Net cash used in investing activities | (28,379) | | | (48,142) | | | (48,082) | |

| Net cash used in financing activities | (20,032) | | | (48,598) | | | (2,015) | |

USA COMPRESSION PARTNERS, LP

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

ADJUSTED GROSS MARGIN TO GROSS MARGIN

(In thousands — Unaudited)

The following table reconciles Adjusted gross margin to gross margin, its most directly comparable GAAP financial measure, for each of the periods presented:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 |

| Total revenues | $ | 239,968 | | | $ | 235,313 | | | $ | 217,085 | |

| Cost of operations, exclusive of depreciation and amortization | (81,814) | | | (78,162) | | | (74,928) | |

| Depreciation and amortization | (67,237) | | | (65,313) | | | (64,101) | |

| Gross margin | $ | 90,917 | | | $ | 91,838 | | | $ | 78,056 | |

| Depreciation and amortization | 67,237 | | | 65,313 | | | 64,101 | |

| Adjusted gross margin | $ | 158,154 | | | $ | 157,151 | | | $ | 142,157 | |

USA COMPRESSION PARTNERS, LP

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

ADJUSTED EBITDA TO NET INCOME AND NET CASH PROVIDED BY OPERATING ACTIVITIES

(In thousands — Unaudited)

The following table reconciles Adjusted EBITDA to net income and net cash provided by operating activities, its most directly comparable GAAP financial measures, for each of the periods presented:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 |

| Net income | $ | 19,327 | | | $ | 31,238 | | | $ | 20,902 | |

| Interest expense, net | 49,361 | | | 48,828 | | | 43,257 | |

| Depreciation and amortization | 67,237 | | | 65,313 | | | 64,101 | |

| Income tax expense | 793 | | | 463 | | | 255 | |

| EBITDA | $ | 136,718 | | | $ | 145,842 | | | $ | 128,515 | |

| Unit-based compensation expense (1) | 2,669 | | | 562 | | | 8,024 | |

| Transaction expenses (2) | (15) | | | 63 | | | — | |

| Severance charges | 223 | | | 44 | | | 45 | |

| Gain on disposition of assets | (123) | | | (18) | | | (3,865) | |

| | | | | |

| Loss (gain) on derivative instrument | 6,218 | | | (3,131) | | | (3,437) | |

| Impairment of compression equipment (3) | — | | | 311 | | | 882 | |

| Adjusted EBITDA | $ | 145,690 | | | $ | 143,673 | | | $ | 130,164 | |

| Interest expense, net | (49,361) | | | (48,828) | | | (43,257) | |

| Non-cash interest expense | 2,251 | | | 2,257 | | | 1,819 | |

| Income tax expense | (793) | | | (463) | | | (255) | |

| Transaction expenses | 15 | | | (63) | | | — | |

| Severance charges | (223) | | | (44) | | | (45) | |

| Cash received on derivative instrument | 2,000 | | | 2,466 | | | 2,528 | |

| Other | 330 | | | 37 | | | (65) | |

| Changes in operating assets and liabilities | (51,428) | | | (2,294) | | | (40,817) | |

| Net cash provided by operating activities | $ | 48,481 | | | $ | 96,741 | | | $ | 50,072 | |

____________________________________

(1)For the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, unit-based compensation expense included $1.0 million, $1.0 million, and $1.1 million, respectively, of cash payments related to quarterly payments of distribution equivalent rights on outstanding phantom unit awards. The remainder of unit-based compensation expense for all periods was related to non-cash adjustments to the unit-based compensation liability.

(2)Represents certain expenses related to potential and completed transactions and other items. The Partnership believes it is useful to investors to exclude these expenses.

(3)Represents non-cash charges incurred to decrease the carrying value of long-lived assets with recorded values that are not expected to be recovered through future cash flows.

USA COMPRESSION PARTNERS, LP

RECONCILIATION OF NON-GAAP FINANCIAL MEASURES

DISTRIBUTABLE CASH FLOW TO NET INCOME AND NET CASH PROVIDED BY OPERATING ACTIVITIES

(Dollars in thousands — Unaudited)

The following table reconciles Distributable Cash Flow to net income and net cash provided by operating activities, its most directly comparable GAAP financial measures, for each of the periods presented:

| | | | | | | | | | | | | | | | | |

| Three Months Ended |

| September 30,

2024 | | June 30,

2024 | | September 30,

2023 |

| Net income | $ | 19,327 | | | $ | 31,238 | | | $ | 20,902 | |

| Non-cash interest expense | 2,251 | | | 2,257 | | | 1,819 | |

| Depreciation and amortization | 67,237 | | | 65,313 | | | 64,101 | |

| Non-cash income tax expense (benefit) | 330 | | | 37 | | | (65) | |

| Unit-based compensation expense (1) | 2,669 | | | 562 | | | 8,024 | |

| Transaction expenses (2) | (15) | | | 63 | | | — | |

| Severance charges | 223 | | | 44 | | | 45 | |

| Gain on disposition of assets | (123) | | | (18) | | | (3,865) | |

| | | | | |

| Change in fair value of derivative instrument | 8,218 | | | (665) | | | (909) | |

