Net Sales of $74.2 Million Gross Margin

Increased 80 basis points vs. Q2 FY2023 Updates Full Year FY2024

Outlook

Vince Holding Corp. (NYSE: VNCE) ("VNCE" or the "Company"), a

global contemporary retailer, today reported its financial results

for the second quarter ended August 3, 2024.

David Stefko, Interim Chief Executive Officer of VNCE said, "We

are pleased with our second quarter results driven by strong

performance in our wholesale channel, ongoing focus on full price

selling and disciplined expense management of our core operating

cost structure which helped to partially offset the expected

headwinds from ongoing royalty expenses as well as the

re-establishment of our incentive compensation program. The

strength in our wholesale channel was driven in part by our ability

to fulfill demand earlier than expected and helped to offset softer

performance in our direct-to-consumer channel which was impacted by

store closures and our strategic decision to continue to pull back

on promotional activity. As we look ahead to the remainder of the

year, while we are taking a more prudent approach to our outlook

for direct-to-consumer sales as we continue to execute our strategy

amidst an increasingly uncertain macroeconomic backdrop, our

outlook for our wholesale channel remains unchanged and our

increased expectations for profitability underscore our commitment

to operating a stronger full price business model."

In this press release, the Company is presenting its financial

results in conformity with U.S. generally accepted accounting

principles ("GAAP") as well as on an "adjusted" basis. Adjusted

results presented in this press release are non-GAAP financial

measures. See "Non-GAAP Financial Measures" below for more

information about the Company's use of non-GAAP financial measures

and Exhibit 3 to this press release for a reconciliation of GAAP

measures to such non-GAAP measures.

For the second quarter ended August 3, 2024:

- Total Company net sales increased 6.8% to $74.2 million

compared to $69.4 million in the second quarter of fiscal 2023. The

year-over-year increase was driven by a 7.0% increase in Vince

brand sales due to a 29.6% increase in the wholesale channel driven

by earlier than expected shipments of fall product as well as the

normalization of the off-price business within the channel. The

growth in the wholesale channel more than offset the 18.1% decline

in the direct-to-consumer channel which continued to be impacted by

the reduction in promotional activity as well as store closures.

The prior year period Total Company net sales included $0.1 million

in Rebecca Taylor and Parker segment sales.

- Gross profit was $35.1 million, or 47.4% of net sales, compared

to gross profit of $32.3 million, or 46.6% of net sales, in the

second quarter of fiscal 2023. The increase in gross margin rate

was primarily driven by approximately 510 basis points related to

lower product costing and freight costs. These factors were

partially offset by approximately 220 basis points attributable to

channel mix, and approximately 180 basis points of royalty expenses

associated with the Licensing Agreement (as defined below).

- Selling, general, and administrative expenses were $34.0

million, or 45.8% of sales, compared to $31.5 million, or 45.4% of

sales, in the second quarter of fiscal 2023. The increase in

SG&A dollars was primarily driven by a $2.0 million increase in

rent and occupancy costs due to lease adjustments in the prior year

as well as $1.8 million in increased compensation and benefits due

primarily to higher severance and bonuses, and was partially offset

by $2.0 million of expense favorability compared to last year given

the transaction-related expenses (the "Transaction Expenses")

associated with the Authentic Transaction (defined below).

- Income from operations was $1.1 million compared to income from

operations of $32.9 million in the same period last year. The

second quarter of fiscal 2023 included one-time items related to

the gain on sale of intangible assets relating to the Vince IP Sale

(the "Vince IP Sale Gain") and Transaction Expenses. Excluding the

$32.0 million Vince IP Sale Gain and the $2.0 million of

Transaction Expenses, Adjusted income from operations* in the

second quarter of fiscal 2023 was $2.8 million.

