The Western Union Company (NYSE: WU) announced today that its

Board of Directors approved a new $1 billion authorization for the

Company to repurchase its common stock and declared a quarterly

cash dividend of $0.235 per common share. The dividend will be

payable December 31, 2024, to stockholders of record at the close

of business on December 23, 2024.

“We remain committed to returning capital to our shareholders

with our disciplined approach focused on driving long-term

shareholder value through both dividends and stock repurchases and

today’s announcements allows us the flexibility to continue to do

that,” said Devin McGranahan, President and Chief Executive

Officer.

Repurchases may be made at management’s discretion through

open-market transactions, privately negotiated transactions, tender

offers, Rule 10b5-1 plans, or by other means. The amount and timing

of any repurchases made under the share repurchase program will

depend on a variety of factors, including market conditions, share

price, legal requirements, and other factors. The program does not

have a set expiration date and may be suspended, modified, or

discontinued at any time without prior notice.

Safe Harbor Compliance Statement for Forward-Looking

Statements

This press release contains certain statements that are

forward-looking within the meaning of the Private Securities

Litigation Reform Act of 1995. These statements are not guarantees

of future performance and involve certain risks, uncertainties, and

assumptions that are difficult to predict. Actual outcomes and

results may differ materially from those expressed in, or implied

by, our forward-looking statements. Words such as “expects,”

“intends,” “targets,” “anticipates,” “believes,” “estimates,”

“guides,” “provides guidance,” “provides outlook,” “projects,”

“designed to,” and other similar expressions or future or

conditional verbs such as “may,” “will,” “should,” “would,”

“could,” and “might” are intended to identify such forward-looking

statements. Readers of this press release of The Western Union

Company (the “Company,” “Western Union,” “we,” “our,” or “us”)

should not rely solely on the forward-looking statements and should

consider all uncertainties and risks discussed in the Risk Factors

section and throughout the Annual Report on Form 10-K for the year

ended December 31, 2023. The statements are only as of the date

they are made, and the Company undertakes no obligation to update

any forward-looking statement.

Possible events or factors that could cause results or

performance to differ materially from those expressed in our

forward-looking statements include the following: (i) events

related to our business and industry, such as: changes in general

economic conditions and economic conditions in the regions and

industries in which we operate, including global economic downturns

and trade disruptions, or significantly slower growth or declines

in the money transfer, payment service, and other markets in which

we operate, including downturns or declines related to

interruptions in migration patterns or other events, such as public

health emergencies, epidemics, or pandemics, civil unrest, war,

terrorism, natural disasters, or non-performance by our banks,

lenders, insurers, or other financial services providers; failure

to compete effectively in the money transfer and payment service

industry, including among other things, with respect to price or

customer experience, with global and niche or corridor money

transfer providers, banks and other money transfer and payment

service providers, including digital, mobile and internet-based

services, card associations, and card-based payment providers, and

with digital currencies and related exchanges and protocols, and

other innovations in technology and business models; geopolitical

tensions, political conditions and related actions, including trade

restrictions and government sanctions, which may adversely affect

our business and economic conditions as a whole, including

interruptions of United States or other government relations with

countries in which we have or are implementing significant business

relationships with agents, clients, or other partners;

