Webster Bank and Marathon Asset Management Announce Private Credit Joint Venture

01 July 2024 - 11:15PM

Business Wire

Synergistic and strategic partnership will

finance middle market companies of private equity sponsors

Webster Financial Corporation, the holding company for Webster

Bank, N.A. (“Webster Bank”), a top performing commercial bank with

$76 billion in assets, and Marathon Asset Management, L.P.

(“Marathon”), a leading global credit manager with $23 billion in

assets under management, today announced they are forming a private

credit joint venture, which will deliver direct lending solutions

to sponsor-backed middle market companies.

The partnership combines each firm’s credit expertise, private

equity sponsor relationships and standing in the middle market with

Webster Bank’s full banking product suite that serves companies

primarily in the middle market and Marathon’s 26-plus years of

experience in asset management. The joint venture will originate

directly sourced senior secured loans across various industries in

which Webster Bank and Marathon have established track records of

investing, with more than 100 employees from both companies working

closely together, including investment and business development

professionals.

Webster Bank’s Sponsor & Specialty Finance Group has

provided credit solutions and other banking services to the

portfolio companies of private equity sponsors for two decades. Its

dedicated team of over 50 bankers has fostered relationships with

more than 125 sponsors nationwide.

“This joint venture allows Webster to better serve and support

our clientele, while at the same time diversifying our revenue and

realizing a greater portion of our Sponsor franchise’s

capabilities,” said John Ciulla, Chairman and Chief Executive

Officer, Webster Financial Corporation. “We will be able to offer

our clients larger facilities and additional financing solutions

alongside the outstanding client experience Webster has always

provided. Expanding our capabilities with this venture will have

the added benefit of generating asset management income.”

“We are excited to partner with Marathon as we augment the

credit solutions available to our clients,” added Andre Paquette,

Group Head of Sponsor & Specialty Finance at Webster Bank.

“Webster has a strong sponsor finance business, reliable execution

and client-centric approach. This will complement Marathon’s long

operating history, deep knowledge of the credit markets and proven

asset management expertise.”

“Marathon is proud to announce this unique private credit

partnership with Webster Bank,” said Bruce Richards, CEO and

Chairman, Marathon. “Both companies possess deep private equity

sponsor relationships, a strong reputation in the middle market,

and a renowned investment team dedicated to middle market lending.

By combining our strengths, together we have created a powerful

partnership in direct lending that will benefit our investors for

years to come.”

Marathon’s direct lending business provides private equity

sponsors with creative financing solutions for acquisitions,

refinancings and recapitalizations, while also providing borrowers

with private credit asset-based lending and capital solutions.

“This partnership with Webster Bank is a natural extension of

our collaboration over several years,” added Curtis Lueker,

Managing Director and Head of Direct Lending, Marathon. “Together,

we look forward to serving private equity sponsors as a trusted and

reliable capital provider with full capabilities.”

About Webster Financial Corporation

Webster Financial Corporation (NYSE:WBS) is the holding company

for Webster Bank, a leading commercial bank in the Northeast that

provides a wide range of digital and traditional financial

solutions across three differentiated lines of business: Commercial

Banking, Consumer Banking and Healthcare Financial Services, one of

the country's largest providers of employee benefits and

administration of medical insurance claim settlements solutions.

Headquartered in Stamford, CT, Webster Bank is a values-driven

organization with $76 billion in assets. Its core footprint spans

the northeastern U.S. from New York to Massachusetts, with certain

businesses operating in extended geographies. Webster Bank is a

member of the FDIC and an equal housing lender. For more

information, including past press releases and the latest annual

report, please visit the company’s website at

www.websterbank.com.

About Marathon Asset Management

Marathon is a leading global credit manager with $23 billion of

capital under management. The firm was founded in 1998 and is

managed by Bruce Richards, CEO & Chairman, and Louis Hanover,

CIO, and employs approximately 190 professionals, with a 20-member

Executive Committee and 8 Partners that include Christine

Chartouni, Ed Cong, Jason Friedman, Jeff Jacob, Jamie Raboy, and

Andy Springer. Its corporate headquarters are in New York City, and

it has offices in London, Miami, Los Angeles, and Luxembourg.

Marathon is a Registered Investment Adviser with the Securities and

Exchange Commission. For more information, please visit the

company’s website at www.marathonfund.com or contact Curtis Lueker,

Managing Director and Head of Direct Lending at 212-500-3088 or

clueker@marathonfund.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240701574857/en/

Webster Financial Corporation Media Inquiries Alice

Ferreira acferreira@websterbank.com 203-578-2610

Webster Financial Corporation Investor Inquiries Emlen

Harmon eharmon@websterbank.com 212-309-7646

Marathon Asset Management Media Inquiries Prosek Partners

pro-marathon@prosek.com 646-818-9283

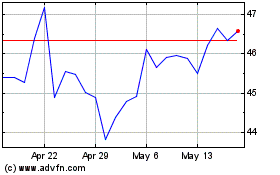

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Nov 2024 to Dec 2024

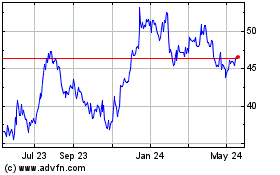

Webster Financial (NYSE:WBS)

Historical Stock Chart

From Dec 2023 to Dec 2024