- Income tax benefit was $0.8 million due to the reversal of the

$0.8 million of ordinary tax expense recorded during the first

quarter of fiscal 2024 as the Company has year-to-date ordinary

pre-tax losses for the interim period and is anticipating annual

ordinary pre-tax income for the fiscal year. The Company has

determined that it is more likely than not that the tax benefit of

the year-to-date loss will not be realized in the current or future

years and as such, tax provisions for the interim periods should

not be recognized until the Company has year-to-date ordinary

pre-tax income. The tax benefit in the second quarter of fiscal

2024 compares to an income tax benefit of $0.6 million in the same

period last year.

- Net income was $0.6 million or $0.05 per diluted share compared

to net income of $29.5 million or $2.36 per share in the same

period last year. The prior year period includes the one-time item

noted above. Excluding these items, Adjusted net loss* in the

second quarter of fiscal 2023 was $0.5 million or $(0.04) per

share.

- The Company ended the quarter with 61 company-operated Vince

stores, a net decrease of 5 stores since the second quarter of

fiscal 2023.

Vince Second Quarter Review

- Net sales increased 7.0% to $74.2 million as compared to the

second quarter of fiscal 2023.

- Wholesale segment sales increased 29.6% to $47.2 million

compared to the second quarter of fiscal 2023.

- Direct-to-consumer segment sales decreased 18.1% to $27.0

million compared to the second quarter of fiscal 2023.

- Income from operations excluding unallocated corporate expenses

was $15.3 million compared to income from operations of $12.5

million in the same period last year.

Rebecca Taylor and Parker Second Quarter Review

- On September 12, 2022, the Company announced the strategic

decision to wind down its Rebecca Taylor business to focus its

resources on the Vince brand. The wind down of the Rebecca Taylor

business was completed in Q2 Fiscal 2023.

- Following the completion of the wind down of the Rebecca Taylor

business in Fiscal 2023, in the first quarter of Fiscal 2024, the

Company completed a nominal sale of all outstanding shares of

Rebecca Taylor, which prior to the sale was in a net liability

position, resulting in a gain of $7.6 million ("Gain on Sale of

Subsidiary").

- Given the completion of the wind down of the Rebecca Taylor and

Parker segment, in the second quarter of fiscal 2024 there was no

income from operations associated with the segment. In the second

quarter of fiscal 2023, the Rebecca Taylor and Parker segment had

income from operations of $1.3 million.

Net Sales and Operating Results by Segment:

Three Months Ended

August 3,

July 29,

(in thousands)

2024

2023

Net Sales:

Vince Wholesale

$

47,184

$

36,407

Vince Direct-to-consumer

26,985

32,930

Rebecca Taylor and Parker

—

110

Total net sales

$

74,169

$

69,447

Income (loss) from operations:

Vince Wholesale

$

16,663

$

11,360

Vince Direct-to-consumer

(1,398

)

1,098

Rebecca Taylor and Parker

—

1,257

Subtotal

15,265

13,715

Unallocated corporate (1)

(14,135

)

19,135

Total income from operations

$

1,130

$

32,850

(1) Unallocated corporate expenses are related to the Vince

brand and are comprised of selling, general and administrative

expenses attributable to corporate and administrative activities

(such as marketing, design, finance, information technology, legal

and human resource departments), and other charges that are not

directly attributable to the Company's Vince Wholesale and Vince

Direct-to-consumer reportable segments. In addition, for the three

months ended July 29, 2023, unallocated corporate expenses includes

the $32.0 million from the Vince IP Sale Gain as well as $2.0

million in Transaction Expenses.

Balance Sheet

At the end of the second quarter of fiscal 2024, total

borrowings under the Company's debt agreements totaled $54.6

million and the Company had $41.1 million of excess availability

under its revolving credit facility.

Net inventory at the end of the second quarter of fiscal 2024

was $66.3 million compared to $85.1 million at the end of the

second quarter of fiscal 2023. The year-over-year decrease in

inventory was driven by a decline in Vince as the Company sold

through higher levels of inventory from the prior year and

rebalanced its inventory purchases for the current season.

