false

0001175535

0001175535

2024-05-14

2024-05-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 Or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 14, 2024

Whitestone REIT

(Exact name of registrant as specified in charter)

|

Maryland

|

|

001-34855

|

|

76-0594970

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

|

|

|

| |

2600 South Gessner, Suite 500,

|

|

77063

|

|

| |

Houston, Texas

|

|

|

|

| |

(Address of principal executive offices)

|

|

(Zip Code)

|

|

Registrant's telephone number, including area code: (713) 827-9595

Not Applicable

(Former name or former address, if changed since last report)

|

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

|

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule #14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares of Beneficial Interest, par value $0.001 per share

|

WSR

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On May 14, 2024, Whitestone REIT (“the Company”) issued a press release announcing preliminary results of the 2024 Annual Meeting of Shareholders.

A copy of the Company’s press release dated May 14, 2024 is attached hereto as Exhibits 99.1 and is incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

|

Exhibit Number

|

Description

|

| |

|

|

|

|

| 104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

Whitestone REIT

|

| |

|

(Registrant)

|

| |

|

|

|

Date:

|

May 14, 2024

|

By: /s/ David K. Holeman

|

| |

|

Name: David K. Holeman

Title: Chief Executive Officer

|

Exhibit 99.1

Whitestone REIT Announces Preliminary Results of 2024 Annual Meeting of Shareholders

HOUSTON, May 14, 2024 (GLOBE NEWSWIRE) -- Whitestone REIT (NYSE:WSR) (“Whitestone” or the “Company”) today announced that, based on the preliminary vote count at the Company’s 2024 Annual Meeting of Shareholders (the “Annual Meeting”), subject to the final certification of the voting results by the inspector of election, all six Whitestone’s nominees have been re-elected to the Whitestone Board of Trustees (the “Board”).

In addition, based on the preliminary vote count and subject to the final certification of the voting results by the inspector of election, the Company today announced that, at the Annual Meeting, Whitestone shareholders approved, on a non-binding advisory basis, the Company’s executive compensation and approved the ratification of Pannell Kerr Forster of Texas, P.C. as the Company’s auditor.

Whitestone issued the following statement:

“Whitestone’s Board and management team thank our shareholders for their support and input during this proxy contest. We value the perspectives of all shareholders. We are pleased that shareholders have reaffirmed their support for the Board’s highly qualified nominees and recognized our commitment to continue creating shareholder value. We have heard the collective voice of shareholders and will continue to incorporate feedback in our strategy, governance, and other practices.”

The Company will file a Form 8-K with the Securities and Exchange Commission (“SEC”) reporting the preliminary results based on the independent inspector of election’s preliminary tabulation. In addition, the Company will amend the Form 8-K to report the final voting outcome once it has received the final, certified report from the inspector.

About Whitestone REIT

Whitestone REIT (NYSE: WSR) is a community-centered real estate investment trust (REIT) that acquires, owns, operates, and develops open-air, retail centers located in some of the fastest growing markets in the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San Antonio.

Our centers are convenience focused: merchandised with a mix of service-oriented tenants providing food (restaurants and grocers), self-care (health and fitness), services (financial and logistics), education and entertainment to the surrounding communities. The Company believes its strong community connections and deep tenant relationships are key to the success of its current centers and its acquisition strategy. For additional information, please visit https://ir.whitestonereit.com/.

Forward-Looking Statements

This Report contains forward-looking statements within the meaning of the federal securities laws, including discussion and analysis of our financial condition and results of operations, statements related to our expectations regarding the performance of our business, and other matters. These forward-looking statements are not historical facts but are the intent, belief or current expectations of our management based on its knowledge and understanding of our business and industry. Forward-looking statements are typically identified by the use of terms such as “may,” “will,” “should,” “potential,” “predicts,” “anticipates,” “expects,” “intends,” “plans,” “believes,” “seeks,” “estimates” or the negative of such terms and variations of these words and similar expressions, although not all forward-looking statements include these words. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control, are difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements.

Factors that could cause actual results to differ materially from any forward-looking statements made in this Report include: the imposition of federal income taxes if we fail to qualify as a real estate investment trust (“REIT”) in any taxable year or forego an opportunity to ensure REIT status; uncertainties related to the national economy, the real estate industry in general and in our specific markets; legislative or regulatory changes, including changes to laws governing REITs; adverse economic or real estate developments or conditions in Texas or Arizona, Houston and Phoenix in particular, including the potential impact of public health emergencies, such as COVID-19, on our tenants’ ability to pay their rent, which could result in bad debt allowances or straight-line rent reserve adjustments; increases in interest rates, including as a result of inflation operating costs or general and administrative expenses; our current geographic concentration in the Houston and Phoenix metropolitan area makes us susceptible to local economic downturns and natural disasters, such as floods and hurricanes, which may increase as a result of climate change, increasing focus by stakeholders on environmental, social, and governance matters, financial institution disruption; availability and terms of capital and financing, both to fund our operations and to refinance our indebtedness as it matures; decreases in rental rates or increases in vacancy rates; harm to our reputation, ability to do business and results of operations as a result of improper conduct by our employees, agents or business partners; litigation risks; lease-up risks, including leasing risks arising from exclusivity and consent provisions in leases with significant tenants; our inability to renew tenant leases or obtain new tenant leases upon the expiration of existing leases; risks related to generative artificial intelligence tools and language models, along with the potential interpretations and conclusions they might make regarding our business and prospects, particularly concerning the spread of misinformation; our inability to generate sufficient cash flows due to market conditions, competition, uninsured losses, changes in tax or other applicable laws; geopolitical conflicts, such as the ongoing conflict between Russia and Ukraine, the conflict in the Gaza Strip and unrest in the Middle East; the need to fund tenant improvements or other capital expenditures out of operating cash flow; the extent to which our estimates regarding Pillarstone REIT Operating Partnership LP's financial condition and results of operations differ from actual results; and the risk that we are unable to raise capital for working capital, acquisitions or other uses on attractive terms or at all and other factors detailed in the Company's most recent Annual Report on Form 10-K, Quarterly Reports on Form 10-Q and other documents the Company files with the Securities and Exchange Commission from time to time.

Investor and Media Contact:

David Mordy

Director of Investor Relations

Whitestone REIT

(713) 435-2219

ir@whitestonereit.com

v3.24.1.1.u2

Document And Entity Information

|

May 14, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Whitestone REIT

|

| Document, Type |

8-K

|

| Document, Period End Date |

May 14, 2024

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

001-34855

|

| Entity, Tax Identification Number |

76-0594970

|

| Entity, Address, Address Line One |

2600 South Gessner, Suite 500,

|

| Entity, Address, Postal Zip Code |

77063

|

| Entity, Address, City or Town |

Houston

|

| Entity, Address, State or Province |

TX

|

| City Area Code |

713

|

| Local Phone Number |

827-9595

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares of Beneficial Interest

|

| Trading Symbol |

WSR

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001175535

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

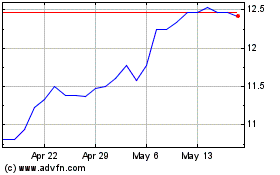

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From Apr 2024 to May 2024

Whitestone REIT (NYSE:WSR)

Historical Stock Chart

From May 2023 to May 2024