Data Center Trends 2025: Vertiv Predicts Industry Efforts to Support, Enable, Leverage and Regulate AI

21 November 2024 - 12:00AM

Business Wire

Innovation in powering and cooling AI racks,

management of energy consumption and emissions all to be a focus in

new year

AI continues to reshape the data center industry, a reality

reflected in the projected 2025 data center trends from Vertiv

(NYSE: VRT), a global provider of critical digital infrastructure

and continuity solutions. Vertiv experts anticipate increased

industry innovation and integration to support high-density

computing, regulatory scrutiny around AI, as well as increasing

focus on sustainability and cybersecurity efforts.

“Our experts correctly identified the proliferation of AI and

the need to transition to more complex liquid- and air-cooling

strategies as a trend for 2024, and activity on that front is

expected to further accelerate and evolve in 2025,” said Vertiv CEO

Giordano (Gio) Albertazzi. “With AI driving rack densities into

three- and four-digit kWs, the need for advanced and scalable

solutions to power and cool those racks, minimize their

environmental footprint, and empower these emerging AI Factories

has never been higher. We anticipate significant progress on that

front in 2025, and our customers demand it.”

The 2025 trends most likely to emerge across the data center

industry, according to Vertiv experts:

1. Power and cooling infrastructure innovates to keep pace

with computing densification: In 2025, the impact of

compute-intense workloads will intensify, with the industry

managing the sudden change in a variety of ways. Advanced computing

will continue to shift from CPU to GPU to leverage the latter’s

parallel computing power and the higher thermal design point of

modern chips. This will further stress existing power and cooling

systems and push data center operators toward cold-plate and

immersion cooling solutions that remove heat at the rack level.

Enterprise data centers will be impacted by this trend, as AI use

expands beyond early cloud and colocation providers.

- AI racks will require UPS systems, batteries, power

distribution equipment and switchgear with higher power densities

to handle AI loads that can fluctuate from a 10% idle to a 150%

overload in a flash.

- Hybrid cooling systems, with liquid-to-liquid, liquid-to-air

and liquid-to-refrigerant configurations, will evolve in rackmount,

perimeter and row-based cabinet models that can be deployed in

brown/greenfield applications.

- Liquid cooling systems will increasingly be paired with their

own dedicated, high-density UPS systems to provide continuous

operation.

- Servers will increasingly be integrated with the infrastructure

needed to support them, including factory-integrated liquid

cooling, ultimately making manufacturing and assembly more

efficient, deployment faster, equipment footprint smaller, and

increasing system energy efficiency.

2. Data centers prioritize energy availability

challenges: Overextended grids and skyrocketing power demands

are changing how data centers consume power. Globally, data centers

use an average of 1-2% of the world’s power, but AI is driving

increases in consumption that are likely to push that to 3-4% by

2030. Expected increases may place demands on the grid that many

utilities can’t handle, attracting regulatory attention from

governments around the globe – including potential restrictions on

data center builds and energy use – and spiking costs and carbon

emissions that data center organizations are racing to control.

These pressures are forcing organizations to prioritize energy

efficiency and sustainability even more than they have in the

past.

In 2024, we predicted a trend toward energy alternatives and

microgrid deployments, and in 2025 we are seeing an acceleration of

this trend, with real movement toward prioritizing and seeking out

energy-efficient solutions and energy alternatives that are new to

this arena. Fuel cells and alternative battery chemistries are

increasingly available for microgrid energy options. Longer-term,

multiple companies are developing small modular reactors for data

centers and other large power consumers, with availability expected

around the end of the decade. Progress on this front bears watching

in 2025.

3. Industry players collaborate to drive AI Factory

development: Average rack densities have been increasing

steadily over the past few years, but for an industry that

supported an average density of 8.2kW in 2020, the predictions of

AI Factory racks of 500 to 1000kW or higher soon represent an

unprecedented disruption. As a result of the rapid changes, chip

developers, customers, power and cooling infrastructure

manufacturers, utilities and other industry stakeholders will

increasingly partner to develop and support transparent roadmaps to

enable AI adoption. This collaboration extends to development tools

powered by AI to speed engineering and manufacturing for

standardized and customized designs. In the coming year, chip

makers, infrastructure designers and customers will increasingly

collaborate and move toward manufacturing partnerships that enable

true integration of IT and infrastructure.