During the quarter ended August 3, 2024, the Company did not

issue shares of common stock under the ATM program. The Company

continues to have shares available under the program to exercise

with proceeds to be used as sources, along with cash from

operations, to fund future growth.

Stock Repurchase Program

On September 16, 2024, the Company announced that its Board of

Directors has authorized a stock repurchase program of up to $1

million of VNCE common stock, par value $0.01 per share. The stock

repurchase program does not obligate the Company to acquire any

particular amount of common stock, and it may be modified, extended

or terminated by the Board of Directors at any time. The Company

expects to fund the repurchases through cash on hand and future

cash flow from operations.

Under the stock repurchase program, the Company may repurchase

shares of common stock from time to time in open market

transactions or in privately negotiated transactions as permitted

under applicable rules and regulations of the Securities and

Exchange Commission and subject to market conditions and other

relevant factors. Open market repurchases will be conducted in

accordance with the limitations set forth in Rule 10b-18 under the

Securities Exchange Act of 1934, as amended (the "Exchange Act"),

and applicable legal requirements. The timing, volume and nature of

such purchases will be determined at the sole discretion of the

Company's management at prices the Company considers attractive and

in the best interests of the Company, subject to the availability

of stock, general market conditions, trading price, alternate uses

for capital, the Company's financial performance, both present and

anticipated, and to partially offset dilution from events such as

vesting of stock-based compensation and secondary offerings and/or

distribution of stock by the Company's majority stockholder, as

well as applicable securities laws. No assurance can be given that

any particular amount of common stock will be repurchased. All or

some portion of the repurchases may be made pursuant to trading

plans under Rule 10b5-1 under the Exchange Act, which will permit

shares to be repurchased when the Company might otherwise be

precluded from doing so because of self-imposed trading blackout

periods or other regulatory restrictions.

Transformation Program

On October 31, 2023, the Company announced its Transformation

Program focused on driving enhanced profitability through an

improved gross margin profile and an optimized expense structure.

The Transformation Program is expected to result in over $30

million in savings over the next three years, including

approximately $10 million of savings in fiscal 2024. As of the end

of the second quarter of fiscal 2024, the Company is ahead of its

mid-year fiscal 2024 target.

Strategic Partnership with Authentic

Brands Group

On May 25, 2023, the Company announced that it completed the

previously announced transaction (the "Authentic Transaction") with

Authentic Brands Group ("Authentic").

In connection with the Authentic Transaction, VNCE entered into

an exclusive, long-term license agreement (the "License Agreement")

with Authentic for usage of the contributed intellectual property

for VNCE's existing business in a manner consistent with the

Company's current wholesale, retail and e-commerce operations. The

License Agreement contains an initial ten-year term and eight

ten-year renewal options allowing VNCE to renew the agreement.

Outlook

For the third quarter of fiscal 2024 the Company expects total

company net sales to be flat to down low single digits compared to

$84.1 million in the third quarter of fiscal 2023. The Company

expects third quarter fiscal 2024 total company operating margin to

increase 350 basis points to 450 basis points compared to total

company adjusted operating margin of 3.7% in the third quarter of

fiscal 2023. Starting with the third quarter of fiscal 2024, the

Company has anniversaried periods of non-comparable royalty

expenses and non-comparable expense favorability due to the wind

down of Rebecca Taylor and therefore, the third quarter of fiscal

2024 is the Company's first full quarter in which it is comparing

to a more like-for-like business model. In addition, this guidance

takes into account the earlier than expected timing of wholesale

shipments which benefitted the second quarter of fiscal 2024, as

well as the expected ongoing impact of more disciplined promotional

activity in the Company's direct-to-consumer channel.

