0001825079false00018250792024-09-122024-09-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 12, 2024

Velo3D, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-39757 |

|

98-1556965 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

|

2710 Lakeview Court, |

|

|

Fremont, |

California |

|

94538 |

(Address of principal executive offices) |

|

(Zip Code) |

(408) 610-3915

Registrant’s telephone number, including area code

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

N/A |

|

N/A |

|

N/A |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 12, 2024, Velo3D, Inc. (the “Company”) entered into an Intellectual Property License and Support Services Agreement (the “Agreement”) with Space Exploration Technologies Corp. (“SPACEX”) granting SpaceX a non-exclusive license to the Company’s additive manufacturing technologies. In consideration for the license, SPACEX has agreed to pay the Company a license fee of $5,000,000 in the aggregate payable in two tranches as follows: (a) $2,500,000 to be paid within three business days of the Company initiating delivery of the technologies; and (b) $2,500,000 to be paid within three business days following completion by the Company of delivery of the technologies. Further, for the provision of certain related engineering and other support services by the Company under the Agreement, SPACEX will pay the Company $3,000,000 in the aggregate, which amount will be invoiced by the Company in arrears, based on actual services provided to SPACEX. The Agreement is effective until terminated in accordance with its terms as provided in the Agreement. This summary of the Agreement is qualified in its entirety by reference to the full text of the Agreement, which is attached hereto as Exhibit 10.1 and incorporated by reference herein.

In connection with its entry into the Agreement, the Company also entered into a Limited Consent with the note holders (collectively, the “Note Holders”). The Note Holders hold a series of notes of the Company in the aggregate principal amount of $28,416,667 (the “Notes”). As required by the terms of the Notes, under the Limited Consent, the Note Holders consented to the Company’s entry into the Agreement upon the condition that the Company must utilize 50% of the fees received by the Company under the Agreement to redeem outstanding principal and accrued but unpaid interest under the Notes. This summary of the Limited Consent is qualified in its entirety by reference to the full text of the Limited Consent, which is attached hereto as Exhibit 10.2 and incorporated by reference herein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

|

|

|

Exhibit Number |

|

Description |

10.1 |

|

License and Support Services Agreement, effective September 12, 2024, by and among Space Exploration Technologies Corp., Velo3D, Inc. and Velo3D US, Inc. |

10.2 |

|

Limited Consent dated September 12, 2024 by and between Velo3D, Inc., Note Holders, and U.S. Bank Trust Company, National Association |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Velo3D, Inc. |

|

|

|

|

|

Date: |

September 13, 2024 |

|

By: |

/s/ Bradley Kreger |

|

|

|

Name: |

Bradley Kreger |

|

|

|

Title: |

Chief Executive Officer |

SPACEX - VELO3D License and Support Services Agreement

_____________________________________________________________________________________

This Intellectual Property License and Support Services Agreement (the “Agreement”) is entered into as of the last date of signature below (the “Effective Date”) by and among Space Exploration Technologies Corp., a Texas Corporation with its principal place of business at 1 Rocket Road, Hawthorne, California 90250 (“SPACEX”), Velo3D, Inc., a Delaware corporation (“Parent”) and Velo3D US, Inc., a Delaware corporation and a wholly owned subsidiary of Parent (together with Parent, “VELO3D”), each with a principal place of business at 2710 Lakeview Court, Fremont, CA 94358 (each of SPACEX and VELO3D, is a “Party” and together “Parties”), and, solely for purposes of Section 11, High Trail Investments ON LLC and HB SPV I Master Sub LLC solely in their capacities as holders of the Notes (in such capacities, together, the “Required Holders”).

1.Definitions. For the purposes of this Agreement, the following definitions shall apply:

1.1.“Business” means SpaceX’s business of designing, manufacturing and launching advanced rockets and spacecraft.

1.2.“Control” by a party means (a) with respect to IP, the possession of the ability to assign or grant a license or sublicense of such IP without violating the terms of any agreement or arrangement between such party and any third party and (b) with respect to information, materials or technology, the possession by such party of the ability to supply such information, materials or technology to the other party as provided herein without violating the terms of any agreement or arrangement between such party and any third party.

1.3.“Improvements” means any enhancements, corrections, improvements, modified versions, or derivative works of VELO3D Technology and the Intellectual Property embodied therein, in part or in whole.

1.4. “Intellectual Property” or “IP” means any or all of the following and all rights in, arising out of, or associated therewith: (a) all United States and foreign patents and applications therefore and all reissues, divisions, renewals, extensions, provisionals, continuations and continuations-in-part thereof; (b) all inventions (whether patentable or not), invention disclosures, improvements, trade secrets, proprietary information, know how, technology, algorithms, techniques, methods, devices, data, and all documentation embodying or evidencing any of the foregoing; (c) all copyrights, copyright registrations and applications therefore, software, and all materials that are or may be subject to protection under copyright laws; (d) all so-called “moral rights” or “droit moral” and (e) any similar, corresponding, or equivalent rights to any of the foregoing anywhere in the world.