| Impairment of compression equipment (3) | — | | | 311 | | | 882 | |

| Distributions on Preferred Units (4) | (4,388) | | | (4,387) | | | (12,188) | |

| | | | | |

| Maintenance capital expenditures (5) | (9,123) | | | (8,892) | | | (7,172) | |

| Distributable Cash Flow | $ | 86,606 | | | $ | 85,863 | | | $ | 71,574 | |

| Maintenance capital expenditures | 9,123 | | | 8,892 | | | 7,172 | |

| Transaction expenses | 15 | | | (63) | | | — | |

| Severance charges | (223) | | | (44) | | | (45) | |

| Distributions on Preferred Units | 4,388 | | | 4,387 | | | 12,188 | |

| | | | | |

| Changes in operating assets and liabilities | (51,428) | | | (2,294) | | | (40,817) | |

| Net cash provided by operating activities | $ | 48,481 | | | $ | 96,741 | | | $ | 50,072 | |

| | | | | |

| Distributable Cash Flow | $ | 86,606 | | | $ | 85,863 | | | $ | 71,574 | |

| | | | | |

| Distributions for Distributable Cash Flow Coverage Ratio (6) | $ | 61,437 | | | $ | 61,429 | | | $ | 51,608 | |

| | | | | |

| Distributable Cash Flow Coverage Ratio | 1.41 | x | | 1.40 | x | | 1.39 | x |

____________________________________(1)For the three months ended September 30, 2024, June 30, 2024, and September 30, 2023, unit-based compensation expense included $1.0 million, $1.0 million, and $1.1 million, respectively, of cash payments related to quarterly payments of distribution equivalent rights on outstanding phantom unit awards. The remainder of unit-based compensation expense for all periods was related to non-cash adjustments to the unit-based compensation liability.

(2)Represents certain expenses related to potential and completed transactions and other items. The Partnership believes it is useful to investors to exclude these expenses.

(3)Represents non-cash charges incurred to decrease the carrying value of long-lived assets with recorded values that are not expected to be recovered through future cash flows.

(4)During 2024, 320,000 Preferred Units were converted into 15,990,804 common units, all of which occurred on or prior to the distribution record date for the first quarter of 2024.

(5)Reflects actual maintenance capital expenditures for the periods presented. Maintenance capital expenditures are capital expenditures made to maintain the operating capacity of the Partnership’s assets and extend their useful lives, replace partially or fully depreciated assets, or other capital expenditures that are incurred in maintaining the Partnership’s existing business and related cash flow.

(6)Represents distributions to the holders of the Partnership’s common units as of the record date.

USA COMPRESSION PARTNERS, LP

FULL-YEAR 2024 ADJUSTED EBITDA AND DISTRIBUTABLE CASH FLOW GUIDANCE RANGE

RECONCILIATION TO NET INCOME

(Unaudited)

| | | | | |

| Guidance |

| Net income | $105.0 million to $125.0 million |

| Plus: Interest expense, net | 189.0 million to 186.0 million |

| Plus: Depreciation and amortization | 259.0 million to 262.0 million |

| Plus: Income tax expense | 2.0 million |

| EBITDA | $555.0 million to $575.0 million |

| Plus: Unit-based compensation expense and other (1) | 10.0 million |

| Plus: Loss on disposition of assets | 1.0 million |

| Plus: Loss on extinguishment of debt | 5.0 million |

| Less: Gain on derivative instrument | 6.0 million |

| Adjusted EBITDA | $565.0 million to $585.0 million |

| Less: Cash interest expense | 181.0 million to 178.0 million |

| Less: Current income tax expense | 1.0 million |

| Less: Maintenance capital expenditures | 27.0 million to 30.0 million |

| Less: Distributions on Preferred Units | 18.0 million |

| Plus: Cash received on derivative instrument | 7.0 million |

| Distributable Cash Flow | $345.0 million to $365.0 million |

____________________________________

(1)Unit-based compensation expense is based on the Partnership’s closing per unit price of $22.92 on September 30, 2024.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

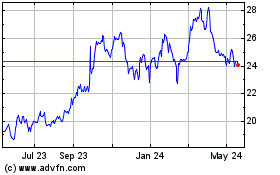

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Dec 2024 to Jan 2025

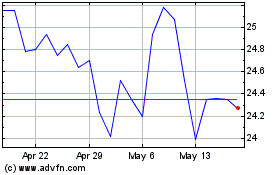

USA Compression Partners (NYSE:USAC)

Historical Stock Chart

From Jan 2024 to Jan 2025