For full year fiscal 2024 the Company now expects total company

net sales to decrease in the low-single-digit range compared to

$292.9 million in fiscal 2023. The updated guidance reflects

revised expectations for the Company's direct-to-consumer

performance, while expectations for the wholesale business has

remained unchanged. The Company now expects full year fiscal 2024

total company operating margin, excluding the $7.6 million Gain on

Sale of Subsidiary recorded in the first quarter, to increase 25

basis points to 50 basis points compared to total company adjusted

operating margin of 1.4% in fiscal 2023. This outlook includes an

approximate 140 basis point negative impact from non-comparable

royalty expenses through May 2024.

As a reminder, fiscal 2023 included a 53rd week which

represented approximately $2.2 million in net sales. The outlook

for fiscal 2024 incorporates the impact from the comparison of a

52-week fiscal year to a 53-week fiscal year.

*Non-GAAP Financial

Measures

In addition to reporting financial results in accordance with

GAAP, the Company has provided, with respect to the financial

results relating to the three and six months ended August 3, 2024

and July 29, 2023, respectively, adjusted income (loss) from

operations, adjusted income (loss) before income taxes and equity

in net income (loss) of equity method investment, adjusted income

(loss) before equity in net income (loss) of equity method

investment, adjusted net income (loss), and adjusted earnings

(loss) per share, which are non-GAAP measures, in order to

eliminate the effect of the Gain on Sale of Subsidiary, Gain on

Sale of Vince Intangible Assets, Transaction Expenses, the Gain on

Sale of Parker Intangible Assets and the Discrete Tax Benefit

Associated with Classification Change. The Company believes that

the presentation of these non-GAAP measures facilitates an

understanding of the Company's continuing operations without the

impact associated with the aforementioned items. While these types

of events can and do recur periodically, they are excluded from the

indicated financial information due to their impact on the

comparability of earnings across periods. Non-GAAP financial

measures should not be considered in isolation from, or as a

substitute for, financial information prepared in accordance with

GAAP. A reconciliation of GAAP to non-GAAP results has been

provided in Exhibit 3 to this press release.

Conference Call

A conference call to discuss the second quarter results will be

held today, September 16, 2024, at 4:30 p.m. ET, hosted by Vince

Holding Corp. Interim Chief Executive Officer, Dave Stefko, and

Chief Financial Officer, John Szczepanski. During the conference

call, the Company may make comments concerning business and

financial developments, trends and other business or financial

matters. The Company's comments, as well as other matters discussed

during the conference call, may contain or constitute information

that has not been previously disclosed.

Those who wish to participate in the call may do so by dialing

(833) 470-1428, conference ID 726141. Any interested party will

also have the opportunity to access the call via the Internet at

http://investors.vince.com/. To listen to the live call, please go

to the website at least 15 minutes early to register and download

any necessary audio software. For those who cannot listen to the

live broadcast, a recording will be available for 12 months after

the date of the event. Recordings may be accessed at

http://investors.vince.com.

ABOUT VINCE HOLDING CORP.

Vince Holding Corp. is a global retail company that operates the

Vince brand women's and men's ready to wear business. Vince,

established in 2002, is a leading global luxury apparel and

accessories brand best known for creating elevated yet understated

pieces for every day effortless style. Vince Holding Corp. operates

47 full-price retail stores, 14 outlet stores, and its e-commerce

site, vince.com and through its subscription service Vince Unfold,

www.vinceunfold.com, as well as through premium wholesale channels

globally. Please visit www.vince.com for more information.

Forward-Looking Statements: This document, and any statements

incorporated by reference herein contain forward-looking statements

under the Private Securities Litigation Reform Act of 1995.