1.5.“Notes” means, collectively, the Senior Secured Note due 2026, Certificate No. A-1, issued on November 28, 2023, in the original principal amount of $23,000,000.00, the Senior Secured Note due 2026, Certificate No. A-2, issued on November 28, 2023, in the original principal amount of $34,500,000.00, the Senior Secured Convertible Note due 2026, Certificate No. B-1, issued on August 29, 2024, in the original principal amount of

$200,000.00, and the Senior Secured Convertible Note due 2026, Certificate No. B-2, issued on August 29, 2024, in the original principal amount of $300,000.00, which are held by the Required Holders.

1.6.“Note Security Documents” means, collectively, the Notes, that certain Securities Exchange Agreement, dated as of November 27, 2023, by and among Parent, the Required Holders and U.S. Bank Trust Company, National Association (the “Trustee”), the Second Supplemental Indenture, dated as of November 28, 2023, by and between the Trustee and Parent, and all certificates, filings, security, debt or other documents issued under, or delivered pursuant to, any of the foregoing.

1.7.“Proprietary Information” means VELO3D’s information embodying trade secrets or is technical, scientific, commercial or financial information that is privileged or confidential and any other information disclosed, provided or made accessible to SPACEX or its representatives by or on behalf of VELO3D under this Agreement that is marked or otherwise designated as confidential at the time of disclosure or in a follow-up writing or that is information a reasonable person would recognize from the surrounding facts and circumstances to be proprietary or confidential to VELO3D.

1.8.“Services” means the engineering support and other services described in Addendum A.

1.9.“VELO3D Technology” means the specific technology, materials and information identified in Addendum A attached hereto and the Intellectual Property embodied in such technology, materials and information that is Controlled by VELO3D as of the Effective Date.

2.License to the VELO3D Technology.

2.1.Subject to the terms and conditions of this Agreement, and in addition to any rights provided under other contracts or agreements between the Parties, as of the Effective Date, VELO3D grants SPACEX a worldwide, non-exclusive, royalty-free, perpetual, irrevocable, non-transferable (except as provided in Section 12.4), non-sublicensable (except as provided in Section 2.4) license under its IP rights in the Velo3D Technology to make, have made, use, import, export, copy, reproduce, create derivative works of, integrate, modify, distribute internally and otherwise develop the VELO3D Technology, in existence as of the Effective Date, and any Improvements thereto made by VELO3D within 12 months after the Effective Date, in each case, solely for the internal operations of SPACEX for the Business.

2.2.Except for the express licenses granted in Section 2.1 (the “License”), no other licenses are granted by VELO3D by implication, estoppel, or otherwise, and all rights not expressly granted herein are reserved by VELO3D.

2.3.All Intellectual Property embodied in the VELO3D Technology, including any Improvements made by VELO3D, is and shall remain the sole and exclusive property of VELO3D. VELO3D shall periodically and upon request inform SPACEX of any Improvements to the VELO3D Technology made by VELO3D within 12 months after the

Effective Date and provide any information reasonably necessary for SPACEX to benefit from its license rights to such Improvements hereunder.

2.4.SPACEX has the right to grant sublicenses under the License solely (a) to affiliates and third parties that are not VELO3D Competitors and (b) to permit such affiliates and third parties to provide services to SPACEX relating to the exercise of its rights under the License. “VELO3D Competitors” means any company primarily engaged in, or with a division or business line primarily engaged in, the business of the development, manufacture, use or sale of metal additive 3D printers. For the avoidance of doubt, SPACEX may not grant sublicences under the License that purport to grant any sublicensee rights to use the VELO3D Technology for any purpose other than in furtherance of the internal operations of SPACEX for the Business. SPACEX assumes full responsibility for the performance of all obligations and observance of all terms of this Agreement by any SPACEX sublicensee.

2.5.SPACEX shall have the right to make Improvements to the VELO3D Technology (and any corresponding licensed software) to the extent permitted under the License at SPACEX’s sole cost and expense without the prior written consent of Parent. All such Improvements made by SPACEX shall be owned entirely by SPACEX. SPACEX shall have no obligation to provide VELO3D with any source code, executable copy or documentation comprising any such Improvement. VELO3D shall give SPACEX all assistance reasonably required to perfect such rights to any such Improvements made by SPACEX, at SPACEX’s expense.

2.6.On or promptly following the Effective Date (and in any case within ten days following the Effective Date), VELO3D will deliver copies of all instances of the VELO3D Technology contemplated by the License, and any other information reasonably necessary to ensure that SPACEX is able to receive the full benefit of the License.

2.7.VELO3D represents and warrants that, to the best of its knowledge, it has provided SPACEX with a list of, and copies of all material agreements with, each third-party supplier or vendor that is material to the production or development of the VELO3D Technology, excluding any generally available commercial off-the-shelf software or services.

3.License Fee; Support Fee.

3.1.In consideration for the License, and subject to the terms of this Agreement, SPACEX shall pay to Parent an aggregate amount equal to $5,000,000 (the “License Fee”), which amount will be payable in two equal tranches of $2,500,000 each as described below: (a) first, within 3 business days following the date that VELO3D has initiated the delivery of Velo3D Technology set forth on Addendum A, and (b) within 3 business days following the date that VELO3D certifies in writing to SPACE X that it has complied with its obligations to deliver the items listed on Addendum A.