4. AI makes cybersecurity harder – and easier: The

increasing frequency and severity of ransomware attacks is driving

a new, broader look at cybersecurity processes and the role the

data center community plays in preventing such attacks. One-third

of all attacks last year involved some form of ransomware or

extortion, and today’s bad actors are leveraging AI tools to ramp

up their assaults, cast a wider net, and deploy more sophisticated

approaches. Attacks increasingly start with an AI-supported hack of

control systems, embedded devices or connected hardware and

infrastructure systems that are not always built to meet the same

security requirements as other network components. Without proper

diligence, even the most sophisticated data center can be rendered

useless.

As cybercriminals continue to leverage AI to increase the

frequency of attacks, cybersecurity experts, network administrators

and data center operators will need to keep pace by developing

their own sophisticated AI security technologies. While the

fundamentals and best practices of defense in depth and extreme

diligence remain the same, the shifting nature, source and

frequency of attacks add nuance to modern cybersecurity

efforts.

5. Government and industry regulators tackle AI applications

and energy use: While our 2023 predictions focused on

government regulations for energy usage, in 2025, we expect the

potential for regulations to increasingly address the use of AI

itself. Governments and regulatory bodies around the world are

racing to assess the implications of AI and develop governance for

its use. The trend toward sovereign AI – a nation’s control or

influence over the development, deployment and regulation of AI and

regulatory frameworks aimed at governing AI – is a focus of The

European Union’s Artificial Intelligence Act and China’s

Cybersecurity Law (CSL) and AI Safety Governance Framework. Denmark

recently inaugurated their own sovereign AI supercomputer, and many

other countries have undertaken their own sovereign AI projects and

legislative processes to further regulatory frameworks, an

indication of the trajectory of the trend. Some form of guidance is

inevitable, and restrictions are possible, if not likely.

Initial steps will be focused on applications of the technology,

but as the focus on energy and water consumption and greenhouse gas

emissions intensifies, regulations could extend to types of AI

application and data center resource consumption. In 2025,

governance will continue to be local or regional rather than

global, and the consistency and stringency of enforcement will

widely vary.

For more information on these 2025 data center trends, visit

Vertiv.com.

About Vertiv

Vertiv (NYSE: VRT) brings together hardware, software, analytics

and ongoing services to enable its customers’ vital applications to

run continuously, perform optimally and grow with their business

needs. Vertiv solves the most important challenges facing today’s

data centers, communication networks and commercial and industrial

facilities with a portfolio of power, cooling and IT infrastructure

solutions and services that extends from the cloud to the edge of

the network. Headquartered in Westerville, Ohio, USA, Vertiv does

business in more than 130 countries. For more information, and for

the latest news and content from Vertiv, visit Vertiv.com.

Forward-Looking Statements

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

Section 27 of the Securities Act, and Section 21E of the Securities

Exchange Act. These statements are only a prediction. Actual events

or results may differ materially from those in the forward-looking

statements set forth herein. Readers are referred to Vertiv’s

filings with the Securities and Exchange Commission, including its

most recent Annual Report on Form 10-K and any subsequent Quarterly

Reports on Form 10-Q for a discussion of these and other important

risk factors concerning Vertiv and its operations. Vertiv is under

no obligation to, and expressly disclaims any obligation to, update

or alter its forward-looking statements, whether as a result of new

information, future events or otherwise.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120295201/en/

Sara Steindorf T +314-982-1725 E

sara.steindorf@fleishman.com

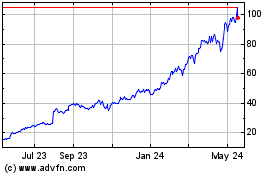

Vertiv (NYSE:VRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

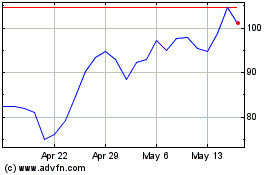

Vertiv (NYSE:VRT)

Historical Stock Chart

From Feb 2024 to Feb 2025