Forward-looking statements include the statements under “Outlook”

above as well as statements regarding, among other things, our

current expectations about possible or assumed future results of

operations of the Company and are indicated by words or phrases

such as "may," "will," "should," "believe," "expect," "seek,"

"anticipate," "intend," "estimate," "plan," "target," "project,"

"forecast," "envision" and other similar phrases. Although we

believe the assumptions and expectations reflected in these

forward-looking statements are reasonable, these assumptions and

expectations may not prove to be correct and we may not achieve the

results or benefits anticipated. These forward-looking statements

are not guarantees of actual results, and our actual results may

differ materially from those suggested in the forward-looking

statements. These forward-looking statements involve a number of

risks and uncertainties, some of which are beyond our control,

including, without limitation: our ability to maintain the license

agreement with ABG Vince, a subsidiary of Authentic Brands Group;

ABG Vince's expansion of the Vince brand into other categories and

territories; ABG Vince's approval rights and other actions; our

ability to maintain adequate cash flow from operations or

availability under our revolving credit facility to meet our

liquidity needs; restrictions on our operations under our credit

facilities, our ability to realize the benefits of our strategic

initiatives; our ability to improve our profitability; the

execution of our customer strategy; our operating experience and

brand recognition in international markets; the execution and

management of our direct-to-consumer business growth plans; our

ability to make lease payments when due; our ability to maintain

our larger wholesale partners; our ability to anticipate and/or

react to changes in customer demand and attract new customers,

including in connection with making inventory commitments; actual

or perceived general economic conditions; our ability to remediate

the identified material weakness in our internal control over

financial reporting; our ability to comply with domestic and

international laws, regulations and orders; increased scrutiny

regarding our approach to sustainability matters and environmental,

social and governance practices; our ability to remain competitive

in the areas of merchandise quality, price, breadth of selection

and customer service; the transition associated with the

appointment of an interim chief executive officer; our ability to

attract and retain key personnel; seasonal and quarterly variations

in our revenue and income; further impairment of our goodwill; the

protection and enforcement of intellectual property rights relating

to the Vince brand; our ability to complete the wind down of the

Rebecca Taylor business; our ability to mitigate system security

risk issues, such as cyber or malware attacks, as well as other

major system failures; our ability to optimize our systems,

processes and functions; our ability to comply with privacy-related

obligations; our ability to ensure the proper operation of the

distribution facilities by third-party logistics providers;

fluctuations in the price, availability and quality of raw

materials; the extent of our foreign sourcing; our reliance on

independent manufacturers; the ethical business and compliance

practices of our independent manufacturers; our status as a

“controlled company”; our status as a “smaller reporting company”;

and other factors as set forth from time to time in our Securities

and Exchange Commission filings, including those described under

"Item 1A—Risk Factors" in our Annual Report on Form 10-K and

Quarterly Reports on Form 10-Q. We intend these forward-looking

statements to speak only as of the time of this release and do not

undertake to update or revise them as more information becomes

available, except as required by law.

Vince Holding Corp. and

Subsidiaries

Exhibit (1)

Condensed Consolidated Statements of

Operations

(Unaudited, amounts in thousands except

percentages, share and per share data)

Three Months Ended

Six Months Ended

August 3,

July 29,

August 3,

July 29,

2024

2023

2024

2023

Net sales

$

74,169

$

69,447

$

133,340

$

133,503

Cost of products sold

39,038

37,099

68,296

71,563

Gross profit

35,131

32,348

65,044

61,940

as a % of net sales

47.4

%

46.6

%

48.8

%

46.4

%

Gain on sale of intangible assets

—

(32,043

)

—

(32,808

)

Gain on sale of subsidiary

—

—

(7,634

)

—

Selling, general and administrative

expenses

34,001

31,541

65,944

64,274

as a % of net sales

45.8

%

45.4

%

49.5

%

48.1

%

Income from operations

1,130

32,850

6,734

30,474

as a % of net sales

1.5

%

47.3

%

5.1

%

22.8

%

Interest expense, net

1,647

4,137

3,293

7,427

(Loss) income before income taxes and

equity in net income (loss) of equity method investment

(517

)

28,713

3,441

23,047

Benefit for income taxes

(794

)