3.2.In consideration for VELO3D’s provision of the Services, SPACEX shall pay to Parent an aggregate amount equal to $3,000,000 (the “Services Fee”, and, together with the

License Fee, collectively, the “Fees”), which amount will be invoiced in arrears, based on actual Services provided, every two weeks by VELO3D for the pro rata portion of the Services performed during such two-week period, which invoiced amounts will be payable within 3 business days following the receipt of invoice. Upon the earlier of the date that VELO3D shall have completed performance of the Services or the date that is three months from the Effective Date (the “Service Target Date”), VELO3D will invoice SPACEX for any remaining unpaid portion of the Services Fee, and such invoiced amount will be payable within 3 business days following the receipt of invoice. For the avoidance of doubt, in the event that SPACEX has not received all of the Services by the Service Target Date, VELO3D will continue to provide the Services in accordance with Addendum A until completed or this Agreement is otherwise terminated in accordance with its terms, it being acknowledged, however, that (a) the Services Fee will, nonetheless, be payable as described above, and (b) SPACEX will not be obligated to pay any fees or expenses for such remaining Services in excess of the Services Fee.

3.3.For all payments of Fees contemplated herein, Parent shall invoice SPACEX, and SPACEX shall submit a wire transfer to the account identified in advance by VELO3D.

3.4.The Fees contemplated herein exclude any taxes that relate to or arise from a transaction hereunder, including sales, use, and value added taxes. As between the Parties, VELO3D is solely responsible for all such taxes. VELO3D agrees to provide SPACEX with information or certificates (including an IRS Form W-9) it may reasonably request in order for SPACEX to comply with any withholding obligations.

3.5.For clarity, in consideration of, and as a material inducement to, SPACEX entering into this Agreement and agreeing to pay the License Fee in accordance with the terms hereof, the License shall continue in perpetuity except as otherwise provided in Section 4.2.

3.6.In the event that VELO3D breaches its obligations hereunder, SPACEX may, at its election, withhold payment of any applicable portion of the Fees that were not paid as of the time of such breach until VELO3D has cured the breach.

3.7.Notwithstanding anything herein to the contrary, SPACEX shall not be required to pay any fees hereunder until and unless it has received evidence that this Agreement and the transactions contemplated hereby have been affirmatively consented to by the Trustee.

4.1.This Agreement is effective from the Effective Date and continues until terminated in accordance with the terms of this Agreement.

4.2.Parent may terminate this Agreement immediately upon written notice to SPACEX in the event of (a) any material misappropriation or infringement of VELO3D IP or material use of the VELO3D Technology other than as strictly permitted under the License or (b) any other uncured material breach by SPACEX of this Agreement of which, in the case of each of the foregoing clauses (a) and (b) SPACEX has been notified by Parent in writing and has not cured within 30 days of said notification. SPACEX may terminate this Agreement (i) in the event of any uncured material breach by VELO3D of this Agreement

of which VELO3D has been notified by SPACEX in writing and has not cured within 30 days of said notification or (ii) at any time after payment by SPACEX in full of all Fees due hereunder by providing written notice to Parent.

4.3.In the event this Agreement is terminated in accordance with Section 4.2 for SPACEX’s failure to pay the License Fee, the License and any other rights granted to SPACEX, including SPACEX’s right to retain the VELO3D Technology and VELO3D’s obligation to perform any Services shall automatically terminate. Other than the foregoing, no termination of any kind pursuant to this Section 4 or otherwise shall affect SPACEX’s right to retain the VELO3D Technology and the License forever and, if SPACEX breaches its obligations to VELO3D, VELO3D’s sole remedy is a claim of money damages at law, and VELO3D shall have no right to terminate the License. Notwithstanding the foregoing, in the event that SPACEX breaches its obligation to pay the Services Fees and VELO3D terminates in accordance with Section 4.2, then VELO3D may terminate any then unperformed Services, in addition to seeking damages at law. In the event of termination for any reason, all definitions in this Agreement and any other terms of this Agreement that by their nature extend beyond its termination shall survive termination of this Agreement.

5.Bankruptcy. All rights and licenses granted by VELO3D to SPACEX under this Agreement are and will be deemed to be rights and licenses to “intellectual property” as such term is used in, and interpreted under, Section 365(n) of the United States Bankruptcy Code (the “Bankruptcy Code”) (11 U.S.C. § 365(n)). SPACEX, as licensee of such rights under this Agreement, shall retain and may fully exercise all rights, elections, and protections under the Bankruptcy Code and all other bankruptcy, insolvency, and similar laws with respect to the Agreement, and the subject matter hereof. Without limiting the generality of the foregoing, VELO3D acknowledges and agrees that, if VELO3D or its estate shall become subject to any bankruptcy or similar proceeding:

5.1.subject to SPACEX’s rights of election under Section 365(n) of the Bankruptcy Code, all rights, licenses, and privileges granted to SPACEX under this Agreement will continue subject to the respective terms and conditions hereof, and will not be affected, even by VELO3D’s (or any trustee’s) rejection of this Agreement; and

5.2.SPACEX shall be entitled to a complete duplicate of, or complete access to, as appropriate, all such intellectual property and embodiments of intellectual property subject to the License, which, if not already in SPACEX’s possession, shall be promptly delivered to SPACEX or its designee, unless VELO3D (or any trustee) elects to and does in fact continue to perform all of its obligations under this Agreement.

