0001739566FALSE00017395662025-01-062025-01-060001739566dei:FormerAddressMember2025-01-062025-01-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): January 6, 2025

Utz Brands, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38686 | | 85-2751850 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

900 High Street

Hanover, PA 17331

(Address of principal executive offices, including zip code)

Registrant’s telephone number, including area code: (717) 637-6644

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, par value $0.0001 per share | | UTZ | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 7, 2025, Utz Brands, Inc. (the “Company” or “Utz”) announced changes to its Executive Leadership Team, that were made effective on January 6, 2025 (the “Effective Date”). Following discussions initiated by Cary Devore, the Company’s current Executive Vice President and Chief Transformation and Operating Officer, Mr. Devore will assume a newly created role as the Company’s Head of Capital Markets and M&A. Mr. Devore will continue to report directly to Howard Friedman, Chief Executive Officer.

With this change, effective as of the Effective Date, the Company will consolidate the Transformation Office and the Integrated Business Planning under Mitch Arends, the Company’s Chief Integrated Supply Chain Officer, and Mr. Arends will assume the position as the Company’s Principal Operating Officer. Through this consolidation, the Company expects to continue to help drive revenue growth, productivity, and operational excellence. Mr. Arends’s compensation will remain unchanged as of the Effective Date. Additional information regarding Mr. Arends’s age, background and experience are disclosed under “Executive Officers of Utz Brands, Inc.” in the Company’s definitive proxy statement filed with the Securities and Exchange Commission on March 14, 2024.

Following these changes, Mr. Devore’s annual base salary will decrease as of the Effective Date to $100,000 per calendar year, subject to standard payroll practices of the Company. Mr. Devore will also be eligible for a short term incentive bonus program tied to specific M&A outcomes, and also the Company’s other compensation and employee benefit plans described in the Proxy Statement, as the same may be adjusted from time-to-time.

Forward-Looking Statements

This current report on Form 8-K includes certain statements made herein that are not historical facts but are “forward-looking statements” within the meaning of the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, as amended. The forward-looking statements generally are accompanied by or include, without limitation, statements such as “will”, “expect”, “intends”, “goal”, “on track” or other similar words, phrases or expressions. These forward-looking statements include statements related to the Company’s expectations to expand revenue, improve productivity and drive operational excellence, and other statements that are not historical facts.

These statements are based on the current expectations of the Company’s management and are not predictions of actual performance. These statements are subject to a number of risks and uncertainties and the Company’s business and actual results may differ materially. Some factors that could cause actual results to differ include, without limitation: the risk that the Company’s gross profit margins may be adversely impacted by a variety of factors, including variations in pricing of raw materials, retail customer requirements and mix, sales velocities, and required promotional support; changes in consumers’ loyalty to the Company’s brands due to factors beyond the Company’s control, including changes in consumer spending due to factors such as increasing household debt; changes in demand for the Company’s products affected by changes in consumer preferences and tastes or if the Company is unable to innovate or market its products effectively, particularly in the Company’s “expansion geographies”; costs associated with building brand loyalty and interest in the Company’s products which may be affected by actions by the Company’s competitors that result in the Company’s products not being suitably differentiated from the products of their competitors; consolidation of key suppliers of the Company; any inability of the Company to adopt efficiencies into its manufacturing processes, including automation and labor optimization, its network, including through plant consolidation and lowest landed cost for shipping its products, or its logistics operations; fluctuations in results of operations of the Company from quarter to quarter because of changes in promotional activities; the possibility that the Company may be adversely affected by other economic, business, or competitive factors; the risk that recently completed business combinations and other acquisitions recently completed by the Company or dispositions disrupt plans and operations; the ability of the Company to recognize the anticipated benefits of such business combinations, acquisitions, or dispositions, which may be affected by, among other things, competition and the ability of the Company to grow and manage growth profitably and retain its key employees; the outcome of any legal proceedings that may be instituted against the Company following the consummation of such business combinations, acquisitions, or dispositions; changes in applicable law or regulations; costs related to any planned business combinations, acquisitions, or dispositions; the ability of the Company to develop and maintain effective

internal controls; and other risks and uncertainties set forth in the section entitled “Risk Factors” and “Forward-Looking Statements” in the Company’s Annual Report on Form 10-K filed with the Commission for the fiscal year ended December 31, 2023, and other reports filed by the Company with the Commission. Forward-looking statements provide the Company’s expectations, plans or forecasts of future events and views as of the date of this communication. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this communication. The Company cautions investors not to place undue reliance upon any forward-looking statements, which speak only as of the date made. The Company does not undertake or accept any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions, or circumstances on which any such statement is based, except as otherwise required by law.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Utz Brands, Inc.

Dated: January 7, 2025

By: /s/ Ajay Kataria

Name: Ajay Kataria

Title: Executive Vice President,

Chief Financial Officer and Chief Accounting Officer

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

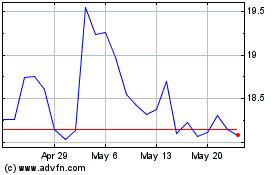

Utz Brands (NYSE:UTZ)

Historical Stock Chart

From Jan 2025 to Feb 2025

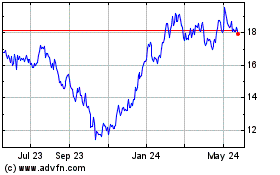

Utz Brands (NYSE:UTZ)

Historical Stock Chart

From Feb 2024 to Feb 2025