(592

)

(1,681

)

(5,877

)

Income before equity in net income (loss)

of equity method investment

277

29,305

5,122

28,924

Equity in net income (loss) of equity

method investment

292

207

(173

)

207

Net income

$

569

$

29,512

$

4,949

$

29,131

Earnings per share:

Basic earnings per share

$

0.05

$

2.37

$

0.39

$

2.35

Diluted earnings per share

$

0.05

$

2.36

$

0.39

$

2.34

Weighted average shares

outstanding:

Basic

12,569,488

12,428,339

12,538,695

12,385,347

Diluted

12,617,085

12,479,667

12,606,575

12,470,085

Vince Holding Corp. and

Subsidiaries

Exhibit (2)

Condensed Consolidated Balance

Sheets

(Unaudited, amounts in

thousands)

August 3,

February 3,

July 29,

2024

2024

2023

ASSETS

Current assets:

Cash and cash equivalents

$

711

$

357

$

869

Trade receivables, net

35,054

20,671

20,859

Inventories, net

66,343

58,777

85,079

Prepaid expenses and other current

assets

6,564

4,997

11,148

Total current assets

108,672

84,802

117,955

Property and equipment, net

6,298

6,972

8,345

Operating lease right-of-use assets

79,659

73,003

75,286

Goodwill

31,973

31,973

31,973

Equity method investment

24,727

26,147

26,232

Other assets

2,294

2,252

2,595

Total assets

$

253,623

$

225,149

$

262,386

LIABILITIES AND STOCKHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

36,736

$

31,678

$

39,170

Accrued salaries and employee benefits

6,442

3,967

2,764

Other accrued expenses

9,545

8,980

9,022

Short-term lease liabilities

14,787

16,803

18,250

Total current liabilities

67,510

61,428

69,206

Long-term debt

54,401

43,950

67,204

Long-term lease liabilities

75,704

67,705

72,901

Deferred income tax liability and other

liabilities

3,567

4,913

2,976

Stockholders' equity

52,441

47,153

50,099

Total liabilities and stockholders'

equity

$

253,623

$

225,149

$

262,386

Vince Holding Corp. and

Subsidiaries

Exhibit (3)

Reconciliation of GAAP to Non-GAAP

measures

(Unaudited, amounts in thousands except

share and per share amounts)

For the Three Months ended

August 3, 2024

As Reported (GAAP)

Gain on sale of subsidiary

As Adjusted (Non-GAAP)

Income from operations

$

1,130

$

—

$

1,130

Interest expense, net

1,647

—

1,647

Loss before income taxes and equity in net

income of equity method investment

(517

)

—

(517

)

Benefit for income taxes

(794

)

—

(794

)

Income before equity in net income of

equity method investment

277

—

277

Equity in net income of equity method

investment

292

—

292

Net income

$

569

$

—

$

569

Earnings per share (1)

$

0.05

$

—

$

0.05

For the Six Months ended

August 3, 2024

As Reported (GAAP)

Gain on sale of subsidiary

As Adjusted (Non-GAAP)

Income (loss) from operations

$

6,734

$

7,634

$

(900

)

Interest expense, net

3,293

—

3,293

Income (loss) before income taxes and

equity in net loss of equity method investment

3,441

7,634

(4,193

)

Benefit for income taxes

(1,681

)

—

(1,681

)

Income (loss) before equity in net loss of

equity method investment

5,122

7,634

(2,512

)

Equity in net loss of equity method

investment

(173

)

—

(173

)

Net income (loss)

$

4,949

$

7,634

$

(2,685

)

Earnings (loss) per share (1)

$

0.39

$

0.61

$

(0.21

)

For the Three Months ended

July 29, 2023

As Reported (GAAP)

Gain on Sale of Vince Intangible

Assets

Transaction Related Expenses

Associated with the Authentic Transaction

Gain on Sale of Parker Intangible

Assets

Transaction Related Expenses

Associated with the sale of Parker Intangible Assets

Discrete Tax Benefit Associated

with Classification Change

As Adjusted (Non-GAAP)

Income (loss) from operations

$

32,850

$

32,043

$

(2,041

)

$

—

$

—

$

—

$

2,848

Interest expense, net

4,137

—

—

—

—

—

4,137

Income (loss) before income taxes and

equity in net loss of equity method investment.