6.Maintenance and Support. VELO3D will perform the Services in accordance with Section 8.2. VELO3D will not have any obligation to provide to SPACEX or its sublicensees any other maintenance, support, or training, except as otherwise provided herein.

7.1.The terms of the Mutual Non-Disclosure Agreement executed between the applicable Parties on June 14, 2018 (the “NDA”) are incorporated by reference into this Agreement and, shall apply to the Proprietary Information of VELO3D which shall be considered the Confidential Information (as that term is defined in the NDA) of VELO3D, provided, however, that (a) the terms of this Agreement supersede any conflicting terms in the NDA (b) notwithstanding any termination of the NDA in accordance with its terms, the NDA as incorporated into this Agreement will continue to apply to this Agreement for its term and will survive expiration or termination of this Agreement, and (c) SPACEX acknowledges that VELO3D may be required to identify SPACEX and disclose all or a portion of the terms of this Agreement to comply with applicable laws or regulations or stock exchange requirements, and agrees that any such required disclosure will not be considered a public statement without SPACEX’s consent entitling SPACEX to liquidated damages as provided in the Breach and Remedies section of the NDA, so long as, to the extent practical and legally permitted, VELO3D provides SPACEX with a reasonable opportunity to comment on the portion of any such disclosure that references SPACEX and considers any reasonable comments in good faith. SPACEX acknowledges that the VELO3D Technology is the Proprietary Information of VELO3D and is disclosed to SPACEX for the sole purpose of SPACEX exercising its rights under the License. The terms of this Agreement are deemed the Confidential Information of the Parties.

7.2.Without limitation of any of the foregoing, SPACEX shall implement and maintain reasonable administrative, physical and technical safeguards to protect the security, integrity, and confidentiality of the VELO3D Proprietary Information that are at least the same or substantially the same as those safeguards that SPACEX implements with respect to its own information that is similar in nature to the Proprietary Information. SPACEX will promptly notify VELO3D, and cooperate with VELO3D as VELO3D may reasonably request, upon any discovery of any loss, unauthorized use or other compromise of Proprietary Information.

8.Representations and Warranties.

8.1.VELO3D represents and warrants that (i) to its knowledge, it owns or Controls all of the rights necessary for VELO3D to grant the License to SPACEX; (ii) it has the full power and authority to enter into and perform its obligations under this Agreement; and (iii) the VELO3D Technology in the form delivered by VELO3D to SPACEX shall not contain any computer viruses or other code designed or intended to disable the functionality of any software or system, or otherwise designed or intended to adversely affect the operation of any systems or data of SPACEX.

8.2.VELO3D shall exercise due skill, care and diligence in the performance of the Services and shall carry out its activities in a professional manner, using appropriately qualified, skilled and experienced personnel as can be reasonably expected given the scope, type, nature and complexity of the Services.

8.3.VELO3D, SPACEX, and the Required Holders each acknowledges and agrees that (a) this Agreement is being provided for good and valuable consideration, which consideration provided by each party is reasonably equivalent to the respective consideration such party

shall receive pursuant to this Agreement, and (b) neither VELO3D, the Required Holders, nor SPACEX is entering into this Agreement or the License with the intent to hinder, delay or defraud any person (including, but not limited to, any person to which VELO3D is, or may become, indebted).

8.4.EXCEPT AS EXPRESSLY SET FORTH HEREIN AND EXCEPT TO THE EXTENT PROHIBITED BY APPLICABLE LAW, THE VELO3D TECHNOLOGY AND THE SERVICES ARE PROVIDED AS IS WITHOUT WARRANTIES OF ANY KIND, AND VELO3D HEREBY DISCLAIMS AND EXCLUDES ALL REPRESENTATIONS, WARRANTIES AND CONDITIONS OF ANY KIND, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, THE IMPLIED WARRANTIES OF TITLE, NON-INFRINGEMENT, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE, AND ANY WARRANTIES IMPLIED BY ANY COURSE OF PERFORMANCE, USAGE OF TRADE, OR COURSE OF DEALING.

9.Limitations of Liability. Notwithstanding anything in this Agreement to the contrary, to the extent permitted by law:

9.1.Except for Excluded Liabilities (as defined below), neither Party shall be liable to the other for any incidental, punitive, indirect, special, exemplary or consequential damages or for loss of use or data or production or lost profits, savings or revenues of any kind arising under or in connection with this Agreement, under any theory of liability (whether in contract, tort or otherwise), even if such Party has been advised, or is aware, of the possibility of such damages.

9.2.Except for Excluded Liabilities, either Party’s total liability arising under or in connection with this Agreement for any kind of loss or damage, under any theory of liability (whether in contract, tort or otherwise), shall be limited to, in the aggregate to the total amount paid or payable by SPACEX to VELO3D under this Agreement.

