Tesla, GameStop, Coherent: What to Watch When the Stock Market Opens Today

20 January 2021 - 1:15AM

Dow Jones News

By Caitlin Ostroff

Here's what we're watching ahead of Tuesday's opening bell.

-- U.S. stock futures climbed ahead of a slew of earnings

releases and testimony by Janet Yellen in which she is expected to

support higher coronavirus relief spending.

Futures tied to the S&P 500 rose 0.7%, pointing to a rally

after the opening bell. Those linked to the Nasdaq-100 added 0.8%,

suggesting gains in tech stocks. Read our full market wrap

here.

What's Coming Up

-- Janet Yellen, President-elect Joe Biden's choice for Treasury

secretary, is set to testify before the Senate Finance Committee,

which is considering her nomination, at 10 a.m. ET. She is expected

to tell lawmakers that the U.S. risks a longer recession unless

Congress approves more aid and affirm the commitment to

market-determined exchange rates.

-- Interactive Brokers, J.B. Hunt and Netflix will report

quarterly earnings after markets close.

Market Movers to Watch

-- Shares in videogame retailer GameStop rose more than 8%

premarket. The company has recently been a favorite among

individual traders who have encouraged others to scoop up the stock

on social media forums.

-- Coherent climbed 33% in premarket trading after Lumentum

Holdings confirmed Tuesday that it would acquire the laser maker.

The Wall Street Journal reported earlier that Lumentum was in

advanced talks to buy Coherent. Shares in Lumentum fell 5%

premarket.

-- Tesla rose 1.9% premarket after the electric car maker

delivered its first made-in-China Model Y compact crossover

vehicles on Monday.

-- Shares in Triterras gained more than 17% premarket after the

financial technology company authorized a share repurchase program

of up to $50 million.

-- Shares in Gritstone Oncology rallied more than 40% after the

biotechnology company said it is advancing development of a vaccine

against the virus that causes Covid-19.

-- Jeep-owner Stellantis, the recently combined business of Fiat

Chrysler and PSA Group, gained 5.1% in European trading, extending

Monday's pop after it made its debut on French and Italian

exchanges. The company's shares on the New York Stock Exchange will

start trading Tuesday.

-- Shares of Western Union shot up 6.3% in premarket trading,

after the money-movement company announced a new agreement with

Walmart in which money transfer services will be enabled at Walmart

stores nationwide.

-- Bank of America fell 1.4% premarket after second-largest bank

in the U.S. said earnings fell 22% in the fourth quarter.

-- Shares in Halliburton rose 2.2% after the Houston-based

oil-field services company said its loss for the fourth quarter

narrowed as it took less in impairment charges than the same period

last year, and that it is seeing recovery in the energy sector.

-- Office Depot shed 4.6% premarket after The Wall Street

Journal reported that the office supplies company rebuffed an

unsolicited takeover offer from Staples but indicated it is open to

an alternative deal.

-- Goldman Sachs rose 2.6% premarket after the bank reported

sharply higher profits for the fourth quarter.

-- Shares in MGM Resorts International gained 5.7% in premarket

trading after the company said it doesn't plan to submit a revised

proposal to buy Entain, the U.K. sports betting and gambling

company. Shares in Entain fell more than 18% in London trading.

Market Fact

In the past four years, U.S. government debt held by the public

has increased by $7 trillion to $21.6 trillion. At 100.1% of gross

domestic product, the debt already exceeds the annual output of the

economy, putting the U.S. in company with economies including

Greece, Italy and Japan.

Chart of the Day

U.K. merger activity slumped in the early summer from the

year-earlier period as part of a broader decline amid virus-induced

lockdowns, but the fourth quarter marked a rebound in mergers and

acquisitions in the U.K. as a vaccination program raised the

prospect of bringing the virus under control.

Must Reads Since You Went to Bed

U.S. Corporate-Bond Rally Rolls Into 2021

Renaissance Says Losses Should Have Been Expected at Some

Point

Yellen Calls for More Aid to Avoid Longer, More Painful

Recession

After Stock Surge, Investors Ask Companies What's Ahead

(END) Dow Jones Newswires

January 19, 2021 09:00 ET (14:00 GMT)

Copyright (c) 2021 Dow Jones & Company, Inc.

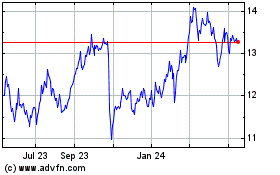

Western Union (NYSE:WU)

Historical Stock Chart

From Nov 2024 to Dec 2024

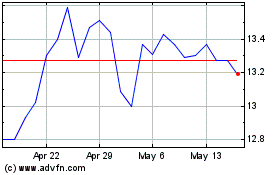

Western Union (NYSE:WU)

Historical Stock Chart

From Dec 2023 to Dec 2024