deterioration in customer confidence in our business, or in money

transfer and payment service providers generally; failure to

maintain our agent network and business relationships under terms

consistent with or more advantageous to us than those currently in

place; our ability to adopt new technology and develop and gain

market acceptance of new and enhanced services in response to

changing industry and consumer needs or trends; mergers,

acquisitions, and the integration of acquired businesses and

technologies into our Company, divestitures, and the failure to

realize anticipated financial benefits from these transactions, and

events requiring us to write down our goodwill; decisions to change

our business mix; changes in, and failure to manage effectively,

exposure to foreign exchange rates, including the impact of the

regulation of foreign exchange spreads on money transfers; changes

in tax laws, or their interpretation, any subsequent regulation,

and unfavorable resolution of tax contingencies; any material

breach of security, including cybersecurity, or safeguards of or

interruptions in any of our systems or those of our vendors or

other third parties; cessation of or defects in various services

provided to us by third-party vendors; our ability to realize the

anticipated benefits from restructuring-related initiatives, which

may include decisions to downsize or to transition operating

activities from one location to another, and to minimize any

disruptions in our workforce that may result from those

initiatives; our ability to attract and retain qualified key

employees and to manage our workforce successfully; failure to

manage credit and fraud risks presented by our agents, clients, and

consumers; adverse rating actions by credit rating agencies; our

ability to protect our trademarks, patents, copyrights, and other

intellectual property rights, and to defend ourselves against

potential intellectual property infringement claims; material

changes in the market value or liquidity of securities that we

hold; restrictions imposed by our debt obligations; (ii) events

related to our regulatory and litigation environment, such as:

liabilities or loss of business resulting from a failure by us, our

agents, or their subagents to comply with laws and regulations and

regulatory or judicial interpretations thereof, including laws and

regulations designed to protect consumers, or detect and prevent

money laundering, terrorist financing, fraud, and other illicit

activity; increased costs or loss of business due to regulatory

initiatives and changes in laws, regulations and industry practices

and standards, including changes in interpretations, in the United

States and abroad, affecting us, our agents or their subagents, or

the banks with which we or our agents maintain bank accounts needed

to provide our services, including related to anti-money laundering

regulations, anti-fraud measures, our licensing arrangements,

customer due diligence, agent and subagent due diligence,

registration and monitoring requirements, consumer protection

requirements, remittances, immigration, and sustainability

reporting including climate-related reporting; liabilities,

increased costs or loss of business and unanticipated developments

resulting from governmental investigations and consent agreements

with, or investigations or enforcement actions by regulators and

other government authorities; liabilities resulting from

litigation, including class-action lawsuits and similar matters,

and regulatory enforcement actions, including costs, expenses,

settlements, and judgments; failure to comply with regulations and

evolving industry standards regarding consumer privacy, data use,

the transfer of personal data between jurisdictions, and

information security, failure to comply with the Dodd-Frank Wall

Street Reform and Consumer Protection Act, as well as regulations

issued pursuant to it and the actions of the Consumer Financial

Protection Bureau and similar legislation and regulations enacted

by other governmental authorities in the United States and abroad

related to consumer protection; effects of unclaimed property laws

or their interpretation or the enforcement thereof; failure to

maintain sufficient amounts or types of regulatory capital or other

restrictions on the use of our working capital to meet the changing

requirements of our regulators worldwide; changes in accounting

standards, rules and interpretations, or industry standards

affecting our business; and (iii) other events, such as

catastrophic events and management’s ability to identify and manage

these and other risks.

About Western Union

The Western Union Company (NYSE: WU) is committed to helping

people around the world who aspire to build financial futures for

themselves, their loved ones and their communities. Our leading

cross-border, cross-currency money movement, payments and digital

financial services empower consumers, businesses, financial

institutions and governments—across more than 200 countries and

territories and nearly 130 currencies—to connect with billions of

bank accounts, millions of digital wallets and cards, and a global

footprint of hundreds of thousands of retail locations. Our goal is

to offer accessible financial services that help people and

communities prosper. For more information, visit

www.westernunion.com.

WU-G

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241213394701/en/

Media Relations: Brad Jones media@westernunion.com

Investor Relations: Tom Hadley

WesternUnion.IR@westernunion.com

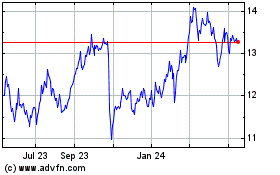

Western Union (NYSE:WU)

Historical Stock Chart

From Jan 2025 to Feb 2025

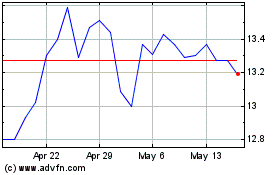

Western Union (NYSE:WU)

Historical Stock Chart

From Feb 2024 to Feb 2025