9.3. The limitations and exclusions set forth in Sections 9.1 and 9.2 above shall not apply (a) in case of gross negligence or willful misconduct by a Party, (b) to the indemnification obligations under Section 10, (c) to liability for breach of Section 7 or the NDA, or (d) to misappropriation, infringement or violation by a party of the IP of the other party (collectively, “Excluded Liabilities”), and shall only apply to the extent permitted by applicable mandatory law.

10.1.VELO3D shall, at its expense, indemnify and defend SPACEX and its current and future affiliates and their respective equity holders, directors, officers, affiliates, employees, agents, advisors, and representatives, and the successors and assigns of each of the foregoing (each, a “SPACEX Indemnitee”) against a claim or action brought by a third party to the extent that such claim or action is based on an assertion that any VELO3D Technology or Services provided under this Agreement infringes or misappropriates any patent, copyright, trade secret or other intellectual property right of a third party. VELO3D shall indemnify SPACEX Indemnitees against and pay any costs and damages incurred

by any SPACEX Indemnitee as a result of such a claim or action, provided that (a) such SPACEX Indemnitee promptly notifies Parent in writing of any such claim or action, (b) VELO3D has sole control of the defense and settlement of the claim or action, and (c) such SPACEX Indemnitee reasonably cooperates in the defense at VELO3D’s expense. Each SPACEX Indemnitee will be entitled to participate in the defense of such claim or action and to employ counsel at its own expense. If SPACEX’s use of any licensed VELO3D Technology is enjoined as a result of any such claim or action, VELO3D shall use its commercially reasonable efforts to either: (a) procure the right to allow the continued use of the licensed VELO3D Technology as licensed hereunder; or (b) modify or replace the affected licensed VELO3D technology so that it no longer infringes but contains substantially the same or better functionality.

10.2.VELO3D shall have no indemnification obligation for any infringement to the extent relating to, or arising or resulting from (i) modifications by SPACEX where the infringement claim or action would have been avoided but for such modification; (ii) the VELO3D Technology being used by SPACEX in combination with any other products, devices, equipment, designs or other items or technology where the infringement claim or action would have been avoided but for such combination; or (iii) the failure to use modified or substitute non-infringing VELO3D Technology, to the extent provided by VELO3D. This Section 10.2 and Section 10.1 set forth SPACEX’s sole remedies and VELO3D’s sole liability and obligation for any claims that the Services or the VELO3D Technology infringe, misappropriate or otherwise violate any third party intellectual property rights.

11.Noteholder Consent. As condition of, and a material inducement to, SPACEX’s entry into this Agreement, VELO3D and the Required Holders agree, notwithstanding anything to the contrary set forth in the Notes or any other Note Security Document, as follows, subject to SPACEX’s satisfaction of its obligation to pay the Fees as required by this Agreement.

11.1.The Required Holders hereby consent to this Agreement and the transactions contemplated hereby, including the License and VELO3D’s provision of the Services and acknowledge that neither the execution nor performance of this Agreement, including the License and VELO3D’s provision of the Services, constitutes an Event of Default (or analogous term) under any Note Security Document.

11.2.The Required Holders hereby consent to SPACEX exercising rights pursuant to section 365(n) of the Bankruptcy Code in accordance with Section 5 hereof.

11.3.For the avoidance of doubt, no failure of VELO3D to comply with the provisions of this Section 11, will limit or otherwise affect the consent granted by the Required Holders pursuant to Section 11.1, which shall be deemed to be irrevocably given as of the Effective Date.

12.1.Export controls. Each Party acknowledges that VELO3D Technology is subject to international trade controls, including but not limited to the International Traffic in

Arms Regulations (ITAR) (22 C.F.R. §§ 120-130); the Export Administration Regulations (EAR) (15 C.F.R. §§ 730-774); and economic sanctions laws and regulations, including those administered by the U.S. Department of the Treasury, Office of Foreign Assets Control (OFAC) and the U.S. Department of State. Without first obtaining any required U.S. or other governmental licenses and approvals, each Party agrees to comply with all applicable international trade controls, including not shipping, transferring, discussing, disclosing, disseminating, or otherwise providing access to any location outside the United States or any entity, group, or organization incorporated outside the United States, or any person who is not a US citizen, US green card holder, been granted asylum under 8 USC § 1158, or granted protected refugee status under 8 USC § 1157 (“Foreign Person”). In connection with any request to sublicense under this Agreement, SPACEX agrees to identify whether any proposed sublicensee is a Foreign Person. Each Party agrees to indemnify and hold the other Party harmless from all losses, claims, demands, damages, costs, fines, fees, and all other reasonable expenses incurred by the indemnified Party, including, but not limited to, attorneys’ fees, resulting from failure to comply with this section.

12.2.Governing Law/Jurisdiction. The laws of the State of California, U.S.A shall govern this Agreement and the Parties’ and the Required Holders’ respective performances hereunder, without regard to provisions on the conflicts of laws. The provisions of the UN Convention on Contracts for the International Sale of Goods shall not apply.