28,713

32,043

(2,041

)

—

—

—

(1,289

)

Benefit for income taxes

(592

)

—

—

—

—

—

(592

)

Income (loss) before equity in net income

of equity method investment

29,305

32,043

(2,041

)

—

—

—

(697

)

Equity in net income of equity method

investment

207

—

—

—

—

—

207

Net income (loss)

$

29,512

$

32,043

$

(2,041

)

$

—

$

—

$

—

$

(490

)

Earnings (loss) per share (2)

$

2.36

$

2.57

$

(0.16

)

$

—

$

—

$

—

$

(0.04

)

For the Six Months ended July

29, 2023

As Reported (GAAP)

Gain on Sale of Vince Intangible

Assets

Transaction Related Expenses

Associated with the Authentic Transaction

Gain on Sale of Parker Intangible

Assets

Transaction Related Expenses

Associated with the sale of Parker Intangible Assets

Discrete Tax Benefit Associated

with Classification Change

As Adjusted (Non-GAAP)

Income (loss) from operations

$

30,474

$

32,043

$

(4,782

)

$

765

$

(150

)

$

—

$

2,598

Interest expense, net

7,427

—

—

—

—

—

7,427

Income (loss) before income taxes and

equity in net income of equity method investment.

23,047

32,043

(4,782

)

765

(150

)

—

(4,829

)

(Benefit) Provision for income taxes

(5,877

)

—

—

—

—

(6,127

)

250

Income (loss) before equity in net income

of equity method investment

28,924

32,043

(4,782

)

765

(150

)

6,127

(5,079

)

Equity in net income of equity method

investment

207

—

—

—

—

—

207

Net income (loss)

$

29,131

$

32,043

$

(4,782

)

$

765

$

(150

)

$

6,127

$

(4,872

)

Earnings (loss) per share (2)

$

2.34

$

2.57

$

(0.38

)

$

0.06

$

(0.01

)

$

0.49

$

(0.39

)

(1) As reported and as adjusted are based on diluted

weighted-average shares outstanding of 12,617,085 for the three

months ended August 3, 2024. As reported is based on diluted

weighted-average shares outstanding of 12,606,575 and as adjusted

is based on basic weighted average shares outstanding of 12,538,695

for the six months ended August 3, 2024. Accordingly, the sum of

the as reported earnings (loss) per share and the reconciling items

may not equal the as adjusted earnings (loss) per share.

(2) As reported is based on diluted weighted-average shares

outstanding of 12,479,667 and as adjusted is based on basic

weighted average shares outstanding of 12,428,339 for the three

months ended July 29, 2023. As reported is based on diluted

weighted-average shares outstanding of 12,470,085 and as adjusted

is based on basic weighted average shares outstanding of 12,385,347

for the six months ended July 29, 2023. Accordingly, the sum of the

as reported earnings (loss) per share and the reconciling items may

not equal the as adjusted earnings (loss) per share.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240916094392/en/

Investor Relations: ICR, Inc. Caitlin Churchill,

646-277-1274 Caitlin.Churchill@icrinc.com

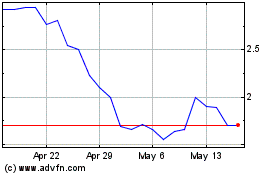

Vince (NYSE:VNCE)

Historical Stock Chart

From Dec 2024 to Dec 2024

Vince (NYSE:VNCE)

Historical Stock Chart

From Dec 2023 to Dec 2024