12.3.Disputes. If a dispute arises from or relates to this contract or the breach thereof, and if the dispute cannot be settled through direct discussions, the Parties agree that except for disputes related to infringement or misappropriation of VELO3D’s Intellectual Property or Proprietary Information, or breaches by either party of the NDA, any unresolved controversy or claim arising out of or relating to this contract, or breach thereof, shall be settled by arbitration administered by the American Arbitration Association (AAA) in accordance with its Commercial Arbitration Rules and judgment on the award rendered by the arbitrator(s) may be entered in any court having jurisdiction thereof. The dispute will be decided by a single neutral arbitrator to be mutually agreed upon by the parties from AAA’s panel of arbitrators.

12.3.1.Except as may be required by law, neither Party nor an arbitrator may disclose the existence, content, or results of any arbitration hereunder without the prior written consent of the Parties.

12.3.2.Nothing in this provision will be construed to prohibit either party from applying to a court of competent jurisdiction for a temporary restraining order, a preliminary injunction, or other equitable relief to preserve the status quo or prevent irreparable harm.

12.3.3.All disputes related to infringement or misappropriation of VELO3D’s Intellectual Property or Proprietary Information, use of the VELO3D Technology outside of the scope of the License, ownership of Improvements, or breaches by either party of the

NDA or Section 7 hereof shall be litigated exclusively in the Federal courts located in the Central District of California.

12.4.Assignment. No party hereto may assign any of its rights or obligations hereunder without the other party’s prior written consent, provided that either party may assign all of its rights and obligations hereunder without such consent to a successor-in-interest in connection with a sale of substantially all of such party’s business or assets relating to this Agreement (except in the case of SPACEX to a VELO3D Competitor, which will require VELO3D’s prior written consent which may be withheld in VELO3D’s discretion). Notwithstanding the foregoing, SPACEX may assign this Agreement, in whole or in part, without notice to VELO3D to any entity that controls, is controlled by, or is under common control with, SPACEX, or any entity that is a successor in a spinoff of SPACEX or otherwise in an internal corporate reorganization (provided the entity to which this Agreement is assigned is not a VELO3D Competitor).

12.5.Invalidity. If any provision in this Agreement is or becomes, at any time and for any reason, invalid or unenforceable, the validity or enforceability of any other provision of this Agreement shall not be affected, and such invalid or unenforceable provision shall be changed and interpreted so as to best accomplish the objective of such provision within the limits of applicable law or applicable court decision.

12.6.Notices. Any demands, notices, communications and reports to be given under this Agreement shall be in writing and shall be either personally delivered, sent by reputable overnight courier services (delivery charges prepaid), or sent by registered or certified mail, postage prepaid and return receipt requested, to any Party at the address and to the attention indicated below (and any such demand, notice, communication or report shall be deemed to have been given pursuant to this Agreement when received or tendered for delivery):

|

|

If to VELO3D: Velo3D, Inc. Attn : Chief Financial Officer 2710 Lakeview Ct. Fremont, CA 94538 |

If to SPACEX: Space Exploration Technologies Corp. Attn: Chief Financial Officer 1 Rocket Road Hawthorne, CA 90250 |

With copy to: Attn : Legal 2710 Lakeview Ct. Fremont, CA 94538 |

With copy to: Attn: Legal 1155 F Street NW Suite 475 Washington, DC 20004 USA |

Each Party may change its designated notice contact person and/or address by written notice given to the other Party in the manner as set forth above. Any notices delivered hereunder to the Required Holders shall be delivered in the manner and to the recipients prescribed by the Notes.

12.7.Amendment and Waiver. No amendment to this Agreement shall be effective unless it is in writing signed by a duly authorized representative of both Parties and the

Required Holders. The waiver of any breach or default shall not constitute a waiver of any other right hereunder.

12.8.Validity and Enforceability. If any term or other provision of this Agreement is invalid, illegal, or incapable of being enforced by any rule of law or public policy, all other conditions and provisions of this Agreement shall nevertheless remain in full force and effect so long as the economic or legal substance of the transactions contemplated hereby is not affected in any manner adverse to any Party. Upon such determination that any term or other provision is invalid, illegal, or incapable of being enforced, the Parties shall negotiate in good faith to modify this Agreement so as to effect the original intent of the Parties as closely as possible in a mutually acceptable manner in order that the transactions contemplated hereby be consummated as originally contemplated to the fullest extent possible.

12.9.Further Assurances. Each Party agrees to do and perform all such further acts and things and shall execute and deliver such other agreements, certificates, instruments and documents necessary or that the other Party may reasonably deem advisable in order to carry out the intent and accomplish the purposes of this Agreement and to evidence, perfect or otherwise confirm its rights hereunder.

12.10.Counterparts. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original with the same force and effect as if fully and simultaneously executed in a singular original document, but all of which shall constitute one and the same Agreement, and any signature evidenced by facsimile transmission or electronic transmission shall be accepted as an original signature.

12.11.Entire Agreement. This Agreement, together with all Addendums and any other documents incorporated herein by reference, constitutes the sole and entire agreement of the parties to this Agreement with respect to the subject matter contained herein, and supersedes all prior and contemporaneous understandings and agreements, both written and oral, with respect to such subject matter. In the event of any conflict between the terms and provisions of this Agreement and any other agreement between the parties hereto, the terms and provisions of this Agreement shall govern.

Signature page follows.

In Witness Whereof, the parties hereto have caused this Agreement to be duly executed and become effective on the last date executed by us as indicated below

|

|

Space Exploration Technologies Corp. By: Name: Title: Dated: |

VELO3D, INC. By: Name: Title: Dated: VELO3D US, INC. By: Name: Title: Dated: |

|

|

|

High Trail Investments ON LLC By: Name: Title: Dated: |

HB SPV I Master Sub LLC By: Name: Title: Dated: |

LIMITED CONSENT

This LIMITED CONSENT, dated as of September 12, 2024 (this “Agreement”), is entered into by and between Velo3D, Inc., a Delaware corporation (the “Company”), High Trail Investments ON LLC (“Holder 1”), HB SPV I Master Sub LLC (“Holder 2” and, together with Holder 1, the “Note Holders”), constituting the Required Holders (as defined in each of the Notes referred to below), and U.S. Bank Trust Company, National Association, as trustee (the “Trustee”).

PRELIMINARY STATEMENTS:

WHEREAS, the Company and the Note Holders are parties to that certain Securities Exchange Agreement, dated as of November 27, 2023 (the “Securities Exchange Agreement”), pursuant to which the Company issued (a) Senior Secured Note due 2026, Certificate No. A-1, on November 28, 2023 in the principal amount of $23,000,000.00 (“Note A-1”), (b) Senior Secured Note due 2026, Certificate No. A-2, on November 28, 2023 in the principal amount of $34,500,000.00 (“Note A-2”), (c) Senior Secured Convertible Note due 2026, Certificate No. B-1, on August 29, 2024 in the amount of 120% of the principal sum of $200,000 (“Note B-1”) and (d) Senior Secured Convertible Note due 2026, Certificate No. B-1, on August 29, 2024 in the amount of 120% of the principal sum of $300,000 (“Note B-2”); and

WHEREAS, Note A-1, Note A-2, Note B-1 and Note B-2were issued also pursuant to that certain Indenture and Supplemental Indenture, each dated as of August 14, 2023 (collectively, the “Base Indenture”), by and between the Company and the Trustee, as amended and supplemented by the Second Supplemental Indenture, dated as of November 28, 2023 and the Third Supplemental Indenture, dated as of August 14, 2023 (collectively, “Supplemental Indentures” and, the Base Indenture as amended and supplemented by the Supplemental Indentures, the “Indenture”), by and between the Company and the Trustee; and

WHEREAS, the Company and the Note Holders are parties to certain Note Amendments, dated as of December 27, 2023, March 31, 2024 and July 1, 2024 (the “Prior Note Amendments”), pursuant to which Note A-1 and Note A-2, were amended (as amended by the Prior Note Amendments, collectively, together with Note B-1 and Note B-2, the “Notes”); and

WHEREAS, the Notes represent 100% of the outstanding Senior Secured Notes due 2026 issued under the Indenture as of the date hereof and 100% of the Senior Secured Convertible Notes due 2026; and

WHEREAS, the Company and the Note Holders are also parties to that certain Securities Purchase Agreement, dated as of August 10, 2023 (as amended, the “Securities Purchase Agreement”); and

WHEREAS, the Company intends on entering into that certain Intellectual Property License and Support Services Agreement, dated as of the date hereof, by and between Space Exploration Technologies Corp., a Texas Corporation, the Company and Velo3D US, Inc., a Delaware corporation and a wholly owned subsidiary of the Company, and consented to by the Required Holders in the form attached hereto as Exhibit A (the “SpaceX Licensing Agreement”); and

WHEREAS, pursuant to the Notes (including, without limitation, Sections 7(H) and 17 of the Senior Secured Notes due 2026 and Sections 8(H) and 18 of the Senior Secured Convertible Notes due 2026), the Company is required to obtain prior written consent of the Trustee and Required Holders to enter into the SpaceX Licensing Agreement; and

NOW THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, each party to this Agreement agrees, as follows:

1.01.Definitions. Unless otherwise defined herein or the context otherwise requires, terms used in this Agreement, including its preamble and recitals, have the meanings provided in the Notes.

ARTICLE II

REPRESENTATIONS AND WARRANTIES

In order to induce the Note Holders and the Trustee to enter into this Agreement, the Company hereby represents and warrants that on and as of the date hereof after giving effect to this Agreement:

2.01.No Default. No Default has occurred and is continuing and no Event of Default has occurred or resulted from the consummation of the transactions contemplated by this Agreement and the Company hereby acknowledges and agrees that it is not aware of any prospective Event of Default.

2.02.Binding Effect of Documents. The Company hereby represents, warrants, and covenants that this Agreement has been duly authorized, executed, and delivered to the Required Note Holders by the Company, are enforceable in accordance with their terms, and are in full force and effect, except as enforceability may be limited by applicable equitable principles or by bankruptcy, insolvency, reorganization, moratorium or other similar laws affecting creditors’ rights generally.

ARTICLE III

LIMITED CONSENT

3.01.Limited Consent. Notwithstanding anything to the contrary set forth in the Notes, the Indenture, the Securities Exchange Agreement and the Securities Purchase Agreement, subject to the terms and conditions hereof, including Section 3.02 hereof, the Trustee (at the direction of the Required Holders of each series of Notes) and Required Holders of each series of Notes each hereby consent to SpaceX Licensing Agreement. The foregoing consent is expressly limited to the SpaceX Licensing Agreement.

3.02.Use of Proceeds From SpaceX Licensing Agreement. As a condition to the limited consent contained in Section 3.01, the Company agrees that it shall, promptly following receipt thereof (but in no event greater than one (1) Business Day after receipt thereof), utilize at least fifty percent (50%) of all Fees (as defined in the SpaceX Licensing Agreement) received by the Company under the SpaceX Licensing Agreement to redeem outstanding principal and accrued

but unpaid interest thereon under the Notes issued by the Company to the Holders, to be applied ratably to the Notes of each series and ratably among the Holders of such series. The Company shall deliver to the Trustee a written notice of any such redemption, including the applicable amount of the such redemption payment, within two (2) Business Days after the applicable redemption date (or such later date agreed to by the Trustee, which agreement may be made in e-mail).

4.01.Section Captions. Section captions used in this Agreement are for convenience

of reference only, and shall not affect the construction of this Agreement.

4.02.Counterparts. This Agreement may be executed by one or more of the parties hereto on any number of separate counterparts, and all of said counterparts taken together shall be deemed to constitute one and the same instrument. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Agreement and/or any document to be signed in connection with this Agreement and the transactions contemplated hereby shall be deemed to include Electronic Signatures (as defined below), electronic deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be. As used herein, “Electronic Signatures” means any electronic symbol or process attached to, or associated with, any contract or other record and adopted by a person with the intent to sign, authenticate or accept such contract or record. A party’s electronic signature (complying with the New York Electronic Signatures and Records Act (N.Y. State Tech. §§ 301-309), as amended from time to time, or other applicable law) of this Agreement shall have the same validity and effect as a signature affixed by the party’s hand.

4.03.Governing Law. All questions concerning the construction, validity, enforcement and interpretation of this Agreement shall be governed by the internal laws of the State of Delaware, without giving effect to any choice of law or conflict of law provision or rule (whether of the State of Delaware or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of Delaware. The Company and the Note Holders each hereby irrevocably submits to the exclusive jurisdiction of the Court of Chancery of the State of Delaware, for the adjudication of any dispute hereunder or in connection herewith or under any of the other Transaction Documents or with any transaction contemplated hereby or thereby, and hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not personally subject to the jurisdiction of such court, that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. Each party hereby irrevocably waives personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to such party at the address for such notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. Nothing contained herein shall be deemed or operate to preclude the Note Holders from bringing suit or taking other legal action against the Company in any other jurisdiction to collect on the Company’s obligations to the Note Holders or to enforce a judgment or other court ruling in favor of the Note Holders . EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE TO, AND

AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR UNDER ANY OTHER TRANSACTION DOCUMENT OR IN CONNECTION WITH OR ARISING OUT OF THE NOTES OR ANY OTHER TRANSACTION DOCUMENT OR ANY TRANSACTION CONTEMPLATED HEREBY OR THEREBY.

4.04.Concerning the Trustee. By their signatures hereto, each Holder (constituting 100% of the Holders of each series of Notes) hereby consents to the terms of this Agreement and directs the Trustee to execute and deliver this consent and to perform its obligations hereunder. The parties hereto acknowledge and agree that the rights, privileges and immunities of the Trustee set forth in the Indenture shall apply as though fully set forth herein. The Trustee shall have no obligation to monitor the terms of the Securities Purchase Agreement, the Prior Note Amendments or the SpaceX Licensing Agreement.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed by their respective officers thereunto duly authorized, as of the date first above written.

|

COMPANY: Velo3D, Inc. By: Name: Bradley Kreger Title: Chief Executive Officer |

|

[Signature Page to Limited Consent]

|

THE REQUIRED NOTE HOLDERS: HB SPV I Master Sub LLC By: Name: Title: |

High Trail Investments ON LLC By: Name: Title: |

* Hudson Bay Capital Management LP not individually, but solely as Investment Advisor to HB SPV I Master Sub LLC and High Trail Investments ON LLC

[Signature Page to Limited Consent]

TRUSTEE:

U.S. Bank Trust Company, National Association, as trustee

By:

Name:

Title:

Exhibit A

SpaceX Licensing Agreement

v3.24.2.u1

Cover

|

Sep. 12, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 12, 2024

|

| Entity Registrant Name |

Velo3D, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-39757

|

| Entity Tax Identification Number |

98-1556965

|

| Entity Address, Address Line One |

2710 Lakeview Court,

|

| Entity Address, City or Town |

Fremont,

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

94538

|

| City Area Code |

408

|

| Local Phone Number |

610-3915

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001825079

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

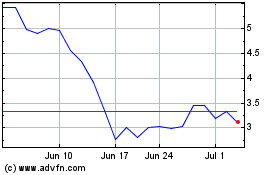

Velo3D (NYSE:VLD)

Historical Stock Chart

From Sep 2024 to Oct 2024

Velo3D (NYSE:VLD)

Historical Stock Chart

From Oct 2023 to Oct 2024